Académique Documents

Professionnel Documents

Culture Documents

Balance Coca-Cola 2011

Transféré par

AinMora0 évaluation0% ont trouvé ce document utile (0 vote)

74 vues4 pagesCOCA-COLA COMPANY and SUBSIDIARIES CONSOLIDATED STATEMENTS of income Year Ended December 31, 2011 2010 2009 (In millions except per share data) NET OPERATING REVENUES $ 46,542 $ 35,119 $ 30,990 Cost of goods sold 18,216 12,693 11,088 GROSS PROFIT 28,326 22,426 19,902 Selling, general and administrative expenses 17,440 13,158 11,358 other operating charges 732 819

Description originale:

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentCOCA-COLA COMPANY and SUBSIDIARIES CONSOLIDATED STATEMENTS of income Year Ended December 31, 2011 2010 2009 (In millions except per share data) NET OPERATING REVENUES $ 46,542 $ 35,119 $ 30,990 Cost of goods sold 18,216 12,693 11,088 GROSS PROFIT 28,326 22,426 19,902 Selling, general and administrative expenses 17,440 13,158 11,358 other operating charges 732 819

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

74 vues4 pagesBalance Coca-Cola 2011

Transféré par

AinMoraCOCA-COLA COMPANY and SUBSIDIARIES CONSOLIDATED STATEMENTS of income Year Ended December 31, 2011 2010 2009 (In millions except per share data) NET OPERATING REVENUES $ 46,542 $ 35,119 $ 30,990 Cost of goods sold 18,216 12,693 11,088 GROSS PROFIT 28,326 22,426 19,902 Selling, general and administrative expenses 17,440 13,158 11,358 other operating charges 732 819

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

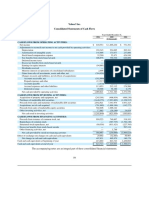

THE COCA-COLA COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31, 2011 2010 2009

(In millions except per share data)

NET OPERATING REVENUES $ 46,542 $ 35,119 $ 30,990

Cost of goods sold 18,216 12,693 11,088

GROSS PROFIT 28,326 22,426 19,902

Selling, general and administrative expenses 17,440 13,158 11,358

Other operating charges 732 819 313

OPERATING INCOME 10,154 8,449 8,231

Interest income 483 317 249

Interest expense 417 733 355

Equity income (loss) net 690 1,025 781

Other income (loss) net 529 5,185 40

INCOME BEFORE INCOME TAXES 11,439 14,243 8,946

Income taxes 2,805 2,384 2,040

CONSOLIDATED NET INCOME 8,634 11,859 6,906

Less: Net income attributable to noncontrolling interests 62 50 82

NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY $ 8,572 $ 11,809 $ 6,824

BASIC NET INCOME PER SHARE

1

$ 3.75 $ 5.12 $ 2.95

DILUTED NET INCOME PER SHARE

1

$ 3.69 $ 5.06 $ 2.93

AVERAGE SHARES OUTSTANDING 2,284 2,308 2,314

Effect of dilutive securities 39 25 15

AVERAGE SHARES OUTSTANDING ASSUMING DILUTION 2,323 2,333 2,329

1

Basic net income per share and diluted net income per share are calculated based on net income attributable to shareowners of

The Coca-Cola Company.

Refer to Notes to Consolidated Financial Statements.

78

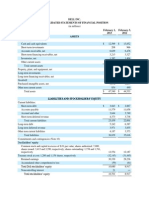

THE COCA-COLA COMPANY AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31, 2011 2010

(In millions except par value)

ASSETS

CURRENT ASSETS

Cash and cash equivalents $ 12,803 $ 8,517

Short-term investments 1,088 2,682

TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS 13,891 11,199

Marketable securities 144 138

Trade accounts receivable, less allowances of $83 and $48, respectively 4,920 4,430

Inventories 3,092 2,650

Prepaid expenses and other assets 3,450 3,162

TOTAL CURRENT ASSETS 25,497 21,579

EQUITY METHOD INVESTMENTS 7,233 6,954

OTHER INVESTMENTS, PRINCIPALLY BOTTLING COMPANIES 1,141 631

OTHER ASSETS 3,495 2,121

PROPERTY, PLANT AND EQUIPMENT net 14,939 14,727

TRADEMARKS WITH INDEFINITE LIVES 6,430 6,356

BOTTLERS FRANCHISE RIGHTS WITH INDEFINITE LIVES 7,770 7,511

GOODWILL 12,219 11,665

OTHER INTANGIBLE ASSETS 1,250 1,377

TOTAL ASSETS $ 79,974 $ 72,921

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Accounts payable and accrued expenses $ 9,009 $ 8,859

