Académique Documents

Professionnel Documents

Culture Documents

Compare-Lic Has No Option

Transféré par

SandeepSapre0 évaluation0% ont trouvé ce document utile (0 vote)

441 vues3 pagesA term plan is the best form of insurance because it gives a very high cover at a low price. The premium of a term plan is a fraction of what you have to shell out when you buy an endowment plan, a money-back policy or a ULIP with the same coverage. Of course, this is also because there is no investment component in a term plan. The entire premium goes in covering the risk.

Titre original

COMPARE-LIC HAS NO OPTION

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentA term plan is the best form of insurance because it gives a very high cover at a low price. The premium of a term plan is a fraction of what you have to shell out when you buy an endowment plan, a money-back policy or a ULIP with the same coverage. Of course, this is also because there is no investment component in a term plan. The entire premium goes in covering the risk.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

441 vues3 pagesCompare-Lic Has No Option

Transféré par

SandeepSapreA term plan is the best form of insurance because it gives a very high cover at a low price. The premium of a term plan is a fraction of what you have to shell out when you buy an endowment plan, a money-back policy or a ULIP with the same coverage. Of course, this is also because there is no investment component in a term plan. The entire premium goes in covering the risk.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

COMPARE-LIC TERM PLAN HAS NO OPTION

(By Sandeep Sapre)

A term plan is the best form of insurance because it gives a very high cover at a low price.

The premium of a term plan is a fraction of what you have to shell out when you buy an

endowment plan, a money-back policy or a ULIP with the same coverage. Of course, this is

also because there is no investment component in a term plan. The entire premium goes in

covering the risk.

However many companies and investment consultants advise you to compare and buy a

term plan. Most of them consider two criteria for selection of plan:

1. Which company has excellent Claim Settlement Ratio

2 .Which company has more features and cheap premiums.

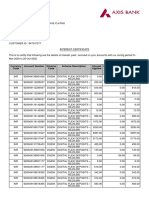

Table 1. Claim Settlement Ratio of All Life Insurers

In the first criteria LIC comes 1

st

with 98 % Claim Settlement Ratio ,whereas LICs premiums

are costly. Here we are not discussing e-plans. A separate article will be posted on e- plans.

Our present focus is on the plans that are bought from individual agents. With this in

mind it is important to look as to whether the two criteria mentioned above are sufficient

to buy a plan. It is very important to see which company gives better after sales service.

The first person that is often contacted by or is expected to have liaison with the insured is

the advisor who sold the policy. In many private insurance companies it is often found that

the person who sold the policy may no longer be working with that company in the next

year. More often than not his agency gets terminated for not fulfilling the criteria of

minimum no. of lives (12 ) to be insured in his agency year. Table no. 2 shows the company

wise average no. of policies an individual agent sold during the year in the past 3 years

Table 2

AVERAGE NO. OF LIFE POLICIES SOLD BY INDIVIDUAL AGENTS

SR.NO. INSURER 2010-11 2011-12 2012-13

1 AEGON RELIGARE 4 4 3

2 AVIVA 3 3 3

3 BAJAJ ALLIANZ 4 3 3

4 BHARTI AXA 4 4 3

5 BIRLA SUNLIFE 3 3 3

6 CANARA HSCBC NA NA NA

7 DLF PRAMERICA 5 5 4

8 EDWLWEISS TOKIO NA 12 8

9 FUTURE GENERALLY 2 2 1

10 HDFC STANDARD 3 3 4

11 ICICI PRIDENTIAL 3 2 2

12 IDBI FEDERAL 4 3 3

13 INDIA FIRST 4 5 7

14 ING LIFE 4 6 5

15 KOTAK MAHINDRA 3 3 2

16 MAX LIFE 7 6 6

17 PNB METLIFE 3 3 3

18 RELIANCE 4 4 3

19 SAHARA 5 5 5

20 SBI LIFE 8 6 6

21 SHRIRAM LIFE 3 5 5

22 STAR UNION DAI-ICHI 3 12 5

23 TATA AIA 3 2 3

PRIVATE AVERAGE 4 3 3

24 LIC 26 27 29

INDUSTRY AVERAGE 15 16 18

SERVICE BY AGENTS

Table No.2 shows that there must be a few individual agents of private insurance companies

