Académique Documents

Professionnel Documents

Culture Documents

Smwe

Transféré par

vatimetro20120 évaluation0% ont trouvé ce document utile (0 vote)

43 vues8 pagesINDUSTRY MARKET RESEARCH for BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS 767 beta drive Cleveland, OH 44143-2326 USA Toll Free US Tel: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 www.freedoniagroup.com Table of Contents 2 List of Tables and Charts 3 Study Overview 4 Sample Text, Table & Chart 5 Sample Profile, Table and

Description originale:

Titre original

smwe

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentINDUSTRY MARKET RESEARCH for BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS 767 beta drive Cleveland, OH 44143-2326 USA Toll Free US Tel: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 www.freedoniagroup.com Table of Contents 2 List of Tables and Charts 3 Study Overview 4 Sample Text, Table & Chart 5 Sample Profile, Table and

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

43 vues8 pagesSmwe

Transféré par

vatimetro2012INDUSTRY MARKET RESEARCH for BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS 767 beta drive Cleveland, OH 44143-2326 USA Toll Free US Tel: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 www.freedoniagroup.com Table of Contents 2 List of Tables and Charts 3 Study Overview 4 Sample Text, Table & Chart 5 Sample Profile, Table and

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 8

INDUSTRY MARKET RESEARCH FOR BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS

767 Beta Drive

Cleveland, OH 44143-2326 USA

Toll Free US Tel: 800.927.5900 or +1 440.684.9600

Fax: +1 440.646.0484

E-mail: info@freedoniagroup.com

The Freedonia Group

www.freedoniagroup.com

Table of Contents 2

List of Tables & Charts 3

Study Overview 4

Sample Text, Table

& Chart 5

Sample Prole, Table &

Forecast 6

Order Form 7

About Freedonia, Custom

Research, Related Studies,

Corporate Use License 8

CLICK TO VIEW

US Industry Study with Forecasts for 2014 & 2019

Study #2639 | July 2010 | $4900 | 388 pages

Electronic Security Systems

Study #2639

July 2010

$4900

388 Pages

Electronic Security Systems

US Industry Study with Forecasts for 2014 & 2019

Page 2 Order now, click here!

