Académique Documents

Professionnel Documents

Culture Documents

Asgard Personal Protection PDS

Transféré par

Life Insurance AustraliaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Asgard Personal Protection PDS

Transféré par

Life Insurance AustraliaDroits d'auteur :

Formats disponibles

Asgard Personal Protection package SPDS | 1

Asgard

Personal

Protection

Package

Supplementary Product

Disclosure Statement (SPDS)

This SPDS is dated 1 February

2009 and relates to the Product

Disclosure Statement (PDS) dated

18 February 2008 for the Asgard

Personal Protection Package.

This SPDS is issued by Asgard

Capital Management Ltd ABN

92 009 279 592, AFSL 240695

and should be read together with

the PDS and a previous SPDS

dated 15 September 2008.

From 1 February 2009, your fnancial

adviser should provide you with the

PDS dated 18 February 2008, the

SPDS dated 15 September 2008 and

this SPDS. If you do not receive all of

these documents, please contact your

fnancial adviser. You should read

these documents before you make

a decision in relation to the Asgard

Personal Protection Package.

This SPDS has been issued to

outline changes resulting from the

appointment of American International

Assurance Company (Australia)

Limited (trading as AIG Life) ABN

79 004 837 861 AFSL 230043 of 549

St Kilda Road, Melbourne, Victoria

3004, as the provider of the insurance

referred to in the PDS.

AIG Life has consented to the inclusion

in this SPDS of references to them and

statements attributed to them and this

consent has not been withdrawn before

the date of this SPDS.

PDS inside front cover fourth point

under the heading In this PDS.

This section is deleted.

References to the Insurer and

TOWER throughout the PDS.

Throughout the PDS all references to

the Insurer and TOWER must be

read as references to AIG Life.

PDS page 6 About TOWER the Insurer

This section is replaced with the

following text.

About AIG Life the Insurer

The Insurer is American International

Assurance Company (Australia)

Limited trading as AIG Life

ABN 79 004 837 861 AFSL 230043.

AIG Life is an ultimate subsidiary of

American International Group, Inc.

(AIG) and has been providing risk

insurance to Australians since 1970.

AIG Life provides comprehensive,

fexible life cover options that aim

to protect the fnancial health and

welfare of Australians. AIG Life

combines its extensive international

experience with local expertise to offer

some of the countrys most innovative

life cover options. The AIG Life

products and services are constantly

under review to ensure they meet

the changing needs of the Australian

population.

AIG Life offers risk protection life

insurance products to help you

protect the things that matter most to

you your family, your health, your

mortgage or your business.

All insurance benefts are provided

by the Insurer and not the Trustee or

Administrator.

2 | Asgard Personal Protection package SPDS

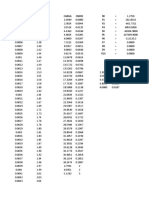

PDS page 9 Life Protection premium rates

The premium rate table on page 9 is replaced with the

following table.

Annual rates per $1,000 sum insured rates include maximum

adviser commission, Asgard management fee and stamp duty.

Life Protection only

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

16 0.96 1.85 0.43 0.89

17 0.96 1.85 0.46 0.89

18 0.96 1.85 0.46 0.89

19 0.96 1.85 0.46 0.89

20 0.96 1.85 0.46 0.89

21 0.91 1.75 0.41 0.85

22 0.85 1.63 0.38 0.80

23 0.80 1.54 0.35 0.77

24 0.75 1.42 0.32 0.76

25 0.68 1.31 0.32 0.76

26 0.66 1.26 0.31 0.76

27 0.64 1.22 0.32 0.76

28 0.61 1.18 0.32 0.76

29 0.59 1.13 0.31 0.76

30 0.56 1.08 0.31 0.76

31 0.56 1.08 0.31 0.76

32 0.56 1.09 0.32 0.81

33 0.57 1.11 0.32 0.83

34 0.55 1.11 0.33 0.87

35 0.55 1.12 0.33 0.88

36 0.57 1.15 0.37 0.94

37 0.59 1.24 0.41 0.97

38 0.62 1.32 0.46 1.02

39 0.67 1.44 0.50 1.06

40 0.69 1.54 0.56 1.13

41 0.76 1.67 0.59 1.20

42 0.82 1.84 0.65 1.27

43 0.90 2.02 0.70 1.37

44 0.99 2.21 0.77 1.49

45 1.09 2.43 0.85 1.63

46 1.21 2.69 0.95 1.81

47 1.33 2.97 1.07 2.01

48 1.49 3.32 1.17 2.21

49 1.66 3.70 1.28 2.46

50 1.86 4.14 1.40 2.75

51 2.08 4.64 1.56 3.00

52 2.34 5.22 1.69 3.35

53 2.65 5.90 1.88 3.72

54 2.96 6.75 2.03 4.13

55 3.45 7.86 2.19 4.59

56 3.88 9.05 2.36 5.10

57 4.40 10.27 2.62 5.65

Life Protection only

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

58 4.94 11.52 2.91 6.27

59 5.49 12.81 3.21 6.95

60 6.08 14.18 3.56 7.70

61 6.79 15.83 3.95 8.54

62 7.65 17.84 4.39 9.48

63 8.67 20.22 4.89 10.55

64 9.86 23.01 5.44 11.74

65 11.21 26.16 6.04 13.04

66* 12.83 29.94 6.91 14.93

67* 14.60 34.07 7.87 16.98

68* 16.54 38.61 8.91 19.23

69* 18.69 43.61 10.07 21.74

70** 20.96 42.71 11.36 23.33

71** 26.34 50.94 12.99 24.93

72** 30.61 55.10 14.91 27.02

73** 35.47 59.46 17.14 30.47

74** 40.96 65.46 19.67 34.00

75** 47.12 70.21 22.64 37.51

76** 53.24 75.32 26.09 41.27

77** 59.09 78.98 29.88 45.61

78** 65.48 84.46 33.90 50.65

79** 72.44 92.00 38.60 56.43

80** 80.07 100.09 43.97 62.86

81** 89.39 109.94 50.47 70.57

82** 99.81 120.75 57.76 78.90

83** 111.49 132.67 65.84 87.83

84** 124.55 145.72 74.98 97.62

85** 139.12 159.98 85.33 106.66

86** 155.22 175.40 96.26 120.32

87** 172.90 191.92 108.30 135.38

88** 192.24 209.54 121.66 152.08

89** 213.38 228.31 136.51 170.63

90** 236.41 248.23 152.98 191.22

91** 261.27 271.72 171.24 214.07

92** 288.36 297.02 191.57 239.45

93** 317.93 324.30 214.18 267.73

94** 350.19 353.69 239.35 299.19

95** 385.27 385.27 267.31 334.14

96** 422.89 422.89 298.33 372.91

97** 463.58 463.58 332.66 415.82

98** 507.40 507.40 370.58 463.22

99** 554.46 554.46 412.37 515.46

Maximum entry age is 65 next birthday

* Superannuation cover expires at age 70

** Non-superannuation cover expires at age 99

Asgard Personal Protection package SPDS | 3

PDS page 11 Total & Permanent Disablement

(TPD) rates TPD Protection

The premium rate table on page 11 is replaced with the

following table.

Annual rates per $1,000 sum insured rates include maximum

adviser commission, Asgard management fee and stamp duty.

TPD Protection

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

16 0.50 0.68 0.62 1.10

17 0.50 0.68 0.59 1.10

18 0.50 0.68 0.59 1.10

19 0.50 0.68 0.59 1.10

20 0.50 0.68 0.59 1.10

21 0.45 0.64 0.53 0.91

22 0.41 0.59 0.48 0.78

23 0.40 0.54 0.43 0.71

24 0.35 0.49 0.45 0.69

25 0.32 0.44 0.43 0.68

26 0.32 0.44 0.44 0.62

27 0.30 0.44 0.42 0.60

28 0.32 0.45 0.41 0.55

29 0.32 0.46 0.41 0.53

30 0.34 0.48 0.41 0.53

31 0.34 0.48 0.42 0.55

32 0.35 0.49 0.43 0.57

33 0.34 0.50 0.43 0.59

34 0.38 0.52 0.44 0.58

35 0.39 0.54 0.45 0.58

36 0.41 0.56 0.44 0.58

37 0.41 0.61 0.44 0.60

38 0.43 0.70 0.44 0.62

39 0.44 0.71 0.44 0.67

40 0.49 0.75 0.47 0.77

41 0.50 0.84 0.54 0.94

42 0.57 0.92 0.61 1.11

43 0.63 1.00 0.73 1.31

44 0.71 1.13 0.85 1.53

45 0.81 1.31 0.76 1.48

46 0.93 1.50 0.66 1.40

47 1.07 1.75 0.57 1.38

48 1.20 1.97 0.51 1.17

49 1.36 2.21 0.49 1.19

50 1.52 2.48 1.12 2.15

51 1.73 2.81 1.80 3.48

52 1.90 3.18 2.57 5.36

53 2.18 3.65 3.36 7.20

54 2.68 4.28 3.50 7.71

55 3.13 5.12 4.24 9.16

56 3.72 6.26 5.72 10.93

57 4.46 7.52 6.83 13.10

58 5.22 8.65 8.24 15.78

59 6.15 10.22 9.96 19.07

60 6.60 11.78 11.47 21.95

TPD Protection

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

61* 7.77 13.94 13.56 25.95

62* 8.08 14.45 14.08 26.95

63* 6.74 11.75 11.57 22.17

64* 3.83 6.09 6.21 12.00

*TPD renewal only, as maximum entry age is 60 next birthday.

