Académique Documents

Professionnel Documents

Culture Documents

Astro

Transféré par

ThenewsminuteDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Astro

Transféré par

ThenewsminuteDroits d'auteur :

Formats disponibles

imagine

A NNUA L R E P ORT

07

...a world of non-stop

excitement, channels & choices

stimulating talent inspiring content

over 20 unique, multi-genre,

multi-lingual TV channels and growing

for Asias multi-faceted, fast-growing

and increasingly sophisticated audience

TRANSCENDING

lifestyles...

Over 24,000 hours of original

programming and 1,700 hours of

in-house productions. Award-winning

shows, innovative services and new

products. Because our customers

deserve the best.

cartoons

drama

comedy

action

platforms...

publications

new media

mobile

More than RM5 billion invested in media

infrastructure and content since the inception of Astro.

Enabling customers to access our growing range

of services - whenever and wherever they are.

& borders

Bringing our experience, expertise and balance sheet

strength to complementary markets in Asia.

Working with regional partners to reach new customers.

2 ASTRO ALL ASI A NETWORKS pl c

Inside

Letter from the Chairman 4 Key Performance Indicators 6 Accolades 10 Calendar Highlights 12

Board of Directors 14 Board of Directors Proles 16 Group Management 18 The Year In Review 24

Risk Factors 29 Our Businesses 32 Corporate Social Responsibility 54 Our Staff 56

Corporate Governance Statement 58 Audit Committee Report 62 Statement on Internal Control 64

LEVERAGING

Television

our brands

Radio

ASTRO ALL ASI A NETWORKS pl c 3

Malay Filmed

Entertainment

Talent

Management Animation

Directors Report and Audited Statutory Financial Statements 66 Additional Disclosures 147

Share Price Performance 156 Financial Calendar 156 Analysis of Shareholdings 157

Corporate Information 163 Notice of Annual General Meeting 164 Statement Accompanying Notice

of Fourth Annual General Meeting 166 Form of Proxy Regional Ofces

Publications

TV Channels and

Global Content Distribution

DEAR SHAREHOLDERS

I am pleased to present the Annual Report 2007 for

ASTRO ALL ASIA NETWORKS plc or ASTRO as it will

be referred to in the rest of this Report.

Over the past year we continued to build on our core

competencies, with improved performance in our key

operating units. Our Astro pay-TV subscriber base

grew to 2.016 million residential subscribers as at

the end of the nancial year ended 31 January 2007.

Our radio networks in Malaysia remain market leaders

in terms of listenership and share of customers

advertising expenditure, with a weekly listenership of

about 11 million listeners.

We made signicant progress in our content

development efforts as we launched the Astro

Entertainment Network (AEN), a collection of over

20 TV channels with locally-packaged proprietary

content for broadcast on our Astro platforms in Asia.

These channels are the driver for both acquisition of

new customers and viewership among existing ones.

I am condent that we will benet from our increasing

knowledge and experience of producing and marketing

original content as we seek to develop business

opportunities in other Asian markets, including India,

China and Indonesia.

Progress has been made over the past year in

expanding our businesses into overseas markets

where we can leverage our core skills and capabilities.

In April 2007, we announced a joint-venture with the

Sun Group in India, one of the countrys leading media

groups. The planned Direct-To-Home (DTH) satellite

TV venture will allow us to participate in the fast-

growing Indian consumer market. In China, through

our alliance with local partners, we have launched an

airtime marketing venture, initially focusing on radio

syndication, with the possibility of expanding into other

media platforms across the country.

Within the region, we are working to formalise our

participation in the pay-TV business in Indonesia.

Progress has been slower and more difcult than we

had expected. Nonetheless, we remain committed

to this market. We currently produce ve channels

in Bahasa Indonesia using home-grown talent and

production teams, over and above procuring local and

international content from third parties.

Letter

4 ASTRO ALL ASI A NETWORKS pl c

ASTRO ALL ASI A NETWORKS pl c 123

30 COMMITMENTS (CONT D. )

(c) Operating lease commitments (non-cancellable)

The future aggregate minimum lease payments under non-cancellable operating leases are as follows:

2007 2006

RM000 RM000

Not later than 1 year 5,774 434

Later than 1 year and not more than 5 years 6,632 9,580

Later than 5 years 11,054 12,527

23,460 22,541

31 CONTINGENT LIABILITIES

The Group have provided guarantees to third parties amounting to RM33,367,000 (2006: RM27,216,000), of which RM30,986,000 was in respect of working

capital facilities secured by associates and RM2,381,000 in respect of licence fees in subsidiaries.