Click here to purchase online

Table of Contents

EXECUTIVE SUMMARY

MARKET ENVIRONMENT

General ...................................................... 4

Demographic & Social Environment ................. 6

Demographic Trends .................................. 7

Employment Outlook ................................10

Macroeconomic Environment .........................12

Building Construction Outlook .......................16

Residential Building Construction ...............18

Nonresidential Building Construction ..........20

Building Stock Trends ..................................23

Residential Building Stock ........................24

Nonresidential Building Stock ....................27

Business Establishment Trends ......................29

Motor Vehicle Outlook ..................................31

Public Safety Environment ............................34

Crime .....................................................35

Violent Crimes .....................................37

Property Crimes ....................................39

Terrorism/Other Nonconventional Crimes ..42

Terrorism .........................................43

Other Nonconventional Crimes ............44

Fire .......................................................45

Pricing Dynamics ........................................48

Legal & Regulatory Environment ....................51

International Environment ............................54

World Electronic Security Markets ...............54

Foreign Trade ..........................................56

TECHNOLOGY

General .....................................................59

Electronics Overview ....................................60

Electronic Components & Systems ..............61

Information Technology ............................63

Electronic Security Technologies ....................65

Sensors ..................................................65

Automatic Identication ...........................68

Systems Integration .................................69

Environmental Control/Building Automation 69

PRODUCTS

General .....................................................71

Access Controls ...........................................75

Card-Based Access Controls .......................79

Technologies .......................................80

Suppliers ............................................83

Biometric Access Controls .........................83

Technologies .......................................86

Suppliers ............................................88

Keypad/Combination Access Controls ..........89

Alarms ......................................................91

Local Alarms ...........................................94

Smoke Detectors ..................................95

Types ..............................................97

Suppliers .........................................98

Local Intrusion Alarms ..........................99

Carbon Monoxide Detectors .................. 101

Types ............................................ 103

Suppliers ....................................... 104

Central Station Alarms ............................ 105

Intrusion .......................................... 107

Fire & Smoke ..................................... 108

Suppliers .......................................... 109

Direct Connect Alarms ............................ 109

Fire & Smoke ..................................... 111

Intrusion .......................................... 112

Suppliers .......................................... 112

PERS & Related Alarms ........................... 112

Closed-Circuit Television Systems ................. 115

Cameras ............................................... 119

Monitors .............................................. 122

Recording Equipment ............................. 123

Other Components ................................. 125

Suppliers .............................................. 126

Contraband Detection Systems .................... 127

Products ............................................... 129

Bulk EDS ........................................... 131

Metal Detectors, X-rays &

Advanced Imaging Systems ................ 133

Trace Detectors .................................. 135

Suppliers .............................................. 136

Electronic Article Surveillance Systems ......... 137

Products ............................................... 140

Suppliers .............................................. 143

Automotive & Other Electronic

Security Products .................................... 144

Automotive Security Systems ................... 145

Anti-Theft Systems ............................. 146

Keyless Entry Systems ......................... 146

Vehicle Recovery Systems .................... 147

All Other ........................................... 148

MARKETS

General ................................................... 151

Government & Institutional ........................ 154

Sector Outlook ...................................... 155

Electronic Security Outlook ..................... 156

Government ....................................... 158

Institutions ....................................... 159

Industrial ................................................ 161

Sector Outlook ...................................... 162

Electronic Security Outlook ..................... 164

Trade & Distribution .................................. 167

Sector Outlook ...................................... 169

Electronic Security Outlook ..................... 171

Air Transport ............................................ 175

Sector Outlook ...................................... 176

Electronic Security Outlook ..................... 177

Financial Institutions ................................ 181

Sector Outlook ...................................... 181

Electronic Security Outlook ..................... 183

Ofce & Lodging Establishments .................. 185

Sector Outlook ...................................... 186

Electronic Security Outlook ..................... 188

Services ................................................... 191

Sector Outlook ...................................... 191

Electronic Security Outlook ..................... 192

Consumer ................................................. 194

Sector Outlook ...................................... 195

Electronic Security Outlook ..................... 197

Residential ........................................ 199

Automotive ....................................... 202

INDUSTRY STRUCTURE

General ................................................... 204

Industry Composition ................................ 205

Market Share ............................................ 210

Research & Product Development ................. 214

Manufacturing .......................................... 216

Marketing & Distribution ............................ 217

Mergers & Acquisitions ............................... 220

Cooperative Agreements ............................. 224

COMPANY PROFILES

American Science and Engineering ............... 228

Analogic Corporation ................................. 231

ASSA ABLOY ............................................. 234

Bosch (Robert) ......................................... 241

Brady ...................................................... 247

Checkpoint Systems ................................... 249

Danaher................................................... 252

DataCard.................................................. 255

Diebold ................................................... 258

Federal Signal ........................................... 262

General Electric ........................................ 265

Hitachi .................................................... 268

Honeywell International ............................. 270

Ingersoll-Rand .......................................... 279

Jarden ..................................................... 283

Johnson Controls ...................................... 285

(continued on following page)

Study #2639

July 2010

$4900

388 Pages

Electronic Security Systems

US Industry Study with Forecasts for 2014 & 2019

Page 3 Order now, click here!

