Académique Documents

Professionnel Documents

Culture Documents

Anti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014

Transféré par

stephin k jCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Anti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014

Transféré par

stephin k jDroits d'auteur :

Formats disponibles

[TO BE PUBLISHED IN PART II, SECTION 3, SUB-SECTION (i) OF THE GAZETTE OF

INDIA, EXTRAORDINARY]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. 35/2014-Customs (ADD)

New Delhi, the 24th July, 2014

G.S.R. (E). Whereas, the designated authority, vide notification No. 15/1/2013-

DGAD dated 30th April, 2013, published in Gazette of India, Extraordinary, Part I, Section 1,

had initiated a review in the matter of continuation of anti-dumping duty on imports of Rubber

Chemicals, namely, MBT, CBS, TDQ, PVI, TMT and PX-13(6PPD) originating in or exported

from the Peoples Republic of China and PX-13(6PPD) originating in or exported from Korea

RP falling under Chapter 29 or 38 of the First Schedule to the Customs Tariff Act, 1975 (51 of

1975) (hereinafter referred to as the Customs Tariff Act), imposedvide notification of the

Government of India, in the Ministry of Finance (Department of Revenue), No. 133/2008-

Customs, dated the 12th December, 2008, published in the Gazette of India, Extraordinary

Part II, Section 3, Sub-section (i) vide number G.S.R. 853 (E), dated the 12th December,

2008 and vide notification of the Government of India, in the Ministry of Finance (Department

of Revenue), No. 92/2011-Customs, dated the 20th September, 2011, published in the

Gazette of India, Extraordinary Part II, Section 3, Sub-section (i) vide number G.S.R. 700 (E),

dated the 20th September, 2011;

And whereas, the Central Government had extended the anti-dumping duty on Rubber

Chemicals, namely, MBT, CBS, TDQ, PVI, TMT and PX-13(6PPD) originating in or exported

from the Peoples Republic of China and PX-13(6PPD) originating in or exported from Korea

RP upto and inclusive of the 4th May, 2014, vide notification of the Government of India, in the

Ministry of Finance (Department of Revenue), No.16/2013-Customs (ADD), dated the 5th July,

2013, published in the Gazette of India, Extraordinary Part II, Section 3, Sub-section

(i) vide number G.S.R 465 (E), dated the 5th July, 2013 and vide notification of the

Government of India, in the Ministry of Finance (Department of Revenue), No. 17/2013-

Customs (ADD), dated the 5th July, 2013, published in the Gazette of India, Extraordinary ,Part

II, Section 3, Sub-section (i) vide number G.S.R 466 (E), dated the 5th July, 2013 respectively;

And whereas, in the matter of review of anti-dumping duty on import of the above mentioned

rubber chemicals (hereinafter referred to as the subject goods), originating in or exported

from the Peoples Republic of China and Korea RP (hereinafter referred to as the subject

countries), the designated authority in its final findings, vide notification No. 15/1/2013-DGAD,

dated 29th April, 2014, published in the Gazette of India, Extraordinary, Part I, Section 1, has

come to the conclusion that-

(i) the dumped imports of subject goods from the subject countries are causing injury to the

domestic industry;

(ii) there is likelihood of dumping and injury to the domestic industry if the existing duties on

the subject goods being imported from the subject countries are allowed to expire

and has recommended continuation of the imposition of anti-dumping duty on the subject

goods, originating in or exported from subject countries.

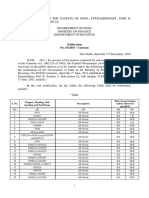

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A of the

Customs Tariff Act, read with rules 18 and 23 of the Customs Tariff (Identification, Assessment and

Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the

Central Government, after considering the aforesaid final findings of the designated authority, hereby

imposes on the subject goods, the description of which is specified in column (3) of the Table-1 below,

specification of which is specified in column (4), falling under the heading of the First Schedule to the

Customs Tariff Act as specified in the corresponding entry in column (2), originating in the countries as

specified in the corresponding entry in column (5), exported from the countries as specified in the

corresponding entry in column (6), produced by the producers as specified in the corresponding entry in

column (7), exported by the exporters as specified in the corresponding entry in column (8), and

imported into India, an anti-dumping duty at the rate equal to the amount as specified in the

corresponding entry in column (9) in the currency as specified in the corresponding entry in column

(11) and as per unit of measurement as specified in the corresponding entry in column (10), of the said

Table-1, namely:-

Table-1

Sl.