Loans and notes payable 12,871 8,100

Current maturities of long-term debt 2,041 1,276

Accrued income taxes 362 273

TOTAL CURRENT LIABILITIES 24,283 18,508

LONG-TERM DEBT 13,656 14,041

OTHER LIABILITIES 5,420 4,794

DEFERRED INCOME TAXES 4,694 4,261

THE COCA-COLA COMPANY SHAREOWNERS EQUITY

Common stock, $0.25 par value; Authorized 5,600 shares;

Issued 3,520 and 3,520 shares, respectively 880 880

Capital surplus 11,212 10,057

Reinvested earnings 53,550 49,278

Accumulated other comprehensive income (loss) (2,703) (1,450)

Treasury stock, at cost 1,257 and 1,228 shares, respectively (31,304) (27,762)

EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 31,635 31,003

EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS 286 314

TOTAL EQUITY 31,921 31,317

TOTAL LIABILITIES AND EQUITY $ 79,974 $ 72,921

Refer to Notes to Consolidated Financial Statements.

79

THE COCA-COLA COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31, 2011 2010 2009

(In millions)

OPERATING ACTIVITIES

Consolidated net income $ 8,634 $ 11,859 $ 6,906

Depreciation and amortization 1,954 1,443 1,236

Stock-based compensation expense 354 380 241

Deferred income taxes 1,028 617 353

Equity (income) loss net of dividends (269) (671) (359)

Foreign currency adjustments 7 151 61

Significant (gains) losses on sales of assets net (220) (645) (43)

Other significant (gains) losses net (4,713)

Other operating charges 214 264 134

Other items (335) 477 221

Net change in operating assets and liabilities (1,893) 370 (564)

Net cash provided by operating activities 9,474 9,532 8,186

INVESTING ACTIVITIES

Purchases of short-term investments (4,057) (4,579) (2,130)

Proceeds from disposals of short-term investments 5,647 4,032

Acquisitions and investments (977) (2,511) (300)

Purchases of other investments (787) (132) (22)

Proceeds from disposals of bottling companies and other investments 562 972 240

Purchases of property, plant and equipment (2,920) (2,215) (1,993)

Proceeds from disposals of property, plant and equipment 101 134 104

Other investing activities (93) (106) (48)

Net cash provided by (used in) investing activities (2,524) (4,405) (4,149)

FINANCING ACTIVITIES

Issuances of debt 27,495 15,251 14,689

Payments of debt (22,530) (13,403) (12,326)

Issuances of stock 1,569 1,666 664

Purchases of stock for treasury (4,513) (2,961) (1,518)

Dividends (4,300) (4,068) (3,800)

Other financing activities 45 50 (2)

Net cash provided by (used in) financing activities (2,234) (3,465) (2,293)

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS (430) (166) 576

CASH AND CASH EQUIVALENTS

Net increase (decrease) during the year 4,286 1,496 2,320

Balance at beginning of year 8,517 7,021 4,701

Balance at end of year $ 12,803 $ 8,517 $ 7,021

Refer to Notes to Consolidated Financial Statements.

80

THE COCA-COLA COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREOWNERS EQUITY

Year Ended December 31, 2011 2010 2009

(In millions except per share data)

EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY

NUMBER OF COMMON SHARES OUTSTANDING

Balance at beginning of year 2,292 2,303 2,312

Purchases of treasury stock (63) (49) (26)

Treasury stock issued to employees related to stock compensation plans 34 38 17

Balance at end of year 2,263 2,292 2,303

COMMON STOCK $ 880 $ 880 $ 880

CAPITAL SURPLUS

Balance at beginning of year 10,057 8,537 7,966

Stock issued to employees related to stock compensation plans 724 855 339

Replacement share-based awards issued in connection with an acquisition 237

Tax benefit (charge) from employees stock option and restricted stock plans 79 48 (6)

Stock-based compensation 354 380 238

Other activities (2)

