Académique Documents

Professionnel Documents

Culture Documents

PROP 1 Information

Transféré par

apackof20 évaluation0% ont trouvé ce document utile (0 vote)

167 vues5 pagesWayne County Taxpayers Association Position Paper and Citizens Research Council of Michigan Key Summary

Grassroots in Michigan Research

http://grassrootsmichigan.com/

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentWayne County Taxpayers Association Position Paper and Citizens Research Council of Michigan Key Summary

Grassroots in Michigan Research

http://grassrootsmichigan.com/

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

167 vues5 pagesPROP 1 Information

Transféré par

apackof2Wayne County Taxpayers Association Position Paper and Citizens Research Council of Michigan Key Summary

Grassroots in Michigan Research

http://grassrootsmichigan.com/

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 5

Wayne County Taxpayers Association Position Paper

and Citizens Research Council of Michigan Paper

Proposal 1

APPROVAL OR DISAPPROVAL OF AMENDATORY ACT TO REDUCE STATE USE

TAX AND REPLACE WITH A LOCAL COMMUNITY STABILIZATION SHARE TO

MODERNIZE THE TAX SYSTEM TO HELP SMALL BUSINESSES GROW AND

CREATE JOBS

The amendatory act adopted by the Legislature would:

1. Reduce the state use tax and replace with a local community stabilization share

of the tax for the purpose of modernizing the tax system to help small businesses

grow and create jobs in Michigan.

2. Require Local Community Stabilization Authority to provide revenue to local

governments dedicated for local purposes, including police safety, fire

protection, and ambulance emergency services.

3. Increase portion of state use tax dedicated for aid to local school districts.

4. Prohibit Authority from increasing taxes.

5. Prohibit total use tax rate from exceeding existing constitutional 6% limitation.

Should this law be approved?

************

I want to state that the Personal Property Tax is a horrible tax and a burden to business

and employment. If I were to say to the average taxpayer that their stove, refrigerator,

washer, dryer and any other appliance or furniture were all subject to personal property

tax for 10 years after purchase with a reduction each year for depreciation, we would

have a revolt.

Anyone wishing to understand how the tax works and its effects can go to Personal

Property Tax Reform in Michigan. The Fiscal and Economic Impact of SB 1065-SB

1072, Anderson Economic Group at:

http://www.andersoneconomicgroup.com/SearchAEG/tabid/59/articleType/ArticleView/a

rticleId/8021/Personal-Property-Tax-Reform-in-Michigan-The-Fiscal-and-Economic-

Impact-of-SB-1065SB-1072.aspx or the Citizen Research Council at

https://crcmich.org/TaxOutline/index.html

This is not just an elimination of the Personal Property Tax for some small businesses.

It is about much more. It is my estimation that it was not necessary to place anything on

the ballot to allow the reduction of that tax. Everything they needed is presently included

in the State Constitution as defined in the Headlee Amendment.

Article IX Michigan Constitution

25 Voter approval of increased local taxes; prohibitions; emergency conditions;

repayment of bonded indebtedness guaranteed; implementation of section.

Sec. 25. Property taxes and other local taxes and state taxation and spending may not

be increased above the limitations specified herein without direct voter approval. The

state is prohibited from requiring any new or expanded activities by local governments

without full state financing, from reducing the proportion of state spending in the form of

aid to local governments, or from shifting the tax burden to local government. A

provision for emergency

conditions is established and the repayment of voter approved bonded indebtedness is

guaranteed.

Implementation of this section is specified in Sections 26 through 34, inclusive, of this

Article.

26 Limitation on taxes; revenue limit; refunding or transferring excess

revenues;

exceptions to revenue limitation; adjustment of state revenue and spending

limits.

Sec. 26. There is hereby established a limit on the total amount of taxes which may be

imposed by the legislature in any fiscal year on the taxpayers of this state. This limit

shall not

be changed without approval of the majority of the qualified electors voting thereon, as

provided for in Article 12 of the Constitutio n. If responsibility for funding a program

or programs is transferred from one level of government to another, as a consequence

of constitutional amendment, the state revenue and spending limits may be adjusted to

accommodate such change, provided that the total revenue authorized for

collection by both state and local governments does not exceed that amount which

would have

been authorized without such change.

29 State financing of activities or services required of local government by state

law.

Sec. 29. The state is hereby prohibited from reducing the state financed proportion of

the

necessary costs of any existing activity or service required of units of Local Government

by

state law. A new activity or service or an increase in the level of any activity or service

beyond

that required by existing law shall not be required by the legislature or any state agency

of

units of Local Government, unless a state appropriation is made and disbursed of Local

Government for any necessary increased costs. The provision of this section shall not

apply to costs incurred pursuant to Article VI, Section 18 to pay the unit.

There are 10 Senate Bills connected to this proposal. Nowhere in the ballot language is

a Personal Property Tax mentioned specifically. The bills range from SB821 through

SB830. For brevity and simplification I will address SB822 which must be passed for

most of the others to take effect.

