Académique Documents

Professionnel Documents

Culture Documents

Total-Annual Report 2011

Transféré par

Rachele Q RegisCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Total-Annual Report 2011

Transféré par

Rachele Q RegisDroits d'auteur :

Formats disponibles

nergies!

S

h

a

r

i

n

g

O

u

r

PERSPECTIVES 2011 / ANNUAL REPORT

Oil and gas are our core business. Exploring,

discovering and bringing new fields on stream

drive our growth.

Confronted with a demanding competitive

environment, Total is adapting and evolving.

An integrated business model, competitiveness

and industrial excellence are our lead strengths.

Preparing the energy future means making

clear choices now. Photovoltaic solar energy

and biomass are the two resources were

promoting.

Being in the right place at the right time is the name

of the game. The Middle East and the Asia-Pacific

region are experiencing economic booms. Now more

than ever, were there on the spot.

GROW

OPTIMIZE

DIVERSIFY

EXPAND

01 POINTERS

02 WHO WE ARE

03 OUR STRATEGIC VISION

04 MESSAGE FROM THE

CHAIRMAN & CEO

We need profits in order

to invest, stay financially

healthy and deliver

shareholder return.

Its vital to move forward

regardless of the business

environment.

Christophe de Margerie,

Chairman & Chief Executive Officer

08 Oil and Gas Still Very Much

in the Picture

09 Expanding Our Acreage

10 Boldness Pays Off in Exploration

12 A Conversation with Marc Blaizot,

Senior Vice President,

Exploration

14 High Technology

in the Deep Offshore

17 New Natural Gas Resources

20 The Promise of

Unconventional Gas

22 Downstream and Chemicals

Reorganize

24 Conversations with Patrick Pouyann,

President of Refining & Chemicals,

and Philippe Boisseau, President

of Supply & Marketing

27 World-Class Industrial Facilities

29 A Conversation with Bernadette

Spinoy, Senior Vice President,

Refining & Petrochemicals Eastern

Hemisphere

36 A Place in the Sun

38 A Conversation with

Jean-Yves Daclin, Vice President,

Photovoltaic Solar

39 Meeting the Challenges

of Biotechnology

08

Energy reinvents itself every day, constantly

becoming more efficient, accessible, creative

even astonishing.

INNOVATE

40 Energy for People Without

42 Filling Up the Total Concept Car

with Inventions

44 Total access and Total Ecosolutions

40

22

36

30

1

2

4

9

Lets take

a chance on

new ideas!

An unexpected showcase

of our know-how.

Total scales up

in photovoltaic

solar energy.

Understanding

the dynamics

of emerging

markets.

Whether you plan to scan our report

quickly or read every word of it, our

estimated times for a selection of

articles will help you decide which

ones to pick based on how many

minutes you have to spare.

30 Jubail, a Refinery Deep in the Desert

32 A New Wind Blows Across

the Middle East

33 Exciting Developments

in Asia

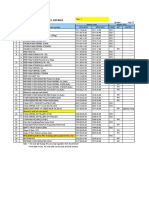

45 OUR 2011 PERFORMANCE

50 CORPORATE GOVERNANCE

52 SHAREHOLDERS NOTEBOOK

54 GLOSSARY

4

Two new businesses

to enhance

competitiveness

and agility.

CONTENTS

Total is more of a global energy operator

than ever. We continue to grow in our original

business oil and gas exploration and

production discovering giant fields and

bringing on stream projects such as Pazflor and

Usan. We are also becoming a major renewable

energy company, especially in solar and biomass.

Lastly, we are fine-tuning our integrated

business model to optimize the synergies among

our activities and become more agile at serving

our markets. All to achieve a single goal:

constantly improving our ability to meet

the worlds energy needs.

JUNE 15

Spotlight on solar: Total

becomes a global leader

in the photovoltaic industry

after acquiring a majority

stake in SunPower.

AUGUST 26

Production begins from

the Pazflor field in Angola,

an extraordinary offshore

development.

SEPTEMBER 9

Oil is discovered on French

territory or, more

accurately, offshore

French Guiana.

OCTOBER 10

Downstream and Chemicals'

reorganization announced,

to enhance their industrial

competitiveness and

marketing performance.

NOVEMBER 8

Total celebrates 20 years

in Russia, a strategic region

in terms of natural gas

resources. We are now

a shareholder in Novatek.

BILLION

Sales

184.7

BILLION

Gross capital expenditure

24.5

BILLION

Adjusted net income

11.4

INTEGRATED, INTERNATIONAL

OIL COMPANY in the world

5

th-

RANKED LISTED,

EMPLOYEES

worldwide

96,104

Operations in more than

130

COUNTRIES

Use your smartphone to read

this QR code, found throughout

the report, and go to the mini-site at

http://annual-report.total.com

Words

highlighted

in gray

are defined

in the glossary.

2

0

1

1

,

a

y

e

a

r

o

f

c

h

a

n

g

e

01 POINTERS PERSPECTIVES 2011 ANNUAL REPORT

top-tier international oil company, Total is also a global gas and petrochemical

operator. Today, in response to soaring energy demand, we are stepping up our expansion

into solar and biomass. Going forward, we define ourselves as an energy company. Our mission

is to enable as many people as possible to access energy. To do that we are counting first

and foremost on oil and gas, which are far from being depleted. Our oil and gas activities

range from exploration and production to refining,

shipping and trading.

Choices to Help Us Diversify

We are also investing in renewable energies,

opting to branch out into photovoltaic solar

energy and biomass in particular. We have

moved up our timeline for capital expenditure

in those sectors, so that we can offer efficient,

reliable solutions to partner fossil energies.

Total is also a world-class chemical producer.

We make polymers as well as fertilizers, leveraging our integrated business model to do so.

We also produce specialty chemicals, an activity that encompasses elastomer processing,

adhesives and electroplating.

GROW INNOVATE DIVERSIFY DISCOVER PRODUCE EXCELLENCE SHARE OPTIMIZE MEET BOLDNESS SUCCESS CROSS-

L O O K A H E A D L I S T E N I N G G R O W I N N O V A T E D I V E R S I F Y D I S C O V E R P R O D U C E E X C E L L E N C E S H A R E O P T I M I Z E M E E T B O L D N E S S

F

U

N

C

T

I

O

N

A

L

I

T

Y

P

E

R

F

O

R

M

A

N

C

E

C

R

E

A

T

I

V

E

S

E

R

V

I

C

E

S

A

F

E

T

Y

M

U

T

U

A

L

S

U

P

P

O

R

T

L

O

C

A

L

P

R

E

S

E

N

C

E

Q

U

A

L

I

T

Y

D

E

V

E

L

O

P

S

U

C

C

E

S

S

C

R

O

S

S

-

F

U

N

C

T

I

O

N

A

L

I

T

Y

P

E

R

F

O

R

M

A

N

C

E

C

R

E

A

T

I

V

E

S

E

R

V

I

C

E

S

A

F

E

T

Y

M

U

T

U

A

L

S

U

P

P

O

R

T

L

O

C

A

L

P

R

E

S

E

N

C

E

a

WE ARE AN

ENERGY COMPANY

Based in more than 130 countries,

our some 96,000 employees produce

the energy and products the world

needs while putting into practice

the four cornerstone behaviors

of the Total Attitude:

Boldness.

Mutual support.

Listening.

Cross-functionality.

02 WHO WE ARE

A

mbition

AA

To realize our ambition, we are leveraging our integrated business model, which enables us

to capture all of the synergies in our business base. Together, our commitment to ethical

practices, safety and corporate social responsibility form a shared foundation for our four

strategic objectives:

Drive profitable, sustainable growth in our exploration and production operations.