Balance at end of year 11,212 10,057 8,537

REINVESTED EARNINGS

Balance at beginning of year 49,278 41,537 38,513

Net income attributable to shareowners of The Coca-Cola Company 8,572 11,809 6,824

Dividends (per share $1.88, $1.76 and $1.64 in 2011, 2010 and 2009, respectively) (4,300) (4,068) (3,800)

Balance at end of year 53,550 49,278 41,537

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Balance at beginning of year (1,450) (757) (2,674)

Net foreign currency translation adjustment (640) (935) 1,824

Net gain (loss) on derivatives 145 (120) 34

Net change in unrealized gain on available-for-sale securities (7) 102 (52)

Net change in pension and other benefit liabilities (751) 260 111

Net other comprehensive income (loss) (1,253) (693) 1,917

Balance at end of year (2,703) (1,450) (757)

TREASURY STOCK

Balance at beginning of year (27,762) (25,398) (24,213)

Stock issued to employees related to stock compensation plans 830 824 333

Purchases of treasury stock (4,372) (3,188) (1,518)

Balance at end of year (31,304) (27,762) (25,398)

TOTAL EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY $ 31,635 $ 31,003 $ 24,799

EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS

Balance at beginning of year $ 314 $ 547 $ 390

Net income attributable to noncontrolling interests 62 50 82

Net foreign currency translation adjustment (52) (12) 49

Dividends paid to noncontrolling interests (38) (32) (14)

Contributions by noncontrolling interests 1 40

Increase due to business combinations 13

Deconsolidation of certain variable interest entities (253)

TOTAL EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS $ 286 $ 314 $ 547

COMPREHENSIVE INCOME

Consolidated net income $ 8,634 $ 11,859 $ 6,906

Consolidated net other comprehensive income (loss) (1,305) (705) 1,966

CONSOLIDATED COMPREHENSIVE INCOME $ 7,329 $ 11,154 $ 8,872

Refer to Notes to Consolidated Financial Statements.

81

Vous aimerez peut-être aussi

- Worldcom Financials 2000 2002 ADocument5 pagesWorldcom Financials 2000 2002 AmominPas encore d'évaluation

- Method Statement of Static Equipment ErectionDocument20 pagesMethod Statement of Static Equipment Erectionsarsan nedumkuzhi mani100% (4)

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniPas encore d'évaluation

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91Pas encore d'évaluation

- Turkish Airlines Financial Statements Exel (Hamada SH)Document89 pagesTurkish Airlines Financial Statements Exel (Hamada SH)hamada1992Pas encore d'évaluation

- Yahoo! and Kodenko financial statement analysisDocument7 pagesYahoo! and Kodenko financial statement analysisPriyah RathakrishnahPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- 60 HK Food Investment 1Q2011Document17 pages60 HK Food Investment 1Q2011Lye Shyong LingPas encore d'évaluation

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohPas encore d'évaluation

- Apple Inc: FORM 10-QDocument76 pagesApple Inc: FORM 10-Qwill2222Pas encore d'évaluation

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809Pas encore d'évaluation

- Coca-Cola Financial Statements AnalysisDocument4 pagesCoca-Cola Financial Statements AnalysisJossy AndrinaPas encore d'évaluation

- IRRI AR 2013 Audited Financial StatementsDocument62 pagesIRRI AR 2013 Audited Financial StatementsIRRI_resourcesPas encore d'évaluation

- June 2013 Q3 QuarterDocument49 pagesJune 2013 Q3 Quartergrkyiasou33Pas encore d'évaluation

- Consolidated Financial Statements Dec 312012Document60 pagesConsolidated Financial Statements Dec 312012Inamullah KhanPas encore d'évaluation

- Integrated Micro-Electronics: Q2 Results (Press Release)Document17 pagesIntegrated Micro-Electronics: Q2 Results (Press Release)BusinessWorldPas encore d'évaluation

- Dell IncDocument6 pagesDell IncMohit ChaturvediPas encore d'évaluation

- Home Depot in The New MillenniumDocument3 pagesHome Depot in The New MillenniumElaineKongPas encore d'évaluation

- K-C Corp Form 10-Q Filing Highlights Quarterly ResultsDocument41 pagesK-C Corp Form 10-Q Filing Highlights Quarterly Resultsmanumehndiratta123Pas encore d'évaluation

- Finals Output-AgadDocument16 pagesFinals Output-AgadClarito, Trisha Kareen F.Pas encore d'évaluation

