Académique Documents

Professionnel Documents

Culture Documents

Global Macro Commentary August 6

Transféré par

dpbasic0 évaluation0% ont trouvé ce document utile (0 vote)

333 vues2 pagesby Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentby Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

333 vues2 pagesGlobal Macro Commentary August 6

Transféré par

dpbasicby Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Global Macro Commentary

The Putin Matryoshka Doll

Wednesday, August 06, 2014

Guy Haselmann

(212) 225-6686

Director, Capital Markets Strategy

John Zawada

Director, US Rate Sales

The Putin Matryoshka Doll

In a highly globalized world, protectionist actions are one of the greatest risks to

the global economy. Western sanctions imposed on Russia are no doubt anti-

globalization, but the potential counter-measures being developed, as ordered by

Putin, are blatant protectionism. His decree to find counter-measures is entitled

On the Application of Certain Special Economic Measures to Ensure the Security

of the Russian Federation. It appears Russian officials are developing a list

which would restrict or prohibit, for one year, the import of specific agricultural

products, raw materials and food originating in any country that has imposed

economic sanctions against Russian companies, and/or individuals, who have

joined such sanctions.

To offset any adverse domestic effects, Putin ordered an increase in domestic food

supplies, as well as ordering the government to implement measures which would

prevent prices from accelerating higher.

In theory, this decree would ban all agricultural products from the US, EU,

Canada, J apan and Australia. Ultimately, Moscow might be more selective in its

import bans for the EU, because it imports over 40% of its food from aboard -

mostly from Europe.

Over the past week, Russia has banned imports of Romanian beef, Polish fruits

and vegetables, Latvian Pork, Ukrainian dairy products, cereals and juice, and

Moldovan apples, all under the pretext of food safety. Shipments of American

frozen shrimp have been turned back and US poultry imports are threatened.

In what could be an even more significant measure, a front page article in the

Financial Times reports that Moscow is considering banning western flights into

Russian airspace. Currently, European airlines headed to much of Asia crosses

Russian territory. Disallowing trans-Siberian routes would cost airlines at least

$30,000 in fuel per flight and add many travel hours via the added travel distance

of up to 2400 miles. Airlines stocks were punished the past two days.

After Russia annexed Crimea and even after Russia tinkered in Eastern Ukraine,

Europe was reluctant to follow the US, UK, and Polish hawks seeking sanctions.

Angela Merkel (and the sentiment of the German public) played the crucial role

and mostly sided with the doves in France, Italy and Spain. However, as Der

Spiegel stated: The wreckage of MH17 is also the wreckage of diplomacy. The

MH17 disaster was shocking to the Germans (and the rest of the world) and

shifted sentiment against Russia. Sentiment shifted even further when pro-

Russian separatists failed to protect the dead and even robbed the victims.

NATO meets next month in Wales. They will discuss an action plan to boost

readiness and how to best deploy forces for defense and deterrence. The alliance

consists of 28 sovereign nations whose decisions are reached by consensus (talk

about many chefs in the kitchen). It is an incredibly strong military alliance.

However, during the past five years, NATO allies have on average cut defense

spending by 20%, while Russia has increased its defense budget by 50% over the

same period. The trend is troublesome and will have difficulty reversing in the

near future given the magnitude of NATO countries collective indebtedness.

When everything is coming your way, youre in the wrong lane. Steven Wright

FOMC Speeches

Key Events

ECB Aug 7

BOE Aug 7

BoJ Aug 8

J ackson Hole Aug 29

RBA Sep 2

FOMC Sep 17

www.gbm.scotiabank.com

TM

Trademark of The Bank of Nova Scotia. Used under license, where applicable. Scotiabank, together with "Global Banking and

Markets", is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova

Scotia and certain of its affiliates in the countries where they operate, including Scotia Capital Inc.

