Académique Documents

Professionnel Documents

Culture Documents

Do

Transféré par

Randora LkDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Do

Transféré par

Randora LkDroits d'auteur :

Formats disponibles

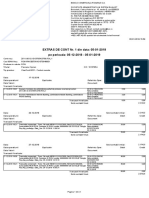

Lanka Century Investments PLC

Independent Advisors Report to the Board of Directors and

Shareholders of Lanka Century Investments PLC on the Voluntary

Offer made by Taprobane Holdings PLC

CORPORATE ADVISORY & CAPITAL MARKETS DIVISION

BOC Merchant Tower

18

th

Floor, 28 St Micheals Road

Colombo 03.

Tel: 4711711 Fax: 4711741

DATE: 28 July 2014

www.randora.lk

www.randora.lk

~ 1 ~

Contents

1. KEY MEMBERS INVOLVED IN THE INDEPENDENT OPINION ADVISORY ............ 4

2. THE TRANSACTION .............................................................................................. 5

3. LANKA CENTURY INVESTMENTS PLC (GREG) .................................................... 6

Recent performance ................................................................................................... 9

Subsidiary and Associate Companies ..................................................................... 10

Ceylon Leather Products PLC (CLPL) ........................................................................................ 10

Dankotuwa Porcelain PLC (DPL) ................................................................................................ 12

Royal Fernwood Porcelain Ltd (RFPL) ....................................................................................... 14

South Asia Textile Industries Lanka (Pvt) Limited (SAT) ........................................................... 15

Palla & Company (Pvt) Limited (PALL) ...................................................................................... 16

Colombo City Holdings PLC (PHAR) .......................................................................................... 17

OLANCOM (Pvt) Limited (OLAN) ................................................................................................ 19

Enterprise Technology (Pvt) Limited (ETPL) ............................................................................... 20

Senit technologies (Pvt) Limited (SENT) ..................................................................................... 21

Browns Investment PLC (BIL) ........................................................................................................ 22

4. TAPROBANE HOLDINGS PLC ............................................................................ 24

Top 20 Shareholders as at 30 June 2014 .................................................................. 25

5. THE VALUATIONS .............................................................................................. 26

Free Cash Flow (FCF) valuation ................................................................................ 26

Relative valuations..................................................................................................... 28

Sector based valuation ................................................................................................................ 28

Market based valuation............................................................................................................... 28

Peer based valuation ................................................................................................................... 29

Market Price based valuation .................................................................................. 30

Market Value of Investments .................................................................................... 31

6. INDEPENDENT OPINION ................................................................................... 32

Risk Factors specifically associated with the offer .................................................. 32

7. DECLARATION TO THE SHAREHOLDERS AND DIRECTORS OF GREG .............. 33

www.randora.lk

~ 2 ~

Contents

Tables

Table 1- Corporate profile ........................................................................................................................ 6

Table 2- Top 20 Shareholders as at 17 July 2014................................................................................... 8

Table 3- Top 20 Warrant- 2015 Holders (GREG.W0006) as at 17 July 2014 ...................................... 8

Table 4- Financial Highlights ..................................................................................................................... 9

Table 5 - Sectorial performance 2014 ................................................................................................. 9

Table 6- CLPL's group financial indicators ........................................................................................... 11

Table 7- DPLs financial indicators......................................................................................................... 13

Table 8- RFPLs financial Indicators ....................................................................................................... 14

Table 9- SATs financial indicators ......................................................................................................... 15

Table 10- PALLs financial indicators ..................................................................................................... 16

Table 11- PHARs financial indicators ................................................................................................... 17

Table 12- OLANs financial indicators ................................................................................................... 19

Table 13- ETPLs financial indicators ...................................................................................................... 20

Table 14- SENTs financial indicators ..................................................................................................... 21

Table 15 - BIL's financial indicators ........................................................................................................ 23

Table 16- Top 20 Shareholders as at 30 June 2014 ............................................................................ 25

Table 17- Results of FCF valuation ......................................................................................................... 26

Table 18 - GREG Offer details ................................................................................................................ 28

Table 19 - GREG Sector PBV Valuation ................................................................................................ 28

Table 20 - GREG Market PBV Valuation ............................................................................................... 28

Table 21 - Peer based PBV valuation ................................................................................................... 29

Table 22 - GREG price statistics ............................................................................................................. 30

Table 23- Realizable Market Values ...................................................................................................... 31

Table 24- Summary of valuations .......................................................................................................... 32

Figures

Figure 1- Transaction Structure ................................................................................................................ 5

Figure 2- GREG group structure ............................................................................................................... 7

Figure 3- CLPL one year price trend ..................................................................................................... 10

Figure 4- DPL one year price trend ....................................................................................................... 12

Figure 5- PHAR one year price trend .................................................................................................... 18

Figure 6- BIL One year price trend ........................................................................................................ 23

Figure 7- Taprobane Group Structure .................................................................................................. 24

Figure 8- GREG One year price trend .................................................................................................. 30

www.randora.lk

~ 3 ~

In preparing this document, we have placed reliance, on the information

contained in the offer document prepared by Taprobane Wealth Plus (Pvt)

Ltd, company profiles and financial information provided by Lanka Century

Investments PLC and its group companies, information available on the

Colombo Stock Exchange, information gathered from explanations

provided and discussions had with Lanka Century Investments PLCs senior

management and information available from any public domain. These

information was adequate to facilitate an informed view of the offer and to

form a reasonable basis for the opinion.

