Académique Documents

Professionnel Documents

Culture Documents

PGDM 739 - Priyankur Dhar - 7th Fortnightly Report - Reliance Securities Ltd.

Transféré par

প্রিয়াঙ্কুর ধরDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PGDM 739 - Priyankur Dhar - 7th Fortnightly Report - Reliance Securities Ltd.

Transféré par

প্রিয়াঙ্কুর ধরDroits d'auteur :

Formats disponibles

7

th

Fortnightly Report

(5

th

JULY, 2014 19

th

JULY, 2014)

Priyankur Dhar

PGDM 739, Finance 2013-15(F2)

Company Name: Reliance Securities Ltd.

Assigned Project Title: Understanding Derivative Strategies.

Tasks assigned: Learning about

Insurance life & General

life Insurance

o Features of a life insurance policy

o Life Insurance Products

Endowment Policy

Whole Life Insurance Policy

Term life Insurance Policy

Money Back Policy

Joint Life Insurance Policy

Group Insurance

Loan Cover Term Assurance Policy

Term Assurance Plans

Unit Linked Insurance Plans

Insurance Plans for Child's Future

Pension Plans

General Insurance

o Health Insurance

o Personal Accident/Disability Income Insurance

o Personal Property Insurance

o Householder's insurance

o Personal accident and third party liability covers

o Motor vehicle insurance

o Overseas and Travel Insurance

o Other Liability Insurance

o Directors' and Officers' Liability

o Professional Indemnity Policy

o Products Liability Insurance

o Public Liability Insurance

o Workmen's Compensation Insurance

Gold

Investments in Gold

Advantages

Gold Coins

Financial Derivatives

Introduction

Market participants

Derivative Exchanges

Forwards

Futures

Options

Clearing & Settlement

Watching the share market dealing and up-downs of the shares through

Reliance Security trading software platform.

Make phone calls to the clients.

Takeaways and learnings:

Insurance life and General

Life Insurance is a contract that pledges payment of an amount to the person assured (or his

nominee) on the happening of the event insured against.

The contract is valid for payment of the insured amount during:

1) The date of maturity or

2) Specified dates at periodic intervals, or

3) Unfortunate death, if it occurs earlier.

Among other things, the contract also provides for the payment of premium periodically to the

insurance company by the policyholder. life insurance is universally acknowledged an

institution, which eliminates 'risk' substituting certainty for uncertainty and comes to the timely

aid of the family in the unfortunate event of death of the breadwinner. Life insurance, in short, is

concerned with two hazards that stand across the life path of every person:

- That of dying prematurely, leaving a dependent family to fend for themselves.

- That of living until old age without visible means of support.

(a) Features of a life insurance policy

There are three parties in a life insurance transaction: the insurer, the insured and the owner of

the policy (policyholder), although the owner and the insured are often the same person. For

example, if Mr. Kumar buys a policy on his own life, he is both the owner and the insured.

However, if Mrs. Kumar, his wife, buys a policy on Mr. Kumar's life, she is the owner and he is

the insured.

Another important person involved is the beneficiary. The beneficiary is the person or persons

who will receive the policy proceeds upon death of the insured.

The beneficiary in not a party to the policy, but is designated by the owner, who may change

the beneficiary unless the policy has an irrevocable beneficiary designation. With an irrevocable

beneficiary, that beneficiary must agree to changes in beneficiary, policy assignment, or

borrowing of cash value.

Death Benefit

The primary feature of a life insurance policy is the death benefit it provides. Permanent policies

provide a death benefit that is guaranteed for the life of the insured, provided the premiums

have been paid and the policy has been surrendered.

Nomination

When one makes a nomination, as the policyholder you continue to be the owner of the policy

and nominate the beneficiary/ nominee of the policy. The nominee does not have any right

under the policy so long as you are alive. The nominee has only the fight to receive the policy

monies in case of your death within the term of the policy.

Assignment

If your intention is that your policy monies should go only to a particular person, you need to

assign the policy in favor of that person.

Cash Value

The cash value of a permanent life insurance policy is accumulated throughout the life of the

policy. It equals the amount a policy owner would receive, after any applicable surrender

charges, if the policy were surrendered before the insured's death.

Dividends

Many life insurance companies issue life insurance policies that entitle the policy owner to share

m the company's divisible surplus.

Paid-Up Additions

Dividends paid to a policy owner of a participating policy can be used in numerous ways, one of

which is towards the purchase of additional coverage, called paid-up additions.

Policy Loans

Some life insurance policies allow a policy owner to apply for a loan against the value of the

policy. Either a fixed or variable rate of interest is charged. This feature allows the policy owner

an easily accessible loan in times of need or opportunity.

(b) Life Insurance Products

Life insurance is a misunderstood concept in India. Basically, Life Insurance Plans should

provide insurance cover to protect the dependents of the Life Assured. But conventionally Life

Insurance policies have been sold as investment products where the Life Assured gets a lump

sum at the end of a fixed term or periodic returns on a regular basis during the term. The

emphasis has been more on the investment aspects than on life cover. The private players in

Life Insurance sector in India have brought in newer concepts like adding riders to life insurance

policies but they also continue to sell insurance plans with more emphasis on the investment

features.

Let us look at some of the standard policies offered by Life Insurance Companies.

(1) Endowment Policy:

o An endowment policy covers risk for a specified period, at the end of which the sum

assured is paid back to the policyholder, along with the bonus accumulated during the

term of the policy.

o The method of bonus payment is called reversionary bonus. The quantum of bonus is not

assured and it is based on the investment outcome of life insurance companies.

o It is insurance cum investment product where the emphasis is more on investment

because life cover for a given premium is less compared to a whole life policy with more

focus on maturity benefit compared to death benefit.

o Endowment life insurance pays the sum assured in the policy either at the insured's death

or at a certain age or after a number of years of premium payment.

o Ideally, this policy is used by investors who would like to have a certain amount of capital

at the end of a fixed term and protect the end capital through life insurance of the saver.

o This has been the most popular life insurance plan of UC of India before the private

players entered life insurance sector and popularized Unit linked Insurance Plans.

(2) Whole Life Insurance Policy

o A whole life policy runs as long as the policyholder is alive.

o As risk is covered for the entire life of the policyholder, therefore, such policies are known

as whole life policies.

o A simple whole life policy requires the insurer to pay regular premiums throughout the life.

o Whole life plans with limited payment options are also available where the insured is

required to pay premium for a specific term after which premium payment will stop but life

cover will continue.

o In a whole life policy, the insured amount and the bonus is payable only to the nominee of

the beneficiary upon the death of the policyholder.

o There is no survival benefit as the policyholder is not entitled to any money during his/ her

own lifetime.

(3) Term Life Insurance Policy

o Term life insurance policy covers risk only during the selected term period.

o The sum assured becomes payable only on death of the policy holder and not on end of

the term as in an endowment plan.

o The term life insurance policy offers maximum life insurance cover for a given premium

payment as this is pure life insurance without any investment built in.

o Term life policies are primarily designed to meet the needs of those people who are

initially unable to pay the larger premium required for a whole life or an endowment

assurance policy.

o No surrender, loan or paid-up values are granted under term life policies because

reserves are not accumulated.

o If the premium is not paid within the grace period, the policy lapses without acqumng any

paid-up value.

