Académique Documents

Professionnel Documents

Culture Documents

B2

Transféré par

yrijvszpCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

B2

Transféré par

yrijvszpDroits d'auteur :

Formats disponibles

| |

75

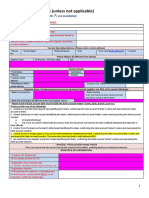

B2 SELF ASSESSMENT FOR

INDIVIDUALS

The self assessment system (SAS) for individuals (include salaried individuals and sole proprietors) and for

partnerships was implemented with effect from Y/A 2004 following the release of the Income Tax

(Amendment) Act 2002.

Under SAS which is based on the concept of File and Pay, individuals are required to:

File their completed income tax return forms to the Inland Revenue Board (IRB) together with the

payment of the balance of tax payable (if any).

Pay their income tax liability through monthly salary deductions for salaried individuals or through

bi-monthly instalments for individuals having business income.

2.1 Estimate of tax

For individuals other than salaried individuals, the IRB may issue a prescribed form (Form CP500) setting

out the estimate of tax payable (ETP) under an instalment scheme. ETP is determined by the IRB based on

the tax assessed in the preceding year. The taxpayer is required to pay the ETP in 6 bi-monthly instalments

as directed by the IRB commencing from the month of March. Each instalment payment accompanied by a

remittance slip (Form CP501) must be paid to the IRB within 30 days from the due date.

For salaried individuals, income tax will continue to be deducted through the monthly salary deductions

under the Monthly Tax Deduction (MTD) scheme.

2.2 Variation of instalments

Every individual under an instalment payment scheme may apply to revise the instalment payments not later

than 30 June of the relevant year by submitting the Form CP502. The IRB will issue a revised notice of

instalment payments (Form CP503) if the application is successful, setting out the revised instalment

payments. Where the revised estimate exceeds the amount of instalments paid to date, the difference shall

be payable in the remaining months of the instalment scheme. In addition, if the revised estimated tax for a

year of assessment is less than RM300, the individual is allowed to stop the subsequent payment starting

from the date of submission of the Form CP502.

2.3 Penalty provisions

(a) Late payment of instalment

Where any instalment due and payable on the date specified by the IRB has not been paid within 30 days

from the due date, a penalty of 10% shall be imposed on the amount unpaid without any further notice.

(b) Difference between the revised estimate submitted and final tax liability

When the tax payable excluding tax attributable to employment income, if any, exceeds the revised estimate

(if a revision is submitted) by an amount exceeding 30% of the tax payable, the difference exceeding the

30% will be subject to a penalty of 10%.

3.1 Filing of tax returns

Every individual who:

(i) has chargeable income for a year of assessment; or

BACKGROUND

FILING OF TAX RETURNS

| |

76

(ii) has no chargeable income for that year of assessment but:

has chargeable income for the year of assessment immediately preceding that year of

assessment; or

has furnished a return for the immediately preceding year; or

has been required to furnish a return (but failed to furnish a return) for the immediately

preceding year,

must file a tax return to the Director General by 30 April of the following year unless that individual with no

chargeable income receives a waiver from the Director General or has business income.

The tax filing deadline for a person carrying on a business, such as sole proprietor, partnership, club,

association and Hindu joint family, is 30 June of the following year.

Under SAS, no supporting documents need to be submitted to the IRB, but should be kept for the purpose

of tax audit. The taxpayer also has to indicate whether he/she has complied with the Public Rulings issued

by the IRB. In cases where the taxpayer receives dividend income which results in a tax repayable position,

HK-3 (Helaian Kerja 3) should be submitted together with the return. Effective Y/A 2008, the original

dividend vouchers are not required to be submitted to the IRB.

An individual and his/her spouse are required to file separate income tax return forms regardless of whether

the return forms are filed on a separate or combined assessment basis. The tax return furnished by the

taxpayer is deemed to be a notice of assessment and the notice of assessment is deemed to be issued on

the day the return is submitted to the IRB. Any balance of tax payable after taking into account the

instalment payments made via the instalment payment scheme or salary deductions, if any, would have to

be remitted to the IRB by 30 April/30 June of the following year.

With effect from Y/A 2011, to further enhance the e-Filing system in line with current technological

advances, the IRB has launched the m-Filing system, whereby the system allows individual tax payers to

furnish tax returns through e-Filing via mobile devices. The taxpayers can access the system at

https://mfiling.hasil.gov.my/ from the following supported devices:

iPhone and iPad with iOS version 4.0 and above

Android version 2.2 (Froyo) and above

BlackBerry (OS 6 and above) and Playbook

Windows Phone version 7.0 and above, 7.5 (Mango) recommended.