For the Own Occupation defnition, multiply the TPD premium rate by 1.5

(available to specifc occupations including professionals, executives and

senior management).

PDS page 12 Total & Permanent Disablement

(TPD) rates TPD Only

The premium rate table on page 12 is replaced with the

following table.

Annual rates per $1,000 sum insured rates include maximum

adviser commission, Asgard management fee and stamp duty.

TPD Only

Age next

birthday

Male

non- smoker

Male

smoker

Female

non-smoker

Female

smoker

16 0.59 0.83 0.75 1.32

17 0.59 0.83 0.70 1.32

18 0.59 0.83 0.70 1.32

19 0.59 0.83 0.70 1.32

20 0.59 0.83 0.70 1.32

21 0.55 0.77 0.65 1.10

22 0.50 0.70 0.58 0.94

23 0.48 0.65 0.52 0.86

24 0.42 0.58 0.53 0.83

25 0.40 0.53 0.52 0.81

26 0.37 0.52 0.52 0.75

27 0.37 0.53 0.50 0.73

28 0.38 0.55 0.50 0.66

29 0.40 0.55 0.50 0.65

30 0.41 0.58 0.50 0.65

31 0.41 0.58 0.50 0.66

32 0.42 0.58 0.50 0.68

33 0.42 0.59 0.52 0.72

34 0.45 0.63 0.53 0.68

35 0.46 0.65 0.53 0.68

36 0.48 0.68 0.53 0.70

37 0.50 0.73 0.52 0.73

38 0.52 0.85 0.52 0.76

39 0.53 0.86 0.53 0.80

40 0.58 0.90 0.56 0.94

41 0.60 1.00 0.65 1.13

42 0.68 1.10 0.75 1.32

43 0.76 1.21 0.88 1.58

44 0.85 1.36 1.01 1.84

45 0.97 1.58 0.90 1.76

4 | Asgard Personal Protection package SPDS

TPD Only

Age next

birthday

Male

non- smoker

Male

smoker

Female

non-smoker

Female

smoker

46 1.11 1.81 0.80 1.68

47 1.28 2.09 0.68 1.66

48 1.45 2.38 0.62 1.40

49 1.63 2.66 0.59 1.43

50 1.83 2.98 1.35 2.58

51 2.06 3.37 2.16 4.19

52 2.28 3.81 3.08 6.44

53 2.63 4.38 4.03 8.63

54 3.21 5.14 4.21 9.26

55 3.76 6.17 5.09 10.99

56 4.46 7.51 6.85 13.11

57 5.35 9.03 8.20 15.72

58 6.27 10.37 9.89 18.94

59 7.37 12.27 11.96 22.89

60 7.92 14.15 13.75 26.34

61* 9.32 16.73 16.28 31.13

62* 9.70 17.33 16.90 32.32

63* 8.10 14.09 13.88 26.60

64* 4.61 7.31 7.45 14.40

*TPD renewal only, as maximum entry age is 60 next birthday.

For the Own Occupation defnition, multiply the TPD premium rate by 1.5

(available to specifc occupations including professionals, executives and senior

management).

PDS page 15 Trauma Protection rates (includes

Life Protection cover)

The premium rate table on page 15 is replaced with the

following table.

Annual rate per $1,000 sum insured rates include maximum

adviser commission, Asgard management fee and stamp duty.

Trauma Protection

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

18 1.66 2.69 1.16 1.81

19 1.66 2.69 1.16 1.81

20 1.66 2.69 1.16 1.81

21 1.60 2.64 1.17 1.81

22 1.56 2.57 1.17 1.81

23 1.53 2.55 1.20 1.82

24 1.49 2.52 1.22 1.84

25 1.46 2.48 1.25 1.86

26 1.46 2.51 1.28 1.93

27 1.46 2.56 1.29 1.98

28 1.47 2.61 1.31 2.03

29 1.48 2.67 1.32 2.08

30 1.49 2.74 1.34 2.13

31 1.50 2.82 1.37 2.21

32 1.53 2.95 1.42 2.30

Trauma Protection

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

33 1.57 3.14 1.49 2.48

34 1.61 3.39 1.58 2.68

35 1.67 3.69 1.68 2.92

36 1.81 4.04 1.79 3.24

37 1.96 4.45 1.91 3.61

38 2.15 4.88 2.03 4.01

39 2.38 5.34 2.15 4.44

40 2.63 5.85 2.29 4.86

41 2.97 6.56 2.47 5.28

42 3.32 7.35 2.71 5.72

43 3.73 8.35 3.02 6.33

44 4.20 9.54 3.41 6.97

45 4.68 10.87 3.82 7.62

46 5.28 12.26 4.23 8.37

47 5.90 13.72 4.65 9.14

48 6.53 15.26 5.09 9.99

49 7.11 16.88 5.53 10.86

50 7.97 18.62 5.99 11.67

51 9.00 20.52 6.50 12.62

52 10.11 22.61 7.04 13.57

53 11.29 24.98 7.64 14.67

54 12.75 27.71 8.30 15.79

55 14.33 30.90 9.03 16.88

56 15.99 33.60 9.76 18.29

57 17.66 36.41 10.59 19.59

58 19.33 39.39 11.54 21.56

59 21.10 42.60 12.64 23.58

60 22.89 46.05 13.91 25.61

61* 24.76 49.81 15.28 27.67

62* 26.71 53.92 16.73 29.69

63* 28.69 58.46 18.28 31.72

64* 30.67 63.48 19.92 33.56

65* 22.46 44.79 16.38 25.79

66* 25.95 48.43 22.11 34.81

67* 28.76 52.60 29.85 46.99

68* 32.15 57.67 40.30 63.44

69* 36.07 63.44 54.41 85.64

* Renewal only.

Asgard Personal Protection package SPDS | 5

PDS page 18 Critical Trauma Protection rates

(includes Life Protection cover)

The premium rate table on page 18 is replaced with the

following table.

Annual rate per $1,000 sum insured rates include maximum

adviser commission, Asgard management fee and stamp duty.

Critical Trauma Protection

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

18 2.37 3.29 1.75 1.90

19 2.37 3.29 1.75 1.90

20 2.38 3.29 1.75 1.90

21 2.37 3.24 1.74 1.89

22 2.31 3.19 1.71 1.87

23 2.22 3.09 1.66 1.85

24 2.11 2.99 1.57 1.82

25 2.01 2.87 1.48 1.80

26 1.91 2.83 1.49 1.81

27 1.85 2.79 1.49 1.85

28 1.81 2.77 1.51 1.91

29 1.82 2.78 1.55 1.98

30 1.82 2.81 1.60 2.07

31 1.82 2.85 1.65 2.21

32 1.82 2.98 1.73 2.36

33 1.82 3.15 1.79 2.57

34 1.84 3.38 1.90 2.78

35 1.94 3.84 2.02 3.01

36 2.06 4.10 2.11 3.27

37 2.20 4.48 2.24 3.59

38 2.35 4.88 2.42 3.99

39 2.53 5.36 2.52 4.31

40 2.72 5.86 2.66 4.67

41 2.97 6.53 2.93 5.14

42 3.24 7.25 3.11 5.53

43 3.54 8.02 3.25 5.80

44 3.86 8.86 3.31 5.95

45 4.24 9.79 3.36 6.07

46 4.66 10.81 3.48 6.34

47 5.15 11.85 3.70 6.69

48 5.69 13.06 4.00 7.21

49 6.30 14.36 4.30 7.74

50 6.98 15.96 4.73 8.50

51 7.76 17.30 5.24 9.35

52 8.63 18.86 5.74 10.21

53 9.60 20.63 6.04 10.66

54 10.70 22.46 6.58 11.54

55 11.92 24.43 7.15 12.44

56 13.21 26.31 7.98 13.77

57 14.61 28.24 8.90 15.13

58 16.14 30.27 9.74 16.32

59 17.79 32.55 10.61 17.52

Critical Trauma Protection

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

60 20.20 36.21 11.81 19.22

61* 22.45 39.29 12.91 20.61

62* 24.88 42.96 14.12 22.16

63* 27.55 46.92 15.69 24.12

64* 30.54 51.23 17.45 26.28

65* 33.86 55.88 19.51 28.74

66* 37.04 59.88 21.65 31.19

67* 40.55 64.04 24.08 33.97

68* 44.29 68.27 26.96 37.27

69* 48.21 72.62 30.29 40.99

*Renewal only.

PDS page 24 Salary Continuance rates two year

beneft period

30 day waiting period

The premium rates table on page 24 is replaced with the

following table.

Annual rate per $100 monthly beneft rates include

maximum adviser commission, Asgard management fee

and stamp duty.

