Académique Documents

Professionnel Documents

Culture Documents

Nintendo Wii Blue Ocean Strategy

Transféré par

kaykscribdCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Nintendo Wii Blue Ocean Strategy

Transféré par

kaykscribdDroits d'auteur :

Formats disponibles

Industry Overview

The video gaming industry in this decade sees the introduction of the 8

th

generation gaming

console. The console manufacturers have continued to adopt the five-year console

development life cycle. Since the 6

th

generation gaming consoles i.e. around the early 2000s

three prominent players in the form of Sony, Microsoft and Nintendo have emerged.

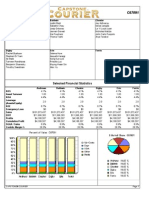

As of January 2014 the Sony had the biggest chunk of the $9.9 Billion market with 62% of

the market share. Microsoft was second with 23%, followed by Nintendo with 15% market

share.

With the 8

th

generation console, the PlayStation 4(PS4), Sony has emerged to be the market

leader gaining the position after 4 years. Sony is followed by Microsoft with the XboxOne,

which has seen rapid decline in sales in the last quarter. Nintendo Wii U sold about 2 million

consoles after its launch in 2012 and similar sales for the PS4 and XboxOne are expected by

the end of 2014. The console industry as a whole has seen dive in sales because of increased

competition from the mobile and internet based gaming.

The expected sales for the 6

th

, 7

th

and 8

th

generation are as shown below:

Sony

63%

Nintendo

14%

Microsoft

23%

Console Gaming Market Share

Competitive strategy prior to Nintendo Wii

The gaming console industry has been a Red Ocean with the three main players competing

for market share for the last decade. The Strategy adopted by the console players prior to

launch Nintendo Wii (6

th

generation) was based on value creation rather than innovation.

They achieved this by focusing more on technology advancement by providing more inbuilt

storage, better graphics and improved processing capacity.

Bundle Deals: Console makers introduced bundle deals by offering additional controllers,

remote controls or games in order to tempt them away from competitors.

Pricing Strategy: One of the important tools used for gaining market share is the aggressive

pricing strategy. They have adopted a loss leader strategy where the products are prices

below the production cost and they expect that lower input cost over the years will make their

product profitable.

Captive deals: As price of games consoles fall, console manufacturer release much hyped

games that can only be played on their platform. Games console manufacturers usually make

most of their money on software sales. They get the console into the household by selling it

cheaply then they capture the customer on the premium price for new game releases. For

example if you wanted to play Halo, it could only be played on the Xbox 360

All these strategies are for value creation and thus created a Red Ocean. With Nintendo Wii,

Nintendo created a blue ocean to attract new customer base.

Porter Forces in the game console market

Customers

Customers tend to buy only one console at a time. The bargaining power of the customers is

also restricted since the prices are fixed for an entire region. Switching costs are also high as

there is no platform portability for games; if an individual wants to play a particular game, he

or she is usually locked into the console that plays it.

Suppliers

The Manufacturing and Assembly of most of the part of Nintendo are outsourced. Thus the

costs for Nintendo are higher in comparison to Sony and Microsoft. Also, for them there is a

threat of forward integration by the part suppliers.

In case of software Nintendo does most of the development on its own. It also licenses a

software development kit (SDK) to outside game developers. These firms could have a

bargaining power over Nintendo as they too act as customers which Nintendo looks forward

to satisfy. Overall, Nintendo's SDK tends to be priced lower and have better support than

similar packages offered by competitors.

Threat of new entrants

The console market has a strong threat of new entry. There is very little patentable

technology in game consoles, and most consoles tend to have similar features and

functionality.

Economies of scale act as one barrier. The new entrant will have to build its own games and

would have to market it well since the existing players are a household name.

Substitutes

The customers have high bargaining power since there is multiple source of entertainment

available which could substitute gaming. In addition to competitors' products available to

them, they may choose television, movies, PC games, board games, literature, sports, etc., in

their leisure time. Thus, game consoles have to make an effort to be wanted since they are not

needed.

Rivalry

There is a very strong rivalry in the console industry. At this juncture there are three major

players in the form of Sony, Nintendo and Microsoft. There was heavy price competition

among the players in 2004 and Nintendo, as the weakest competitor, would have suffered

most loss from price competition. Thus in order to be profitable Nintendo had to think out of

the box and come out with innovate strategy.