Meanwhile, with effect from Y/A 2012, it is proposed that information on total income, Monthly Tax

Deductions, Employees Provident Fund contributions, insurance and zakat are pre-filled by the IRB for

salaried taxpayers using the e-Filing system. Such information must be submitted by their employers to the

IRB.

With effect from Y/A 2013, taxpayers who file income tax returns before the expiry of the stipulated due date

will be given compensation of 2% p.a. on the amount of tax refunded late by the IRB computed on a daily

basis commencing 1 day:

(i) After 90 days from the due date for e-Filing; and

(ii) After 120 days from the due date for manual tax filing.

With effect from Y/A 2014, it is proposed that salaried individuals may elect not to file a tax return provided

that they meet the relevant criteria. Refer to A2.2.

3.2 Amendment to the self-assessed return

A new provision has been gazetted in the Income Tax Act 1967 (ITA 1967) effective from Y/A 2009 to allow

taxpayers to make self amendments for additional assessment under the following conditions:

(i) Amendments allowed are in respect of errors resulting in increased assessments.

(ii) Self amendment be allowed only once for each year of assessment.

| |

77

(iii) Self amendment be allowed within a period of 6 months from the due date of furnishing the tax

form.

(iv) Taxpayer makes self amendment in specified forms.

3.3 Penalty provisions

(i) Failure to submit a tax return

Failure to submit a tax return will constitute an offence under the Act and upon conviction, the taxpayer will

be liable to a fine ranging from RM200 to RM2,000 or to imprisonment for a term not exceeding 6 months or

both. The IRB is allowed to impose a penalty of up to 3 times the amount of tax and/or additional tax

payable if no prosecution action is taken against the taxpayer.

As a matter of practice, effective from 1 June 2011, the following late filing penalty rates will be imposed by

the MIRB on the tax payable before any set-off, repayment or rebates:

Submission of tax return Rate

Within 12 months from the due date for furnishing the return 20%

Within 24 months from the due date for furnishing the return 25%

Within 36 months from the due date for furnishing the return 30%

After 36 months from the due date for furnishing the return 35%

(ii) Failure to remit tax payable

Failure to remit the balance of tax payable by 30 April/30 June of the following year will attract a penalty of

10%. A further 5% penalty will be imposed on any balance remaining unpaid after 60 days.

(iii) Under-declaration of income or excessive claim on deductions or expenses

A taxpayer who makes a self amendment within 6 months from the due date of furnishing the return will

not be subject to a penalty for under-declaration of income or excessive claim on deductions or expenses.

However, he/she will be subject to a late payment penalty equivalent to the penalty imposed on a taxpayer

who files a correct return but defaults in paying tax due within the stipulated period.

Defaults in paying tax due within the stipulated period will attract a penalty of 10%. A further 5% penalty will

be imposed on any balance remaining unpaid after 60 days.

4.1 Nature

Under SAS, tax audit is a primary activity of the IRB. It is aimed at enhancing voluntary compliance with the

tax laws and regulations. A taxpayer can be selected for an audit at any time. However, it does not

necessarily mean that a taxpayer who is selected for an audit has committed an offence.

A tax audit is an examination of a taxpayers business records and financial affairs to ascertain that the right

amount of income should be declared and the right amount of tax that should be calculated and paid are in

accordance with tax laws and regulations. The IRB carries out 2 types of audit, namely desk audit and field

audit.

(i) Desk audit

Desk audit is held at the IRBs office and is normally concerned with straightforward issues or tax

adjustments which are easily dealt with via correspondence.

TAX AUDIT

| |

78

(ii) Field audit

Field audit takes place at a taxpayers premises and involves the examination of the taxpayers

business records. In the case of a sole proprietorship or partnership, if the taxpayers business

records are incomplete, it may involve the examination of non-business records such as personal

bank statements, etc.

Upon completion of an audit and if there is no adjustment to the tax computation, the taxpayer will be

informed via a letter that the case has been finalised without any adjustments. On the other hand, if there

are adjustments to be made, the IRB will issue a tax computation summarising the tax adjustments based

on their findings. If an appeal is not made within a specific time, an additional assessment will be issued with

appropriate penalties where applicable.

To facilitate the audit process, taxpayers must therefore ensure that businesses as well as non-business

records are properly kept. Generally, the types of records to be kept are as follows:

(i) Employment income Forms EA/EC, pay slip, etc.

(ii) Business income sales and purchases invoices, cash bills, payment vouchers, official receipts

for payments, bank statements, cheque butts and other relevant documents.

(iii) Original receipts to substantiate all expenses or claims made.

