Académique Documents

Professionnel Documents

Culture Documents

Income Tax Declaration Formatt

Transféré par

Gopal Sudhir0 évaluation0% ont trouvé ce document utile (0 vote)

51 vues2 pagesTitre original

Copy of Income Tax Declaration Formatt

Copyright

© © All Rights Reserved

Formats disponibles

XLS, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

51 vues2 pagesIncome Tax Declaration Formatt

Transféré par

Gopal SudhirDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

To : Mr. T.K.

RAVI From: (Name)

Kalina Office, Mumbai Employee Code No.

Mobile No. 9893287199

Permanent Account No.

Financial Year : 2014-15 Residential Address:

Assessment Year : 2015-16

Sub: Income tax declaration of direct savings for the F/Y 2014 -15

I hereby declare that the following amounts are / would be paid / invested by me during the Financial

Year ending 31st March 2015, which please be taken into account for computing Income-tax payable

by me during the said year.

1. Life Insurance Premium paid in respect of policies taken on own life / on the life of wife / husband

or on life of any minor children as the case may be as detailed below:

S. No. Policy No. Sum Assured Type of Policy Total Amount of Premium

1

2

3

4

5

6

7

8

Total 0.0 0.0

2. National Saving Certificates (VIII Issue) purchased / to be purchased during the period April 2014

to March 2015 (Certificates should be in the name of self) as detailed below:

S. No. Certificate No. Date of Purchase

1

2

3. Subscription to Public Provident Fund Scheme, 1968 as detailed below:

PPF A/c. No. Name of the A/c. Holder

5518002299 Sudhir Gopal

4. Tuition Fees paid / to be paid to School / College for Children (maximum 2 children)

Name of the Children

Name of School /

College / Institution

1

2

5. Unit Link Insurance Premium paid / to be paid to UTI during the period from April 2014 to March 2015

Policy / Membership No. Date of Payment

1

2

6. Accrued interest on NSC:

Certificate No. Date of Purchase

Amount of NSC

(Rs.)

Interest (Rs.)

7. Fixed Deposit for 5 years or more with a Scheduled Bank or any other Tax Saving Investment:

Fixed Deposit Receipt No. Date of Purchase Period Amount (Rs.)

201,2ND FLOOR, KHB COLONY, HOOTAGALLI

HUNSUR MAIN ROAD HOOTAGALLI MYSORE

SY NO 67 KHATA NO 177 178, MYSORE-570018

GOPAL SUDHIR

4312

BTVPS1270H

0.0

Amount (Rs.)

Amount (Rs.)

Amount (Rs.)

1,50,000/-

Total

Total 0.0

Total premium (Rs.)

9. U/S 80CCC - Premium paid / to be paid under Pension Scheme

Name of Company Sum Assured Date of Purchase Total Premium (Rs.)

10. U/S 80D - Mediclaim premium (maximum allowed Rs.15,000/-):

Policy No. Sum Assured

1

11. Interest paid on Housing Loan u/s. 24(1) (Vi) during the period from April 2014 to March 2015

(to consider this amount, provisional statement of the Financial Institution from where housing loan

is taken to be attached):

Name of the Finance Company /

Bank & the date of Loan made

Date of possession of

the said house

ICICI Bank Ltd., A/C no:

LBMYS00002011967

14/08/2013

12. Rent paid - Eligible for exemption u/s 10 (13A):

I am in receipt of monthly House Rent Allowance and residing in a rented house (which is not

owned by me) and I pay monthly rent as per the attached receipts.

Name and address of the

Landlord

Address of the rented

house

Note: Exemption is not available for the house where the employee does not pay any rent. Rent Receipt

13. Perquisite

For Independent Accommodation - Rent paid by Company @ Rs.per month 10,000/-

For Sharing Accommodation - Propo. Rent (Rent / No. of person) paid by Co. @ Rs.00.00 p.m.

I declare that the particulars furnished by me are true and correct to the best of my knowledge and belief.

Name : GOPAL SUDHIR

Employee No.: 4312

Place: WAIDHAN

Date:

has be accompanied by registered Lease Agreement copy & PAN Card copy of the Landlord for claiming tax

exemption.

Signature

Total Premium (Rs.)

