Académique Documents

Professionnel Documents

Culture Documents

Mutual Fund Offer Documents Have Two Parts

Transféré par

YK Singh0 évaluation0% ont trouvé ce document utile (0 vote)

54 vues4 pagesNew Guidelines for

Titre original

Mutual Find Offer Document

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentNew Guidelines for

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

54 vues4 pagesMutual Fund Offer Documents Have Two Parts

Transféré par

YK SinghNew Guidelines for

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

Mutual Fund Offer Documents have two parts:

1. Scheme Information Document (SID), which has details of the scheme

2. Statement of Additional Information (SAI), which has statutory information about the mutual

fund, that is offering the scheme.

It stands to reason that a single SAI is relevant for all the schemes offered by a mutual fund. In practice,

SID and SAI are two separate documents, though the legal technicality is that SAI is part of the SID. Both

documents are prepared in the format prescribed by SEBI, and submitted to SEBI. The contents need to

flow in the same

Contents of SID

The cover page has the name of the scheme followed by its type viz.

Open-ended / Close-ended / Interval (the scheme structure)

Equity / Balanced / Income / Debt / Liquid / ETF (the expected nature of scheme portfolio)

It also mentions the face value of the Units being offered, relevant NFO dates (opening, closing, re-

opening), date of SID, name of the mutual fund, and name & contact information of the AMC and

trustee company. Finally, the cover page has the following standard clauses, which every investor ought

to note:

The particulars of the Scheme have been prepared in accordance with the Securities and Exchange

Board of India (Mutual Funds) Regulations 1996, (herein after referred to as SEBI (MF) Regulations) as

amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units

being offered for public subscription have not been approved or recommended by SEBI nor has SEBI

certified the accuracy or adequacy of the Scheme Information Document. The Scheme Information

Document sets forth concisely the information about the scheme that a prospective investor ought to

know before investing. Before investing, investors should also ascertain about any further changes to

this Scheme Information Document after the date of this Document from the Mutual Fund / Investor

Service Centers / Website / Distributors or Brokers. The investors are advised to refer to the Statement

of Additional Information (SAI) for details of ________ Mutual Fund, Tax and Legal issues and general

information on www.__________. (Website address). SAI is incorporated by reference (is legally a part

of the Scheme Information Document). For a free copy of the current SAI, please contact your nearest

Investor Service Centre or log on to our website. The Scheme Information Document should be read in

conjunction with the SAI and not in isolation.

Table of Contents

Highlights

Introduction

Risk Factors

1. Standard

2. Scheme-specific

I. Provisions regarding minimum no. of investors in the scheme

II. Any other special considerations

III. Definitions

IV. Due Diligence Certificate (issued by the AMC)

Information about the scheme

Units and Offer

Fees & Expenses

Rights of Unit-holders

Penalties, Litigation etc

Draft SID is a public document, available for viewing in SEBIs website (www.sebi.gov.in) for 21 working

days. The final SID (after incorporating SEBIs observations) has to be hosted on AMFIs website

(www.amfiindia.com) two days before the issue opens. Every mutual fund, in its website, provides for

download of the SID for all its current schemes.

Update of SID

Regular

If a scheme is launched in the first 6 months of the financial year (say, April 2010), then the first update

of the SID is due within 3 months of the end of the financial year (i.e. by June 2011). If a scheme is

launched in the second 6 months of the financial year (say, October 2010), then the first update of the

SID is due within 3 months of the end of the next financial year (i.e. by June 2012). Thereafter, SID is to

be updated every year.

Need-based

In case of change in the fundamental attributes, the SID has to be updated immediately after the lapse

of the time period given to existing investors to exit the scheme.

In case of any other change-

It will be printed on a separate piece of paper (addendum) and distributed along with the SID, until the

SID is updated.

If a change is superseded by a further change (for instance, change in load), then addenda is not

required for the superseded change i.e. addenda is only required to disclose the latest position.

The change is to be advertised in an English newspaper having nation-wide circulation, and in a

newspaper of the language of the region where the head office of the mutual fund is located.

The change is to be mentioned in the website of the mutual fund.

Contents of SAI

Information about Sponsors, AMC and Trustee Company (includes contact information, shareholding

pattern, responsibilities, names of directors and their contact information, profiles of key personnel, and

contact information of service providers {Custodian, Registrar & Transfer Agent, Statutory Auditor, Fund

Accountant (if outsourced) and Collecting Bankers}

Condensed financial information (for schemes launched in last 3 financial years)

How to apply

Rights of Unit-holders

Investment Valuation Norms

Tax, Legal & General Information (including investor grievance redressal mechanism, and data on

number of complaints received and cleared, and opening and closing number of complaints for previous

3 financial years, and for the current year to-date).