Salary Continuance

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

16 6.94 8.66 11.60 12.08

17 6.94 8.66 11.60 12.08

18 6.94 8.66 11.60 12.08

19 6.94 8.66 11.60 12.08

20 6.94 8.66 11.60 12.08

21 6.94 8.66 11.60 12.08

22 6.94 8.66 11.60 12.08

23 7.28 9.10 11.69 12.61

24 7.53 9.41 11.69 13.04

25 7.88 9.85 11.69 13.48

26 7.90 9.88 11.64 13.86

27 7.83 9.79 11.60 14.24

28 7.87 9.83 11.54 14.60

29 7.88 9.85 11.50 14.97

30 7.90 9.88 11.45 15.34

31 8.00 10.00 11.48 15.79

32 8.44 10.55 11.93 16.28

33 8.53 11.00 12.46 16.43

34 8.72 11.25 12.59 16.61

35 8.91 11.48 12.74 16.82

36 9.11 11.75 13.20 17.41

37 9.31 12.00 13.60 17.95

38 9.60 12.37 13.99 18.47

39 9.87 12.73 14.42 19.01

40 10.28 13.24 14.83 19.55

41 10.66 13.73 15.55 20.51

42 11.12 14.35 16.36 21.59

43 11.72 15.10 17.69 22.58

44 12.28 15.82 18.53 23.66

45 12.95 16.70 20.03 24.76

6 | Asgard Personal Protection package SPDS

Salary Continuance

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

46 13.72 17.68 21.50 26.60

47 14.67 18.92 23.75 28.49

48 15.62 20.15 25.47 30.56

49 16.79 21.00 28.07 32.68

50 18.14 22.67 30.17 35.12

51 19.76 24.69 32.85 38.22

52 21.59 26.99 36.77 41.58

53 23.66 29.58 40.20 45.46

54 25.96 32.45 44.22 50.01

55 28.60 35.75 48.80 53.72

56* 31.31 39.13 52.49 56.24

57* 34.31 42.89 56.79 60.84

58* 37.62 47.04 62.03 66.47

59* 41.33 51.67 68.11 72.97

60* 45.55 56.93 75.39 80.78

61* 50.17 62.71 83.99 89.99

62* 55.29 69.11 94.25 100.98

63* 49.97 62.47 87.32 93.56

64* 28.40 35.49 52.61 56.36

*Renewal only

PDS page 25 Salary Continuance rates two year

beneft period

60 day waiting period

The premium rate table on page 25 is replaced with the

following table.

Annual rate per $100 monthly beneft rates include

maximum adviser commission, Asgard management fee

and stamp duty.

Salary Continuance

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

16 6.59 7.79 10.44 10.88

17 6.59 7.79 10.44 10.88

18 6.59 7.79 10.44 10.88

19 6.59 7.79 10.44 10.88

20 6.59 7.79 10.44 10.88

21 6.59 7.79 10.44 10.88

22 6.59 7.79 10.44 10.88

23 6.67 7.91 10.51 10.95

24 6.67 7.91 10.51 10.95

25 6.76 8.01 10.51 10.95

26 6.78 8.02 10.47 10.91

27 6.72 7.96 10.44 10.88

28 6.74 7.98 10.38 10.81

29 6.76 8.01 10.35 10.78

30 6.78 8.02 10.59 11.03

31 6.87 8.13 10.91 11.05

32 7.01 8.55 10.66 11.10

33 7.08 8.87 11.05 11.49

34 7.25 9.07 11.15 11.63

35 7.40 9.27 11.31 11.78

36 7.58 9.47 11.71 12.19

37 7.73 9.68 12.05 12.56

38 7.98 9.98 12.40 12.92

Salary Continuance

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

39 8.20 10.25 12.78 13.31

40 8.54 10.67 13.13 13.32

41 8.86 11.07 13.79 13.98

42 9.26 11.56 14.51 14.72

43 9.74 12.18 15.18 15.80

44 10.20 12.74 15.89 16.55

45 10.76 13.46 16.64 17.33

46 11.40 14.26 17.88 18.61

47 12.20 15.26 19.15 19.94

48 12.99 16.25 20.54 21.39

49 13.96 17.45 21.95 22.88

50 15.07 18.86 23.60 24.59

51 16.41 20.52 25.69 26.75

52 17.95 22.45 27.95 29.11

53 19.67 24.59 30.55 31.81

54 21.58 26.98 33.61 35.01

55 23.78 29.71 37.08 38.63

56* 26.03 32.54 39.89 41.54

57* 28.52 35.66 43.16 44.96

58* 31.28 39.09 47.15 49.11

59* 34.36 42.95 51.76 53.93

60* 37.87 47.33 57.29 59.68

61* 41.69 52.13 63.83 66.49

62* 45.95 57.46 71.63 74.61

63* 41.54 51.92 66.38 69.14

64* 23.60 29.51 39.98 41.65

*Renewal only

PDS page 25 Salary Continuance rates two year

beneft period

90 day waiting period

The premium rate table on page 25 is replaced with the

following table.

Annual rate per $100 monthly beneft rates include maximum

adviser commission, Asgard management fee and stamp duty.

Salary Continuance

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

16 4.16 5.20 6.96 8.70

17 4.16 5.20 6.96 8.70

18 4.16 5.20 6.96 8.70

19 4.16 5.20 6.96 8.70

20 4.16 5.20 6.96 8.70

21 4.16 5.20 6.96 8.70

22 4.16 5.20 6.96 8.70

23 4.22 5.27 7.01 8.76

24 4.22 5.27 7.01 8.76

25 4.28 5.34 7.01 8.76

26 4.28 5.54 6.98 8.74

27 4.26 5.50 6.96 8.70

28 4.26 5.70 6.94 8.66

29 4.28 5.72 6.89 8.63

30 4.28 5.73 6.62 8.28

31 4.33 5.80 6.63 7.98

Asgard Personal Protection package SPDS | 7

Salary Continuance

Age next

birthday

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

32 4.59 5.74 7.16 8.96

33 4.64 5.80 7.22 9.02

34 4.75 5.93 7.29 9.13

35 5.01 6.26 7.65 9.57

36 5.12 6.41 7.91 9.89

37 5.24 6.56 8.16 10.20

38 5.58 6.97 8.69 10.49

39 5.73 7.17 8.94 10.81

40 5.97 7.47 9.49 11.11

41 6.20 7.74 9.95 11.67

42 6.68 8.35 10.46 12.68

43 7.02 8.78 10.96 13.70

44 7.60 9.50 11.83 14.81

45 8.01 10.01 12.38 15.48

46 8.75 10.93 13.71 17.13

47 9.35 11.69 14.69 18.36

48 10.25 12.83 16.22 20.27

49 11.01 13.78 17.34 21.68

50 12.24 14.87 18.62 23.28

51 13.33 16.20 20.28 25.36

52 14.97 17.71 22.06 27.57

53 16.41 19.96 24.81 31.00

54 18.00 21.91 27.29 34.10

55 19.82 24.11 30.11 37.64

56* 21.73 26.41 32.39 40.49

57* 23.81 28.95 35.04 43.81

58* 26.09 31.73 38.27 47.85

59* 28.69 34.88 42.05 52.55

60* 31.61 38.45 46.54 58.17

61* 34.81 42.32 51.84 64.79

62* 38.36 46.67 58.17 72.71

63* 34.67 42.17 53.89 67.37

64* 19.69 23.95 32.46 40.57

*Renewal only

Example 1

A male, non-smoker, white collar worker is 35 next birthday and is

applying for Life and TPD Protection cover. The monthly premium

for a sum insured of $500,000 is calculated as follows.

1. Select the base rate:

0.55 (Life Protection) + 0.39 (TPD Protection) = 0.94

2. Because the sum insured is $500,000, a 10% discount applies

(see Large Cover Discount on page 40):

0.94 x 0.9 = 0.846

3. Multiply the rate by the sum insured and divide by 1000:

0.846 x 500,000 / 1000 = 423.00 annual premium

4. Multiply this annual premium by 1.06 / 12:

423.00 x 1.06 / 12 = 37.37 monthly premium

5. Add the administration fee:

37.37 + 4.10* = $41.47 monthly premium

* The monthly administration fee is $4.10 for cover under superannuation or $4.40

if under non-superannuation.

Example 2

A male, white collar employee with an annual income of $45,000

is 35 next birthday and resides in NSW. The monthly premium for

insuring 75% of his income under Salary Continuance with a 90

day waiting period and a two year beneft period is calculated as

follows.

1. Select the base rate:

5.01

2. Calculate the monthly sum insured:

75% x $45,000 / 12 = 2,812

3. Multiply the rate by the sum insured then divide by 100:

5.01 x 2812 / 100 = 140.88

4. Multiply this annual premium by 1.06 / 12:

140.88 x 1.06 / 12 = 12.44 monthly premium

5. Add the administration fee:

12.44 + 4.10* = $16.54 monthly premium

(including stamp duty)

* The monthly administration fee is $4.10 as Salary Continuance is a product

specifc to cover under superannuation. Refer to the table on page 19 of the PDS.

PDS page 30 Examples

The following text is added to the PDS on page 30 as

examples of how to calculate a premium.