With effect from 1 January 2014, to increase the certainty of the costs of doing business, enhance investor

confidence and to be in tandem with best practices, it is proposed that the time bar for tax audits be reduced

from 6 years to 5 years from the date the tax assessment is made. The proposal is not applicable for cases

of false declaration, willful late payment and negligence. The proposal will not alter the requirement to keep

records for 7 years.

4.2 Tax audit framework

A revised tax audit framework which is effective from 1 January 2009 has been issued by the IRB to replace

the framework issued in January 2007. The framework is to ensure that a tax audit is carried out in a fair,

transparent and impartial manner. The main areas covered in the framework are as follows:

(a) Selection of cases;

(b) Tax audit methodology;

(c) Rights and responsibilities of taxpayers, tax agents and audit officers;

(d) Confidentiality of information;

(e) Offences and penalties;

(f) Complaints and payment procedures;

(g) Appeals.

This framework is not applicable to audit cases involving transfer pricing, thin capitalisation and advance

pricing arrangement.

On 1 April 2013, a revised version of the Tax Audit Framework of Inland Revenue Board Malaysia was

introduced in Section 1 of the document

4.3 Penalty provisions

(a) Penalties for omission/understatement of income

The penalty for omission or understatement of income is provided under S. 113(2) of the ITA 1967, which is

100% of the tax undercharged. However, the Director General of Inland Revenue may impose a lower

penalty of 45% for the first offence.

In the event the taxpayer makes voluntary disclosure of the omitted income before the commencement of

the tax audit, the Director General may impose the concessionary penalty rates.

| |

79

The revised concessionary penalty rates as set out in the latest tax audit framework, which supersedes the

old framework with effect from 1 January 2009, is as follows:

Period from the due date of submitting return

form

Old rate

(%)

Revised rate

(%)

Voluntary

disclosure before

case is selected for

audit

< 60 days 15 10

> 60 days to 6 months 15 15.5

> 6 months to 1 year 15 20

> 1 year to 3 years 20 25

> 3 years and above 30 30

Voluntary disclosure after taxpayer has been informed but before the

commencement of the audit visit

35 35

For each repeated offence, the rate of penalty shall be increased by 10% as compared to the last penalty

rate imposed for the previous offence but is restricted to a sum not exceeding 100% of the amount of tax

undercharged.

(b) Penalty for not providing reasonable facilities and assistance

Public Ruling 7/2000 on Providing Reasonable Facilities and Assistance is also applicable to individuals.

The offender upon conviction may be liable to a fine of RM1,000 to RM10,000 or to imprisonment for a term

not exceeding one year or both.

(c) Penalty for not complying with a notice asking for certain information as required

Pursuant to S. 120(1) of the ITA 1967, the offender upon conviction may be liable to a fine of RM200 to

RM2,000 or to imprisonment for a term not exceeding 6 months or both.

(d) Penalty for failure to keep sufficient records

In accordance with Public Ruling 5/2000 (Revised), individuals carrying on a business as a sole

proprietorship or a partnership are required to keep sufficient records. The offender upon conviction may be

liable to a fine of not less than RM300 and not more than RM10,000 or to imprisonment for a term not

exceeding 12 months or both.

If a taxpayer is dissatisfied with an assessment deemed to be served on him/her, he/she should file an

appeal within 30 days from the date of submission of the tax return. Specific details and the grounds of

appeal should be stated in the appeal to the IRB. In the case where a notice of additional assessment is

issued because of audit adjustments made by the IRB, the appeal should be submitted within 30 days after

the service of the notice of additional assessment.

A new provision of the ITA 1967, S. 97A, provides clarification in relation to an appeal against a notification

of non-chargeability. Effective 1 January 2009, the right to appeal to the Special Commissioners of the

Income Tax (SCIT) by a person is extended to cases which are not liable to tax.

With the issuance of Public Ruling 3/2012 (Appeal Against An Assessment) by the IRB on 4 May 2012, an

appeal against an assessment has to be submitted by using Form Q. An appeal letter will no longer be

considered by the IRB.

Upon coming into operation of the Finance (No. 2) Act 2013, an appeal to the Special Commissioners is not

applicable to the deemed assessment made under S. 90(1) or S. 91A of the ITA 1967 except where the

taxpayer is aggrieved by the deemed assessment as a result of complying with the public ruling issued by

the Director General (2014 Budget).