We have not verified in detail, the information made available by Lanka

Century Investments PLC or the group companies to us and not conducted

any independent investigation into the business affairs of Taprobane

Holdings PLC. While MBSL has taken reasonable care to ensure full and fair

disclosure, nothing has come to the attention of the independent advisor to

believe that the facts and data set forth in the report are incorrect.

However, Merchant Bank of Sri Lanka PLC does not assume responsibility for

any investment decisions made by the investors based on the information

contained herein. In making an investment decision, prospective investors

must rely on their own examination and assessments of the Company,

including the risks involved. Recommendations given in this report is valid as

at the report date and for a period of 6 months period from the report date.

This document has been approved by the Securities and Exchange Commission of

Sri Lanka (SEC) in terms of the Takeovers and Mergers Code. However, the SEC

assumes no responsibility for the content of the Report including but not limited to

the statements made and opinions expressed in the Independent Advisors

Report.

www.randora.lk

~ 4 ~

1. Key members involved in the Independent Opinion Advisory

Mr A M A Cader

Deputy General Manager - Corporate Advisory & Capital Markets

E-mail - cader@mbslbank.com / Tel: 011 - 4 711 769

Specialized by 35 years of industry proficiency, Mr Cader is currently heading the Corporate

Advisory & Capital Markets division of MBSL for 21 years. During his professional career Mr

Cader has gained experience as a competent investment banker with specialization in

services such as IPOs, Pre-IPO Restructuring & Advisory, Business Plans, Corporate Valuations,

Portfolio Management, Employee Share Option Plans, Debt Syndications, Securitizations and

delivering training Programs.

Fellow Member of the Chartered Institute of Management Accountants, UK

Fellow Member Society of Certified Management Accountants of Sri Lanka

Associate Member of the Institute of Financial Accountants, London

M.Sc. In Information Technology from Sri Lanka Institute of Information Technology (SLIIT)

Masters of Business Studies (MBS) from University of Colombo

Ms Lalangi Goonawardena

Manager - Corporate Advisory

E-mail- lalangig@mbslbank.com / Tel: 011 - 4 711 746

The long-standing industry exposure of 20 years is indeed a recourse to the bank. Her sound

technical awareness of listing procedures and legislative guidelines has generated much

comfort and value to the clients in successful listings of companies in the Colombo Stock

Exchange.

B.Sc.(Hons) Physical Science from versity of Sri Jayewardenepura

Diploma in Credit Management from Institute of Bankers, Sri Lanka

Mr Hijas Suhair

Assistant Manager - Corporate Advisory & Capital Markets

E-mail - hijass@mbslbank.com

Having started his professional career at PricewatrerhouseCoopers followed by DFCC

Stockbrokers, Mr Hijas stands out with the ideal combination of know-how in investment

banking, business advisory and portfolio management.

MBA - University of Wales

Chartered Institute of Management Accountants (CIMA)

The Institute of Chartered Accountants of Sri Lanka (CA)

Mr Angelo Brandan Keil

Analyst/ Executive - Corporate Advisory and Capital Markets

E-mail - angelob@mbslbank.com

Qualified with a strong academic background, Mr Angelo Keil has experience in Tax advisory,

corporate advisory, portfolio management and other investment banking activities.

M.Sc. in Applied Finance from University of Sri Jayewardenepura

Bachelor of Business Management (Finance) special from University of Kelaniya

Chartered Institute of Management Accountants (CIMA) - Pass Finalist

www.randora.lk

~ 5 ~

2. The Transaction

On the 13 March 2014 Taprobane Holdings PLC (herein after referred to as Taprobane or the

Offeror) acquired 100% of issued shares of Capital Trust Partners (Pvt) Ltd (CTP), which held

Sixty Million Three Hundred Five Thousand Six Hundred and Nine (60,305,609) Ordinary Voting

shares of Lanka Century Investments PLC (herein after referred to as GREG or the Offeree)

amounting to 17.26% of the issued Ordinary Voting shares of GREG.

Prior to this, Taprobane directly owned 28.91% of the issued Ordinary Voting shares of GREG

and indirectly via its fully owned subsidiary, Taprobane Wealth Plus (Pvt) Ltd owned 0.02% of

the issued Ordinary Voting shares of GREG. Hence, the entire shareholding of GREG held by

Taprobane directly and indirectly amounts to 46.19%. Further, as at 13 March 2014 a Director

of Taprobane, Mr R.R Anthony had 19,925 shares of GREG, amounting to 0.01% of the

shareholding of the Offeree, which have subsequently disposed.