doing very good performance in selling the plans but large number of agents sell just 3 to 5

policies, and their agency gets terminated next year. Most of these companies get large part

of their business from Corporate Agents. The Sales Managers who appoint the individual

agents are often under pressure of performance and are always on the lookout of getting a

better job in the same field on higher post and package. As soon as they get this opportunity

they leave their present jobs making the agents orphans. Normally this does not happen

with advisors of LIC.

LIC advisor keeps record of his customers and renders all possible services to them from

reminding about renewal, change of mode, change of address, and claims etc. at his

doorstep. LIC advisors should take maximum advantage of this. They should keep a copy of

Table No.2 with them to emphasize possible hardship if their potential customer is thinking

of buying a policy from private insurer.

LIC AGENTS SHOULD NOT AVOID SELLING TERM INSURANCE

It is observed that LIC agents avoid selling term insurance under the pretext that once

they sell it, they will not have scope to sell him another non term plan in future.

Remember if you avoid selling it, you might lose him permanently. The private insurers

and so called investment consultants are making huge propaganda of compare and buy.

There is all possibility that before you reach the customer he is already insured adequately

by some other insurer. It is always better to combine an endowment type plan with a

term plan so that your customer will also get sizable amount on maturity. Some private

companies have also features like Critical Illness Rider, Premium Waiver Benefit Rider and

Accident Rider etc.. LIC has Plain Vanilla Plan without such tooty fruity. Advisors should be

able to show their customers how much tasty the real stuff is under the tooty fruity.

( Sandeep Sapre)

Like us on : https://www.facebook.com/ssiacademy?ref=hl

Vous aimerez peut-être aussi

- How To Secure A Bank Account From Levy 1Document5 pagesHow To Secure A Bank Account From Levy 1api-374440897% (124)

- Infinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1D'EverandInfinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1Évaluation : 2.5 sur 5 étoiles2.5/5 (2)

- Chapter 1 Partnership Formation Test BanksDocument46 pagesChapter 1 Partnership Formation Test BanksRaisa Gelera91% (23)

- Loan FormatDocument2 pagesLoan Formatashly scott90% (112)

- AIG Global Funds ProspectusDocument257 pagesAIG Global Funds ProspectusserebryakovPas encore d'évaluation

- Can You Invest On Your Own?: Keep Asking QuestionsDocument1 pageCan You Invest On Your Own?: Keep Asking QuestionsShrinivasPas encore d'évaluation

- Chapter 1 Page NoDocument70 pagesChapter 1 Page NoKaran PandeyPas encore d'évaluation

- Mutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1D'EverandMutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1Évaluation : 4 sur 5 étoiles4/5 (2)

- Entrepreneurial Finance - Luisa AlemanyDocument648 pagesEntrepreneurial Finance - Luisa Alemanytea.liuyudanPas encore d'évaluation

- Automatic PaymentsDocument12 pagesAutomatic PaymentsfinerpmanyamPas encore d'évaluation

- BRD 1133Document4 pagesBRD 1133Syed AbdulPas encore d'évaluation

- Project Report On Field Study in Insurance SectorDocument86 pagesProject Report On Field Study in Insurance Sectorsunny_choudhary@hotmail.com100% (1)

- Development Bank of The Philippines v. The Hon. Secretary of Labor, Cresencia Difontorum, Et AlDocument2 pagesDevelopment Bank of The Philippines v. The Hon. Secretary of Labor, Cresencia Difontorum, Et AlKriselPas encore d'évaluation

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelPas encore d'évaluation

- ICICI Lombard Project ReportDocument91 pagesICICI Lombard Project ReportMahesh Parab75% (4)

