Académique Documents

Professionnel Documents

Culture Documents

Small Business Accounting

Transféré par

SDaroosterCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Small Business Accounting

Transféré par

SDaroosterDroits d'auteur :

Formats disponibles

UNIVERSITY OF SOUTH AUSTRALIA

DIVISION OF BUSINESS

SCHOOL OF COMMERCE

ACCT 2011 (012270) - Small Bus!"ss A##$u!%!&

L"#%u'" Ou%l!"

("") 1 - A##$u!%!& a!* Small Bus!"ss - A! O+"'+",

_____________________________________________________________________

1. Introduction to the subject, aims, emphases, materials and assessment

requirements.

Points to note:

Amount and source of reading

Updating of information (particularl ta!"

Preparation, participation and attendance at tutorials

#h no e!am.

$usiness Plan % $rief Introduction & 'or(ard planning

). #hat is small business*

).1 +ften difficult to accuratel define the fine line bet(een big and small

business. ,urrentl used Australian definitions from -o.ernment

sources:

).1.1 /ualitati.e 0efinitions

A small business is one in (hich one or t(o persons are required

to ma1e all the critical management decisions (ithout the aid of

internal specialists and (ith o(ners onl ha.ing specific

1no(ledge in onl one or t(o functional areas of management

#iltshire 2eport (1341"

5he characteristics of a small business are:

It is independentl o(ned.

It is closel controlled b o(ner%managers (ho ha.e

responsibilit for the principal decisions.

Its o(ner%mangers contribute most, if not all, of the capital.

Its operations are locall based, although its mar1ets might

not be.

0ept. of Industr, 5echnolog 6 ,ommerce (133)"

).1.) /uantitati.e 0efinitions

A small business is one that has less than )7 emploees.

Australian $ureau of 8tatistics ()771"

A business (ith aggregated turno.er of 9)m per ear or less

qualifies for small business status in relation to income ta!.

A5+ ()71)"

).) 8mall 6 :edium ;nterprise (8:;" % the ;uropean Union approach to

getting o.er the definition problem.

5he definition of 8:; Incorporates:

:icro enterprises: <17 emploees

8mall enterprises: =3 and <177 emploees

:edium enterprises: =33 and <>77 emploees

?. ,haracteristics of small business that ma1es it different from big business.

@. +bjecti.es of 8mall $usiness

@.1 'inancial

@.) /ualitati.eA self actualising

>. #hat is accounting and its purpose*

>.1 Accounting is the process of identifing, measuring and communicating

economic information to permit informed judgements and decisions b

the users of the information.

American Accounting Association % AAA

>.) -eneral purpose financial reports shall pro.ide information useful to

users for ma1ing and e.aluating decisions about the allocation of scarce

resources. 8A, 1

B. #h 8mall $usiness and Accounting*

B.1 'rom the small business perspecti.e:

B.1.1 Pi.otal profession for business ad.isor ser.ices and assistance

for the meeting of regulator obligations

B.1.) A source of information for decision ma1ing 6 accountabilit

B.) 'rom the accounting perspecti.e:

B.).1 A source of professional (or1

B.).) Presents a challenge to the discipline in terms of appropriate

practices (eg in financial reporting".

4. 8mall business and accounting . small business and accountants.

C. #hat does research tell us about small business and its need for accounting

and its interactions (ith it*

C.1 ,auses of small business failure

C.) 8tate of record 1eeping in small business

C.? #hat small businesses use accountants for

C.@ #hat small businesses belie.es that accountants can do for them

)

3. Accounting profit .. 5a! DprofitD (ta!able income".

3.1 Accounting profit

5he residual after e!penses incurred for a period are subtracted from

the income earned for that same period. 5he processes of earning and

incurrence are adjudged (ithin the frame(or1 of accrual accounting as

built up through the -AAP (hich in.ol.es the application of traditional

con.ention, 8A,s and accounting standards.

3.) 5a!able income (or ta! DprofitD"

Eet Income (profit" upon (hich ta! is to be paid measured b a socio%

politico%legal frame(or1 (I5AA". 5hough most of its calculati.e base of

(hat is considered assessable income and deductions (e!penses" ma

seem similar to that of accounting profit calculation at first glance,

ta!able income, and (hat ma1es it up, differs from profit in a number of

important (as.