Total amount of Principal and Interest paid / to be

paid during the F/Y

Total Rent paid / to be paid for the period April 2014 to

March 2015

Principal----- 33990.70

Interest ----- 240252.50

Vous aimerez peut-être aussi

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- Income Tax Declaration FormattDocument4 pagesIncome Tax Declaration FormattAjay MalikPas encore d'évaluation

- Declaration Form For 2014-2015Document3 pagesDeclaration Form For 2014-2015RahulKumbharePas encore d'évaluation

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887Pas encore d'évaluation

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purPas encore d'évaluation

- Motor ClaimDocument4 pagesMotor Claimsndakshin@gmail.comPas encore d'évaluation

- Tax Investments Format 2010-11Document2 pagesTax Investments Format 2010-11mcnavinePas encore d'évaluation

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghPas encore d'évaluation

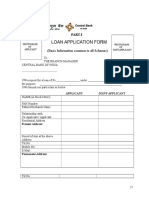

- Loan Application Form: Part-I Cent VidyarthiDocument8 pagesLoan Application Form: Part-I Cent VidyarthiSandeep ChowdhuryPas encore d'évaluation

- SBI Scholar Loan - Application FormDocument4 pagesSBI Scholar Loan - Application FormHimansh RakhejaPas encore d'évaluation

- Application For Auto LoanDocument6 pagesApplication For Auto Loanbanduat83Pas encore d'évaluation

- Bank of IndiaDocument4 pagesBank of Indiavivek75% (8)

- 3 - Sat0720151654 - Declaration - Field - Staff 15-16Document2 pages3 - Sat0720151654 - Declaration - Field - Staff 15-16Faiz AhmedPas encore d'évaluation

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiPas encore d'évaluation

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoPas encore d'évaluation

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyPas encore d'évaluation

- Intimation of Retirement/Death/Leaving Service: Sample FormDocument9 pagesIntimation of Retirement/Death/Leaving Service: Sample FormDeliver rPas encore d'évaluation

- GTCPhase4 - Terms N ConditionDocument28 pagesGTCPhase4 - Terms N ConditionMitraPas encore d'évaluation

- Statement of Computation of Loss From House Property For The Financial Year 2012-13Document5 pagesStatement of Computation of Loss From House Property For The Financial Year 2012-13Jagdish ModiPas encore d'évaluation

- LN TBond FormDocument90 pagesLN TBond FormboargzcrPas encore d'évaluation

- Epsf Form & Guideliness - 2016-17Document8 pagesEpsf Form & Guideliness - 2016-17SumanPas encore d'évaluation

- Instruction For Submitting ProofsDocument3 pagesInstruction For Submitting Proofssastrylanka_1980Pas encore d'évaluation

- Camfil Air Filtration India Private Limited Tax Declaration Form For The Financial Year 2018-19Document3 pagesCamfil Air Filtration India Private Limited Tax Declaration Form For The Financial Year 2018-19सौरव डेPas encore d'évaluation

- 2 Employee Proof Submission (EPS) Form-TemplateDocument13 pages2 Employee Proof Submission (EPS) Form-TemplateAnil GanduriPas encore d'évaluation

- Sbi Gen Pai InsuDocument11 pagesSbi Gen Pai InsuAnonymous UjEPpvYDPas encore d'évaluation

- Income Tax Declaration Form - 2014-15Document2 pagesIncome Tax Declaration Form - 2014-15Ketan Tiwari0% (1)

- For Shalini Investment Declaration-2012-13Document1 pageFor Shalini Investment Declaration-2012-13Poorni GanesanPas encore d'évaluation

- Welcome LetterDocument3 pagesWelcome LetterDeepak DevasiPas encore d'évaluation

- Loan Application Template PDFDocument5 pagesLoan Application Template PDFaslan firstPas encore d'évaluation

- EPF Book PDFDocument47 pagesEPF Book PDFKrishnarao MadhurakaviPas encore d'évaluation

- Application For Admission To The General Provident FundDocument3 pagesApplication For Admission To The General Provident FundVenkataramana NippaniPas encore d'évaluation

- (For Office Use Only) : Instruction For Filling This FormDocument6 pages(For Office Use Only) : Instruction For Filling This Formspatel1972Pas encore d'évaluation

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaPas encore d'évaluation

- Application Form For Central Sector Scholarship Scheme (Govt. of India)Document6 pagesApplication Form For Central Sector Scholarship Scheme (Govt. of India)ocinejPas encore d'évaluation

- SA Form Filling GuidelinesDocument9 pagesSA Form Filling Guidelinesd128128Pas encore d'évaluation

- Non Face To Face Account Opening FormDocument10 pagesNon Face To Face Account Opening FormAlvin Samuel PandianPas encore d'évaluation

- Investment Declaration Form F.Y. 2016-17Document2 pagesInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- Income Tax Declaration Form (09-010)Document2 pagesIncome Tax Declaration Form (09-010)tanilshuklaPas encore d'évaluation

- Postpone Mortgage (Single Borrower) Unemployed 2020Document1 pagePostpone Mortgage (Single Borrower) Unemployed 2020Ng Yen YoongPas encore d'évaluation

- Pradhan Mantri Suraksha Bima YojanaDocument2 pagesPradhan Mantri Suraksha Bima YojanaRavindra ParmarPas encore d'évaluation

