Académique Documents

Professionnel Documents

Culture Documents

Revenue Recognition

Transféré par

Kevin Smith0%(1)0% ont trouvé ce document utile (1 vote)

211 vues49 pages1. The document discusses revenue recognition for long-term construction contracts using the percentage-of-completion method. It provides an example to illustrate calculating percentage complete, revenue, and gross profit recognized each year of a multi-year contract.

2. Key accounts used include Construction in Process (CIP) to accumulate costs and profits, and Billings on Construction in Process as a contra-asset account to track billings.

3. Journal entries are made each period to record costs, billings, cash receipts, revenue, and gross profit based on the percentage of the contract completed.

Description originale:

Complex revenue recognition

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document1. The document discusses revenue recognition for long-term construction contracts using the percentage-of-completion method. It provides an example to illustrate calculating percentage complete, revenue, and gross profit recognized each year of a multi-year contract.

2. Key accounts used include Construction in Process (CIP) to accumulate costs and profits, and Billings on Construction in Process as a contra-asset account to track billings.

3. Journal entries are made each period to record costs, billings, cash receipts, revenue, and gross profit based on the percentage of the contract completed.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0%(1)0% ont trouvé ce document utile (1 vote)

211 vues49 pagesRevenue Recognition

Transféré par

Kevin Smith1. The document discusses revenue recognition for long-term construction contracts using the percentage-of-completion method. It provides an example to illustrate calculating percentage complete, revenue, and gross profit recognized each year of a multi-year contract.

2. Key accounts used include Construction in Process (CIP) to accumulate costs and profits, and Billings on Construction in Process as a contra-asset account to track billings.

3. Journal entries are made each period to record costs, billings, cash receipts, revenue, and gross profit based on the percentage of the contract completed.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 49

1

Recall: Revenue is recognized at the earliest moment

that both of the following conditions are met:

1.Earned: The critical event in the process of earning

revenue has taken place. (seller)

2. Realized: The amount of revenue that will be collected is

reasonably assured and measurable with a reasonable

degree of reliability. (buyer)

Chapter 18 & 18A

Complex Revenue Recognition

2

Basic Idea:

Various types of franchise arrangements, we will

focus on service sponsor-retailer

Franchisor sells

(1) right to operate business and

(2) provides on-going support activities.

Revenue streams

(1) initial sale of franchise and related assets/services

(2) fees based on the operation of the franchise

So how does franchisor record this revenue?

Franchise Revenue

(Appendix 18A)

3

Initial Franchise fee

Revenue recorded when there is:

Substantial performance

No remaining obligation to refund any cash or excuse any

non-payment of note. Generally assumed to be when

franchisee commences operations

Collection of fee is reasonably assured

If terms not met, then Unearned Franchise Fees

Often payment is in cash and a LT note receivable

Continuing Fees

When earned and receivable.

Often amount must be verified

Franchise Revenue

4

On 3/31/09 the Red Hot Chicken Wing Corp. entered into a

franchise agreement with Thomas Keller. In exchange for an initial

franchise fee of $50,000, Red Hot will provide initial services to

include the selection of location, construction of building,

employee training and consulting services over several years.

$10,000 is payable on 3/31/09, with the remaining $40,000 payable

in annual installments. 10% interest on the note (at market rate) is

payable annually. In addition, the franchisee will pay continuing

franchise fees of $1000 per month for advertising and promotion

provided by Red Hot, beginning immediately after the franchise

begins operations. Thomas Keller opened his Red Hot franchise for

business on 9/30/09

Franchise Revenue Example

5

Initial Franchise fee

3/31/09 Cash 10,000

Note Receivable 40,000

Unearned franchise fee revenue 50,000

9/30/09 Unearned franchise fee revenue 50,000

Franchise fee revenue 50,000

Continuing Fees

10/31/09 Cash 1000

(& monthly) Service Revenue 1000

Debt Service

3/31/10 Cash 4000

Interest revenue 4000

Franchise Revenue Example

6

Basic idea:

Consignor gives merchandise to a a reseller to sell on your behalf

to an end user.

Cant recognize revenue until sold to end user

Entries:

Ships to consignee

Inventory on consignment xxx

Finished good inventory xxx

Notified of sale to end user

Cash xxx

Commission expense xxx

Revenue from consigned sales xxx

COGS xxx

Inventory on consignment xxx

Consignments (Appendix 18A)

7

What type of sales terms would result

in an in substance consignment

arrangement?

Often take form of side deal

Consignments

Revenue may be recognized before

delivery under certain circumstances.

