Académique Documents

Professionnel Documents

Culture Documents

Quanto Lecture Note

Transféré par

Tze ShaoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Quanto Lecture Note

Transféré par

Tze ShaoDroits d'auteur :

Formats disponibles

4.

Option pricing models under the Black-

Scholes framework

Riskless hedging principle

Writer of a call option hedges his exposure by holding certain units

of the underlying asset in order to create a riskless portfolio.

In an ecient market with no riskless arbitrage opportunity, a riskless

portfolio must earn rate of return equals the riskless interest rate.

1

Dynamic replication strategy

How to replicate an option dynamically by a portfolio of the riskless

asset in the form of money market account and the risky underlying

asset?

The cost of constructing the replicating portfolio gives the fair price

of an option.

Risk neutrality argument

The two tradeable securities, option and asset, are hedgeable with

each other. Hedgeable securities should have the same market price

of risk.

2

Black-Scholes assumptions on the nancial market

(i) Trading takes place continuously in time.

(ii) The riskless interest rate r is known and constant over time.

(iii) The asset pays no dividend.

(iv) There are no transaction costs in buying or selling the asset or

the option, and no taxes.

(v) The assets are perfectly divisible.

(vi) There are no penalties to short selling and the full use of pro-

ceeds is permitted.

(vii) There are no arbitrage opportunities.

3

The stochastic process of the asset price S is assumed to follow the

Geometric Brownian motion

dS

S

= dt + dZ.

Consider a portfolio which involves short selling of one unit of a

European call option and long holding of units of the underlying

asset. The value of the portfolio is given by

= c +S,

where c = c(S, t) denotes the call price.

Since both c and are random variables, we apply the Ito lemma

to compute their stochastic dierentials as follows:

dc =

c

t

dt +

c

S

dS +

2

2

S

2

2

c

S

2

dt

4

d = dc + dS

=

_

c

t

2

2

S

2

2

c

S

2

_

dt +

_

c

S

_

dS

=

_

c

t

2

2

S

2

2

c

S

2

+

_

c

S

_

S

_

dt +

_

c

S

_

S dZ.

Why the dierential Sd does not enter into d? By virtue of

the assumption of following a self-nancing trading strategy, the

contribution to d due to Sd is oset by the accompanying pur-

chase/sale of units of options.

5

If we choose =

c

S

, then the portfolio becomes a riskless hedge in-

stantaneously

_

since

c

S

changes continuously with time

_

. By virtue

of no arbitrage, the hedged portfolio should earn the riskless in-

terest rate.

By setting d = rdt

d =

_

c

t

2

2

S

2

2

c

S

2

_

dt = rdt = r

_

c +S

c

S

_

dt.

Black-Scholes equation:

c

t

+

2

2

S

2

2

c

S

2

+rS

c

S

rc = 0.

Terminal payo: c(S, T) = max(S X, 0).

The parameter (expected rate of return) does not appear in the

governing equation and the auxiliary condition.

6

5 parameters in the option model: S, T, X, r and ; only is

unobservable.

Deciencies in the model

1. Geometric Brownian motion assumption? Actual asset price

dynamics is much more complicated.

2. Continuous hedging at all times

trading usually involves transaction costs.

3. Interest rate should be stochastic instead of deterministic.

7

Dynamic replication strategy (Mertons approach)

Q

S

(t) = number of units of asset

Q

V

(t) = number of units of option

M

S

(t) = dollar value of Q

S

(t) units of asset

M

V

(t) = dollar value of Q

V

(t) units of option

M(t) = value of riskless asset invested in money market account

Construction of a self-nancing and dynamically hedged portfo-

lio containing risky asset, option and riskless asset.

8

Dynamic replication: Composition is allowed to change at all

times in the replication process.

The self-nancing portfolio is set up with zero initial net invest-

ment cost and no additional funds added or withdrawn after-

wards.

The zero net investment condition at time t is

(t) = M

S

(t) +M

V

(t) +M(t)

= Q

S

(t)S +Q

V

(t)V +M(t) = 0.

Dierential of option value V :

dV =

V

t

dt +

V

S

dS +

2

2

S

2

2

V

S

2

dt

=

_

V

t

+S

V

S

+

2

2

S

2

2

V

S

2

_

dt +S

V

S

dZ.

9

Formally, we write

dV

V

=

V

dt +

V

dZ

where

V

=

V

t

+S

V

S

+

2

2

S

2

2

V

S

2

V

and

V

=

S

V

S

V

.

d(t) = [Q

S

(t) dS +Q

V

(t) dV +rM(t) dt]

+[SdQ

S

(t) +V dQ

S

(t) +dM(t)]

. .

zero due to self-nancing trading strategy

10

The instantaneous portfolio return d(t) can be expressed in terms

of M

S

(t) and M

V

(t) as follows:

d(t) = Q

S

(t) dS +Q

V

(t) dV +rM(t) dt

= M

S

(t)

dS

S

+M

V

(t)

dV

V

+rM(t) dt

= [( r)M

S

(t) +(

V

r)M

V

(t)] dt

+ [M

S

(t) +

V

M

V

(t)] dZ.

We then choose M

S

(t) and M

V

(t) such that the stochastic term

becomes zero.

From the relation:

M

S

(t) +

V

M

V

(t) = SQ

S

(t) +

S

V

S

V

V Q

V

(t) = 0,

we obtain

Q

S

(t)

Q

V

(t)

=

V

S

.

11

Taking the choice of Q

V

(t) = 1, and knowing

0 = (t) = V +S +M(t)

we obtain

V = S +M(t), where =

V

S

.

Since the replicating portfolio is self-nancing and replicates the

terminal payo, by virtue of no-arbitrage argument, the initial cost

of setting up this replicating portfolio of risky asset and riskless asset

must be equal to the value of the option being replicated.

12

The dynamic replicating portfolio is riskless and requires no net

investment, so d(t) = 0.

0 = [( r)M

S

(t) +(

V

r)M

V

(t)] dt.

Putting

Q

S

(t)

Q

V

(T)

=

V

S

, we obtain

( r)S

V

S

= (

V

r)V.

Replacing

V

by

_

V

t

+S

V

S

+

2

2

S

2

2

V

S

2

_ _

V , we obtain the Black-

Scholes equation

V

t

+

2

2

S

2

2

V

S

2

+rS

V

S

rV = 0.

13

Alternative perspective on risk neutral valuation

From

V

=

V

t

+S

V

S

+

2

2

S

2

2

V

S

2

V

, we obtain

V

t

+

2

2

S

2

2

V

S

2

+S

V

S

V

V = 0.

We need to calibrate the parameters and

V

, or nd some other

means to avoid such nuisance.

Combining

V

=

S

V

S

V

and ( r)S

V

S

= (

V

r)V , we obtain

V

r

V

. .

V

=

r

. .

S

Black-Scholes equation.

14

The market price of risk is the rate of extra return above r per

unit risk.

Two hedgeable securities should have the same market price of

risk.