Click here to purchase online

List of Tables/Charts

EXECUTIVE SUMMARY

1 Summary Table ...................................... 3

MARKET ENVIRONMENT

1 Populations & Households ...................... 9

2 Employment Outlook .............................12

3 Macroeconomic Indicators .....................15

4 Building Construction Expenditures .........18

5 Residential Building Construction

Expenditures ....................................20

6 Nonresidential Building Construction

Expenditures ....................................23

7 Housing Stock by Type ..........................26

Cht Year of Construction of

Housing Stock, 2009 .........................27

8 Nonresidential Building Stock.................29

9 Business Establishments ........................31

10 Motor Vehicle Indicators ........................34

Cht US Crime Rates, 1998-2008 ....................37

11 Violent Crime Levels .............................39

12 Property Crime Levels ............................42

13 Other Crimes ........................................45

14 Fire Levels & Losses ..............................48

Cht World Electronic Security

System Market, 2009 .........................56

15 US Foreign Trade of Electronic

Security Systems ...............................58

TECHNOLOGY

1 Electronic & Computer Product Shipments 61

2 Nonresidential Fixed Investment .............65

PRODUCTS

1 Electronic Security System

Supply & Demand ..............................74

Cht Electronic Security System

Demand by Product Type, 2009 ...........75

2 Electronic Access Control

Supply & Demand ..............................78

Cht Electronic Access Control Demand

by Product Type, 2009 .......................78

3 Card-Based Access Control

Demand by Product Type ....................80

4 Biometric Access Control Demand

by Product Type ................................86

5 Keypad/Combination Access

Control Demand ................................90

6 Alarm System Supply & Demand ..............93

Cht Alarm System Demand

by Product Type, 2009 .......................93

7 Local Alarm Demand by Product Type.......95

8 Smoke Detector Demand by Product Type .97

9 Local Intrusion Alarm Demand .............. 100

10 Carbon Monoxide Detector Demand ....... 103

11 Central Station Alarm Demand

by Product Type .............................. 107

12 Direct Connect Alarm Demand

by Product Type .............................. 111

13 Personal Emergency Response Service

(PERS) & Related Alarm Demand ....... 115

14 Closed-Circuit Television

System Supply & Demand ................. 118

Cht Closed-Circuit Television System

Demand by Component, 2009 ........... 118

15 Closed-Circuit Television Camera Demand 122

16 Closed-Circuit Television

Monitor Demand ............................. 123

17 Closed-Circuit Television Recording

Equipment Demand ......................... 125

18 Other Closed-Circuit Television

Component Demand ........................ 126

19 Contraband Detection System

Supply & Demand ............................ 129

20 Contraband Detection System

Demand by Product Type .................. 130

Cht Contraband Detection System

Demand by Product Type, 2009 ......... 130

21 Electronic Article Surveillance

System Supply & Demand ................. 139

Cht Electronic Article Surveillance System

Demand by Product Type, 2009 ......... 140

22 Automotive & Other Electronic Security

Supply & Demand ............................ 145

MARKETS

1 Electronic Security System

Demand by Market .......................... 153

Cht Electronic Security System

Demand by Market, 2009 .................. 154

2 Government & Institutional

Sector Indicators ............................ 156

3 Government & Institutional Sector

Electronic Security Market ................ 158

4 Industrial Sector Indicators ................. 164

5 Industrial Electronic Security Market ..... 167

6 Retail Sales ....................................... 171

7 Trade & Distribution Electronic

Security Market .............................. 175

8 Air Carrier Outlook .............................. 177

9 Air Transport Electronic Security Market . 180

10 Financial Sector Indicators .................. 182

11 Financial Institutions Electronic

Security Market .............................. 185

12 Ofce & Lodging Construction

Expenditures & Building Space .......... 188

13 Ofce & Lodging Electronic

Security Market .............................. 190

14 Service Sector Revenues/Establishments 192

15 Service Sector Electronic Security Market 194

16 Consumer Sector Indicators .................. 197

17 Consumer Electronic Security Market ..... 199

18 Residential Electronic Security Market.... 202

19 Consumer Automotive Electronic

Security Market .............................. 203

INDUSTRY STRUCTURE

1 Electronic Security Sales

by Company, 2009 ........................... 209

Cht Electronic Security System

Market Share, 2009 ......................... 211

2 Selected Acquisitions & Divestitures ...... 222

3 Selected Cooperative Agreements .......... 225

COMPANY PROFILES

(continued from previous page)

JVC KENWOOD Holdings .............................. 288

L-1 Identity Solutions ................................ 290

L-3 Communications .................................. 297

MDI ........................................................ 301

Motorola .................................................. 304

NAPCO Security Technologies ...................... 306

Nortek ..................................................... 311

OSI Systems ............................................. 314

Panasonic ................................................ 319

Royal Philips Electronics ............................ 324

Schneider Electric ..................................... 326

Science Applications International ............... 330

Sielox...................................................... 334

Siemens ................................................... 338

Smiths Group............................................ 343

Sony ....................................................... 347

Stanley Black & Decker .............................. 350

Thermo Fisher Scientic ............................. 355

3M .......................................................... 358

Tyco International ..................................... 361

United Technologies .................................. 370

Vicon Industries........................................ 382

Additional Companies Mentioned in Study ..... 386

Table of Contents

Study #2639

July 2010

$4900

388 Pages

Electronic Security Systems

US Industry Study with Forecasts for 2014 & 2019

Page 4 Order now, click here!