- Al-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Document6 pagesAl-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Umair KhanPas encore d'évaluation

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012Pas encore d'évaluation

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraPas encore d'évaluation

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaPas encore d'évaluation

- American International Ventures Inc /de/: FORM 10-QDocument18 pagesAmerican International Ventures Inc /de/: FORM 10-QChapter 11 DocketsPas encore d'évaluation

- 025the Final Print NaaaDocument63 pages025the Final Print NaaaRhealyn Cabel CapalaranPas encore d'évaluation

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564Pas encore d'évaluation

- S H D I: Untrust OME Evelopers, NCDocument25 pagesS H D I: Untrust OME Evelopers, NCfjl300Pas encore d'évaluation

- AESCorporation 10Q 20130808Document86 pagesAESCorporation 10Q 20130808Ashish SinghalPas encore d'évaluation

- DemonstraDocument75 pagesDemonstraFibriaRIPas encore d'évaluation

- 2013 04 24 171829 Accounting 504 6q Uestions 1 1Document16 pages2013 04 24 171829 Accounting 504 6q Uestions 1 1jodh26Pas encore d'évaluation

- 2019 PFRS For Se - Jack Margie Farm Inc For PrintingDocument16 pages2019 PFRS For Se - Jack Margie Farm Inc For PrintingJenver BuenaventuraPas encore d'évaluation

- Income StatementDocument44 pagesIncome Statementyariyevyusif07Pas encore d'évaluation

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinPas encore d'évaluation

- Airbus Annual ReportDocument201 pagesAirbus Annual ReportfsdfsdfsPas encore d'évaluation

- Net Sales: January 28, 2012 January 29, 2011Document9 pagesNet Sales: January 28, 2012 January 29, 2011장대헌Pas encore d'évaluation

- 3Q14 Financial StatementsDocument58 pages3Q14 Financial StatementsFibriaRIPas encore d'évaluation

- Life Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDocument33 pagesLife Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-Qpeterlee100Pas encore d'évaluation

- 2022 - BPE 44903 BUSINESS VALUATION - 2022 Final ExamDocument5 pages2022 - BPE 44903 BUSINESS VALUATION - 2022 Final ExamShaza NaPas encore d'évaluation

- PCC - Financial Stahtements 2013 - Final by RashidDocument56 pagesPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryPas encore d'évaluation

- Fianancial StatementsDocument84 pagesFianancial StatementsMuhammad SaeedPas encore d'évaluation

- Zimplow FY 2012Document2 pagesZimplow FY 2012Kristi DuranPas encore d'évaluation

- Leucadia 2012 Q3 ReportDocument43 pagesLeucadia 2012 Q3 Reportofb1Pas encore d'évaluation

- Niocorp Developments LTD.: (Formerly Quantum Rare Earth Developments Corp.)Document18 pagesNiocorp Developments LTD.: (Formerly Quantum Rare Earth Developments Corp.)niobfPas encore d'évaluation

- Wassim Zhani Cheesecake Factory Practice Problem SolutionDocument7 pagesWassim Zhani Cheesecake Factory Practice Problem Solutionwassim zhaniPas encore d'évaluation

- Changes in Equity StatementDocument1 pageChanges in Equity StatementAnonymous f7wV1lQKRPas encore d'évaluation

- Beng Kuang Marine Limited: Page 1 of 10Document10 pagesBeng Kuang Marine Limited: Page 1 of 10pathanfor786Pas encore d'évaluation

- United States Securities and Exchange Commission FORM 10-QDocument71 pagesUnited States Securities and Exchange Commission FORM 10-QWai LonnPas encore d'évaluation

- Coca Cola Financial Statements 2008Document75 pagesCoca Cola Financial Statements 2008James KentPas encore d'évaluation

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiPas encore d'évaluation

- 70 XTO Financial StatementsDocument5 pages70 XTO Financial Statementsredraider4404Pas encore d'évaluation

- Consolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedDocument6 pagesConsolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedMbanga PennPas encore d'évaluation

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkPas encore d'évaluation

- Audited FS 2010 PfrsDocument46 pagesAudited FS 2010 Pfrsracs_ann110% (1)

- Appendix 5 Consolidated Cash Flow Statement: For The Year Ended 31 December 2008Document15 pagesAppendix 5 Consolidated Cash Flow Statement: For The Year Ended 31 December 2008Architecture ArtPas encore d'évaluation

