Académique Documents

Professionnel Documents

Culture Documents

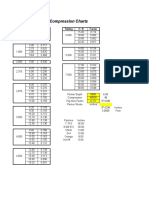

Dep Rate 1-n Scrap Value/ori Cost 100 Residual Value 5% of Original Cost Useful Life & Depreciation Rates (WDV) As Per Companies Act 2013

Transféré par

Mahaveer DhelariyaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dep Rate 1-n Scrap Value/ori Cost 100 Residual Value 5% of Original Cost Useful Life & Depreciation Rates (WDV) As Per Companies Act 2013

Transféré par

Mahaveer DhelariyaDroits d'auteur :

Formats disponibles

Particulars Life (In years)

Buildings (RCC) 60

Plant & Mach (not a specific ind) 15

Plant & mach (used in medical & surgical operations)

Electrical Machinery, X-ray and electrotherapeutic apparatus

and accessories thereto, medical, diagnostic equipments,

namely, Cat-scan, Ultrasound Machines, ECG Monitors, etc.

Furniture (General) 10

Motor cycle 10

Motor car 8

Motor car given on hire 6

Barge & Tugs 14

Boats 28

Speed boat 13

Heavy Vehicles (Trailers & trucks etc) 8

Cranes (more than 100 tons) 20

Cranes (less than 100 tons) 15

Earth-moving equipments 9

Electrical Equiptments 10

Desktops and laptops etc 3

Servers and networks 6

Office equiptment 5

Dep Rate = 1- nscrap value/ori cost * 100

Residual value = 5% of original Cost

No separate depreciation rate is prescribed for intangible assets in the Schedule II of the Companies Act, 2013. Rather, the same

will be governed by the notified AS (i.e., AS 26).

The period of time an asset is used in double shift, depreciation will increase by 50% and by 100% in case of triple shift working.

Useful life & depreciation rates (WDV) as per Companies Act 2013

13

n0.05

Depre Rate

(%)(WDV)

Depre Rate

(%)(SLM)

0.951 4.90 1.67

0.819 18.10 6.67

0.741 25.90 10.00

0.741 25.90 10.00

0.687 31.30 12.50

0.607 39.30 16.67

0.807 19.30 7.14

0.899 10.10 3.57

0.794 20.60 7.69

0.687 31.30 12.50

0.861 13.90 5.00

0.819 18.10 6.67

0.717 28.30 11.11

0.741 25.90 10.00

0.368 63.20 33.33

0.607 39.30 16.67

0.549 45.10 20.00

Dep Rate = 1- nscrap value/ori cost * 100

Residual value = 5% of original Cost

No separate depreciation rate is prescribed for intangible assets in the Schedule II of the Companies Act, 2013. Rather, the same

will be governed by the notified AS (i.e., AS 26).

The period of time an asset is used in double shift, depreciation will increase by 50% and by 100% in case of triple shift working.

Useful life & depreciation rates (WDV) as per Companies Act 2013

20.60 0.794 7.69

Vous aimerez peut-être aussi

- Kurva LorenzDocument12 pagesKurva Lorenzanwar deliPas encore d'évaluation

- Plangaleria Ufscar ImprDocument10 pagesPlangaleria Ufscar ImpreusouumaplantaPas encore d'évaluation

- Laxmi R7 90degDocument3 pagesLaxmi R7 90degAamir KhanPas encore d'évaluation

- Maruti Suzuki Financial StatementDocument5 pagesMaruti Suzuki Financial StatementMasoud AfzaliPas encore d'évaluation

- CT, CV, CF, CMV, CMF, CMT, CMGDocument2 pagesCT, CV, CF, CMV, CMF, CMT, CMGmguel gatoPas encore d'évaluation

- Análisis Granulométrico de Los Productos Del Molino - LaboratorioDocument5 pagesAnálisis Granulométrico de Los Productos Del Molino - LaboratorioMilton Elfer Poma tacuri100% (1)

