Académique Documents

Professionnel Documents

Culture Documents

Stock Analysis Checklist: Sr. No. What Why

Transféré par

Ashish Arora0 évaluation0% ont trouvé ce document utile (0 vote)

271 vues4 pagesStock Analysis

Titre original

Stock Analysis Checklist

Copyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentStock Analysis

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

271 vues4 pagesStock Analysis Checklist: Sr. No. What Why

Transféré par

Ashish AroraStock Analysis

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

Sr.

No. What Why

1

One-year Price chart with 50-day

moving average

Buying a stock while its in a downtrend is dangerous, as it will

likely move lower. A stock is in a downtrend if its price is below its

MA, and in an uptrend if above. Use the 50-day MA.

2 Price/Sales ratio (P/S)

Valuation check. A stock with a P/S above 10 is momentum

priced.

Buying momentum priced stocks is only recommended in a strong

market.

3 Cash Flow per share

Companies with positive operating cash flow are safer investments

than cash burners (negative cash flow).

4 Average Daily Volume (shares)

Institutional buying is an important catalyst for stock price growth.

Institutions buy hundreds of thousands of shares and prefer stocks

with large daily trading volumes so they can easily move in and out

of positions.

5 Financial Health Grade Invest, dont gamble! Stick with companies with solid financials.

6 Growth Grade

Consistent strong sales growth over extended periods translates to

long-term stock price appreciation.

7 Institutional Ownership

Lack of institutional ownership means mutual funds, pension plans

and other institutional buyers dont think they will make money

owning the stock. Why would you want to own it?

8

Number of Analysts Making

Buy/Hold/Sell Recommendations

A companys performance can go unrewarded if nobody knows

about it.

Sufficient analyst coverage is necessary to create investor interest,

especially from institutions.

9 Gross Margin Trend

Changes in gross margin percentages from quarter to quarter

point to changes in a companys competitive position in its

marketplace.

Increasing gross margins signal an improving competitive position,

and declining margins warn of increasing competition.

10

Revenue Growth Rate

Latest Quarter compared to year-

ago quarter

Slowing revenue (sales) growth is an important red flag signaling

danger ahead.

11 Forecast Revenue Growth Rate

Look at consensus revenue forecasts to determine if historical

growth rates are expected to continue.

Advanced Research & Analysis - Calculater Required

Stock Analysis Checklist

12

Accounts Receivables Growth vs.

Sales Growth

Accounts receivables are monies owed by a companys customers

for goods received.

The Accounts Receivables Ratio (ratio) is the net receivables

divided by the revenue for the same quarter.

A significantly higher ratio vs. year-ago is a red flag pointing to

future problems.

Action

O.K. to buy if stock price is above its 50-day moving average.

O.K. to buy if P/S is less than 10. P/S ratios between 3 and 5 are

best for growth stocks.

Ratios below 2 reflect value priced stocks.

O.K. to buy if Cash Flow per share is a positive number.

O.K. to buy if Average Daily Volume is 100,000 shares or higher

(0.1 mil), and above one million shares is best.

O.K. to buy if Financial Health Grade = A, B or C

O.K. to buy if Growth Grade = A or B

O.K. to buy if institutions own at least 30% of shares outstanding.

O.K. to buy if a total of at least four analysts are listed as currently

making strong buy, buy, hold, underperform, or sell

recommendations.

Look only at the total number of analysts making recommendations,

not whether there are more buys than holds, etc.

Gross margin (GM) is the "Gross Profit" divided by "Total Revenue,"

expressed as a percentage.

Calculate the GM for each of the past five quarters, and observe the

GM trend.

O.K. to buy if the trend is flat or increasing. Ignore variations of less

than 1%, e.g. from 41% to 40.5%.

Use your calculator to compute the most recent quarters (MRQ)

revenue growth rate (percentage) vs. the year-ago quarter.