The Black-Scholes equation can be obtained by setting =

V

= r (implying zero market price of risk).

In the world of zero market price of risk, investors are said to be

risk neutral since they do not demand extra returns on holding

risky assets.

Option valuation can be performed in the risk neutral world by

articially taking the expected rate of returns of the asset and

option to be r.

15

Arguments of risk neutrality

We nd the price of a derivative relative to that of the underlying

asset mathematical relationship between the prices is invariant

to the risk preference.

Be careful that the actual rate of return of the underlying as-

set would aect the asset price and thus indirectly aects the

absolute derivative price.

We simply use the convenience of risk neutrality to arrive at the

mathematical relationship but actual risk neutrality behaviors of

the investors are not necessary in the derivation of option prices.

16

How we came up with the option formula? Black (1989)

It started with tinkering and ended with delayed recognition.

The expected return on a warrant should depend on the risk of

the warrant in the same way that a common stocks expected

return depends on its risk.

I spent many, many days trying to nd the solution to that (dif-

ferential) equation. I have a PhD in applied mathematics, but

had never spent much time on dierential equations, so I didnt

know the standard methods used to solve problems like that. I

have an A.B. in physics, but I didnt recognize the equation as

a version of the heat equation, which has well-known solutions.

17

Continuous time securities model

Uncertainty in the nancial market is modeled by the ltered

probability space (, F, (F

t

)

0tT

, P), where is a sample space,

F is a -algebra on , P is a probability measure on (, F), F

t

is the ltration and F

T

= F.

There are M + 1 securities whose price processes are modeled

by adapted stochastic processes S

m

(t), m = 0, 1, , M.

We dene h

m

(t) to be the number of units of the m

th

security

held in the portfolio.

The trading strategy H(t) is the vector stochastic process (h

0

(t)

h

1

(t) h

M

(t))

T

, where H(t) is a (M+1)-dimensional predictable

process since the portfolio composition is determined by the in-

vestor based on the information available before time t.

18

The value process associated with a trading strategy H(t) is

dened by

V (t) =

M

m=0

h

m

(t)S

m

(t), 0 t T,

and the gain process G(t) is given by

G(t) =

M

m=0

_

t

0

h

m

(u) dS

m

(u), 0 t T.

Similar to that in discrete models, H(t) is self-nancing if and

only if

V (t) = V (0) +G(t).

19

We use S

0

(t) to denote the money market account process that

grows at the riskless interest rate r(t), that is,

dS

0

(t) = r(t)S

0

(t) dt.

The discounted security price process S

m

(t) is dened as

S

m

(t) = S

m

(t)/S

0

(t), m = 1, 2, , M.

The discounted value process V

(t) is dened by dividing V (t)

by S

0

(t). The discounted gain process G

(t) is dened by

G

(t) = V

(t) V

(0).

20

No-arbitrage principle and equivalent martingale measure

A self-nancing trading strategy H represents an arbitrage op-

portunity if and only if (i) G

(T) 0 and (ii) E

P

G

(T) > 0 where

P is the actual probability measure of the states of occurrence

associated with the securities model.

A probability measure Q on the space (, F) is said to be an

equivalent martingale measure if it satises

(i) Q is equivalent to P, that is, both P and Q have the same

null set;

(ii) the discounted security price processes S

m

(t), m = 1, 2, , M

are martingales under Q, that is,

E

Q

[S

m

(u)|F

t

] = S

m

(t), for all 0 t u T.

21

Theorem

Let Y be an attainable contingent claim generated by some trading

strategy H and assume that an equivalent martingale measure Q

exists, then for each time t, 0 t T, the arbitrage price of Y is

given by

V (t; H) = S

0

(t)E

Q

_

Y

S

0

(T)

F

t

_

.

The validity of the Theorem is readily seen if we consider the dis-

counted value process V

(t; H) to be a martingale under Q. This

leads to

V (t; H) = S

0

(t)V

(t; H) = S

0

(t)E

Q

[V

(T; H)|F

t

].

Furthermore, by observing that V

(T; H) = Y/S

0

(T), so the risk

neutral valuation formula follows.

22

Change of numeraire

The choice of S

0

(t) as the numeraire is not unique in order that

the risk neutral valuation formula holds.

Let N(t) be a numeraire whereby we have the existence of an

equivalent probability measure Q

N

such that all security prices

discounted with respect to N(t) are Q

N

-martingale. In addition,

if a contingent claim Y is attainable under (S

0

(t), Q), then it is

also attainable under (N(t), Q

N

).

23

The arbitrage price of any security given by the risk neutral valuation

formula under both measures should agree. We then have

S

0

(t)E

Q

_

Y

S

0

(T)

F

t

_

= N(t)E

Q

N

_

Y

N(T)

F

t

_

.

To eect the change of measure from Q

N

to Q, we multiply

Y

N(T)

by the Radon-Nikodym derivative so that

S

0

(t)E

Q

_

Y

S

0

(T)

F

t

_

= N(t)E

Q

_

Y

N(T)

dQ

N

dQ

F

t

_

.

By comparing like terms, we obtain

dQ

N

dQ

=

N(T)

N(t)

_

S

0

(T)

S

0

(t)

.

24

Black-Scholes model revisited

The price processes of S(t) and M(t) are governed by

dS(t)

S(t)

= dt + dZ

dM(t) = rM(t) dt.

The price process of S

(t) = S(t)/M(t) becomes

dS

(t)

S

(t)

= ( r)dt + dZ.

We would like to nd the equivalent martingale measure Q such

that the discounted asset price S

is Q-martingale. By the Girsanov

Theorem, suppose we choose (t) in the Radon-Nikodym derivative

such that

(t) =

r

,

then

Z is a Brownian motion under the probability measure Q and

d

Z = dZ +

r

dt.

25

Under the Q-measure, the process of S

(t) now becomes

dS

(t)

S

(t)

= d

Z,

hence S

(t) is Q-martingale. The asset price S(t) under the Q-

measure is governed by

dS(t)

S(t)

= r dt + d

Z.

When the money market account is used as the numeraire, the cor-

responding equivalent martingale measure is called the risk neutral

measure and the drift rate of S under the Q-measure is called the

risk neutral drift rate.

26

The arbitrage price of a derivative is given by

V (S, t) = e

r(Tt)

E

t,S

Q

[h(S

T

)]

where E

t,S

Q

is the expectation under the risk neutral measure Q

conditional on the ltration F

t

and S

t

= S. By the Feynman-Kac

representation formula, the governing equation of V (S, t) is given

by

V

t

+

2

2

S

2

2

V

S

2

+rS

V

S

rV = 0.

Consider the European call option whose terminal payo is max(S

T

X, 0). The call price c(S, t) is given by

c(S, t) = e

r(Tt)

E

Q

[max(S

T

X, 0)]

= e

r(Tt)

{E

Q

[S

T

1

{S

T

X}

] XE

Q

[1

{S

T

X}

]}.