US demand to increase

9.3% yearly through 2014

Sales of electronic security products and

systems in the US are expected to

increase 9.3 percent per year to $17

billion in 2014. Growth will be driven in

large part by a strong cyclical rebound in

construction and capital investment

spending from a low 2009 base, follow-

ing a period of economic contraction and

a tight credit environment. Ongoing

technological improvements and falling

prices will motivate customers to up-

grade existing systems or install new

ones. Ultimately, the main driver of

demand for electronic security equip-

ment is the perceived risk of crime.

Americans perception of crime risk has

trended upward, despite actual crime

rates having trended downward.

Access controls to offer

best growth opportunities

Access controls represent the largest

and fastest growing product segment.

Demand for access controls is forecast

to grow 12.8 percent annually through

2014. Advances will be driven by interest

in automating security and thus reducing

the need for traditional alternatives, such

as keys and security personnel. Demand

will also beneft from the continued roll-

out of new technology, such as smart

cards and biometrics, and the increasing

adoption of these higher-value technolo-

gies. Relatively mature access control

technologies, such as magnetic stripe

cards and keypad systems, will continue

to be used in many applications due to

their low cost and simplicity. In 2009,

alarms accounted for the second largest

share of electronic security equipment

demand due to their widespread use in

most markets. Sales of new alarms are

forecast to increase 7.2 percent annually

through 2014, driven by a cyclical

recovery in business and consumer

spending, especially residential building

expenditures.

Strong growth forecast

for largest markets

The consumer sector represented the

largest market for electronic security

equipment in 2009, with 26 percent of

total demand, which was split about

evenly between residential and automo-

tive applications. This segment is

projected to expand 8.5 percent per year

through 2014, refecting a cyclical

rebound in consumer spending and

motor vehicle production from a low

2009 base. The government and institu-

tional market accounted for the second

largest share of sales, with 18 percent.

Favorable demographic trends will

support security spending in institutional

facilities, as the graying of the American

population will drive construction expen-

ditures for health care facilities, and

migration patterns will fuel school

construction in newer suburbs, espe-

cially in the South and West. However,

the government sector will be restrained

by changing priorities and concerns

about the federal budget defcit.

Copyright 2010 The Freedonia Group, Inc.

Click here to purchase online

Americans perception of crime risk coupled with ongoing technological improvements and fall-

ing prices will motivate customers to upgrade existing security systems or install new ones.

US Electronic Security System

Demand, 2009

($10.9 billion)

Access Controls

37%

Contraband

Detection 10%

Alarms

19%

CCTV

10%

Automotive

Security & Other

24%

p

h

o

t

o

:

R

e

d

b

u

s

I

n

t

e

r

h

o

u

s

e

Study #2639

July 2010

$4900

388 Pages

Electronic Security Systems

US Industry Study with Forecasts for 2014 & 2019

Page 5 Order now, click here!

Click here to purchase online

PRODUCTS

Alarms

The market for electronic security alarms is projected to increase

7.2 percent per year to $2.9 billion in 2014. Although this rate of growth

is slower than that expected for electronic security systems as a whole,

it nonetheless represents a signifcant acceleration for this relatively

mature market from a low 2009 base. The year 2009 was unusually poor

for alarm sales because the recession that began in December 2007 was

associated with an especially sharp drop in residential building construc-

tion, and many households and businesses put off any spending that

could be postponed. Going forward, gains will be driven by a cycli-

cal recovery in consumer and business spending, especially residential

building expenditures. Growth of demand for traditional intrusion and

fre alarms is driven by new building construction -- residential and

nonresidential -- as well as periodic replacement of old alarms. Demand

for electronic security alarms will also beneft from improving business

and household cash fow, which will facilitate replacement or upgrade of

aging alarms. Additionally, upgrades will be motivated by availability of

new technology, such as wireless connectivity, digital transmission and

integration with automated building controls.

Shipments of electronic alarm systems from US facilities will

increase 3.7 percent annually to $1.5 billion in 2014, reversing a down-

trend in shipments in the 2004-2009 period. However, the increase in

shipments will be much slower than the increase in sales, due to strong

growth in imports. Production of easily shipped and relatively low-tech-

nology electronic products continues to migrate to overseas facilities. In

some cases, US brand-owners have expanded their own overseas produc-

tion facilities or outsourced production to foreign contract manufactur-

ers, and in other cases foreign companies have increased penetration

of the US market. Alarm and detector manufacturers such as Diebold,

Honeywell International, Jarden and NAPCO Security Technologies

have generally increased manufacturing or outsourcing activities outside

91

Copyright 2010 The Freedonia Group, Inc.