Compare that figure to the 1 Year sales growth listed in the

Growth Rate section.

Ideally, the MRQ growth should exceed the 1-year figure, signaling

accelerating growth. But, it's O.K. to buy if MRQ growth is at least

85 % of 1-Year growth.

Check the forecast revenue growth percentage for the current

quarter vs. the corresponding year-ago quarter.

Ideally, the growth rate should be accelerating but it's O.K. to buy if

the forecast year-over-year revenue growth is at least 80% of the 1-

Year growth from the previous step.

Advanced Research & Analysis - Calculater Required

Stock Analysis Checklist

Compute the ratio for the most recent and the year-ago quarters.

Ideally the most recent ratio would be less than year-ago, but it's

O.K. to buy if the ratio is the same or lower than year-ago. Ignore

increases that are less than 5%, e.g. from 60% to 64%.

Vous aimerez peut-être aussi

- Stock Analysis ChecklistDocument5 pagesStock Analysis Checklistaugur886Pas encore d'évaluation

- Day Trading Academy: Complete Day Trading Guide for Beginners and Advanced Investors: Top Trading Strategies that Every Elite Trader is Using: Option and Stock Trading AdviceD'EverandDay Trading Academy: Complete Day Trading Guide for Beginners and Advanced Investors: Top Trading Strategies that Every Elite Trader is Using: Option and Stock Trading AdviceÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Multibagger Stock IdeasDocument16 pagesMultibagger Stock IdeasNitin KumarPas encore d'évaluation

- Intrinsic Value CalculationDocument9 pagesIntrinsic Value Calculationmumbaideepika100% (1)

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument32 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetRavi RanjanPas encore d'évaluation

- Stock Analysis PointersDocument49 pagesStock Analysis PointershareshpkPas encore d'évaluation

- Investor, You Failed The Psychology Test!: A Safal Niveshak Special Report Exclusively For Subscribers ofDocument33 pagesInvestor, You Failed The Psychology Test!: A Safal Niveshak Special Report Exclusively For Subscribers ofKarambir Singh DhayalPas encore d'évaluation

- Stock Screener Sheet PDFDocument5 pagesStock Screener Sheet PDFSujesh GPas encore d'évaluation

- Recerse DCF Calculation Yellow Manual InputDocument6 pagesRecerse DCF Calculation Yellow Manual InputErvin Khouw100% (1)

- How To Value Stocks - by Value SpreadsheetDocument19 pagesHow To Value Stocks - by Value SpreadsheetNick Kraakman100% (2)

- Stock AnalysisDocument5 pagesStock AnalysisArun Kumar GoyalPas encore d'évaluation

- What Is A Share or Stock?Document12 pagesWhat Is A Share or Stock?Vicky MbaPas encore d'évaluation

- Biggest Lessons of 20 Years InvestingDocument227 pagesBiggest Lessons of 20 Years InvestingRohi Shetty100% (5)

- Safal Niveshak Stock Analysis Excel Version 3.0Document32 pagesSafal Niveshak Stock Analysis Excel Version 3.0SivaRamanPas encore d'évaluation

- My STK NotesDocument22 pagesMy STK Notespammy singhPas encore d'évaluation

- Market Tops Booklet PDFDocument16 pagesMarket Tops Booklet PDFAzraf HamidPas encore d'évaluation

- Vinati Organics - ResearchDocument10 pagesVinati Organics - ResearchjackkapuparaPas encore d'évaluation

- CPR Formula ExcelsheetDocument2 pagesCPR Formula ExcelsheetHarshit KarnaniPas encore d'évaluation

- Value InvestingDocument18 pagesValue InvestingharshmarooPas encore d'évaluation

- Vijay MalikDocument4 pagesVijay MalikJerry LouisPas encore d'évaluation

- Fundamentals of Stock AnalysisDocument39 pagesFundamentals of Stock Analysisraveendhar.k100% (4)

