Académique Documents

Professionnel Documents

Culture Documents

Option Pricing For Undeveloped Resources

Transféré par

Ajay BagariaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Option Pricing For Undeveloped Resources

Transféré par

Ajay BagariaDroits d'auteur :

Formats disponibles

Option pricing for undeveloped resources

The mining assets which will only be developed in the future, conditional on whether or not the

assets have a positive net present value at the decision date, cannot be valued using traditional

DCF method. For them we need to use option pricing model. For pricing a real option using

binomial we need Value of underlying asset (St), the exercise or strike price K, The volatility of

the underlying asset, the time of expiration, Time delay due to development lag & Risk Free rate.

To calculate these values we have taken some assumption:

1. As there is no free-market price formation for lignite used in power generation. This is

because its low calorific value makes transport uneconomic over longer distances. We

have taken volatility in coal prices which is 30% (According to RB index,NEWC

Index,ICI index)

2. Revenue and cost are determined using total revenue from lignite and total cost of

extraction of lignite divided by total lignite production

3. As exercising the option today is not profitable so we used the current profit per unit of

lignite as a proxy for cost of developing new mine resources

4. In the annual report we have total reserve of lignite in Rajasthan and Gujarat but to

calculate minable resources as a percentage of total resources we use Tamil Nadu as a

proxy because the firm is operating there from last 50 years and hence have already

developed mineable resources,

5. To develop a mine huge infrastructure has to be created so long development is to be

expected

6. For risk free rate yield of 10 year govt. bonds is used

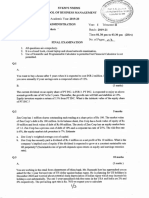

Using these assumptions the final value for each variable is

BSM parameter For Rajasthan For Gujarat

Value of underlying asset(St), 81309894052.92 Rs 47018278250.72 Rs

The exercise or strike price K 118444889657.59 Rs 68491969448.05 Rs

The volatility of the underlying asset 30 % 30 %

The time of expiration 20 years 20 years

Time delay due to development lag 5 Years 5 Years

Risk Free rate 8.15% 8.15%

By setting in the inputs in Black-Scholes-Merton model and calculating the value using an excel

spreadsheet tool for real options valuation, we become the value of the natural resource option

equal to Rs 16771637604.13 for Rajasthan mines and Rs 9698371062.67 for Gujarat mines.

To make our model more robust we performed sensitivity analysis on two variable of real option

pricing model (The volatility of the underlying asset & development cost per unit)

From the Sensivity analysis we can see that Option value is some what sensitive with volatility but

little sensitive with cost of developing resource. Sum of the value of base cases of having option to

develop mine in Rajasthan and Gujarat is 1677.16 Crore Rs, Best case is 3577.59 Crore Rs and worst

case is 1366.75 Crore Rs.

Vous aimerez peut-être aussi

- DCF Analysis TemplateDocument8 pagesDCF Analysis TemplateAdeel Qayyum100% (4)

- Discounted Cash Flow Analysis Input Parameters and SensitivityDocument13 pagesDiscounted Cash Flow Analysis Input Parameters and Sensitivityfr5649Pas encore d'évaluation

- Corporate Vendor List for Products and ServicesDocument162 pagesCorporate Vendor List for Products and ServicesAjay Bagaria100% (2)

- Network of Global Corporate Control. Swiss Federal Institute of Technology in ZurichDocument36 pagesNetwork of Global Corporate Control. Swiss Federal Institute of Technology in Zurichvirtualminded100% (2)

- Lex CaseDocument8 pagesLex CaseAshlesh MangrulkarPas encore d'évaluation

- QAP - LT Panel PDFDocument8 pagesQAP - LT Panel PDFAkshay Ajay100% (2)

- Real Property Valuation Methods & TechniquesDocument7 pagesReal Property Valuation Methods & TechniquesLavanya LakshmiPas encore d'évaluation

- Real Property Valuation MethodsDocument6 pagesReal Property Valuation MethodsMuhammadIqbalMughalPas encore d'évaluation

- KujiDocument17 pagesKujiGorumbha Dhan Nirmal Singh100% (2)

- Member List & Phone NoDocument24 pagesMember List & Phone NoAjay Bagaria100% (4)

- Bidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIDocument6 pagesBidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIAnh ThoPas encore d'évaluation

- Methods of Valuation of A BuildingDocument9 pagesMethods of Valuation of A BuildingNanda Kumar100% (1)

- ANALISIS INVESTASI ALAT BERATDocument14 pagesANALISIS INVESTASI ALAT BERATRizto Salia Zakri100% (2)