SAMPLE

TEXT

Sample Text,

Table & Chart

TABLE IV-1

ELECTRONIC SECURITY SYSTEM SUPPLY & DEMAND

(million dollars)

Item 1999 2004 2009 2014 2019

Private Fixed Investment (bil $) 1581 1904 1750 2650 3445

$ security/000$ investment 3.6 4.6 6.2 6.4 7.3

Electronic Security System Demand 5680 8665 10900 17000 25200

Access Controls 1550 2505 4000 7300 13000

Alarms 1960 2355 2020 2860 3550

Closed-Circuit Television 660 1120 1140 1600 2100

Contraband Detection 190 570 1080 1500 2000

Electronic Article Surveillance 350 495 460 620 650

Automotive Security & Other 970 1620 2200 3120 3900

- net imports 906 1430 1935 3100 4600

Electronic Security System Shipments 4774 7235 8965 13900 20600

SAMPLE

TABLE

CHART VI-1

ELECTRONIC SECURITY SYSTEM MARKET SHARE

($10.9 billion, 2009)

M a rke t

L e a d e rs

4 4 . 6 %

A l l O t h e rs

5 5 . 4 %

Sch n eid er

Sm it h s

L - 3

U T C

GE

H o n eywell

T yco

2.5%

2.8%

3.0%

4.1%

8.3%

9.2%

14.7%

SAMPLE

CHART

Study #2639

July 2010

$4900

388 Pages

Electronic Security Systems

US Industry Study with Forecasts for 2014 & 2019

Page 6 Order now, click here!

Click here to purchase online

Analogic Corporation

8 Centennial Drive

Peabody, MA 01960

978-326-4000

http://www.analogic.com

Revenues: $396 million (FY 2009)

US Revenues: $155 million (FY 2009)

Employment: 1,450 (FY 2009)

Key Products: explosives and weapons detection systems

Analogic is a leading designer and producer of advanced security

and medical imaging systems and subsystems for original equipment

manufacturers (OEMs). The Company operates through fve segments:

Security Technology Products, Medical Imaging Products, B-K Medi-

cal, Digital Radiography Products, and Corporate and Other.

The Company is involved in the US electronic security prod-

ucts industry through the Security Technology Products segment,

which generated FY 2009 revenues of $49 million. Via this segment,

Analogic makes and sells advanced explosives and weapons detection

systems and subsystems. These systems include EXACT, ONGUARD,

KING COBRA and XLB types.

Products -- EXACT systems utilize multislice computed tomog-

raphy (CT) technologies to detect explosives, weapons and other forms

of contraband. These systems feature high-effciency, multi-row, solid-

state X-ray detectors and wide-dynamic-range data acquisition systems

to take images every one-half degree. These images are then recon-

structed into three-dimensional (3-D), axial and projection images of

the entire contents of a bag or parcel. The EXACT systems detection

231

Copyright 2010 The Freedonia Group, Inc.

COMPANY PROFILES

TABLE V-9

AIR TRANSPORT ELECTRONIC SECURITY MARKET

(million dollars)

Item 1999 2004 2009 2014 2019

Air Carrier Revenue (bil $) 119.0 134.3 179.0 230.0 315.0

$ security/000$ revenue 1.7 3.9 5.3 6.2 7.3

Air Transport Electronic Security Market 205 530 940 1420 2295

Access Controls 75 145 310 620 1240

Alarms 25 40 35 40 50

Closed Circuit Television 20 40 45 80 110

Contraband Detection 80 295 530 650 850

Electronic Article Surveillance -- -- 5 10 20

Other Products 5 10 15 20 25

% air transport 3.6 6.1 8.6 8.4 9.1

Electronic Security System Demand 5680 8665 10900 17000 25200

Sample Prole,

Table & Forecast

The market for electronic security

products and systems in the air transport

sector is projected to rise 8.6 percent per

year through 2014 to $1.4 billion. This

is far below the growth rate experienced

during the post-2001 air transport secu-

rity buildup since the systems to satisfy

air safety regulations are now largely in

place. Spending on airport security held

up better than most other sectors during

the recession that began in December

2007 because of ...