27

Exchange rate process under domestic risk neutral measure

Consider a foreign currency option whose payo function de-

pends on the exchange rate F, which is dened to be the do-

mestic currency price of one unit of foreign currency.

Let M

d

and M

f

denote the money market account process in

the domestic market and foreign market, respectively. The pro-

cesses of M

d

(t), M

f

(t) and F(t) are governed by

dM

d

(t) = rM

d

(t) dt, dM

f

(t) = r

f

M

f

(t) dt,

dF(t)

F(t)

= dt + dZ

F

,

where r and r

f

denote the riskless domestic and foreign interest

rates, respectively.

28

We may treat the domestic money market account and the for-

eign money market account in domestic dollars (whose value

is given by FM

f

) as traded securities in the domestic currency

world.

With reference to the domestic equivalent martingale measure,

M

d

is used as the numeraire.

By Itos lemma, the relative price process X(t) = F(t)M

f

(t)/M

d

(t)

is governed by

dX(t)

X(t)

= (r

f

r +) dt + dZ

F

.

29

With the choice of = (r

f

r +)/ in the Girsanov Theorem,

we dene

dZ

d

= dZ

F

+ dt,

where Z

d

is a Brownian process under Q

d

.

Under the domestic equivalent martingale measure Q

d

, the pro-

cess of X now becomes

dX(t)

X(t)

= dZ

d

so that X is Q

d

-martingale.

The exchange rate process F under the Q

d

-measure is given by

dF(t)

F(t)

= (r r

f

) dt + dZ

d

.

The risk neutral drift rate of F under Q

d

is found to be r r

f

.

30

Recall that the Black-Scholes equation for a European vanilla call

option takes the form

c

=

2

2

S

2

2

c

S

2

+rS

c

S

rc, 0 < S < , > 0, = T t.

Initial condition (payo at expiry)

c(S, 0) = max(S X, 0), X is the strike price.

Using the transformation: y = lnS and c(y, ) = e

r

w(y, ), the

Black-Scholes equation is transformed into

w

=

2

2

2

w

y

2

+

_

r

2

2

_

w

y

, < y < , > 0.

The initial condition for the model now becomes

w(y, 0) = max(e

y

X, 0).

31

Green function approach

The innite domain Green function is known to be

(y, ) =

1

2

exp

_

_

[y +(r

2

2

)]

2

2

2

_

_

.

Here, (y, ) satises the initial condition:

lim

0

+

(y, ) = (y),

where (y) is the Dirac function representing a unit impulse at the

origin.

The initial condition can be expressed as

w(y, 0) =

_

w(, 0)(y ) d,

so that w(y, 0) can be considered as the superposition of impulses

with varying magnitude w(, 0) ranging from to .

32

Since the Black-Scholes equation is linear, the response in po-

sition y and at time to expiry due to an impulse of magnitude

w(, 0) in position at = 0 is given by w(, 0)(y , ).

From the principle of superposition for a linear dierential equa-

tion, the solution is obtained by summing up the responses due

to these impulses.

c(y, ) = e

r

w(y, )

= e

r

_

w(, 0) (y , ) d

= e

r

_

lnX

(e

X)

1

2

exp

_

_

[y +(r

2

2

) ]

2

2

2

_

_

d.

33

Note that

_

lnX

e

2

exp

_

_

[y +(r

2

2

) ]

2

2

2

_

_

d

= exp(y +r)

_

lnX

1

2

exp

_

_

_

_

_

_

y +

_

r +

2

2

_

_

2

2

2

_

_

_

_

_

d

= e

r

SN

_

_

ln

S

X

+(r +

2

2

)

_

_

, y = lnS;

_

lnX

1

2

exp

_

_

[y +(r

2

2

) ]

2

2

2

_

_

d

= N

_

_

y +(r

2

2

) lnX

_

_

= N

_

_

ln

S

X

+(r

2

2

)

_

_

, y = lnS.

34

Hence, the price formula of the European call option is found to be

c(S, ) = SN(d

1

) Xe

r

N(d

2

),

where

d

1

=

ln

S

X

+(r +

2

2

)

, d

2

= d

1

.

The call value lies within the bounds

max(S Xe

r

, 0) c(S, ) S, S 0, 0,

35

36

c(S, ) = e

r

E

Q

[(S

T

X)1

{S

T

X}

]

= e

r

_

0

max(S

T

X, 0)(S

T

, T; S, t) dS

T

.

Under the risk neutral measure,

ln

S

T

S

=

_

r

2

2

_

+

Z()

so that ln

S

T

S

is normally distributed with mean

_

r

2

2

_

and

variance

2

, = T t.

From the density function of a normal random variable, the

transition density function is given by

(S

T

, T; S, t) =

1

S

T

2

exp

_

_

_

_

_

_

ln

S

T

S

_

r

2

2

_

_

2

2

2

_

_

_

_

_

.

37

If we compare the price formula with the expectation representation

we deduce that

N(d

2

) = E

Q

[1

{S

T

X}

] = Q[S

T

X]

SN(d

1

) = e

r

E

Q

[S

T

1

{S

T

X}

].

N(d

2

) is recognized as the probability under the risk neutral

measure Q that the call expires in-the-money, so Xe

r

N(d

2

)

represents the present value of the risk neutral expectation of

payment paid by the option holder at expiry.

SN(d

1

) is the discounted risk neutral expectation of the terminal

asset price conditional on the call being in-the-money at expiry.

38

Delta - derivative with respect to asset price

c

=

c

S

= N(d

1

) +S

1

2

e

d

2

1

2

d

1

S

Xe

r

1

2

e

d

2

2

2

d

2

S

= N(d

1

) +

1

2

[e

d

2

1

2

e

(r+ln

S

X

)

e

d

2

2

2

]

= N(d

1

) > 0.

Knowing that a European call can be replicated by units of asset

and riskless asset in the form of money market account, the factor

N(d

1

) in front of S in the call price formula thus gives the hedge

ratio .

39

c

is an increasing function of S since

S

N(d

1

) is always posi-

tive. Also, the value of

c

is bounded between 0 and 1.

The curve of

c

against S changes concavity at

S

c

= X exp

_

_

r +

3

2

2

_

_

so that the curve is concave upward for 0 S < S

c

and concave

downward for S

c

< S < .

lim

c

S

= 1 for all values of S,

while

lim

0

+

c

S

=

_

_

1 if S > X

1

2

if S = X

0 if S < X

.

40

Variation of the delta of the European call value with respect to the

asset price S. The curve changes concavity at S = Xe

_

r+

3

2

2

_

.

41

Variation of the delta of the European call value with respect to

time to expiry . The delta value always tends to one from below

when the time to expiry tends to innity. The delta value tends to

dierent asymptotic limits as time comes close to expiry, depending

on the moneyness of the option.

42

Continuous dividend yield models

Let q denote the constant continuous dividend yield, that is, the

holder receives dividend of amount equal to qS dt within the interval

dt. The asset price dynamics is assumed to follow the Geometric

Brownian Motion

dS

S

= dt + dZ.