Long-term construction contracts are a

notable example

US GAAP

The percentage-of-completion method, and

The completed contract method

Revenue Recognition Before

Delivery

Long-Term Construction

Accounting Methods

1) Terms of contract must

be certain, enforceable.

2) Certainty of performance

by both parties

3) Estimates of completion

can be made reliably

1) To be used only when

the percentage method is

inapplicable [uncertain]

2) For short-term contracts

Percentage-of-Completion

Method

Completed Contract

Method

Revenue Recognition Before

Delivery

1. Long-term construction contracts when outcomes

cannot be reasonably estimated:

US GAAP: must use Completed Contract Method (No revenue

or expense is recognized until the end of the contract)

IFRS: must use the zero-profit method (revenues are

recognized only to the extent of costs)

2. Service Revenue

US GAAP: follow specific industry guidance for revenue

recognition

IFRS: typically use the % Completion method (or straight-

line if services are specified over a period of time)

Revenue Recognition:

US GAAP vs. IFRS

11

Want to reflect economic substance of the

activities of the company

I/S: Revenues earned and expenses incurred

B/S: Value of asset being constructed

Requires the use of estimates

What information do we need?

Contract revenue

Expenses incurred

Estimated remaining expenses

Billing and cash from customer

Percentage of Completion: Basic Idea

12

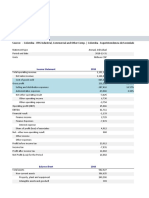

Data: Contract price: $4,500,000 Estimated cost: $4,000,000

Start date: July, 2003 Finish: October, 2005

Balance sheet date: Dec. 31

Given: 2003 2004 2005

Costs to date $1,000,000 $2,916,000 $4,050,000

Estimated costs to complete $3,000,000 $1,134,000 $ -0-

Progress Billings during year $900,000 $2,400,000 $1,200,000

Cash collected during year $750,000 $1,750,000 $2,000,000

What is the percent complete, revenue, and gross

profit recognized each year?

Percentage-of-Completion:

Example

13

2003

To record cost of construction:

DR Construction in process (CIP) 1,000,000

CR Accounts Payable 1,000,000

To record progress billings to customer:

DR Accounts receivable 900,000

CR Billings on CIP 900,000

To record cash collections:

DR Cash 750,000

CR Accounts receivable 750,000

Percentage-of-Completion: Entries

Involving Third Parties

14

Construction in Process

Similar to a Work-In-Process inventory account

Accumulates all costs and profits

Billings on Construction in Process

Similar to a deferred revenue account

Gets offset to CIP (i.e., think of as a contra-account to

Construction in Process)

At the end of any accounting period, the difference between the

balance in CIP and Billings on CIP will appear on the balance

sheet.

If CIP > Billings on CIP, the difference will be reported as an

asset.

If Billing on CIP > CIP, the difference will appear as a

liability.

Percentage-of-Completion:

Balance Sheet Accounts

15

Costs incurred to date = Percent complete

Most recent estimated total costs

1

Estimated total revenue x Percent complete

= Revenue to be recognized to date

2

Total revenue to be recognized to date less Revenue

recognized in PRIOR periods = Current period revenue

3

Current Period Revenue less current costs = Gross profit

4

Percentage-of-Completion: Entries

to Record Revenue & Expense

16

2003 2004 2005

% complete

to-date

1,000,000 = 25% 2,916,000= 72% 100 %

4,000,000 4,050,000

Revenue

recognized

4,500,000 * 25% 4,500,000 * 72% 4,500,000

= 1,125,000 less 1,125,000 less 3,240,000

= 2,115,000 = 1,260,000

1,125,000 less 2,115,000 less 1,260,000

1,000,000 1,916,000 less 1,134,000

= 125,000 = 199,000 = 126,000

Gross Profit

recognized

Percentage-of-Completion:

Example

17

2003

To record revenue and expense

DR CIP (plug gross profit here) 125,000

DR Construction Expenses 1,000,000

CR Revenue (1m/(1m+3m)x4.5m) 1,125,000

Note: Construction expenses = actual expenditures for the

period

Percentage-of-Completion: Entries

Involving Third Parties

18

Balance Sheet 2003

Construction In Progress

1,000,000

125,000

1,125,000

Billings

900,000

900,000

Balance Sheet

in current assets:

CIP 1,125,000

Billings (900,000)

Costs and Recognized Gross Profit

in excess of Billings 225,000

19

2004:

Construction in Progress (2.916m 1.0m) 1,916,000

A/P, etc. 1,916,000

A/R 2,400,000

Billings 2,400,000

Cash 1,750,000

A/R 1,750,000

CIP 199,000

Construction Expenses 1,916,000

Revenue (2.916m/4.050m x 4.5m) 1,125,000 2,115,000

Percentage-of-Completion:

Journal Entries

20

% Completion Balance Sheet 2004

Construction In Progress

1,000,000

125,000

1,916,000

199,000

3,240,000

Billings

900,000

2,400,000

3,300,000

Balance Sheet

in current liabilities:

Billings 3,300,000

Less: CIP (3,240,000)

Billings in excess of cost

and recognized gross profit 60,000

21

2005:

CIP (4,050 2,916) 1,134,000

A/P, etc. 1,134,000

A/R 1,200,000

Billings 1,200,000

Cash 2,000,000

A/R 2,000,000

CIP 126,000

Construction Expenses 1,134,000

Revenue (4,050/4,050 x 4,500) 1,125 - 2,115 1,260,000

Percentage-of-Completion: Journal Entries

22

% Completion Balance Sheet 2005

CIP Billings

1,000,000 900,000

125,000 2,400,000

1,916,000 1,200,000

199,000 4,500,000

1,134,000 -

126,000

4,500,000

-

23

At the end of the contract:

To record completion of project:

DR Billings on CIP 4,500,000

CR Construction in process 4,500,000

Over the life of the contract, the total credits to Billings on CIP

will equal the total amount billed to the customer, which is the

total revenue received over the life of the contract.

Percentage-of-Completion: Entries

24

Note that Gross Profit is stored in the CIP Account this is very

different from ordinary sales transactions, where gross profit is

not in any specific account

A T-account analysis of the CIP account is very useful in answering

questions

For example, you could be told that Daniels Construction incurred

$1 million in construction costs on a new contract this year. They

expect to incur another $7 million to complete the project. The

balance in the CIP account at year end is $1.2 million. What is

the total revenue they expect to earn on the contract?

Answer: 1.2 1 = 200,000 in GP recognized

Project is 1/(1+7) or 12.5% complete, so 200,000 / 0.125 = $1,600,000

in total profit

Since profit is revenues minus expenses, total revenues must be 1.6 +

8 = $9.6 million

Percentage-of-Completion: the Construction

in Progress Account

25

Use when is a lack of dependable estimates

No revenue, no expense, no gross profit recognized until

the project is actually completed.

Journal entries prepared during the life of contract are

the same as those prepared under the percentage-of-

completion method with the exception of the last

journal entry that recognizes periodic revenue, expense

and gross profit.

Instead, the entire revenue, expense and gross profit are

recorded at the end of the project.

Completed Contract Method

26

Completed Contract

Assuming the same numbers as example

before, what are the journal entries under

the completed contract method?

All journal entries for 2003, 2004, and 2005

would appear exactly as before, except that

there would be no revenue recognition journal

entry in each year

Therefore, the balance in CIP at the end of each

year would represent only the inventoried

construction costs

27

2003:

Construction in Progress (CIP) 1,000,000

Cash, A/P, etc. 1,000,000

A/R 900,000

Billings 900,000

Cash 750,000

A/R 750,000

Entries above same as for % Completion. No entry to record

revenues and expenses.

Completed Contract: Journal Entries

28

Balance Sheet 2003 Completed Contract

Construction In Progress

1,000,000

1,000,000

Billings

900,000

900,000

Balance Sheet

in current assets:

CIP 1,000,000

Billings (900,000)

Costs

in excess of Billings 100,000

29

2004:

Construction in Progress (2,916 1,000) 1,916,000

Cash, A/P, etc. 1,916,000

A/R 2,400,000

Billings 2,400,000

Cash 1,750,000

A/R 1,750,000

J/E above are same as for % Completion (no entry made for

revenue and expense)

Completed Contract: Journal Entries

30

Completed Contract Balance Sheet 2004

Construction In Progress

1,000,000

1,916,000

2,916,000

Billings

900,000

2,400,000

3,300,000

Balance Sheet

in current liabilities:

Billings 3,300,000

Less: CIP (2,916,000)

Billings in excess of cost 384,000

31

2005:

CIP (4,050 2,916) 1,134,000

Cash, A/P, etc. 1,134,000

A/R 1,200,000

Billings 1,200,000

Cash 2,000,000

A/R 2,000,000

Now that the project is done, we can close out the Billings and CIP accounts and

record Construction Revenue and Construction Expense:

Billings 4,500,000

Revenue 4,500,000

Construction Expenses 4.050,000

CIP 4,050,000

Completed Contract: Journal Entries

32

Completed Contract Balance Sheet 2005

CIP Billings

1,000,000 900,000

2,400,000

1,916,000 1,200,000

4,500,000

1,134,000 -

4,050,000

-

33

Losses on Contracts

Need to determine if the loss is for the current

period or if for the contract overall.