- Valuation For High-Risk Coal Mining Project Case Study: PT. Berau Coal Block ParapatanDocument8 pagesValuation For High-Risk Coal Mining Project Case Study: PT. Berau Coal Block Parapatanpuput utomoPas encore d'évaluation

- Value Risk and Capital MarketsDocument3 pagesValue Risk and Capital MarketspranavPas encore d'évaluation

- Feasibility Study of Apartment XYZ Investment by RDocument5 pagesFeasibility Study of Apartment XYZ Investment by RmauricePas encore d'évaluation

- Pioneer Invest Corp - Harshit TaunkDocument40 pagesPioneer Invest Corp - Harshit Taunkrjain_112Pas encore d'évaluation

- Mineral Appraisal HandoutDocument16 pagesMineral Appraisal HandoutHarry100% (1)

- 8 PDFDocument1 page8 PDFJIGNA NAKARPas encore d'évaluation

- 16 - Rahul Mundada - Mudita MathurDocument8 pages16 - Rahul Mundada - Mudita MathurRahul MundadaPas encore d'évaluation

- Financial AppraisalDocument14 pagesFinancial AppraisalRuvini DilhaniPas encore d'évaluation

- Valuation Methods of Mineral ResourcesDocument13 pagesValuation Methods of Mineral ResourcesHamid KorPas encore d'évaluation

- Project Report FMDocument1 pageProject Report FMmuhammad shamsadPas encore d'évaluation

- GSM Network Capacity Investment in China Under Uncertain DemandDocument8 pagesGSM Network Capacity Investment in China Under Uncertain DemandArun KumarPas encore d'évaluation

- Forecasting Price of The Crude Oil Using LSTM Based On RNNDocument13 pagesForecasting Price of The Crude Oil Using LSTM Based On RNNIJRASETPublicationsPas encore d'évaluation

- Ijsrp p7761Document6 pagesIjsrp p7761Thai Binh TranPas encore d'évaluation

- Prosiding Teknik Pertambangan: A. Pendahuluan Latar BelakangDocument8 pagesProsiding Teknik Pertambangan: A. Pendahuluan Latar BelakangAgus HilapokPas encore d'évaluation

- List of Favourite SFM Examination QuestionsDocument12 pagesList of Favourite SFM Examination QuestionsAnkit RastogiPas encore d'évaluation

- Pem Appraisal of Returns: Calculating Cash Flows and Equipment ChoicesDocument4 pagesPem Appraisal of Returns: Calculating Cash Flows and Equipment ChoicesRajesh GoelPas encore d'évaluation

- NPV Analysis & Sensitivity of Investment ScenariosDocument3 pagesNPV Analysis & Sensitivity of Investment ScenariosSakura Rosella100% (1)

- The DataDocument7 pagesThe DatashettyPas encore d'évaluation

- ESOP - Ankolekar - Sep 2011Document20 pagesESOP - Ankolekar - Sep 2011Brexa ManagementPas encore d'évaluation

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANPas encore d'évaluation

- Valuation Using The Income Approach: Real Estate FIN 331 Fall 2013Document13 pagesValuation Using The Income Approach: Real Estate FIN 331 Fall 2013Sammy ZalaPas encore d'évaluation

- Second-Hand Car Price Prediction Using Machine Learning: Albinpthomas@mca - Ajce.in Shellyshijugeorge@amaljyothi - Ac.inDocument5 pagesSecond-Hand Car Price Prediction Using Machine Learning: Albinpthomas@mca - Ajce.in Shellyshijugeorge@amaljyothi - Ac.inPaDiNjArAnPas encore d'évaluation

- SFM Exam Capsule Question Part Old Syllabus PDFDocument77 pagesSFM Exam Capsule Question Part Old Syllabus PDFKrishna AdhikariPas encore d'évaluation

- Stock Price Prediction Using Genetic Algorithms and Evolution StrategiesDocument5 pagesStock Price Prediction Using Genetic Algorithms and Evolution Strategies1. b3Pas encore d'évaluation

- Konsep Internal Rate of Return Analysis (XII)Document11 pagesKonsep Internal Rate of Return Analysis (XII)firmanaan ferdianPas encore d'évaluation

- Cost of Capital Part 3Document19 pagesCost of Capital Part 3Gowthami 20 MBAPas encore d'évaluation

- 16350GROUP XV Executive Summary On BCML ValuationDocument5 pages16350GROUP XV Executive Summary On BCML ValuationShi LohPas encore d'évaluation