We form a riskless hedging portfolio by short selling one unit of the

European call and long holding units of the underlying asset. The

dierential of the portfolio value is given by

43

d = dc + dS +qS dt

=

_

c

t

2

2

S

2

2

c

S

2

+qS

_

dt +

_

c

S

_

dS.

The last term qS dt is the wealth added to the portfolio due to

the dividend payment received. By choosing =

c

S

, we obtain a

riskless hedge for the portfolio. The hedged portfolio should earn

the riskless interest rate.

We then have

d =

_

c

t

2

2

S

2

2

c

S

2

+qS

c

S

_

dt = r

_

c +S

c

S

_

dt,

which leads to

c

=

2

2

S

2

2

c

S

2

+(r q)S

c

S

rc, = T t, 0 < S < , > 0.

44

Martingale pricing approach

Suppose all the dividend yields received are used to purchase addi-

tional units of asset, then the wealth process of holding one unit of

asset initially is given by

S

t

= e

qt

S

t

,

where e

qt

represents the growth factor in the number of units. The

wealth process

S

t

follows

d

S

t

S

t

= ( +q) dt + dZ.

We would like to nd the equivalent risk neutral measure Q under

which the discounted wealth process

S

t

is Q-martingale. We choose

(t) in the Radon-Nikodym derivative to be

(t) =

+q r

.

45

Now

Z is Brownian process under Q and

d

Z = dZ +

+q r

dt.

Also,

S

t

becomes Q-martingale since

d

t

= d

Z.

The asset price S

t

under the equivalent risk neutral measure Q be-

comes

dS

t

S

t

= (r q) dt + d

Z.

Hence, the risk neutral drift rate of S

t

is r q.

Analogy with foreign currency options

The continuous yield model is also applicable to options on foreign

currencies where the continuous dividend yield can be considered as

the yield due to the interest earned by the foreign currency at the

foreign interest rate r

f

.

46

Call and put price formulas

The price of a European call option on a continuous dividend paying

asset can be obtained by changing S to Se

q

in the price formula.

This rule of transformation is justied since the drift rate of the

dividend yield paying asset under the risk neutral measure is r q.

Now, the European call price formula with continuous dividend yield

q is found to be

c = Se

q

N(

d

1

) Xe

r

N(

d

2

),

where

d

1

=

ln

S

X

+(r q +

2

2

)

,

d

2

=

d

1

.

47

Similarly, the European put formula with continuous dividend yield

q can be deduced from the Black-Scholes put price formula to be

p = Xe

r

N(

d

2

) Se

q

N(

d

1

).

The new put and call prices satisfy the put-call parity relation

p = c Se

q

+Xe

r

.

Furthermore, the following put-call symmetry relation can also be

deduced from the above call and put price formulas

c(S, ; X, r, q) = p(X, ; S, q, r),

48

The put price formula can be obtained from the corresponding

call price formula by interchanging S with X and r with q in the

formula. Recall that a call option entitles its holder the right to

exchange the riskless asset for the risky asset, and vice versa for

a put option. The dividend yield earned from the risky asset is

q while that from the riskless asset is r.

If we interchange the roles of the riskless asset and risky asset

in a call option, the call becomes a put option, thus giving the

justication for the put-call symmetry relation.

49

Time dependent parameters

Suppose the model parameters become deterministic functions of

time, the Black-Scholes equation has to be modied as follows

V

=

2

()

2

S

2

2

V

S

2

+[r()q()] S

V

S

r()V, 0 < S < , > 0,

where V is the price of the derivative security.

When we apply the following transformations: y = lnS and w =

e

_

0

r(u) du

V , then

w

=

2

()

2

2

w

y

2

+

_

r() q()

2

()

2

_

w

y

.

Consider the following form of the fundamental solution

f(y, ) =

1

_

2s()

exp

_

[y +e()]

2

2s()

_

,

50

it can be shown that f(y, ) satises the parabolic equation

f

=

1

2

s

()

2

f

y

2

+e

()

f

y

.

Suppose we let

s() =

_

0

2

(u) du

e() =

_

0

[r(u) q(u)] du

s()

2

,

one can deduce that the fundamental solution is given by

(y, ) =

1

_

2

_

0

2

(u) du

exp

_

_

_

{y +

_

0

[r(u) q(u)

2

(u)

2

] du}

2

2

_

0

2

(u) du

_

_

_.

Given the initial condition w(y, 0), the solution can be expressed as

w(y, ) =

_

w(, 0) (y , ) d.

51

Note that the time dependency of the coecients r(), q() and

2

() will not aect the spatial integration with respect to . We

make the following substitutions in the option price formulas

r is replaced by

1

_

0

r(u) du

q is replaced by

1

_

0

q(u) du

2

is replaced by

1

_

0

2

(u) du.

For example, the European call price formula is modied as follows:

c = Se

0

q(u) du

N(

d

1

) Xe

0

r(u) du

N(

d

2

)

where

d

1

=

ln

S

X

+

_

0

[r(u) q(u) +

2

(u)

2

] du

_

_

0

2

(u) du

,

d

2

=

d

1

_

0

2

(u) du.

52

Implied volatilities

The only unobservable parameter in the Black-Scholes formulas is

the volatility value, . By inputting an estimated volatility value, we

obtain the option price. Conversely, given the market price of an

option, we can back out the corresponding Black-Scholes implied

volatiltiy.

Several implied volatility values obtained simultaneously from

dierent options (varying strikes and maturities) on the same

underlying asset provide the market view about the volatility of

the stochastic movement of the asset price.

Given the market prices of European call options with dierent

maturities (all have the strike prices of 105, current asset price

is 106.25 and short-term interest rate over the period is at at

5.6%).

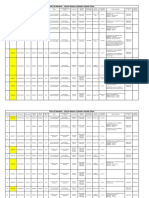

maturity 1-month 3-month 7-month

Value 3.50 5.76 7.97

Implied volatility 21.2% 30.5% 19.4%

53

Time dependent volatility

The Black-Scholes formulas remain valid for time dependent volatil-

ity except that

1

T t

_

T

t

()

2

d is used to replace .

How to obtain (t) given the implied volatility measured at time t

of a European option expiring at time t. Now

imp

(t

, t) =

1

t t

_

t

t

()

2

d

so that

_

t

t

()

2

d =

2

imp

(t

, t)(t t

).

Dierentiate with respect to t, we obtain

(t) =

imp

(t

, t)

2

+2(t t

)

imp

(t

, t)

imp

(t

, t)

t

.

54

Practically, we do not have a continuous dierentiable implied volatil-

ity function

imp

(t

, t), but rather implied volatilities are available at

discrete instants t

i

. Suppose we assume (t) to be piecewise con-

stant over (t

i1

, t

i

), then

(t

i

t

)

2

imp

(t

, t

i

) (t

i1

t

)

2

imp

(t

, t

i1

)

=

_

t

i

t

i1

2

() d =

2

(t)(t

i

t

i1

), t

i1

< t < t

i

,

(t) =

_

(t

i

t

)

2

imp

(t

, t

i1

) (t

i1

t

)

2

imp

(t

, t

i1

)

t

i

t

i1

, t

i1

< t < t

i

.