- The Journey of Safal Niveshak (Vishal Khandelwal)Document28 pagesThe Journey of Safal Niveshak (Vishal Khandelwal)Vishal Safal Niveshak Khandelwal100% (1)

- Dalal StreetDocument108 pagesDalal StreetMayank ChandrakarPas encore d'évaluation

- Sharekhan - Fundamental AnalysisDocument72 pagesSharekhan - Fundamental Analysissomeshol9355100% (8)

- SSR Stock Analysis SpreadsheetDocument33 pagesSSR Stock Analysis Spreadsheetpvenky100% (1)

- Which Tool Is Good For Intraday Stock Scanning - QuoraDocument4 pagesWhich Tool Is Good For Intraday Stock Scanning - QuoracsanchezptyPas encore d'évaluation

- 03 MAR MAR2014: Weekly Stock Weekly Stock AnalysisDocument8 pages03 MAR MAR2014: Weekly Stock Weekly Stock AnalysisDewayne PuckettPas encore d'évaluation

- Indian Investment BlogsDocument2 pagesIndian Investment BlogsOccasionalVisitorPas encore d'évaluation

- How To Select StocksDocument19 pagesHow To Select StocksPrakhyati Raut100% (1)

- Jae Jun's Top 10 Stock Valuation Ratios: Owner EarningsDocument3 pagesJae Jun's Top 10 Stock Valuation Ratios: Owner EarningsAtanas KosturkovPas encore d'évaluation

- Safal Niveshak Stock Analysis Excel Version 5.0Document49 pagesSafal Niveshak Stock Analysis Excel Version 5.0mcmaklerPas encore d'évaluation

- Time Tested Classic Trading Rules For The Modern Trader To FollowDocument19 pagesTime Tested Classic Trading Rules For The Modern Trader To FollowArt James100% (1)

- Videos Trading 2Document2 pagesVideos Trading 2Jesu CryptoPas encore d'évaluation

- Intrinsic Value SpreadsheetDocument6 pagesIntrinsic Value SpreadsheetveeragaPas encore d'évaluation

- Safal Niveshak Stock Analysis Excel (Ver. 5.0) - How To Use This SpreadsheetDocument38 pagesSafal Niveshak Stock Analysis Excel (Ver. 5.0) - How To Use This SpreadsheetThamsPas encore d'évaluation

- Safal Niveshak Mastermind BrochureDocument3 pagesSafal Niveshak Mastermind BrochureNaveen K. JindalPas encore d'évaluation

- NIFTY Options Open Interest AnalysisDocument26 pagesNIFTY Options Open Interest AnalysisindianroadromeoPas encore d'évaluation

- BCI Covered Call Stock Evaluation Worksheet: Option Month: Date: Fundamental Analysis Technical AnalysisDocument2 pagesBCI Covered Call Stock Evaluation Worksheet: Option Month: Date: Fundamental Analysis Technical Analysislramadur1Pas encore d'évaluation

- Multibagger Stocks For Long Term InvestmentsDocument10 pagesMultibagger Stocks For Long Term InvestmentsSaurav KumarPas encore d'évaluation

- Investing ChecklistsDocument6 pagesInvesting ChecklistsDhananjayan JayabalPas encore d'évaluation

- Master Class On Stock TradingDocument163 pagesMaster Class On Stock TradingAbbasi Adrien100% (1)

- Currency 101 - Safal NiveshakDocument4 pagesCurrency 101 - Safal NiveshakArjun GhosePas encore d'évaluation

- Stock Analysis: Financing and InvestingDocument21 pagesStock Analysis: Financing and InvestinganankrisPas encore d'évaluation

- Our Top 3 Swing Trading Setups: Deron WagnerDocument36 pagesOur Top 3 Swing Trading Setups: Deron Wagnerανατολή και πετύχετεPas encore d'évaluation

- My Value InvestingDocument54 pagesMy Value InvestingJitendra SutarPas encore d'évaluation