Asgard Capital Management Ltd ABN 92 009 279 592 AFSL 240695 APJPPP11208_supp

PDS pages 33 and 35 Are you

eligible to apply for insurance

The following text is added to the

section headed Are you eligible to

apply for insurance? on pages 33 and

35 of the PDS.

Some occupations may not be eligible

for cover or may attract a premium

loading due to the nature of the duties

required to be undertaken. Your

adviser has access to an Occupation

Categories guide and can assist you

with any questions in determining

your eligibility or whether any

premium loadings are likely to apply.

Please note that Entry Ages shown

in the table headed Entry and expiry

ages are your age next birthday.

PDS page 36 Overseas or

temporary residents

The following text replaces the section

headed Overseas or temporary

residents on page 36 of the PDS.

Your insurance cover provides

worldwide cover, 24 hours a day,

subject to any terms and conditions

noted on your Policy Information

Statement.

The Insurer may require you to return

to Australia at your own expense for

assessment in the event of a claim.

Usually, only permanent residents of

Australia who have been residing in

Australia for more than two years are

eligible for cover. If you receive cover

and then subsequently move overseas

your cover will automatically continue

under the same terms and conditions

for three years (for Life Protection

& TPD Protection) or two years (for

Salary Continuance). If you wish the

Insurer to consider an extension to this

cover period please apply in writing to:

Asgard Contact Centre

PO Box 7490

Perth WA 6850

This extension will need to be

approved by the Insurer prior to the

expiry of the automatic three year

(or two year for Salary Continuance)

continuation period. It is important

to note that failure to receive written

agreement to extend the automatic

continuation period will result in an

inability for the Insurer to consider a

claim for benefts under the policy.

PDS page 39 Your Policy

The following text is added to the Your

Policy section commencing on page 39

of the PDS.

Your Duty of Disclosure

Before you enter into, or become

insured under, a contract of insurance

you have a duty, under the Insurance

Contracts Act 1984 as amended, to

disclose to the Insurer every matter

that you know, or could reasonably

be expected to know, that is relevant

to the Insurers decision whether to

accept the risk of the insurance and, if

so, on what terms.

You have the same duty to disclose

those matters to the Insurer before you

extend, vary or reinstate a contract of

insurance.

Your duty, however, does not require

disclosure of a matter:

that diminishes the risk to be

undertaken by the Insurer,

that is of common knowledge,

that your Insurer knows or, in the

ordinary course of business, ought

to know, or

as to which compliance with

your duty is expressly waived

by the Insurer.

Non-Disclosure

If you fail to comply with your Duty of

Disclosure and the Insurer would not

have entered into the contract on any

terms if the failure had not occurred,

the Insurer may avoid the contract

within three years of entering into it.

If your non-disclosure is fraudulent,

the Insurer may avoid the contract at

any time.

An Insurer who is entitled to avoid

a contract of insurance may, within

three years of entering into it, elect

not to avoid it, but to reduce the sum

that you have been insured for in

accordance with a formula that takes

into account the premium that would

have been payable if you had disclosed

all relevant matters to the Insurer.

8 | Asgard Personal Protection package SPDS

Asgard

Personal

Protection

Package

Supplementary Product

Disclosure Statement (SPDS)

This SPDS is dated 15 September

2008 and relates to the Product

Disclosure Statement (PDS) dated

18 February 2008 for the Asgard

Personal Protection Package. This

SPDS is issued by Asgard Capital

Management Ltd ABN 92 009 279 592,

AFSL 240695 and should be read

together with the PDS.

The purpose of this SPDS is twofold.

The frst is to provide the ABN

of the superannuation fund that

includes all of the following Asgard

superannuation accounts mentioned

in this PDS. The ABN for the Funds

listed below is

ABN 90 194 410 365:

Asgard Managed Profles

Super Account

Asgard Separately Managed

Accounts Funds Super Account

Asgard Employee Super Account

Asgard Elements Super Account

Asgard eWRAP Super Account.

The second purpose is to correct

typographical errors within the PDS:

Page 13 Cancer defnition

Reference is made to the cancer

defnition appearing on page 48.

It should be page 45.

Page 19 Benefts

The benefts available for Income

Protection and Salary Continuance are

summarised in the following table:

Beneft

Income

Protection

Salary

Continuance

Total Disability Beneft while unemployed or on leave 3 3

Partial Disability Beneft while unemployed or on leave 3 3

Indemnity option 3 3

Recurrent Disability Beneft 3 3

Rehabilitation Beneft 3 7

Rehabilitation Expenses Beneft 3 7

Specifc Injuries Beneft 3 7

Crisis Beneft 3 7

Accommodation Beneft 3 7

Family Support Beneft 3 7

Home Care Beneft 3 7

Bed Confnement Beneft 3 7

Transportation Beneft 3 7

Overseas Assist Beneft 3 7

Death Beneft 3 7

Waiver of premium 3 3

Elective surgery 3 7

Increasing Claim Beneft 3 3

Pages 23 & 24 Individual Disability

Income Protection and Salary

Continuance tables of premium rates

The Age next birthday column in

each of the 4 tables appearing on those

pages should have * against each of

the ages 56 to 60 inclusive indicating

that the premium rates shown are

renewal only.

Asgard Capital Management Ltd ABN 92 009 279 592 AFSL 240695 APJPDS70708_supp

Personal Protection

Package

Issue date: 18 February 2008

A

s

g

a

r

d

P

e

r

s

o

n

a

l

P

r

o

t

e

c

t

i

o

n

P

a

c

k

a

g

e

Product Disclosure Statement (PDS)

Issue date: 18 February 2008

Life Protection

Total & Permanent Disablement

Trauma Protection

Critical Trauma Protection

Income Protection/Salary Continuance

Business Expenses Protection

In this PDS:

Asgard, the trustee and administrator refer to

Asgard Capital Management Limited ABN 92 009 279 592

AFSL 240695 RSE L0001946

Level 38, Central Park, 152 St Georges Terrace,

Perth WA 6000

Telephone 08 9415 5688

Facsimile 08 9481 4834

Contact Centre 1800 998 185

www.asgard.com.au

Asgard Super Account means:

an Asgard Managed Profles Super Account

an Asgard Separately Managed Accounts Funds Super Account

an Asgard Employee Super Account

an Asgard Elements Super Account

an Asgard eWRAP Super Account

any other eWRAP Super Account of which Asgard is the trustee.

Asgard Investment Account means:

an Asgard Managed Profles Investment Account

an Asgard Separately Managed Accounts Funds Investment Account

an Asgard Elements Investment Account

an eCASH Account

a CASH Connect Account

an Asgard Trustee Funds Account.

TOWER and the Insurer refer to:

TOWER Australia Limited

ABN 70 050 109 450

AFSL 237848

80 Alfred Street, Milsons Point NSW 2061

(All correspondence should be directed to Asgard)

we, us and our is a reference to TOWER

Master Policies refer to the master policies of insurance issued by

the Insurer to, and owned by, Asgard, under which all of the insurance

offered by this PDS is provided

TPD refers to Total & Permanent Disablement

you means an applicant for insurance under the relevant Master

Policies and your has a corresponding meaning, however, where the

applicant is not the life insured, you and your are references to the

life insured, where the context requires

general and medical terms used throughout this PDS are defned in

the glossary on pages 43 to 49.

This PDS was prepared on 18 February 2008.

Available from fnancial advisers across Australia.

Who is this document for?

For those people who consider that their most valuable asset is their

health. For individuals who wish to protect themselves, their families

and their assets if they suffer a serious sickness or injury, or in the event

of their death. For self-employed and small business owners who want

to know that they will be assisted with the reimbursement of certain

business expenses if they become totally disabled.

On the cover: In her roles of Offce Manager and Business Development Support, Sharyn provides support to our Sales team.

Product Disclosure Statement | 1

Updating the information in this PDS

This PDS is up to date at the time of preparation. From time to time we may change or update information in this PDS that is not materially adverse to your interests, provided we

give you a means of fnding out about these changes. You can do this by ringing the Contact Centre on 1800 998 185 or, if youre an existing investor, by checking Investor Online.

You can also obtain a paper copy of the updated information free of charge by contacting your fnancial adviser or us.

Whats inside

Asgard Personal Protection Package

3 Asgard Personal Protection Package at a glance

5 Insurance with Asgard

7 Asgard Personal Protection Package products

7 Life Protection

10 Total & Permanent Disablement

13 Trauma Protection

16 Critical Trauma Protection

19 Income Protection/Salary Continuance

26 Business Expenses Protection

29 Premiums and charges

33 Stand-alone (non-superannuation) insurance

35 Insurance through an Asgard Super Account

39 Your Policy

41 Privacy statement

43 Glossary

51 Direct debit request service agreement

53 Interim Cover Certifcate

Application booklet

Important information

Insurance benefts payable under the Master Policies are liabilities of the Insurer and the

premiums for these insurance benefts are payable to the Insurer. They are not deposits

in, nor liabilities of, and not guaranteed by, any bank or company whether related to the

Insurer or not.