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeePas encore d'évaluation

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocument27 pagesUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888Pas encore d'évaluation

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryD'EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- UBI1Document66 pagesUBI1Rudra SinghPas encore d'évaluation

- HW3Document3 pagesHW3Noviyanti Tri Maretta Sagala0% (1)

- Discount & Percentage Word Problems SolutionsDocument4 pagesDiscount & Percentage Word Problems SolutionsrhePas encore d'évaluation

- StrutsDocument7 pagesStrutsBatrisyialya RusliPas encore d'évaluation

- Best Homeopathic Doctor in SydneyDocument8 pagesBest Homeopathic Doctor in SydneyRC homeopathyPas encore d'évaluation

- Leapfroggers, People Who Start A Company, Manage Its Growth Until They Get Bored, and Then SellDocument3 pagesLeapfroggers, People Who Start A Company, Manage Its Growth Until They Get Bored, and Then Sellayesha noorPas encore d'évaluation

- Kunci Jawaban Creative English 3BDocument14 pagesKunci Jawaban Creative English 3BLedjab Fatima67% (3)

- The Earthing of Zenner BarrierDocument4 pagesThe Earthing of Zenner BarrierFatholla SalehiPas encore d'évaluation

- Tambunting Pawnshop Vs CIR Re VATDocument7 pagesTambunting Pawnshop Vs CIR Re VATMark Lester Lee AurePas encore d'évaluation

- Data SheetDocument14 pagesData SheetAnonymous R8ZXABkPas encore d'évaluation

- CELF Final ProspectusDocument265 pagesCELF Final ProspectusDealBookPas encore d'évaluation

- Company's Profile Presentation (Mauritius Commercial Bank)Document23 pagesCompany's Profile Presentation (Mauritius Commercial Bank)ashairways100% (2)

- Instruction/Special Maintenance Instruction (IN/SMI)Document2 pagesInstruction/Special Maintenance Instruction (IN/SMI)ANURAJM44Pas encore d'évaluation

- Dewatering Construction Sites Below Water TableDocument6 pagesDewatering Construction Sites Below Water TableSOMSUBHRA SINGHAPas encore d'évaluation

- Responsibility Centres: Nature of Responsibility CentersDocument13 pagesResponsibility Centres: Nature of Responsibility Centersmahesh19689Pas encore d'évaluation

- Wheat as an alternative to reduce corn feed costsDocument4 pagesWheat as an alternative to reduce corn feed costsYuariza Winanda IstyanPas encore d'évaluation

- Exercise Manual For Course 973: Programming C# Extended Features: Hands-OnDocument122 pagesExercise Manual For Course 973: Programming C# Extended Features: Hands-OnAdrian GorganPas encore d'évaluation

- BIU and EU functions in 8086 microprocessorDocument12 pagesBIU and EU functions in 8086 microprocessorDaksh ShahPas encore d'évaluation

- 702190-Free PowerPoint Template AmazonDocument1 page702190-Free PowerPoint Template AmazonnazPas encore d'évaluation

- Analysis of Trend Following SystemsDocument52 pagesAnalysis of Trend Following SystemsClement Li100% (1)

- Embedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDocument27 pagesEmbedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDhirenKumarGoleyPas encore d'évaluation

- The Study of Accounting Information SystemsDocument44 pagesThe Study of Accounting Information SystemsCelso Jr. AleyaPas encore d'évaluation

- Unit 13 AminesDocument3 pagesUnit 13 AminesArinath DeepaPas encore d'évaluation

- TicketDocument2 pagesTicketbikram kumarPas encore d'évaluation

- Sample Contract Rates MerchantDocument2 pagesSample Contract Rates MerchantAlan BimantaraPas encore d'évaluation

- Harry Styles: The Rise of a Pop StarDocument9 pagesHarry Styles: The Rise of a Pop StarBilqis LaudyaPas encore d'évaluation

- 04 Activity 2Document2 pages04 Activity 2Jhon arvie MalipolPas encore d'évaluation

- AutocadDocument8 pagesAutocadbrodyPas encore d'évaluation

- Jenga Cash Flow Solution: InstructionsDocument1 pageJenga Cash Flow Solution: InstructionsPirvuPas encore d'évaluation