(4) Money Back Policy

o Money back policy provides for periodic payments of partial survival benefits during the

term of the policy, as long as the policyholder is alive.

o They differ from endowment policy in the sense that in endowment policy, survival

benefits are payable only at the end of the endowment period.

o An important feature of money back policies is that in the event of death at any time within

the policy term, the death claim comprises full sum assured without deducting any of the

survival benefit amounts, which may have already been paid as money-back

components. The bonus is also calculated on the full sum assured.

o This is an insurance plan with emphasis on investments and periodic return.

o A segment of investor population finds the periodic receipts from Life Insurance Company

attractive and hence prefers this plan.

(5) Joint Life Insurance Policy

o These plans are ideal for a married couple especially when both are bread winners or

business partners.

o Joint life insurance policies are similar to endowment policies offering maturity benefits as

well as death benefits.

o In case of death of one of the persons, the sum assured becomes payable.

o The sum assured is paid again on death of the surviving policy holder or on policy

maturity.

o The premiums payable cease on the first death or on the expiry of the selected term,

whichever is earlier.

o If one or both the lives survive to the maturity date, the sum assured as well as the vested

bonuses are payable on the maturity date.

(6) Group Insurance

o Group insurance offers life insurance protection under group policies to various groups

such as employers-employees, professionals, co-operatives, weaker sections of society,

etc.

o It also provides insurance coverage for people in certain approved occupations at the

lowest possible premium cost.

o Group insurance plans have low premiums. Such plans are particularly beneficial to those

for whom other regular policies are a costlier proposition.

o Companies with a large workforce have preferred to provide life insurance to their less

sophisticated employees /workers through Group Insurance Plans.

o Group insurance plans extend cover to large segments of the population including those

who cannot afford individual insurance.

o A number of group insurance schemes have been designed for various groups.

(7) Loan Cover Term Assurance Policy

o Loan cover term assurance policy is an insurance policy, which covers a home loan.

o In the event of unfortunate death of the policy holder, before the full repayment of the

housing loan, the amount outstanding in the housing loan is paid in full.

o The cover on such a policy keeps reducing with the passage of time as individuals keep

paying their EMls (equated monthly installments) regularly, which reduces the loan

amount.

o This plan provides a lump sum in case of death of the life assured during the term of the

plan.

o The lump sum will be a decreasing percentage of the initial sum assured as per the policy

schedule.

o Since this is a non-participating (without profits) pure risk cover plan, no benefits are

payable on survival to the end of the term of the policy

(8) Term Assurance Plans

o Under this plan, in case of death of the policy holder during the policy term, the sum

assured will be paid to the beneficiary.

o There are no maturity benefits. Hence on survival, the policy will terminate.

o The life insured will need to pay the regular annual premium for the term chosen.

o These are typically low cost bare insurance plans with no investment frills.

o For a little additional cost, some companies offer Term assurance plans with return of

premium and here on survival till maturity, all the premiums paid will be returned.

o Some term assurance plans provide extended life cover rider where after the end of term,

insurance up to certain percentage of sum assured continues for a specified term, say 5

years, without payment of any premium.

o Insurance companies tend to place a number of restrictions on term plans like:

1. Maximum life cover say Rs. 50 lakh

2. Maximum term say 25 years

3. Maximum age at maturity say 55 years, and so on

(9) Unit linked Insurance Plans

o ULIPs are market-linked insurance plans with a life cover thrown in.

o The said insurance cover is lower than most plain-vanilla plans (like endowment plans) as

a sizable portion of the premium goes towards investments in market-linked instruments

like stocks, corporate bonds, and government securities.

o On death, sum assured together with market related returns on the investments is paid -in

other words, the death benefit could be more than sum assured.

o Generally, the choice of extent of life cover is left to the insured I policy holder.

o The choice of investment plans is also left to the policy holder with an option to switch

between different investment plans, a number of times, during the entire term of the plan.

For example, an investor may choose the aggressive or equity plan at his young age and

switch to conservative or protective or debt plan at a later age.

o ULIP provides multiple benefits to the consumer. The benefits besides life protection

include:

1. Investment and Savings

2. Flexibility

3. Adjustable Life Cover

4. Investment Options

5. Transparency

6. Options to take additional cover against:

o Death due to accident

o Disability

o Critical illness

o Surgeries

o ULIPs have managed to outsell plain vanilla plans by quite a margin. For some private

insurance companies, they account for up to 70% of new business generated.

o ULIPs by their very nature are long term investment vehicles because of costs involved

as well the nature of underlying investments, especially equities.

o Investors while choosing ULIPs should very carefully study the loads charged by Life

Insurance Companies because past performance shown by these companies are

essentially on the net investment portion of the premium paid by the policy holder. So if

the charges are high, naturally, the lump sum receivable at the end of the term will also

be affected substantially.

o The policy holders should pay premium continuously for a minimum period of five years.

The insurance cover will continue even if the policy holder fails to pay the annual premium

after a minimum period of at least five years. The policy becomes paid up after 5 years

and upon surrender, the market value becomes payable.

o Equity, as an asset class, will perform better over longer period of time.

o In the short term, equity may perform erratically and may not deliver superior returns.

Most insurers offer a wide range of investment funds to suit one's investment objectives, risk

profile and time horizons. Different funds have different risk profiles. The potential for returns

also varies from fund to fund.

The following are some of the common types of funds available along with an indication of their

risk characteristics.

1. Liquid fund

The Liquid fund invests 100% in bank deposits and high quality short-term money market

instruments. The fund is designed to be cash secure and has a very low level of risk; however

unit prices may occasionally go down due to the use of short-term money market instruments.

The returns on the funds also tend to be lower.

2. Secure Managed/ Protector Fund

The Secure Managed fund invests 100% in Government Securities and Bonds issued by

companies or other bodies with a high credit standing. However, a small amount of working

capital may be invested in cash to facilitate the day-to-day running of the fund. This fund has a

low level of risk but unit prices may still go up or down. The risk that this fund may face is the

interest rate risk. If after investment, the, interest rates rise, it may le ad to a fall in unit prices

temporarily.

3. Hybrid Fund/ Moderate fund/ Defensive Managed

5% to 30% of the Defensive Managed fund will be invested in high quality Indian equities. The

remainder yield will be invested in Government Securities and Bonds issued by companies or

other bodies with a high credit standing. In addition, a small amount of working capital may be

invested in cash to facilitate the day-to-day running of the fund. The fund has a moderate level

of risk with the opportunity to earn higher returns in the long term from some equity investment.

Unit prices may go up or down.

4. Balanced Fund

30% to 60% of the Balanced Managed fund will be invested in high quality Indian equities. The

remainder will be invested in Government Securities and Bonds issued by companies or other

bodies with a high credit standing. In addition, a small amount of working capital may be

invested in cash to facilitate the day-to-day running of the fund. The fund has a higher level of

risk with the opportunity to earn higher returns in the long term from the higher proportion it

invests in equities.