All of the insurance offered by this PDS is provided under, and is subject to the terms

and conditions in, the Master Policies. A copy of the relevant Master Policy for your

chosen insurance can be obtained by calling the Contact Centre on 1800 998 185 or by

contacting your fnancial adviser. Further terms and conditions may also be set out in the

Policy Information Statements given to members. No beneft will be paid unless the

Insurer accepts the claim.

Asgard has been appointed by the Insurer to administer the insurance offered under the

Master Policies. As administrator, Asgard performs certain functions in relation to the

insurance, including receiving and processing applications and collecting premiums on

behalf of the Insurer. Asgard is your point of contact and will advise you of any changes

to your insurance cover including the fees, charges or benefts applying to that cover.

TOWER has consented to the inclusion in this PDS of references to it and statements

attributed to it and this consent has not been withdrawn before the date of this PDS.

Asgard is a subsidiary of St.George Bank Limited ABN 92 055 513 070 (St.George). St.

George, its subsidiaries, Asgard Wealth Solutions Limited ABN 28 009 143 597, Asgard

or any other subsidiary of St.George, are collectively referred to in this PDS as Asgard

Wealth Solutions.

Information in this PDS is based on the continuance of present taxation and

superannuation laws. All applications for insurance must be received on an application

taken from a current PDS. The information provided and statements made in this PDS

should not be taken as the giving of fnancial product advice by either the Insurer or

Asgard as they do not take into account your personal objectives, fnancial situation or

needs. As a result, you should, before acting on the information, consider the

appropriateness of the information having regard to these factors. The insurance types

described in this document are not savings plans. The primary purpose of each type of

cover is to provide a beneft upon specifed events happening. If you terminate your

cover (other than during the cooling-off period), your cover will cease and there will be no

refund of any premiums paid.

This PDS provides information in relation to insurance cover only. Further information

concerning the superannuation and investment products it refers to may be obtained

from your fnancial adviser. Any references to superannuation or investment products

are not to be taken as an offer of those products. To the extent permitted by law, the

Insurer does not accept any liability in connection with these superannuation and

investment products.

As a Business Superannuation Consultant within

our Distribution & Sales team, Euan helps advisers

with all of their business superannuation needs.

Product Disclosure Statement Asgard Personal Protection Package at a glance | 3

Asgard Personal

Protection Package

at a glance

This table outlines Asgards personal protection products, the risk covered and the beneft payable. Further detailed

descriptions of the personal protection products can be found on pages 7 to 28. Information on exclusions, premiums, fees and

charges, taxation and cooling-off periods can also be found throughout this PDS.

Product Risk covered Beneft

(if this happens to a life insured) (what we pay)

Life Protection Death Agreed lump sum

Terminal illness Agreed lump sum (maximum $2,000,000)

Total & Permanent Disablement (TPD) Option Permanent disability cannot work Agreed lump sum (maximum $3,000,000)

Trauma Protection

1

Certain defned medical conditions Agreed lump sum (some events trigger a partial

payment of the agreed lump sum)

Terminal illness Agreed lump sum

Death Agreed lump sum

Critical Trauma Protection

1

Certain defned medical conditions Minimum 25% of agreed lump sum for localised

cancer, myocardial infarction, or open chest

surgery; or full agreed lump sum for all other

medical condition defnitions

Terminal illness Agreed lump sum

Death Agreed lump sum

Income Protection

1

Professional, clerical and general occupations

Permanent or temporary disability

cannot work

Monthly beneft to replace lost income, can be

agreed value or indemnity

Salary Continuance

2

Permanent or temporary disability

cannot work

Monthly beneft to replace lost income, can be

agreed value or indemnity

Business Expenses Protection

1

Total disability Reimbursement of business costs incurred while

disabled, up to an agreed monthly beneft

1 Not available through an Asgard Super Account.

2 Only available through an Asgard Super Account.

The Asgard Personal

Protection Package provides

a means of protecting your

familys lifestyle, their

future and the assets you

have worked hard for.

Product Disclosure Statement Insurance with Asgard | 5

Insurance

with Asgard

Why do I need Asgard personal

protection insurance?

Your most valuable asset is your

health. If you suffer a serious sickness

or injury, the fnancial security and

quality of life of you and your family

will be dramatically affected. As a

result, you may:

be unable to care for your children

disrupt your partners work, as

they support and care for you

incur additional expenses, such as

rehabilitation and hospital care

jeopardise your retirement

plans by cutting off your income

prematurely.

Serious accidents, trauma and disease

are all unexpected events. The Asgard

Personal Protection Package is a way

to protect yourself and your family

should the unforeseen happen. It

provides a means of protecting your

familys lifestyle, their future and the

assets youve worked hard for. The

Asgard Personal Protection Package

offers you a range of insurance

products that can be tailored to your

individual needs.

The insurance cover detailed in this

PDS is either available through

an Asgard Super Account (where

premiums are deducted from this

account each month) or it can be

purchased on a stand-alone (non-

superannuation) basis (where

premiums are deducted from a

nominated Asgard Investment

Account or paid separately). If you

purchase insurance through an Asgard

Super Account, there are signifcant

differences in the way benefts may be

paid. For more information, see pages

35 to 37.

About Asgard the trustee

and administrator

Asgard currently administers

superannuation, retirement and

investment savings worth more

than $40 billion for over 400,000

Australians. Asgard also offers

insurance that can be tailored to your

individual needs, a service which

complements its investment and

super accounts.

With an Asgard account, its easy

for you to diversify your savings and

manage all your investments and

insurance needs.

6 | Product Disclosure Statement Insurance with Asgard

Asgard hall of fame

Asgard has over 17 years experience

in investment and superannuation

administration. It has received the

following awards in recognition of its

ongoing commitment to providing

service of the highest quality.

2007: Rainmaker Excellence

Awards Finalist

Asgard Employee Super Account.

SelectingSuper Awards for

Superannuation Product of the Year,

Premium Choice.

2007/08:

5 Quality Stars

The Heron Partnership

Corporate Funds

Asgard Employee Super.

Retail Funds

Asgard Elements Super-Pension.

Asgard eWRAP Super-Pension.

2007: Highly Commended

Platform of the Year - Super

for Asgard eWRAP Super/Pension.

2006: Winner Platform

of the Year Super

for Asgard eWRAP Super/Pension.

Retail Portfolio Platform of the Year

Small Investors (Super):

eWRAP Super/Pension.

Retail Portfolio Platform of the Year

Large Investors (Super):

eWRAP Super/Pension.

2006: Asgard eWRAP Winner

2007: Asgard Elements 2nd Place

Asgard products have been voted in the

top 5 in the Assirt Service Level Survey

in each of the six years prior to 2007.

5 apples Chant West rating

Small Plans for plans with less

than $10m: Asgard Employee

Superannuation Account.

Medium Plans for plans with

$10m-$50m: Asgard Employee

Superannuation Account.

Asgard Elements

Superannuation Account.

Asgard Elements Pension Account

Asgard eWRAP Pension Account

Asgard Allocated Pension Account

Best hybrid

AdviserNETgain has been ranked

number one in the hybrid category

as judged by independent expert

Investment Trends in their

Competitive Analysis Reports for 2006.

Top Performing Superannuation

Master Trust

Asgard Superannuation Account.

Top Performing Property Fund

Asgard Superannuation Account.

Independently

Researched

by Rainmaker

Information

Lic: 2003081

AAA rating (highest possible) for the

Asgard Employee Superannuation

Account by Selecting Super, a division

of Rainmaker Information.

About TOWER the insurer

The insurer is TOWER Australia

Limited (TOWER) ABN 70 050 109

450. TOWER is a specialist Australian

life insurance company with well over

130 years experience and over $500

million of annual in-force premium.

TOWER is one of the top fve life

insurance companies in Australia and

an industry leader in the provision of

life insurance arrangements to super

funds and administration platforms.

TOWER is widely acknowledged in

the market as a provider of quality

products with superior service.

All insurance benefts described in

this PDS are provided by TOWER and

not Asgard.

Product Disclosure Statement Asgard Personal Protection Package products | 7

Asgard Personal

Protection

Package products

Life Protection

What is Life Protection?

Life Protection provides life cover for

an agreed amount. If you hold Life

Protection on a stand-alone (non-

superannuation) basis and youre

diagnosed with a terminal illness,

the lump sum will be paid to you. If

you die, a lump sum will be paid to

your estate.

Where cover is held through your

Asgard Super Account, the beneft is

paid to your account and access to the

beneft is subject to superannuation

preservation rules. See Insurance

through an Asgard Super Account on

pages 35 to 37 for more information.

Benefts

Death Beneft

If you die, your sum insured (at the

date of death) will be paid to your

estate. Your Death Beneft is reduced

by any benefts paid for Terminal

Illness or TPD Protection prior to your

death. See below.

Terminal Illness Beneft

A terminal illness is defned as any

disease or condition that, in the opinion

of an appropriate specialist medical

practitioner approved by us and having

regard to the current treatment or such

treatment as you may reasonably be

expected to receive, is likely to lead to

your death within twelve months from

the date you are diagnosed with of

your condition.

