Académique Documents

Professionnel Documents

Culture Documents

Lecture 13 Bretton Woods II

Transféré par

W. K. WinecoffDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lecture 13 Bretton Woods II

Transféré par

W. K. WinecoffDroits d'auteur :

Formats disponibles

D

r

a

f

t

International Political Economy #13

The Bretton Woods II Monetary System

William Kindred Wineco

Indiana University Bloomington

October 15, 2013

W. K. Wineco | IPE #13: Bretton Woods II 1/15

D

r

a

f

t

Out with the Old

The original Bretton Woods monetary system was unsustainable if it

was successful.

Trin Dilemma: The dollar-gold link would break if

economies kept growing.

Additionally, domestic politics placed demands on governments.

In the US: low taxes + expanding welfare state.

And international politics was dicult for US to manage as well.

Communist expansionism, esp in Indochina.

By the 1970s the old system was doomed. But what would come next?

W. K. Wineco | IPE #13: Bretton Woods II 2/15

D

r

a

f

t

W. K. Wineco | IPE #13: Bretton Woods II 3/15

D

r

a

f

t

W. K. Wineco | IPE #13: Bretton Woods II 4/15

D

r

a

f

t

The Shift

The previous macroeconomic system: independent monetary policy and

xed exchange rates.

The previous political system: independent national politics, democratic

political system.

The new macroeconomic system: independent monetary policy and

oating exchange rates.

The new political system: golden straitjacket or global federalism?

W. K. Wineco | IPE #13: Bretton Woods II 5/15

D

r

a

f

t

The Politics

Which countries would we expect to pick which politics?

Lets think about comparative advantage:

Capital abundant countries should prefer capital openness.

Capital scarce should prefer capital closedness.

W. K. Wineco | IPE #13: Bretton Woods II 6/15

D

r

a

f

t

The Politics

Which countries would we expect to pick which politics?

Lets think about comparative advantage:

Capital abundant countries should prefer capital openness.

Capital scarce should prefer capital closedness.

W. K. Wineco | IPE #13: Bretton Woods II 6/15

D

r

a

f

t

Trends in Capital Openness

W. K. Wineco | IPE #13: Bretton Woods II 7/15

D

r

a

f

t

More Politics

About what wed expect.

But why have developing countries begun liberalizing?

Partly under pressure from developed countries + institutions

(i.e. IMF). More later.

Partly because of changes in domestic politics:

W. K. Wineco | IPE #13: Bretton Woods II 8/15

D

r

a

f

t

The Performance

W. K. Wineco | IPE #13: Bretton Woods II 9/15

D

r

a

f

t

The Politics

Increasing independence plus democratization in the post-Cold War era

meant:

Citizens have more political voice.

Citizens tend to be labor more than capital.

When labor is abundant and capital scarce, labor benets

from capital openness.

Hence, more democracy leads to more capital openness: trend is toward

Global Federalism rather than Golden Straitjacket.

Threatened by crises?

W. K. Wineco | IPE #13: Bretton Woods II 10/15

D

r

a

f

t

Capital Openness

W. K. Wineco | IPE #13: Bretton Woods II 11/15

D

r

a

f

t

Political Openness

W. K. Wineco | IPE #13: Bretton Woods II 12/15

D

r

a

f

t

Bretton Woods II

But the previous patterns of interconnectedness didnt just go away.

The system is still organized around the US $ to a signicant extent.

$ is still more than 60% of known reserves.

$ is still involved in about half of foreign exchange

transactions.