Company Overview: Nintendo

Nintendo began as a handmade playing card company in 1889 and developed into a video

game company, becoming the most influential in the industry, and Japans third most

valuable listed company, with a market value of over US$ 85 billion. Nintendo has enjoyed

the leading space in Gaming industry for over decades with Strong competitors like Sony and

more recently Microsoft vying for the top spot. Nintendo holds the record for the most

number of consoles sold cumulatively which is approximately 625 million till Nov 2013.

The major successes of Nintendo include Super Nintendo, Game Boy, Virtual Boy, Game

Cube, Nintendo DS, Nintendo Wii and Nintendo Wii U.

Nintendo Wii

Through the launch of Wii in 2006, Nintendo successfully created a niche market for their

product and in effect were successful in increasing the size of the market without actually

competing with the existing players (The detail strategy is explained further in the document).

Before Wii was launched, Nintendo had lost a lot of ground to its competitors Sony (PS2)

and Microsoft (Xbox 360). Sony and Microsoft were far superior in terms of technological

advancements in their gaming experience in terms of HD graphics and faster processor

speeds and online user experience. Thus in early 2006 Nintendos GameCube with 22 million

units was a distant third after Xbox360 with 24 million units and PS3 in terms of market

share and sale of consoles.

After Wii was launched the market scenario started changing gradually and by the year 2009

Wii was able to regain the lost market share for Nintendo and at that time held the greatest

lifetime market share (41%) out of the three major video game consoles. Wii reached

maturity early as compared to its competitors leading to a 3

rd

place position in terms of

Market share in 2011.

Snapshot of Comparative performance of three market leaders in Gaming industry in 2008:

0

1000

2000

3000

4000

Mar-08 Apr-08 May-08 Jun-08

Wii Sale

PS3 Sale

Xbox 360 Sale

SWOT Analysis for Nintendo Wii

Strengths

Important heritage in video game

development

Strong global brand in video game

market with Valuable IPs Like Mario,

Zelda

Focus on Value Innovation (Pioneer -

Motion Sensing)

Simple User Interface and Greater

Playability

Family Friendly Values

Backward Compatibility

Attracting traditional Non Gamers to

the gaming world by offering them

unique entertainment value

Focus on providing an immersive and

entertaining experience

Weakness

Low focus on offering online user

experience

e.g. No unied user account system

Lack of innovative video games

(partly due to poor tie ups with third

party developers)

Complete exclusion/ignorance of

DVD gaming market

Unable to back up / Replicate the

Huge success of Wii with new

product launches like Wii U

Complete lack of focus on the

hardcore gamers needs and

expectations

Opportunities

New unifying Nintendo OS under

development for coming release

Tablet games can be ported to Wii U

without hassle

Microsoft XBOX One seemingly

missing the mark with consumers

Aging population in Developed

markets

Growing consumer base in emerging

markets

Improved online experience through

improved OS and a unified account

system

Threats

Sony PlayStation 4 which comes

with Superior motion detectors and

HD graphics

Games available on Smart phones

and Social Media

Third party developers are likely to

flock to other more successful

systems, if the Sales of new launch

Wii U do not improve

The niche possessed by Wii in

motion sensing being eroded away

with numerous new entrants like

Oculus Rift, Valve Steam Box, Ouya

etc.

Wii U will no longer compete in

Blue Ocean

Nintendo & Blue Ocean Strategy

At the end of 2005, Nintendo was hardly sailing smooth. Its GameCube had failed and its

GameBoy withered after reaching an early peak. Its games were also not so well received and

hardly any competition to Sony's PlayStation2.

Nintendo came up with their path breaking product Nintendo Wii in Nov 2006, which

challenged the way a video game was played by creating a completely unique offering

through the introduction of motion sensors in a gaming experience.

When Nintendo introduced Wii, its President talked about Blue Ocean and disruptive

thinking, inspired by Kim Chan and Mauborgne's then-recent book "Blue Ocean Strategy".

Nintendo, he said, intended to not simply compete, but to expand the industry.

Why Nintendo felt the need to create a blue ocean

With the hyped release of Wii, it earned the scorn of gamers because Wii didnt have any

high-definition graphics, its graphical output was a measly 480p in comparison to industry's

1080p ceiling. Wii had a miserable 512MB internal storage compared to the 20GB and 80GB

its competitors had at launch. It had no optical audio-out port nor did it have any external

storage option and also lacked a centralized online service.