If youre diagnosed with a terminal

illness, well pay your full Death

Beneft up to a maximum of

$2,000,000. If your Death Beneft

exceeds $2,000,000, your insurance

will continue at a reduced beneft with

a reduced premium. Your remaining

Death Beneft will be paid on

your death.

Your Terminal Illness Beneft will

expire on the anniversary of the

commencement date of insurance

immediately prior to age 70 if taken

through Asgard Superannuation

Account, or 80 if stand alone

(non-super).

Guaranteed Future Insurability Beneft

Under the Guaranteed Future

Insurability Beneft, you can increase

the sum insured of the Death Beneft

and TPD Beneft (if applicable) for a

life insured, subject to:

an application in writing for an

increase being made within 30 days

of an Allowable Event (as described

below) or within 30 days of the

policy anniversary following an

Allowable Event;

the life insured being less than

age 55 at the time of an Allowable

Event;

the increase being up to the

lesser of:

- 25% of the original sum insured;

- $200,000;

- fve times the annual amount of

salary increase (if applicable);

- the amount of mortgage being

taken out or increased (if

applicable);

8 | Product Disclosure Statement Asgard Personal Protection Package products

total death cover on the life insured,

(including the cover with TOWER

and any other organisation) being

less than $3,000,000;

total Total and Permanent

Disablement cover on the life

insured (including the cover

with TOWER and any other

organisation) being less than

$3,000,000; and

provision of evidence, satisfactory

to us, of the Allowable Event. (The

required evidence for each event is

detailed in the application form for

an increase under this beneft.)

For all increases applied for under

this beneft, the maximum amount

by which you can increase the sum

insured is the lower of:

the original sum insured; or

$1,000,000, subject to total cover

(with TOWER and any other

organisation) not exceeding

$3,000,000 for death and

$3,000,000 for Total and Permanent

Disablement.

If TPD Benefts are attached to Life

Protection cover, the TPD cover cannot

exceed the death cover.

Only one Guaranteed Future

Insurability Beneft increase may be

exercised in any twelve month period.

The premium for the new sum insured

will be calculated in line with the

plan conditions.

If cover increases as a result of the

Guaranteed Future Insurability

Beneft, changes in the health,

occupation or pastimes of the life

insured will not be taken into account.

Allowable Events are:

the birth of a child where the life

insured is a parent;

the adoption of a child by the life

insured;

a dependent child of the life insured

starts secondary school;

a dependent child of the life insured

starts university;

marriage of the life insured;

a change in employment status

of the life insured where the life

insureds salary increases by at

least $10,000 a year;

the taking out, or increasing of,

a mortgage by the life insured

(either alone or jointly with

another person) on a home which

is the primary residence of the life

insured; and

an increase in the life insureds

value to the business where the

life insured is a key person in that

business. In this situation, the sum

insured may be increased in the

same proportion as the increase in

the life insureds value, subject to

the maximums described earlier.

During the frst six months after

exercising the Guaranteed Future

Insurability Beneft, the increased

portion of the sum insured will

only be paid in the event of the life

insured suffering:

Accidental Death (unless the cover

is TPD); or

TPD that is caused by Accident (if

applicable).

This beneft is not available if:

a loading or an exclusion has been

applied to your cover for the life

insured.

Exclusions

A Death Beneft wont be paid where

death is the result of:

an intentional self-inficted injury

(whether you were sane or insane)

within twelve months of the

commencement or reinstatement of

cover; or

an exclusion which is specifc

to you and noted on your Policy

Information Statement.

If death is the result of an intentional,

self-inficted injury committed within

twelve months after an increase in

your cover (not including indexation),

the amount of the increase in cover will

not be paid. A Terminal Illness Beneft

wont be paid where any intentional

self-inficted injury or attempt at

suicide causes the terminal illness,

directly or indirectly.

Level of cover

Theres no maximum level of Death

Beneft that you can apply for (subject

to underwriting requirements). The

minimum level of Death Beneft is

$50,000.

Minimum premium

Theres no minimum premium if paid

through an Asgard Super Account.

Otherwise, the minimum premium

is $200 per annum (not including the

Administration fee).

How to calculate a premium

To calculate a Life Protection premium,

see page 30 and the Life Protection

rates table on the following page.

Product Disclosure Statement Asgard Personal Protection Package products | 9

Age next

birthday Death only

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

16 1.07 2.06 0.48 0.99

17 1.07 2.06 0.51 0.99

18 1.07 2.06 0.51 0.99

19 1.07 2.06 0.51 0.99

20 1.07 2.06 0.51 0.99

21 1.01 1.94 0.45 0.94

22 0.94 1.81 0.42 0.89

23 0.89 1.71 0.39 0.86

24 0.83 1.58 0.36 0.84

25 0.76 1.46 0.36 0.84

26 0.73 1.40 0.34 0.84

27 0.71 1.35 0.36 0.84

28 0.68 1.31 0.36 0.84

29 0.65 1.25 0.34 0.84

30 0.62 1.20 0.34 0.84

31 0.62 1.20 0.34 0.84

32 0.62 1.21 0.35 0.90

33 0.63 1.23 0.36 0.92

34 0.61 1.23 0.37 0.97

35 0.61 1.24 0.37 0.98

36 0.63 1.28 0.41 1.04

37 0.66 1.38 0.45 1.08

38 0.69 1.47 0.51 1.13

39 0.74 1.60 0.55 1.18

40 0.77 1.71 0.62 1.26

41 0.84 1.85 0.66 1.33

42 0.91 2.04 0.72 1.41

43 1.00 2.24 0.78 1.52

44 1.10 2.45 0.85 1.65

45 1.21 2.70 0.94 1.81

46 1.34 2.99 1.06 2.01

47 1.48 3.30 1.19 2.23

48 1.66 3.69 1.30 2.46

49 1.84 4.11 1.42 2.73

50 2.07 4.60 1.55 3.05

51 2.31 5.15 1.73 3.33

52 2.60 5.80 1.88 3.72

53 2.94 6.55 2.09 4.13

54 3.29 7.50 2.25 4.59

55 3.83 8.73 2.43 5.10

56 4.31 10.05 2.62 5.67

57 4.89 11.41 2.91 6.28

58 5.49 12.80 3.23 6.97

59 6.10 14.23 3.57 7.72

Age next

birthday Death only

Male

non-smoker

Male

smoker

Female

non-smoker

Female

smoker

60 6.75 15.76 3.96 8.56

61 7.54 17.59 4.39 9.49

62 8.50 19.82 4.88 10.53

63 9.63 22.47 5.43 11.72

64 10.96 25.57 6.04 13.04

65 12.46 29.07 6.71 14.49

66* 14.26 33.27 7.68 16.59

67* 16.22 37.86 8.74 18.87

68* 18.38 42.90 9.90 21.37

69* 20.77 48.46 11.19 24.16

70** 23.29 47.46 12.62 25.92

71** 29.27 56.60 14.43 27.70

72** 34.01 61.22 16.57 30.02

73** 39.41 66.07 19.04 33.85

74** 45.51 72.73 21.85 37.78

75** 52.36 78.01 25.16 41.68

76** 59.15 83.69 28.99 45.85

77** 65.66 87.76 33.20 50.68

78** 72.75 93.84 37.67 56.28

79** 80.49 102.22 42.89 62.70

80** 88.97 111.21 48.85 69.84

81** 99.32 122.16 56.08 78.41

82** 110.90 134.17 64.18 87.67

83** 123.88 147.41 73.15 97.59

84** 138.39 161.91 83.31 108.47

85** 154.58 177.76 94.81 118.51

86** 172.47 194.89 106.95 133.69

87** 192.11 213.24 120.33 150.42

88** 213.60 232.82 135.18 168.98

89** 237.09 253.68 151.68 189.59

90** 262.68 275.81 169.98 212.47

91** 290.30 301.91 190.27 237.85

92** 320.40 330.02 212.85 266.06

93** 353.26 360.33 237.98 297.48

94** 389.10 392.99 265.94 332.43

95** 428.08 428.08 297.01 371.27

96** 469.88 469.88 331.48 414.34

97** 515.09 515.09 369.62 462.02

98** 563.78 563.78 411.76 514.69

99** 616.07 616.07 458.19 572.73

Maximum entry age is 65 next birthday

* Superannuation cover expires at age 70

** Non-superannuation cover expires at age 99

Life Protection rates (these rates also apply for Life and TPD Protection through an Asgard Super Account)

Annual rates per $1,000 sum insured rates include maximum adviser commission, Asgard Management fee and stamp duty.

10 | Product Disclosure Statement Asgard Personal Protection Package products

Total & Permanent Disablement

What is Total & Permanent

Disablement (TPD)?

If held on a stand-alone (non-

superannuation basis), TPD pays

a lump sum to you if, or when, you

become totally and permanently

disabled due to sickness or injury.

Where cover is held through your

Asgard Super Account, your TPD

beneft is paid to your account and

access to the beneft is subject to

superannuation preservation rules. See

Insurance through an Asgard Super

Account on pages 35 to 37 for more

information.

There are two types of TPD Beneft

available TPD Protection and TPD

Only. The difference between the two

TPD Benefts is the treatment of your

death beneft, as explained in the

following table.