Disclaimer

This publication has been prepared for Major U.S. Institutional Investors by Fixed Income Strategists of the Bank of Nova Scotia, New York

Agency. (BNS/NYA). BNS/NYA Fixed Income Strategists are employees of Scotiabanks Fixed Income Credit Sales & Trading Desk and

support the trading desk through the preparation of market commentary, including specific trading ideas, and other materials, both written and

verbal, which may or may not be made publicly available, and which may or may not be made publicly available at the same time it is made

available to the Fixed Income Credit Sales & Trading Desk. Fixed Income Strategists are not research analysts, and this report was not reviewed

by the Research Departments of Scotiabank. Fixed Income Strategist publications are not research reports and the views expressed by Fixed

Income Strategists in this and other reports may differ fromthe views expressed by other departments, including the Research Department, of

Scotiabank. The securities laws and regulations, and the policies of Scotiabank that are applicable to Research Analysts may not be applicable to

Fixed Income Strategists.

This publication is provided to you for informational purposes only. Prices shown in this publication are indicative and Scotiabank is not offering

to buy or sell, or soliciting offers to buy or sell any financial instrument. Scotiabank may engage in transactions in a manner inconsistent with the

views discussed herein. Scotiabank may have positions, or be in the process of acquiring or disposing of positions, referred to in this publication.

Other than the disclosures related to Scotiabank, the information contained in this publication has been obtained fromsources that Scotiabank

knows to be reliable, however we do not represent or warrant that such information is accurate and complete. The views expressed herein are the

views of the Fixed Income Strategists of Scotiabank and are subject to change, and Scotiabank has no obligation to update its opinions or

information in this publication. Scotiabank and any of its officers, directors and employees, including any persons involved in the preparation or

issuance of this document, may fromtime to time act as managers, co-managers or underwriters of a public offering or act as principals or agents,

deal in, own or act as market-makers or advisors, brokers or commercial and/or investment bankers in relation to the securities or related

derivatives which are the subject of this publication.

Neither Scotiabank nor any of its officers, directors, partners, or employees accepts any liability for any direct or consequential loss arising from

this publication or its contents. The securities discussed in this publication may not be suitable for all investors. Scotiabank recommends that

investors independently evaluate each issuer and security discussed in this publication, and consult with any advisors they deemnecessary prior

to making any investment.

Vous aimerez peut-être aussi

- GMOMelt UpDocument13 pagesGMOMelt UpHeisenberg100% (2)

- BMO ETF Portfolio Strategy Report: Playing Smart DefenseDocument7 pagesBMO ETF Portfolio Strategy Report: Playing Smart DefensedpbasicPas encore d'évaluation

- Credit Suisse Investment Outlook 2018Document64 pagesCredit Suisse Investment Outlook 2018dpbasic100% (1)

- Thackray Seasonal Report Storm Warning 2017-May-05Document12 pagesThackray Seasonal Report Storm Warning 2017-May-05dpbasic100% (1)

- Fidelity Multi-Sector Bond Fund - ENDocument3 pagesFidelity Multi-Sector Bond Fund - ENdpbasicPas encore d'évaluation

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocument12 pagesRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicPas encore d'évaluation

- Hot Charts 9feb2017Document2 pagesHot Charts 9feb2017dpbasicPas encore d'évaluation

- Hot Charts 17nov2016Document2 pagesHot Charts 17nov2016dpbasicPas encore d'évaluation

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicPas encore d'évaluation

- INM 21993e DWolf Q4 2016 NewEra Retail SecuredDocument4 pagesINM 21993e DWolf Q4 2016 NewEra Retail SecureddpbasicPas encore d'évaluation

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicPas encore d'évaluation

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicPas encore d'évaluation

- CMX Roadshow Final Oct 27 2016Document25 pagesCMX Roadshow Final Oct 27 2016dpbasicPas encore d'évaluation

- Next Edge Private Lending Presentation v1Document16 pagesNext Edge Private Lending Presentation v1dpbasicPas encore d'évaluation

- An Investment Only A Mother Could Love The Case For Natural Resource EquitiesDocument12 pagesAn Investment Only A Mother Could Love The Case For Natural Resource EquitiessuperinvestorbulletiPas encore d'évaluation

- Advantagewon Presentation Oct 2016 Draft 1Document16 pagesAdvantagewon Presentation Oct 2016 Draft 1dpbasicPas encore d'évaluation

- Thackray Newsletter 2016 09 SeptemberDocument9 pagesThackray Newsletter 2016 09 SeptemberdpbasicPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Banking Operations: Cheques & EndorsementsDocument12 pagesBanking Operations: Cheques & EndorsementsSharath SaunshiPas encore d'évaluation