In short, Wii could never compete with Xbox or PlayStation and that was the primary reason

of Wii's existence. Rather than fight for the same finite market and dollars, Wii wanted to

create its own market space and attract new audience altogether. Wii's target was beyond just

kids, it was the whole family.

The heart of Wii's strategy was that consoles do not necessarily require state-of-the-art

technology, power and performance. It shifted its focus to providing a new form of player

interaction to a wider audience

How it went about creating the Blue Ocean

Wii simply proved that there are far more noncustomers than customers and that a better

solution to an existing problem is not good enough. Nintendo focused on the demand side and

redefined the problem itself. Nintendo looked into the gaming industry's noncustomers for

insights i.e.; older non-gamers, parents who wanted their kids to play active games, elderly

and the very young.

CREATING BLUE OCEAN

Value innovation

Value innovation is the cornerstone of blue strategy which simply defies the traditional

dilemma of value-cost trade-off. In value innovation, companies dont just concentrate on

value creation or just on innovation. If you concentrate only on value creation, you cannot

stand out in the crowd as competition catches up with you. If only innovation is focused

upon, the value to customers tends to be technology-driven and not cost leadership, which

buyers are not ready to pay for.

Hence in value innovation, instead of focusing on beating the competition, companies focus

on creating a leap in value for buyers and hence make competition irrelevant.

How to implement

Value innovation occurs only when companies align innovation with utility, price, and cost

positions. Buyer value is lifted by raising and creating elements the industry has never

offered. Cost savings are made by eliminating and reducing the factors an industry competes

on. Over time, costs are reduced further due to high sales volumes that superior value

generates. Hence, companies have to drive costs down while driving value up for buyers.

Wii's Value Innovation

Changing the Concept with New Game-Play, New Consumers, New Approach

As of 2005, Nintendo's main business of gaming consoles was a speck in the gaming arena,

with its GameCube selling just 20 million whereas Sony's PS2 had amasses an excess of 115

million buyers. Nintendo desperately needed a radical change in its strategy and market focus

in order to gain major traction in the video game industry.

With the creation of the Wii, Nintendo made radical changes to its strategy:

Now gamers were playing with their families, their friends and not alone in the dark at night.

This was the biggest utility Wii provided. Nintendo changed its focus from the technological

race towards a more user-oriented strategy - from better graphics to having more fun, thus

providing value for its buyers with low costing consoles.

Another cost saving offer was with its Wii Sports package, which includes Baseball,

Bowling, Golf, Tennis etc., some people did not even find a reason to buy more games. Also,

after realizing its past mistake when aiming for a younger audience, Nintendo started tapping

into the casual gamers category; reaching far beyond the hard-core gamers which the PS3

and Xbox 360 target directly.

Analytical tools and frameworks

The Strategy Canvas

The strategy canvas is both a diagnostic and an action framework for building blue ocean

strategy. It serves two main purposes: to understand where the competition is investing and

what the consumer perception is of these offerings. The vertical axis depicts the value derived

from each of the factors the industry competes in (horizontal axis).

The above figure is called the value curve, a graphic depiction of a companys relative

performance across its industrys factors of competition.

The vertical axis depicts the offering level that buyers receive across each factor. All these

factors together depict the strategy that each of the companies chose to differentiate

themselves in the market. These are compared among the competitive group and a certain

value is assessed to be perceived by consumers. The resulting value curve is the graphic

depiction of a companys relative performance across its industrys factors of competition.

Wiis Value Curve

Wiis strategic vision was to lower cost by reducing high-end technological features like

DVD integration, processor quality, graphics etc. but at the same time providing value to the

customer with a new revolutionary motion control stick and a gaming experience with family

and friends which also provides fitness at a lower price point. Thus, Wiis value curve scores

high on the factors of social gaming, fitness, wireless motion-sensing controllers and price.

The Four Actions Framework & E-R-R-C Grid

BOS also defines a framework to reconstruct those buyer value elements that a company

should look across if it intends to create a new market space and hence define its strategic

logic. Called the four action framework, it explains the four key questions to be asked in

order to challenge an industrys strategic logic and business model.

The Eliminate-Reduce-Raise-Create grid pushes companies to not only ask the four questions

but also to act on all four to create a new value curve.

Wiis ERRC Grid

We have tried to map BOS four action framework with Wiis strategies to understand how

Wii has created a Blue Ocean.