If on overall profitable contract, recognize the

loss in the period incurred via negative gross

profit

Overall unprofitable contract

Percentage of completion: Recognize entire contract

loss now by backing out previous gross profit

Completed contract: Recognize the entire loss now.

What is the theoretical justification for this?

34

Loss on an

overall unprofitable

contract

Percentage Method: Recognize entire

loss now (this means backing out any

previously recognized gross profit)

Completed method:

Recognize loss currently.

Recognizing Overall Losses on

Long-Term Contracts

35

Revenue recognition is deferred when

collection of sales price is not reasonably

assured and no reliable estimates can be

made. GAAP allows:

the installment sales method

the cost recovery method

Revenue Recognition After

Delivery

36

Emphasizes income recognition in periods of

collection rather than at point of sale.

Title does not pass to the buyer until all cash

payments have been made to the seller.

Gross profit is deferred to the periods of

collection.

Other expenses, selling and administrative,

are not deferred.

The Installment Sales Method

37

Installment sales must be kept separate

Gross profit on installment sales must be

determinable

The amount of cash collected from

installment accounts must be known

The cash collected from current years and

prior years accounts must be known

Provision must be made for the carry forward

of each years deferred gross profit

The Installment Sales Method

38

Installment Sales Issues - Interest

and Repossessions

Interest: recognize at time of receipt (do

not defer)

Repossessions:

Be sure to account for all payments and

recognition of gross profit until the repossession

date

Set up repossessed goods at their fair value at

repossession (not what they were worth when

originally sold)

Write off any remaining A/R and deferred GP,

plugging a gain/loss to make entry balance

39

For installment sales in

any year

For installment sales

made in prior years

(realized gross profit)

Determine rate of gross

profit on installment

sales

Apply this rate to cash

collections of current

years installment sales

to yield realized gross

profit

The gross profit not

realized is deferred

Apply the relevant rate

to cash collections of

prior years installment

sales

The Installment Sales Method:

Steps

40

Given: 2003 2004 2005

Installment sales $200,000 $250,000 $240,000

Cost of sales $150,000 $190,000 $168,000

Gross Profit $ 50,000 $ 60,000 $ 72,000

Cash received in:

from 2003 sales $ 60,000 $ 100,000 $ 40,000

from 2004 sales $ -0- $ 100,000 $125,000

from 2005 sales $ -0- $ -0- $ 80,000

Determine the realized and deferred gross profit.

The Installment Sales Method:

Example

41

2003 2004 2005

Gross profit rate 25% 24% 30%

Realized Gross Profit:

From 2003 sales (e.g., 60,000 x 25%)

Realized in $ 15,000 $ 25,000 $ 10,000

From 2004 sales:

Realized in: $ -0- $ 24,000 $ 30,000

From 2005 sales:

Realized in: $ -0- $ -0- $ 24,000

The Installment Sales Method:

Example

42

When the 2003 installment sale is made:

Installment A/R (2003) 200,000

Installment Sales 200,000

Installment Cost of Sales 150,000

Inventory 150,000

Installment Sales 200,000

Installment Cost of Sales 150,000

Deferred Gross Profit, 2003 50,000

When cash is received, some deferred GP is recogd as revenue:

Cash 60,000

Installment A/R (2003) 60,000

Deferred Gross Profit, 2003 15,000

Realized Gross Profit (I/S) 15,000

(Realized: $60,000 x 25%)

The Installment Sales Method: 2003

Journal Entries for Gross Profit

43

Installment A/R (2004) 250,000

Installment Sales 250,000

Installment Cost of Sales 190,000

Inventory 190,000

Installment Sales 250,000

Installment Cost of Sales 190,000

Deferred Gross Profit, 2004 60,000

When cash is received, some deferred GP is recogd as revenue:

Cash 200,000

Installment A/R (2003) 100,000

Installment A/R (2004) 100,000

Deferred Gross Profit, 2003 25,000

Deferred Gross Profit, 2004 24,000

Realized Gross Profit (I/S) 49,000

(Realized: 03: $100K x 25% + 04 $100K X 24%)