3.? :ain causes of differences bet(een the t(o profit measures

5he main differences bet(een accounting profit and profit for ta!

purposes are caused b the follo(ing (the points belo( are not

e!hausti.e, rather, the are meant to be illustrati.e":

D--"'"!#"s ! s$m" !#$m" '"#$&!%$!

Example 1: In accounting, gains made on the sale of non%

current assets are calculated b comparing the carring amount

of the asset as at the date of sale (ith the sale price (stable

monetar unit assumption". Example 2: In the case of a ,apital

-ain, for ta! purposes one calculation method allo(ed for

calculation (for assets purchased before )1 8eptember 1333" is

to discount the original .alue (or cost base" for inflation before

an income gain is recognised. 5he method allo(ed since is to

include half of the nominal gain as part of Assessable Income in

the ear of disposal.

D--"'"!#"s ! *".'"#a%$!

In the case of accounting, depreciation is an attempt to

recognise the loss of economic benefits of an asset o.er the

period of its useful life. 5he ta! .ersion of depreciation is based

upon the concept of recognising the e!istence of accounting

depreciation, but it is not treated as a reflection of that

depreciation, but as an allo(ance for it ha.ing happened. 5his is

reflected b the follo(ing:

Published depreciation rates: 5he Australian 5a! +ffice

publishes depreciation rates (both straight line and reducing

balance methods allo(ed" (hich are used to establish the

amount of deduction allo(ed across entities for the same tpes

of assets. 5his contrasts (ith the accounting .ie(, (here both

the method and amount are set subjecti.el as an attempt to

conte!tualise the loss of benefits for that particular asset in that

particular entit.

Special rates of depreciation: 5o implement their

socialAeconomicApolitical agendas, go.ernments of the da use

allo(ed rates for deductions to implement polic (eg offering

accelerated depreciation on Dhigh techD equipment". 0uring the

ta! ears ended ?7 Fune 1333 and )777, assets purchased for

?

income production (plant" could be full depreciated in one ear

if the (ere e!pected to ha.e a useful life of less than ? ear or

cost less than 9?77. In the )71)%1? ear, all items of plant

costing less than 9B,>77 can be (ritten off b small businesses

immediatel. Items costing 9B,>77 or abo.e, are depreciated at

1>G in the first ear, then added to the o.erall pool of business

depreciable assets and depreciated at ?7G pa each ear

thereafter. An e!ception is made for motor .ehicles of 9B,>77 or

abo.e, (here an initial 9>,777 plus 1>G of the remainder of the

purchase price is allo(ed as a deduction is allo(ed in the first

ear, before the ?7G pa rule applies in subsequent ears.

D--"'"!#"s ! $%/"' "0."!s" '"#$&!%$!

8ome items are considered e!penses in accounting but not

deductions under the ta! la(. 'or e!ample, non%deductable

donations, entertainment, income ta! e!pense itself and

pro.isions for doubtful debts, holida pa 6 long ser.ice lea.e.

8ome items are not considered e!penses for accounting

purposes but are gi.en special deduction status for income ta!

purposes. 'or e!ample, some capital e!penditures on building

and structural impro.ements (assets in accounting", research

and de.elopment e!penditure 6 e!penditure on Australian films

(increased rates of up to 1>7G deduction" and carried for(ard

losses from pre.ious ears.

@

L"#%u'" Illus%'a%$! 1

A##$u!%!& .'$-% +1 Ta0a2l" !#$m"

-otno :aits, is a sole trader (ho sells carpet care products. Hou are pro.ided (ith the

follo(ing information in relation to the financial ear ended ?7 Fune, )71?:

8ales for the ear 9C7,777.

Purchases of stoc1 during the ear 91C,777.

5here (as no stoc1 on hand at either the start or end of the ear.

+perating e!penses (all ta! deductable" 91B,777

:otor Iehicle purchased for the business on 1A4A1) for 91C,777. ;!pected useful

life @ ears (ith a 9),777 residual e!pected (straight line".

+n 1A4A11, -otno purchased land for the business for 9)77,777 to build a future

(arehouse. Je changed his mind and sold it on ?7ABA1? for 9)@7,777.