Develop competitive, top-tier refining and petrochemical platforms.

Respond to customer needs by delivering innovative solutions, particularly

in terms of energy efficiency.

Focus on two renewable energies, solar and biomass, to secure the energy future.

To responsibly enable as many

people as possible to access

energy in a world of constantly

growing demand.

Our vision is to be an energy company, a leading international oil company and a global operator

in gas, petrochemicals and, tomorrow, biomass and solar energy.

STRATEGIC

OUR

AA

Mission

AA

Our

VISION

TRATEGIC TRATEGIC

OUR

03 PERSPECTIVES 2011 ANNUAL REPORT - OUR STRATEGIC VISION

A Conversation

with

Christophe de Margerie,

chairman & CEO

We need profits in order

to invest, stay financially

healthy and deliver

shareholder return.

Its vital to move

forward regardless

of the business

environment.

MESSAGE FROM THE CHAIRMAN & CEO 04

IN 2011, OUR INTEGRATED

BUSINESS MODEL DEMONSTRATED

ITS EFFECTIVENESS

PHILIPPE MANIRE

is a consultant and

essayist. He spent

20 years as a journalist,

with publications such as

the daily Le Quotidien de

Paris, the business

weekly Le Nouvel

conomiste and the

weekly news magazine

Le Point, as well as on

radio stations Europe 1

and BFM.

He subsequently headed

the Institut Montaigne

think tank, which he left

in 2008 to set up his

own consulting firm,

Footprint > consultants,

to serve corporate

executives and public

decision-makers. He is

also a columnist for

weekly news magazine

LExpress and has

published several

essays, including 2012s

Le pays o la vie est plus

dure [The Country Where

Life is Harder].

Philippe Manire: Total experienced a serious

event in March 2012 a gas leak on the Elgin

wellhead platform in the North Sea. Doesnt it

call into question the safety of your facilities?

Christophe de Margerie: The Elgin gas leak is a serious

incident, but fortunately no one was hurt. The UK Depart-

ment of Environment and Climate Change itself has said

that the environmental impact is not significant, though

any impact at all is always unacceptable. Id like to empha-

size that the leak involves gas, not oil. We responded to

the situation by applying two fundamental principles.

One is personal safety, our top concern: the first deci-

sion we made was to evacuate everyone from the plat-

form. The second was transparency, both with respect

to the UK authorities, the general public and of course

our employees.

After BPs accident in the Gulf of Mexico, we reviewed

the integrity of all our sites, including the Elgin well-

head platform. Unfortunately that wasnt enough, but

we remain committed to safety. We must take steps

to ensure that such incidents do not happen again. We

must constantly strengthen the operational standards

of our businesses, and not just in the Upstream; refining

and road transportation, for example, are also, inevita-

bly, high-risk activities. We know that. We made

immense strides in 2011, sharply reducing the number

of incidents. But its not enough we must do better,

and then better still. Safety is more than ever Totals top

priority, and we focus on it every day.

P. M.: 2011 saw another business and financial

slump, which didnt stop Total from posting

profits of more than 11billion. You seem immune

to the recession unlike many households.

C. de M.: Were a long way from the record earnings of

2008, but a big part of who we are is an integrated

upstream-downstream company. As it happens, in the

area were investing in most heavily the upstream

we benefited from a favorable environment, with oil

prices averaging $111 a barrel for the year. The down-

stream situation is much more mixed, with refining as

a whole posting a deficit, petrochemicals hit by the

sharply deteriorating economy in the second half, and

marketing and specialty chemicals holding their own

quite well.

Remember that we need profits in order to invest, stay

financially healthy and deliver shareholder return. Thats

why its vital to keep reshaping our company, to allow it

to move forward and to maintain a satisfactory level of

profitability and capital expenditure regardless of the

business environment.

P. M.: How do you explain the startling

disconnect between oil prices and

the economy?

C. de M.: The fact is, oil is not an ordinary commodity: its

price is not, or not any longer, the result of a simple tug

of war between supply and demand. That is quite clear

right now, with prices climbing despite the fact that

theres enough oil to meet demand. So its not a problem

of reserves. Speaking of which, Total had a nearly 200%

reserve replacement rate, our best performance in a

long time.

The markets are actually factoring in geopolitical insta-

bility that could jeopardize not just supply, but also the

industrys ability to develop new reserves. Added to

Watch the video

interview with

Christophe

de Margerie.

05 PERSPECTIVES 2011 ANNUAL REPORT

that is the fact that oil is increasingly difficult to find

and more and more expensive to develop.

P. M.: The periods other troubling phenomenon

is the strong regional disparity in gas prices,

which are high in Asia but historically low

in North America. How do you explain that

and what are you doing to adapt to it?

C. de M.: The Fukushima accident sent demand for gas

soaring because gas, which is cleaner than coal and

even oil, is the best substitute for nuclear power. Thats

true all over the world, including in the United States,

where most power plants have switched over to gas.

Its even truer in Asia, where demand for energy is not

letting up. However, at the same time significant gas

finds were made in the United States. Since the U.S. market

has very few export capabilities, prices there have

plummeted, hence the geographic divide. Thanks to our

strong positions and recognized LNG know-how, Total

quickly adapted to the situation by shipping available

cargoes to the areas of highest demand, thereby enjoy-

ing better terms and conditions while helping to ease

the pressure in the market.

P. M.: The United States new production

consists mainly of shale gas. Its development

has often seriously damaged the areas

concerned, prompting France to ban it.

How do we balance peoples legitimate

concerns and the need to produce energy?

C. de M.: People have often generalized based on iso-

lated examples. Admittedly, some questionable methods

have been used in the past. They are not our methods.

At any rate, I notice that the United States has created

600,000 direct jobs in the shale gas industry, with very

positive impacts on growth. In France, where people

complain endlessly about deindustrialization, we need

to keep in mind that energy prices are a basic component

of industrial competitiveness: you cant simultaneously

demand lower prices and rely on imported gas and oil,

whose prices are rising.

Its our job to convince people that its possible to develop

this resource in France too, but cleanly. Meanwhile, weve

decided to join the quest in the countries that allow it,

the United States, Poland and also China, where this type

of unconventional gas is a major energy issue.

P. M.: Your goal was to position Total as a multi-

energy company and today you are very active

in photovoltaic solar energy. Regulations in

that field, too, are moving in a less-than-

favorable direction, with a decrease in feed-in

tariffs. Are you still interested in this sector,

which is languishing as a result of surplus

capacity?

C. de M.: Subsidies have in fact been cut in France and

several European countries. They were probably too

high to begin with, but its dangerous to play a go-stop-

go fiscal game that deprives businesses of the visibility

they need to invest for the long term. Im convinced that

solar has a place in the energy mix and that our invest-

ment in SunPower, whose technology is remarkable, will

pay off: todays surplus capacity will not last.

That said, we would be fooling ourselves to think that

renewable energies can replace fossil fuels overnight.

We have to realize that, given the scale of demand, the

world will need every available type of energy. By 2030,

renewable energies will rise to 4% of final demand from

1%, which is already a big jump. A responsible company

like Total cannot sit on the sidelines, for the planets

sake and also if we want to better serve our customers.

Here at Total, we made choices, which included develop-

ing solar energy in which weve become a major player

and biofuels. But fossil fuels as a share of global energy

demand, though declining, will only fall from 80% to

76% over the next 20 years, in a market that is growing

at a rate of 25% itself. So they will continue to play a

crucial role. That tells you how important it is that we

stay ambitious in our core business.

P. M.: Unlike some of your competitors,

you wanted to continue downstream

operations, but have reorganized them

into two new businesses, Refining

& Chemicals and Supply & Marketing.