- H Q (M) (M /DT)Document15 pagesH Q (M) (M /DT)chevyPas encore d'évaluation

- Utilities Size Distribution PinaDocument3 pagesUtilities Size Distribution PinaDefsson DouglasPas encore d'évaluation

- Planilha de Calculo RAIN CRANE WalterDocument5 pagesPlanilha de Calculo RAIN CRANE WalterThiagoPas encore d'évaluation

- April YTD 2010Document1 pageApril YTD 2010sincfrlibPas encore d'évaluation

- Demonstration Pelton TurbineDocument5 pagesDemonstration Pelton TurbineMARLITH LUSDINA VEGA CARRIONPas encore d'évaluation

- Analisis Granulometrico Valorado Alimento Ciclon 15 B Analisis Granulometrico Valorado U/F Ciclon 15 BDocument3 pagesAnalisis Granulometrico Valorado Alimento Ciclon 15 B Analisis Granulometrico Valorado U/F Ciclon 15 BMetalurgista SosPas encore d'évaluation

- Hidrocilon D 15Document3 pagesHidrocilon D 15Metalurgista SosPas encore d'évaluation

- Practico Manufactura 2Document7 pagesPractico Manufactura 2Rebeca Salvatierra AramayoPas encore d'évaluation

- Coordenograma de FASE Curva Extremamente InversaDocument10 pagesCoordenograma de FASE Curva Extremamente InversaWilliam GalvaoPas encore d'évaluation

- Consolidation ReportDocument7 pagesConsolidation ReportJay KhadkaPas encore d'évaluation

- Task 7aDocument3 pagesTask 7aJun Hao ChongPas encore d'évaluation

- Laxmi Sample2 R7 120degDocument3 pagesLaxmi Sample2 R7 120degAamir KhanPas encore d'évaluation

- Utilities Size DistributionDocument4 pagesUtilities Size DistributionMetalurgia ProcesosPas encore d'évaluation

- GR Ficos Tempo Corrente 1565293045233 9731Document10 pagesGR Ficos Tempo Corrente 1565293045233 9731Guilherme OliveiraPas encore d'évaluation

- Vertical Hitch W.L.L. X Number of Legs X Sling Angle FactorDocument4 pagesVertical Hitch W.L.L. X Number of Legs X Sling Angle FactorsuryaPas encore d'évaluation

- Co (MG/L) : A% Exponential (A %)Document35 pagesCo (MG/L) : A% Exponential (A %)Οδυσσεας ΚοψιδαςPas encore d'évaluation

- Parámetros Usados para El Cálculo Según PASQUILL-GIFFORD De: Tabla 1-1Document1 pageParámetros Usados para El Cálculo Según PASQUILL-GIFFORD De: Tabla 1-1Miguel AngelPas encore d'évaluation

- Relay Settings: Operation CurveDocument6 pagesRelay Settings: Operation Curvemaruf048Pas encore d'évaluation

- Anova: Sum of Squares DF Mean Square F Sig. Between Groups Within Groups TotalDocument2 pagesAnova: Sum of Squares DF Mean Square F Sig. Between Groups Within Groups TotalHanaPas encore d'évaluation

- Curva de CargaDocument4 pagesCurva de CargaOscar VelasquezPas encore d'évaluation

- Simulador de Hidrociclon D - 10Document2 pagesSimulador de Hidrociclon D - 10César Jacobo0% (1)

- Task 7aDocument3 pagesTask 7aJun Hao ChongPas encore d'évaluation

- Attribute Coeffs S.E. Wald Z P-ValueDocument8 pagesAttribute Coeffs S.E. Wald Z P-Valuesarthak mendirattaPas encore d'évaluation

- Advanced Capital Budgeting 3 HW - q7Document3 pagesAdvanced Capital Budgeting 3 HW - q7sairad1999Pas encore d'évaluation

- Prog-Hidrocicloncalculos B 30Document6 pagesProg-Hidrocicloncalculos B 30Miguel Angel Zavala riosPas encore d'évaluation

