Académique Documents

Professionnel Documents

Culture Documents

Central Excise Non Tariff Notification No.22/2014 Dated 11th July, 2014

Transféré par

stephin k jCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Central Excise Non Tariff Notification No.22/2014 Dated 11th July, 2014

Transféré par

stephin k jDroits d'auteur :

Formats disponibles

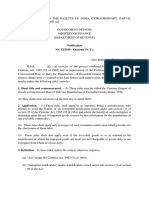

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION

3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification

No. 22/2014--Central Excise (N.T.)

New Delhi, the 11th July, 2014

G.S.R (E). In exercise of the powers conferred by sub-sections (2) and (3) of section

3A of the Central Excise Act, 1944 (1 of 1944), the Central Government hereby makes the

following rules further to amend the Pan Masala Packing Machines (Capacity Determination and

Collection of Duty) Rules, 2008, namely :-

1. (1) These rules may be called the Pan Masala Packing Machines (Capacity

Determination and Collection of Duty) Second Amendment Rules, 2014.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Pan Masala Packing Machines (Capacity Determination and Collection of Duty)

Rules, 2008, in FORM 2, in paragraph 4, for item (iv), the following item shall be substituted,

namely:-

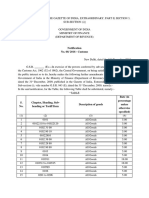

(iv) Break-up of duty payment for apportionment between various duties is as per details

below:-

Sl.

No.

Duty Duty ratio

for pan

masala

Duty paid

(in

rupees)

Duty ratio

for pan

masala

containing

tobacco

Duty

paid (in

rupees)

(1) (2) (3) (4) (5) (6)

1 The duty leviable under the

Central Excise Act, 1944

0.3453 0.7903

2 The additional duty of excise

leviable under section 85 of the

Finance Act, 2005

0.1294 0.0677

3 National Calamity Contingent 0.4962 0.1129

Duty leviable under section 136 of

the Finance Act, 2001

4 Education Cess leviable under

section 91 of the Finance Act,

2004

0.0194 0.0194

5 Secondary and Higher Education

Cess leviable under section 136 of

the Finance Act, 2007

0.0097 0.0097

[F No.334/15/2014-TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Note.- The principal rules were published in the Gazette of India, Extraordinary, Part II, Section

3, Sub-section (i), dated the 1

st

July, 2008 by notification No. 30/2008-Central Excise (N.T.),

dated the 1

st

July, 2008, vide number G.S.R.127 (E), dated the 1

st

July, 2008] and were last

amended by notification number 03/2014-Central Excise (N.T.), dated the 24

th

January, 2014,

published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-Section (i), vide number

G.S.R 58 (E), dated the 24

th

January, 2014.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Customs Circular No.10/2016 Dated 15th March, 2016Document4 pagesCustoms Circular No.10/2016 Dated 15th March, 2016stephin k jPas encore d'évaluation

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jPas encore d'évaluation

- Customs Circular No. 06/2015 Dated 11th February, 2015Document1 pageCustoms Circular No. 06/2015 Dated 11th February, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 13/2014 Dated 18th November, 2014Document3 pagesCustoms Circular No. 13/2014 Dated 18th November, 2014stephin k jPas encore d'évaluation

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 16/2015 Dated 19th May, 2015Document6 pagesCustoms Circular No. 16/2015 Dated 19th May, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 10/2014 Dated 17th October, 2014Document3 pagesCustoms Circular No. 10/2014 Dated 17th October, 2014stephin k jPas encore d'évaluation

- Customs Circular No. 03/2015 Dated 16th January, 2015Document2 pagesCustoms Circular No. 03/2015 Dated 16th January, 2015stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.54/2016 Dated 3rd October, 2016Document6 pagesCustoms Tariff Notifications No.54/2016 Dated 3rd October, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.30/2016 Dated 1st March, 2016Document6 pagesCustoms Non Tariff Notifications No.30/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.34/2016 Dated 29th February, 2016Document2 pagesCustoms Non Tariff Notifications No.34/2016 Dated 29th February, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.20/2016 Dated 8th February, 2016Document4 pagesCustoms Non Tariff Notifications No.20/2016 Dated 8th February, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.26/2016 Dated 16th February, 2016Document11 pagesCustoms Non Tariff Notifications No.26/2016 Dated 16th February, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.31/2016 Dated 1st March, 2016Document2 pagesCustoms Non Tariff Notifications No.31/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.22/2016 Dated 8th February, 2016Document9 pagesCustoms Non Tariff Notifications No.22/2016 Dated 8th February, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Digest - Tanada vs. TuveraDocument3 pagesDigest - Tanada vs. TuveraVloudy Mia Serrano PangilinanPas encore d'évaluation