The Installment Sales Method: 2004 Journal

Entries for Gross Profit

44

Installment A/R (2005) 240,000

Installment Sales 240,000

Installment Cost of Sales 168,000

Inventory 168,000

Installment Sales 240,000

Installment Cost of Sales 168,000

Deferred Gross Profit, 2005 72,000

When cash is received, some deferred GP is recognized as revenue:

Cash 245,000

Installment A/R (2003) 40,000

Installment A/R (2004) 125,000

Installment A/R (2005) 80,000

Deferred Gross Profit, 2003 10,000

Deferred Gross Profit, 2004 30,000

Deferred Gross Profit, 2005 24,000

Realized Gross Profit (I/S) 64,000

(Realized: 03: $40K x 25% + 04 $125K X 24% + 05 80K X 30%)

Installment Sales Method: 2005 Journal

Entries

45

Used when no reasonable basis for estimating

collectibility as in franchises and real estate.

Seller recognizes no profit until cash

payments by buyer exceed sellers cost of

merchandise.

After recovering all costs, seller includes

additional cash collections in income.

The income statement reports the amount of

gross profit recognized and the amount

deferred.

The Cost Recovery Method

46

Given: 2003 2004 2005

Installment sales $200,000 $250,000 $240,000

Cost of sales $150,000 $190,000 $168,000

Gross Profit $ 50,000 $ 60,000 $ 72,000

Cash received in:

from 2003 sales $ 60,000 $ 100,000 $ 40,000

from 2004 sales $ -0- $ 100,000 $125,000

from 2005 sales $ -0- $ -0- $ 80,000

Determine the realized and deferred gross profit.

The Original Example Cost

Recovery Method

47

2003:

(J/Es for sales and deferral of GP are same as in installment method)

Installment A/R (2003) 200,000

Installment Sales 200,000

Cost of Installment sales 150,000

Inventory 150,000

Installment Sales 200,000

Cost of Installment Sales 150,000

Deferred Gross Profit 50,000

Cash collection J/Es:

Cash 60,000

Installment A/R (2003)

60,000

Note: costs remaining to recover = 150,000 60,000 = 90,000 before

any recognition of profit

The Cost Recovery Method

48

2004:

J/Es for sales and deferral of GP are same as in installment method

Cash 200,000

Installment A/R (2003) 100,000

Installment A/R (2004) 100,000

2003 GP can be recognized: 150,000 60,000 100,000 = 10,000 to

be recognized

No 2004 GP to be recognized: 190,000 100,000 = 90,000

Deferred GP, 2003 sales 10,000

Recognized GP 10,000

The Cost Recovery Method

49

2005:

J/Es for sales and deferral of GP are same as in installment method

Cash 245,000

Installment A/R (2003) 40,000

Installment A/R (2004) 125,000

Installment A/R (2005) 80,000

All cash collected in 2003 can be recognized as GP because costs

covered in 2004

2004 GP to be recognized: 190,000 100,000 125,000 = 35,000

No GP for 2005: 168,000 80,000 = 88,000

Deferred GP, 2003 sales 40,000

Deferred GP, 2004 sales 35,000

Recognized GP 75,000

The Cost Recovery Method

Vous aimerez peut-être aussi

- Statement of Cash Flows: Preparation, Presentation, and UseD'EverandStatement of Cash Flows: Preparation, Presentation, and UsePas encore d'évaluation

- Recenue Recognition PDFDocument33 pagesRecenue Recognition PDFVinay GoyalPas encore d'évaluation

- ACCT550 Homework Week 1Document6 pagesACCT550 Homework Week 1Natasha DeclanPas encore d'évaluation

- Process Lockboxes 190421Document11 pagesProcess Lockboxes 190421Maria ChavezPas encore d'évaluation

- Chapter 14 SolutionsDocument11 pagesChapter 14 Solutionssalsabilla rpPas encore d'évaluation

- Session 2Document17 pagesSession 2SylvesterPas encore d'évaluation

- CH 19 SMDocument26 pagesCH 19 SMNafisah MambuayPas encore d'évaluation

- Financial Data MartDocument9 pagesFinancial Data Martvvnssatish0% (1)

- Jawaban P5-6 Intermediate AccountingDocument3 pagesJawaban P5-6 Intermediate AccountingMutia WardaniPas encore d'évaluation

- Corporate FinanceDocument5 pagesCorporate FinancejahidkhanPas encore d'évaluation

- Tugas Chapter 15Document12 pagesTugas Chapter 15Ach Junaidi Irham FauziPas encore d'évaluation