55

Quanto-prewashing techniques

1. Consider two assets whose dynamics follow the lognormal pro-

cesses

df

f

=

f

dt +

f

dZ

f

dg

g

=

g

dt +

g

dZ

g

.

By the Ito Lemma

d(fg)

fg

= (

f

+

g

+

f

g

) dt + dZ

where

2

=

2

f

+

2

g

+2

f

g

;

d(f/g)

f/g

= (

f

g

g

+

2

g

) dt +

dZ

where

2

=

2

f

+

2

g

2

f

g

.

56

Proof

d(fg) = f dg +g df +

f

g

fg dt

. .

arising from dfdg and

observing dZ

f

dZ

g

= dt

d(fg)

fg

=

dg

g

+

df

f

+

f

g

dt

= (

f

+g +

f

g

) dt +

f

dZ

f

+

g

dZ

g

. (1)

Observe that the sum of two Brownian processes remains to be

Brownian. Recall the formula

VAR(X +Y ) = VAR(X) +VAR(Y ) +2COV(X, Y ).

Hence, the sum of

f

dZ

f

+

g

dZ

g

can be expressed as dZ, where

2

=

2

f

+

2

g

+2

f

g

.

57

d

_

1

g

_

=

dg

g

2

+

2

g

3

dg

2

2

; (2)

d

_

1

g

_

1

g

=

g

dt +

2

g

dt

g

dZ

g

. (3)

Replacing g by 1/g in formula (1), we obtain

d(f/g)

f/g

= (

f

g

g

+

2

g

) dt +

f

dZ

f

g

dZ

g

. (4)

Recall the formula: VAR(XY ) = VAR(X)+VAR(Y )2COV(X, Y ).

The sum of

f

dZ

f

g

dZ

y

can be expressed as

dZ, where

2

=

2

f

+

2

g

2

f

g

.

58

2.

S = foreign asset price in foreign currency

F = exchange rate

= domestic currency price of one unit of foreign currency

S

= FS = foreign asset price in domestic currency

q = dividend yield of the asset.

Under the domestic risk neutral measure Q

d

, the risk neutral

drift rate of S

and F are

d

S

= r

d

q and

d

F

= r

d

r

f

.

Under the foreign Q

f

, the risk neutral drift rate for S and 1/F

are

f

S

= r

f

q and

f

1/F

= r

f

r

d

.

59

Quanto prewashing is to nd

d

S

, that is, the risk neutral drift rate

of the price of the asset in foreign currency under Q

d

.

Recall the formula:

d

S

=

d

FS

=

d

F

+

d

S

+

F

S

where the dynamics of S and F under Q

d

are

dS

S

=

d

S

dt +

S

dZ

d

S

dF

F

=

d

F

dt +

F

dZ

d

F

,

where Z

d

S

and Z

d

F

are Q

d

-Brownian process.

60

We obtain

d

S

=

d

S

d

F

F

S

= (r

d

q) (r

d

r

f

)

F

S

= (r

f

q)

F

S

.

Comparing with

f

S

= r

f

q and

d

S

, there is an extra term

F

S

.

The risk neutral drift rate of the asset is changed by the amount

S

when the risk neutral measure is changed from the foreign

currency world to the domestic currency world.

61

Siegels paradox

Given that the price dynamics of F under Q

d

is

dF

F

= (r

d

r

f

) dt +

F

dZ

d

,

then the process for 1/F is

d(1/F)

1/F

= (r

f

r

d

+

2

F

) dt

F

dZ

d

.

This is seen as a puzzle to many people since the risk neutral drift

rate for 1/F should be r

f

r

d

instead of r

f

r

d

+

2

F

.

We observe directly from the above SDEs that

F

=

1/F

and

F,1/F

= 1.

62

An interesting application of Siegels paradox

Suppose the terminal payo of an exchange rate option is F

T

1

{F

T

>K}

.

Let V

d

(F, t) denote the value of the option in the domestic currency

world. Dene

V

f

(F

t

, t) = V

d

(F

t

, t)/F

t

,

so that the terminal payo of the exchange rate option in foreign

currency world is 1

{F

T

>K}

. Now

V

f

(F, t) = e

r

f

(Tt)

E

Q

f

t

[1

{F

T

>K}

|F

t

= F].

63

From

d

1/F

=

f

1/F

+

2

F

and observing

F

=

1/F

, we deduce that

f

F

=

d

F

+

2

F

.

This is easily seen if we interchange the foreign and domestic cur-

rency worlds. We obtain

V

d

(F, t) = FV

f

(F, t) = e

r

f

(Tt)

FN(d)

where

d =

ln

F

K

+

_

f

F

2

F

2

_

=

ln

F

K

+

_

r

d

r

f

+

2

F

2

_

.

64

Foreign exchange options

Under the domestic risk neutral measure Q

d

, the exchange rate

process follows

dF

F

= (r

d

r

f

) dt +

F

dZ

F

.

Suppose the terminal payo is max(F

T

X

d

, 0), then the price of

the exchange rate call option is

V (F, ) = Fe

r

f

N(d

1

) X

d

e

r

d

N(d

2

),

where

d

1

=

ln

F

X

d

+

_

r

d

r

f

+

2

F

2

_

, d

2

= d

1

.

65

Equity options with exchange rate risk exposure

Quanto options are contingent claims whose payo is determined

by a nancial price or index in one currency but the actual payout

is done in another currency.

1. Foreign equity call struck in foreign currency

c

1

(S

T

, F, 0) = F

T

max(S

T

X

f

, 0).

2. Foreign equity call struck in domestic currency

c

2

(S

T

, F, 0) = max(F

T

S

T

X

d

, 0).

3. Foreign exchange rate foreign equity call

c

3

(S

T

, F, 0) = F

0

max(S

T

X

f

, 0).

66

Under the domestic risk neutral measure Q

d

dS

S

=

d

S

dt +

S

dZ

S

dF

F

=

d

F

dt +

F

dZ

F

S

= FS = asset price in domestic currency

dS

=

d

S

dt +

S

dZ

S

.

where Z

S

, Z

F

, and Z

S

are all Q

d

-Brownian processes.

By Itos lemma,

d

S

=

d

S

+

d

F

+

SF

2

S

=

2

S

+

2

F

+2

SF

F

.

Under the risk neutral measures,

d

S

= r

d

q,

d

F

= r

d

r

f

,

f

S

= r

f

q,

d

S

=

d

S

d

F

SF

F

= r

f

q

SF

F

=

f

S

SF

F

.

67

1. Dene

c

1

(S, F, )/F =

c

1

(S, ) so that

c

1

(S, 0) = max(S X

f

, 0).

This call option behaves like the usual vanilla call option in the

foreign currency world so that

c

1

(S, 0) = Se

q

N(d

(1)

1

) X

f

e

r

f

N(d

(1)

2

)

where

d

(1)

1

=

ln

S

X

f

+

_

f

S

+

2

S

2

_

, d

(1)

2

= d

(1)

1

S

.