.

We start our problem with the establishment of yet another Authority which would be

granted enormous power. Since this new Authority would not be elected by the voters,

there would be no true accountability but they would have the responsibility of handling

a huge amount of our money.

BEGINNING ON OCTOBER 1, 2015, THE SPECIFIC TAX LEVIED UNDER

SUBSECTION (1) INCLUDES BOTH A STATE SHARE TAX LEVIED BY THIS STATE

AND A LOCAL COMMUNITY STABILIZATION SHARE TAX AUTHORIZED BY THE

AMENDATORY ACT THAT ADDED SECTION 2C AND LEVIED BY THE

AUTHORITY, WHICH REPLACES THE REDUCED STATE SHARE AT THE

FOLLOWING RATES IN EACH OF THE FOLLOWING STATE FISCAL YEARS

Legislation then goes on to define the states portion of THE LOCAL COMMUNITY

STABILIZATION SHARE TAX RATE TO BE LEVIED BY THE AUTHORITY IS THAT

RATE CALCULATED BY THE DEPARTMENT OF TREASURY ON BEHALF OF THE

AUTHORITY THE STATE SHARE TAX RATE IS THAT RATE DETERMINED BY

SUBTRACTING THE LOCAL COMMUNITY STABILIZATION SHARE TAX RATE

FROM 6%.

The state then declares the revenue portion from 2015-2016 through 2029 without

knowing the accuracy of the amount listed. They will also be committing future

legislatures to a dollar amount.

This Authority would be granted an enormous responsibility. That cannot be good for

taxpayers. The line in the proposal that limits the used/sales tax to 6% does not

address the expansion of the sales tax to, for example, internet purchases or fines or

penalties for failure to comply. It does not address other things that they may choose to

include as taxable by the sales tax which they seem to think they have the authority to

adjust.

Whatever your feelings on taxes, this proposal does not give the taxpayer more

security. The language does not reflect the full nature of the outcome if it passes. If you

have concerns, I will be glad to forward copies of the bills. Please feel free to contact

me with any questions or comments. wctaxpayers@comcast.net . 313-278-8383.

The Wayne County Taxpayer Association suggests vote NO on

Proposal 1

Citizens Research Council of Michigan

http://www.crcmich.org/PUBLICAT/2010s/2014/memo1128.pdf

Summary of Key Issues

State policymakers succeeded in 2012 in enacting legislation to eliminate a large

portion of the personal property tax burden on Michigan businesses, pacticularly those

involved in the manufacturing sector.

They followed up that success with revised legislation in 2014 part of a compromise

reached with local government organizations that would largely reimburse local units

of government for their revenue losses under the new PPT exemptions. Given the

fiscal tensions between the state and local units of government, the agreement relies on

a unique and somewhat peculiar arrangement through which a new local (yet statewide)

unit of government is given authority to levy a portion of the states existing use tax as a

new local tax. Given this construct, constitutional restrictions on new local taxes require

approval by local voters which in this unique case, is all of the Michigan electorate.

The package also comes at a price.

The reimbursement provisions contained in the package are not cheap, and the State of

Michigan will forego an increasing amount of its general fund/general purpose revenue

in future years in order to hold local governments harmless from the PPT reforms. The

net loss to GF/GP revenue rises to over $500 million by FY2025, and this foregone

revenue also means foregone opportunities to use this revenue to meet other budget

priorities.

State voters in August will be asked, in a direct sense, to vote on the proposed

redirection of the states existing use tax revenue to help facilitate the reimbursement to

local governments of lost PPT revenues. But again, the vote has much broader

implications as a rejection of the ballot measure effectively repeals the entire set of

reforms, essentially re-establishing the imposition of the personal property tax on

businesses and canceling the need for the local reimbursement. Valid arguments have

been advanced by supporters of the PPT repeal that the reforms will enhance business

competitiveness and encourage additional private sector investment.

Voters will need to weigh these arguments against their own judgments as to the

potential value of other possible budget and tax reforms that could be achieved with the

state GF/GP resources that will otherwise be invested to facilitate the PPT reforms

Vous aimerez peut-être aussi

- Brochure Trifold - Responsible Citizens For Public Safety (RC4PS)Document2 pagesBrochure Trifold - Responsible Citizens For Public Safety (RC4PS)apackof2Pas encore d'évaluation

- Pit Bull Warning Flyer - Responsible Citizens For Public Safety (RC4PS)Document1 pagePit Bull Warning Flyer - Responsible Citizens For Public Safety (RC4PS)apackof2Pas encore d'évaluation

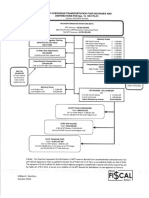

- Michigan 2018-2019 Transportation Fund Revenues and DistributionsDocument1 pageMichigan 2018-2019 Transportation Fund Revenues and Distributionsapackof2100% (1)