--Section V, pg. 177

SAMPLE

PROFILE

SAMPLE

TABLE

The Freedonia Group, Inc. 767 Beta Drive Cleveland, OH 44143-2326 USA Web site: www.freedoniagroup.com

Tel US: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 e-mail: info@freedoniagroup.com

ORDER INFORMATION

Five Convenient Ways to Order

Title

Fax

Company

Division

Street

City/State/Zip

Country

Phone

Name

(No PO Box please)

Signature

ORDER FORM

Electronic Security Systems ................................... $4900

Additional Print Copies @ $600 each *

Total (including selected option) $

Enclosed is my check (5% discount) drawn on a US bank and payable to

The Freedonia Group, Inc., in US funds (Ohio residents add 7.75% sales tax)

Corporate Use License (add to study price) * +$2600

F-WEB.2639

Signature

Signature

Page 7

Corporate Use License

Now every decision maker in your organization can act on the key intelligence found in all

Freedonia studies. For an additional $2600, companies receive unlimited use of an electronic

version (PDF) of the study. Place it on your intranet, e-mail it to coworkers around the world,

or print it as many times as you like,

Click here to learn more about

the Corporate Use License

Corporate Use License Agreement

The above captioned study may be stored on the companys intranet or

shared directory, available to company employees. Copies of the study may

be made, but the undersigned represents that distribution of the study will

be limited to employees of the company.

* Please check appropriate option and sign below to order an electronic

version of the study.

Individual Use License Agreement

The undersigned hereby represents that the above captioned study will be

used by only ___ individual(s) who are employees of the company and that

the study will not be loaded on a network for multiple users. In the event

that usage of the study changes, the Company will promptly notify Freedo-

nia of such change and will pay to Freedonia the appropriate fee based on

Freedonias standard fee schedule then in effect. Note: Entire company cor-

porate use license, add $2600; one additional user, add $600; two additional

users, add $1200; three additional users, add $1800.

Bill my company Visa MasterCard American Express

Orders Outside of the US

Checks must be made payable in US funds,

drawn against a US bank and mailed directly to

The Freedonia Group. For wire transfers please

contact our customer service department at info@

freedoniagroup.com. Credit cards accepted.

ONLINE: www.freedoniagroup.com

MAIL: Print out and complete the order

form and send to The Freedonia Group

(see address at the bottom of this form)

PHONE: Call toll free, 800.927.5900

(US) or +1 440.684.9600

FAX: +1 440.646.0484 (US)

EMAIL: info@freedoniagroup.com

Free Handling & Shipping

There is NO charge for handling or UPS shipping

in the US. Expect delivery in 3 to 5 business days.

Outside the US, Freedonia provides free airmail

service. Express delivery is available at cost.

Save 15%

If you order three (3) different titles at the same

time, you can receive a 15% discount. If your

order is accompanied by a check or wire transfer,

you may take a 5% cash discount (discounts do

not apply to Corporate Use Licenses).

Credit Card Orders

For convenience, Freedonia accepts American Ex-

press, MasterCard or Visa. Credit card purchases

must include account number, expiration date and

authorized signature.

MM YY

Credit Card # Expiration

INDUSTRY MARKET RESEARCH FOR BUSINESS

LEADERS, STRATEGISTS, DECISION MAKERS

About The Freedonia Group

The Freedonia Group, Inc., is a leading international industry market research com-

pany that provides its clients with information and analysis needed to make informed

strategic decisions for their businesses. Studies help clients identify business oppor-

tunities, develop strategies, make investment decisions and evaluate opportunities

and threats. Freedonia research is designed to deliver unbiased views and reliable

outlooks to assist clients in making the right decisions. Freedonia capitalizes on

the resources of its proprietary in-house research team of experienced economists,

professional analysts, industry researchers and editorial groups. Freedonia covers a

diverse group of industries throughout the United States, the emerging China mar-

ket, and other world markets. Industries analyzed by Freedonia include:

Chemicals Plastics Life Sciences Packaging Building Materials Security

& Electronics Industrial Components & Equipment Automotive & Transportation

Equipment Household Goods Energy/Power Equipment

The Freedonia Group, Inc. 767 Beta Drive Cleveland, OH 44143-2326 USA Web site: www.freedoniagroup.com

Tel US: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 e-mail: info@freedoniagroup.com

Freedonia Custom Research

Freedonia Custom Research delivers the same high quality, thorough and unbiased

assessment of an industry or market as an industry study. Since the research initia-

tive is based upon a companys specifc needs, companies harness Freedonias

research capabilities and resources to answer unique questions. When you leverage

the results of a Freedonia Custom Research engagement, you are able to obtain

important answers to specifc questions and issues associated with: mergers and

acquisitions, new product launches/development, geographic expansion, entry into

new markets, strategic business planning, and investment and funding decisions.