-otno bought 9)77 (orth of tic1ets for himself and a client to go to the local

snchronised s(imming finals to enhance business good(ill. 5he .alued client had

once mentioned that he admired the s(immersK abilit to breathe and smile (hilst

(earing nosepegs. 5ic1ets to an e.ent such as this is not considered an

entertainment e!pense for ta! purposes.

2equired:

a. ,alculate -otno :aitsK business accounting profit for the ear ended ?7 Fune

)71?.

b. Assuming that there are no other financial issues rele.ant to the preparation of

his ta! return, calculate -otnoKs ta!able income for the same ear.

a1 A##$u!%!& 3'$-%4 21 Ta0a2l" I!#$m"4

Assessable Income:

8ales 9C7,777 Income from sales 9C7,777

less ,+8 1C,777 ,apital gain ()" )7,777

-ross Profit B),777 177,777

add net gain on disposal @7,777 Less allowable

deductions:

17),777 8toc1 used 1C,777

less expenses: +perating e!penses 1B,777

+perating e!penses 1B,)77 0epreciation

deduction(?"

B,3>7

0epKn on :I (1" @,777 @7,3>7

)7,)77 5a!able Income 9>3,7>7

Eet Profit 9C1,C77

(1" (91C,777%9),777"A@

()" (9)@7,777%9)77,777"A)

(?" 9>,777 L M(91C,777 % 9>,777" ! 1>GN

>

Vous aimerez peut-être aussi

- AccountingDocument13 pagesAccountingArjun SrinivasPas encore d'évaluation

- Solution For The Analysis and Use of Financial Statements (White.G) ch03Document50 pagesSolution For The Analysis and Use of Financial Statements (White.G) ch03Hoàng Thảo Lê69% (13)

- Guidelines For BUDGET PreparationDocument8 pagesGuidelines For BUDGET Preparationsheer2_98Pas encore d'évaluation

- Chapter08 KGWDocument24 pagesChapter08 KGWMir Zain Ul HassanPas encore d'évaluation

- Financial Management & Control FinalDocument25 pagesFinancial Management & Control FinalAnees Ur RehmanPas encore d'évaluation

- A Short Course On Financial Accounting For I.T. ProfessionalsDocument8 pagesA Short Course On Financial Accounting For I.T. ProfessionalsPrasad PanditPas encore d'évaluation

- Chapter 04 - AnswerDocument9 pagesChapter 04 - AnswerCrisalie Bocobo0% (1)

- SCDL PGDBA Finance Sem 1 Management AccountingDocument19 pagesSCDL PGDBA Finance Sem 1 Management Accountingamitm17Pas encore d'évaluation

- This Page Is Designed For The Sole Purpose of Teaching Someone How To Read Financial StatementsDocument77 pagesThis Page Is Designed For The Sole Purpose of Teaching Someone How To Read Financial StatementsAhmad Fauzi MehatPas encore d'évaluation

- Assignment 2 - Financial ManagementDocument29 pagesAssignment 2 - Financial ManagementemailtheodorePas encore d'évaluation

- Solution 2011Document16 pagesSolution 2011Krutika MehtaPas encore d'évaluation

- Analyzing Financial Performance of Bata BangladeshDocument54 pagesAnalyzing Financial Performance of Bata BangladeshCarbon_AdilPas encore d'évaluation

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Pas encore d'évaluation

- ASSETS AND LIABILITIES SUMMARYDocument11 pagesASSETS AND LIABILITIES SUMMARYAmelia Butan50% (2)

- Case Company Organization: Unit ContentsDocument64 pagesCase Company Organization: Unit Contentsfab10moura32Pas encore d'évaluation

- ACC561 Final ExamDocument7 pagesACC561 Final ExamRogue PhoenixPas encore d'évaluation

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1Pas encore d'évaluation

- Section 1: Introduction To Principles of AccountsDocument6 pagesSection 1: Introduction To Principles of AccountsArcherAcsPas encore d'évaluation

- Acc 501 Midterm Solved Papers Long Questions SolvedDocument34 pagesAcc 501 Midterm Solved Papers Long Questions SolvedAbbas Jafri33% (3)