- Buckley - Leverett (Practico)Document5 pagesBuckley - Leverett (Practico)Juan Carlos GarecaPas encore d'évaluation

- Curva Fe FabianDocument11 pagesCurva Fe FabianFabian RodriguezPas encore d'évaluation

- Diametro (MM) : Grafica Granulomerica (Fino)Document6 pagesDiametro (MM) : Grafica Granulomerica (Fino)Remberto Menchaca VillcaPas encore d'évaluation

- Tabla Diferencia Potencial (V) V/s Corriente (I) : 16.00 F (X) 0.2140585593x + 0.0335509278 R 0.9998985627Document4 pagesTabla Diferencia Potencial (V) V/s Corriente (I) : 16.00 F (X) 0.2140585593x + 0.0335509278 R 0.9998985627IgnacioLamillaPas encore d'évaluation

- Lectures+24 25+Examples+CompleteDocument6 pagesLectures+24 25+Examples+CompletePRATEEK SHARMAPas encore d'évaluation

- Curvas de Nivel (M) Superficie (Km2)Document6 pagesCurvas de Nivel (M) Superficie (Km2)Julio LZPas encore d'évaluation

- TUGAS III Ekonomi Managerial - 2017920182Document3 pagesTUGAS III Ekonomi Managerial - 2017920182H4N1f TtPas encore d'évaluation

- Harmonic #: A1 A2 A3 A4 DC Amplitude PhaseDocument3 pagesHarmonic #: A1 A2 A3 A4 DC Amplitude PhaseZokiPas encore d'évaluation

- Zidan Ahmad Fauzani - TP Modul VIDocument10 pagesZidan Ahmad Fauzani - TP Modul VIMuhammad DahmanPas encore d'évaluation

- Chart Title: Verd EulerDocument12 pagesChart Title: Verd EulerJuan D RodriiguezPas encore d'évaluation

- IsocineticasycalculosDocument8 pagesIsocineticasycalculosJonhatan Pierre Aparicio VenturaPas encore d'évaluation

- Compression CalculatorDocument1 pageCompression CalculatorAnonymous rey6aU3ZPas encore d'évaluation

- P13Document21 pagesP13Saeful AzizPas encore d'évaluation

- Homework Materials4Document3 pagesHomework Materials4adahrenellePas encore d'évaluation

- Balance ZarandaDocument4 pagesBalance ZarandaPedro RodriguezPas encore d'évaluation

- Variatia Turatiei Unitare de Ambalare in Functie de Caderea HDocument2 pagesVariatia Turatiei Unitare de Ambalare in Functie de Caderea HAndrei TudorasPas encore d'évaluation

- Ndfi Endmember Spectral Library LANDSAT TM, ETM+, OLIDocument7 pagesNdfi Endmember Spectral Library LANDSAT TM, ETM+, OLICédric AurelPas encore d'évaluation

- 636348425255096150PR PDFDocument2 pages636348425255096150PR PDFPrashantPas encore d'évaluation

- Jio Hu Ha HuDocument2 pagesJio Hu Ha HuJatin PandePas encore d'évaluation

- Gradation of SDBC GR 2: Weight of The Sample in GM Location CHDocument1 pageGradation of SDBC GR 2: Weight of The Sample in GM Location CHBinayalal PatraPas encore d'évaluation

- Ndfi Endmember Spectral Library LANDSAT TM, ETM+, OLIDocument7 pagesNdfi Endmember Spectral Library LANDSAT TM, ETM+, OLIcarlos arturoPas encore d'évaluation

- Syauqi - Nano Silika - Sampel 5 - 1273.nsz Measurement ResultsDocument3 pagesSyauqi - Nano Silika - Sampel 5 - 1273.nsz Measurement ResultsAhmad FarhanPas encore d'évaluation