5. Growth fund/ Aggressive Fund

The Growth fund invests 80% to 100% in high quality Indian equities. In addition, a small

amount of working capital may be invested in cash to facilitate the day-to-day running of the

fund. The fund has a higher level of risk with the opportunity to earn higher returns in the long

term from the investment in equities.

o The past performance of any of the funds is not necessarily an indication of future

performance.

o There are no investment guarantees on the returns of unit linked funds.

ULIPs can be most useful for

o Individuals who are already adequately insured

o Individuals who are well informed regarding the market and are in a position to take a call

on the performance of equity and or debt markets over a period of time

o Investors who are prepared to take more risk for better returns compared to pure

endowment plans

(10) Insurance Plans for Child's Future

Life insurance plans help in servicing various needs in an individual's financial planning

exercise. One such need happens to be planning for a child's future. Children's insurance plans

help in addressing many of these needs.

While individuals might have a financial plan for themselves in place, it is equally important that

they secure the financial future of their children. For example, suppose an individual wants to

plan for his son's education. A child plan will serve in achieving this goal. An illustration will help

you understand this better.

(11) Pension Plans

A pension plan is a retirement plan. An investor can start planning retirement for retirement from

an early age or look at the options close to

o Ideally, investments should start from an early age through regular installments on yearly

basis.

o Lump sum single premium payment is also allowed for investors, past a particular

minimum age limit minimum age limit for starting of pension in many cases, n happens to

be 40 years.

o The pension payments can start immediately or after a time lag immediate annuity or

deferred annuity.

o In case of deferred annuities, at the end of the term of deferment, the pensioner can

exercise an option of getting some lump sum and pension on the balance amount or

pension on the full amount part payment of capital is allowed.

o The pension payments are at guaranteed rates for entire life of the pensioner or for a

fixed term of say 10115120 years.

o Some pension plans provide for paying increased rates of pension over a period of time

ideal hedge against inflation.

o The pension payments can be monthly, quarterly, half yearly or yearly at the option of the

pensioner.

o The pension payments can continue to spouse on the death of the pensioner, at the same

rates or reduced rates, as prescribed by Life Insurance companies this option can be

exercised by pensioner.

The capital sum may be returned to the nominee on the death of the pensioner (return of

purchase price) or forfeited. The rate of return on annuity plans will depend on which option the

pensioner exercises the rate of returns is lower when the pensioner wants return of purchase

price.

o In case of immediate pension the quantum pension depends on the age, at entry, of the

pensioner- the higher the age at entry, the higher the amount of pension.

o Pension plans typically offer no life insurance cover but some plans do have term

assurance rider for deferred pension plans, at an additional cost.

The most important factor that should be considered while choosing a pension plan is that it

provides protection from interest rate risk. Insurance companies guarantee a specific return for

the entire life of the pensioner, whereas in other avenues like fixed deposits I small savings, etc.

the interest rates may go down disrupting the budget of the pensioner.

General Insurance

Insurance other than 'Life Insurance' falls under the category of General Insurance. General

Insurance comprises of insurance of property against fire, burglary etc., personal insurance

such as Accident and Health Insurance, and liability insurance which covers legal liabilities.

There are also other covers such as Errors and Omissions insurance for professionals, credit

insurance etc.

Non-life insurance companies have products that cover property against Fire and allied perils,

flood storm and inundation, earthquake and so on. There are products that cover property

against burglary, theft etc. The non-life companies also offer policies covering machinery

against breakdown, there are policies that cover the hull of ships and so on. A Marine Cargo

policy covers goods in transit including by sea, air and road. Further, insurance of motor

vehicles against damages and theft forms a major chunk of non-life insurance business.

Suitable general insurance covers are necessary for every family. It is important to protect one's

property, which one might have acquired from one's hard earned income. A loss or damage to

one's property can leave one shattered. Losses created by catastrophes such as the tsunami,

earthquakes, cyclones etc. have left many homeless and penniless. Such losses can be

devastating but insurance could help mitigate them. Property can be covered, so also the

people against Personal Accident. A Health Insurance policy can provide financial relief to a

person undergoing medical treatment whether due to a disease or an injury.

Industries also need to protect themselves by obtaining insurance covers to protect their

building, machinery, stocks etc. They need to cover their liabilities as well. Financiers insist on

insurance. So, most industries or businesses that are financed by banks and other institutions

do obtain covers. But are they obtaining the right covers? And are they insuring adequately are

questions that need to be given some thought. Also organizations or industries that are self-

financed should ensure that they are protected by insurance.

(a). Health Insurance

Medical insurance is a type of insurance where the insurer pays the medical costs of the

insured if the insured becomes sick due to covered causes, or due to accidents.

1. The need for health insurance.

Today, health care costs are high, and getting higher by the day. In case of a medical

emergency, the cost of treatment cannot be predicted, and thus can be very well beyond what

one can afford. In a particular year, the cost of medical treatment might be low, but in some

other year to could be prohibitively high. Thus, medical insurance is required to protect oneself

against such emergencies as well as uncertainties.

2. Benefits of health Insurance

o Provides cover against sudden illness or accidents that one may encounter

o Adequate coverage can prevent sudden cash outflow and can sometimes help by

providing capital for immediate surgeries.

3. Types of Medical Insurance

There are two major categories of medical insurance namely

a. Indemnity Plans

These are also referred to as reimbursement plans, and they offer reimbursement against

medical expenses, irrespective of which service provider is used. There are three common

practices that are used to determine the amount of reimbursement in an indemnity plan:

o Reimbursement of actual charges: where the actual cost of medical expenses rs

reimbursed.

o Reimbursement of a percentage of actual charges: where only a set percentage of the

actual charges is reimbursed. The rest has to be borne by the consumer.

b. Managed Care Plans

These are the plans in which the insurer has a network of selected health care provider i.e.

hospitals and they offer incentives to the insured to encourage this to use the provider in the

network.

(b). Personal Accident/ Disability Income Insurance

Such an insurance policy enables planning for eventualities of loss/ damage arising out of

accidents or permanent disability caused hereof. Roads accidents are increasing day by day

necessitating a look at such a policy.

Benefits

o This policy offers compensation in case of death or bodily injury to the insured person,

solely as a result of an accident, by external, visible and violent means.

o The different variations have different coverage ranging from death to comprehensive

covers including death, permanent disablements and temporary total disablements.

o An Indian adult up to the age of 70 can cover himself I herself and dependent family

members between the age of 5 and 70 years.

o This policy also provides a daily allowance for the tenure of hospitalization.

o Some policies of this category also provide for the education of 2 dependent children of

the insured person and a bonus on the total sum insured ion case of permanent

disability.

(c). Personal Property Insurance

Apart from risks to life and health, a person is also exposed to risks that may cause damage to

his/ her property. These risks can be covered by opting for personal property insurance. Let us

look at some of the major property insurance types in more detail.