- PDF EvaDocument36 pagesPDF EvaShrey GoelPas encore d'évaluation

- MBA Strategic Finance AssignmentDocument14 pagesMBA Strategic Finance AssignmentStephanie StephensPas encore d'évaluation

- Solution To The CIAP Requirement For Brazil: Sap AgDocument17 pagesSolution To The CIAP Requirement For Brazil: Sap AgRod Don PerinaPas encore d'évaluation

- Accounting GlossaryDocument242 pagesAccounting GlossaryNelson FernandezPas encore d'évaluation

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010Pas encore d'évaluation

- SM Chapter 01Document36 pagesSM Chapter 01mfawzi010Pas encore d'évaluation

- Appendix: Special G/L Transactions (Optional) Periodic Processing (Optional)Document39 pagesAppendix: Special G/L Transactions (Optional) Periodic Processing (Optional)fab10moura32Pas encore d'évaluation

- Chapter 1Document9 pagesChapter 1craig52292Pas encore d'évaluation

- Business Accountant CertificationDocument0 pageBusiness Accountant CertificationVskills CertificationPas encore d'évaluation

- Mba Faa I UnitDocument8 pagesMba Faa I UnitNaresh GuduruPas encore d'évaluation

- ABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysisDocument16 pagesABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysissamuel_dwumfourPas encore d'évaluation

- SwrfeDocument204 pagesSwrfekmillatPas encore d'évaluation

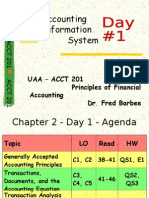

- Accounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeDocument55 pagesAccounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeyenzelPas encore d'évaluation

- S - ALR - 87012284 - Financial Statements & Trial BalanceDocument9 pagesS - ALR - 87012284 - Financial Statements & Trial Balancessrinivas64Pas encore d'évaluation

- FICO COURSE CONTENT STRUCTURE AND CONFIGURATIONDocument5 pagesFICO COURSE CONTENT STRUCTURE AND CONFIGURATIONvikasbumcaPas encore d'évaluation

- Account Determination SDDocument5 pagesAccount Determination SDSanathSanathPas encore d'évaluation

- FMM Acct For Business Ch1Document99 pagesFMM Acct For Business Ch1Rubi JangraPas encore d'évaluation

- Unit VI Part 1 General Journal, General Ledger, Trial BalanceDocument20 pagesUnit VI Part 1 General Journal, General Ledger, Trial BalancePatrick BernilPas encore d'évaluation

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDocument3 pagesHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraPas encore d'évaluation

- Cost ReconcillationDocument6 pagesCost ReconcillationmahendrabpatelPas encore d'évaluation

- Distinguish Between Capital Expenditure and Revenue ExpenditureDocument11 pagesDistinguish Between Capital Expenditure and Revenue ExpenditureGopika GopalakrishnanPas encore d'évaluation

- Chapter09.Profit Planning, Activity-Based Budgeting, and E-BudgetingDocument34 pagesChapter09.Profit Planning, Activity-Based Budgeting, and E-BudgetingAnjo Padilla100% (4)

- Kieso IFRS TestBank Ch03Document44 pagesKieso IFRS TestBank Ch03Zhim Handjoko100% (1)

- The Conceptual Frame Work of AccountingDocument12 pagesThe Conceptual Frame Work of AccountingSneha KanadePas encore d'évaluation

- Porter SM Ch. 03 - 2ppDocument72 pagesPorter SM Ch. 03 - 2ppmfawzi010Pas encore d'évaluation

- Sap Fi T-CodesDocument11 pagesSap Fi T-CodesejascbitPas encore d'évaluation

- Definition of 'Ratio Analysis'Document12 pagesDefinition of 'Ratio Analysis'VikasDoshiPas encore d'évaluation

- MySAP Financials Certification QuestionsDocument4 pagesMySAP Financials Certification QuestionsJuan ManuelPas encore d'évaluation

- Cheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosDocument5 pagesCheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosQaiser KhanPas encore d'évaluation