- Vishwakarma Government Engineering College ChandkhedaDocument9 pagesVishwakarma Government Engineering College ChandkhedaVedant ThakkarPas encore d'évaluation

- Notes - Class - 10th - Social Science2023-24 KVSDocument55 pagesNotes - Class - 10th - Social Science2023-24 KVSsanjaymalakar087224100% (3)

- Hara Hara Tokei 1.0Document40 pagesHara Hara Tokei 1.0zhaleyleitnibPas encore d'évaluation

- Council of Red Men Vs Veteran ArmyDocument2 pagesCouncil of Red Men Vs Veteran ArmyCarmel LouisePas encore d'évaluation

- What Really Happened at Paris The Story of The Peace Conference, 1918-1919 - House, Edward Mandell, 1858-1938 & Seymour, Charles, 1885-1963Document505 pagesWhat Really Happened at Paris The Story of The Peace Conference, 1918-1919 - House, Edward Mandell, 1858-1938 & Seymour, Charles, 1885-1963Anonymous vnTWqRDmLPas encore d'évaluation

- I C Booking AgreementDocument3 pagesI C Booking AgreementlorenzomossmanPas encore d'évaluation

- Court upholds workers' right to form associationDocument18 pagesCourt upholds workers' right to form associationJerry SerapionPas encore d'évaluation

- Booking Report 7-29-2020Document2 pagesBooking Report 7-29-2020WCTV Digital Team100% (1)

- Pak301 Assignment No 1Document2 pagesPak301 Assignment No 1Razzaq MalikPas encore d'évaluation

- Argosy November 3, 2011Document32 pagesArgosy November 3, 2011Geoff CampbellPas encore d'évaluation

- Let's Hear It For The BoyDocument48 pagesLet's Hear It For The Boyapi-26032005Pas encore d'évaluation

- The Meaning ofDocument12 pagesThe Meaning ofAnonymous ORqO5yPas encore d'évaluation

- Nandinee (211839)Document17 pagesNandinee (211839)dattananddineePas encore d'évaluation

- Npa CBP RequestDocument5 pagesNpa CBP RequestWashington ExaminerPas encore d'évaluation

- Nationalism and Globalization Are Two Concepts That Have Been Debated For CenturiesDocument2 pagesNationalism and Globalization Are Two Concepts That Have Been Debated For Centuriesjohn karloPas encore d'évaluation

- Filed & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkDocument6 pagesFiled & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkChapter 11 DocketsPas encore d'évaluation

- Columbia Roosevelt Review 2012Document71 pagesColumbia Roosevelt Review 2012Sarah ScheinmanPas encore d'évaluation

- WEF GRR18 Report PDFDocument80 pagesWEF GRR18 Report PDFZerohedgePas encore d'évaluation

- Circassian Resistance To Russia, by Paul B. HenzeDocument32 pagesCircassian Resistance To Russia, by Paul B. HenzecircassianworldPas encore d'évaluation

- Simmons J ResumeDocument1 pageSimmons J Resumeapi-317605998Pas encore d'évaluation

- Letter To Erie County Executive Kathy Dahlkemper From Erie County Councilman Kyle FoustDocument2 pagesLetter To Erie County Executive Kathy Dahlkemper From Erie County Councilman Kyle FoustMattMartinPas encore d'évaluation

- Ereno v. Public Service Commission (G.R. No. L-25962)Document3 pagesEreno v. Public Service Commission (G.R. No. L-25962)Rache GutierrezPas encore d'évaluation

- Sexual Harassment Quiz Master With AnswersDocument4 pagesSexual Harassment Quiz Master With AnswersTUSHAR 0131% (171)

- I. Heijnen - Session 14Document9 pagesI. Heijnen - Session 14Mădălina DumitrescuPas encore d'évaluation

- Media and Information Literacy: Quarter 3, Week 3 Types of Media: Print, Broadcast and New MediaDocument7 pagesMedia and Information Literacy: Quarter 3, Week 3 Types of Media: Print, Broadcast and New MediaIkay CerPas encore d'évaluation

- Personal Laws IIDocument12 pagesPersonal Laws IIAtulPas encore d'évaluation

- Hall - The Secret Lives of Houses Women and Gables in The 18 C Cape - ReducedDocument13 pagesHall - The Secret Lives of Houses Women and Gables in The 18 C Cape - ReducedAbhishek AndheePas encore d'évaluation

- Mankin v. United States Ex Rel. Ludowici-Celadon Co., 215 U.S. 533 (1910)Document5 pagesMankin v. United States Ex Rel. Ludowici-Celadon Co., 215 U.S. 533 (1910)Scribd Government DocsPas encore d'évaluation

- Essay 1Document6 pagesEssay 1api-273268490100% (1)