W. K. Wineco | IPE #13: Bretton Woods II 13/15

D

r

a

f

t

Foreign Exchange

G

G

G

G

G

G

G

G

G

G

G

G

G G

G

G

G

G

G

USD

DEM

FRF

XEU

OthEMS

JPY

Oth

GBP

AUD

CAD

CHF

HKD

KRW SEK

INR

CNY

BRL

ZAR

NZD

1998

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G

USD

EUR

JPY

Oth

GBP

AUD

CAD

CHF

HKD

KRW

SEK

INR

BRL

ZAR

NZD

2001

G

G

G

G

G

G

G

G

G

G

G G

G

G

G

G

USD

EUR

JPY

Oth

GBP

AUD

CAD

CHF

HKD

KRW

SEK INR

CNY

BRL

ZAR

NZD

2004

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G

USD

EUR

JPY

Oth

GBP

AUD

CAD

CHF

HKD

KRW

SEK

INR

CNY

BRL

ZAR

NZD

2007

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G

USD

EUR

JPY

Oth

GBP

AUD

CAD

CHF

HKD

KRW

SEK

INR

CNY

BRL

ZAR

NZD

2010

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G

G G

G

G

G

G

G

G

G

USD

EUR

JPY

Oth

GBP

AUD

CAD

CHF

HKD

KRW

SEK

INR

CNY

BRL

ZAR

NZD

MXN RUB

SGD

TRY

NOK

PLN

TWD

DKK

HUF

2013

W. K. Wineco | IPE #13: Bretton Woods II 14/15

D

r

a

f

t

The Exorbitant Privilege Remains

This means the US still benets from the n - 1 condition.

This means the US can have all of capital openness, stable exchange

rates, and monetary independence.

This means the US can have all of economic integration, independent

governance, and democracy.

But it also means that the US can destabilize the system.

And it means that the US must manage capital inows from the rest of

the world.

W. K. Wineco | IPE #13: Bretton Woods II 15/15

Vous aimerez peut-être aussi

- Kennedy Balance of PaymentDocument5 pagesKennedy Balance of PaymentKinza ZaheerPas encore d'évaluation

- Exposed TBZ UAE - Tahnoun Bin Zayed UAE Syriya Sanction - WSJ ExclusiveDocument4 pagesExposed TBZ UAE - Tahnoun Bin Zayed UAE Syriya Sanction - WSJ ExclusiveArabLeaksPas encore d'évaluation

- Lecture 12 Bretton WoodsDocument14 pagesLecture 12 Bretton WoodsW. K. WinecoffPas encore d'évaluation

- Lecture 10 Pre WWII MonetaryDocument18 pagesLecture 10 Pre WWII MonetaryW. K. WinecoffPas encore d'évaluation

- Lecture 14 Politics ImbalancesDocument22 pagesLecture 14 Politics ImbalancesW. K. WinecoffPas encore d'évaluation

- Draft: International Political Economy #8Document21 pagesDraft: International Political Economy #8W. K. WinecoffPas encore d'évaluation

- China Is Top Economy, Not USADocument2 pagesChina Is Top Economy, Not USAAndy YongPas encore d'évaluation

- Draft: International Political Economy #11Document8 pagesDraft: International Political Economy #11W. K. WinecoffPas encore d'évaluation

- G20 Riot ReportDocument5 pagesG20 Riot ReportRaheela KhawajaPas encore d'évaluation

- March 012010 PostsDocument7 pagesMarch 012010 PostsAlbert L. PeiaPas encore d'évaluation

- Studies and PERSPECTIvesDocument41 pagesStudies and PERSPECTIvesIsraelPas encore d'évaluation

- Dissertation Bretton WoodsDocument4 pagesDissertation Bretton WoodsPayForAPaperCanada100% (1)

- Neeraj Chaudhary - Great Depression II Developing Into Something Far MoreDocument15 pagesNeeraj Chaudhary - Great Depression II Developing Into Something Far MoreAlbert L. PeiaPas encore d'évaluation

- Neither A Lender Nor A Borrower Be Richard B. Gold Lend Lease Real Estate Investments Equity ResearchDocument8 pagesNeither A Lender Nor A Borrower Be Richard B. Gold Lend Lease Real Estate Investments Equity ResearchMichael CypriaPas encore d'évaluation

- Global Market Outlook July 2011Document8 pagesGlobal Market Outlook July 2011IceCap Asset ManagementPas encore d'évaluation

- Zero HedgeDocument12 pagesZero HedgeRasta PapaPas encore d'évaluation

- Faber: Don't Buy The Rally: Predicts The Equity Markets Will End Lower inDocument6 pagesFaber: Don't Buy The Rally: Predicts The Equity Markets Will End Lower inAlbert L. PeiaPas encore d'évaluation

- Microsoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Document5 pagesMicrosoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Subramanya BhatPas encore d'évaluation

- Balance of PaymentsDocument4 pagesBalance of Paymentsjamespco_119633823Pas encore d'évaluation

- Why America Is Going To Win The Global Currency Battle: FinancialDocument6 pagesWhy America Is Going To Win The Global Currency Battle: FinancialverliamPas encore d'évaluation

- More Spin, Merger Bubble Activity Helps Lift Stocks For 3rd Day (AP)Document5 pagesMore Spin, Merger Bubble Activity Helps Lift Stocks For 3rd Day (AP)Albert L. PeiaPas encore d'évaluation

- Balance of Payments Accounts Chapter NotesDocument2 pagesBalance of Payments Accounts Chapter NotesJocelyn WilliamsPas encore d'évaluation

- Dow Nasdaq S&P 500: (Video) Gold SurgesDocument7 pagesDow Nasdaq S&P 500: (Video) Gold SurgesAlbert L. PeiaPas encore d'évaluation

- Mike Whitney - If The Coming Wave Of: See RICO CaseDocument9 pagesMike Whitney - If The Coming Wave Of: See RICO CaseAlbert L. PeiaPas encore d'évaluation

- 7 Bernanke Global Savings GlutDocument13 pages7 Bernanke Global Savings GlutNabyKatPas encore d'évaluation

- Lecture 21 Structuralism Vs NeoliberalismDocument15 pagesLecture 21 Structuralism Vs NeoliberalismW. K. WinecoffPas encore d'évaluation

- Doomsday for the US Dollar as World's "Reserve CurrencyDocument7 pagesDoomsday for the US Dollar as World's "Reserve CurrencyklatifdgPas encore d'évaluation

- Economic Insights 25 02 13Document16 pagesEconomic Insights 25 02 13vikashpunglia@rediffmail.comPas encore d'évaluation

- Ben S Bernanke: The Global Saving Glut and The US Current Account DeficitDocument10 pagesBen S Bernanke: The Global Saving Glut and The US Current Account Deficitfc297Pas encore d'évaluation

- Spring 2014 Optimal Bundle: Issue XIDocument2 pagesSpring 2014 Optimal Bundle: Issue XIColennonPas encore d'évaluation

- The Paradox of A Gift: Foreign Aid and Its Conditions: CalledDocument16 pagesThe Paradox of A Gift: Foreign Aid and Its Conditions: CalledGreyie kimPas encore d'évaluation

- February 162010 PostsDocument7 pagesFebruary 162010 PostsAlbert L. PeiaPas encore d'évaluation

- Dow Nasdaq S&P 500: (Video) Gold SurgesDocument5 pagesDow Nasdaq S&P 500: (Video) Gold SurgesAlbert L. PeiaPas encore d'évaluation

- Vishal Manish M (123PS01629) - IMG CommentryDocument7 pagesVishal Manish M (123PS01629) - IMG Commentryamsavalli.vfPas encore d'évaluation

- AssigmentktptDocument5 pagesAssigmentktptCherry KikoPas encore d'évaluation

- Plummeting Dollar, Treasuries, Toxic Waste as QE3 LoomsDocument4 pagesPlummeting Dollar, Treasuries, Toxic Waste as QE3 LoomssankaratPas encore d'évaluation

- 0811 The Greatest Trade of All Time 1Document6 pages0811 The Greatest Trade of All Time 1bi11yPas encore d'évaluation

- The VFilesDocument89 pagesThe VFilesVincit Omnia VeritasPas encore d'évaluation

- CFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentDocument12 pagesCFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentJeremy JamesPas encore d'évaluation

- Rising Jobless Claims Reflect Weakening Recovery (AP)Document6 pagesRising Jobless Claims Reflect Weakening Recovery (AP)Albert L. PeiaPas encore d'évaluation