- Project Risk Analysis Assignment Xi 2011Document3 pagesProject Risk Analysis Assignment Xi 2011Piyush SikariaPas encore d'évaluation

- ScriptDocument5 pagesScriptnavyaPas encore d'évaluation

- M.P. Warehousing and Logistics Corporation Bhopal: 1 I 1 To 3 2 II 1 3 III 1 To 7Document12 pagesM.P. Warehousing and Logistics Corporation Bhopal: 1 I 1 To 3 2 II 1 3 III 1 To 7Akshay MishraPas encore d'évaluation

- A Review of All Risks Yield and Implied PDFDocument22 pagesA Review of All Risks Yield and Implied PDFabdul majid khawajaPas encore d'évaluation

- Investment Feasibility Analysis of Coil Warehouse Construction ProjectDocument9 pagesInvestment Feasibility Analysis of Coil Warehouse Construction ProjectIJAR JOURNALPas encore d'évaluation

- Investment Feasibility Analysis of Coil Warehouse Construction ProjectDocument9 pagesInvestment Feasibility Analysis of Coil Warehouse Construction ProjectIJAR JOURNALPas encore d'évaluation

- Capital Expenditure Decisions and Machine Replacement AnalysisDocument2 pagesCapital Expenditure Decisions and Machine Replacement AnalysisSundarPas encore d'évaluation

- Bahan Investasi Tambang PT Lagadar AbadiDocument8 pagesBahan Investasi Tambang PT Lagadar AbadiBintangPas encore d'évaluation

- OPTIONS ANALYSISDocument10 pagesOPTIONS ANALYSISWaleed MinhasPas encore d'évaluation

- DM DCFDocument2 pagesDM DCFAJAY GOYALPas encore d'évaluation

- Principles of Property ValuationDocument8 pagesPrinciples of Property ValuationcivilsadiqPas encore d'évaluation

- Lecture Notes_Utilization and Impairment-2Document14 pagesLecture Notes_Utilization and Impairment-2Josh PagnamitanPas encore d'évaluation

- Ameri TradeDocument7 pagesAmeri TradexenabPas encore d'évaluation

- 78 - Used Car Price Prediction Using Machine LearningDocument5 pages78 - Used Car Price Prediction Using Machine LearningPaDiNjArAn100% (1)

- Commercial Profitability Case StudyDocument47 pagesCommercial Profitability Case StudyVIVEK KUMARPas encore d'évaluation

- SharpDocument6 pagesSharppathanfor786Pas encore d'évaluation

- Reliance Capital: Ankit Chadha, Gaurav Vijay Shah, Mohit Dhand, Sandeep Aggrawal, Tamal TaruDocument15 pagesReliance Capital: Ankit Chadha, Gaurav Vijay Shah, Mohit Dhand, Sandeep Aggrawal, Tamal TaruBhavna PruthiPas encore d'évaluation

- Present Worth Analysis: 5.1. Formulating AlternativesDocument13 pagesPresent Worth Analysis: 5.1. Formulating AlternativesZoloft Zithromax ProzacPas encore d'évaluation

- Corporate Finance I176 Xid-3384732 1Document8 pagesCorporate Finance I176 Xid-3384732 1kashualPas encore d'évaluation

- Capital Asset Pricing ModelDocument6 pagesCapital Asset Pricing ModelkelvinramosPas encore d'évaluation

- CoverDocument6 pagesCoverAnkit BhattaraiPas encore d'évaluation

- JP Associates LTD.Document13 pagesJP Associates LTD.AKHIL1211Pas encore d'évaluation

- Case StudyDocument7 pagesCase StudyPatricia TabalonPas encore d'évaluation

- Finals Sa1: Depreciation and Depletion: MC TheoryDocument8 pagesFinals Sa1: Depreciation and Depletion: MC TheoryShaina NavaPas encore d'évaluation

- Job Description StatisticianDocument2 pagesJob Description StatisticianAjay BagariaPas encore d'évaluation

- Business Valuation of Alpha Power Limited: As of 30th September, 2009Document52 pagesBusiness Valuation of Alpha Power Limited: As of 30th September, 2009Ajay BagariaPas encore d'évaluation

- Corporate Restructuring FinalDocument21 pagesCorporate Restructuring FinalAjay BagariaPas encore d'évaluation

- Neyveli Lignite Business Valuation Report SummaryDocument13 pagesNeyveli Lignite Business Valuation Report SummaryAjay BagariaPas encore d'évaluation