(d). Householder's insurance

A comprehensive householder's insurance policy covers most of the risks faced by any

household. It protects against natural calamities like flood and earthquake and also man-made

disasters like theft and burglary. Instead of opting for separate policies for the building and for

the contents of the house, the holder can take up one package policy.

The policy covers damages to the structure of the home due to:

o Fire

o Storm, tempest, flood, cyclone, hurricane and tornado

o Riot, strike and malicious damage

o Lighting

o Explosion and implosion

o Aircraft damage

o Damage due to impact by vehicles

o Flood, tornado, landslides and rockslides

o Bursting and/ or overflowing of water tanks apparatus and pipes

o Missile testing operation

o Leakage from automatic sprinkler installations

o Bush fire

(e). Personal accident and third party liability covers:

1. Personal accident: This section covers accidental injury ca using death/ disablement (total/

partial) to the insured and his family members

2. Third party liability/ public Liability: This section covers injury to third party or damage to third

party property.

(f). Motor vehicle insurance

Motor insurance is compulsory in India. It is essential for all motor vehicle owners since it

protects them from legal liability that might arise during their vehicle operation.

There are two types of policies available for motor vehicles third party liability insurance and

comprehensive insurance policy.

1. Third party liability Insurance

2. Comprehensive Motor Insurance

(g). Overseas and Travel Insurance

The amount of travel in one's daily life is constantly increasing. These days one is always on

the move, traveling either for business or for pleasure. Whatever be the purpose, travel entails a

lot of risk. One can fall ill and medical expenses can prove to be very costly, one can lose his

baggage, or even his passport. In a foreign country, with hardly any known faces, one can face

any form of emergency. One can even require some urgent financial assistance.

Gold

Investments in Gold

Gold was in use as a form of money. It was used as a store of value both by individuals and

countries for much of that period. However in recent times it is still considered as a store of

value, a safe haven, anti-inflationary and as insurance in crisis situations. Considering its high

density and high value per unit mass, storing and transporting gold is very easy. Gold also does

not corrode. Gold has the potential for appreciation (or depreciation), but lacks the two other

components of total return: interest and compound interest. Besides physical gold now gold can

be purchased through a gold exchange traded fund or in the form of gold certificate.

Advantages

There are six primary reasons why investors own gold:

o As a hedge against inflation.

o As a hedge against a declining dollar.

o As a safe haven in times of geopolitical and financial market instability.

o As a commodity, based on gold's supply and demand fundamentals.

o As a store of value.

o As a portfolio diversifier.

(a) Hedge against inflation

Gold is considered as a hedge against inflation. The most consistent factor determining the

price of gold has been inflation as inflation goes up, the price of gold goes up along with it.

Oil, Inflation and Gold

Although the prices of gold and oil don't exactly mirror one another, there is no question that oil

prices do affect gold prices. If oil prices rise or fall sharply, investors can expect a

corresponding reaction in gold prices, often with a lag.

(b) Hedge against a Declining Dollar

Gold is bought and sold in U.S. dollars, so any decline in the value of the dollar causes the

price of gold to rise. The U.S. dollar is the world's reserve currency the primary medium for

international transactions, the principal store of value for savings, the currency in which the

worth of commodities and equities are calculated, and the currency primarily held as reserves

by the world's central banks. However, now that it has been stripped of its gold backing, the

dollar is nothing more than a fancy piece of paper.

(c) Gold as a Safe Haven

Despite the fact that the United States is the only superpower, there are a myriad of problems

festering around the world, any one of which could erupt with little warning. Gold has often been

called the "crisis commodity" because it tends to outperform other investments during periods of

world tensions. The very same factors that cause other investments to suffer cause the price of

gold to rise. A bad economy can sink poorly run banks. Bad banks can sink an entire economy.

And, perhaps most importantly to the rest of the world, the integration of the global economy

has made it possible for banking and economic failures to destabilize the world economy. As

banking crises occur, the public begins to distrust paper assets and turns to gold for a safe

haven. When all else fails, governments rescue themselves with the printing press, making their

currency worth less and gold worth more. Gold has always raised the most when confidence in

government is at its lowest.

(d) Gold Supply and Demand

First, demand is outpacing supply across the board. Gold production is declining; copper

production is declining; the production of lead and other metals is declining. It is very difficult to

open new mines when the whole process takes about seven years on average, making it hard

to address the supply issue quickly.

(e) Gold Store of Value

Gold will always maintain an intrinsic value. Gold will not get lost in an accounting scandal or a

market collapse. Although the gold price may fluctuate, over the very long run gold has

consistently reverted to its historic purchasing power parity against other commodities and

intermediate products. Historically, gold has proved to be an effective preserver of wealth. It has

also proved to be a safe haven in times of economic and social instability. In a period of a long

bull run in equities, with low inflation and relative stability in foreign exchange markets, it is

tempting for investors to expect continual high rates of return on investments. It sometimes

takes a period of falling stock prices and market turmoil to focus the mind on the fact that it may

be important to invest part of one's portfolio in an asset that will, at least, hold its value.

(f) Gold. Portfolio Diversifier

The most effective way to diversify your portfolio and protect the wealth created in the stock and

financial markets is to invest in assets that are negatively correlated with those markets. Gold is

the ideal diversifier for a stock portfolio, simply because it is among the most negatively

correlated assets to stocks.

Investment advisors recognize that diversification of investments can improve overall portfolio

performance. The key to diversification is finding investments that are not closely correlated to

one another. Because most stocks are relatively closely correlated and most bonds are

relatively closely correlated with each other and with stocks, many investors combine tangible

assets such as gold with their stock and bond portfolios in order to reduce risk. Gold and other

tangible assets have historically had a very low correlation to stocks and bonds.

Gold Coins

Precious metals in bulk form are known as bullion. They are traded on commodity markets. The

important feature of bullion is that it is valued by its mass and purity rather than by a face value

as money.

Gold coins are a common way of owning gold. Bullion coins are priced according to their fine

weight, plus a small premium based on supply and demand (as opposed to numismatic (study

of coins or medals) gold coins which are priced mainly by supply and demand based on rarity

and condition). Gold coins are primarily collected for their numismatic value. Investors view it as

a "hedge" against inflation or a store of value.

Fineness of gold coins

Coins are usually made of an alloy as other metals are mixed into the coin to make it more

durable. Fineness is the actual gold content in a coin or bar. It is expressed as "per mil," or

thousandths. So if .999 is 999 thousandths of the weight are pure gold then the other 1 /1000 is

an alloy. Carat is the unit of fineness for gold i.e. equal to 1/24 part of pure gold in an alloy.

The relation between Carats and fineness in Gold

24 carats= 1000 fine

23 carats= 958.3 fine

22 carats= 916.6 fine

21 carats= 875.0 fine

20 carats= 833.3 fine

18 carats= 750.0 fine

16 carats= 666.7 fine

14 carats= 583.3 fine

10 carats= 416.6 fine

Grading coins

Evaluation of a coin's grade is done by amount of wear on a coin. Amount of wear decides the

price of the coin. Coins with little wear are graded higher and therefore assigned higher prices

than those with a lot of wear. Rare coins with low grade can easily be more valuable than more

widely available, higher grade coins of common dates.