- Senate Hearing, 114TH Congress - Economic Crisis: The Global Impact of A Greek DefaultDocument50 pagesSenate Hearing, 114TH Congress - Economic Crisis: The Global Impact of A Greek DefaultScribd Government DocsPas encore d'évaluation

- Daily Tel ObamaDocument4 pagesDaily Tel ObamaDonato PaglionicoPas encore d'évaluation

- Dow Nasdaq S&P 500: (Video) Gold SurgesDocument17 pagesDow Nasdaq S&P 500: (Video) Gold SurgesAlbert L. PeiaPas encore d'évaluation

- Dow Nasdaq S&P 500: (Video) Gold SurgesDocument6 pagesDow Nasdaq S&P 500: (Video) Gold SurgesAlbert L. PeiaPas encore d'évaluation

- Op EdDocument15 pagesOp EdJoresol AlorroPas encore d'évaluation

- How The West Fell Out of Love With Economic Growth - The EconomistDocument8 pagesHow The West Fell Out of Love With Economic Growth - The EconomistDito InculoPas encore d'évaluation

- Lajolla Bank Among 4 Closures: True Unemployment Figure Reveals Recession Far From OverDocument5 pagesLajolla Bank Among 4 Closures: True Unemployment Figure Reveals Recession Far From OverAlbert L. PeiaPas encore d'évaluation

- Lecture 1.3 - Weapon of The Dollar - USDocument2 pagesLecture 1.3 - Weapon of The Dollar - USBhargav Sri DhavalaPas encore d'évaluation

- June 142010 PostsDocument28 pagesJune 142010 PostsAlbert L. PeiaPas encore d'évaluation

- Vinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalDocument4 pagesVinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalFinterestPas encore d'évaluation

- What Is The Trade Deficit?: Neil IrwinDocument4 pagesWhat Is The Trade Deficit?: Neil IrwinaaharisPas encore d'évaluation

- How the Dinar and Dong RV Threatens Fiat CurrenciesDocument5 pagesHow the Dinar and Dong RV Threatens Fiat CurrenciesRevdrAnnie MantzPas encore d'évaluation

- Trinity 2012 1nc Fiscal Discipline Key to Perception of DollarDocument23 pagesTrinity 2012 1nc Fiscal Discipline Key to Perception of DollarLing JiaPas encore d'évaluation

- 2011 09 09 Dana CommentaryDocument2 pages2011 09 09 Dana CommentarybgeltmakerPas encore d'évaluation

- InternationalizationoftheYuanandDe DollarizationDocument15 pagesInternationalizationoftheYuanandDe DollarizationAndini valentinaPas encore d'évaluation

- Ard Boun TW D U oDocument6 pagesArd Boun TW D U ooptionarmageddonPas encore d'évaluation

- JPF The G-20 and The Currency War 01Document3 pagesJPF The G-20 and The Currency War 01BruegelPas encore d'évaluation

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsD'EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsPas encore d'évaluation

- Debt CeilingDocument4 pagesDebt Ceilingsam_cancerianPas encore d'évaluation

- The Monarch Report 7-18-11Document4 pagesThe Monarch Report 7-18-11monarchadvisorygroupPas encore d'évaluation

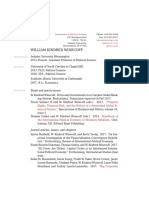

- Winecoff CVDocument9 pagesWinecoff CVW. K. WinecoffPas encore d'évaluation

- Winecoff Y300 Spring2017Document9 pagesWinecoff Y300 Spring2017W. K. WinecoffPas encore d'évaluation

- William Kindred Winecoff: Department of Political ScienceDocument8 pagesWilliam Kindred Winecoff: Department of Political ScienceW. K. WinecoffPas encore d'évaluation

- Winecoff Y376 Fall2017Document11 pagesWinecoff Y376 Fall2017W. K. WinecoffPas encore d'évaluation

- Political Science Y490: The Political Economy of Global InequalityDocument10 pagesPolitical Science Y490: The Political Economy of Global InequalityW. K. WinecoffPas encore d'évaluation

- Winecoff Y109 Fall2017Document11 pagesWinecoff Y109 Fall2017W. K. WinecoffPas encore d'évaluation