No

.

Tariff

Item

Descriptio

n of goods

Specifica

tions

Country of

origin

Country

of

export

Producer Exporter Amou

nt

Unit Currency

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

1

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PX - 13

S. No.1

of Table-2.

Peoples

Republic of

China

Peoples

Republi

c of

China

Shandong

SinorgchemT

echnology

Co. Ltd.

Jiangsu

Sinorgchem

Technology

Co. Ltd.

1.55 Kilogram US Dollar

2

2902,

2907,

2909,

2917,

2921,

2925,

2930,

Rubber

chemical

PX - 13

S.No.1

of Table-2.

Peoples

Republic of

China

Peoples

Republi

c of

China

Sinorgchem

Co. Taian

Jiangsu

Sinorgchem

Technology

Co. Ltd.

1.55 Kilogram US Dollar

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

3

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PX - 13

S. No.1

of Table-2.

Peoples

Republic of

China

Peoples

Republi

c of

China

Any combination of

Producer and Exporter

other than at S. No.1and 2.

1.84 Kilogram US Dollar

4

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PX - 13

S No.1

of Table-2.

Peoples

Republic of

China

Any

Country

Any other

than above.

Any other

than

above.

1.84 Kilogram US Dollar

5

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PX - 13

S. No.1

of Table-2.

Any

Country

other than

Korea RP

Peoples

Republi

c of

China

Any other

than above.

Any other t

han above.

1.84 Kilogram US Dollar

6

2902,

2907,

2909,

2917,

2921,

2925,

Rubber

chemical

PX - 13

S. No.1

of Table-2.

Korea RP Korea

RP

Kumho

Petrochemical

s

Co Ltd.

Kumho

Petrochemic

als

Co Ltd.

1.33 Kilogram US Dollar

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

7

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PX - 13

S. No.1

of Table-2.

Korea RP Korea

RP

Kumho

Petrochemical

s

Co Ltd.

Daewoo

International

Corporatio

n

1.33 Kilogram US Dollar

8

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PX - 13

S. No.1

of Table-2.

Korea RP Korea

RP

Any combination of

Producer and Exporter

other than at S. No.6 and 7.

1.63 Kilogram US Dollar

9

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PX - 13

S. No.1

of Table-2.

Korea RP Any

Country

Any other

than above.

Any other

than

above.

1.63 Kilogram US Dollar

10

2902,

2907,

2909,

2917,

2921,

Rubber

chemical

PX - 13

S No.1

of Table-2.

Any

Country

other

than Peopl

Korea

RP

Any other

than above.

Any other

than

above.

1.63 Kilogram US Dollar

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

es

Republic of

China

11

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

MBT

S. No.2

of Table-2.

Peoples

Republic

of China

Peoples

Republi

c of

China

Any Any 0.70 Kilogram US Dollar

12

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

MBT

S. No.2

of Table-2

.

Any

Country

Peoples

Republi

c of

China

Any Any 0.70 Kilogram US Dollar

13

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

MBT

S. No.2

of Table-2

.

Peoples

Republic of

China

Any

Country

Any Any 0.70 Kilogram US Dollar

14

2902,

2907,

2909,

2917,

Rubber

chemical

TDQ

S. No.3

of Table-2

.

Peoples

Republic

of China

Peoples

Republi

c of

China

Any Any 0.55 Kilogram US Dollar

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

15

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

TDQ

S. No.3

of Table-2

.

Any

Country

Peoples

Republi

c of

China

Any Any 0.55 Kilogram US Dollar

16

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

TDQ

S. No.3

of Table-2

.

Peoples

Republic of

China

Any

Country

Any Any 0.55 Kilogram US Dollar

17

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

TMT

S. No.4

of Table-2.

Peoples

Republic

of China

Peoples

Republi

c of

China

Any Any 0.62 Kilogram US Dollar

18

2902,

2907,

2909,

Rubber

chemical

TMT

S. No.4

of Table-2.