Eliminate

High resolution graphics

DVD/HD-DVD Playback

Hard Disk storage

Raise

Hardware accessories

Wireless controller

Social gaming

Fitness & Sports

Backward compatibility

Reduce

Processing power

Graphics quality

Online gaming

Complexity of games

Price

Create

Motion sensor controller

Family-friendly gaming

Character customization

Active fun

New

Value

REDUCE

Which factors

should be

reduces well

below the

industry

standard ?

CREATE

What Factors

should be

created that

the industry

has never

offered ?

ELIMINATE

What factors

should be

eliminated that

the consumers

dont require ?

RAISE

What factors

should be

raised well

beyond the

industry

standard ?

Strategically

reduce cost

Strategically

invest in

Three Characteristics of a Good Strategy

When expressed through a value curve, then, an effective blue ocean strategy like has three

complementary qualities: focus, divergence, and a compelling tagline.

Focus

Looking at the value curve of Wii, it is clear that the focus is on ease of use and interactive

games for groups. In contrast, Microsoft and Sony concentrated on high definition graphics

and complex games which made it very difficult for them to focus on developing motion

sensor based video games as well as consoles. Consequently, Wii could sell more appealing

group oriented games and consoles at cheaper prices than the Xbox and PlayStation 2 games

and consoles.

Divergence

On the strategy canvas, therefore, reactive strategists tend to share the same strategic profile.

In case of Nintendo Wii, the value curve of Microsoft Xbox and Sony PlayStation 2 are

virtually identical. Wii, however, pioneered the motion sensor based gameplay and brought in

the non-traditional buyer group of non-gaming women and elderly.

Compelling Tagline

A good tagline delivers a clear message to gain customers interest and trust. Nintendo Wiis

tagline Wii would like to play delivered a clear message that it was focused on a group

based gameplay which proved to be a game changer in the industry.

6 Paths Framework

To break out of red oceans, companies must look beyond the generally accepted boundaries

that define the competition. Instead of confining themselves within these boundaries,

managers need to look systematically across them to create blue oceans. They need to look

across alternative industries, across strategic groups, across buyer groups, across

complementary product and service offerings, across the functional-emotional orientation of

an industry, and even across time. This gives companies keen insight into how to reconstruct

market realities to open up blue oceans.

Looking Across Buyer Groups

Till 2006, Nintendo had been fighting Sony PlayStation 2 and Microsoft Xbox on the

technological front. The industry was dominated by high definition graphics and complex

games. The competition was intense since low differentiation was forcing companies to lower

price of offerings. This meant that profit could be achieved only through huge sales volumes.

Nintendo found out that 2 of the biggest factors which affected the sale of video games were

the fact that parents believed that video games made children obese and isolated them from

their families and made them socially awkward.

A CDC/NCHS study shows that 18.4% of children in US suffer from obesity. 99% of boys

under 18 and 94% of girls under 18 report playing video-games regularly. In a related study,

NCOOR discovered that children and adolescents aged 8-18 years spend, on average, more

than six hours per day watching television, playing video games and using other types of

media. Hence there was a clear link between the rise of obesity and video games.

Nintendo addressed this problem by coming up with a new gaming console based on motion

capture the Nintendo Wii. The Wii had easier games and titles appealing to older audiences.

The fact that Wii combined fun with exercise made it very attractive to the parents who were

the main buyers in the industry. Games were designed keeping the family involvement in

mind. Nintendo essentially created a new market space for itself by targeting a completely

different buyer group than the traditional gamers.

In most industries, competitors usually define the target buyer in similar terms. In reality,

though, there exists a chain of buyers who are directly or indirectly involved in the buying

decision. The purchasers who pay for the product or service may differ from the actual users,

and in some cases there are important influencers as well. Although these three groups may

overlap, they often differ.

In case of the video game industry, the avid gamer of age group 18-25 was the main target.

Nintendo, before Wii, targeted the under-18 market, which represented only 1/3 of the total

market. This put a cap on Nintendos success, a strong differentiation from its competitors

who had a higher price but targeted an older audience with much more buying power.

Wii's target was beyond just kids, it was the whole family. The heart of Wii's strategy was

that consoles do not necessarily require state-of-the-art technology, power and performance.

It shifted its focus to providing a new form of player interaction to a wider audience. The new

Wii boosted the fun factor and made video gaming active fun.