- Winecoff Y376 Fall2017Document11 pagesWinecoff Y376 Fall2017W. K. WinecoffPas encore d'évaluation

- Political Science 669: Network Analysis and World Politics: Course DescriptionDocument13 pagesPolitical Science 669: Network Analysis and World Politics: Course DescriptionW. K. WinecoffPas encore d'évaluation

- Winecoff Y669 Spring2018shortDocument19 pagesWinecoff Y669 Spring2018shortW. K. WinecoffPas encore d'évaluation

- Winecoff Y109 Fall2017Document11 pagesWinecoff Y109 Fall2017W. K. WinecoffPas encore d'évaluation

- Political Science Y490: The Political Economy of Global InequalityDocument10 pagesPolitical Science Y490: The Political Economy of Global InequalityW. K. WinecoffPas encore d'évaluation

- Winecoff Y669 Spring2018shortDocument19 pagesWinecoff Y669 Spring2018shortW. K. WinecoffPas encore d'évaluation

- William Kindred Winecoff: Department of Political ScienceDocument8 pagesWilliam Kindred Winecoff: Department of Political ScienceW. K. WinecoffPas encore d'évaluation

- Winecoff Y300 Spring2017Document9 pagesWinecoff Y300 Spring2017W. K. WinecoffPas encore d'évaluation

- William Kindred Winecoff: Department of Political ScienceDocument7 pagesWilliam Kindred Winecoff: Department of Political ScienceW. K. WinecoffPas encore d'évaluation

- William Kindred Winecoff: Department of Political ScienceDocument7 pagesWilliam Kindred Winecoff: Department of Political ScienceW. K. WinecoffPas encore d'évaluation

- Winecoff CVDocument6 pagesWinecoff CVW. K. WinecoffPas encore d'évaluation

- Winecoff CVDocument6 pagesWinecoff CVW. K. WinecoffPas encore d'évaluation

- Winecoff Y109 Fall2015Document11 pagesWinecoff Y109 Fall2015W. K. WinecoffPas encore d'évaluation

- Winecoff Y669 Fall2015Document13 pagesWinecoff Y669 Fall2015W. K. WinecoffPas encore d'évaluation

- Winecoff CVDocument3 pagesWinecoff CVW. K. WinecoffPas encore d'évaluation

- Winecoff Y109 Fall2015Document11 pagesWinecoff Y109 Fall2015W. K. WinecoffPas encore d'évaluation

- Political Science Y200: The Politics of Economic Crisis and ReformDocument9 pagesPolitical Science Y200: The Politics of Economic Crisis and ReformW. K. WinecoffPas encore d'évaluation

- Winecoff 2015 LacaixaDocument11 pagesWinecoff 2015 LacaixaW. K. WinecoffPas encore d'évaluation

- William Kindred Winecoff: AppointmentsDocument3 pagesWilliam Kindred Winecoff: AppointmentsW. K. WinecoffPas encore d'évaluation

- Winecoff 2014 APSADocument17 pagesWinecoff 2014 APSAW. K. WinecoffPas encore d'évaluation

- Winecoff CVDocument4 pagesWinecoff CVW. K. WinecoffPas encore d'évaluation

- Political Science Y490: The Political Economy of Global InequalityDocument10 pagesPolitical Science Y490: The Political Economy of Global InequalityW. K. WinecoffPas encore d'évaluation

- Winecoff Y669 Fall2014Document29 pagesWinecoff Y669 Fall2014W. K. WinecoffPas encore d'évaluation

- Winecoff Y376 Fall2014Document10 pagesWinecoff Y376 Fall2014W. K. WinecoffPas encore d'évaluation

- Political Theory Major ConceptsDocument17 pagesPolitical Theory Major ConceptshenryPas encore d'évaluation

- Public International Law concepts explainedDocument10 pagesPublic International Law concepts explainedSagar BaluPas encore d'évaluation

- Territorial Waters, Exclusive Economic Zones (EEZ) & Continental ShelfDocument5 pagesTerritorial Waters, Exclusive Economic Zones (EEZ) & Continental ShelfGavriil Prigkipakis100% (2)