- RatiosDocument6 pagesRatiosFaisal AwanPas encore d'évaluation

- Changed Course Outlines With Old OneDocument10 pagesChanged Course Outlines With Old OneRana ToseefPas encore d'évaluation

- The Entrepreneur’S Dictionary of Business and Financial TermsD'EverandThe Entrepreneur’S Dictionary of Business and Financial TermsPas encore d'évaluation

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthD'EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthPas encore d'évaluation

- Cambridge O Level Accounting 7707: Second EditionD'EverandCambridge O Level Accounting 7707: Second EditionPas encore d'évaluation

- Remodelers' Cost of Doing Business Study, 2020 EditionD'EverandRemodelers' Cost of Doing Business Study, 2020 EditionPas encore d'évaluation

- Accounting: A Simple Guide to Financial and Managerial Accounting for BeginnersD'EverandAccounting: A Simple Guide to Financial and Managerial Accounting for BeginnersPas encore d'évaluation

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- CPA (USA) Financial Accounting: Examination Preparation GuideD'EverandCPA (USA) Financial Accounting: Examination Preparation GuidePas encore d'évaluation

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationD'EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationPas encore d'évaluation

- Ader - 1994 - Response - Psychosomatic Medicine Rides AgainDocument2 pagesAder - 1994 - Response - Psychosomatic Medicine Rides AgainSDaroosterPas encore d'évaluation

- Joanna Briggs Institute PacesDocument31 pagesJoanna Briggs Institute PacesSDaroosterPas encore d'évaluation

- Heidegger - Heraclitus Seminar 1966 67Document185 pagesHeidegger - Heraclitus Seminar 1966 67SDarooster100% (2)

- Working Memory in The ClassroomDocument4 pagesWorking Memory in The ClassroomSDarooster100% (1)

- Results & Procesess Guide 2008 AugDocument96 pagesResults & Procesess Guide 2008 AugSDaroosterPas encore d'évaluation

- Using Participatory Action Research To Build A Priority Setting Process in A Canadian Regional Health AuthorityDocument14 pagesUsing Participatory Action Research To Build A Priority Setting Process in A Canadian Regional Health AuthoritySDaroosterPas encore d'évaluation

- Leading ImprovementDocument18 pagesLeading ImprovementSDaroosterPas encore d'évaluation

- Guide Dogs Disability Action PlanDocument16 pagesGuide Dogs Disability Action PlanSDaroosterPas encore d'évaluation

- The Missing Dialogue Between Heidegger and Merleau-Ponty On The Importance of The Zollikon SeminarsDocument24 pagesThe Missing Dialogue Between Heidegger and Merleau-Ponty On The Importance of The Zollikon SeminarsSDarooster100% (1)

- Social Psych 160 - 2007 - Lect 03Document1 pageSocial Psych 160 - 2007 - Lect 03SDaroosterPas encore d'évaluation

- Honour Based Violence in Kurdish CommunitiesDocument11 pagesHonour Based Violence in Kurdish CommunitiesSDaroosterPas encore d'évaluation

- Social Psych 160 - 2007 - Lect 04Document1 pageSocial Psych 160 - 2007 - Lect 04SDaroosterPas encore d'évaluation

- Barossa Disability Action PlanDocument27 pagesBarossa Disability Action PlanSDaroosterPas encore d'évaluation

- Social Psych 160 - 2007 - Lect 01Document1 pageSocial Psych 160 - 2007 - Lect 01SDaroosterPas encore d'évaluation

- BigPond User Guide ADSL Cable WirelessDocument84 pagesBigPond User Guide ADSL Cable WirelessdrwisonPas encore d'évaluation

- Cisco Router WRT160N v2Document38 pagesCisco Router WRT160N v2SDaroosterPas encore d'évaluation

- Social Psych 160 - 2007 - Lect 02Document1 pageSocial Psych 160 - 2007 - Lect 02SDaroosterPas encore d'évaluation

- Wilhelm Dilthey On The Objectivity of Knowledge in Human SciencesDocument12 pagesWilhelm Dilthey On The Objectivity of Knowledge in Human SciencesRobson Corrêa de CamargoPas encore d'évaluation

- Leo Strauss What Is Political PhilosophyDocument26 pagesLeo Strauss What Is Political PhilosophyAlexa G. MaldonadoPas encore d'évaluation