Four Steps of Visualizing Strategy

Visual Awakening

Firstly create an as is (status quo or the current situation) strategy canvas of the company in

comparison with the competitors on a set of competitive factors. Then look at the factors that

need to be modified.

Visual Exploration

Venture into the field to explore the six paths to creating blue oceans. Evaluate the distinctive

advantages of alternative products and services. Use the four actions framework to determine

which factors to raise, reduce, create and eliminate. The alternative products/services in the

case of Wii were field sports played by those who wanted to stay fit. The advantages offered

were entertainment and fitness.

Visual Strategy Fair

Create the To Be Strategy Canvas based on insights from field observations. Get feedback on

alternative strategy canvases from customers, competitors customers and non-customers.

Use Utilize the feedback to choose the best 'to be' future strategy. The strategists at Nintendo

tried to answer the question why aren't more people playing videogames? Reflecting on

this question gave them two insights. The first, the game consoles in the market had become

far too complicated. Most people felt intimidated by that. And the second insight was that

most games were created for hard-core gamers, which again put people off.

Visual Communication

Distribute your before-and-after strategic profiles on one page for easy comparison. Support

only those projects and operational moves that allow your company close the gaps to

actualize the new strategy.

Expanding demand in the Blue Ocean

Another principle of Blue Ocean Strategy talks about reaching beyond existing demand. To

expand the demand, this principle says that companies should challenge two conventional

practices: 1) focus on existing customers 2) drive for finer market segmentation.

By reversing the strategic course from the above two practices, companies can maximize the

size of their blue oceans. To do this, a company should look to noncustomers. And instead of

focusing on differences, they need to build on powerful commonalities in what buyers value.

Nintendo did exactly this. It looked beyond its existing customer base and built a product that

appealed to a larger mass, thereby attracting non-gamers and casual gamers. It built on

commonalities that buyers value: ease of use, family gaming and active fun.

The Three Tiers Of Noncustomers

There are 3 tiers of noncustomers that can be transformed into customers by a company in

Blue Ocean.

Wiis three tiers

The Wii offers the first tier a leap of value that attracts them (casual gamers), and, while the

second tier customers seem mostly unaffected, it is the third tier that was readily attracted by

the Wii. The 1

st

tier was attracted because of the price point and new motion sensing

controllers. Wiis strategy also pulled in the 2

nd

tier customers to an extent because of the

first-of-its-kind motion controller cum active gaming. However, the 3

rd

tier was Wiis biggest

pull because of the simplicity of its games, the fitness-oriented gaming provided and the idea

of playing with your family.

The Wii has even been praised for use as means of recovery as physical therapy for patients,

being prescribed by doctors to regain strength and help with rehabilitation of certain injuries.

The Right Strategic Sequence

With an understanding of the right strategic sequence and of how to assess blue ocean ideas

along the key criteria in that sequence, one can reduce business model risk. Companies need

to build their blue ocean strategy in the sequence of buyer utility, price, cost, and adoption.

Wiis Strategic Sequence

The Blue Ocean Idea (BOI) Index

Microsoft

Xbox

Sony

PS2

Nintendo

Wii

Utility Is there exceptional utility? Are there

compelling reasons to buy your offering?

Price Is your price easily accessible to the mass of

buyers?

Cost Does your cost structure meet the target

cost?

Adoption Have you addressed adoption hurdles up

front?

Vous aimerez peut-être aussi

- Azamat Anvarov - SIM - Blue Ocean StrategyDocument15 pagesAzamat Anvarov - SIM - Blue Ocean StrategyAzamat AnvarovPas encore d'évaluation

- Blue Ocean Strategy (OM)Document4 pagesBlue Ocean Strategy (OM)SorayaInayahFidran100% (1)

- Innovative Tools Report Title Under 40 CharactersDocument9 pagesInnovative Tools Report Title Under 40 CharactersDarren Tan Chee ZhePas encore d'évaluation

- Blue Ocean StrategyDocument24 pagesBlue Ocean StrategyPaurush YadavPas encore d'évaluation

- Blue Ocean Strategy Book ReviewDocument8 pagesBlue Ocean Strategy Book ReviewKarl BarnuevoPas encore d'évaluation

- Blue Ocean Strategy Business ApplicationDocument19 pagesBlue Ocean Strategy Business ApplicationMonir HosenPas encore d'évaluation