Figure 1- Transaction Structure

As such in compliance with the Takeovers and Mergers Code, the Offeror has made a

Voluntary Offer to purchase the balance One Hundred Eighty Seven Million Nine Hundred

Seventy Six Thousand Five Hundred and Ten (187,976,510) Ordinary Voting shares constituting

approximately 53.81% of the total shareholding of the issued Ordinary Voting shares of GREG

at a price of Eleven Rupees (LKR 11.00) per share, being the highest price paid by the Offeror

during the period of one year, prior to the date of the acquisition.

In this regard, Merchant Bank of Sri Lanka PLC - Corporate Advisory and Capital Markets

Division (MBSL) was appointed by the Directors of the Lanka Century Investments PLC to act

as the Independent Advisor to the shareholders of Lanka Century Investments PLC in

connection with the above offer made to GREG by the Offeror.

Taprobane

Holdings PLC

Capital Trust

Partners Pvt Limited

Lanka Century

Investments PLC

17.26%

28.93% 100.00%

www.randora.lk

~ 6 ~

3. Lanka Century Investments PLC (GREG)

Lanka Century Investment PLC is a leading investment holding company in Sri Lanka executing

complex corporate restructuring investments. GREG creates sustainable value addition for

investors and the companies in which they invest. The GREG group holding consist companies

in diversified sectors such as manufacturing, information technology, retail , distribution, and

real estate development and employees over 3,000 personnel.

Domicile & Legal Form

Lanka Century Investments PLC is a Public Limited Liability

Company incorporated and domiciled in Sri Lanka.

Principal Activity &

Nature of the Company

Investment Holding

Company Reg. No.

PQ 26

Board of Directors

Mr A.G. Weerasinghe Chairman

Mr Eric B. Wikramanayake Deputy Chairman

Mr Kelly T. Ehler

Independent Director/ Non-

Executive

Mr D.S.K. Amarasekara

Independent Director/ Non-

Executive

Mr R.P. Sugathadasa Non-Executive Director

Mr Thomas Scanlan Non-Executive Director

Mr I. C. Nanayakkkara Non-Executive Director

Secretaries

P W Corporate Secretarial (Private) Limited

3/17, Kynsey Road, Colombo 08.

Registrars

S P Corporate Services (Private) Limited

101, Inner Flower Road, Colombo 3

Auditors Ernst & Young

Chartered Accountants,

No. 201, De Saram Place, Colombo 10.