In the early years of coin collecting, three general terms were used to describe a coin's grade:

o Good where details were visible but circulation had worn the surface

o Fine Features were less worn from circulation and a bit of the mint luster showed on the

surfaces

o Uncirculated Details were sharp and there was a luster approaching the state of the coin

at the mint, prior to general circulation

Financial Derivatives

Derivative is a contract or a product whose value is derived from the value of some other asset,

known as underlying. Derivatives are based on a wide range of underlying assets. This includes

o Metals such as Gold, Silver etc;

o Commodities such as Grains, Coffee beans, Orange juice etc;

o Energy resources such as Oil and Gas etc; and

o Financial Assets such as Shares, Bonds and Foreign Currencies.

Forwards

A forward contract is a contractual agreement made directly between two parties. One party

agrees to buy a commodity or a financial asset on a date in the future at a fixed price. The other

side agrees to deliver that commodity or asset at the predetermined price. There is no element

of optionality about the deal. Both sides are obliged to go through with the contract, which is a

legal and binding commitment, irrespective of the value of the commodity or asset at the point

of delivery. Since forwards are negotiated directly between two parties, the terms and

conditions of a contract can be customized. However, there is a risk that one side might default

on its obligations.

Futures

A futures contract is essentially the same as a forward, except that the deal is made through an

organized and regulated exchange rather than being negotiated directly between two parties.

One side agrees to deliver a commodity or asset on a future date (or within a range of dates) at

a fixed price, and the other party agrees to take delivery. The contract is a legal and binding

commitment. There are three key differences between forwards and futures. Firstly, a futures

contract is guaranteed against default. Secondly, futures are standardized, in order to promote

active trading. Thirdly, they are settled on a daily basis.

Swaps

A swap is an agreement made between two parties to exchange payments on regular future

dates, where the payment legs are calculated on a different basis. As swaps are OTC deals,

there is a risk that one side or the other might default on its obligations. Swaps are used to

manage or hedge the risks associated with volatile interest rates, currency exchange rates,

commodity prices and share prices. A typical example occurs when a company has borrowed

money from a bank at a variable rate and is exposed to an increase in interest rates; by

entering into a swap the company can fix its cost of funding.

Options

A call option gives the holder the right to buy an underlying asset by a certain date at a fixed

price. A put option conveys the right to sell an underlying asset by a certain date at a fixed

price. The purchaser of an option has to pay an initial sum of money called the premium to the

seller or writer of the contract. This is because the option provides flexibility; it need never be

exercised (taken up). Options are either negotiated between two parties in the OTC market, one

of which is normally a specialist dealer, or freely traded on organized exchanges.

Traded options are generally standardized products, though some exchanges have introduced

contracts with some features that can be customized.

Market participants

Derivatives have a very wide range of applications in business as well as in finance. There are

four main participants in the derivatives market: dealers, hedgers, speculators and arbitrageurs.

The same individuals and organizations may play different roles in different market

circumstances. There are also large numbers of individuals and organizations supporting the

market in various ways.

Dealers

Derivative contracts are bought and sold by dealers who work for major banks and securities

houses. Some contracts are traded on exchanges, others are OTC transactions. In a large

investment bank the derivatives operation is now a highly specialized affair. Marketing and

sales staff speak to clients about their requirements. Experts help to assemble solutions to

those problems using combinations of forwards, swaps and options. Any risks that the bank

assumes as a result of providing tailored products for clients is managed by the traders who run

the bank's derivatives books. Meantime, risk managers keep an eye on the overall level of risk

the bank is running, and mathematicians known as 'quants' devise the tools required to price

new products.

Hedgers

Corporations, investing institutions, banks and governments all use derivative products to

hedge or reduce their exposures to market variables such as interest rates, share values, bond

prices, currency exchange rates and commodity prices. The classic example is the farmer who

sells futures contracts to lock into a price for delivering a crop on a future date. The buyer might

be a food-processing company which wishes to fix a price for taking delivery of the crop in the

future, or a speculator. Another typical case is that of a company due to receive a payment in a

foreign currency on a future date. It enters into a forward transaction with a bank agreeing to

sell the foreign currency and receive a predetermined quantity of domestic currency. Or it buys

an option which gives it the right but not the obligation to sell the foreign currency at a set

exchange rate.

Speculators

Derivatives are very well suited to speculating on the prices of commodities and financial assets

and on key market variables such as interest rates, stock market indices and currency

exchange rates. Generally speaking, it is much less expensive to create a speculative position

using derivatives than by actually trading the underlying commodity or asset. As a result, the

potential returns are that much greater. A classic application is the trader who believes that

increasing demand or reduced production is likely to boost the market price of a commodity. As

it would be too expensive to buy and store the physical commodity, the trader buys an

exchange-traded futures contract, agreeing to take delivery on a future date at a fixed price. If

the commodity price increases, the value of the contract will also rise and can then be sold back

into the market at a profit.

Arbitrageurs

An arbitrage is a deal that produces risk-free profits by exploiting a mis-pricing in the market. A

simple example occurs when a trader can purchase an asset cheaply in one location and

simultaneously arrange to sell it in another at a higher price. Such opportunities are unlikely to

persist for very long, since arbitrageurs would rush in to buy the asset in the 'cheap' location,

thus closing the pricing gap. In the derivatives business arbitrage opportunities typically arise

because a product can be assembled in different ways out of different building blocks. If it is

possible to sell a product for more than it costs to buy the constituent parts, then a risk-free

profit can be generated. In practice, the presence of transaction costs often means that only the

larger market players can benefit from such opportunities.

Derivative exchanges

Over-the-Counter

In the modern world, there is a huge variety of derivative products available. They are either

traded on organized exchanges (called exchange traded derivatives) or agreed directly

between the contracting counterparties over the telephone or through electronic media (called

Over-the-Counter (OTC) derivatives). Few complex products are constructed on simple building

blocks like forwards, futures, options and swaps to cater to the specific requirements of

customers.

Over-the-counter market is not a physical marketplace but a collection of broker-dealers

scattered across the country. Main idea of the market is more a way of doing business than a

place. Buying and selling of contracts is matched through negotiated bidding process over a

network of telephone or electronic media that link thousands of intermediaries. OTC derivative

markets have witnessed a substantial growth over the past few years, very much contributed by

the recent developments in information technology. The OTC derivative markets have banks,

financial institutions and sophisticated market participants like hedge funds and high net-worth

individuals. OTC derivative market is less regulated market because most of the transactions

occur in private, without activity being visible on any exchange.

Few risks are associated with OTC derivatives markets that give rise to instability in financial

systems. Some of the risks are

1. The dynamic nature of gross credit exposures;

2. Information asymmetries;

3. The effects of OTC derivative activities on available aggregate credit;

4. The high concentration of OTC derivative activities in major institutions; and

5. The central role of OTC derivatives markets in the global financial system.

Many events such counter-party credit events and sharp movements in asset prices that

underlie derivative contracts bring instability to the financial system, which significantly alter the

perceptions of current and potential future credit exposures. Frequent change in asset price, the

size and configuration of counter-party exposures can become unsustainably large and provoke

a rapid unwinding of positions.