- Transfering Corner Office Strategy Into Frontline ActionDocument10 pagesTransfering Corner Office Strategy Into Frontline ActionShailanchal Uniyal0% (2)

- Blue Ocean Shift CasebookDocument39 pagesBlue Ocean Shift CasebookMarwan AzouriPas encore d'évaluation

- The Ten Types of Innovation (Doblin Inc.)Document1 pageThe Ten Types of Innovation (Doblin Inc.)Berry CheungPas encore d'évaluation

- Blue Ocean Simulation: StrategyDocument38 pagesBlue Ocean Simulation: StrategyArif Kamal BasyariahPas encore d'évaluation

- Blue Ocean Vs Red OceanDocument16 pagesBlue Ocean Vs Red OceanQema Jue100% (1)

- SCP Paradigm Industrial DynamicsDocument37 pagesSCP Paradigm Industrial DynamicsAndi Yosh100% (1)

- Six Misconceptions About Blue Ocean Strategy JiDocument8 pagesSix Misconceptions About Blue Ocean Strategy Jigusti_muhammad_1Pas encore d'évaluation

- Quest MBA EnI Pragya Budhathoki Assignment IIDocument8 pagesQuest MBA EnI Pragya Budhathoki Assignment IIpragya budhathokiPas encore d'évaluation

- Red Vs Blue Ocean StrategiesDocument3 pagesRed Vs Blue Ocean StrategiesMuhammad AfzalPas encore d'évaluation

- Blue Ocean Strategy for US Wine Industry with Yellow TailDocument8 pagesBlue Ocean Strategy for US Wine Industry with Yellow TailAyan100% (1)

- Review On Blue Ocean StrategyDocument7 pagesReview On Blue Ocean StrategynisargoPas encore d'évaluation

- Blue Ocean ShiftDocument67 pagesBlue Ocean ShiftMuhammad Syafiq100% (4)

- Blue Ocean StrategyDocument44 pagesBlue Ocean StrategyVijaykumarPas encore d'évaluation

- Dry Idea B Case Study NoteDocument4 pagesDry Idea B Case Study NoteSenthil KumarPas encore d'évaluation

- Lenovo's acquisition of IBM PC business through eclectic paradigm analysisDocument3 pagesLenovo's acquisition of IBM PC business through eclectic paradigm analysisraviyadavilliPas encore d'évaluation

- Portfolio AnalysisDocument20 pagesPortfolio AnalysisevaPas encore d'évaluation

- Marketingmanagement 120821023825 Phpapp02Document45 pagesMarketingmanagement 120821023825 Phpapp02ratiPas encore d'évaluation

- BOSS3 B2C Intro Round Blue 1Document40 pagesBOSS3 B2C Intro Round Blue 1Kiril Iliev100% (1)

- Disruptive InnovationDocument8 pagesDisruptive InnovationSudeep Doke100% (1)

- Responding To The Wii: Group E Avijit Singh Yadav, Bishwadeep Bagchi, Himanshu Jha, Krupa Bathia, Tanmay SrivastavaDocument7 pagesResponding To The Wii: Group E Avijit Singh Yadav, Bishwadeep Bagchi, Himanshu Jha, Krupa Bathia, Tanmay SrivastavaNaimil ShahPas encore d'évaluation

- BOSS Assignment 1Document14 pagesBOSS Assignment 1charu.chopra3237100% (1)

- Global Strategy SyllabusDocument28 pagesGlobal Strategy SyllabusjulioruizPas encore d'évaluation

- Blue Ocean StrategyDocument12 pagesBlue Ocean StrategySandeep MohanPas encore d'évaluation

- Blue Ocean StrategyDocument17 pagesBlue Ocean StrategyakshitaPas encore d'évaluation

- Paper - JCPenneyDocument44 pagesPaper - JCPenneySyeda Fakiha AliPas encore d'évaluation

- Blue Ocean Strategy for Perfetti's Herbal CandyDocument5 pagesBlue Ocean Strategy for Perfetti's Herbal Candyanubhav7286Pas encore d'évaluation

- Disney 'S Successful Adaptation in Hong Kong: A Glocalization PerspectiveDocument15 pagesDisney 'S Successful Adaptation in Hong Kong: A Glocalization PerspectiveLee Tat ShingPas encore d'évaluation

- Blue Ocean Strategy - SynopsisDocument22 pagesBlue Ocean Strategy - SynopsisMario Luis Tavares Ferreira100% (9)