- Customer Satisfactionat Kotak MahindraDocument56 pagesCustomer Satisfactionat Kotak MahindraRaj KumarPas encore d'évaluation

- Life Insurance - Why You Should Worry About Policies That DieDocument3 pagesLife Insurance - Why You Should Worry About Policies That DiePankaj KhindriaPas encore d'évaluation

- Icici PrudentialDocument20 pagesIcici PrudentialdevurenemyPas encore d'évaluation

- Capital Letter July 2011Document5 pagesCapital Letter July 2011marketingPas encore d'évaluation

- Market Survey of Reliance Life InsuranceDocument27 pagesMarket Survey of Reliance Life InsuranceMaulikk PatelPas encore d'évaluation

- Insurance As An Wealth Builder Option Repect To HDFC LifeDocument62 pagesInsurance As An Wealth Builder Option Repect To HDFC LifeJoel MariyarajPas encore d'évaluation

- A Project Report On Risk Analysis and Risk Management in Investing Ininsurance PolicesDocument44 pagesA Project Report On Risk Analysis and Risk Management in Investing Ininsurance PolicesTanmay ZendePas encore d'évaluation

- Online Term PlanDocument9 pagesOnline Term PlanPradeep PatilPas encore d'évaluation

- Analysing The Consumer Behaviour in Relation To Insurance ProductsDocument7 pagesAnalysing The Consumer Behaviour in Relation To Insurance ProductsAVINASH TOPNOPas encore d'évaluation

- ICICI Lombard Project ReportDocument92 pagesICICI Lombard Project ReportShweta SawantPas encore d'évaluation

- Chapter 1Document25 pagesChapter 1Momentum PressPas encore d'évaluation

- Online Term Plans (ML-30!06!2011)Document8 pagesOnline Term Plans (ML-30!06!2011)Amit UpalekarPas encore d'évaluation

- New Microsoft Office Word DocumentDocument88 pagesNew Microsoft Office Word DocumentNaveen KandukuriPas encore d'évaluation

- Evaluate Your Life Insurance Needs: P V Subramanyam, Financial TrainerDocument5 pagesEvaluate Your Life Insurance Needs: P V Subramanyam, Financial TrainerAjit AgnihotriPas encore d'évaluation

- Literature Review of HDFC Standard Life InsuranceDocument4 pagesLiterature Review of HDFC Standard Life InsurancewoeatlrifPas encore d'évaluation

- Bba Project ADocument19 pagesBba Project Asarvesh.bharti0% (1)

- Doon Business SchoolDocument44 pagesDoon Business SchoolHimanshuPas encore d'évaluation

- Risk Management and Analysis of Insurance CompaniesDocument40 pagesRisk Management and Analysis of Insurance CompaniesMohit Bihani100% (1)

- Project ReportDocument37 pagesProject ReportAshu SharmaPas encore d'évaluation

- IDM EditedDocument22 pagesIDM EditedVaishnaviPas encore d'évaluation

- Hybrid Distribution Model: Department of Business Administration Chaudhary Devi Lal University, Sirsa (Session: 2015-2016)Document48 pagesHybrid Distribution Model: Department of Business Administration Chaudhary Devi Lal University, Sirsa (Session: 2015-2016)ninnyakgPas encore d'évaluation

- Summer PROJECT Report: Bajaj AllianzDocument54 pagesSummer PROJECT Report: Bajaj AllianzChirag Mittal50% (2)

- Reliance Life InsuranceDocument71 pagesReliance Life Insurancemanav_3Pas encore d'évaluation

- Lic Final ReportDocument109 pagesLic Final ReportAbhisek BanerjeePas encore d'évaluation

- Project BJDocument69 pagesProject BJgaurav_boy001Pas encore d'évaluation

- Part - C Findings AND Suggestio NSDocument18 pagesPart - C Findings AND Suggestio NSFrancisco TylerPas encore d'évaluation