- MIGOP 1st District Republican Executive Committee Resolution Against Medicaid Expansion Part 4Document1 pageMIGOP 1st District Republican Executive Committee Resolution Against Medicaid Expansion Part 4apackof2Pas encore d'évaluation

- Michigan Proposal 1 of 2015Document1 pageMichigan Proposal 1 of 2015Beverly TranPas encore d'évaluation

- Patient-Centered Care Solution PresentationDocument10 pagesPatient-Centered Care Solution Presentationapackof2Pas encore d'évaluation

- PRESS RELEASE: State-Wide Grassroots Activists Open Letter To Governor SnyderDocument5 pagesPRESS RELEASE: State-Wide Grassroots Activists Open Letter To Governor Snyderapackof2Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Solvency PPTDocument1 pageSolvency PPTRITU SINHA MBA 2019-21 (Kolkata)Pas encore d'évaluation

- C. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRADocument1 pageC. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRAJocelyn Yemyem Mantilla VelosoPas encore d'évaluation

- Jerolan Trucking Vs CADocument5 pagesJerolan Trucking Vs CAJof BotorPas encore d'évaluation

- George F. Nafziger, Mark W. Walton-Islam at War - A History - Praeger (2008)Document288 pagesGeorge F. Nafziger, Mark W. Walton-Islam at War - A History - Praeger (2008)موسى رجب100% (2)

- Internship Report On Dhaka BankDocument78 pagesInternship Report On Dhaka Bankparvin akhter evaPas encore d'évaluation

- Credit, Background, Financial Check Disclaimer2Document2 pagesCredit, Background, Financial Check Disclaimer2ldigeriePas encore d'évaluation

- RA 8042 As Amended by RA 10022Document28 pagesRA 8042 As Amended by RA 10022Benjamin Hernandez Jr.50% (8)

- Suggested Solution Far 660 Final Exam December 2019Document6 pagesSuggested Solution Far 660 Final Exam December 2019Nur ShahiraPas encore d'évaluation

- Mathematical Solutions - Part ADocument363 pagesMathematical Solutions - Part ABikash ThapaPas encore d'évaluation

- SALES - Cui Vs Cui - Daroy Vs AbeciaDocument5 pagesSALES - Cui Vs Cui - Daroy Vs AbeciaMariaAyraCelinaBatacan50% (2)

- Why I Love This ChurchDocument3 pagesWhy I Love This ChurchJemicah DonaPas encore d'évaluation

- 20 Rules of Closing A Deal PDFDocument21 pages20 Rules of Closing A Deal PDFbioarquitectura100% (9)

- POCSODocument12 pagesPOCSOPragya RaniPas encore d'évaluation

- Presentation Mini Case MeDocument10 pagesPresentation Mini Case MeMohammad Osman GoniPas encore d'évaluation

- Quality Manual.4Document53 pagesQuality Manual.4dcol13100% (1)

- Job Order ContractDocument1 pageJob Order ContractPaulo Abenio Escober100% (1)

- Global Payments NetworkDocument3 pagesGlobal Payments NetworkSadaqt ZainPas encore d'évaluation

- Foaming at The MouthDocument1 pageFoaming at The Mouth90JDSF8938JLSNF390J3Pas encore d'évaluation

- Mongodb Use Case GuidanceDocument25 pagesMongodb Use Case Guidancecresnera01Pas encore d'évaluation

- UntitledDocument4 pagesUntitledNgân Võ Trần TuyếtPas encore d'évaluation

- DemocarcyDocument5 pagesDemocarcyAdil ZiaPas encore d'évaluation

- Renter Information Rental Information Charge Information: Biswadeep Das Time ChargesDocument1 pageRenter Information Rental Information Charge Information: Biswadeep Das Time ChargesBiswadeep DasPas encore d'évaluation

- What Is Corporate RestructuringDocument45 pagesWhat Is Corporate RestructuringPuneet GroverPas encore d'évaluation

- Catu Vs Atty. RellosaDocument5 pagesCatu Vs Atty. RellosaUnknown userPas encore d'évaluation

- Project WBS DronetechDocument1 pageProject WBS DronetechFunny Huh100% (2)

- Grading Systems in The Netherlands The United States and The United KingdomDocument4 pagesGrading Systems in The Netherlands The United States and The United KingdombaphoPas encore d'évaluation

- ASME Steam Table PDFDocument32 pagesASME Steam Table PDFIsabel Pachucho100% (2)

- A Project Report On Labour LawDocument4 pagesA Project Report On Labour LawSaad Mehmood SiddiquiPas encore d'évaluation

- Recruiting in Europe: A Guide For EmployersDocument12 pagesRecruiting in Europe: A Guide For EmployersLate ArtistPas encore d'évaluation

- 12 Feb 2000 Male Obc-Ncl: Manish KushwahaDocument1 page12 Feb 2000 Male Obc-Ncl: Manish KushwahaManish KushwahaPas encore d'évaluation