- Blue Ocean Strategy - INBDocument61 pagesBlue Ocean Strategy - INBKarthik Achin100% (1)

- OnePlus Two Targets U.S. Market OpportunitiesDocument27 pagesOnePlus Two Targets U.S. Market OpportunitiesgeetaPas encore d'évaluation

- VRIN framework explains why Netflix market share unsustainableDocument3 pagesVRIN framework explains why Netflix market share unsustainablejacklee1918Pas encore d'évaluation

- The Marketing Strategy Of: XiaomiDocument13 pagesThe Marketing Strategy Of: XiaomiThan Duc Luong (FGW HN)Pas encore d'évaluation

- How Open Is InnovationDocument11 pagesHow Open Is InnovationkarishmakakarishmaPas encore d'évaluation

- Target Case StudyDocument10 pagesTarget Case StudyAbbie Sajonia DollenoPas encore d'évaluation

- Open InnovationDocument199 pagesOpen InnovationyesterowPas encore d'évaluation

- Corporate Entrepreneurship - HowDocument30 pagesCorporate Entrepreneurship - HowHoang Anh TuanPas encore d'évaluation

- Blue Ocean Simulation: StrategyDocument26 pagesBlue Ocean Simulation: StrategyParitosh PushpPas encore d'évaluation

- Hypercompetitive MarketDocument9 pagesHypercompetitive MarketGarima Mohit JindalPas encore d'évaluation

- Blue Ocean IkeaDocument11 pagesBlue Ocean IkeaJose Florez0% (1)

- NotesDocument7 pagesNoteschady.ayrouthPas encore d'évaluation

- Five Generations of Innovation ModelsDocument5 pagesFive Generations of Innovation ModelsJavi OlivoPas encore d'évaluation

- Gillette Dry IdeaDocument12 pagesGillette Dry IdeaShruti PandeyPas encore d'évaluation

- Capstone Round 0 ReportDocument16 pagesCapstone Round 0 Reportcricket1223100% (1)

- A CEO's Perspective - Making Innovation Work by Galvin 2010Document2 pagesA CEO's Perspective - Making Innovation Work by Galvin 2010International Journal of Innovation SciencePas encore d'évaluation

- Avery Dennison Case Study2Document6 pagesAvery Dennison Case Study2bossdzPas encore d'évaluation

- Value Merchants Anderson eDocument5 pagesValue Merchants Anderson esarah123Pas encore d'évaluation

- Barney Strategy Map 1Document16 pagesBarney Strategy Map 1rhariprasadr100% (1)

- The Internationalization of Indian FirmsDocument252 pagesThe Internationalization of Indian FirmsManmeet KaurPas encore d'évaluation

- SiemensDocument11 pagesSiemensMegha ParabPas encore d'évaluation

- Nielsen Global New Product Innovation Report June 2015 PDFDocument37 pagesNielsen Global New Product Innovation Report June 2015 PDFarchana1111100% (1)

- Innovation Best Practices 3mDocument4 pagesInnovation Best Practices 3mDarleen Joy UdtujanPas encore d'évaluation

- Managing Innovation Case Study on Nintendo's Wii Console SuccessDocument12 pagesManaging Innovation Case Study on Nintendo's Wii Console SuccessLeonel Zapata BernalPas encore d'évaluation

- Nintendos Disruptive Strategy Implications For The Video Game IndustryDocument19 pagesNintendos Disruptive Strategy Implications For The Video Game Industrybmobilelee100% (1)

- Pepperfry - The Litmus TestDocument12 pagesPepperfry - The Litmus TestkaykscribdPas encore d'évaluation

- Culinarian CookwareDocument16 pagesCulinarian Cookwarekaykscribd100% (2)

- Giant Consumer ProductsDocument9 pagesGiant Consumer Productskaykscribd100% (2)

- BankerToThePoor Book ReviewDocument12 pagesBankerToThePoor Book ReviewkaykscribdPas encore d'évaluation

- The Home Video Game Industry:) Case Study Analysis (Document6 pagesThe Home Video Game Industry:) Case Study Analysis (الباحث عن المعرفةPas encore d'évaluation

- Microsoft Activision Final ReportDocument418 pagesMicrosoft Activision Final ReportMelek sarePas encore d'évaluation