OTC derivatives market, unable to manage risks like counterparty risk, liquidity risk and

operational risk, pose threat to international financial stability. The problem is more acute as

heavy reliance on OTC derivatives creates the possibility of systemic financial events, which fall

outside the more formal clearing house structures. Moreover, those who provide OTC derivative

products, hedge their risks using exchange-traded derivatives. In view of the inherent risks

associated with OTC derivatives, and their dependence on exchange-traded derivatives, Indian

law considers them illegal.

Exchange Traded Derivatives

An exchange-traded contract, such as a futures contract, has a standardized format that

specifies the underlying asset to be delivered. They trade on organized exchanges with prices

determined by the interaction of many buyers and sellers. In India, two exchanges offer

derivatives trading the Bombay Stock Exchange (BSE) and the National Stock Exchange

(NSE). A clearing house which is a wholly owned subsidiary of the exchanges, guarantees

contract performance. Margin requirements and daily marking-to-market of futures positions

substantially reduce the credit risk of exchange-traded contracts, relative to OTC contracts.

Forwards

A forward is an agreement made directly between two parties to buy/ sell a commodity/ asset

o On a specific date in the future.

o At a fixed price that is agreed at the outset between the two parties

o Forwards are widely used in commodities, foreign exchange market etc.

Essential features of a forward are

It is a contract between two parties (Bilateral contract)

o Price is fixed today

o Settlement date is fixed today

o Quantity of the underlying

o Quality of the underlying

o Delivery place is fixed

Forwards are bilateral over the counter (OTC) transactions where the terms of the contract as

price, quantity, quality, time and place are negotiated between two parties to the contract. Any

alteration in the terms of the contract is possible if both parties agree to it. Buyer agrees to buy

an underlying asset on a date in the future at a fixed price. The Seller agrees to deliver

underlying asset at the predetermined price. Corporations, traders and investing institutions

extensively use OTC transactions for a deal to meet their specific requirements. The essential

idea of entering into a forward is to fix the price and thereby avoid the price risk. Thus by

entering into forwards, one is assured of the price at which one can buy/ sell goods or other

assets.

Limitations

Liquidity Risk

Liquidity is nothing but the ability of the market participants to buy or sell the desired quantity of

an underlying asset. As forwards are tailor made contracts i.e. the terms of the contract are

according to the specific requirements of the parties. Other market participants may not be

interested in these contracts. Forwards are not listed or traded in exchanges, which indirectly

makes difficult for other market participants to easily access these contracts or contracting

parties. The tailor made contracts and the non-availability on exchanges creates illiquidity in the

contracts. Therefore, it is very difficult for contracting parties to exit from the forward contract

before the contract's maturity.

Counterparty risk

In most financial contracts, counterparty risk is also known as default risk. It is the risk of an

economic loss from the failure of counterparty to fulfill its contractual obligation. For example A

& B enter into a bilateral agreement, where A will purchase 100 kg of rice@ Rs20/ kg from B

after 6 months. Here A is counterparty to B and vise-versa. After 6 months if price of rice is Rs

30 in the market then B may forego his obligation to deliver 100 kg of rice@ Rs 20 to A.

Similarly, if prices of rice fall to Rs 15 then A may purchase from the market at a lower price,

instead of honoring the contract. Thus, a contracting party defaults only when there is some

incentive to default.

Lack of centralized trading platform

Lack of liquidity can make trading infeasible, while lack of transparency can make potential

trading partners unwilling to trust one another. Both can cause markets to seize up and threaten

a cascade of failures. Transparent, liquid financial markets are less prone to such systemic

threats. Thus, a centralized trading platform can solve most of the risks.

Futures contract

Futures markets were innovated to overcome the drawbacks of forwards. A futures contract is

an agreement made through an organized exchange to buy or sell a fixed amount of a

commodity or a financial asset on a future date at an agreed price. Futures market is

standardised forwards contract. Buyers and sellers trade in a centralized trading platform of

exchanges where the terms of the contract are standardized. The clearinghouse associated

with the exchange guarantees delivery. As exchange specifies all the terms of the contract, the

trader needs to bargain over the future price. A trader who buys futures contract takes a long

position and one who sells futures takes a short position. The words buy and sell are figurative

only because no money or underlying asset changes hand when the deal is signed.

Features

o Contract between two parties through Exchange

o Centralized trading platform i.e. exchange

o Price discovery

o Margins are payable by both the parties

o Quality decided today (quality as per the specifications decided by the exchange)

o Quantity decided today (standardized)

Limitations

o The leverage effect works in both directions and, therefore, makes trading in futures

contracts highly risky. Futures operate on margins, meaning to take a position in a

contract only a fraction of the total value needs to be made available in cash in the

trading account. In fact, a trader needs to deposit only 5 to 10 % of the contract value

and rest of the contract are brought in margin. Low margin requirements can encourage

poor money management, leading to excessive risk taking. Additionally, it is easy to lose

the entire deposit in a volatile market. Therefore, trading in futures contract is considered

risky.

o Futures contract have a linear payoff charts i.e. a trader has to bear unlimited loss and

simultaneously gain unlimited profits in his futures contract position. Therefore, a trader

should frequently monitor his futures positions.

Options

Like forward and futures, options represent another derivative instrument and provide a

mechanism by which one can acquire a certain commodity or any other financial asset, or take

position in, in order to make profit or cover risk for a price. The options are similar to the futures

contracts in the sense that they are also standardized but are different from them in many ways.

An option is a right, but not the obligation, to buy or sell an underlying asset at a predetermined

price, within or at the end of a specified period. The party buying the option is called buyer of

the option and the party selling the option is called the seller/ writer of the option.

The option buyer who is also called long on option has the right and no obligation with regard to

buying or selling the underlying asset, while the option writer who is also called short on option

has the obligation but no right in the contract.

Equity option holder does not enjoy the rights as an ordinary share holder e.g. voting rights,

regular cash or special dividends. The option holder must exercise the option and take

ownership of underlying shares to be eligible for these rights. But in India, derivative

instruments are cash settled.

As mentioned in earlier module SEBI has come up with new circular, on July 15, 2010, which

states physical settlement of stock derivatives. A Stock Exchange may introduce physical

settlement in a phased manner. On introduction, however, physical settlement for all stock

options and/ or all stock futures, as the case may be, must be completed within six months.

Options may be categorized as call options and put options depending upon the right conferred

on the buyer.

Call Option

It is an option to buy a stock at a specific price on or before a certain date. In this way, Call

options are like security deposits. If, for example, you wanted to rent a certain property, and left

a security deposit for it, the money would be used to insure that you could, in fact, rent that

property at the price agreed upon when you returned. If you never returned, you would give up

your security deposit, but you would have no other liability. Call options usually increase in

value as the value of the underlying instrument rises.