Freedonia Custom Research is ideal for companies seeking to make a strategic dif-

ference in the status quo and focus on future business growth. Working side by side

with clients, Freedonias team is able to defne a research project that is custom-

tailored to answer specifc questions and provide the basis from which a company

can make informed business decisions.

Click here to learn more about Freedonia

Click here to learn more about Custom Research

Page 8

Click here for complete title list

OTHER STUDIES

INDUSTRY MARKET RESEARCH FOR BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS

Click here to visit freedoniagroup.com

Home Organization Products

US demand for home organization products will rise

4.3% annually through 2013. Bins, baskets and totes

will remain the largest group while modular units grow

the fastest. Garage units will overtake family room

products as the second largest segment, with closet

organizers also doing well. This study analyzes the

$7.2 billion US home organization product indus-

try, with forecasts for 2013 and 2018 by material,

product, room and market. It also evaluates company

market share and profles industry players.

#2527 .................. July 2009 .................... $4600

Commercial & Residential

Cleaning Services

Revenues for contract commercial and residential

cleaning services are forecast to advance 4.5%

yearly through 2013. Exterior building cleaning will

be one of the fastest growing services, while interior

cleaning remains dominant. Residential and institu-

tional buildings will see the biggest market gains. This

study analyzes the $53.6 billion US commercial and

residential cleaning service industry, with forecasts

for 2013 and 2018 by service, market and US region.

It also evaluates company market share and profles

industry players.

#2581 ................January 2010 ................. $4700

World Security Equipment

Global security equipment demand will rise 7.4%

yearly through 2014. China, India, Russia and Turkey

will see rapid growth, while North America posts

gains well above average from a low 2009 base.

Electronic security products will remain dominant

and greatly outpace mechanical types. This study

analyzes the $70 billion world security equipment

industry, with forecasts for 2014 and 2019 by product,

market, world region and for 28 countries. It also

evaluates company market share and profles indus-

try participants.

#2669 ...............December 2010 ................ $6100

Private Security Services

US sales of private contractual security services will

rise 4.9% yearly through 2014. Guarding and alarm

monitoring will remain the largest segments while

pre-employment screening, systems integration and

management, and consulting will grow the fastest.

The residential market will outpace nonresidential

uses. This study analyzes the $49.8 billion US private

security service industry, with forecasts for 2014 and

2019 by type, market and US region. It also evaluates

company market share and profles industry players.

#2675 .............. November 2010 ................ $4900

Sensors

Demand for sensors in the US will rise 6.1% annually

to 2014. The motor vehicle market will grow the fast-

est based on a rebound in motor vehicle production

and the rising use of newer sensor-laden systems.

Proximity and positioning and chemical property

sensors will be the fastest growing types. This study

analyzes the $9.7 billion US sensors industry, with

forecasts for 2014 and 2019 by product and market.

The study also reviews sensor technology, evaluates

company market share and profles industry players.

#2662 .............. September 2010................ $4900

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Shock Absorber DynamometerDocument19 pagesShock Absorber DynamometerUmanath R Poojary100% (1)

- Promt MidjourneyDocument2 pagesPromt MidjourneyMarcelo PaixaoPas encore d'évaluation

- Ahsmrw30dam SD101Document48 pagesAhsmrw30dam SD101ibrahimPas encore d'évaluation

- SPC & MSA PresentationDocument84 pagesSPC & MSA PresentationRaajha Munibathiran100% (3)

- For Calibration List - OrginalDocument62 pagesFor Calibration List - Orginaluttam khatriPas encore d'évaluation

- Silver Nano ParticleDocument70 pagesSilver Nano Particleasad ullah100% (1)

- The Rising Tide of US Electronic Payments: White PaperDocument11 pagesThe Rising Tide of US Electronic Payments: White Papervatimetro2012Pas encore d'évaluation

- Firewall Geometric Design-SaiTejaDocument9 pagesFirewall Geometric Design-SaiTejanaveenPas encore d'évaluation

- 25 Powerful Business English Presentation Phrases To Impress Your AudienceDocument3 pages25 Powerful Business English Presentation Phrases To Impress Your AudienceMutia ChimoetPas encore d'évaluation