Any

Country

Peoples

Republi

c of

Any Any 0.62 Kilogram US Dollar

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

China

19

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

TMT

S. No.4

of Table-2

.

Peoples

Republic of

China

Any

Country

Any Any 0.62 Kilogram US Dollar

20

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

CBS

S. No.5

of Table-2

.

Peoples

Republic

of China

Peoples

Republi

c of

China

Any Any 0.85 Kilogram US Dollar

21

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

CBS

S. No.5

of Table-2

.

Any

Country

Peoples

Republi

c of

China

Any Any 0.85 Kilogram US Dollar

22

2902,

2907,

Rubber

chemical

S. No.5

of Table-2

Peoples

Republic of

Any

Country

Any Any 0.85 Kilogram US Dollar

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

CBS . China

23

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PVI

S. No.6

of Table-2

.

Peoples

Republic

of China

Peoples

Republi

c of

China

Any Any 1.24 Kilogram US Dollar

24

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PVI

S. No.6

of Table-2

.

Any

Country

Peoples

Republi

c of

China

Any Any 1.24 Kilogram US Dollar

25

2902,

2907,

2909,

2917,

2921,

2925,

2930,

2933,

2934,

2935,

2942,

3811,

3812 ,

3815

Rubber

chemical

PVI

S. No.6

of Table-2

.

Peoples

Republic of

China

Any

Country

Any Any 1.24 Kilogram US Dollar

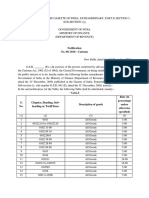

Note: The specifications indicated in the Table-2 below shall be applicable for the

specifications referred to in column (4) of Table-1.

Table-2

S.

No.

Generic Name Chemical Description/Other trade name/brand names

1 PX-13(6PPD) N- (1, 3-dimethyl butyl)-N Phenyl p phenylenediamine, or 6C ,

or Pilflex13, Antooxide 4020, Kumanox 13, Vulcanox 4020

2 MBT 2-Mercapto Benzothiazole, or Accelerator M, Accelerator MBT

3 TDQ/TMQ Polymerized 2,2, 4-Trimethyl-1,2-dihydroquinoline, or TDQ or

Antioxidant RD

4 TMT Tetramethylthiuram Disulfude, or Accelerator TMTD, Thiuram C

5 CBS N-cyclohexyl-2-benzothiazole sulphenamide, or Accelerator CZ.

Accelerator HBS, CBS

6 PVI N-(Cyclohexylthio)pthalimide, or Anti Scorch Agent CTP , PVI

2. The anti-dumping duty imposed under this notification shall be effective for a period of

five years (unless revoked, superseded or amended earlier) from the date of publication of this

notification in the Official Gazette and shall be paid in Indian currency.

Explanation.- For the purposes of this notification, rate of exchange applicable for the

purposes of calculation of such anti-dumping duty shall be the rate which is specified in the

notification of the Government of India, in the Ministry of Finance (Department of Revenue),

issued from time to time, in exercise of the powers conferred by section 14 of the Customs Act,

1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be

the date of presentation of the bill of entry under section 46 of the said Customs Act.

[F.No.354/32/2008-TRU (Pt.-II)]

(Akshay Joshi)

Under Secretary to the Government of India

Vous aimerez peut-être aussi

- Notification No. 9/2013-Customs (ADD)Document3 pagesNotification No. 9/2013-Customs (ADD)stephin k jPas encore d'évaluation

- Csadd 11 2013Document3 pagesCsadd 11 2013stephin k jPas encore d'évaluation

- Notification No. 11/2014-Customs (ADD)Document3 pagesNotification No. 11/2014-Customs (ADD)stephin k jPas encore d'évaluation

- Notification No. 8 /2013-Customs (ADD)Document3 pagesNotification No. 8 /2013-Customs (ADD)stephin k jPas encore d'évaluation

- Anti Dumping Duty Notifications (Customs) No.15/2014 Dated 11th April, 2014Document5 pagesAnti Dumping Duty Notifications (Customs) No.15/2014 Dated 11th April, 2014stephin k jPas encore d'évaluation