- Iim Calcutta - Job Description Form: Name of The Firm AirtelDocument2 pagesIim Calcutta - Job Description Form: Name of The Firm AirtelAjay BagariaPas encore d'évaluation

- Final Presentation of MRP-1Document21 pagesFinal Presentation of MRP-1Ajay BagariaPas encore d'évaluation

- Business Valuation of Alpha Power Limited: As of 30th September, 2009Document52 pagesBusiness Valuation of Alpha Power Limited: As of 30th September, 2009Ajay BagariaPas encore d'évaluation

- Unit I The Scientific Approach in EducationDocument4 pagesUnit I The Scientific Approach in EducationadesaPas encore d'évaluation

- 124C1ADocument4 pages124C1AParthiban DevendiranPas encore d'évaluation

- 34a65 PDFDocument33 pages34a65 PDFvinu100% (2)

- Balmer PDFDocument3 pagesBalmer PDFVictor De Paula VilaPas encore d'évaluation

- Formulas For Thermodynamics 1Document2 pagesFormulas For Thermodynamics 1Stefani Ann CabalzaPas encore d'évaluation

- TCP Operational Overview and The TCP Finite State Machine (FSM)Document4 pagesTCP Operational Overview and The TCP Finite State Machine (FSM)Mayank JaitlyPas encore d'évaluation

- Renormalization Group: Applications in Statistical PhysicsDocument37 pagesRenormalization Group: Applications in Statistical PhysicsJaime Feliciano HernándezPas encore d'évaluation

- Central Angles and Inscribed Angles GuideDocument22 pagesCentral Angles and Inscribed Angles GuideEric de Guzman100% (1)

- Kollidon 30 Technical InformationDocument10 pagesKollidon 30 Technical InformationhomarearisugawaPas encore d'évaluation

- Mste 3.0 Plane Geometry Hand OutsDocument8 pagesMste 3.0 Plane Geometry Hand OutsJasmine MartinezPas encore d'évaluation

- Composition, Thermal and Rheological Behaviour of Selected Greek HoneysDocument13 pagesComposition, Thermal and Rheological Behaviour of Selected Greek HoneyssyazaqilahPas encore d'évaluation

- Correct AnswerDocument120 pagesCorrect Answerdebaprasad ghosh100% (1)

- Truth Without ObjectivityDocument4 pagesTruth Without ObjectivityMetafisco Parapensante0% (1)

- Is 4410 9 1982 PDFDocument25 pagesIs 4410 9 1982 PDFSameer Singh PatelPas encore d'évaluation

- SERO BA-2019.11 S enDocument52 pagesSERO BA-2019.11 S enJuan AlejandroPas encore d'évaluation

- Phase Transition of RNA Protein Complexes Into Ordered Hollow CondensatesDocument9 pagesPhase Transition of RNA Protein Complexes Into Ordered Hollow CondensatesMilan StepanovPas encore d'évaluation

- Guide For Scavenge InspectionDocument36 pagesGuide For Scavenge InspectionNeelakantan SankaranarayananPas encore d'évaluation

- Problem Set 1 CirclesDocument2 pagesProblem Set 1 Circlesapi-339611548100% (1)

- DBMS Lab QuestionsDocument4 pagesDBMS Lab Questionsvignesh dhayalanPas encore d'évaluation

- LAB REPORT-Rock Pore Volume and Porosity Measurement by Vacuum Saturation-GROUP - 5-PETE-2202Document13 pagesLAB REPORT-Rock Pore Volume and Porosity Measurement by Vacuum Saturation-GROUP - 5-PETE-2202Jeremy MacalaladPas encore d'évaluation

- Thinsat®300 Installation and User'S Manual: Thinkom Solutions, IncDocument39 pagesThinsat®300 Installation and User'S Manual: Thinkom Solutions, IncHiep Mai Van100% (1)

- SteganographyDocument13 pagesSteganographyIgloo JainPas encore d'évaluation

- Chapter 13: The Electronic Spectra of ComplexesDocument42 pagesChapter 13: The Electronic Spectra of ComplexesAmalia AnggreiniPas encore d'évaluation

- Sling PsychrometerDocument8 pagesSling PsychrometerPavaniPas encore d'évaluation

- Unit 10 - Week 9: Assignment 9Document4 pagesUnit 10 - Week 9: Assignment 9shubhamPas encore d'évaluation

- Innovative High Throw Copper Electrolytic ProcessDocument6 pagesInnovative High Throw Copper Electrolytic Processyonathan fausaPas encore d'évaluation

- Alkali MetalsDocument12 pagesAlkali MetalsSaki Sultana LizaPas encore d'évaluation