68

2. c

2

(S, F, 0) = max(S

T

X

d

, 0)

c

2

(S, F, ) = S

e

q

N(d

(2)

1

) X

d

e

r

d

N(d

(2)

2

)

where

d

(2)

1

=

ln

S

X

d

+

_

d

S

+

2

S

2

_

, d

(2)

2

= d

(2)

1

2

S

=

2

S

+

2

F

+2

SF

F

.

69

3. For c

3

(S, 0) = F

0

max(S

T

X

f

, 0), the payo is denominated in

the domestic currency world, so the risk neutral drift rate is of

the stock price

d

S

. The call price is

c

3

(S, ) = F

0

e

r

d

[Se

d

S

N(d

(3)

1

) X

f

N(d

(3)

2

)]

where

d

(3)

1

=

ln

S

X

f

+

_

d

S

+

2

S

2

_

, d

(3)

2

= d

(3)

1

S

.

The price formula does not depend on the exchange rate F since

the exchange rate has been chosen to be the xed value F

0

.

The currency exposure is reected through the dependence on

F

and correlation coecient

SF

.

70

Digital quanto option relating 3 currency worlds

F

S\U

= SGD currency price of one unit of USD currency

F

H\S

= HKD currency price of one unit of SGD currency

Digital quanto option payo: pay one HKD if F

S\U

is above

some strike level K.

We may interest F

S\U

as the price process of a tradeable asset

in SGD. The dynamics is governed by

dF

S\U

F

S\U

= (r

SGD

r

USD

) dt +

F

S\U

dZ

S

F

S\U

.

71

Given

S

F

S\U

= r

SGD

r

USD

, how to nd

H

F

S\U

, which is the risk

neutral drift rate of the SGD asset denominated in Hong Kong

dollar?

By the quanto-prewashing technique

H

F

S\U

=

S

F

S\U

F

S\U

F

H\S

.

Digital option value = E

Q

H

t

_

1

{F

S\U

>K}

_

= N(d)

where

d =

ln

F

S\U

K

+

_

_

H

F

S\U

2

F

S\U

2

_

_

F

S\U

.

72

Exchange options

Exchange asset 2 for asset 1 so that the terminal payo is

V (S

1

, S

2

, 0) = max(S

1

S

2

, 0).

Assume

dS

1

S

1

=

S

1

dt +

1

dZ

1

,

S

1

= r q

1

,

dS

2

S

2

=

S

2

dt +

2

dZ

2

,

S

2

= r q

2

.

Dene S =

S

1

S

2

,

2

S

=

2

1

2

12

2

+

2

2

. Write

V (S

1

, S

2

, 0)

S

2

= max

_

S

1

S

2

1, 0

_

.

V (S

1

, S

2

, ) = e

r

_

S

1

e

S

1

N(d

1

) S

2

e

S

2

N(d

2

)

_

, where

d

1

=

ln

S

1

S

2

+

_

_

S

1

S

2

_

+

2

S

2

_

, d

2

= d

1

.

73

Hints on the proof of the price formula

Under the risk neutral measure

dS

S

= (

S

1

S

2

12

2

+

2

2

) dt +

1

dZ

1

2

dZ

2

.

It is convenient to use S

2

(t)e

q

2

t

as numeraire, where

S

2

(t) = S

2

(0)e

_

S

2

2

2

2

_

t+

2

Z

2

(t)

or

S

2

(t)e

q

2

t

S

2

(0)

e

rt

= e

2

2

2

t+

2

Z

2

(t)

.

We can take =

2

in Girsanov Theorem so that

S

2

(t)e

q

2

t

S

2

(0)

e

rt

= e

1

2

2

2

t+

2

Z

2

(t)

=

dQ

dQ

.

74

We then have d

Z

2

= dZ

2

2

dt where d

Z

2

is under Q

. In a similar

manner, we obtain

d

Z

1

= dZ

1

12

2

dt.

Putting everything together,

dS

S

= (

S

1

S

2

) dt +(

1

d

Z

1

2

d

Z

2

)

and

1

d

Z

1

2

d

Z

2

=

d

Z

where

2

=

2

1

+

2

2

2

12

2

.

75

Use of the exchange option formula to price quanto options

Consider

C

2

(S, F, 0) = F max(S X, 0) = max(S

XF, 0)

C

4

(S, F, 0) = S max(F X, 0) = max(S

XS, 0)

where S

= FS. Both can be considered as exchange options.

Though an exchange option appears to be a two-state option, it

can be reduced to an one-state pricing model when the similarity

variable S =

S

1

S

2

is dened. Similarly, the two-state quanto options

can be reduced to one-state pricing models.

76

For valuation of C

4

(S, F, ), we consider the similarity variable

S

S

=

F. Note that

d

S

=

d

S

+

d

F

+

SF

F

,

=

F

,

and the corresponding dierence in the risk neutral drift rates in Q

d

is

d

S

d

S

=

d

F

+

SF

F

= r

d

r

f

+

SF

F

.

77

Vous aimerez peut-être aussi

- Pricing Financial Derivatives with Local Volatility ModelsDocument114 pagesPricing Financial Derivatives with Local Volatility ModelsTze ShaoPas encore d'évaluation

- Volatility Radar: Profit From Low Vol and High SkewDocument14 pagesVolatility Radar: Profit From Low Vol and High SkewTze ShaoPas encore d'évaluation

- Qis - Insights - Qis Insights Style InvestingDocument21 pagesQis - Insights - Qis Insights Style Investingpderby1Pas encore d'évaluation

- Index Variance Arbitrage: Arbitraging Component CorrelationDocument39 pagesIndex Variance Arbitrage: Arbitraging Component Correlationcclaudel09Pas encore d'évaluation

- HSBC - Finding Optimal Value in Real Yield 2013-12-13Document16 pagesHSBC - Finding Optimal Value in Real Yield 2013-12-13Ji YanbinPas encore d'évaluation

- Auto Call 1Document24 pagesAuto Call 1Jérémy HERMANTPas encore d'évaluation

- Barclays Capital Equity Correlation Explaining The Investment Opportunity PDFDocument2 pagesBarclays Capital Equity Correlation Explaining The Investment Opportunity PDFAnonymous s41KVlqkPas encore d'évaluation

- Practical Relative-Value Volatility Trading: Stephen Blyth, Managing Director, Head of European Arbitrage TradingDocument23 pagesPractical Relative-Value Volatility Trading: Stephen Blyth, Managing Director, Head of European Arbitrage TradingArtur SilvaPas encore d'évaluation

- AKUZAWA NewApproachVolatilitySkewDocument38 pagesAKUZAWA NewApproachVolatilitySkewfloqfloPas encore d'évaluation

- (Deutsche Bank) Modeling Variance Swap Curves - Theory and ApplicationDocument68 pages(Deutsche Bank) Modeling Variance Swap Curves - Theory and ApplicationMaitre VincePas encore d'évaluation