- Anti Dumping Duty Notifications (Customs) No.09/2014 Dated 23rd January, 2014Document3 pagesAnti Dumping Duty Notifications (Customs) No.09/2014 Dated 23rd January, 2014stephin k jPas encore d'évaluation

- Notification No. 04/2015-Customs (ADD)Document3 pagesNotification No. 04/2015-Customs (ADD)ashly_099Pas encore d'évaluation

- Notification-No.-46-2011-Customs (ASIAN COUNTRIES) PDFDocument45 pagesNotification-No.-46-2011-Customs (ASIAN COUNTRIES) PDFsureshPas encore d'évaluation

- 01-10 Feb 2013eximDocument16 pages01-10 Feb 2013eximgopvij1Pas encore d'évaluation

- cs25 2013Document3 pagescs25 2013stephin k jPas encore d'évaluation

- Anti Dump CH 72.pdf JsessionidDocument97 pagesAnti Dump CH 72.pdf JsessionidprasadPas encore d'évaluation

- Anti-Dumping Chapter 72Document105 pagesAnti-Dumping Chapter 72retrogradesPas encore d'évaluation

- Customs Tariff Notification No.25/2014 Dated 11th July, 2014Document1 pageCustoms Tariff Notification No.25/2014 Dated 11th July, 2014stephin k jPas encore d'évaluation

- Find Export PolicyDocument40 pagesFind Export PolicyMukaram Irshad NaqviPas encore d'évaluation

- 10 2018 Notification Dated 02 Feb 2018Document2 pages10 2018 Notification Dated 02 Feb 2018vinodPas encore d'évaluation

- DGFTDocument156 pagesDGFTArul SakthiPas encore d'évaluation

- Customs Tariff Notification No.22/2014 Dated 11th July, 2014Document2 pagesCustoms Tariff Notification No.22/2014 Dated 11th July, 2014stephin k jPas encore d'évaluation

- LBT Rates NagpurDocument15 pagesLBT Rates NagpurPankaj GoyenkaPas encore d'évaluation

- Customs Tariff Notification No.20/2014 Dated 11th July, 2014Document2 pagesCustoms Tariff Notification No.20/2014 Dated 11th July, 2014stephin k jPas encore d'évaluation

- Circular 52 2018 Customs NewDocument2 pagesCircular 52 2018 Customs NewSteve MclarenPas encore d'évaluation

- Anti Dum CH 64Document2 pagesAnti Dum CH 64savaliyamaheshPas encore d'évaluation

- PRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsDocument6 pagesPRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsSudeep DuttPas encore d'évaluation

- 9 Central Excise Notifications 2009Document17 pages9 Central Excise Notifications 2009aveeramani@yahoo.comPas encore d'évaluation

- Cus Not NT 63 18 06 15Document1 pageCus Not NT 63 18 06 15RKPas encore d'évaluation

- List of PSIA (As On 31-1-2014)Document26 pagesList of PSIA (As On 31-1-2014)Jeyshree GkmPas encore d'évaluation

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument88 pagesY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri Lankaharsha.dilan4320Pas encore d'évaluation

- 2016 P T D 648Document4 pages2016 P T D 648haseeb AhsanPas encore d'évaluation

- Https Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmDocument4 pagesHttps Chennaicustoms - Gov.in Wp-Content Uploads 2021 08 1434517275.htmBhuvanPas encore d'évaluation

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDocument10 pagesCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatPas encore d'évaluation

- Non-Levy/Short Levy of Additional DutyDocument5 pagesNon-Levy/Short Levy of Additional Dutybiko137Pas encore d'évaluation

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaPas encore d'évaluation

- Hand Book of Procedures Export & Import - Volume 1, India 2009 - 2014Document157 pagesHand Book of Procedures Export & Import - Volume 1, India 2009 - 2014focusindiagroupPas encore d'évaluation

- 17th July - Gazette 2184.21 - EDocument122 pages17th July - Gazette 2184.21 - EShami MudunkotuwaPas encore d'évaluation

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentKrishna Kumar VermaPas encore d'évaluation

- Notification No 8 2002Document6 pagesNotification No 8 2002Dhananjay KulkarniPas encore d'évaluation