C. de M.: Im a big believer in the idea that since were

responsible for producing oil, we should also be respon-

sible for selling it, profitably and efficiently. Before we

reorganized we had an integrated refining and market-

ing model, like most of the other majors.

06 MESSAGE FROM THE CHAIRMAN & CEO

By separating refining and marketing, we have created

two aligned businesses, both of which we are counting

on to generate profits and drive Totals growth. Were

not turning our back on our integrated business model,

but we are changing the way we integrate our activi-

ties. There is a real rationale for that decision. Refining

and petrochemicals are essentially the same fields. It

makes sense to consolidate them to make them stronger.

For its part, the new, independent Supply & Marketing

business will find it easier to advance our goals with

respect to retail distribution, a sector that still has sig-

nificant untapped growth potential globally.

P. M.: In the summer of 2011 you predicted

that gasoline prices would hit 2 a liter and

you took a lot of heat for it. In the spring

of 2012, they have. How does it feel to be

proved right? How do you see drivers worries

about fuel prices?

C. de M.: I did say that the 2 mark would be reached

some day, but I was hoping it would be as far in the

future as possible. The price of oil rose much faster

than expected and has been passed on in prices at the

pump, which have a retail margin this really cant be

repeated often enough of just one euro cent per liter.

Most of the price consists of taxes and, of course, the

price of oil. So the best way to hold prices down is to

produce more oil and more energy including non-

petroleum-based fuels such as biomass and biofuels

to ward off the risk of tight supply. So what I said about

gasoline prices shouldnt create anxiety: its a realistic

yet positive message, encouraging everyone involved

to become aware of the issues and challenges.

Total fully realizes the impact high gasoline prices have

on end consumers and we are constantly working to

find solutions. With the rollout of the Total access service

station concept in France, we are phasing in more compet-

itive solutions that will also help us regain market share.

Safety is more than ever

Total

s top priority, and

we focus on it every day.

07 PERSPECTIVES 2011 ANNUAL REPORT

Total had a highly productive year in 2011, discovering major fields,

bringing innovative projects on stream and making headway in LNG.

A bold plan of attack keeps our exploration and production activities growing.

ere more bullish than ever about the

future of oil and gas. With global energy demand

steadily rising, they have a vital role to play. In 2030,

fossil fuels will still make up 76% of the energy mix

and remain the most effective resources for meeting

needs.

We have set three goals to take our core business

forward: to continually replace our reserves , either

through new discoveries or partnerships with resource

holders; to maximize our existing production; and to

bring our building block projects on stream as quickly

as possible.

Of course, finding and producing oil and gas is grow-

ing ever more complex and technically demanding.

But our skills and expertise enable us to regularly

push the envelope. In 2011, we made major strides

and our reserves and production capacity climbed.

Higher Production Forecasts

We discovered major fields in Azerbaijan, Bolivia and

French Guiana. We brought Angolas giant Pazflor

field on stream and got ready to start up production

from Nigerias Usan which we did in early 2012.

These two deepwater finds required top-tier exper-

tise and cutting-edge technology. We finalized major

partnership agreements including with Novatek

in Russia giving us access to new gas reserves.

Lastly, we made further inroads in the fast-growing

unconventional oil and gas sector, by developing

projects or taking positions in Argentina, Australia,

Canada, Poland and the United States.

These accomplishments have allowed us to lift our

production growth forecasts to an average of 2.5%

a year between 2010 and 2015.

w

STILL VERY MUCH

IN THE PICTURE

as,

ENERGY MIX

All the energy

sources used

to meet demand.

oil

AND

08 GROW

UGANDA

FEBRUARY 2012

Finalization of the agreement

announced in March 2011 with Tullow

and CNOOC. Total has a 33.33%

working interest in the EA-1 (Total

operator) and EA-2 licenses , in the

Kanywataba license and in the

Kingfisher production license. All are

located in the Lake Albert region,

where oil resources have already been

discovered and which has significant

exploration potential.

MAURITANIA

JANUARY 2012

Acquisition of a 90% interest in two

licenses that we operate alongside

national oil company SMH (10%):

Block C9, spanning an area of more

than 10,000 square kilometers

roughly 140 kilometers offshore

western Mauritania, in water depths

ranging from 2,500 to 3,000 meters.

Block Ta 29 in the Taoudeni Basin,

1,000 kilometers east of Nouakchott,

deep in the Sahara desert.

INDONESIA

2011

Several deals to acquire interests were

signed across the country:

A 50% interest in the 1,500-square-

kilometer Kutai Timur coalbed

methane (CBM) block, in East

Kalimantan province.

A 100% stake in the South West

Birds Head exploration block ,

a 7,200-square-kilometer onshore

and offshore block in West Papua.

The deep offshore Sageri (50%),

South Sageri (45%) and Sadang (30%)

blocks.

An interest in the South Mandar Block

in the southern part of Makassar Strait.

ANGOLA

DECEMBER 2011

Three exploration licenses and three

production sharing agreements signed

with national oil company Sonangol.

The blocks are located in the deep

offshore Kwanza Basin, in still largely

unexplored subsalt plays.

Block 40: 7,604 square kilometers,

in water depths ranging from 1,500

to 3,400 meters. We are the operator

with a 50% stake.

Block 25: 4,842 square kilometers,

in water depths ranging from 700

to 2,200 meters. We are the operator

with a 35% stake.

Block 39: 7,831 square kilometers,

in water depths ranging from 1,330

to 3,400 meters. We are a partner

in the block, with a 15% stake.

KENYA

SEPTEMBER 2011

Acquisition of a 40% interest in five

licenses in the Lamu Basin in the Indian

Ocean, offshore acreage spanning

more than 30,500 square kilometers,

with water depths ranging from

100 to 3,000 meters.

QATAR

MAY 2011

A partnership agreement with

CNOOC Middle East Ltd. (operator)

to acquire a 25% interest in the BC

exploration license awarded by

the Qatar government. The block,

located 130 kilometers east of

the Qatari coast, covers an area of

5,649 square kilometers, in water

depths ranging from 15 to 35 meters.

Before we can explore plays and find

oil and gas, we need access to

acreage. The only way we can keep

replacing our reserves is if we

acquire interests in exploration

licenses. Growing our exploration

portfolio now is how we boost our

chances of making valuable

discoveries in the future. Opposite,

a selection of the interests we

acquired around the world in 2011

and early 2012.

EXPANDING

OUR

ACREAGE

December1, 2011

A FIRST IN CANADA

The Canadian government has approved our

Joslyn North Mine project to extract oil sands

crude. The decision is an important milestone

for Total as an operator in Canada. It also shows

that the Canadian authorities are confident in our

ability to develop this unconventional resource

safely and responsibly. Preliminary work began

in 2012 to prepare construction of a mine expected

to commence operations in 2018 and to produce

100,000 barrels of bitumen a day at plateau.

We have a

38.25% interest

in the Joslyn

North Mine,

which will be

developed in

partnership with

Suncor Energy.

09 PERSPECTIVES 2011 ANNUAL REPORT

he elephants are back! Alongside their little

brothers, big cats, these giant fields have been our

chief quarry for three years.

Totals aim is to add 700 million new barrels each

year through exploration. To achieve it, we are ori-

enting our strategy toward new and bolder types of

exploration, using two simple approaches: trying out

new ideas in already known plays and taking an

interest in regions where oil and gas have never

been discovered.

In 2011 our efforts paid off. In Azerbaijan, a giant

gas field was found in the Absheron Block. A first

well drilled in 2001 had come up dry. But innovative

thinking and new information about the regions

geology prompted us to start looking again in 2009

as an operator, and to explore farther north and

deeper, up to 6,550 meters below the seabed in a

water depth of 500 meters. Our exploration was

right on target.