- Position PaperDocument3 pagesPosition Paperapi-178099475100% (1)

- The Role of International Organisations in World PoliticsDocument8 pagesThe Role of International Organisations in World PoliticsAnonymous i7InXpWAbJPas encore d'évaluation

- The Bretton Woods SystemDocument2 pagesThe Bretton Woods SystemMuhammad FaizanPas encore d'évaluation

- ROLE OF INTERNATIONAL INSTITUTIONSDocument10 pagesROLE OF INTERNATIONAL INSTITUTIONSYousafxai StudioPas encore d'évaluation

- JENESYS Programme: Japan-East Asia Network of Exchange For Students and YouthsDocument25 pagesJENESYS Programme: Japan-East Asia Network of Exchange For Students and YouthsAkshat Radix GoyalPas encore d'évaluation

- Peter Pan Freedom FlightsDocument8 pagesPeter Pan Freedom Flightsapi-526691999Pas encore d'évaluation

- G7 and BricsDocument25 pagesG7 and BricsDr.Yogesh BhowtePas encore d'évaluation

- International Law SynopsisDocument2 pagesInternational Law SynopsisGarvit ChaudharyPas encore d'évaluation

- Babar Ali Qureshi &hanook Hayat PakistanDocument8 pagesBabar Ali Qureshi &hanook Hayat PakistanHanook BhattiPas encore d'évaluation

- Contemporary South AsiaDocument15 pagesContemporary South AsiaRamita Udayashankar90% (21)

- 21 Gashi I MaqedonciDocument12 pages21 Gashi I MaqedonciElena JelerPas encore d'évaluation

- Short Answer Questions on French Revolution and Unification of Italy and GermanyDocument4 pagesShort Answer Questions on French Revolution and Unification of Italy and GermanyAnaryanPas encore d'évaluation

- Regionalism vs GlobalizationDocument2 pagesRegionalism vs GlobalizationAlnie Shane BacolbasPas encore d'évaluation

- ss2201 - 14.0 - Notes - Modern Conflict and CooperationDocument16 pagesss2201 - 14.0 - Notes - Modern Conflict and CooperationChristopher SweetlandPas encore d'évaluation

- A State of The Art On An Art of The State Authored by Friedrich Kratochwil and John GerardDocument2 pagesA State of The Art On An Art of The State Authored by Friedrich Kratochwil and John GerardMichaella Claire LayugPas encore d'évaluation

- Long Quiz in Ls 26Document4 pagesLong Quiz in Ls 26Emmanuel Jimenez-Bacud, CSE-Professional,BA-MA Pol SciPas encore d'évaluation

- Prologue From Visions of Freedom byDocument8 pagesPrologue From Visions of Freedom byRenee Feltz100% (1)

- Kuroda V Jalandoni Case DigestDocument2 pagesKuroda V Jalandoni Case DigestMichael Parreño VillagraciaPas encore d'évaluation

- Third Republic (Post-American Era) 1946-1972: The Presidents and ChallengesDocument21 pagesThird Republic (Post-American Era) 1946-1972: The Presidents and ChallengesrePas encore d'évaluation

- YessirDocument6 pagesYessirmaria smithPas encore d'évaluation

- High Commission of India: Visa Application FormDocument2 pagesHigh Commission of India: Visa Application FormAnonymous ZGcs7MwsLPas encore d'évaluation

- IATA - Australia Passport, Visa and Health AdviceDocument2 pagesIATA - Australia Passport, Visa and Health AdviceedricePas encore d'évaluation

- MearsheimerDocument25 pagesMearsheimerRosario Sinche VegaPas encore d'évaluation

- MilitaryReview 20100630 Art001Document143 pagesMilitaryReview 20100630 Art001abraobabyPas encore d'évaluation

- Cold War in International RelationsDocument9 pagesCold War in International RelationsZeeshan ShabbirPas encore d'évaluation

- Reviewer in GE 113Document14 pagesReviewer in GE 113John Rafael Monteverde AcuñaPas encore d'évaluation