TPD beneft -

TPD Protection

TPD beneft -

TPD Only

The Death Beneft

sum insured is

reduced by the

amount of TPD

payment, with

premiums adjusted

appropriately. If the

Death Beneft sum

insured is reduced

to nil, cover ceases.

Any Death Beneft

sum insured is not

reduced.

Premiums for the

Death Beneft

continue for the

remaining life of the

cover.

Benefts

TPD Beneft

Standard defnition

Total and Permanent Disablement

(TPD) means the life insured:

(A) has suffered the permanent loss of:

the use of two limbs (where

limb is defned as the whole

hand below the wrist or whole

foot below the ankle); or

the sight in both eyes; or

the use of one limb and sight in

one eye.

OR

(B) solely because of illness or injury,

has:

suffered at least 25%

impairment of Whole Person

Function;

is not engaged in any

occupation; and

is disabled to such an extent

as to render the life insured

unlikely to ever be engaged

in any occupation for which

they are reasonably suited

by education, training

or experience.

OR

(C) is unable to perform at least two

of the following Activities of Daily

Living:

Dressing the ability to put on

and take off clothing without

assistance; or

Bathing the ability to wash or

shower without assistance; or

Toileting the ability use the

toilet, including getting on and

off, without assistance; or

Mobility the ability to get

in and out of bed and a chair

without assistance; or

Feeding the ability to get food

from a plate into the mouth

without assistance.

Where assistance means the

assistance of another person.

OR

(D) (i) where at the time of disablement,

the life insured was employed 15

or more hours a week (averaged

over the 13 week period prior to the

date of disablement or such shorter

period if employed for less than 13

weeks immediately prior to the date

of disablement):

has been absent from

employment as a result of illness

or injury for 3 consecutive

months; and

in TOWERs opinion, after

consideration of all relevant

evidence, the life insured is

disabled to such an extent

to render them unlikely to

ever again be engaged in any

occupation for which they

are reasonably suited by

their education, training or

experience.

OR

(D) (ii) where at the time of

disablement, the life insured was

not employed and was engaged in

unpaid domestic duties at home:

is as a result of illness or injury

under the care of a medical

practitioner; and

is unable to perform those

domestic duties; and

is unable to leave their home

unaided; and

has not engaged in any gainful

employment for a period of 3

consecutive months after the

occurrence of the illness or

injury; and

at the end of the period of 3

months is, in TOWERs opinion,

and after consideration of all

relevant evidence, disabled to

such an extent as to render

them unlikely to perform those

domestic duties or engage in any

gainful occupation.

Own occupation defnition

Depending on your occupation,

you have the option of applying for

Own Occupation TPD. The Own

Occupation defnition of TPD is the

same as the standard defnition above,

except clause (D) (i) is replaced with:

has been absent as a result of

illness or injury from employment

for 3 consecutive months; and

in TOWERs opinion, after

consideration of all relevant

evidence, the life insured is disabled

to such an extent as to render them

unlikely to ever again engage in

their Own Occupation.

Conditions

The following conditions apply to TPD:

this cover is only available until the

anniversary of the commencement

date of your insurance immediately

prior to age 65; and

your TPD Beneft is payable once

only.

If you take the TPD beneft TPD

Protection:

your TPD Beneft cannot exceed

your Death Beneft; and

the amount paid under your TPD

Beneft will reduce the subsequent

amount paid under your Death

beneft or Terminal Illness Beneft

by the amount of TPD Beneft paid.

Exclusions

A TPD Beneft wont be paid where

your disability is:

directly or indirectly caused by any

intentional self-inficted injury or

any attempt at suicide; or

due to an exclusion which is specifc

to you and noted on your Policy

Information Statement.

Product Disclosure Statement Asgard Personal Protection Package products | 11

TPD tapering

Once you reach age 60, the TPD

Beneft reduces by 20% per

year at each anniversary of the

commencement date of insurance, up

to the anniversary immediately prior

to your 65th birthday (according to the

table below).

Age next birthday at

the anniversary of the

commencement date

TPD cover is

reduced by

61 20%

62 40%

63 60%

64 80%

65 TPD cover

ceases

Level of cover

The minimum level of TPD Beneft is

$50,000. The maximum level of cover

is shown in the table below. Indexation

of the TPD Beneft will cease when the

beneft reaches $3,000,000.

TPD defnition

Maximum

sum insured

Standard Occupation $3,000,000

Own Occupation $3,000,000

Home Duties Occupation

Standard occupation (Dii)

$500,000

For the Own Occupation defnition,

multiply the TPD premium rate by 1.5

(available to specifc occupations only,

including professionals, executives and

senior management).

How to calculate a premium

To calculate a TPD premium, see page

30 and the TPD rates tables following.

Total & Permanent Disablement (TPD) rates TPD Protection

Annual rates per $1,000 sum insured rates include maximum adviser commission,

Asgard Management fee and stamp duty.

Age next

birthday

Male non-

smoker

Male

smoker

Female

non-smoker

Female

smoker

16 0.55 0.76 0.69 1.22

17 0.55 0.76 0.66 1.22

18 0.55 0.76 0.66 1.22

19 0.55 0.76 0.66 1.22

20 0.55 0.76 0.66 1.22

21 0.50 0.71 0.59 1.01

22 0.46 0.65 0.53 0.87

23 0.44 0.60 0.48 0.79

24 0.39 0.54 0.50 0.77

25 0.36 0.49 0.48 0.75

26 0.35 0.49 0.49 0.69

27 0.33 0.49 0.47 0.67

28 0.35 0.50 0.45 0.61

29 0.36 0.51 0.46 0.59

30 0.38 0.53 0.46 0.59

31 0.38 0.53 0.47 0.61

32 0.39 0.54 0.48 0.63

33 0.38 0.55 0.48 0.66

34 0.42 0.58 0.49 0.64

35 0.43 0.60 0.50 0.64

36 0.45 0.62 0.49 0.64

37 0.46 0.68 0.49 0.67

38 0.48 0.78 0.49 0.69

39 0.49 0.79 0.49 0.74

40 0.54 0.83 0.52 0.86

41 0.56 0.93 0.60 1.04

42 0.63 1.02 0.68 1.23

43 0.70 1.11 0.81 1.46

44 0.79 1.26 0.94 1.70

45 0.90 1.45 0.84 1.64

46 1.03 1.67 0.73 1.56

47 1.19 1.94 0.63 1.53

48 1.33 2.19 0.57 1.30

49 1.51 2.46 0.54 1.32

50 1.69 2.76 1.24 2.39

51 1.92 3.12 2.00 3.87

52 2.11 3.53 2.85 5.96

53 2.42 4.05 3.73 8.00

54 2.98 4.76 3.89 8.57

55 3.48 5.69 4.71 10.18

56 4.13 6.95 6.35 12.14

57 4.95 8.36 7.59 14.55

58 5.80 9.61 9.15 17.53

59 6.83 11.36 11.07 21.19

60 7.33 13.09 12.74 24.39

61* 8.63 15.49 15.07 28.83

62* 8.98 16.05 15.64 29.94

63* 7.49 13.05 12.85 24.63

64* 4.26 6.77 6.90 13.33

*TPD renewal only, as maximum entry age is 60 next birthday.

For the Own Occupation defnition, multiply the TPD premium rate by 1.5 (available to specifc occupations

including professionals, executives and senior management).

12 | Product Disclosure Statement Asgard Personal Protection Package products

Total & Permanent Disablement (TPD) rates TPD Only

Annual rates per $1,000 sum insured rates include maximum adviser commission, Asgard Management fee and stamp duty.

Age next

Birthday Male Female

Non

Smoker

Smoker Non

Smoker

Smoker

16 0.65 0.92 0.83 1.47

17 0.65 0.92 0.78 1.47

18 0.65 0.92 0.78 1.47

19 0.65 0.92 0.78 1.47

20 0.65 0.92 0.78 1.47

21 0.61 0.86 0.72 1.22

22 0.55 0.78 0.64 1.04

23 0.53 0.72 0.58 0.95

24 0.47 0.64 0.59 0.92

25 0.44 0.59 0.58 0.90

26 0.41 0.58 0.58 0.83

27 0.41 0.59 0.56 0.81

28 0.42 0.61 0.55 0.73

29 0.44 0.61 0.55 0.72

30 0.45 0.64 0.55 0.72

31 0.45 0.64 0.56 0.73

32 0.47 0.64 0.56 0.75

33 0.47 0.65 0.58 0.80

34 0.50 0.70 0.59 0.76

35 0.51 0.72 0.59 0.76

36 0.53 0.75 0.59 0.78

37 0.55 0.81 0.58 0.81

38 0.58 0.94 0.58 0.84

39 0.59 0.95 0.59 0.89

40 0.64 1.00 0.62 1.04

41 0.67 1.11 0.72 1.25

42 0.75 1.22 0.83 1.47

43 0.84 1.34 0.98 1.75

44 0.94 1.51 1.12 2.04

45 1.08 1.75 1.00 1.96

46 1.23 2.01 0.89 1.87

47 1.42 2.32 0.76 1.84

48 1.61 2.64 0.69 1.56

49 1.81 2.95 0.65 1.59

50 2.03 3.31 1.50 2.87

51 2.29 3.74 2.40 4.65

52 2.53 4.23 3.42 7.16

53 2.92 4.87 4.48 9.59

54 3.57 5.71 4.68 10.29

55 4.18 6.85 5.65 12.21

56 4.96 8.34 7.61 14.57

57 5.94 10.03 9.11 17.47

58 6.97 11.52 10.99 21.04

Age next

Birthday Male Female

Non

Smoker

Smoker Non

Smoker

Smoker

59 8.19 13.63 13.29 25.43

60 8.80 15.72 15.28 29.27

61* 10.35 18.59 18.09 34.59

62* 10.78 19.26 18.78 35.91

63* 9.00 15.66 15.42 29.55

64* 5.12 8.12 8.28 16.00

*TPD renewal only, as maximum entry age is 60 next birthday.