- JPM Flows Liquidity 2016-10-07 2145906Document18 pagesJPM Flows Liquidity 2016-10-07 2145906chaotic_pandemoniumPas encore d'évaluation

- SABR Model PDFDocument25 pagesSABR Model PDFRohit Sinha100% (1)

- EarningRiskPremiaIRVol PDFDocument16 pagesEarningRiskPremiaIRVol PDFkiza66Pas encore d'évaluation

- Volatility Trading InsightsDocument5 pagesVolatility Trading Insightspyrole1100% (1)

- JPMQ: Pairs Trade Model: Pair Trade Close Alert (AGN US / BMY US)Document6 pagesJPMQ: Pairs Trade Model: Pair Trade Close Alert (AGN US / BMY US)smysonaPas encore d'évaluation

- Derivatives Strategy: Factors Behind Single Stock VolatilityDocument10 pagesDerivatives Strategy: Factors Behind Single Stock Volatilityhc87Pas encore d'évaluation

- Pricing and Hedging Volatility Derivatives: Mark Broadie Ashish Jain January 10, 2008Document40 pagesPricing and Hedging Volatility Derivatives: Mark Broadie Ashish Jain January 10, 2008Aakash KhandelwalPas encore d'évaluation

- QIS: Equity: Investment ObjectiveDocument4 pagesQIS: Equity: Investment ObjectivepwnwchPas encore d'évaluation

- Can Alpha Be Captured by Risk Premia PublicDocument25 pagesCan Alpha Be Captured by Risk Premia PublicDerek FultonPas encore d'évaluation

- Which Free Lunch Would You Like Today, Sir?: Delta Hedging, Volatility Arbitrage and Optimal PortfoliosDocument104 pagesWhich Free Lunch Would You Like Today, Sir?: Delta Hedging, Volatility Arbitrage and Optimal PortfolioskabindingPas encore d'évaluation

- Dispersion Trading HalleODocument29 pagesDispersion Trading HalleOHilal Halle OzkanPas encore d'évaluation

- Volatility - A New Return Driver PDFDocument16 pagesVolatility - A New Return Driver PDFrlprisPas encore d'évaluation

- Day1 Session3 ColeDocument36 pagesDay1 Session3 ColeLameunePas encore d'évaluation

- TradeDocument6 pagesTradekyleleefakePas encore d'évaluation

- 2013 Nov 26 - Conditional Curve Trades e PDFDocument13 pages2013 Nov 26 - Conditional Curve Trades e PDFkiza66Pas encore d'évaluation

- Risk On Risk Off 1Document16 pagesRisk On Risk Off 1ggersztePas encore d'évaluation

- ACM - Vol, Correlation, Unified Risk Theory - 092010Document8 pagesACM - Vol, Correlation, Unified Risk Theory - 092010ThorHollisPas encore d'évaluation

- TurboCarryZoomsAhead PDFDocument8 pagesTurboCarryZoomsAhead PDFkiza66Pas encore d'évaluation

- Nomura US Vol AnalyticsDocument26 pagesNomura US Vol Analyticshlviethung100% (2)

- FX Deal ContingentDocument23 pagesFX Deal ContingentJustinPas encore d'évaluation

- GS-Implied Trinomial TreesDocument29 pagesGS-Implied Trinomial TreesPranay PankajPas encore d'évaluation

- Day 3 Keynote - DupireDocument57 pagesDay 3 Keynote - DupiremshchetkPas encore d'évaluation

- Demystifying Equity Risk-Based StrategiesDocument20 pagesDemystifying Equity Risk-Based Strategiesxy053333Pas encore d'évaluation

- Derivatives 2012Document44 pagesDerivatives 2012a p100% (1)

- Local Volatility SurfaceDocument33 pagesLocal Volatility SurfaceNikhil AroraPas encore d'évaluation

- Understanding Duration and Volatility: Salomon Brothers IncDocument32 pagesUnderstanding Duration and Volatility: Salomon Brothers IncoristhedogPas encore d'évaluation

- Stochastic Local VolatilityDocument12 pagesStochastic Local VolatilityContenderCPas encore d'évaluation

- Trend-Following Primer - January 2021Document8 pagesTrend-Following Primer - January 2021piyush losalkaPas encore d'évaluation

- Breakeven Skew IIIDocument57 pagesBreakeven Skew IIIveeken77Pas encore d'évaluation

- (Dresdner Klein Wort, Bossu) Introduction To Volatility Trading and Variance SwapsDocument56 pages(Dresdner Klein Wort, Bossu) Introduction To Volatility Trading and Variance Swapstwilgaal100% (1)

- Bloom Berg) Volatility CubeDocument33 pagesBloom Berg) Volatility CubeAna MolinaPas encore d'évaluation

- JPM Fixed inDocument236 pagesJPM Fixed inMikhail ValkoPas encore d'évaluation

- Stock Correlation (Natix!s Paper)Document10 pagesStock Correlation (Natix!s Paper)greghmPas encore d'évaluation

- Carry TraderDocument62 pagesCarry TraderJuarez CandidoPas encore d'évaluation

- (AXA Investment) Why The Implied Correlation of Dispersion Has To Be Higher Than The Correlation Swap StrikeDocument4 pages(AXA Investment) Why The Implied Correlation of Dispersion Has To Be Higher Than The Correlation Swap StrikeShikhar SharmaPas encore d'évaluation

- Options - Capturing The Volatility Premium Through Call Overwriting PDFDocument12 pagesOptions - Capturing The Volatility Premium Through Call Overwriting PDFPablo RaffaelliPas encore d'évaluation

- From Thesis To Trading A Trend PDFDocument25 pagesFrom Thesis To Trading A Trend PDFfnmeaPas encore d'évaluation

- Dispersion Trading: Many ApplicationsDocument6 pagesDispersion Trading: Many Applicationsjulienmessias2100% (2)

- Optimal Delta Hedging For OptionsDocument11 pagesOptimal Delta Hedging For OptionsSandeep LimbasiyaPas encore d'évaluation

- Barclays Weekly Options Report Vols Die HardDocument10 pagesBarclays Weekly Options Report Vols Die HardVitaly ShatkovskyPas encore d'évaluation

- JPM - Correlations - RMC - 20151 Kolanovic PDFDocument22 pagesJPM - Correlations - RMC - 20151 Kolanovic PDFfu jiPas encore d'évaluation

- John Carpenter, Bank of America, Introduction To CVA, DVA, FVA, UNC Charlotte Math Finance Seminar Series, 2014Document17 pagesJohn Carpenter, Bank of America, Introduction To CVA, DVA, FVA, UNC Charlotte Math Finance Seminar Series, 2014IslaCanelaPas encore d'évaluation

- Situation Index Handbook 2014Document43 pagesSituation Index Handbook 2014kcousinsPas encore d'évaluation

- 2018 Equity Volatility Outlook Credit SuisseDocument47 pages2018 Equity Volatility Outlook Credit SuissePipi Ququ0% (1)