- Revenue Recognition Accounting TheoryDocument4 pagesRevenue Recognition Accounting TheorychristoperedwinPas encore d'évaluation

- Advanced Accounting 11 Ed Chapter 2 PowerPointsDocument26 pagesAdvanced Accounting 11 Ed Chapter 2 PowerPointsIdiomsPas encore d'évaluation

- CH 12Document2 pagesCH 12flrnciairn100% (1)

- Giachetti, Ronald E. - Design of Enterprise Systems - Theory, Architecture, and Methods (2010, CRC Press) - Páginas-229-261Document33 pagesGiachetti, Ronald E. - Design of Enterprise Systems - Theory, Architecture, and Methods (2010, CRC Press) - Páginas-229-261Loraynne Beatriz Amaya MarmolPas encore d'évaluation

- Rangkuman Chapter 9 Cost of CapitalDocument4 pagesRangkuman Chapter 9 Cost of CapitalDwi Slamet RiyadiPas encore d'évaluation

- Tugas Chapter 6 - Sandra Hanania - 120110180024Document4 pagesTugas Chapter 6 - Sandra Hanania - 120110180024Sandra Hanania PasaribuPas encore d'évaluation

- FORMAT-Jurnal JAEMB UpdateDocument2 pagesFORMAT-Jurnal JAEMB UpdateevasariPas encore d'évaluation

- TerDocument7 pagesTerShalsa ByllaPas encore d'évaluation

- Present Value TableDocument2 pagesPresent Value TableNagham Abdel RazakPas encore d'évaluation

- Week 4Document5 pagesWeek 4Erryn M. ParamythaPas encore d'évaluation

- AccountingDocument8 pagesAccountingDarshan SomashankaraPas encore d'évaluation

- Lecture 6.1-General Cost Classifications (Problem 1)Document3 pagesLecture 6.1-General Cost Classifications (Problem 1)Nazmul-Hassan Sumon100% (4)

- Chapter 17 Notes INVESTMENTSDocument14 pagesChapter 17 Notes INVESTMENTSBusiness Administration DepartmentPas encore d'évaluation

- Kelompok 6 - Tugas Case 7-4Document9 pagesKelompok 6 - Tugas Case 7-4Jaisyur Rahman SetyadharmaatmajaPas encore d'évaluation

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123Document3 pagesFinancial Accounting - Tugas 5 - 18 Sep - REVISI 123AlfiyanPas encore d'évaluation

- CH 21 SMDocument45 pagesCH 21 SMNafisah Mambuay100% (1)

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaPas encore d'évaluation

- Kunci Jawaban Bab 5 Manajemen Biaya CompressDocument10 pagesKunci Jawaban Bab 5 Manajemen Biaya Compressrilakkuma6Pas encore d'évaluation

- Supply Planning in Microsoft Dynamics NAV 2013Document66 pagesSupply Planning in Microsoft Dynamics NAV 2013George Baciu100% (1)

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksPas encore d'évaluation

- Simple Finance - The Convergence of The GL Account and The Cost ElementDocument12 pagesSimple Finance - The Convergence of The GL Account and The Cost Elementjoseph davidPas encore d'évaluation

- Jawaban TugasDocument7 pagesJawaban TugasRani AdhirasariPas encore d'évaluation

- A. B. C. D.: Soal Final Simulasi IDocument12 pagesA. B. C. D.: Soal Final Simulasi IAndre LiuPas encore d'évaluation

- CH 01Document71 pagesCH 01Arya WisanggeniPas encore d'évaluation

- Waterways Problem WeygDocument10 pagesWaterways Problem WeygRoselina Baez50% (2)

- Face Amount 5,000,000 Cost 4,562,000 Bond Discount 438,000Document2 pagesFace Amount 5,000,000 Cost 4,562,000 Bond Discount 438,000Tin BatacPas encore d'évaluation

- Akuntansi Keuangan LanjutanDocument28 pagesAkuntansi Keuangan LanjutanYulitaPas encore d'évaluation

- CH 5Document2 pagesCH 5tigger5191Pas encore d'évaluation

- Assignment ..Document5 pagesAssignment ..Mohd Saddam Saqlaini100% (1)

- Twelve Cases of AccountingDocument152 pagesTwelve Cases of AccountingregiscardosoPas encore d'évaluation

- Modern Advanced Accounting Group AssignmentDocument1 pageModern Advanced Accounting Group Assignmentmohamed dahir Abdirahmaan100% (1)

- Intermediate Accounting III Homework Chapter 18Document15 pagesIntermediate Accounting III Homework Chapter 18Abdul Qayoum Awan100% (1)