For the Own Occupation defnition, multiply the TPD premium rate by 1.5

(available to specifc occupations including professionals, executives and senior

management).

Product Disclosure Statement Asgard Personal Protection Package products | 13

Trauma Protection

What is Trauma Protection?

Trauma Protection will pay a lump

sum to your estate if you die, or to you

if you are diagnosed with a terminal

illness, or on the frst occurrence of

you suffering one of the specifed

trauma medical conditions listed in the

following table.

Trauma Protection is not available

through an Asgard Super Account.

Benefts

Trauma Beneft

Well pay your sum insured on the frst

occurrence of you suffering one of the

specifed trauma medical conditions

listed in the following table. A medical

condition is a sickness or injury

that causes you great distress and

disruption.

Your Trauma Beneft will expire on the

anniversary of the commencement date

of insurance immediately prior to age

70, with the exception of the Death and

Terminal Illness components which

continue to age 99.

Trauma medical conditions

Alzheimers disease Major organ transplant

Angioplasty*^ Medically acquired HIV

Aorta surgery Meningitis

Aplastic anaemia Meningococcal disease

Benign Brain Tumour Motor neurone disease

Blindness Multiple sclerosis

Cancer* Muscular dystrophy

Cardiomyopathy Occupationally acquired HIV

Chronic kidney failure Open heart surgery

Chronic liver disease Out of hospital cardiac arrest

Chronic lung disease Paralysis:

Coma Diplegia

Coronary artery bypass surgery* Hemiplegia

Dementia Paraplegia

Encephalitis Quadriplegia

Heart attack* Tetraplegia

Heart valve surgery* Parkinsons disease

Loss of hearing Pneumonectomy

Loss of independent existence Primary pulmonary hypertension

Loss of limbs or sight Severe burns

Loss of speech Stroke*

Major head trauma Triple Vessel Angioplasty

* Theres no Trauma Beneft payable for these conditions if the condition occurs, or frst becomes apparent,

during the frst 90 days after your commencement date of insurance. If transferring existing cover to the Asgard

Trauma Protection policy, this qualifying period is waived for conditions previously covered (for the amount of

cover transferred).

^ Payment is 10% of the Trauma Beneft at the date of the event up to a maximum of $25,000.

The Trauma Beneft is reduced by any

amount payable and the premium is

reduced accordingly.

Defnitions of all trauma medical

conditions can be found in the glossary

under Medical terms Trauma

Protection/Income Protection on

pages 45 to 47.

Cancer defnition

The defnition of cancer (see page 48)

provides for a partial payment of 10%

of the sum insured, up to a maximum

of $25,000, payable on the occurrence of

the following trauma events:

Carcinoma In Situ;

Early Stage Chronic Lymphocytic

Leukaemia;

Early Stage Melanoma; and

Early Stage Prostate Cancer.

The Trauma sum insured is reduced by

the amount of any payment made for

these events.

The partial payment will be paid once

only for each trauma event above.

Well pay for multiple events up to a

maximum of $100,000.

Death Beneft

If you die, your Trauma Beneft

(at your date of death) will be paid to

your estate.

On expiry of your Trauma Beneft

at age 70, well continue your Death

Beneft through Life Protection. Your

Death Beneft will expire on the

anniversary of the commencement

date of insurance immediately prior to

age 99.

Terminal Illness Beneft

A terminal illness is defned as any

disease or condition that, in the opinion

of an appropriate specialist medical

practitioner approved by us and having

regard to the current treatment or such

treatment as you may reasonably be

expected to receive, is likely to lead to

your death within twelve months from

the date you are diagnosed with of

your condition.

If youre diagnosed with a terminal

illness, well pay your full Trauma

Beneft. Your Terminal Illness Beneft

will expire on the anniversary of the

commencement date of insurance

immediately prior to age 80.

14 | Product Disclosure Statement Asgard Personal Protection Package products

Buy Back Beneft

If youre paid a full Trauma Beneft,

you have the option to buy back

your Trauma sum insured as Life

Protection cover, without providing

further underwriting information.

This option is available provided you

notify us within twelve months from

the payment date of the initial claim.

Cover will be made available upon the

twelve month anniversary of the claim.

Advancement Beneft

The Advancement Beneft will be

paid when the life insured is frst

diagnosed by a Medical Practitioner as

suffering from:

Motor neurone disease.

Multiple sclerosis.

Muscular dystrophy.

Parkinsons disease.

Primary pulmonary hypertension.

For the purposes of the Advancement

Beneft only, these conditions have

their normal medical meaning rather

than the meaning defned in the

glossary under Medical terms

Trauma Protection/Income Protection

on pages 45 to 47.

The Advancement Beneft will also be

paid if the life insured has been placed

on a waiting list to receive a major

organ transplant and that procedure is

unrelated to any previous procedure or

surgery undergone by the life insured.

The amount to be paid will be 25%

of the sum insured, to a maximum

payment of $25,000. Only one

Advancement Beneft will be paid in

respect of the life insured. The Trauma

Protection sum insured will be reduced

by the Advancement Beneft paid.

Automatic indexation

To ensure your level of cover isnt

devalued by infation, your Trauma

Beneft will be automatically

increased on each anniversary of the

commencement date of insurance by

the indexation factor. Your premiums

will increase accordingly.

Automatic increases will cease at the

anniversary of the commencement date

of insurance prior to age 65. When the

Trauma Beneft reaches $2,500,000,

future increases will be based on

this amount.

Exclusions

A Trauma Beneft wont be paid if your

condition is:

directly or indirectly caused by any

intentional self-inficted injury or

any attempt at suicide; or

due to an exclusion which is specifc

to you and noted on your Policy

Information Statement.

A Death Beneft wont be paid where

death is the result of:

an intentional self-inficted injury

(whether you were sane or insane)

within twelve months of the

commencement or reinstatement

of cover; or

an exclusion which is specifc

to you and noted on your Policy

Information Statement.

If death was the result of an

intentional, self-inficted injury

committed within twelve months after

an increase in your cover (not including

automatic indexation), the amount of

the increase in cover will not be paid.

A Terminal Illness Beneft wont

be paid where any intentional self-

inficted injury or attempt at suicide

causes the terminal illness, directly

or indirectly.

Level of cover

The maximum sum insured for

Trauma Protection is $2,500,000.

Minimum premium

There is a minimum premium of

$200 per annum (not including the

administration fee).

How to calculate a premium

To calculate a Trauma Protection

premium, see page 30 and the

Trauma Protection rates table on the

following page.

Product Disclosure Statement Asgard Personal Protection Package products | 15

Trauma Protection rates (includes Life Protection cover)

Annual rates per $1,000 sum insured rates include maximum adviser commission, Asgard Management fee and stamp duty.

Age next

birthday

Male non-

smoker

Male

smoker

Female

non-smoker

Female

smoker

18 1.84 2.99 1.29 2.01

19 1.84 2.99 1.29 2.01

20 1.84 2.99 1.29 2.01

21 1.78 2.93 1.30 2.01

22 1.73 2.86 1.30 2.01

23 1.70 2.83 1.33 2.02

24 1.66 2.80 1.36 2.04

25 1.62 2.76 1.39 2.07

26 1.62 2.79 1.42 2.14

27 1.62 2.84 1.43 2.20

28 1.63 2.90 1.45 2.25

29 1.64 2.97 1.47 2.31

30 1.65 3.04 1.49 2.37

31 1.67 3.13 1.52 2.45

32 1.70 3.28 1.58 2.55

33 1.74 3.49 1.66 2.75

34 1.79 3.77 1.75 2.98

35 1.86 4.10 1.87 3.24

36 2.01 4.49 1.99 3.60

37 2.18 4.94 2.12 4.01

38 2.39 5.42 2.25 4.46

39 2.64 5.93 2.39 4.93

40 2.92 6.50 2.54 5.40

41 3.30 7.29 2.74 5.87

42 3.69 8.17 3.01 6.36

43 4.14 9.28 3.36 7.03

44 4.67 10.60 3.79 7.74

45 5.20 12.08 4.24 8.47

46 5.87 13.62 4.70 9.30

47 6.55 15.24 5.17 10.15

48 7.26 16.95 5.65 11.10

49 7.90 18.76 6.14 12.07

50 8.86 20.69 6.66 12.97

Age next