A Good Hunch

In French Guiana we and our partners, have discov-

ered a brand-new oil basin. Located in the Guyane

Maritime license 170 kilometers northeast of Cayenne,

the oil reservoir was discovered at a depth of more

than 5,000 meters. It is thought to contain 0.5 to

1 billion barrels of oil. In deciding where to look, our

explorers followed their gut instinct: they suspected

that the regions geology might mirror the play in

which the Jubilee field, discovered in 2007 off the

coast of Ghana, formed on the other side of the

Atlantic.

We found our third elephant in Bolivia, by exploring

the Aquio Block north of Ipati, where a find had

already been made.

Hunches, bold moves and know-how spelled success as Total got back

to making major finds in 2011. We discovered a slew of oil and gas fields,

including three huge ones. They are our new elephants and big cats,

as such mammoth reserves are called.

BOLDNESS PAYS OFF

IN EXPLORATION

t

NEW FIELDS

are discovered in deeply buried

reservoirs, in increasingly complex

geological environments.

METERS

The Absheron exploratory well in Azerbaijan encountered

a 160-meter gas column that is estimated to contain

several trillion cubic feet of gas and condensate. 160

ELEPHANT

AND BIG CAT

Fields with

reserves of over

500 million and

200 million

barrels of oil

equivalent

respectively.

Senior managements greenlighting of

resumed exploration of the Absheron

field was a bold move on its part.

Bertrand Chevallier,

Geosciences Manager, Total E&P Azerbaijan

10 GROW

FRENCH GUIANA

The hunt continues for new fields;

the block to be explored stretches

over roughly 24,100 square kilometers.

NORTH

The Norvarg well in Norway

is Totals first Arctic find

as an operator.

A LATITUDE

OF MORE

THAN

72

The Aquio and Ipati Blocks contain huge quantities

of gas and condensate, with resources totaling close

to a billion barrels of oil equivalent.

Our survey of finds would not be complete without

mentioning the big cat tracked down in Norway, the

Norvarg field. Lurking at the bottom of the Barents

Sea, it is thought to hold 10 to 50 billion cubic meters

of very high-grade gas. Our new exploration drive is

well and truly off to a great start!

Protecting the Environment

in French Guiana

PRESERVING FRENCH GUIANAS FRAGILE ECOSYSTEM IS

ONE OF OUR MAJOR PREOCCUPATIONS. EVERYTHING

NEEDED TO DO SO IS ALREADY IN PLACE. French Guianas

coast is a rich and fragile ecosystem of rocky shores,

beaches some of which provide leatherback turtles with

a place to lay their eggs and mangroves teeming with

fish and crustaceans. It is also a hub for fishing, an

industry pivotal to the local economy. To protect it, risks

and hazards were thought through before exploration of

the remainder of the block began. Drilling operations,

especially projected pressures, are prepared meticulously.

Drilling parameters are controlled round the clock and

blowout preventers are tested. And response measures

are in place to capture, contain, recover and disperse spills.

In November 2011, the French government also tasked

an expert, Anne Duthilleul, with identifying the steps

required for environmentally safe operation that would

also deliver benefits for local communities. Her report

is due out in June 2012, with production not expected

to start before 2016 at the earliest.

Core samples taken during exploratory drilling

are stored at our Technical and Scientific Center

in Pau, France, for examination.

Before our discovery offshore

French Guiana, few people in

the oil industry believed there

was oil in the area.

Nigel Langridge,

Geographical Manager of Exploration Coordination

& Arbitration (CAE), Americas, Total Exploration

11 PERSPECTIVES 2011 ANNUAL REPORT

GROW 12

Our exploration has a new

emphasis that can be summed

up in two key words: boldness

and tenacity.

What are the new directions

of Totals exploration strategy?

Getting back on the track of major discoveries

and diversifying our acreage. Our goal is clear

adding 700 million new barrels a year. To do

that, we must focus our exploration on large-

scale prospects and strike out into new plays

and areas. The big game hunt is on! Were

willing to risk fewer positive wells, as long as

there are more barrels at the end of the day.

Practically speaking,

how do you manage that?

By stepping up the number of our licenses,

enhancing seismic interpretation and drilling

more wells. But most important, by regaining

a taste for innovation and risk-taking. We have

to take a chance on new ideas! Exploration is

hunting, after all: we must be able to detect

even the faintest scent, venture off the

beaten path, investigate and crosscheck our

leads. It boils down to a mindset that must be

our top priority.

Which plays do you have

the highest hopes for?

Frontier basins where no discoveries have

been made yet, such as abrupt margins, the

sudden transition areas between the continen-

tal shelf and the ocean, as in French Guiana.

And carbonate reservoirs underneath thick

salt layers, as in the Caspian Sea. We also need

to explore around and below existing fields,

like we did in the North Sea. And we plan

to keep expanding in unconventional oil and

gas, such as shale gas, shale oil and coalbed

methane, also known as coal seam gas.

What resources do you have

at your disposal?

We are one of the oil majors that invests the

most in exploration. In this ever more high-

tech and costly field, our budget has been

climbing steadily for three years, reaching

$2.1 billion in 2011. More important though,

our teams are highly motivated. They have a

real pioneering spirit we must keep cultivating!

Lets Take a Chance

on New Ideas!

A Conversation with

Marc Blaizot,

Senior Vice President, Exploration

PERSPECTIVES 2011 ANNUAL REPORT 13

chieving first oil is a long, hard slog. Buried

in increasingly hard to reach places, oil and gas

reserves are anything but easy to develop. Producing

fields hundreds of meters beneath the sea is a formi-

dable technological challenge. Pazflor in 2011 and

Usan in 2012 were decisive steps in our conquest of

the deep.

a

On the Pazflor project,

Total leveraged the pooled

competencies of an international,

integrated team, with even more

local participants than on

previous projects.

P

FIRST OIL

The first barrel

of oil produced

by a field when

it is brought

on stream.

e

e

e

p

O

f

s

h

o

r

H

IG

H

T

E

C

H

N

O

L

O

G

Y

IN

T

H

E

Pazflor and Usan, our tw

o m

ajor deepw

ater projects, are com

ing on stream

and pushing the envelope in every w

ay! Once again, w

e have w

on our

gam

ble to produce vast quantities of oil and gas in the ultra-deep offshore

1,200 m

eters of w

ater in the case of Pazflor. The projects, w

hich allied

unprecedented boldness and innovation, produced several w

orld firsts.

d

14 GROW

P

a

z

f

l

o

r

A World First with Pazflor

In late August 2011, Pazflor, one of the biggest

deep offshore oil projects ever undertaken, came on

stream several weeks ahead of the initial schedule

after 44 months of work. Located in the Gulf of Guinea

offshore Angola, it will produce 220,000 barrels a

day at plateau. The total capital expenditure for the

project was $9 billion.

In a world first on this scale, we pulled off the tech-

nological feat of separating the gas and liquids

(water and oil) on the mudline, in 800 meters of

water. The effluent comes from reservoirs more

than 1,000 meters under the seabed and is gathered

by an extensive network of subsea pipelines spanning

an area of 600 square kilometers. The goal is to pump

the heavy, viscous oil that makes up two-thirds of

Pazflors reserves into these units and then bring

it up to the giant FPSO the biggest built to date

to be processed and stored.

Innovating Through Subsea Separation

In addition to typical light oil, Pazflors reservoirs contain large quantities of heavy, viscous crude.

The technological innovation engineered to extract it involves separating the gas and liquids

on the seabed, in very deep water. This is done by three subsea separation units (SSUs)

and six hybrid pumps purpose-designed for the Pazflor project. The SSUs are real behemoths,

as tall as a seven-story building and weighing in at a thousand metric tons. Installed 800 meters

below the surface, they are built to withstand erosion for 20 years, says Gilles Lematre,

Subsea Production System Manager.