- Muchlambe FinalDocument10 pagesMuchlambe FinalVinay DeshpandePas encore d'évaluation

- Home Loan Application FormDocument4 pagesHome Loan Application FormSudeep ChatterjeePas encore d'évaluation

- It Declaration Form 2010-2011Document1 pageIt Declaration Form 2010-2011Priyanka KhemkaPas encore d'évaluation

- Anx BDocument2 pagesAnx Bnikil13may080Pas encore d'évaluation

- APPLN Part IDocument5 pagesAPPLN Part IAakash GargPas encore d'évaluation

- SaharaRefundFormEnglish PDFDocument2 pagesSaharaRefundFormEnglish PDFPrashantUpadhyayPas encore d'évaluation

- It Declaration Year 2011 12Document1 pageIt Declaration Year 2011 12Vijay BokadePas encore d'évaluation

- SSY Account Opening FormDocument2 pagesSSY Account Opening Formparagaloni8365Pas encore d'évaluation

- One Time Mandate FormDocument4 pagesOne Time Mandate FormAshishPas encore d'évaluation

- Non Face To Face Form With AMB Declaration PDFDocument10 pagesNon Face To Face Form With AMB Declaration PDFrohit.godhani9724Pas encore d'évaluation

- Common Proposal Forms Traditional PlansDocument7 pagesCommon Proposal Forms Traditional PlansShashi SinghPas encore d'évaluation

- Account Opening FormDocument9 pagesAccount Opening FormTej AsPas encore d'évaluation

- Dependency Form PDFDocument5 pagesDependency Form PDFVivek VenugopalPas encore d'évaluation

- Anmol Jassal It Form 2014-15Document2 pagesAnmol Jassal It Form 2014-15anmoljassalPas encore d'évaluation

- Full Set Applications BiDocument5 pagesFull Set Applications Biprince1900Pas encore d'évaluation

- EPF ProformaDocument2 pagesEPF Proformabsnl09Pas encore d'évaluation

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionD'EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionPas encore d'évaluation

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysD'EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysPas encore d'évaluation

- Bar Bending Shape Codes As Per Bs 8666: Structural Engineering & Geospatial ConsultantsDocument7 pagesBar Bending Shape Codes As Per Bs 8666: Structural Engineering & Geospatial ConsultantsGopal SudhirPas encore d'évaluation

- Sree Vishnu Sahasra Nama Stotram - Kannada Lyrics (Text)Document20 pagesSree Vishnu Sahasra Nama Stotram - Kannada Lyrics (Text)HarshithaShrinathPas encore d'évaluation

- Disclosure To Promote The Right To InformationDocument16 pagesDisclosure To Promote The Right To InformationGopal SudhirPas encore d'évaluation

- Acid TilesDocument6 pagesAcid TilesGopal SudhirPas encore d'évaluation

- Pricing The Priceless: PaintingsDocument6 pagesPricing The Priceless: PaintingsGopal SudhirPas encore d'évaluation

- Rate AnalysisDocument19 pagesRate AnalysisNikhil63% (8)

- Civil Works-Rate AnalysisDocument122 pagesCivil Works-Rate Analysisraghacivil96% (23)

- SP46Document213 pagesSP46Gopal SudhirPas encore d'évaluation

- Er. Kashmir Dass: Prepared byDocument32 pagesEr. Kashmir Dass: Prepared byZamadagniNippuPas encore d'évaluation

- Construction Systems - CCANZ CH 15 - FormworkDocument14 pagesConstruction Systems - CCANZ CH 15 - FormworkGopal SudhirPas encore d'évaluation

- Rate Analysis of Power PlantDocument8 pagesRate Analysis of Power PlantGopal SudhirPas encore d'évaluation

- Articulated Trucks: Tam Thoi Gui Bo Ve Cac Thiet Bi Xay Dung. Mai Con Se Gui Bo Ve Thiet Bi Va .N TaiDocument40 pagesArticulated Trucks: Tam Thoi Gui Bo Ve Cac Thiet Bi Xay Dung. Mai Con Se Gui Bo Ve Thiet Bi Va .N TaiGopal SudhirPas encore d'évaluation

- Steel Calculator Brick and Mortar CalculatorDocument12 pagesSteel Calculator Brick and Mortar CalculatorGopal SudhirPas encore d'évaluation

- Estimate Gadawara Power Plant, NTPCDocument420 pagesEstimate Gadawara Power Plant, NTPCGopal SudhirPas encore d'évaluation

- IMS Procedures 2005 PrintDocument215 pagesIMS Procedures 2005 PrintGopal SudhirPas encore d'évaluation