- Appendix 5cDocument2 pagesAppendix 5ckeshavPas encore d'évaluation

- Ramzan Ali PP ApoDocument1 pageRamzan Ali PP ApoAshok RauniarPas encore d'évaluation

- Internship Report of Jamuna Bank About Loans & AdvanceDocument60 pagesInternship Report of Jamuna Bank About Loans & AdvanceMd. Shahnaj Kader100% (3)

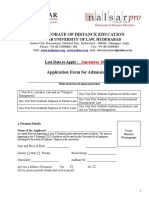

- Application Form 2018-19-1Document6 pagesApplication Form 2018-19-1Latest Laws TeamPas encore d'évaluation

- Import FinancingDocument11 pagesImport FinancingDheeraj rawatPas encore d'évaluation

- Cash Book ObjectivesDocument5 pagesCash Book ObjectivestarabhaiPas encore d'évaluation

- National Chenani-Nashri TunnelDocument5 pagesNational Chenani-Nashri TunnelshreyaPas encore d'évaluation

- Application Form: Loan Requested Purpose of Loan DateDocument2 pagesApplication Form: Loan Requested Purpose of Loan DateZulueta Jing MjPas encore d'évaluation

- Assignment #1Document1 pageAssignment #1Jeevan AbbassPas encore d'évaluation

- HowACreditCardIsProcessed PDFDocument5 pagesHowACreditCardIsProcessed PDFKornelius SitepuPas encore d'évaluation

- AisDocument6 pagesAisSamonte JemimahPas encore d'évaluation

- Quest: Shaking Value Out of The FEVERtreeDocument14 pagesQuest: Shaking Value Out of The FEVERtreegusonePas encore d'évaluation

- TazaTicket PresentationDocument13 pagesTazaTicket Presentationilyas shabbirPas encore d'évaluation

- Failure of Lehman Brothers: Jitendra SoniDocument4 pagesFailure of Lehman Brothers: Jitendra Sonijitu222soni3386Pas encore d'évaluation

- UPI PG RBI - Final PDFDocument83 pagesUPI PG RBI - Final PDFpratik zankePas encore d'évaluation

- Loan AgreementDocument3 pagesLoan AgreementAlex RawlingsPas encore d'évaluation

- Remittance Activities of Janata Bank Ltd.Document61 pagesRemittance Activities of Janata Bank Ltd.Hannanur Omar100% (1)

- S Miller OnlineResumeDocument1 pageS Miller OnlineResumeShauna MillerPas encore d'évaluation

- Post Mid Sem EEFDocument64 pagesPost Mid Sem EEFYug ChaudhariPas encore d'évaluation

- China Banking Corporation vs. CADocument1 pageChina Banking Corporation vs. CAArmstrong BosantogPas encore d'évaluation

- SwiftPay FAQsDocument2 pagesSwiftPay FAQsKiran SheikhPas encore d'évaluation

- Broking Firms in IndiaDocument59 pagesBroking Firms in IndiaNikita Jain100% (1)

- Multiple Choice CH 8Document5 pagesMultiple Choice CH 8gotax100% (1)

- Scope of Retail Loans of Bank of Punjab LTDDocument8 pagesScope of Retail Loans of Bank of Punjab LTDVaibhav RastogiPas encore d'évaluation

- Jean Keating's Prison TreatiseDocument41 pagesJean Keating's Prison Treatise:Lawiy-Zodok:Shamu:-ElPas encore d'évaluation

- SEIC 2019 Handbook PDFDocument24 pagesSEIC 2019 Handbook PDFYing ShengPas encore d'évaluation

- Revision of Commissions & Charges TableDocument5 pagesRevision of Commissions & Charges Tablesimona rusuPas encore d'évaluation

- Salientes, Karl C. Reaction PaperDocument4 pagesSalientes, Karl C. Reaction PaperKarl Salientes50% (2)

- E-Payment Request Form: Payment Details Payment InstructionsDocument1 pageE-Payment Request Form: Payment Details Payment InstructionsSiva ReddyPas encore d'évaluation