- VATActNo15 (E) 2009Document14 pagesVATActNo15 (E) 2009jing qiangPas encore d'évaluation

- Brochure Collection and Deduction of Tax at Source 2013Document76 pagesBrochure Collection and Deduction of Tax at Source 2013Asif MalikPas encore d'évaluation

- Basic Statistics On Indian Petroleum & NG - 2009-10Document46 pagesBasic Statistics On Indian Petroleum & NG - 2009-10ramsudheerb100% (1)

- Central Excise JK ExemptDocument33 pagesCentral Excise JK Exemptadi_vijPas encore d'évaluation

- HighLights ST FEDocument34 pagesHighLights ST FEShakir MuhammadPas encore d'évaluation

- Bangladesh Import Policy Order, 2006-2009 - English PDFDocument70 pagesBangladesh Import Policy Order, 2006-2009 - English PDFMinhazul IslamPas encore d'évaluation

- HANDBOOK OF PROCEDURE OF EXPORT - IMPORT 27th April To 31st March, 2014 PDFDocument184 pagesHANDBOOK OF PROCEDURE OF EXPORT - IMPORT 27th April To 31st March, 2014 PDFSOUMANLALAPas encore d'évaluation

- The Customs Tariff Act, 1975: EctionsDocument1 116 pagesThe Customs Tariff Act, 1975: EctionsAndrea RobinsonPas encore d'évaluation

- TN Vat RatesDocument57 pagesTN Vat RatesdeepadeepadeepaPas encore d'évaluation

- Duty Drawback Feb 2020Document192 pagesDuty Drawback Feb 2020AkashAgarwalPas encore d'évaluation

- Mid AssignmentDocument33 pagesMid Assignmentmani1464Pas encore d'évaluation

- Notification No.248 1985 CEDocument1 pageNotification No.248 1985 CEpatelpratik1972Pas encore d'évaluation

- Chapter II The Companies (Incorporation) Rules, 2014Document116 pagesChapter II The Companies (Incorporation) Rules, 2014Jitendra RavalPas encore d'évaluation

- DGFT Notification No.08/2015-2020 Dated 4th June, 2015Document5 pagesDGFT Notification No.08/2015-2020 Dated 4th June, 2015stephin k jPas encore d'évaluation

- 2008 Customs Tariff - TV NigeriaDocument552 pages2008 Customs Tariff - TV NigeriaAriKurniawanPas encore d'évaluation

- Ce 0713Document1 pageCe 0713yagayPas encore d'évaluation

- Notification No.7/2013-Central Excise: Vide G.S.R No.471 (E), DatedDocument2 pagesNotification No.7/2013-Central Excise: Vide G.S.R No.471 (E), Datedpatelpratik1972Pas encore d'évaluation

- Maharashtra Value Added Tax ActDocument13 pagesMaharashtra Value Added Tax ActKaran Gandhi0% (1)

- North American Free Trade Agreement, 1992 Oct. 7 Tariff Phasing DescriptionsD'EverandNorth American Free Trade Agreement, 1992 Oct. 7 Tariff Phasing DescriptionsPas encore d'évaluation

- Act on Special Measures for the Deregulation of Corporate ActivitiesD'EverandAct on Special Measures for the Deregulation of Corporate ActivitiesPas encore d'évaluation

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jPas encore d'évaluation

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jPas encore d'évaluation

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Document1 pageDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jPas encore d'évaluation

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jPas encore d'évaluation

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Document3 pagesDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jPas encore d'évaluation

- ECN316 Lecture 2 - 2021 - 2022 1Document44 pagesECN316 Lecture 2 - 2021 - 2022 1Blessing OzowaraPas encore d'évaluation

- ECON UA238 004 Ertan SyllabusDocument4 pagesECON UA238 004 Ertan SyllabusSeong-Min ParkPas encore d'évaluation

- Saarc Preferential Trading Arrangement (Sapta) : Naina Lalwani - 19531034Document12 pagesSaarc Preferential Trading Arrangement (Sapta) : Naina Lalwani - 19531034Naina lalwaniPas encore d'évaluation