- Icici ProjectDocument70 pagesIcici ProjectKundan Kumar YadavPas encore d'évaluation

- A Survey Report On Consumer Buying Behaviour: Submitted To, MR - Bhavik Shah (Vnsgu)Document28 pagesA Survey Report On Consumer Buying Behaviour: Submitted To, MR - Bhavik Shah (Vnsgu)Dipak BagsariyaPas encore d'évaluation

- Dissertation On Life InsuranceDocument6 pagesDissertation On Life InsuranceHelpWithYourPaperLittleRock100% (1)

- Summer Training Report: Distribution Enhancement and Study of Product of HDFC Standard Life Insurance CompanyDocument82 pagesSummer Training Report: Distribution Enhancement and Study of Product of HDFC Standard Life Insurance CompanyVaibhav JainPas encore d'évaluation

- Sl. No TopicDocument12 pagesSl. No TopicnarpalchauhanPas encore d'évaluation

- Life Insurance 28 SepDocument11 pagesLife Insurance 28 Sepvivek10491Pas encore d'évaluation

- Saad AnsariDocument57 pagesSaad Ansarisaad ansariPas encore d'évaluation

- Role of Lic in Insurance IndustryDocument83 pagesRole of Lic in Insurance IndustryManisha HarchandaniPas encore d'évaluation

- Marketing of Life Ins Policies in IndiaDocument30 pagesMarketing of Life Ins Policies in IndiarajPas encore d'évaluation

- Lic IiDocument18 pagesLic IiB.Com (BI) CommercePas encore d'évaluation

- Kiran Chavda-Project ReportDocument106 pagesKiran Chavda-Project ReportAshish ThakurPas encore d'évaluation

- A Summer Training Report ON: "Designing A Strategy For Servicing Customers"Document66 pagesA Summer Training Report ON: "Designing A Strategy For Servicing Customers"Shubham BhattPas encore d'évaluation

- Ulip PolicyDocument92 pagesUlip Policybhajayram786Pas encore d'évaluation

- Sales and Distribution Management: Group Assignment-IDocument10 pagesSales and Distribution Management: Group Assignment-IAkash LohiPas encore d'évaluation

- IRDAI Memorandum Jeevan Saral Final DraftDocument4 pagesIRDAI Memorandum Jeevan Saral Final DraftMoneylife FoundationPas encore d'évaluation

- Summer Training HDFC Project ReportDocument88 pagesSummer Training HDFC Project ReportRohit UpadhyayPas encore d'évaluation

- A Project Report On Risk Analysis and RiDocument42 pagesA Project Report On Risk Analysis and RiJyoti ShuklaPas encore d'évaluation

- Grand Project: "Product Stratagy of Private Life Insurance Company''Document81 pagesGrand Project: "Product Stratagy of Private Life Insurance Company''PrInce SarthakPas encore d'évaluation

- Hybrid Distribution Model: Department of Business Administration Chaudhary Devi Lal University, Sirsa (Session: 2015-2016)Document48 pagesHybrid Distribution Model: Department of Business Administration Chaudhary Devi Lal University, Sirsa (Session: 2015-2016)YogendraPas encore d'évaluation

- Literature Review: D. Ramkumar (2003)Document7 pagesLiterature Review: D. Ramkumar (2003)ManthanPas encore d'évaluation

- Insurance Perspective in NepalDocument7 pagesInsurance Perspective in Nepaleshu agPas encore d'évaluation

- How To Choose The Best Health Insurance CompanyDocument5 pagesHow To Choose The Best Health Insurance CompanyPriyank GuptaPas encore d'évaluation

- Bajaj Allianz Live ProjectDocument23 pagesBajaj Allianz Live ProjectSameer YadavPas encore d'évaluation

- Literature Review On HDFC Life InsuranceDocument8 pagesLiterature Review On HDFC Life Insurancec5rr5sqw100% (1)