APPEAL AGAINST AN ASSESSMENT

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- B14 Advance RulingsDocument3 pagesB14 Advance RulingsyrijvszpPas encore d'évaluation

- Irb Exchange RatesDocument2 pagesIrb Exchange RatesyrijvszpPas encore d'évaluation

- Transitional Provisions: B26 Single Tier System and TheDocument2 pagesTransitional Provisions: B26 Single Tier System and TheyrijvszpPas encore d'évaluation

- B10 Income Tax RebatesDocument2 pagesB10 Income Tax RebatesyrijvszpPas encore d'évaluation

- B6Document7 pagesB6yrijvszpPas encore d'évaluation

- Income: B4 Computation of ChargeableDocument1 pageIncome: B4 Computation of ChargeableyrijvszpPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Inventory Trading SampleDocument28 pagesInventory Trading SampleRonald Victor Galarza Hermitaño0% (1)

- BS Book 4 Lesson Notes-1Document89 pagesBS Book 4 Lesson Notes-1Geoffrey ObongoPas encore d'évaluation

- Sap AbapDocument4 pagesSap AbapAarav ChoudharyPas encore d'évaluation

- Understanding Order To Cash Cycle in SapDocument4 pagesUnderstanding Order To Cash Cycle in Sapadit1435Pas encore d'évaluation

- CSP Partner Center Overview and WalkthruDocument113 pagesCSP Partner Center Overview and WalkthruerickmokPas encore d'évaluation

- Shipment and Shipment CostDocument32 pagesShipment and Shipment CostShrinivas Tumma100% (3)

- Vat Assessments Ca Dilip PhadkeDocument31 pagesVat Assessments Ca Dilip PhadkeMahesh PawarPas encore d'évaluation

- List of 100 Animals With Their Male Female Young Group Home SoundDocument7 pagesList of 100 Animals With Their Male Female Young Group Home Soundfakarul islamPas encore d'évaluation

- Mail Attachment GoogleusercontentDocument1 pageMail Attachment GoogleusercontentHelan ElizabethPas encore d'évaluation

- J.R.a. Philippines, Inc. vs. Commissioner of Internal RevenueDocument6 pagesJ.R.a. Philippines, Inc. vs. Commissioner of Internal Revenuevince005Pas encore d'évaluation

- First Aid Guide GazaDocument2 pagesFirst Aid Guide GazaKetheesaran LingamPas encore d'évaluation

- Abbot Ltd..Document3 pagesAbbot Ltd..LoveSahilSharmaPas encore d'évaluation

- Glossary of Shipping TermsDocument38 pagesGlossary of Shipping TermsPrashant SinghPas encore d'évaluation

- RTO ProcessDocument5 pagesRTO Processashutosh mauryaPas encore d'évaluation

- Counties Manukau Touch Association Board Meeting MinutesDocument16 pagesCounties Manukau Touch Association Board Meeting MinutesHarleyPas encore d'évaluation

- Cost Plus Agreement-62Pages PDFDocument62 pagesCost Plus Agreement-62Pages PDFyakarim0% (1)

- 49-57 CarDocument149 pages49-57 CartruckshopPas encore d'évaluation

- NetSuite Billing and Invoicing Process & User GuideDocument76 pagesNetSuite Billing and Invoicing Process & User GuideMohie MondyPas encore d'évaluation

- ESOAUG R12 WhatsNew FINANCIALSDocument84 pagesESOAUG R12 WhatsNew FINANCIALSbgowda_erp1438Pas encore d'évaluation

- Vendor Set Up FormDocument3 pagesVendor Set Up FormDELICIAS PASCAL CHILEAN FOODPas encore d'évaluation

- Kwarsick Invoices Jan-Feb 2011Document2 pagesKwarsick Invoices Jan-Feb 2011southwhidbeyPas encore d'évaluation

- CTI PresentationDocument19 pagesCTI PresentationSantosh BeheraPas encore d'évaluation

- RESA Tax 1410 Preweek 165Document20 pagesRESA Tax 1410 Preweek 165Mike AntolinoPas encore d'évaluation

- Accounts PayableDocument44 pagesAccounts Payablethat_glossmk100% (2)

- Rtgs InvoiceDocument1 pageRtgs InvoicePanaPas encore d'évaluation

- Acc212 Handout:: Midlands State University Department of AccountingDocument23 pagesAcc212 Handout:: Midlands State University Department of AccountingPhebieon MukwenhaPas encore d'évaluation

- EXERCISE 8 With AnswersDocument10 pagesEXERCISE 8 With AnswershanaPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Uddhava Priya DasPas encore d'évaluation

- DEY AMIT KUMAR InternetDocument2 pagesDEY AMIT KUMAR InternetITPas encore d'évaluation

- FICO Real Time ProjectDocument105 pagesFICO Real Time ProjectsowmyanavalPas encore d'évaluation