Put Options

They are options to sell a stock at a specific price on or before a certain date. In this way, Put

options are like insurance policies If you buy a new car and then buy auto insurance on the car,

you pay a premium and are, hence, protected if the car is damaged in an accident. If this

happens, you can use your policy to regain the insured value of the car. In this way, the put

option gains in value as the value of the underlying instrument decreases. If all goes well and

the insurance is not needed, the insurance company keeps your premium in return for taking on

the risk.

Long

Long describes a position (in stock and/ or options) in which you have purchased and own that

security in your brokerage account.

Long an equity option contract:

o You have the right to exercise that option at any time prior to its expiration.

o Your potential loss is limited to the amount you paid for the option contract.

Short

Short describes a position in options in which you have written a contract (sold one that you did

not own) and earned a premium. In return, you now have the obligations inherent in the terms

of that option contract. If the owner exercises the option, you have an obligation to meet. If you

have sold the right to buy 100 shares of a stock to someone else, you are short a call contract.

If you have sold the right to sell 100 shares of a stock to someone else, you are short a put

contract. When you write an option contract you are, in a sense, creating it. The writer of an

option collects and keeps the premium received from its initial sale.

Short an equity option contract:

o You can be assigned an exercise notice at any time during the life of the option contract.

All option writers should be aware that assignment is a distinct possibility.

o Your potential loss on a short call is theoretically unlimited. For a put, the risk of loss is

limited by the fact that the stock cannot fall below zero in price. Although technically

limited, this potential loss could still be quite large if the underlying stock declines

significantly in price.

Open

An opening transaction is one that adds to, or creates a new trading position. It can be either a

purchase or a sale. With respect to an option transaction, consider both:

o Opening purchase a transaction in which the purchaser's intention is to create or

increase a long position in a given series of options.

o Opening sale a transaction in which the seller's intention is to create or increase a short

position in a given series of options.

Close

A closing transaction is one that reduces or eliminates an existing position by an appropriate

offsetting purchase or sale. With respect to an option transaction:

o Closing purchase a transaction in which the purchaser's intention is to reduce or

eliminate a short position in a given series of options. This transaction is frequently

referred to as "covering" a short position.

o Closing sale a transaction in which the seller's intention is to reduce or eliminate a long

position in a given series of options.

Option styles

Settlement of options is based on the expiry date and basic styles of options. The styles have

geographical names, which have nothing to do with the location where a contract is agreed.

The styles are:

European: These options give the holder the right, but not the obligation, to buy or sell the

underlying instrument only on the expiry date. This means that the option cannot be exercised

early. Settlement is based on a particular strike price at expiration. Currently, in India only index

options are European in nature.

American: These options give the holder the right, but not the obligation, to buy or sell the

underlying instrument on or before the expiry date. This means that the option can be exercised

early. Settlement is based on a particular strike price at expiration.

Options in stocks that have been recently launched in the Indian market are" American Options"

while the options on the Index are "European Options".

Clearing and Settlement System

All trades executed on F &O Segment of the Exchange through Clearing Corporation/ Clearing

House with the help of Clearing Members and Clearing Banks. Clearing Corporation acts as a

legal counterparty to all trades on this segment. The Clearing and Settlement process

comprises of three main activities, viz., Clearing, Settlement and Risk Management.

Clearing Members

Broadly speaking there are three types of clearing members

1. Self-Clearing Member (SCM): They clear and settle trades executed by them only either on

their own account or on account of their clients.

2. Trading-cum-Clearing Member (TCM): They clear and settle their own trades as well as trades

of other trading members

3. Professional clearing members (PCM): They clear and settle trades executed by trading

Both TCM and PCM are important for additional security deposits in respect of every trading

member whose trades they undertake to clear and settle.

Clearing Banks

Clearing Banks are responsible for funds settlement in F&O Segment. For settlement purpose,

all clearing members are required to open a separate bank account with Clearing Corporation

designated clearing bank.

Clearing Mechanism

The initial step in clearing mechanism is to calculate open positions and obligations of clearing

members. The open positions of a CM is calculated as an aggregate of the open positions of all

the trading members (TMs) and all custodial participants (CPs) clearing though him, in the

contracts which they have traded. For TM, the open position is attained by adding up his

proprietary open position and clients' open positions, in the contracts which they have traded.

Every order on the trading system should be identified as either proprietary (Pro) or client (Cli).

Proprietary positions are calculated on net basis (buy-sell) for each contract and that of clients

are arrived at by summing together net positions of each individual client. ATM's open position

is the sum of proprietary open position, client open long position and client open short position.

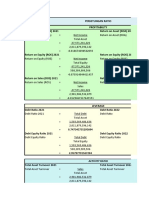

To illustrate, a Clearing Member A, with Trading Members clearing through him ABC and RST

Proprietary Position Client 1 Client 2

TM Security Buy

Qty

Sell

Qty

Net

Qty

Buy

Qty

Sell

Qty

Net

Qty

Buy

Qty

Sell

Qty

Net

Qty

Net

Member

ABC NIFTY

December

Contract

4000 2000 2000 4000 3000 1000 7000 5000 2000 Long

5000

RST NIFTY

December

Contract

2000 3000 (1000) 2500 1500 1000 1000 2000 (1000) Long

1000

Short

2000

Clearing member A's open position for NIFTY December contract is:

Member Long Position Short Position

ABC 5000 0

RST 1000 2000

Total for A 6000 2000

From the above example, ABC's Long Position is arrived by adding both net position of his

proprietary i.e. 3000 and net positions of both his client's 1 & 2 i.e. 1000 and 2000 respectively.

Similarly, we have calculated the long and short positions of X YZ. Clearing member's open

position is attained by adding long positions and short positions of both the clients i.e. 6000 long

open positions and 2000 short open positions.

Settlement Mechanism

At present in India, all futures and options contracts are cash settled. The underlying assets

are not delivered on settlement. These contracts, therefore, has to be settled in cash. Steps

are taken were futures and options on individual securities will be delivered as in the spot

market. The settlement amount for a CM is netted across all their TMs/ clients, with respect to

their obligations on MTM, premium and exercise settlement.

The settlement of trades in F&O segment is on T +1 working day basis. Members with a funds

pay-in obligation are required to have clear funds in their account. Funds in clearing account

should be present on or before 10.30 a.m. on the settlement day. The payout of funds is later

credited to the primary clearing account of the members.

Settlement of Futures Contracts on Index or Individual Securities

In Futures contracts, both the parties to the contract have to deposit margin money which is

called as initial margin. There are two types of settlements in futures contract; they are MTM

settlement which happens on a continuous basis at the end of each day, and the final

settlement which happens on the last trading day of the futures contract.

Mark to Market (MTM) Settlement

Mark to Market is a process by which margins are adjusted on the basis of daily price changes

in the markets for underlying assets. The profits/ losses are computed as the difference

between:

1. The trade price and the day's settlement price for contracts executed during the day but

not squared up.

2. The previous day's settlement price and the current day's settlement price for brought

forward contracts.