Bankers Pan Asia Banking Corporation PLC

Nations Trust Bank PLC

Deutsche Bank

Seylan Bank PLC

Registered Address No. 10, 5th Floor, Gothami Road, Colombo 08

Contact details

Telephone +94 11 570 0700

Fax +94 11 268 0225

E mail info@lci.lk

Website www.lci.lk

Table 1- Corporate profile

www.randora.lk

~ 7 ~

Figure 2- GREG group structure

Source: GREG management and 2012/2013 annual report

www.randora.lk

~ 8 ~

Name of Shareholder No. of Shares %

1. Seylan Bank PLC/Taprobane Holdings PLC 101,000,000 28.91

2. Caledonian Securities Limited 96,852,800 27.72

3. Capital Trust Partners (Pvt) Limited 60,305,609 17.26

4. Octagon Asset Management INC 17,542,317 5.02

5. Dr N Kasim 11,676,834 3.34

6. Lionhart Investments Limited 6,364,717 1.82

7. Carlines Holdings (Private) Limited 2,211,971 0.63

8. Phillip Securities Pte Limited 1,989,899 0.57

9. Mr N Balasingam 1,906,500 0.55

10. Knight Trade (Private) Limited 1,754,137 0.50

11. Mellon Bank N.A. The Frontier Emerging Markets Fund 1,668,159 0.48

12. National Wealth Corporation Limited 1,657,355 0.47

13. Sampath Bank PLC/Capital Trust Holdings PLC 908,480 0.26

14. First Capital Markets Limited/Mr P R B Perera 635,427 0.18

15. Peoples Leasing & Finance PLC/Mr D M P Disanayake 623,000 0.18

16. Peoples Leasing & Finance PLC/M I M Rizly & F R Hassan 604,700 0.17

17. Pan Asia Banking Corporation PLC/Mr V P K A Palpita 577,755 0.17

18. Pan Asia Banking Corporation PLC/Mr Ravindra Erle

Rambukwelle 565,000 0.16

19. Mr P Anandaraja 527,500 0.15

20. Pan Asia Banking Corporation PLC/Mr Mohottallage Nihal

Ranasinghe 521,500 0.15

Table 2- Top 20 Shareholders as at 17 July 2014

Name of Warrant holder No. of Shares %

1. Caledonian Securities Limited 248,158,695 71.37

2. Lionhart Investments Limited 68,391,004 19.67

3. Peoples Leasing & Finance PLC/Mr D M P Disanayake 1,659,900 0.48

4. Mrs H P Gin 1,504,991 0.43

5. Mr W M S K Weerasekara 1,203,900 0.35

6. Mr P Poongunaseelan 917,398 0.26

7. Mr S M Masoor 907,172 0.26

8. Mr K O D Jayaratne 850,000 0.24

9. Mr W B L Perera 769,000 0.22

10. Mr U L N K Perera 603,881 0.17

11. Mr A B Damunupola 561,700 0.16

12. Mr U G K Udayanka 510,000 0.15

13. Mrs R N R Aziz 426,300 0.12

14. Pan Asia Banking Corporation PLC/Mr R P L Eheliyagoda 323,401 0.09

15. Flyasia SND. BHD 320,216 0.09

16. Mr H J De Silva 300,000 0.09

17. Mr B W Kundanmal 282,500 0.08

18. Mrs P Poonkulavathani 281,500 0.08

19. Mr M N M Shiyam 257,899 0.07

20. Mr P Thevarajah 241,430 0.07

Table 3- Top 20 Warrant- 2015 Holders (GREG.W0006) as at 17 July 2014

www.randora.lk

~ 9 ~

Recent performance

Unaudited Audited Audited

2013/2014 2012/2013 2012/2011

Financial Performance

Revenue LKR 000 8,633,438 7,184,808 5,997,943

Operating Profit / (Loss) LKR 000 (56,462) (130,986) 276,379

Profit / (Loss) Before Tax LKR 000 (240,888) (183,421) 138,434

Profit / (Loss) After Tax LKR 000 (304,179) (225,274) 75,944

Interest Cover Time -0.45 0.04 1.72

Return on Equity % -3.43% -2.47% 0.80%

Return on Investment % -2.37% -1.84% 3.32%

Financial Position

Total Assets LKR 000 12,837,692 12,250,594 12,813,039

Total Debt LKR 000 2,386,340 1,739,968 1,734,181

Total Equity LKR 000 8,855,891 9,122,790 9,507,483

No. of shares in Issue 349,367,119 349,367,119 349,367,119

Net Assets per share LKR 22.08 22.97 23.69

Debt/Equity % 25.82% 19.07% 18.24%

Debt/Total Assets % 18.59% 14.20% 13.53%

Net Investments LKR 000 (217,446) 2,273,155 2,049,964

Market/shareholder Information

Market Price of share LKR 12.30 15.60 16.80

Market Capitalization LKR 000 3,877,975 5,450,127 5,869,368

Table 4- Financial Highlights

Source: Annual Reports and Unaudited Financial Statements published as at the report date

The Groups revenue rose to LKR 8.63 Bn in year 2013/2014, mainly contributed from the

revenue of textile manufacturing - LKR 4.84 Bn followed by footwear manufacturing - LKR 1.73

Bn and manufacturing porcelain with LKR 1.79 Bn. Net profit wise the Textile, Services and

Property sectors contributed the highest with LKR 139.83 Mn, LKR 117.40 Mn and LKR 51.70 Mn

respectively whilst the losses were attributed from Investments sector with LKR 108 Mn and

Porcelain sector with LKR 19 Mn.

Sectors Revenue Net profit/(loss) Total assets Return on

investments

Manufacturing Footwear

1,733,888 3,297 2,608,154 0.13%

Manufacturing Porcelain

1,787,976 (19,228) 2,496,017 -0.77%

Manufacturing Textile

4,837,122 139,830 2,823,070 4.95%

Investment

65,916 (108,039) 287,595 -37.57%

Property

45,902 51,703 1,123,695 4.60%

Services

162,634 117,402 279,416 42.02%

8,633,438 184,965 9,617,947

Table 5 - Sectorial performance 2014

Source: Annual Reports and interim Financial Statements published as at the report date

Inter Company Transactions have been eliminated in arriving at net profit/ (loss) for the year.

Segment assets do not include investments in subsidiaries & associates, goodwill,

investment in group preference shares and intercompany current account balances.

www.randora.lk

~ 10 ~

Subsidiary and Associate Companies

Ceylon Leather Products PLC (CLPL)

Ceylon Leather Products PLC is a local pioneer in processing, manufacturing and marketing

of leather, leather footwear and leather products. The business was established in year 1939

by the British Government to produce boots, shoes and accessories for the British Armed Forces.

After the Second World War, the factory diversified its activities to produce shoes and leather

accessories to the domestic market. In year 2009, Environmental Resources Investments PLC

(Lanka Century Investments PLC) took over the controlling interest of CLPL. As at date CLPL is,

a 91.39% held subsidiary of GREG.