- Smart MultibaggersDocument12 pagesSmart MultibaggersSudarsan PPas encore d'évaluation

- Earnings: The Indispensable Element of General Stocks: Elements of Stock Market & AnalysisDocument20 pagesEarnings: The Indispensable Element of General Stocks: Elements of Stock Market & AnalysisjosesmnPas encore d'évaluation

- Icicidirect Centre For Financial Learning Equity: Chapter 2 Module 7 Do It Yourself Basic Investment StrategiesDocument6 pagesIcicidirect Centre For Financial Learning Equity: Chapter 2 Module 7 Do It Yourself Basic Investment StrategiesKSPas encore d'évaluation

- Stock Selection Guide (SSG) : Guidelines For BeginnersDocument2 pagesStock Selection Guide (SSG) : Guidelines For BeginnersJAMILALKHATIBPas encore d'évaluation

- How To Avoid Loss and Earn Consistently in Stock Market by Presenjit PaulDocument8 pagesHow To Avoid Loss and Earn Consistently in Stock Market by Presenjit Pauldrmanhattan61075Pas encore d'évaluation

- How To Avoid Losses-2Document15 pagesHow To Avoid Losses-2AngyPas encore d'évaluation

- Bliss Gvs Pharma ReportsDocument104 pagesBliss Gvs Pharma ReportsrenjuPas encore d'évaluation

- An Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Document23 pagesAn Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Saumil ShahPas encore d'évaluation

- Data Analytics Manual - Mero LaganiDocument3 pagesData Analytics Manual - Mero Laganicalibertrader100% (3)

- Chart HelpDocument76 pagesChart HelpRustom SuiPas encore d'évaluation

- Annual Turnover Is A Term Used When Describing The Amount of Securities Removed From ADocument6 pagesAnnual Turnover Is A Term Used When Describing The Amount of Securities Removed From AElitsa DermendzhiyskaPas encore d'évaluation

- Cap Shot GuideDocument3 pagesCap Shot Guidedtwoodward2921Pas encore d'évaluation

- Introduction To Stock ValuationDocument22 pagesIntroduction To Stock ValuationManash SharmaPas encore d'évaluation

- The Little BookDocument7 pagesThe Little BookGaurav ChhibbaPas encore d'évaluation

- CCTV and VMS SpecsDocument8 pagesCCTV and VMS SpecsAshish AroraPas encore d'évaluation

- ITS - SurveyDocument34 pagesITS - SurveyAshish AroraPas encore d'évaluation

- ATCCDocument3 pagesATCCAshish AroraPas encore d'évaluation

- Binomial Option Pricing - f-0943Document12 pagesBinomial Option Pricing - f-0943Ashish AroraPas encore d'évaluation

- 1134 How To Use Fibonacci Retracement To Predict Forex Market PDFDocument14 pages1134 How To Use Fibonacci Retracement To Predict Forex Market PDFHmt NmslPas encore d'évaluation

- NCFM Fundamental Analysis ModuleDocument88 pagesNCFM Fundamental Analysis Moduleamo87% (15)

- Backup and DR ProposalDocument12 pagesBackup and DR ProposalAshish Arora100% (1)

- Balance Sheet PDFDocument21 pagesBalance Sheet PDFLambourghiniPas encore d'évaluation

- I Love PDFDocument202 pagesI Love PDFYogesh VadherPas encore d'évaluation

- C. Either A or B.: Discussion ProblemsDocument8 pagesC. Either A or B.: Discussion ProblemsGlen JavellanaPas encore d'évaluation

- Tutorial 3 Answer SegmentalDocument6 pagesTutorial 3 Answer Segmental--bolabolaPas encore d'évaluation

- Cellular Lightweight Concrete BlocksDocument71 pagesCellular Lightweight Concrete BlocksRavi Kumar Mogilsetti100% (1)