32 SIGNIFICANT POST BALANCE SHEET EVENTS

Participation in multi-channel digital satellite pay television in India

Subsequent to the year-end, the Group on 5 April 2007, has agreed to participate in a joint-venture for the provision of Direct-to-Home (DTH) digital satellite

television services in India, with Kalanithi Maran, Promoter and Chairman of Sun Network including the agship company Sun TV Network Limited and Kavery

Kalanithi, collectively referred to as the Maran Group. The proposal will be subject to approval of ASTROs shareholders and fullment of certain other mutually

agreed conditions.

Under the proposed transaction, South Asia Entertainment Holdings Limited, a wholly owned subsidiary within the Group, will invest up to USD166 million by

subscribing for new shares representing 20% of the enlarged capital of Sun Direct TV Private Limited (Sun Direct), a company incorporated in India with a license

to provide DTH television services across the country. The Maran Group will hold an 80% interest in Sun Direct.

33 SUBSIDIARIES

All of the subsidiaries have been included in the consolidated nancial statements. Details of principal subsidiaries are shown below:

Country of Class Effective interest

Name of subsidiary incorporation of shares 2007 2006 Principal activities

% %

Directly held by the Company

ASTRO Overseas Limited (AOL) Bermuda Ordinary 100 100 Investment holding

MEASAT Broadcast Network Systems Malaysia Ordinary 100 100 Providing Direct-to-Home satellite

Sdn. Bhd. (MBNS) broadcasting services

MEASAT Publications Sdn. Bhd. (MPUB) Malaysia Ordinary 100 100 Magazine publication and distribution

ASTRO Productions Sdn. Bhd. (APRD) Malaysia Ordinary 100 100 Production and distribution of

television drama programmes

ASTRO Shaw Sdn. Bhd. (ASSB) Malaysia Ordinary 100 100 Production and distribution of lms

MBNS Multimedia Technologies Sdn. Bhd. Malaysia Ordinary 100 100 Research and development of

multimedia related technologies

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 January 2007

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Full Text: SC Order Convicting Sasikala in DA CaseDocument570 pagesFull Text: SC Order Convicting Sasikala in DA CaseAaron PereiraPas encore d'évaluation

- BCCI Secretary LetterDocument1 pageBCCI Secretary LetterThenewsminutePas encore d'évaluation

- Perumal Murugan - Madhorubagan Book - Madras HV VerdictDocument160 pagesPerumal Murugan - Madhorubagan Book - Madras HV VerdictThenewsminute100% (1)

- Karnataka HC Jayalalithaa Bail Rejection OrderDocument46 pagesKarnataka HC Jayalalithaa Bail Rejection OrderThenewsminutePas encore d'évaluation

- Faceless & Forgotten - Photo EssayDocument17 pagesFaceless & Forgotten - Photo EssayThenewsminutePas encore d'évaluation

- Sabyasachi Panda's LetterDocument40 pagesSabyasachi Panda's LetterThenewsminutePas encore d'évaluation

- National Herald Order June 26, 2014Document20 pagesNational Herald Order June 26, 2014ThenewsminutePas encore d'évaluation

- Gen. VK Singh's Letter To The Minister of Home Affairs On 9th Dec 2013Document10 pagesGen. VK Singh's Letter To The Minister of Home Affairs On 9th Dec 2013ThenewsminutePas encore d'évaluation

- Draft Resdraft Resolution HRC25/1 "Promoting Reconciliation, Accountability, and Human Rights in Sri Lanka"Document4 pagesDraft Resdraft Resolution HRC25/1 "Promoting Reconciliation, Accountability, and Human Rights in Sri Lanka"Ada DeranaPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Audit of InventoriesDocument4 pagesAudit of InventoriesVel JunePas encore d'évaluation

- Watching The Watchers - Conducting Ethnographic Research On Covert Police Investigation in The UKDocument16 pagesWatching The Watchers - Conducting Ethnographic Research On Covert Police Investigation in The UKIleana MarcuPas encore d'évaluation