- 20 Zijbemr March12 Vol2 Issue3Document26 pages20 Zijbemr March12 Vol2 Issue3Jag JeetPas encore d'évaluation

- Comparison Between Traditional Plan ULIPs PROJECT REPORTDocument71 pagesComparison Between Traditional Plan ULIPs PROJECT REPORTSunil SoniPas encore d'évaluation

- Comparative Study of Services Provided by LIC ICICI Prudential Life InsuranceDocument94 pagesComparative Study of Services Provided by LIC ICICI Prudential Life InsuranceSimran SomaiyaPas encore d'évaluation

- Term Policy + SIP: Is It Practicable?Document3 pagesTerm Policy + SIP: Is It Practicable?SandeepSaprePas encore d'évaluation

- Raising FDI Limit To 49% in Insurance SectorDocument3 pagesRaising FDI Limit To 49% in Insurance SectorSandeepSaprePas encore d'évaluation

- Don't Be Lured by Low Premium, Check Co's Sttlement Record TooDocument1 pageDon't Be Lured by Low Premium, Check Co's Sttlement Record TooSandeepSaprePas encore d'évaluation

- LIC's All Plans at A GlanceDocument2 pagesLIC's All Plans at A GlanceSandeepSapre33% (3)

- Unit-5 Receivables ManagementDocument26 pagesUnit-5 Receivables ManagementSarthak MattaPas encore d'évaluation

- Ministry of Revenues: Tax Audit ManualDocument304 pagesMinistry of Revenues: Tax Audit ManualYoPas encore d'évaluation

- Management Robbins C10 SlidesDocument45 pagesManagement Robbins C10 SlidesLe Bao Han HuynhPas encore d'évaluation

- SLCM Most Important Topics 2022Document6 pagesSLCM Most Important Topics 2022Amit SinghPas encore d'évaluation

- Power of AttorneyDocument3 pagesPower of Attorneyjames brownPas encore d'évaluation

- Stanford Federal Credit Union - Start A BusinessDocument15 pagesStanford Federal Credit Union - Start A BusinessBayCreativePas encore d'évaluation

- Eng. Book PDFDocument93 pagesEng. Book PDFSelvaraj VillyPas encore d'évaluation

- 13-Fair Value MeasurementDocument46 pages13-Fair Value MeasurementChelsea Anne VidalloPas encore d'évaluation

- UntitledDocument267 pagesUntitledGaurav KothariPas encore d'évaluation

- Pension - RR 01-83 Amend - 211118 - 115738Document4 pagesPension - RR 01-83 Amend - 211118 - 115738HADTUGIPas encore d'évaluation

- Fresh Start', A Big Challenge Facing The Microfinance IndustryDocument4 pagesFresh Start', A Big Challenge Facing The Microfinance IndustryVinod ChanrasekharanPas encore d'évaluation

- Interest CertificateDocument2 pagesInterest CertificatesumitPas encore d'évaluation

- Application GuideDocument130 pagesApplication GuideValentin DobchevPas encore d'évaluation

- Explanatory Notes For The Completion of Vat Return FormDocument3 pagesExplanatory Notes For The Completion of Vat Return FormTendai ZamangwePas encore d'évaluation

- Workshop 2 AccountingDocument6 pagesWorkshop 2 AccountingJulieth CaviativaPas encore d'évaluation

- B40 Confirmation FormDocument3 pagesB40 Confirmation FormJoanne Renu AlexanderPas encore d'évaluation

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- Taizya RevisionDocument2 pagesTaizya Revisiongostavis chilamoPas encore d'évaluation

- SEC 204 Status ReportDocument17 pagesSEC 204 Status Reportthe kingfishPas encore d'évaluation

- Chapter 02Document11 pagesChapter 02Saad mubeenPas encore d'évaluation

- Time Value of MoneyDocument22 pagesTime Value of Moneyshubham abrolPas encore d'évaluation