Every mutual fund, in its website, provides for download of its SAI. Investors have a right to ask for a

printed copy of the SAI. Through AMFI website (www.amfiindia.com) investors can access the SAI of all

the mutual funds. Examinees are advised to study the SAI for any mutual fund, to get a better

understanding of the disclosures.

Update of SAI

Regular update is to be done by the end of 3 months of every financial year. Material changes have to

be updated on an ongoing basis and uploaded on the websites of the mutual fund and AMFI.

Key Information Memorandum

Role of KIM

KIM is essentially a summary of the SID and SAI. It is more easily and widely distributed in the market. As

per SEBI regulations, every application form is to be accompanied by the KIM.

Contents of KIM

Some of the key items are as follows:

Name of the AMC, mutual fund, Trustee, Fund Manager and scheme

Dates of Issue Opening, Issue Closing & Re-opening for Sale and Re-purchase

Plans and Options under the scheme

Risk Profile of Scheme

Price at which Units are being issued and minimum amount / units for initial purchase, additional

purchase and re-purchase

Bench Mark

Dividend Policy

Performance of scheme and benchmark over last 1 year, 3 years, 5 years and since inception.

Loads and expenses

Contact information of Registrar for taking up investor grievances

Update of KIM : KIM is to be updated at least once a year. As in the case of SID, KIM is to be revised in

the case of change in fundamental attributes. Other changes can be disclosed through addenda

attached to the KIM.

Vous aimerez peut-être aussi

- New Fund Offer Documents ExplainedDocument9 pagesNew Fund Offer Documents Explainedamoldesh29Pas encore d'évaluation

- NISM Series 5A Chapter 5Document20 pagesNISM Series 5A Chapter 5sachinaman.2016Pas encore d'évaluation

- Investor Rights: Prepared by Dr. Anupama PardeshiDocument18 pagesInvestor Rights: Prepared by Dr. Anupama PardeshiTwinkal chakradhariPas encore d'évaluation

- Mutual FundsDocument4 pagesMutual FundsSaumya SomanPas encore d'évaluation

- Offer DocumentDocument14 pagesOffer DocumentsidhanthaPas encore d'évaluation

- Peerless EquityDocument85 pagesPeerless EquityLalith KarthikeyanPas encore d'évaluation

- Nism Module VaDocument15 pagesNism Module VaNeha BahetiPas encore d'évaluation

- Amfi Exam NotesDocument2 pagesAmfi Exam NotesjaydipPas encore d'évaluation

- HDFC Mutual Fund ListDocument60 pagesHDFC Mutual Fund Listhshah21Pas encore d'évaluation

- Guide to Offer DocumentsDocument5 pagesGuide to Offer DocumentsGeetika KhandelwalPas encore d'évaluation

- SEBI Role and FunctionsDocument28 pagesSEBI Role and FunctionsAnurag Singh100% (4)

- Presentation On BSEC (Debt Securities) Rules, 2021Document39 pagesPresentation On BSEC (Debt Securities) Rules, 2021Asif Abdullah KhanPas encore d'évaluation

- SEBI Role and Functions SummaryDocument27 pagesSEBI Role and Functions Summaryfokat100% (1)

- Kotak Gold Fund SIDDocument30 pagesKotak Gold Fund SIDsabyasachi_paulPas encore d'évaluation

- Sai1 PDocument5 pagesSai1 PChandra Wati mamgainPas encore d'évaluation

- Note On Public IssueDocument9 pagesNote On Public IssueKrish KalraPas encore d'évaluation

- Primary and Secondary MarketDocument57 pagesPrimary and Secondary MarketRahul Shakya100% (1)

- NTPCDocument19 pagesNTPCamritPas encore d'évaluation

- Merchant BankingDocument6 pagesMerchant BankingVivek TathodPas encore d'évaluation

- Project FinancingDocument22 pagesProject Financingsanket9996Pas encore d'évaluation

- Steps in A Pre and Post Public IssueDocument8 pagesSteps in A Pre and Post Public Issuearmailgm100% (1)

- Sid RgessDocument36 pagesSid Rgessu4rishiPas encore d'évaluation

- Chapter 7Document5 pagesChapter 7swapnil tiwariPas encore d'évaluation

- Sbi Eqty 12 Combined Form MFDocument55 pagesSbi Eqty 12 Combined Form MFanywheremechanical78Pas encore d'évaluation