- Tamiz A.S.T.M. % Acumulado Retenido Pasante Abertura (MM) Peso Retenido Gr. % Peso RetenidoDocument3 pagesTamiz A.S.T.M. % Acumulado Retenido Pasante Abertura (MM) Peso Retenido Gr. % Peso RetenidofrankPas encore d'évaluation

- Tamiz A.S.T.M. % Acumulado Retenido Pasante Abertura (MM) Peso Retenido Gr. % Peso RetenidoDocument3 pagesTamiz A.S.T.M. % Acumulado Retenido Pasante Abertura (MM) Peso Retenido Gr. % Peso RetenidofrankPas encore d'évaluation

- Abertura de La Mapeso en G % Parcial% Ac. Reten . Pasantx' Y' #En Wi F (Xi) G (Xi) F (Xi) Logx Logf (X)Document6 pagesAbertura de La Mapeso en G % Parcial% Ac. Reten . Pasantx' Y' #En Wi F (Xi) G (Xi) F (Xi) Logx Logf (X)valerioPas encore d'évaluation

- Vacuum Pressure Unit Conversions Chart From IsmDocument2 pagesVacuum Pressure Unit Conversions Chart From IsmChintan BhavsarPas encore d'évaluation

- Altitud MSNM D Km2: Perfil LongitudinalDocument4 pagesAltitud MSNM D Km2: Perfil LongitudinalAlex Ivan Riva MejiaPas encore d'évaluation

- Anagra 01 de Enero 1ra G y 2da GDocument1 pageAnagra 01 de Enero 1ra G y 2da GDarwin Laqui TiconaPas encore d'évaluation

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaPas encore d'évaluation

- Top 5 Ways To Break WinRAR Password Easily and EfficientlyDocument11 pagesTop 5 Ways To Break WinRAR Password Easily and EfficientlyMahaveer DhelariyaPas encore d'évaluation

- Taxguru - In-Taxation of Charitable and Religious Trusts - 3Document5 pagesTaxguru - In-Taxation of Charitable and Religious Trusts - 3Mahaveer DhelariyaPas encore d'évaluation

- Salary SlipDocument1 pageSalary SlipMahaveer DhelariyaPas encore d'évaluation

- 43144bos32841 PDFDocument1 page43144bos32841 PDFMahaveer DhelariyaPas encore d'évaluation

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaPas encore d'évaluation

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaPas encore d'évaluation

- CAclubindia News - Speedy Disbursal of Service Tax Refund From Exporters of ServiceDocument2 pagesCAclubindia News - Speedy Disbursal of Service Tax Refund From Exporters of ServiceMahaveer DhelariyaPas encore d'évaluation

- Slump Sale and Related Income Tax ProvisionsDocument4 pagesSlump Sale and Related Income Tax ProvisionsMahaveer DhelariyaPas encore d'évaluation

- GST Impact On Distribution Companies and DealersDocument3 pagesGST Impact On Distribution Companies and DealersMahaveer DhelariyaPas encore d'évaluation

- CAclubindia News - Forensic Audit - A Modern Day Thrust and ThirstDocument5 pagesCAclubindia News - Forensic Audit - A Modern Day Thrust and ThirstMahaveer DhelariyaPas encore d'évaluation

- Resolutions To Be Filed With Registrar of Companies Under Companies Act 2013Document2 pagesResolutions To Be Filed With Registrar of Companies Under Companies Act 2013Mahaveer DhelariyaPas encore d'évaluation

- CAclubindia News - Business Plan For A Budding Investment Advisor - Shri - BoodhimaanDocument3 pagesCAclubindia News - Business Plan For A Budding Investment Advisor - Shri - BoodhimaanMahaveer DhelariyaPas encore d'évaluation

- CAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantDocument2 pagesCAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantMahaveer DhelariyaPas encore d'évaluation

- CAclubindia News - Exemption On Capital GainsDocument2 pagesCAclubindia News - Exemption On Capital GainsMahaveer DhelariyaPas encore d'évaluation

- CAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportDocument2 pagesCAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportMahaveer DhelariyaPas encore d'évaluation