CLPL has three distinct production facilities namely,

A. Tannery - Leather been produced from raw hides and skins. The factory is located

in Mattakuliya, Western province, Sri Lanka with a production capacity of 200,000

sq.ft. Leather per month. There are about 140 employees working in this process.

B. Shoe factory - Produces Leather footwear for gents, women and schoolchildren out

of genuine leather. The factory is located in Belumahara, Western Province, Sri

Lanka and embraces a production capacity of 45,000 shoe pairs per month. There

are about 264 employees working at this facility.

C. Leather goods factory - Produces all types of leather products and accessories.

CLPL owns 9 retail stores covering the main cities and over 350 dealers island wide.

CLPL has strategic investments in Ceylon Leather Products Distributors (Pvt) Ltd (100.00%), South

Asia Textile Industries Lanka (Pvt) Ltd (51.55 % equity control and with effect from 18 July 2014

changed to 80.39% equity control via a rights issue of 8-for-1 at LKR0.10 ) and Palla & Company

Pvt Ltd (60.00%).

50.00

55.00

60.00

65.00

70.00

75.00

80.00

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14

P

r

i

c

e

V

o

l

u

m

e

s

CLPL

Figure 3- CLPL one year price trend

Source: Colombo Stock Exchange

www.randora.lk

~ 11 ~

According to the unaudited financial statements as at 31 March 2014, CLPL group generated

a net revenue of LKR 6.53 Bn (25%) mostly from the textile sector of LKR 4.84 Bn. CLPLs gross

profit and net profit before tax stood at LKR 918.53 Mn (14%) and LKR 190.76 Mn (51%)

respectively. CLPLs earnings per share is LKR 3.59 (31%) and the Net Assets Value per share

is LKR 89.90 as at 31 March 2014.

Based on discussions held with the senior management and budgets prepared, CLPL has

targeted to realize net sales of LKR 1.40 Bn while maintaining a gross margin of 23% and net

margin of 10 % only from its shoe/leather business next year. CLPL expects to improve its

margins and sales mix and anticipates a lower growth after year 2015, since more than 70% of

revenue is from Sri Lanka Armed forces.

As at 13 July 2014 CLPLs share was trading at LKR 69.20 and during the past year, the price

volatility generated a negative return of 2.24%. The annualized standard deviation is about

44.44%.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 6,529,347 5,203,031 25%

Gross profits LKR 000 918,531 805,818 14%

Net profits LKR 000 135,687 97,206 40%

Earnings per share LKR 3.59 2.75 31%

Total assets LKR 000 5,699,989 5,508,006 3%

Net assets per share LKR 89.90 87.72 2%

Market price LKR 57.30 62.30 -8%

Table 6- CLPL's group financial indicators

Source: Annual Reports and interim Financial Statements published as at the report date

www.randora.lk

~ 12 ~

Dankotuwa Porcelain PLC (DPL)

Dankotuwa Porcelain PLC is a leading manufacturer and exporter of Porcelain Tableware

which was incorporated on 6 January 1984. DPL is 65.51% owned subsidiary of GREG and listed

on the Colombo Stock Exchange. With the Japanese skills, German Technology and

adaptability to the changing market trends of the industry, DPL has a reputed client base

including Macys Department Stores, British Home Stores, John Lewis, Jashanmal, El Corte Ingles,

Berghoff, Galeria Kaufhof and many others scattered throughout USA, Asia and Europe. DPL is

the first tableware manufacturer in Sri Lanka to obtain ISO 9001/2008 certification.

With a white ware production capacity of 700,000 pieces per month and other decorative

product capacity more than 675,000 pieces per month, DPL has recognized the necessity of

increasing production capacity and innovativeness in competing globally, while constantly

upgrading its machinery and plant. DPL uses local material combined with imported materials

from countries such as New Zealand, India, Germany and China, to produce the unique brand

of quality porcelain for which Dankotuwa is famed. DPL employees a workforce of

approximately 1,000 personnel.

The demand for DPLs products spans across over 25 countries with buyers from Belgium, Czech

Republic, Colombia, Dubai, Germany, Greece, India, Ice Land, Italy, Japan, Kuwait, Norway,

Brazil Egypt, France, Kenya, Bahrain, Poland, Russia, Spain, Switzerland, U.S.A, U.K, Qatar,

Maldives and Ukraine, etc. DPL is a supplier of Upstairs or up-market tableware to some of the

bigger departmental stores in the United States and Europe. DPL will continue to cater the

upmarket with niche markets strategies to customers with less cost consciousness.

DPL made revenue of LKR 1.7 Bn (9%), gross profit of LKR 294 Mn (17%) and a net profit of

LKR 16.5 Mn (52%) during the year ended 31 March 2014. During the year 2013/2014, DPL

acquired 76% of Royal Fernwood Porcelain Limited for a consideration of LKR 300 Mn.