- Bab 9 AkmDocument44 pagesBab 9 Akmcaesara geniza ghildaPas encore d'évaluation

- ch04 PDFDocument4 pagesch04 PDFMosharraf HussainPas encore d'évaluation

- Intermediate Financial Accounting Study NotesDocument23 pagesIntermediate Financial Accounting Study NotesSayTing ToonPas encore d'évaluation

- BMGT 321 Chapter 11 HomeworkDocument9 pagesBMGT 321 Chapter 11 HomeworkarnitaetsittyPas encore d'évaluation

- FACTORY OVERHEAD Discussion-DDocument11 pagesFACTORY OVERHEAD Discussion-DMaviel SuaverdezPas encore d'évaluation

- Be Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItDocument12 pagesBe Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItHappy MichaelPas encore d'évaluation

- Digital Currency Impact On Finance and Accounting. R21CC125Document8 pagesDigital Currency Impact On Finance and Accounting. R21CC125Vishal SPas encore d'évaluation

- Pertanyaan Bab 14 Accounting Information System RomneyDocument3 pagesPertanyaan Bab 14 Accounting Information System RomneyRiriPas encore d'évaluation

- Portfolio Optimization and Monte Carlo SimulationDocument96 pagesPortfolio Optimization and Monte Carlo Simulationmaha rehmanPas encore d'évaluation

- Contoh Soal Laporan Arus KasDocument2 pagesContoh Soal Laporan Arus KasGabriel HarrisPas encore d'évaluation

- Profitability of Products and Relative ProfitabilityDocument5 pagesProfitability of Products and Relative Profitabilityshaun3187Pas encore d'évaluation

- Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldDocument27 pagesIntermediate Accounting, 11th Ed. Kieso, Weygandt, and Warfieldheart05100% (1)

- CB and Cash Flow (FM Keown10e Chap10Document70 pagesCB and Cash Flow (FM Keown10e Chap10Hasrul HashomPas encore d'évaluation

- Financial Accounting - NotesDocument28 pagesFinancial Accounting - NotesKathrinaRodriguezPas encore d'évaluation

- Acctg For Special Transaction - 3rd Lesson PDFDocument9 pagesAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaPas encore d'évaluation

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorPas encore d'évaluation

- Cash Flows Capital BudgetingDocument57 pagesCash Flows Capital Budgetingvivek patelPas encore d'évaluation

- Analytics: A Practical GuideDocument41 pagesAnalytics: A Practical GuideKevin SmithPas encore d'évaluation

- Wrestle To Be The Man Philosophy Wished To Make You': Marcus Aurelius, Reflective PractitionerDocument9 pagesWrestle To Be The Man Philosophy Wished To Make You': Marcus Aurelius, Reflective PractitionerKevin SmithPas encore d'évaluation

- Start Making MoviesDocument163 pagesStart Making MoviesKevin Smith100% (4)

- Unit 1: Page ! - The Art of Storytelling: Your Hero's Journey 1 Sunyi - CoDocument35 pagesUnit 1: Page ! - The Art of Storytelling: Your Hero's Journey 1 Sunyi - CoKevin SmithPas encore d'évaluation

- Film Documentary Script Writing Process Ijariie1273 Volume 1 14 Page 7 12Document6 pagesFilm Documentary Script Writing Process Ijariie1273 Volume 1 14 Page 7 12Kevin SmithPas encore d'évaluation

- How To Learn Anything Faster With The Feynman TechniqueDocument6 pagesHow To Learn Anything Faster With The Feynman TechniqueKevin Smith100% (3)

- Rebt MemeDocument3 pagesRebt MemeKevin SmithPas encore d'évaluation

- Epictetus' Role Ethics, II: Specific Roles in An Individual's LifeDocument3 pagesEpictetus' Role Ethics, II: Specific Roles in An Individual's LifeKevin SmithPas encore d'évaluation

- Warren Buffett - 50% ReturnDocument4 pagesWarren Buffett - 50% ReturnKevin SmithPas encore d'évaluation

- 10 Intelligence KuperwasserDocument40 pages10 Intelligence KuperwasserKevin SmithPas encore d'évaluation

- Earnings Power ValueDocument2 pagesEarnings Power ValueKevin SmithPas encore d'évaluation

- A Conversation With Benjamin GrahamDocument4 pagesA Conversation With Benjamin GrahamKevin SmithPas encore d'évaluation

- Quality Earnings ChecklistDocument7 pagesQuality Earnings ChecklistKevin SmithPas encore d'évaluation