- Coa Coo & BL Nar 5048 Up Date JunaidiDocument3 pagesCoa Coo & BL Nar 5048 Up Date JunaidiZahra Mosthafavi100% (1)

- Experiment 2: Tensile Test PrelabDocument15 pagesExperiment 2: Tensile Test PrelabR-wah LarounettePas encore d'évaluation

- Your Weight On Different PlanetsDocument2 pagesYour Weight On Different PlanetspianomagicianPas encore d'évaluation

- 2.5x1.5 Fire Hose Rack AssembliesDocument1 page2.5x1.5 Fire Hose Rack AssembliesMostafa El-BalashonyPas encore d'évaluation

- Country Vs The City Intermediate StudentsDocument3 pagesCountry Vs The City Intermediate StudentsAnonymous SPy7vOGbo100% (1)

- Mna Short FormDocument1 pageMna Short FormFetria MelaniPas encore d'évaluation

- Circuit TheoryDocument17 pagesCircuit TheoryMuhammad Anaz'sPas encore d'évaluation

- Layout of Food FactoryDocument1 pageLayout of Food Factorywestern120Pas encore d'évaluation

- 4.1 Esl Topics Quiz Bugs InsectsDocument2 pages4.1 Esl Topics Quiz Bugs InsectsSiddhartha Shankar NayakPas encore d'évaluation

- Supersize Sandbox: Clean-UpDocument2 pagesSupersize Sandbox: Clean-UpChal ArtemiosPas encore d'évaluation

- Solve ElecDocument35 pagesSolve Eleccingoski123Pas encore d'évaluation

- Immobilization SyndromeDocument2 pagesImmobilization SyndromeJuanitoCabatañaLimIII0% (1)

- Aqua MateDocument2 pagesAqua MategangrukaPas encore d'évaluation

- SulphurDocument15 pagesSulphurrsvasanPas encore d'évaluation

- The Difference Between Jakarta and SurabayaDocument2 pagesThe Difference Between Jakarta and SurabayaluchigoPas encore d'évaluation

- Book ListDocument1 pageBook ListMosharraf Hossain SylarPas encore d'évaluation

- Exercises Locus EquationDocument2 pagesExercises Locus EquationCikgu Fayruzz NaseerPas encore d'évaluation

- API Conversion 3Document4 pagesAPI Conversion 3Teuku KhamilPas encore d'évaluation

- Flowers and Cake Design Student Supply ListDocument2 pagesFlowers and Cake Design Student Supply ListAura MateiuPas encore d'évaluation

- Molybdovanadic ReagentDocument2 pagesMolybdovanadic ReagentCeyhun Babac CetinPas encore d'évaluation

- ChotukoolDocument19 pagesChotukoolYash AgarwalPas encore d'évaluation

- Business Name and DescriptionDocument4 pagesBusiness Name and DescriptionpviñezaPas encore d'évaluation

- Jetream 32 07Document2 pagesJetream 32 07Eric ShahPas encore d'évaluation

- HW CH5Document3 pagesHW CH5DODIPas encore d'évaluation

- Vacumat 22 22TDocument2 pagesVacumat 22 22TSandeep ChhonkerPas encore d'évaluation

- Van'S Aircraft, Inc.: F-1211D PreparationDocument1 pageVan'S Aircraft, Inc.: F-1211D PreparationMark Evan SalutinPas encore d'évaluation

- Shortness of Breath: Checklist PMPF Checklist PMPFDocument1 pageShortness of Breath: Checklist PMPF Checklist PMPFanz_4191Pas encore d'évaluation

- Zara Apparel Case StudyDocument3 pagesZara Apparel Case StudyAbdul Rehman100% (4)

- AltimeterDocument8 pagesAltimeterwolffoxxxPas encore d'évaluation

- Dolibarr - Suppliers ManagementDocument6 pagesDolibarr - Suppliers ManagementDiana de AlmeidaPas encore d'évaluation