- The High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsD'EverandThe High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsPas encore d'évaluation

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketD'EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketPas encore d'évaluation

- Sectors and Styles: A New Approach to Outperforming the MarketD'EverandSectors and Styles: A New Approach to Outperforming the MarketÉvaluation : 1 sur 5 étoiles1/5 (1)

- Auto Call AbleDocument20 pagesAuto Call Ablesisko1104Pas encore d'évaluation

- Smile Lecture1Document25 pagesSmile Lecture1ALPas encore d'évaluation

- MonteCarlo OxfordDocument22 pagesMonteCarlo OxfordTze ShaoPas encore d'évaluation

- Introduction To Variance SwapsDocument6 pagesIntroduction To Variance Swapsdbjn100% (1)

- Turner, Adair - Economics, Conventional Wisdom and Public PolicyDocument14 pagesTurner, Adair - Economics, Conventional Wisdom and Public PolicyTze ShaoPas encore d'évaluation

- (Merrill Lynch) Credit Derivatives Handbook 2006 - Volume 2Document196 pages(Merrill Lynch) Credit Derivatives Handbook 2006 - Volume 2tndiemhangPas encore d'évaluation

- Mathics DocumentacionDocument213 pagesMathics DocumentacionMax GrecoPas encore d'évaluation

- Cost of Funding Call OptionDocument13 pagesCost of Funding Call OptionTze ShaoPas encore d'évaluation

- The Myth of Asia's Miracle-Paul KrugmanDocument13 pagesThe Myth of Asia's Miracle-Paul KrugmanteembillPas encore d'évaluation

- Vanna Volga FXDocument28 pagesVanna Volga FXTze Shao100% (1)

- CDS HullWhiteDocument28 pagesCDS HullWhiteTze ShaoPas encore d'évaluation

- Hull, John - Volatility Surfaces Rules of ThumbDocument23 pagesHull, John - Volatility Surfaces Rules of ThumbTze ShaoPas encore d'évaluation

- Deng, Qian - Volatility Dispersion TradingDocument44 pagesDeng, Qian - Volatility Dispersion TradingTze ShaoPas encore d'évaluation

- Option Delta With Skew AdjustmentDocument33 pagesOption Delta With Skew AdjustmentTze Shao100% (1)

- Realized Skewness11Document37 pagesRealized Skewness11Tze ShaoPas encore d'évaluation

- Relative Value Single Stock VolatilityDocument12 pagesRelative Value Single Stock VolatilityTze Shao100% (2)

- Education Manual: The Raspberry PiDocument137 pagesEducation Manual: The Raspberry Pidr7zyqPas encore d'évaluation

- Trader Interview QuestionsDocument2 pagesTrader Interview QuestionsTze ShaoPas encore d'évaluation

- Darrell Due and Jun Pan Preliminary Draft: January 21, 1997Document39 pagesDarrell Due and Jun Pan Preliminary Draft: January 21, 1997Megha P NairPas encore d'évaluation

- 3 The Pricing of Commodity ContractsDocument13 pages3 The Pricing of Commodity ContractsTze Shao0% (1)

- ISO 9001:2015 Explained, Fourth Edition GuideDocument3 pagesISO 9001:2015 Explained, Fourth Edition GuideiresendizPas encore d'évaluation

- Riddles For KidsDocument15 pagesRiddles For KidsAmin Reza100% (8)

- Honda Wave Parts Manual enDocument61 pagesHonda Wave Parts Manual enMurat Kaykun86% (94)

- Sysmex Xs-800i1000i Instructions For Use User's ManualDocument210 pagesSysmex Xs-800i1000i Instructions For Use User's ManualSean Chen67% (6)

- Portfolio by Harshit Dhameliya-1Document85 pagesPortfolio by Harshit Dhameliya-1Aniket DhameliyaPas encore d'évaluation

- Nursing Care Management of a Client with Multiple Medical ConditionsDocument25 pagesNursing Care Management of a Client with Multiple Medical ConditionsDeannPas encore d'évaluation

- Main Research PaperDocument11 pagesMain Research PaperBharat DedhiaPas encore d'évaluation

- Mtle - Hema 1Document50 pagesMtle - Hema 1Leogene Earl FranciaPas encore d'évaluation

- DECA IMP GuidelinesDocument6 pagesDECA IMP GuidelinesVuNguyen313Pas encore d'évaluation

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniPas encore d'évaluation

- Exercises2 SolutionsDocument7 pagesExercises2 Solutionspedroagv08Pas encore d'évaluation

- Planning A Real Estate ProjectDocument81 pagesPlanning A Real Estate ProjectHaile SilasiePas encore d'évaluation

- Traffic LightDocument19 pagesTraffic LightDianne ParPas encore d'évaluation

- Math5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1Document19 pagesMath5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1ronaldPas encore d'évaluation

- On The Behavior of Gravitational Force at Small ScalesDocument6 pagesOn The Behavior of Gravitational Force at Small ScalesMassimiliano VellaPas encore d'évaluation

- Prenatal and Post Natal Growth of MandibleDocument5 pagesPrenatal and Post Natal Growth of MandiblehabeebPas encore d'évaluation

- Disaster Management Plan 2018Document255 pagesDisaster Management Plan 2018sifoisbspPas encore d'évaluation

- Ancient Greek Divination by Birthmarks and MolesDocument8 pagesAncient Greek Divination by Birthmarks and MolessheaniPas encore d'évaluation

- Casting Procedures and Defects GuideDocument91 pagesCasting Procedures and Defects GuideJitender Reddy0% (1)

- WSP Global EnvironmentDocument20 pagesWSP Global EnvironmentOrcunPas encore d'évaluation

- Phys101 CS Mid Sem 16 - 17Document1 pagePhys101 CS Mid Sem 16 - 17Nicole EchezonaPas encore d'évaluation

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- Inorganica Chimica Acta: Research PaperDocument14 pagesInorganica Chimica Acta: Research PaperRuan ReisPas encore d'évaluation

- Neuropsychological Deficits in Disordered Screen Use Behaviours - A Systematic Review and Meta-AnalysisDocument32 pagesNeuropsychological Deficits in Disordered Screen Use Behaviours - A Systematic Review and Meta-AnalysisBang Pedro HattrickmerchPas encore d'évaluation

- Evolution of Bluetooth PDFDocument2 pagesEvolution of Bluetooth PDFJuzerPas encore d'évaluation

- Book Networks An Introduction by Mark NewmanDocument394 pagesBook Networks An Introduction by Mark NewmanKhondokar Al MominPas encore d'évaluation

- Catalogoclevite PDFDocument6 pagesCatalogoclevite PDFDomingo YañezPas encore d'évaluation

- Audit Acq Pay Cycle & InventoryDocument39 pagesAudit Acq Pay Cycle & InventoryVianney Claire RabePas encore d'évaluation

- Water Jet CuttingDocument15 pagesWater Jet CuttingDevendar YadavPas encore d'évaluation