AT 325 METERS

LONG and 62 meters

wide, with a 32-meter-

high hull, the Pazflor

FPSO is the worlds

biggest to date.

It can store 1.9 million

barrels and accommodate

240 people. The Usan

FPSO is not far behind it:

both are big enough

to hold four soccer fields!

AT PAZFLORS

OFFICIAL

INAUGURATION

on November 22, 2011,

attended by Angolas

Minister of Petroleum

Jos Botelho de

Vasconcelos, Sonangol

Chief Executive Officer

Gaspar Martins and Total

E&P President Yves-Louis

Darricarrre, Totals

Chairman & CEO

Christophe de Margerie

hailed one of the worlds

most outstanding oil

projects ever.

FPSO

Floating

production,

storage and

offloading vessel.

Pazflor, the worlds biggest

FPSO to date, able to process

two very different grades of

oil, one light and one heavy.

49 wells, 180 kilometers of pipeline,

84 kilometers of umbilicals and 10,000 metric tons

of equipment installed across a 600-square-

kilometer area of seabed make the Pazflor subsea

network the most complex in the history of deep

offshore developments At peak, as many

as 4,500 people were working on the project

worldwide.

Watch the Pazflor

slideshow.

15 ANNUAL REPORT PERSPECTIVES 2011

U

s

a

n

WATER AND OIL

SEPARATION AND

DESALINATION

inside the hull are

other technological

firsts, designed

to limit the weight

and bulk of the

topsides.

Safety First and Foremost

The safety challenges on large-scale projects are daunting. This is especially true of the safety

of personnel. Thousands of people from several countries are involved, representing dozens

of different nationalities. On both Pazflor and Usan, they work in a complex environment,

especially during offshore installation and hookup. To avoid accidents, Total deploys

an organization grounded in stringent health and safety standards and makes sure that every

contractor working on the projects also adopts it. All equipment was designed and built

in accordance with the latest, toughest safety standards.

Usan Relies on Local Content

Usan, too, is a major-league player. Located a hun-

dred kilometers offshore Nigeria in water depths

of 750 to 850 meters, the field began production

on February 24, 2012.

2011 was spent on the final preparations towing

the mammoth FPSO from South Korea, where it was

built, then mooring it and hooking it up to flowlines

and wells. At plateau, Usan will be able to process up

to 180,000 barrels of oil per day.

The project took our Nigerian content policy to

another level, with 30% of spend going to local

businesses. That went for all the projects sectors and

phases, from engineering and fabrication to assembly

and offshore construction. And beginning in 2008,

project management was also based in Nigeria, in a

first that won plaudits from the government.

Besides creating direct jobs, our local content policy

helps consolidate the transfer of technical skills,

benefiting the local oil industry as a whole.

40 wells, 65 kilometers of pipeline,

70 kilometers of umbilicals and

8 production manifolds set up around

an FPSO anchored in the deep waters off

Port Harcourt 14 million hours worked

in Nigeria, an unprecedented amount of

local content, on this project.

16 GROW

GAS

NEW NATURAL

Gas will be the energy of the 21

st

century.

Demand is forecast to grow 2.5% a year for the next

10 years, ranking it second in the global energy mix

in 2030. Already the worlds number two producer

of liquefied natural gas (LNG), we continue

to expand our positions through a policy of

strategic partnerships. The impressive

projects that reached fruition in 2011

give a picture of the growth

under way.

RESOURCES

LIQUEFIED

NATURAL GAS (LNG)

Gas that has been

liquefied by cooling it

to -163C.

17 PERSPECTIVES 2011 ANNUAL REPORT

wo strategic projects, Ichthys LNG in Australia

and Yamal LNG in Russia, will cement our leadership

position in the liquefied natural gas market and

enable us to respond flexibly to rising global demand.

Europe, where demand is being driven by declining

gas production in the North Sea, is one example.

Another is Asia, a region that in 2010 took 60% of

global LNG production, or more than 130 million

metric tons. And finally and more generally, there are

all the countries that lack both domestic production

and land-based import infrastructure or that experi-

ence spot needs. That means LNG is the only source

of gas supply for Japan, South Korea and Taiwan.

Although China and India are already strong drivers

of global growth in LNG consumption, other coun-

tries are gradually joining the LNG importers club,

including Argentina, Brazil, Dubai, Indonesia, Kuwait

and Thailand, to name just a few. With so much at

stake for our production tomorrow, we are securing

the future with our LNG projects.

Australias Ichthys Megaproject

Ichthys is a gas and condensate field located north-

west of Australia in a water depth of 260 meters. Its

reserves are estimated at 3 billion barrels of oil equiv-

alent (boe) . Launched in partnership with Japans

INPEX, Ichthys is the regions first large-scale LNG

development. By end-2016, it will be producing

8.4 million metric tons of LNG annually. Its develop-

ment is costing $34 billion and represents one of

the largest capital expenditures ever made by Total.

We will assist our operator partner by lending it

our major project management know-how and our

technical expertise.

Arctic Gas in Russia

Russias Yamal Peninsula is known for two things: its

Arctic climate and just as striking its natural gas

resources. The region is home to around 14 trillion

cubic meters of gas. Thanks to a partnership agree-

ment signed in March 2011 with Russian gas pro-

ducer Novatek, Total is the first international oil

company to operate there. Our goal is to develop the

South Tambey field, with an estimated 1.25 trillion

cubic meters of gas in place, and to build a liquefac-

tion plant to export LNG. Christened Yamal LNG, the

project will give us access to proved and probable

reserves of some 800 million barrels of oil equivalent

(boe) through our 20% equity interest. Plateau

production will be 90,000 barrels of oil equivalent

per day.

t

INPEX and Total,

a Long-Term Affair

With the announcement of their decision to launch Ichthys

in January 2012, INPEX and Total embarked on a partnership

that will unite them for another 40 years. That also happens

to be how long the pairs earlier partnership, on Indonesias

Mahakam license, has lasted so far. The Kashagan project

in Kazakhstan and the Joslyn development in Canada

are two more examples of productive collaboration between

the Japanese company and Total. Based on the volume

of its reserves and its oil and gas production,

INPEX is currently the biggest Japanese company

in the exploration and production sector.

Australia, projected to be

the worlds top producer of LNG

in 2020, is now a flagship country

for Total.

Jean-Marie Guillermou,

Senior Vice President, Asia-Pacific,

Total Exploration & Production

ICHTHYS LNG

IN WHICH TOTAL

HAS A 24% INTEREST

IS THREE PROJECTS

ROLLED INTO ONE:

a semi-submersible

central processing facility

200 kilometers offshore

tied into an FPSO that

will stabilize, store and

export the condensate;

an onshore plant in

Darwin with a capacity of

8.4 million metric tons of

LNG a year, where the

gas will be liquefied; and

an 889-kilometer pipeline

linking the two.

BESIDES LNG,

ICHTHYS LNG

WILL PRODUCE

1.6 million metric tons

of LPG a year and

100,000 barrels

of condensate a day

at plateau.

BARREL OF OIL

EQUIVALENT

(BOE)

A standard

reference unit that

enables the energy

content of gas and

oil to be compared.

18 GROW

NOVATEK,

A STRATEGIC PARTNER

In addition to our joint development of

Yamal LNG, Total acquired a 13.09% equity

stake in Novatek in March 2011, which was

increased to 14.09% in December of the same

year and is expected to reach 19.4% by 2014.

This partnership gives us access to proved

and probable reserves of around 1 billion barrels

of oil equivalent.