3. The buy price and the sell price for contracts executed during the day and squared up.

The CM, who incurred loss, is required to pay the MTM loss amount in cash. The amount is

passed on to the CM who has made a MTM profit. The pay-in and pay-out of the MTM

settlement are brought into effect on the T +1 day of the trade day. Trading Member is

responsible to collect/ pay funds from/ to clients by the next day. Clearing Members collects and

settle the daily MTM profits/ losses incurred by the TMs and their clients clearing and settling

through them.

After the completion of day's settlement, all the open positions are reset to the daily settlement

price. These positions become the open positions for the next day.

Final Settlement

After the close of trading hours of expiration day Clearing Corporation marks all positions of a

Clearing Member to the final settlement price. Later the resulting profit/ loss are settled in cash.

Clearing member's clearing bank account is settled on the day following expiry day of the

contract. Long position is assigned to short position with the same series, on a random basis.

Settlement Price

Daily settlement price of future contract is the day's closing price on a particular trading day.

The closing price for a future contract is calculated as the last half an hour weighted average

price of the contract in the F&O Segment of exchanges. Final settlement price is the closing

price of the relevant underlying index/security in the Capital Market segment of exchange, on

the last trading day of the Contract. The closing price of the underlying Index/ security is

currently its last half an hour weighted average value in the Capital Market Segment of

exchange.

Settlement of Options Contracts on Index or Individual Securities

Options contracts have two types of settlements. Daily premium settlement and Final settlement

Daily Premium Settlement

In options contract, buyer of an option pays premium while seller receives premium. The

clearing member with payable position needs to pay premium amount to clearing corporation

which in turn are passed on to the members who have a premium receivable position. This is

known as daily premium settlement. The pay-in and pay-out of the premium settlement is on T

+1 day. The premium amount is directly credited/ debited to the clearing members clearing

bank account.

Final Exercise Settlement

All the in the money stock options contracts shall be exercised on the expiry day. Any unclosed

long/ short positions are immediately assigned to short/ long positions in option contracts with

the same series, on the random basis.

Profit/ loss amount for options contract on index and individual securities on final settlement is

debited/ credited to the relevant clearing members clearing bank account on T +1 day i.e. a day

after expiry day. Open positions, in option contracts, cease to exist after their expiration day.

The settlement of funds for a clearing member on a particular day is the net amount across

settlements and all trading members/ clients, in Future & Option Segment.

Vous aimerez peut-être aussi

- School Fee Payment ReceiptDocument2 pagesSchool Fee Payment Receiptপ্রিয়াঙ্কুর ধরPas encore d'évaluation

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরPas encore d'évaluation

- Bharti Airtel: CMP: INR271 TP: INR265 NeutralDocument10 pagesBharti Airtel: CMP: INR271 TP: INR265 Neutralপ্রিয়াঙ্কুর ধরPas encore d'évaluation

- Tools and Techniques of Cost ReductionDocument27 pagesTools and Techniques of Cost Reductionপ্রিয়াঙ্কুর ধর100% (2)

- 2011 CTS Placement PapersDocument12 pages2011 CTS Placement Papersপ্রিয়াঙ্কুর ধরPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Introduction To Ohs Management System Standards: Presenter: Zaikhasra Zainuddin 17 JULY 2009Document40 pagesIntroduction To Ohs Management System Standards: Presenter: Zaikhasra Zainuddin 17 JULY 2009Chandral VaradanPas encore d'évaluation

- Material Costing - Theory & Practical Questions-3Document12 pagesMaterial Costing - Theory & Practical Questions-3sakshi.sinha56327Pas encore d'évaluation

- ICAI JournalDocument121 pagesICAI Journalamitkhera786Pas encore d'évaluation

- MOU With DCB Bank 9may16Document10 pagesMOU With DCB Bank 9may16Sainik AddaPas encore d'évaluation

- MIS Group 1 Sec F Assignment 2Document2 pagesMIS Group 1 Sec F Assignment 2Debasmita KumarPas encore d'évaluation

- 2-Developing An Information SystemDocument7 pages2-Developing An Information SystemWorld of LovePas encore d'évaluation

- 1st Unit SEDocument31 pages1st Unit SERanjeetSinghPas encore d'évaluation

- Uplift Construction and Development CorporationDocument3 pagesUplift Construction and Development CorporationDAXEN STARPas encore d'évaluation

- Cost Accounting 3Document13 pagesCost Accounting 3Frenz VerdidaPas encore d'évaluation

- Analisis Biaya Pendidikan Tinjauan Sosial Dan PribadiDocument9 pagesAnalisis Biaya Pendidikan Tinjauan Sosial Dan PribadiAsti WulandariPas encore d'évaluation

- Balance StatementDocument4 pagesBalance StatementVitor BinghamPas encore d'évaluation

- HDFCDocument4 pagesHDFCTrue ChallengerPas encore d'évaluation

- Harvest StrategyDocument3 pagesHarvest StrategyAkash NelsonPas encore d'évaluation

- EVA and Compensation Management at TCSDocument9 pagesEVA and Compensation Management at TCSioeuser100% (1)

- Situational Judgement Test 318 - Sample Situations and Questions - Canada - CaDocument1 pageSituational Judgement Test 318 - Sample Situations and Questions - Canada - CaMaysa BlatchfordPas encore d'évaluation

- Internal - Audit - Manual - World Intellectual PropertyDocument25 pagesInternal - Audit - Manual - World Intellectual PropertyEric AnastacioPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationArti YadavPas encore d'évaluation

- Principles of Accounting - CASE NO. 4 - PC DEPOTDocument24 pagesPrinciples of Accounting - CASE NO. 4 - PC DEPOTlouie florentine Sanchez100% (1)

- NullDocument261 pagesNullRabia jamalPas encore d'évaluation

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288Pas encore d'évaluation

- Lesson 1business EthicsDocument19 pagesLesson 1business EthicsNiña Gloria Acuin ZaspaPas encore d'évaluation

- John Smith Resume SampleDocument1 pageJohn Smith Resume SampleDana Beatrice RoquePas encore d'évaluation

- Pension Mathematics With Numerical Illustrations: Second EditionDocument13 pagesPension Mathematics With Numerical Illustrations: Second EditionG.k. FlorentPas encore d'évaluation

- RN Profile Foco 2022Document16 pagesRN Profile Foco 2022MANINDER SINGHPas encore d'évaluation

- IT OS Part 5Document4 pagesIT OS Part 5Business RecoveryPas encore d'évaluation

- New York Placement ListDocument4 pagesNew York Placement ListDan Primack100% (1)

- Carolina Industries vs. CMS Stock Brokerage PDFDocument42 pagesCarolina Industries vs. CMS Stock Brokerage PDFdanexrainierPas encore d'évaluation

- Chapter 15 Data Managment Maturity Assessment - DONE DONE DONEDocument16 pagesChapter 15 Data Managment Maturity Assessment - DONE DONE DONERoche ChenPas encore d'évaluation

- CAPE Accounting Entire SBA (Merlene)Document8 pagesCAPE Accounting Entire SBA (Merlene)Merlene Dunbar56% (9)