- Video Game Industry DissertationDocument6 pagesVideo Game Industry DissertationPaySomeoneToWriteAPaperForMeCanada100% (1)

- 7395 398 WL Console RevA WebDocument7 pages7395 398 WL Console RevA WebSebastian Ezequiel Gomez GiuggioloniPas encore d'évaluation

- Architectural Thesis On Gaming and Animation InstituteDocument67 pagesArchitectural Thesis On Gaming and Animation InstituteAnas AnsARi Studio77% (13)

- Gaming Consoles Seminar ReportDocument82 pagesGaming Consoles Seminar ReportsiyavsPas encore d'évaluation

- 0004 1016 V4-Datasheet-Tetra-Srg3900 English LRDocument4 pages0004 1016 V4-Datasheet-Tetra-Srg3900 English LRPSAILAPas encore d'évaluation

- History of Early Computer GamesDocument30 pagesHistory of Early Computer GamesKyle GammadPas encore d'évaluation

- Nintendo Interactive Branding AuditDocument25 pagesNintendo Interactive Branding AuditmeganPas encore d'évaluation

- Arts10 Q2-2bDocument12 pagesArts10 Q2-2bAnita MusniPas encore d'évaluation

- Dragonball Z Budokai Tenkaichi 2 - ManualDocument18 pagesDragonball Z Budokai Tenkaichi 2 - ManualFelipe MarquesPas encore d'évaluation

- Nintendo (Marketing Research)Document12 pagesNintendo (Marketing Research)afif12Pas encore d'évaluation

- Manual Mando Xbox360 PDFDocument2 pagesManual Mando Xbox360 PDFCarlos Garcia PajePas encore d'évaluation

- (Benjamins Translation Library) Minako O'Hagan, Carmen Mangiron - Game Localization - Translating For The Global Digital Entertainment Industry-John Benjamins (2013)Document387 pages(Benjamins Translation Library) Minako O'Hagan, Carmen Mangiron - Game Localization - Translating For The Global Digital Entertainment Industry-John Benjamins (2013)SIMONE VIEIRA RESENDEPas encore d'évaluation

- Nintendo Disruptive StrategyDocument8 pagesNintendo Disruptive StrategykingofdealPas encore d'évaluation

- Connect and Configure SupplementDocument4 pagesConnect and Configure SupplementLiamJeePas encore d'évaluation

- Introduction to TDC 3000 Automation SystemsDocument267 pagesIntroduction to TDC 3000 Automation SystemsGabriela VelazquezPas encore d'évaluation

- The Rough Guide To Video GamesDocument316 pagesThe Rough Guide To Video GamesFelipe Andres Villalobos100% (3)

- JRC60711Document185 pagesJRC60711internezz100% (1)

- Single Button Game Console With Arduino and PCBDocument23 pagesSingle Button Game Console With Arduino and PCBRusiu SieradzPas encore d'évaluation

- Survey DetailsDocument41 pagesSurvey DetailsTOBIAS UNTERFRANZPas encore d'évaluation

- 1-EA in Online GamingDocument2 pages1-EA in Online GamingCharan CvPas encore d'évaluation

- YouGov Gaming and Esports Whitepaper 2023 Reaching Gamers EverywhereDocument37 pagesYouGov Gaming and Esports Whitepaper 2023 Reaching Gamers Everywheredyego77Pas encore d'évaluation

- Games PS2 FATAL FRAME User ManualDocument18 pagesGames PS2 FATAL FRAME User ManualIsaac HidalgoPas encore d'évaluation

- The Medium of The VideoGameDocument5 pagesThe Medium of The VideoGameCJ CuchillaPas encore d'évaluation

- 1970s - Birth of The Video Game Machines: Roberto DeborahDocument1 page1970s - Birth of The Video Game Machines: Roberto DeborahSarshPas encore d'évaluation

- Video GamesDocument33 pagesVideo GamesEmpire kingPas encore d'évaluation

- Game Consoles Strategic Tools PDFDocument20 pagesGame Consoles Strategic Tools PDFMariaPas encore d'évaluation

- Mitel SX-50 Attendant Console Users GuideDocument87 pagesMitel SX-50 Attendant Console Users GuideRay FerryPas encore d'évaluation

- Responding to the Wii Case: Strategies for Regaining Market LeadershipDocument10 pagesResponding to the Wii Case: Strategies for Regaining Market LeadershipHao GuPas encore d'évaluation