- Sept 13, 2012 - Steps To Re-Energise Mutual Fund IndustryDocument7 pagesSept 13, 2012 - Steps To Re-Energise Mutual Fund IndustryShubh Raj BhagatPas encore d'évaluation

- Bank Credit Facilitation Scheme: Furthermore The MSME's Can Upgrade Their Competence in Terms of BusinessDocument19 pagesBank Credit Facilitation Scheme: Furthermore The MSME's Can Upgrade Their Competence in Terms of BusinessYogesh PrajapatiPas encore d'évaluation

- CMSLUpdates Dec2016Document219 pagesCMSLUpdates Dec2016prachi_sharma_32Pas encore d'évaluation

- About SEBI Establishment of Sebi: Securities and Exchange Board of India ActDocument17 pagesAbout SEBI Establishment of Sebi: Securities and Exchange Board of India ActFaraaz HasnainPas encore d'évaluation

- Indian Debt MarketDocument32 pagesIndian Debt MarketProfessorAsim Kumar Mishra0% (1)

- SEBI Role & FunctionsDocument27 pagesSEBI Role & FunctionsGayatri MhalsekarPas encore d'évaluation

- Role of Sebi in Regulating MfsDocument9 pagesRole of Sebi in Regulating MfsnamwaglePas encore d'évaluation

- Loan RecoveryDocument62 pagesLoan RecoveryKaran Thakur100% (1)

- FCLDocument37 pagesFCLChintan ManekPas encore d'évaluation

- Final Done Section 1 Ceptor 4Document19 pagesFinal Done Section 1 Ceptor 4vijendra chandaPas encore d'évaluation

- Fund Distribution and Channel Management: by Ishaan KumarDocument18 pagesFund Distribution and Channel Management: by Ishaan KumarIshaan KumarPas encore d'évaluation

- Law & Practice of BankingDocument81 pagesLaw & Practice of BankingAhsan ZamanPas encore d'évaluation

- Listing On NSEDocument16 pagesListing On NSEUtejaniPas encore d'évaluation

- Crowd-sourced equity funding now a reality for Australian companiesDocument8 pagesCrowd-sourced equity funding now a reality for Australian companiessilvofPas encore d'évaluation

- Procedure For Change in The Controlling Interest of The Asset Management CompanyDocument2 pagesProcedure For Change in The Controlling Interest of The Asset Management CompanygauravPas encore d'évaluation

- 1392628459421Document48 pages1392628459421ravidevaPas encore d'évaluation

- Summary Due To Law ChangeDocument35 pagesSummary Due To Law ChangeAayush NigamPas encore d'évaluation

- Frequently Asked Questions (Faq) : Under National Pension System (NPS)Document11 pagesFrequently Asked Questions (Faq) : Under National Pension System (NPS)Satish KumarPas encore d'évaluation

- Non-Bank Sources of Short Term FinanceDocument16 pagesNon-Bank Sources of Short Term FinancePushpa RaniPas encore d'évaluation

- Axis Hybrid 9Document12 pagesAxis Hybrid 9Arpan PatelPas encore d'évaluation

- Sbi Mutual FundDocument38 pagesSbi Mutual FundAbhilash MishraPas encore d'évaluation

- KUPres 7 Nov 2010Document63 pagesKUPres 7 Nov 2010Hasan Irfan SiddiquiPas encore d'évaluation

- Securities Exchange Board of India: - A Project ReportDocument17 pagesSecurities Exchange Board of India: - A Project ReportPraveen NairPas encore d'évaluation

- Leaflet CFC February 2016Document2 pagesLeaflet CFC February 2016jnakakandePas encore d'évaluation

- MF IntroductionDocument21 pagesMF Introductionutsav mandalPas encore d'évaluation

- Sebi Updates NovDocument7 pagesSebi Updates NovParidhi JainPas encore d'évaluation

- Birla Sun Life T-20 Fund: Scheme Information DocumentDocument41 pagesBirla Sun Life T-20 Fund: Scheme Information DocumentSatya NarayanaPas encore d'évaluation

- Corporate Law - A ProspectusDocument26 pagesCorporate Law - A Prospectussrodricks123Pas encore d'évaluation

- HDFC Annual Interval FundDocument7 pagesHDFC Annual Interval Fundsandeepkumar404Pas encore d'évaluation

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsD'EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsPas encore d'évaluation

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteD'EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NotePas encore d'évaluation

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703D'EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Pas encore d'évaluation

- Capital Budgeting PPT 1Document75 pagesCapital Budgeting PPT 1Sakshi SharmaPas encore d'évaluation