- Current Ratio: Liquidity Analysis RatiosDocument4 pagesCurrent Ratio: Liquidity Analysis RatiosRahul KaulPas encore d'évaluation

- Segment Reporting and The Contribution ApproachDocument53 pagesSegment Reporting and The Contribution ApproachAbuShahidPas encore d'évaluation

- Assignment On Ratio Analysis On Beximco Pharmaceutical Ltd. Presented by Group: PlatinumDocument19 pagesAssignment On Ratio Analysis On Beximco Pharmaceutical Ltd. Presented by Group: PlatinumProttoy HaquePas encore d'évaluation

- YamahaDocument28 pagesYamahaNguyenZumPas encore d'évaluation

- Cadet Uniform ServicesDocument62 pagesCadet Uniform ServicesManzoor A Khoda67% (6)

- Baseball Stadium Financing SummaryDocument1 pageBaseball Stadium Financing SummarypotomacstreetPas encore d'évaluation

- K ElectricDocument9 pagesK ElectricAyesha Bareen.Pas encore d'évaluation

- Form ITR-6Document35 pagesForm ITR-6Accounting & TaxationPas encore d'évaluation

- 7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperShehroze Ali JanPas encore d'évaluation

- Chapter 1 TATODocument25 pagesChapter 1 TATOAdhil NazerPas encore d'évaluation

- Standardized Financial Statements - SolutionDocument25 pagesStandardized Financial Statements - SolutionanisaPas encore d'évaluation

- self+destructive+habits+TheSmartManager,+JagdishSeth,+Jun-Jul+07 412Document12 pagesself+destructive+habits+TheSmartManager,+JagdishSeth,+Jun-Jul+07 412Nabendu BhaumikPas encore d'évaluation

- Basic Overview of Financial Statements: Income Statement Balance Sheet Cash Flow StatementDocument10 pagesBasic Overview of Financial Statements: Income Statement Balance Sheet Cash Flow StatementRutuja KunkulolPas encore d'évaluation

- Seminar 4 2017Document98 pagesSeminar 4 2017Stephanie XiePas encore d'évaluation

- Chapter 5 Accounting For Merchandising OperationsDocument15 pagesChapter 5 Accounting For Merchandising OperationsSantun Pi TOen100% (2)

- ACC501 Midterm Solved Subjective PapersDocument37 pagesACC501 Midterm Solved Subjective PapersMuhammad SherjeelPas encore d'évaluation

- Oracle 11i and R12 Time and Labor (OTL) Timecard Configuration (Doc ID 304340.1)Document17 pagesOracle 11i and R12 Time and Labor (OTL) Timecard Configuration (Doc ID 304340.1)krishnaPas encore d'évaluation

- Ind As 115 - SolutionsDocument44 pagesInd As 115 - Solutionssoumya saswatPas encore d'évaluation

- Ratio Analysis-1Document4 pagesRatio Analysis-1Ramakrishna J RPas encore d'évaluation

- Reading Sample Sappress 1805 Saps4hanafinancewhatsnewDocument27 pagesReading Sample Sappress 1805 Saps4hanafinancewhatsnewDudhmogrePas encore d'évaluation

- Loss Reserving WiserDocument76 pagesLoss Reserving WiserTeodelinePas encore d'évaluation

- Handbook of VATDocument66 pagesHandbook of VATMd SelimPas encore d'évaluation

- Detergent Powder ReportDocument26 pagesDetergent Powder ReportAmol LawaniyaPas encore d'évaluation

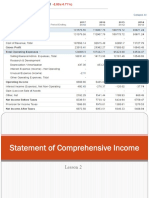

- Lesson 2 Statement of Comprehensive IncomeDocument23 pagesLesson 2 Statement of Comprehensive IncomePaulette Sarno80% (5)

- M1 M5 Baen PoaDocument70 pagesM1 M5 Baen PoaFor Ni-kiPas encore d'évaluation