- V20 - 11 Financial Institutions Fair Value SurveyDocument20 pagesV20 - 11 Financial Institutions Fair Value SurveyKevin SmithPas encore d'évaluation

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurPas encore d'évaluation

- Pandora Jewelry LTD: A Brief of Marketing AnalysisDocument4 pagesPandora Jewelry LTD: A Brief of Marketing AnalysisKomal AroraPas encore d'évaluation

- Frameworks - IIMADocument8 pagesFrameworks - IIMAParth SOODANPas encore d'évaluation

- UntitledDocument2 pagesUntitledRegir Adil100% (1)

- IAS 12 - Income TaxesDocument7 pagesIAS 12 - Income TaxesNdila mangalisoPas encore d'évaluation

- Matching Internal Audit Talent To Organizational NeedsDocument20 pagesMatching Internal Audit Talent To Organizational NeedsEuglena Verde100% (1)

- Amazoncom CaseDocument11 pagesAmazoncom Caseobros_bps2003Pas encore d'évaluation

- Mr. Clean ToolkitDocument6 pagesMr. Clean ToolkitAsad AbbasPas encore d'évaluation

- Introduction To Economics Exercise Chapter TwoDocument5 pagesIntroduction To Economics Exercise Chapter TwoNebiyu NegaPas encore d'évaluation

- Business-Level Strategy: Part 2 Strategic Actions: Strategy FormulationDocument47 pagesBusiness-Level Strategy: Part 2 Strategic Actions: Strategy FormulationDiabyPas encore d'évaluation

- Purchase Order Freight Terms: Revision # Date: Buyer: Ship ToDocument2 pagesPurchase Order Freight Terms: Revision # Date: Buyer: Ship ToMohammed Abdul FaheemPas encore d'évaluation

- Gentry (1988) - State of The Art of Short Run Financial ManagementDocument68 pagesGentry (1988) - State of The Art of Short Run Financial ManagementVasiliki PavlidouPas encore d'évaluation

- All Chepter of ProjectDocument56 pagesAll Chepter of ProjectMohammad Salim HossainPas encore d'évaluation

- Report Sample SssDocument20 pagesReport Sample Sssuser namePas encore d'évaluation

- Introduction To Inventory ManagementDocument71 pagesIntroduction To Inventory ManagementJane LobPas encore d'évaluation

- 4Ms PDFDocument4 pages4Ms PDFRedkylle敬.Pas encore d'évaluation

- Unit 4 - Limiting Factor Lecture NotesDocument5 pagesUnit 4 - Limiting Factor Lecture NotesBarby Angel93% (14)

- Azad Products MGT-600Document3 pagesAzad Products MGT-600Abusufian SajibPas encore d'évaluation

- WholesaleDocument23 pagesWholesaledjumekenziPas encore d'évaluation

- Theoretical Foundations of Firm InternationalizationDocument59 pagesTheoretical Foundations of Firm InternationalizationJoel ChineduPas encore d'évaluation

- A Market Plan: Unit 2 Marketing EssentialsDocument16 pagesA Market Plan: Unit 2 Marketing EssentialsML FastTrackPas encore d'évaluation

- R22 Capital Structure Q Bank PDFDocument6 pagesR22 Capital Structure Q Bank PDFZidane KhanPas encore d'évaluation

- Hul Sales and DistrubutionDocument23 pagesHul Sales and DistrubutionKrishna Praveen PuliPas encore d'évaluation

- Financial Management Assignment - Capitulo 14Document4 pagesFinancial Management Assignment - Capitulo 14Luis Tomas Vazquez BobadillaPas encore d'évaluation

- Glo Marketing 12Document5 pagesGlo Marketing 12Anonymous x4mrSXPas encore d'évaluation

- Corporate Branding Thesis PDFDocument8 pagesCorporate Branding Thesis PDFsarahgriffinbatonrouge100% (2)

- CA Chapter 15-03-05Document14 pagesCA Chapter 15-03-05D DPas encore d'évaluation

- Managerial Economics - Concepts and ToolsDocument20 pagesManagerial Economics - Concepts and ToolsBopzilla0911100% (1)

- Group: B Lecturer: Mohamad Safiai Bin Saad Submission Date: 25 March 2018Document10 pagesGroup: B Lecturer: Mohamad Safiai Bin Saad Submission Date: 25 March 2018nguyễnthùy dươngPas encore d'évaluation

- Cash Flow AnalysisDocument29 pagesCash Flow AnalysisUmer Zaheer100% (1)