Russias second-biggest natural gas producer

after state-owned Gazprom, Novatek has posted

record growth and enjoys strong development

potential by virtue of a portfolio of resources

comprising several giant fields. Russias leading

independent producer, it supplies 13% of the

domestic market and produced 1 million barrels

of oil equivalent per day in 2011.

IN RUSSIA, TOTAL AND NOVATEK ARE

PARTNERS IN THE TERMOKARSTOVOYE

PROJECT, a gas and condensate field given the final

investment nod at end-2011. Production is expected

to start in 2015, with a capacity of some 65,000 barrels

of oil equivalent per day.

Were scaling up. Ten years

from now, Russia could account

for 15% of our production.

Jacques de Boissson,

General Director, Total E&P Russie

20 Years in Russia

In November 2011, Christophe de Margerie,

Totals Chairman & Chief Executive Officer,

and Yves-Louis Darricarrre, President,

Total Exploration & Production, made

the trip to celebrate Totals 20 years

in Russia. Our company was a pioneer,

being the first to venture into exploration

and production operations there, back in

1991. Today we have long-term commitments

in the country, in the form of trading,

marketing and petrochemical activities.

IN 2011, WE CONTINUED

ENGINEERING WORK

and related commercial

negotiations with

Gazprom to develop

the giant Shtokman gas

and condensate field

in the Barents Sea.

YAMAL LNG WILL PRODUCE

15 TO16

MILLION METRIC TONS

of LNG annually, for total gas

and liquids production of

450,000 barrels of oil equivalent

per day.

Twenty-four percent

of global gas

reserves are found

in Russia. We have

to be there.

Michael Borrell,

Senior Vice President,

Continental Europe and Central Asia,

Total Exploration & Production

Yamal LNG project

expedition.

19 PERSPECTIVES 2011 ANNUAL REPORT

he world needs energy, and more and more of it.

Every discovery counts in meeting growing global

demand sustainably. In abundant supply worldwide,

unconventional gas opens up new exploration and

production prospects. Its potential is estimated at a

staggering 380 trillion cubic meters, or about half of

the worlds total gas resources, by the International

Energy Agency (IEA). Most unconventional gas consists

of shale gas.

Huge amounts remain unproduced: at current con-

sumption rates, known unconventional gas resources

will suffice to meet global market needs for more

than 50 years.

Having joined the quest several years ago, in 2011 we

continued expanding our positions in unconventional

gas, a field we know to be promising. Not only are we

believers, we have gained proven skills and expertise

through a policy of partnering with industry experts.

We have everything we need to make the most of

these remarkable resources and meet the primary

challenge of producing them: the associated envi-

ronmental impacts. Total is thoroughly proficient in

and constantly innovating with respect to the tech-

nologies used, such as hydraulic fracturing, especially

throught R&D programs.

Unconventional gas is stealing the energy limelight and will be a crucial

component of resource replacement in the future. We are honing our

knowledge and skills and cementing our positions in this promising sector.

THE PROMISE

OF UNCONVENTIONAL GAS

t UNITED STATES

Already partners

in the Barnett Shale,

Total and Chesapeake

entered into a new

agreement in late 2011,

when we acquired

a 25% equity interest

in the liquid-rich

Utica Shale formation

in eastern Ohio, held

by Chesapeake and

EnerVest. The joint

ventures acreage

covers an area of

2,500 square kilometers.

The investment comes

to $700 million.

We are also financing

our partners share of

the costs of drilling new

wells, for a maximum

capital spend of

$1.63 billion over

seven years.

POLAND

In May 2011, Total (49%)

signed an agreement

with operator ExxonMobil

(51%) to jointly explore

for shale gas in the

Chelm and Werbkowice

concessions in the Lublin

Basin. An initial well was

drilled and a production

test conducted in 2011.

UNCONVENTIONAL GAS

An umbrella term for tight gas,

coalbed methane (also known

as coal seam gas) and shale gas.

LESSENING THE ENVIRONMENTAL FOOTPRINT

How do we make sure that shale gas is produced

under optimal conditions? Our R&D teams

are working on several issues at once.

Our goals are to:

Reduce water use and improve water treatment.

We want to come as close as possible to a 100%

recycling rate and are studying the feasibility

of using brackish or even salt water for production

to avoid competition with other freshwater uses.

Use fewer additives and change their

composition; the ones we employ now

are already highly diluted and can be found

in everyday products.

Limit visual and noise intrusions by reducing

the number of surface wells. We are working

on a solution that clusters several wells on

a single surface pad and lessens their visual

impact.

Aerial view

of work on

the port

in Gladstone,

Australia.

Total is

partnered

with U.S.-based

shale gas

specialist

Chesapeake.

20 GROW

IN FRANCE, in response to the revocation of the exploration license we were

awarded in 2010 in the Montlimar region, Total filed an appeal with the Paris

Administrative Court on December 12, 2011. Our goal is to clarify the situation,

especially since, in compliance with Frances Act of September 12, 2011, our work

program excluded hydraulic fracturing.

IN ARGENTINA, in January 2011 we acquired

interests in four exploration licenses in Neuqun

province in the center of the country, alongside YPF.

We operate two of them. The first wells have been

drilled to assess their shale gas potential.

7.2

MILLION

METRIC TONS

PER YEAR

IN AUSTRALIA, THE ENORMOUS GLNG PROJECT

has kicked off. Up to 5,000 people will work on the development,

which involves extracting coal seam gas, also known as coalbed

methane, from four fields in eastern Australia and building an LNG

plant in Gladstone, Queensland, plus a 420-kilometer gas pipeline

to connect them. The plant will have a capacity of 7.2 million metric

tons a year. The project operator is Santos, alongside partners Total

(27.5%), Kogas and Petronas. The total price tag is $16 billion,

with start-up set for 2015.

Hydraulic fracturing is a long-established technique.

The real issues raised by shale gas projects are those

associated with any industrial operations: reducing

local intrusions and managing water use and surface

facilities. We have no doubt that shale gas can be

produced responsibly, as long as everyone involved agrees

on the resources to be deployed and the steps to be taken.

Bruno Courme,

Vice President, Total Gas Shale Europe

Total has been

present in Argentina

since 1978

and operates 30%

of the countrys

gas production.

21 PERSPECTIVES 2011 ANNUAL REPORT

In an economic and competitive environment shaped

by sweeping change, we are giving new impetus to our

chemical, refining and petroleum product marketing

activities by refocusing them around two major areas

of expertise, production and marketing. The revamp aims

to heighten the visibility and performance of each.

D

C

o

w

n

-

s

t

r

e

a

m

h

e

m

i

c

a

l

s

R

E

O

R

G

A

N

IZ

E

and

22 OPTIMIZE

he market is changing and Total must anticipate

its trends, with one goal in mind: growing and creating

value for all our stakeholders. Reorganizing our chem-

ical, refining and petroleum product marketing activi-

ties into two new businesses in the last few months

clearly demonstrates our determination to move for-

ward proactively. The reorganization has two aims.

One is to build on existing synergies between refining

and petrochemicals by combining them in a single

major production hub, Refining & Chemicals. The other

is to showcase our marketing strengths by giving

Supply & Marketing more visibility.

Refining and Chemicals,

Two of a Kind

Refining and petrochemicals are very similar in terms

of operations and facilities. So combining them will

eventually make our production base more efficient.

This is especially important now, as European refin-

ing struggles with shrinking demand that is spurring

us to leverage every possible synergy to be more

competitive. There are a number of ways we could

improve, such as doing more to unlock the full value

of our products and pooling energy procurement and

our research and innovation efforts.

Although other oil majors have taken steps in this

direction, none has ever designed a strategy as

unified as Totals, which actually merges refining and

petrochemicals in a single organization.