- Building Information Modeling BIM Systems and TheiDocument13 pagesBuilding Information Modeling BIM Systems and Theipurvakul10Pas encore d'évaluation

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012Pas encore d'évaluation

- Syetem ElectronicDocument27 pagesSyetem Electronicvatimetro2012Pas encore d'évaluation

- Airberlin GB2012 enDocument176 pagesAirberlin GB2012 envatimetro2012Pas encore d'évaluation

- U04N RISI Free ProfileDocument11 pagesU04N RISI Free Profilevatimetro2012Pas encore d'évaluation

- Nigerian-German Chemicals PLC (NGC PLC) : Corporate ProfileDocument29 pagesNigerian-German Chemicals PLC (NGC PLC) : Corporate Profilevatimetro2012Pas encore d'évaluation

- Summary Kuch MannDocument6 pagesSummary Kuch Mannvatimetro2012Pas encore d'évaluation

- Annual Report 2013Document118 pagesAnnual Report 2013vatimetro2012Pas encore d'évaluation

- German Country Supplement MGI Funds PLC 310314Document3 pagesGerman Country Supplement MGI Funds PLC 310314vatimetro2012Pas encore d'évaluation

- AC 29 2cincorporatedDocument1 109 pagesAC 29 2cincorporatedzzudhirPas encore d'évaluation

- Hi 8586pdiDocument9 pagesHi 8586pdiDunkMePas encore d'évaluation

- Shell Gadus S3 T100 PDFDocument1 pageShell Gadus S3 T100 PDFAgung BaskaraPas encore d'évaluation

- Sangfor NGAF Introduction 8.0.5 FinalDocument24 pagesSangfor NGAF Introduction 8.0.5 FinalAlbarn Paul AlicantePas encore d'évaluation

- Syllabus New PDFDocument107 pagesSyllabus New PDFmassPas encore d'évaluation

- LibisDocument39 pagesLibisAngelika CalingasanPas encore d'évaluation

- Course Add Drop Form For Ug Course 1718T2 PDFDocument1 pageCourse Add Drop Form For Ug Course 1718T2 PDFArtyomPas encore d'évaluation

- TELEC-Dwg-Al Khater Plastic FactoryDocument8 pagesTELEC-Dwg-Al Khater Plastic FactoryRENJITH K NAIRPas encore d'évaluation

- Void Acoustics 2017 BrochureDocument28 pagesVoid Acoustics 2017 BrochureCraig ConnollyPas encore d'évaluation

- Seminar ReportDocument27 pagesSeminar ReportnitinPas encore d'évaluation

- OpenSAP Byd4 Week 5 Unit 5 Additional ExerciseDocument2 pagesOpenSAP Byd4 Week 5 Unit 5 Additional ExerciseHong YangPas encore d'évaluation

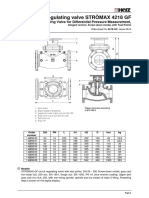

- Circuit Regulating Valve STRÖMAX 4218 GFDocument14 pagesCircuit Regulating Valve STRÖMAX 4218 GFMario Mô Ri APas encore d'évaluation

- G1 Group 1CDocument72 pagesG1 Group 1CNH SyzlnPas encore d'évaluation

- Sneha Foundation PlusDocument17 pagesSneha Foundation PlusBikash KumarPas encore d'évaluation

- RX-78GP03S Gundam - Dendrobium Stamen - Gundam WikiDocument5 pagesRX-78GP03S Gundam - Dendrobium Stamen - Gundam WikiMark AbPas encore d'évaluation

- 9A01304 Fluid MechanicsDocument4 pages9A01304 Fluid MechanicssivabharathamurthyPas encore d'évaluation

- Sample Acceptable Use Policy From Southern Regional High SchoolDocument4 pagesSample Acceptable Use Policy From Southern Regional High Schoolapi-356000194Pas encore d'évaluation

- Swifty Loudspeaker KitDocument5 pagesSwifty Loudspeaker KitTNPas encore d'évaluation

- A Project Report On DMRCDocument22 pagesA Project Report On DMRCRahul Mehrotra100% (1)

- New DatabaseDocument18 pagesNew DatabaseShafiq RosmanPas encore d'évaluation

- Fundamentals of ElectronicsDocument2 pagesFundamentals of ElectronicsatulzendePas encore d'évaluation