9.00

10.00

11.00

12.00

13.00

14.00

15.00

16.00

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

1,800,000

15-Jul 15-Aug 15-Sep 15-Oct 15-Nov 15-Dec 15-Jan 15-Feb 15-Mar 15-Apr 15-May 15-Jun 15-Jul

P

r

i

c

e

V

o

l

u

m

e

s

Figure 4- DPL one year price trend

Source: Colombo Stock Exchange

www.randora.lk

~ 13 ~

DPL expects a turnaround through its investment in Royal Fernwood Porcelain Limited and

replacement of the existing Glost Klin with new energy efficient Fast Firing Klin. The Fast

Firing Klin will reduce the energy consumption drastically and reduce the furniture requirement

in the production process. DPL has already curtailed the work force by nearly 100 employees

last year & wishes to reduce the numbers further in the coming years. DPL strategizes moving

from the traditional export markets in the Europe to Emerging markets such as India, Brazil,

South Africa with a view to get more volumes at relatively higher prices with high value added

products.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 1,668,766 1,528,652 9%

Gross profit LKR 000 294,009 352,939 -17%

Net profit LKR 000 16,484 34,675 -52%

Earnings per share LKR 0.23 0.48 -52%

Total Assets LKR 000 1,658,598 1,353,355 23%

Net assets per share LKR 11.26 11.43 -1%

Table 7- DPLs financial indicators

Source: Annual Reports and Unaudited Financial Statements published as at the report date

www.randora.lk

~ 14 ~

Royal Fernwood Porcelain Ltd (RFPL)

Royal Fernwood Porcelain Limited is a 49.79% owned subsidiary of GREG, manufactures

supreme quality tableware, achieved through superb craftsmanship and unique design

creation that give new meaning to elegance and good taste. RFPL has a monthly production

capacity of 670,000pcs, a blend of modern technology from Germany, Japan and the United

Kingdom, while retaining traditional skills in craftsmanship.

Through its own operation, RFPL has the advantage of producing the highest quality hand

painted tableware; transparent and opaque colour glazed tableware as well as two-tone

colour glazes.

RFPL is able to develop individual designs to customer's preferences within the shortest possible

time. Behind this success story is a highly professional, totally dedicated workforce committed

to achieving only the best with a vastly experienced management team to back them all the

way. With its present customer base predominantly located in the USA, Europe, Australia and

Asia, RFPL uses their high productivity rate to ensure that new customers are offered extremely

competitive prices.

RFPL has the technical know-how and capacity to produce porcelain ware with designs

under glaze, in glaze as well as on glaze decorations.

RFPL products are made to the highest international standards such as ASTM as well as being

the only manufacturer in Sri Lanka to have SLSI standard for porcelain tableware.

Further, RFPL is the only porcelain manufacturing company to have been awarded the

prestigious national quality award and national productivity award for excellence in

manufacturing and productivity.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 654,672 645,134 15%

Gross profit LKR 000 44,907 16,421 173%

Net loss LKR 000 (110,335) (115,505) -4%

Loss per share LKR (0.27) (0.46) -41%

Total Assets LKR 000 1,067,462 1,114,561 -4%

Net assets per share LKR 0.67 1.41 -52%

Table 8- RFPLs financial Indicators

Source: Audited Financial Statements & draft financial statements prepared by the management

www.randora.lk

~ 15 ~

South Asia Textile Industries Lanka (Pvt) Limited (SAT)

South Asia Textiles was incorporated in year 2004 as a subsidiary of South Asia Textiles -

Singapore. SAT, started as a liaison office in 2002 with the objective of marketing fabric in Sri

Lanka from the plant in Singapore. It subsequently set out on an ambitious project of setting

up a fabric manufacturing facility. In June 2010, through a joint acquisition by Ceylon Leather

Products PLC and Lanka Century Investments PLC (GREG) acquired 51.55% and 8.09% of SAT

respectively (totalling a 55.19% effective controlling interest of SAT) for a consideration of LKR

710 Mn. SAT is located in a land area of 73 hectares in Pugoda which is under a 25 year lease

agreement with the BOI and out of which 15 years are still remaining. After this period, the

ownership of the land would be transferred to SAT.

SAT has a fully-fledged manufacturing plant that engages in Weft Knitting, Dyeing, Printing,

Sueding, Brushing and Finishing, with a total monthly capacity to produce 630,000 KG of

finished fabric, catering to world renowned buyers such as M&S, NEXT, Tesco, Bhs, Victoria

Secret, Azda, TEMA, Columbia Sportswear, Sainsbury, Mother Care, H&M, Takko, GAP, JC

Penney, Reebok etc.

The ultra-modern textile manufacturing facility of SAT specializes in Printing, brushing, sueding

and making Anti Pilling Micro Polar Fleece. Currently, SAT produces 100% cotton and Polly

cotton blends and the factory is equipped with 140 lbs circular weft knitting machines, 24

dyeing machines, 4 washing plants 10 coloured and 16 color flatbed printing machines and a

physical testing lab, audited and certified by independent buyer nominated companies. As

Sri Lankas third largest knit fabric manufacturing plant, SAT cater to over 95% of the capacity

for local garment exporters and still the opportunity on exports has not been exploited by SAT.