Supply & Marketing Is the Flagship

for Totals Commercial Ambitions

At the same time, our creation of a business specifi-

cally dedicated to the supply and marketing of petro-

leum products is a response to the profound changes

in our competitive environment.

Our rivals used to resemble us; most were integrated

companies. Today we are competing with more and

more operators that focus exclusively on sales and

marketing. To stay in the game, our Supply & Market-

ing business must be more agile.

What we hope to achieve is competitive supply, more

solid positions in mature market regions, strong

expansion in fast-growing markets and a greater

focus on innovation, especially new products and

services for our customers. In short, our strategy

remains the same, but we are lining up the resources

we need to fully achieve our goals.

t

Why Two New Businesses?

A safe, efficient Refining & Chemicals business expanding

into fast-growing markets.

Make safety and the prevention of major environmental

risks an absolute priority.

Adjust and optimize the production base in Europe

and the United States by concentrating on large-scale facilities

and maximizing synergies.

Expand in Asia and the Middle East to tap into the growth

of emerging markets and secure access to prime oil

and gas resources.

Set ourselves apart through technology.

Make Supply & Marketing activities more competitive.

Solidify our positions in mature markets, especially Europe.

Capitalize on our leadership in Africa.

Grow our presence in Asia and the Middle East.

Expand our specialty products worldwide.

Provide reliable, cost-competitive supply to all our affiliates.

23 PERSPECTIVES 2011 ANNUAL REPORT

What tangible benefits is Total

trying to achieve through

the new organization?

P. P. : Working together will let us do more to

unlock our activities synergies and thereby

lower our break-even points. That creates sev-

eral benefits, including more efficient manage-

ment of our feedstock streams, pooling of our

infrastructure and logistics services, optimized

management of our maintenance turnarounds

and overlapping capital expenditure.

Its a tremendous opportunity to demonstrate the

integrated business strategy we value so highly.

Total wants to develop

world-class production facilities.

What are your priority projects?

P. P. : We want to allocate our capital spending so

that our most efficient sites rival the best in class,

which means focusing on our strategic, integrated

facilities. Weve just done that in Port Arthur, are in

the process of doing so in Gonfreville and are

launching design studies for a large-scale project

in Antwerp. In fast-growing markets, our key facil-

ities are in Qatar (Ras Laffan and Messaied), Saudi

Arabia (Jubail) and South Korea (Daesan).

You lead a business with many

production sites. What safety

issues are involved?

P. P. : Making safety a priority is the cornerstone

of our strategy. Its the first step toward achiev-

ing operational excellence, and investment to

promote safety will, of course, be a core concern

at all our sites. Workplace safety, naturally, but

also process safety. That is how we will keep

the trust of our stakeholders in the long term.

Re ning & Chemicals

OUR PRIORITY IS

IMPROVING OUR COMPETITIVENESS

TO DRIVE OUR GROWTH

What motivated Total to combine

its refining and chemical activities

into a single business?

PATRICK POUYANN : Our goal is to make these very

similar activities more competitive by maximiz-

ing the synergies between them and to develop

new positions. You could say that we are playing

both defense and offense. Defense, because

at this point we have to improve our economic

performance in mature markets especially in

Europe where our positions are strong but

returns are low. Offense, insofar as we want to

expand faster in growth markets in the Middle

East and Asia by designing high-capacity produc-

tion facilities aligned with our customers needs.

PATRICK POUYANNS

CAREER

A graduate of two French

engineering schools,

cole Polytechnique and

cole des Mines in Paris,

Patrick Pouyann joined

Total in 1997 after holding

positions in various ministries,

on the Prime Ministers staff

and as an advisor to the

Minister of Telecommunications.

He held several senior

management positions

in Exploration & Production,

in Angola and Qatar, and

then in Finance and Business

Development, before being

appointed Senior Vice

President of Chemicals and

Petrochemicals in 2011.

On January 1, 2012, he was

appointed President of

the new Refining & Chemicals

business and a member of

Totals Executive Committee.

Patrick Pouyann,

President,

Refining & Chemicals

and member

of the Executive

Committee

24 OPTIMIZE

The new organization boosts the

visibility of Totals marketing activities.

What prompted the decision?

PHILIPPE BOISSEAU : We created the Supply &

Marketing business mainly because we recog-

nized that our marketing activities are different

from the rest of our activities. We have a special

responsibility to bring the Total brand to millions

of customers. To do that, we have to manage our

extensive network while providing top-quality

service around the world. The unification and

independence of our business let us focus more

on our own specific issues and challenges going

forward.

What are Totals strengths in

the global marketplace today?

P. B. : Without question, our ability to constantly

reinvent ourselves. Weve been facing a radically

different type of competitor in the last few years.

Our traditional rivals have gradually concentrated

their activities in just a few countries, while weve

been determined to stay global. New types of

competitors have emerged, such as national

companies, traders and local independents.

They all have one thing in common: an agility

that has done a lot to drive their growth. Our

new organization will help us challenge them

and better showcase our strengths, namely

recognized quality and service know-how and

an ability to innovate.

What makes Total stand out?

P. B. : The Total model technology and a local presence to better serve

our customers is fairly unique. We must continue to offer innovative

products and services, especially by supplying more than one type of

energy. Speaking of which, we have opened the worlds first multi-energy

service station in Germany. Today, Total has the credibility to advise our

customers and offer them an array of solutions that combine conven-

tional and new energies in an intelligent way. Its an opportunity to position

ourselves as a benchmark operator.

Supply & Marketing

CAPITALIZE ON OUR TECHNICAL

AND MARKETING EXPERTISE

TO ACCELERATE OUR GROWTH

Philippe Boisseau,

President, Supply

& Marketing

and member of

the Executive

Committee

PHILIPPE BOISSEAUS CAREER

A graduate of two French engineering schools, cole Polytechnique and cole des Mines in Paris,

Philippe Boisseau joined Total in 1995 after beginning his career in various French ministries

and on the Minister of Defenses staff. He started out in Refining, then joined Exploration &

Production as CEO of the Argentina affiliate and later President, Middle East. In 2007 he was

appointed President of Gas & Power. On January 1, 2012, he was appointed President of the new

Supply & Marketing business and a member of Totals Executive Committee.

25 PERSPECTIVES 2011 ANNUAL REPORT

%

74

OF TOTAL EMPLOYEES

work in the new

Refining & Chemicals and

Supply & Marketing

businesses.

TOTALS STRATEGIC REFOCUS

IN THE UNITED KINGDOM

At end-2011, we sold off part of our marketing

assets in the United Kingdom, in particular

our service station network, to the Rontec

Investments LLP consortium. We remain

in the UK market through our lubricants,

jet fuels and special fluids, as well as

our Lindsey oil refinery and our chemical

production activities.

Total Continues

to Divest Non-Strategic

Assets

In August 2011, we sold our interest

in CEPSA, Spains second-largest

oil company, to the United Arab Emirates

IPIC for 3.7 billion. That further narrowed

our exposure in European refining, after

having already reduced our refining

capacity there by almost 25% since 2007.

However, we have not pulled out of Spain and

continue to grow our lubricant, specialty

product and chemical businesses in the

country.

RESHAPING

SPECIALTY CHEMICALS

We continue to refocus our

Specialty Chemicals business.

A portion of our resins assets, comprising

photocure and coating resins, was sold

to Arkema. And hydrocarbon resins

and composites, which are directly

downstream from petrochemicals,

have been moved to our petrochemicals

business.

DOWNSTREAM

AND CHEMICALS ACTIVITIES

were reorganized into two major businesses, Refining

& Chemicals and Supply & Marketing, on January 1, 2012.

The new organization is being created without

any downsizing or outplacement.