- UntitledDocument120 pagesUntitledFULCHAND DANGEPas encore d'évaluation

- XARD Trading Desk v5Document28 pagesXARD Trading Desk v5tawhid anamPas encore d'évaluation

- A Brief History of The WTODocument7 pagesA Brief History of The WTOmsulwaPas encore d'évaluation

- International Business The New Realities 4th Edition Cavusgil Solutions Manual DownloadDocument84 pagesInternational Business The New Realities 4th Edition Cavusgil Solutions Manual DownloadWalter Wade100% (19)

- Models of Authorization Numbers Issued For Approved Exporters PDFDocument4 pagesModels of Authorization Numbers Issued For Approved Exporters PDFAnna FedchenkoPas encore d'évaluation

- 8 Open-Economy Macroeconomics-1Document24 pages8 Open-Economy Macroeconomics-1Jay MarkPas encore d'évaluation

- V2 Exam 1 Morning PDFDocument77 pagesV2 Exam 1 Morning PDFCatalinPas encore d'évaluation

- Anti-Dumping PaperDocument15 pagesAnti-Dumping PaperMiguel BenedictoPas encore d'évaluation

- EDP MBA-Syllabus SSPUDocument2 pagesEDP MBA-Syllabus SSPUsanzitPas encore d'évaluation

- Exchange Rate and International TradeDocument3 pagesExchange Rate and International TradeAloyPas encore d'évaluation

- Nafta (North American Free Trade Agreement) Rupam and MayaDocument10 pagesNafta (North American Free Trade Agreement) Rupam and MayaRupam LonsanePas encore d'évaluation

- A3a - Individual Reflection: RMIT International University Vietnam OMGT 2321 Global Trade OperationsDocument8 pagesA3a - Individual Reflection: RMIT International University Vietnam OMGT 2321 Global Trade Operationsphuc buiPas encore d'évaluation

- Unilever PDFDocument21 pagesUnilever PDFarundesh20009296Pas encore d'évaluation

- International Commercial ContractsDocument9 pagesInternational Commercial Contractsalfredo_07Pas encore d'évaluation

- Balance of PaymentDocument8 pagesBalance of Paymentnishant vermaPas encore d'évaluation

- Wto GattDocument21 pagesWto GattSukhman BrarPas encore d'évaluation

- Foreign Trading SystemDocument17 pagesForeign Trading SystemS Thavasumoorthi0% (1)

- Sách Foreign Trade-Đã Chuyển ĐổiDocument96 pagesSách Foreign Trade-Đã Chuyển ĐổiPhong TranPas encore d'évaluation

- An Assignment On International Economics Course No.:: Submitted To: Submitted byDocument6 pagesAn Assignment On International Economics Course No.:: Submitted To: Submitted byMD. MEHEDI HASAN BAPPYPas encore d'évaluation

- Geography UACE Paper 2 Revision Questions For Manufacturig Industries in The WorldDocument12 pagesGeography UACE Paper 2 Revision Questions For Manufacturig Industries in The WorldSilas TonnyPas encore d'évaluation

- Protectionism EssayDocument3 pagesProtectionism EssayChloe CharlesPas encore d'évaluation

- Test Bank For International Economics 9th Edition by HustedDocument6 pagesTest Bank For International Economics 9th Edition by HustedJennifer Vega100% (42)

- Rcep PresentationDocument24 pagesRcep Presentationnur syazwinaPas encore d'évaluation

- Significance of Procedures and Documentation in International TradeDocument8 pagesSignificance of Procedures and Documentation in International TradetarunPas encore d'évaluation

- The Foods and Beverages Merchants in Jabodetabek Lost Their Income Until RP 200 BillionDocument2 pagesThe Foods and Beverages Merchants in Jabodetabek Lost Their Income Until RP 200 BillionAnna Uswatun.HPas encore d'évaluation

- Advantages and Disadvantages of The Levels of Economic IntegrationDocument3 pagesAdvantages and Disadvantages of The Levels of Economic IntegrationMartha L Pv RPas encore d'évaluation

- Trade Policy Regulations in IndiaDocument19 pagesTrade Policy Regulations in IndiaSonu_Verma_6613Pas encore d'évaluation