- Quantitative Trading Strategies Using Python Technical Analysis, Statistical Testing, and Machine Learning (Peng Liu) (Z-Library)Document341 pagesQuantitative Trading Strategies Using Python Technical Analysis, Statistical Testing, and Machine Learning (Peng Liu) (Z-Library)alex seow100% (1)

- HWRK Grading Criteria HWRK 1 Ch. 2 - 2017Document5 pagesHWRK Grading Criteria HWRK 1 Ch. 2 - 2017Moulee DattaPas encore d'évaluation

- RBI's Credit Monitoring Arrangement and Tandon Committee recommendationsDocument4 pagesRBI's Credit Monitoring Arrangement and Tandon Committee recommendationsAbhi_IMK100% (1)

- Submission NI Act and Artha Rin 13.03.2018Document21 pagesSubmission NI Act and Artha Rin 13.03.2018Shah Fakhrul Islam AlokPas encore d'évaluation

- Corr 5 R3 INCL DOCUMENTS LINKDocument3 pagesCorr 5 R3 INCL DOCUMENTS LINKsantosh yevvariPas encore d'évaluation

- Financial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionDocument50 pagesFinancial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionNoor Ul Hussain MirzaPas encore d'évaluation

- Module-Intermediate Accounting 1-LM01-CP1 PDFDocument25 pagesModule-Intermediate Accounting 1-LM01-CP1 PDFNikka Rebaya100% (1)

- Comp 202207302138301255Document1 pageComp 202207302138301255nidhikanpur8052Pas encore d'évaluation

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingPas encore d'évaluation

- Genealogy ReportDocument2 pagesGenealogy Reportzhaodonghk3Pas encore d'évaluation

- Métodos Cuantitativos: Alex Contreras MirandaDocument23 pagesMétodos Cuantitativos: Alex Contreras MirandaRafael BustamantePas encore d'évaluation

- 31 Excel Powerful FormulaDocument15 pages31 Excel Powerful FormulaGanesh Tiwari0% (1)

- Module 2a - AR RecapDocument10 pagesModule 2a - AR RecapChen HaoPas encore d'évaluation

- Accountancy & Auditing Paper - 1-2015Document3 pagesAccountancy & Auditing Paper - 1-2015Qasim IbrarPas encore d'évaluation

- Investment Objective: Fund Fact Sheet As of September 2020Document2 pagesInvestment Objective: Fund Fact Sheet As of September 2020Neil MijaresPas encore d'évaluation

- New profit sharing ratiosDocument9 pagesNew profit sharing ratiosAman KakkarPas encore d'évaluation

- Assessment in Income TaxDocument3 pagesAssessment in Income Taxayush sikkewalPas encore d'évaluation

- Thank You For Your CooperationDocument1 pageThank You For Your CooperationTadi Fresco RoycePas encore d'évaluation

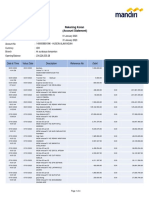

- Rek Koran Mandiri PT HAI Jan-April 2023Document14 pagesRek Koran Mandiri PT HAI Jan-April 2023wahyu suhartonoPas encore d'évaluation

- Rbi 247 Marathon Session 2Document161 pagesRbi 247 Marathon Session 2Jerry ZaidiPas encore d'évaluation

- 6681606Document3 pages6681606Jay O CalubayanPas encore d'évaluation

- ACBP5122wA1 PDFDocument9 pagesACBP5122wA1 PDFAmmarah Ramnarain0% (1)

- Financial Reports and Balance Sheets of a CompanyDocument14 pagesFinancial Reports and Balance Sheets of a CompanySalsa nabila Raflani putriPas encore d'évaluation

- IDBI Bank Powerpoint PresentationDocument7 pagesIDBI Bank Powerpoint Presentationaritra0123Pas encore d'évaluation

- Fabm Dipolog Rice MillDocument10 pagesFabm Dipolog Rice Millgamer boyPas encore d'évaluation

- Shubh Nivesh Brochure - BRDocument15 pagesShubh Nivesh Brochure - BRSumit RpPas encore d'évaluation

- India Startup Ecosystem GuideDocument26 pagesIndia Startup Ecosystem GuideRahul MorePas encore d'évaluation

- Deloitte Au Tax Insight Deconstructing Chevron Transfer Pricing Case 041115 PDFDocument8 pagesDeloitte Au Tax Insight Deconstructing Chevron Transfer Pricing Case 041115 PDFCA.Srikant Parthasarathy ParthasarathyPas encore d'évaluation

- Working Capital Management AssignmentDocument10 pagesWorking Capital Management AssignmentRitesh Singh RathorePas encore d'évaluation