We are asserting our identity as a leading production

and marketing company.

14 %

Total aims to achieve ROACE

of 14% for all Downstream

activities in 2015.

26 OPTIMIZE

UPGRADES

IN MATURE MARKETS

We strongly believe that refining can still be compet-

itive in the West. As a result, we are revamping our

production base to bring it in line with new consumer

demands: less gasoline and more diesel, but also

ever more environmentally friendly production. Faced

with the scale of market change, the Normandy

refinery moved quickly to implement the adjustments

needed to keep it viable. With processing capacity

unmatched by any other Total facility in France, the

refinery has been recalibrating its production since

2006 in response to a sharp downturn in its exports,

especially to the United States. The linchpin of its

efforts is the ambitious RN 2012 project, which aims

to transform the refinery into one of the most

competitive in Europe. The project has three goals:

to produce an additional 500,000 metric tons of

ultra low sulfur (less than 10 ppm) diesel annually, to

slash gasoline surpluses 60% and to lower carbon

emissions 30%. Total is spending 740 million to build

and upgrade the installations concerned, modifying

the refinery configuration by expanding a diesel pro-

duction unit, revamping an atmospheric distillation

unit to make it more energy efficient, and building a

new diesel desulfurization unit scheduled to start

operating in 2013.

We continue to upgrade our production base to tailor it to the markets new needs.

What we do varies by region. In mature markets, we are making our refining

and petrochemical facilities more competitive. In emerging economies, we are

responding to growing consumption by building high-capacity industrial complexes.

WORLD-CLASS

INDUSTRIAL FACILITIES

30%

THE CARBON EMISSIONS REDUCTION TARGET FOR THE

NORMANDY REFINERY. The Packinox heat exchanger

installed in 2011 illustrates the ambitious environmental

policy we have implemented there. The single 150-metric-ton

heat exchanger, ultra-efficient at minimizing air emissions,

replaces 16 old heat exchangers for cooling and heating

fluids, two vital steps in the refining process.

Were going to make

Normandy a benchmark

facility in Europe.

ric Dufour,

RN 2012 Project Manager

at the Normandy refinery

27 PERSPECTIVES 2011 ANNUAL REPORT

Deep Conversion

in the United States

Combustion that meets the strictest environmental

standards is another reason for the sweeping

upgrade of our Port Arthur refinery, completed in

2011. Located in Texas near the Gulf of Mexicos oil

and gas fields, the refinery has a brand-new coker

a deep conversion complex that enables it to more

efficiently process heavy oil and boosts its capacity

to produce light fuel. It also features a new sulfur

recovery unit that will produce an annual 3 million

tons of ultra low sulfur diesel, the object of rising

demand in the United States and around the world.

DEEP CONVERSION

OR COKING

A process that cracks

large oil and gas molecules

and removes some of their

carbon atoms in order

to obtain lighter compounds

such as LPG, naphtha

and diesel.

Now well be able

to process the heavy

oil sourced by our

logistics team, whether

it comes from Latin

America, Canada

or anywhere else!

Graeme Burnett,

Senior Vice President,

Refining & Petrochemicals, Americas

The Port Arthur,

Texas refinery

in the United

States.

Expanding Our Petrochemical Positions in Antwerp

We have acquired ExxonMobils interest in Belgiums

Fina Antwerp Olefins petrochemical plant, making us

its sole shareholder. It is the second-largest plant

in Europe producing base chemicals such as ethylene ,

propylene and benzene.

Our facilities were already using some of its production

to make polymers. The acquisition lifts both

the competitiveness of our petrochemical activities

and the synergies with our Antwerp refinery.

28 OPTIMIZE

Were seeing more and more

projects in emerging economies.

What are your aims?

Naturally our goal is to cement our mar-

keting positions in a region of sharply

rising demand. Especially in China, where

refining capacity needs are taking off

and are projected to reach 12.5 million

barrels a day in 2015, compared to

9.2 million in 2011. Much of the

region still imports petro-

chemicals when demand for

polymers is rising twice as fast

there as in the rest of the world.

Our capital expenditure in this

region reflects our commitment to

remaining a major supplier of value-

added products, by concentrating on

the most efficient integrated facilities,

such as the Daesan petrochemical

complex in South Korea.

Petrochemicals and refining

are growing. Are you adapting

quickly?

Strong Asian demand is also driving up

the Middle Eastern market. Refining

capacity in that region should jump 50%

in the next few years. The regions petro-

chemical capacity has already doubled in

five years and now accounts for close to

20% of global capacity. Thats why Total

has already invested heavily there to

expand our production facilities. The

SATORP project in Jubail, Saudi Arabia

and QAPCO in Qatar, where a third low-

density polyethylene line will start up in

2012, are two examples.

By creating competitive refining and petrochemical

facilities, we cement our global leadership

and meet our customers needs through

energy-efficient solutions.

A Conversation with

Bernadette Spinoy, Senior Vice President,

Refining & Petrochemicals Eastern Hemisphere

AN UPSWING

IN EMERGING MARKET CAPACITY

THIRD LINE

In Qatar, we continue to expand the

QAPCO petrochemical plant, having

started a third line to produce low-

density polyethylene , a plastic used

mainly for packaging film. The project

is part of our strategy to diversify our

feedstock to bring it in line with the

markets current structure.

$1.8BILLION

To meet robust Asian demand, in 2011 we expanded capacity at our Daesan units

in South Korea, bringing the production of ethylene to 1 million metric tons and

of polyolefins to 1.15 million metric tons a year. We are also starting construction

on two new plants at the complex, at a cost to Total Samsung Petrochemicals

of $1.8 billion between now and 2015. The new units will double the sites capacity

and make it possible to produce intermediate aromatics for the polyester chain,

specialty polyolefins and jet fuel and diesel, which are refined products, while

strengthening our position as a leader in energy efficiency.

29 PERSPECTIVES 2011 ANNUAL REPORT

For the last three years, we have been building

our biggest refinery twinned with a world-class

petrochemical complex in Jubail, Saudi Arabia,

in partnership with Saudi Aramco. The facility,

one of the worlds most efficient, will process

the heaviest grades of local crude oil and meet

growing demand for petrochemicals. Construction

kicked into higher gear in 2011. Join us on a tour

of this leviathan rising out of the desert sands.

JUBAIL,

A REFINERY DEEP

IN THE DESERT

The refinery the most

complex in Saudi Arabia

will be able to process the

heaviest local crudes into

refined products that meet

the strictest environmental

standards, such as ultra low

sulfur fuels, diesel and jet

fuel. With an assist from

these cutting-edge

installations, the country

home to a quarter of the

worlds oil reserves will

boost its refining potential

and its production of

petrochemicals.

In a highlight of the year,

the hydrocracker reactors

and coke drums are

delivered to the site

in January.

The project will create

local jobs, with

1, 100

PEOPLE eventually

employed at the complex.

OUR PARTNERSHIP WITH SAUDI ARAMCO

Overall capital spending on the Jubail project, the offspring of the SATORP joint venture between

Total (37.5%) and Saudi Aramco (62.5%), exceeds $10 billion. As on all our projects around the world,

we are offering our partner Saudi Aramco our experience managing very large international projects

and our industrial and technological know-how. We are working together to prepare facility start-up

and have created a training center for 400 young Saudi apprentice operators, who will eventually run Jubail.

The curriculum includes classroom instruction, an internship at Saudi Aramco and hands-on training

onsite. Some 130 of the apprentices, who were recruited in 2009, began working in the first units

in February 2012.

ACTIVITY PEAKS

ON THE WORKSITE

Jubails construction has entered

its final leg: at end-2011,

right on schedule, the project

was nearly 80% complete

and 117 million hours

had already been worked.

At years end, the building