- Rate AnalysisDocument8 pagesRate AnalysisGopal SudhirPas encore d'évaluation

- Gopal Sudhir: Order Placed Processing In-Transit DeliveryDocument7 pagesGopal Sudhir: Order Placed Processing In-Transit DeliveryGopal SudhirPas encore d'évaluation

- Earthwork & VolumesDocument18 pagesEarthwork & VolumesGopal Sudhir100% (1)

- Unit # 4 Pending Jobs Status Dated 21-8-14Document5 pagesUnit # 4 Pending Jobs Status Dated 21-8-14Gopal SudhirPas encore d'évaluation

- Drilling and Blasting Activities at Senakin Mine ProjectDocument18 pagesDrilling and Blasting Activities at Senakin Mine ProjectSlamet SetyowibowoPas encore d'évaluation

- India Timber Supply and Demand 2010-2030Document64 pagesIndia Timber Supply and Demand 2010-2030Divyansh Rodney100% (1)

- Contingent Liabilities For Philippines, by Tarun DasDocument62 pagesContingent Liabilities For Philippines, by Tarun DasProfessor Tarun DasPas encore d'évaluation

- PROVA DE INGLÊS Anpad 2009 JunDocument6 pagesPROVA DE INGLÊS Anpad 2009 JunDavi Zorkot100% (1)

- Punjab AgencyDocument65 pagesPunjab Agencyajay sharmaPas encore d'évaluation

- Application of Memebership Namrata DubeyDocument2 pagesApplication of Memebership Namrata DubeyBHOOMI REALTY AND CONSULTANCY - ADMINPas encore d'évaluation

- Naina Arvind MillsDocument28 pagesNaina Arvind MillsMini Goel100% (1)

- BFSI Chronicle 3rd Annual Issue (14th Edition) September 2023Document132 pagesBFSI Chronicle 3rd Annual Issue (14th Edition) September 2023amanchauhanPas encore d'évaluation

- Dmu Bal Options Accounting&BusinessManagementDocument2 pagesDmu Bal Options Accounting&BusinessManagementMonalisa TayobPas encore d'évaluation

- Economic System and BusinessDocument51 pagesEconomic System and BusinessJoseph SathyanPas encore d'évaluation

- Core Complexities Bharat SyntheticsDocument4 pagesCore Complexities Bharat SyntheticsRohit SharmaPas encore d'évaluation

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahPas encore d'évaluation

- Macroeconomics - Assignment IIDocument6 pagesMacroeconomics - Assignment IIRahul Thapa MagarPas encore d'évaluation

- Ikhlayel 2018Document41 pagesIkhlayel 2018Biswajit Debnath OffcPas encore d'évaluation

- New Almarai Presentation Jan 09Document55 pagesNew Almarai Presentation Jan 09Renato AbalosPas encore d'évaluation

- Sustainable Space Exploration?Document11 pagesSustainable Space Exploration?Linda BillingsPas encore d'évaluation

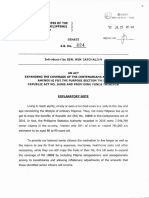

- S.B. No. 824: First Regular SessionDocument5 pagesS.B. No. 824: First Regular SessionKevin TayagPas encore d'évaluation

- Ethiopia Profile Enhanced Final 7th October 2021Document6 pagesEthiopia Profile Enhanced Final 7th October 2021sarra TPIPas encore d'évaluation

- Joint Venture AgreementDocument7 pagesJoint Venture AgreementFirman HamdanPas encore d'évaluation

- Process of Environmental Clerance and The Involve inDocument9 pagesProcess of Environmental Clerance and The Involve inCharchil SainiPas encore d'évaluation

- PPF in SAP EWM 1Document10 pagesPPF in SAP EWM 1Neulers0% (1)

- Fidelity Bond Form Attachment BDocument9 pagesFidelity Bond Form Attachment BLucelyn Yruma TurtonaPas encore d'évaluation

- February-14 Rural Development SchemesDocument52 pagesFebruary-14 Rural Development SchemesAnonymous gVledD7eUGPas encore d'évaluation

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonPas encore d'évaluation

- Volvo Trucks CaseDocument33 pagesVolvo Trucks Caseravichauhan18100% (3)

- Lean Remediation - Azimuth1Document1 pageLean Remediation - Azimuth1Jason DaltonPas encore d'évaluation

- Tata Vistara - Agency PitchDocument27 pagesTata Vistara - Agency PitchNishant Prakash0% (1)

- IB Economics SL8 - Overall Economic ActivityDocument6 pagesIB Economics SL8 - Overall Economic ActivityTerran100% (1)

- Sanjay Sir ShahjahanpurDocument3 pagesSanjay Sir Shahjahanpursinghutkarsh3344Pas encore d'évaluation

- Red Bull FinalDocument28 pagesRed Bull FinalYousaf Haroon Yousafzai0% (1)