- Registration of Different CompanyDocument5 pagesRegistration of Different CompanyAusPas encore d'évaluation

- Activity-Based Costing: Demonstration Problems and Practice QuizDocument5 pagesActivity-Based Costing: Demonstration Problems and Practice QuizMike RobmonPas encore d'évaluation

- Glencore Fact SheetDocument1 pageGlencore Fact SheetIvan RajovicPas encore d'évaluation

- DLSCC Code of Ethics PDFDocument4 pagesDLSCC Code of Ethics PDFRj ArevadoPas encore d'évaluation

- Jai-Alai Corp. of The Phils. v. BPI (1975)Document3 pagesJai-Alai Corp. of The Phils. v. BPI (1975)xxxaaxxxPas encore d'évaluation

- Sap Fi Ecc 6 0 Bootcamp Day 1Document144 pagesSap Fi Ecc 6 0 Bootcamp Day 1Bala Ranganath100% (1)

- ONAR Bulletin Issue22Document5 pagesONAR Bulletin Issue22joreyvilPas encore d'évaluation

- Smart Digital BankingDocument36 pagesSmart Digital Bankinginfo.shreedattaenterprisesPas encore d'évaluation

- How Company Distinguish From PartnershipDocument2 pagesHow Company Distinguish From PartnershipIshan AggarwalPas encore d'évaluation

- Arcelor - Mittal - V1Document12 pagesArcelor - Mittal - V1Divya BhatiaPas encore d'évaluation

- Canara Bank 194A TDSDocument30 pagesCanara Bank 194A TDSArchit AnandPas encore d'évaluation

- The Purple CowDocument4 pagesThe Purple Cowswarup30Pas encore d'évaluation

- Entrepreneurship DevelopmentDocument62 pagesEntrepreneurship DevelopmentNavpreet KaurPas encore d'évaluation

- Instruction To Form 8802Document16 pagesInstruction To Form 8802Eman VillacortePas encore d'évaluation

- Deloitte Workplace SurveyDocument20 pagesDeloitte Workplace SurveyhandoutPas encore d'évaluation

- International HR Management PresentationDocument8 pagesInternational HR Management PresentationMeera AnadkatPas encore d'évaluation

- Mainland Construction Co. Inc. vs. MovillaDocument6 pagesMainland Construction Co. Inc. vs. MovillaGayle AbayaPas encore d'évaluation

- Distribution Budget 20Document16 pagesDistribution Budget 20Ashish RainaPas encore d'évaluation

- RFP ZojilaDocument76 pagesRFP ZojilaZorawar SinghPas encore d'évaluation

- Cid IntropptDocument42 pagesCid IntropptSaira BanuPas encore d'évaluation

- (SM) Amway Swot Analysis BismarianDocument4 pages(SM) Amway Swot Analysis BismarianMade Shri Wijaya SunuPas encore d'évaluation

- Internship Report On KBLDocument33 pagesInternship Report On KBLMurtaza Mari67% (9)

- Week 14 Chapter 16 PC 4 - Wintersport V WhiteDocument1 pageWeek 14 Chapter 16 PC 4 - Wintersport V Whiteapi-340865637Pas encore d'évaluation

- Petition For CertiorariDocument62 pagesPetition For CertiorariRepa Galos75% (4)

- 2018-10-01 Harper S Bazaar Singapore PDFDocument188 pages2018-10-01 Harper S Bazaar Singapore PDFRoxinaPas encore d'évaluation

- GHJDocument6 pagesGHJJilyan SiobalPas encore d'évaluation

- Ex Parte Motion To Correct Protective OrderDocument18 pagesEx Parte Motion To Correct Protective OrderFloridaLegalBlogPas encore d'évaluation

- Position Description WWF Serbia Operations ManagerDocument3 pagesPosition Description WWF Serbia Operations ManagerMilica Lalovic-BozicPas encore d'évaluation

- Honda Recalls Another 4Document4 pagesHonda Recalls Another 4KayeCie RLPas encore d'évaluation

- Assignment No. 1: ReconstructionDocument5 pagesAssignment No. 1: ReconstructionhelperforeuPas encore d'évaluation