SAT has turned around the operations and in year 2013 and 2014 and ended continues profits

since the acquisition. Operating through a challenging year, SAT recorded a net profit of LKR

107 Mn as at 31March 2014.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 4,837,122 3,801,508 27%

Gross profit LKR 000 958,925 623,700 54%

Net profit LKR 000 131,088 154,895 -15%

Earnings per share LKR 0.17 0.21 -19%

Total Assets LKR 000 2,838,188 2,682,454 6%

Net assets per share LKR 1.41 1.23 15%

Table 9- SATs financial indicators

Source: Audited Financial Statements & draft financial statements prepared by the management

www.randora.lk

~ 16 ~

Palla & Company (Pvt) Limited (PALL)

Palla & Company (Pvt) Ltd is a footwear manufacturer, incorporated on 27 February 2004. The

factory complex is formed by 4 acres land with total build area of over 5,000 square meters

and is situated at the Katunayake Export Processing Zone, being one of the most convenient

location in the island to conduce industrial operations focused on the exports.

The build area covers the production floor, office, sample room, show room, engineering, raw

material stores, finished goods warehouse attached to a final inspection line. The production

floor is divided into sections such as cutting, stitching, preparation, and assembly. PALL

maintains an independent quality control department. PALL has installed capacity to

manufacture up to 1,500 pairs per day of high quality leather shoes covering the main

categories of casual and dress shoes offering a range of pumps, oxfords, flats, sandals, ankle

boots and boots. Raw materials such as Upper Leather, Lining Leather, Midsoles, Outsoles, etc.

are sourced locally and imported from countries such as Italy, India, Pakistan, Argentina, Saudi

Arabia, China, etc. PALL also maintains a team of foreign consultants from Italy, India and

Romania overlooking all the steps of the production.

In the year ending on the 31 March 2014, PALL ended with a revenue of LKR 301Mn (18%), a

gross loss of LKR 19 Mn (53%) and a net loss of LKR 124 Mn (31%). PALLs negative outlook is

mainly due to reduced quantities from the slow recovery from the economic recession in the

west. With customer portfolio diversifications and filled capacity, the management is confident

that positive results could be generated.

In November 2011, CLPL made an investment to acquire 60% of Palls share capital and

effectively GREG holds 54.8% of PALL.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 301,294 366,118 -92%

Gross loss LKR 000 (18,893) (41,473) 54%

Net loss LKR 000 (123,983) (179,768) -31%

Loss per share LKR (1,378) (1,997) 31%

Total Assets LKR 000 258,145 250,087 3%

Net deficit per share LKR (3,506) (2,128) -65%

Table 10- PALLs financial indicators

Source: Audited Financial Statements & draft financial statements prepared by the management

www.randora.lk

~ 17 ~

Colombo City Holdings PLC (PHAR)

Colombo City Holdings PLC (formerly known as The Colombo Pharmacy Company PLC)

established as a chemists store named Norris Canal Stores goes back to over a century to its

more humble beginnings in 1876.

With the acquisition of a majority holding of PHAR by GREG in the year 2010, PAHR has

undergone significant changes planned to drive it towards achieving strong growth prospects

in the future. In spite of this initiative, the Union Place building was improved by implementing

a refurbishment program that significantly increased the growth prospects of PHAR. As at

today PHAR is a 66.40% owned subsidiary of GREG.

Due to the strategic importance of the two locations at Union Place & Bambalapitiya PHAR

discontinued its pharmaceutical operations in year 2013 and directed towards high value real

estate business.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 45,902 90,472 -49%

Gross profit LKR 000 45,902 32,500 41%

Net profit LKR 000 48,463 42,606 14%

Earnings per share LKR 38.07 33.47 14%

Total Assets LKR 000 1,129,092 1,121,202 1%

Net assets per share LKR 771.86 733.79 5%

Table 11- PHARs financial indicators

Source: Audited Financial Statements & interim financial statements published as at the report date

According to the unaudited financial statements ended 31 March 2014 PHAR generated

revenue of LKR 45.90 Mn (49%) and a gross profit of the same due to not incurring any cost

of sales. The fair value gain on revaluation of investment property and the decline in

operational expense enabled the PHAR to realize a net profit of LKR 48.46 Mn (14%). PHARs

earnings per share is at LKR 38.07, for the year ended 31 March 2014.

www.randora.lk

~ 18 ~

During the last one year PHARS share price trading generated a return of 5.61% to close at

LKR 501.00 on the 14 July 2014. PHARs share was volatile with an annualized standard deviation

of about 41.32%. Nevertheless, PHAR shares have a public float of 18.7% as at 31 March 2014.