- Local Development Investment Program, CY 2012 To 2014Document61 pagesLocal Development Investment Program, CY 2012 To 2014Lgu Leganes100% (21)

- Infineon TOOL Tutorial Memtool XMC1 TR v01 00 enDocument46 pagesInfineon TOOL Tutorial Memtool XMC1 TR v01 00 enplasma411ny100% (1)

- Private Mergers and Acquisitions Due Diligence Checklist: Preliminary Questions and OrganizationDocument10 pagesPrivate Mergers and Acquisitions Due Diligence Checklist: Preliminary Questions and OrganizationMeo U Luc LacPas encore d'évaluation

- Macasaet Vs Macasaet DigestDocument1 pageMacasaet Vs Macasaet DigestRyan Suaverdez50% (2)

- Chartering TermsDocument9 pagesChartering TermsNeha KannojiyaPas encore d'évaluation

- Czech Republic: Jump To Navigation Jump To SearchDocument5 pagesCzech Republic: Jump To Navigation Jump To SearchRadhika PrasadPas encore d'évaluation

- SPA Liability FormDocument2 pagesSPA Liability FormfoxcitiesstarsPas encore d'évaluation

- NRDA NOC Received For A FileDocument2 pagesNRDA NOC Received For A FileMuktesh SwamyPas encore d'évaluation

- THE Story OF THE Rizal LAW (RA 1425) : FilibusterismoDocument5 pagesTHE Story OF THE Rizal LAW (RA 1425) : FilibusterismoKristine PangahinPas encore d'évaluation

- 17025-2017..1Document109 pages17025-2017..1حسام رسمي100% (2)

- Concept of Race 1Document6 pagesConcept of Race 1api-384240816Pas encore d'évaluation

- Sunday DeductionDocument250 pagesSunday DeductionMuhammad NadeemPas encore d'évaluation

- CivproDocument60 pagesCivprodeuce scriPas encore d'évaluation

- House Site Pattas Details - Bogole MandalDocument36 pagesHouse Site Pattas Details - Bogole MandalnikhileshkumarPas encore d'évaluation

- Intellectual CapitalDocument3 pagesIntellectual CapitalMd Mehedi HasanPas encore d'évaluation

- Deposits: CA. Pramod JainDocument23 pagesDeposits: CA. Pramod JainNishant RajPas encore d'évaluation

- BS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsDocument16 pagesBS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsHiệpBáPas encore d'évaluation

- The Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFDocument218 pagesThe Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFKyaw ZinPas encore d'évaluation

- Belgica vs. Ochoa, G.R. No. 208566Document52 pagesBelgica vs. Ochoa, G.R. No. 208566Daryl CruzPas encore d'évaluation

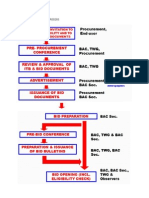

- Bidding Process For Procurement Process and DPWHPDFDocument9 pagesBidding Process For Procurement Process and DPWHPDFGerardoPas encore d'évaluation

- Narrative Report PE 04 1Document10 pagesNarrative Report PE 04 1Divine Mae Delmiguez GuimbaolibotPas encore d'évaluation

- Liberia Ok Physical Examination ReportcertDocument2 pagesLiberia Ok Physical Examination ReportcertRicardo AquinoPas encore d'évaluation

- Prakas On Accreditation of Professional Accounting Firm Providing... EnglishDocument12 pagesPrakas On Accreditation of Professional Accounting Firm Providing... EnglishChou ChantraPas encore d'évaluation

- Teachers Service Commission: Tender Document For Procurement of ServicesDocument56 pagesTeachers Service Commission: Tender Document For Procurement of ServicesinyasiPas encore d'évaluation

- Rebuttal Evidence - PlainitiffDocument6 pagesRebuttal Evidence - PlainitiffSonali CPas encore d'évaluation

- The Wall Street Journal - 19.09.2019Document42 pagesThe Wall Street Journal - 19.09.2019Nadia BustosPas encore d'évaluation

- Bunker HedgingDocument30 pagesBunker Hedgingukhalanthar100% (6)

- Critical Analysis of Anti-Competitive AgreementDocument13 pagesCritical Analysis of Anti-Competitive AgreementAddyAdityaLadha100% (1)