Académique Documents

Professionnel Documents

Culture Documents

Impact of Fdi On Indian Retail Markets

Transféré par

KarthiKeyanKTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Impact of Fdi On Indian Retail Markets

Transféré par

KarthiKeyanKDroits d'auteur :

Formats disponibles

IMPACT OF FDI ON INDIAN RETAIL MARKETS

INTRODUCTION

Foreign direct investment (FDI) is investment directly into production in a country by a company

located in another country, either by buying a company in the target country or by expanding

operations of an existing business in that country. It is cross border investment, where foreign

assets are invested into the organizations of the domestic market excluding the investment in

stock.

Foreign direct investment (FDI) is a direct investment into production or business in a country by

an individual or company of another country, either by buying a company in the target country or

by expanding operations of an existing business in that country. Foreign direct investment is in

contrast to portfolio investment which is a passive investment in the securities of another country

such as stocks and bonds.

OBJECTIVES OF THE STUDY

1. To study present regulatory framework for FDI in general and in retail sector.

2. To study various entry options available to retailers

3. To study and analyze likely impact of FDI in single as well as multi brand retail on different

components of Indian economy.

SWOT ANALYSIS OF INDIAN RETAIL SECTOR

STRENGTH

Will boost economic development

Young and dynamic manpower to take the challenge.

Highest shop density in the world so no fear for small outlet

High growth rate in retail and wholesale trade in India

Presence of big business/industry house which can absorb losses.

WEAKNESS

Low capital investment in retail sector

Lack of trained and educated force

Lack of competition

More prices as compared to specialized shops

Poor infrastructure

Heavy wastage due to non availability of sufficient warehouses and cold storage facilities

OPPORTUNITIES

Hope of Major employment generation in future

Will improve the financial conditions of farmers

Will add to retailers efficiency

Foreign capital inflows

Big markets with better technology and branding

Quality improvement with cost reduction

Increasing the export capacity

Increase in lifestyle changes and status consciousness

THREATS

1.Kirana and retailers will may lose business in long run

2. Fear of controlling the retail sector by foreign investors/ Big stores

3. FDI in multiband retail may result in job losses in manufacturing sector

4. Work will be done by Indian and the profit will go to foreigners

5. Farmers will be exploited and will lose their fields and crops to foreign investors.

GOVERNMENTS VIEW POINT ON FDI IN RETAIL SECTOR

1.Benefit to the farmers

2.Creation of new jobs

3.Benefit to the customer

Division of Retail Industry

Organised Retailing

Organised retailing refers to trading activities undertaken by licensed retailers, that is, those who

are registered for sales tax, income tax, etc. These include the corporate-backed hypermarkets

and retail chains, and also the privately owned large retail businesses.

Unorganised Retailing

Unorganised retailing, on the other hand, refers to the traditional formats of low-cost retailing,

for example,

1.local kirana shops,

2.owner manned general stores,

3.paan/beedi shops,

4.convenience stores,

5.hand cart and

6.vendors, etc.

Government Argument

Benefit to stores & customers:

Fresh produce

Local source

Consistent quality

Safer food

Value for money

Lower cost compared to open market buys

Arguments

1.Less wastage

2.efficient transport

3.more money to farmers

4.no middle agents

5.More discount

6.marketing platform for small industries

Against

1.Unemployement

2.belongs to other country

3.pricing

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Private Organization Pension Amendment ProclamationDocument8 pagesPrivate Organization Pension Amendment ProclamationMulu DestaPas encore d'évaluation

- Internal Audit of MS1480 2019 HACCPDocument3 pagesInternal Audit of MS1480 2019 HACCPrevival195Pas encore d'évaluation

- Ede ReportDocument33 pagesEde ReportMayur Wadal75% (4)

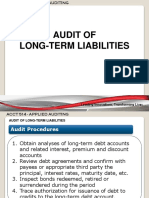

- Audit of Long-Term LiabilitiesDocument43 pagesAudit of Long-Term LiabilitiesEva Dagus0% (1)

- Value of SupplyDocument8 pagesValue of SupplyPratham 5hettyPas encore d'évaluation

- Indo US Ventures Case DebriefDocument19 pagesIndo US Ventures Case DebriefYazad AdajaniaPas encore d'évaluation

- NEFIN Credential: Achieving Carbon Neutrality For YouDocument14 pagesNEFIN Credential: Achieving Carbon Neutrality For YouDieki Rian MustapaPas encore d'évaluation

- Quiz 1Document9 pagesQuiz 1Jyasmine Aura V. AgustinPas encore d'évaluation

- Performance Management ToolkitDocument10 pagesPerformance Management ToolkitErick Audi100% (1)

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceJomarPas encore d'évaluation

- StemGenex Files For BankruptcyDocument53 pagesStemGenex Files For BankruptcyLeighTurnerPas encore d'évaluation

- Chapter 16 Employee Safety and HealthDocument13 pagesChapter 16 Employee Safety and HealthAmmarPas encore d'évaluation

- Marketing Research ReviewerDocument3 pagesMarketing Research ReviewerJayson MeperaquePas encore d'évaluation

- 外部采购 External procurement/ Buy out: NO. 内容 Content 人员 Staff Process Details 流程細節Document1 page外部采购 External procurement/ Buy out: NO. 内容 Content 人员 Staff Process Details 流程細節Chay CruzPas encore d'évaluation

- BDA China Private Equity Report 2023 PDFDocument39 pagesBDA China Private Equity Report 2023 PDFk60.2114410041Pas encore d'évaluation

- Pasdec Holdings Berhad (Assignment)Document22 pagesPasdec Holdings Berhad (Assignment)Nur IzaziPas encore d'évaluation

- Signature____________DateDocument4 pagesSignature____________DateSpencer DavidPas encore d'évaluation

- CHP 2 - Technology - Data AnalyticsDocument19 pagesCHP 2 - Technology - Data AnalyticsShahpal KhanPas encore d'évaluation

- 2015 Hudson NoticeDocument126 pages2015 Hudson NoticeThe Heritage FoundationPas encore d'évaluation

- Internal Financial Controls-IFCOR PDFDocument47 pagesInternal Financial Controls-IFCOR PDFAliah GhinaPas encore d'évaluation

- Supplier ScorecardDocument1 pageSupplier ScorecardJoe biloutePas encore d'évaluation

- Atul Auto LTD.: Ratio & Company AnalysisDocument7 pagesAtul Auto LTD.: Ratio & Company AnalysisMohit KanjwaniPas encore d'évaluation

- ZaraDocument25 pagesZarakarish_sadaranganiPas encore d'évaluation

- Case KokaDocument6 pagesCase KokaLora Hasku0% (1)

- Salesforce RFP for Energy Project ManagementDocument14 pagesSalesforce RFP for Energy Project ManagementDoddy PrimaPas encore d'évaluation

- ShoeDocument8 pagesShoeIlham Anugraha PramudityaPas encore d'évaluation

- Module 4 Topic 1 UTSDocument36 pagesModule 4 Topic 1 UTSAbd El Mounim BzizPas encore d'évaluation

- Dissertation On Employee Engagement and RetentionDocument4 pagesDissertation On Employee Engagement and RetentionOrderAPaperCanadaPas encore d'évaluation

- Policy Ambivalence Hinders India's Manufacturing GoalsDocument5 pagesPolicy Ambivalence Hinders India's Manufacturing GoalsRuby SinglaPas encore d'évaluation

- MSC Chain of Custody Standard - Default Version v5 0Document20 pagesMSC Chain of Custody Standard - Default Version v5 0Daniel PintoPas encore d'évaluation