350.00

400.00

450.00

500.00

550.00

600.00

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

15-Jul 15-Aug 15-Sep 15-Oct 15-Nov 15-Dec 15-Jan 15-Feb 15-Mar 15-Apr 15-May 15-Jun

P

r

i

c

e

V

o

l

u

m

e

s

PHAR

Figure 5- PHAR one year price trend

Source: Colombo Stock Exchange

www.randora.lk

~ 19 ~

OLANCOM (Pvt) Limited (OLAN)

OLANCOM (Pvt) Limited was founded in year 2000 with a small team of professionals to provide

e-commerce solutions. Operating in the ICT sector with a highly skilled set of employees OLAN

offers a diverse range of products and services targeted at individuals, SMEs and large public

and private enterprises. OLAN through its subsidiary companies, Enterprise Technology (Pvt)

Limited, Roomsnet international (Pvt) Limited and Senit technologies (Pvt) Limited is one of the

largest e-commerce operators based in Sri Lanka. It is also one of the leading Systems

integrators in the country, having completed some of the largest systems integration projects

in Sri Lanka.

In year 2014 OLAN alone produced a revenue of LKR 4.5 Mn (29%) while the group achieved

revenue worth of LKR 167 Mn (40%), gross profit of LKR 57 Mn and net profit of LKR 30 Mn.

OLAN expects to benefit from the booming tourism sector and earn increased commission

and package income in times to come.

GREG acquired OLAN on 31 March 2011 and OLAN acquired ETPL on 30 June 2010. At present

OLAN is 93.15% subsidiary of GREG.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 4,534 6,393 -29%

Gross profit LKR 000 (1,135) (1,753) -35%

Net Loss LKR 000 (103,725) (114,429) -9%

Loss per share LKR - (0.01) -

Total Assets LKR 000 81,492 56,759 44%

Net deficit per share LKR (0.04) (0.03) -15%

Table 12- OLANs financial indicators

Source: Audited Financial Statements & draft financial statements prepared by the management

www.randora.lk

~ 20 ~

Enterprise Technology (Pvt) Limited (ETPL)

Enterprise Technology (Pvt) Limited is one of Sri Lanka's premier Network Systems Integrators

with over 15 years of experience in providing business-critical Information Communication

Technology (ICT) solutions for major Sri Lankan Corporations. ETPLs clientele includes

organisations from the Telecommunication, Government, Transportation, Financial,

Manufacturing sector and Universities.

ETPL offers customers secured high performing end-to-end Information Communication

Technology solutions through a team of Sales, Design & Consultancy, Project Implementation

and Support professionals. These solutions include:

ETPL has developed a seamless organizational structure to provide comprehensive services for

deploying the state of art of Information Communication Technology solutions by a team of,

ETPL is 100.0% owned subsidiary of Olancom (Pvt) Ltd, which makes ETPL effectively a 93.15%,

owned subsidiary of GREG.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 110,873 150,063 -26%

Gross profit LKR 000 44,038 60,866 -28%

Net Loss LKR 000 122,197 (21,993) >100%

Earnings/(Losses) per share LKR 0.31 (0.06) >100%

Total Assets LKR 000 52,476 255,286 -79%

Net deficit per share LKR (0.41) (0.71) -43%

Table 13- ETPLs financial indicators

Source: Audited Financial Statements & draft financial statements prepared by the management

Multilayer Routing and Switching IP Networks

IP Telephony and Video Conferencing

Wireless Networks

Information Security

Internet / Enterprise Data Center

Storage and Disaster Recovery Solutions

Unified Messaging and Call Centers /Contact Centers

Consultancy

Design

Project Management and Implementation

Support and Outsourcing services

Application Delivery Networks

Video surveillance

www.randora.lk

~ 21 ~

Senit technologies (Pvt) Limited (SENT)

Senit Technologies (Pvt) Limited is an e-commerce software solution services provider mainly

concentrating on Online Hotel Reservation Solution, Online Shopping Cart Solution, and Online

Payment Gateway Integrations.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 4,198 3,116 35%

Gross profit LKR 000 4,198 3116 35%

Net Loss LKR 000 (3,946) (30,003) -87%

Loss per share LKR 000 (3,946) (30,003) -87%

Total Assets LKR 000 10,194 9,969 2%

Deficit per share LKR 000 (61,536) (57,589) 7%

Table 14- SENTs financial indicators

Source: Audited Financial Statements & draft financial statements prepared the management

www.randora.lk

~ 22 ~

Browns Investment PLC (BIL)

Browns Investment was incorporated in November 2008 as in investment company and has

interests in several sectors namely; plantations, leisure, manufacturing, construction &

engineering, telecommunication and power sector. BIL was initially incorporated as Browns

Plantation Investments Pvt Limited and subsequently changed to Browns Investments Limited.

The main course of business is diversifying investments into different sectors deriving investment

income, dividend income and capital gains. BIL was listed on the Colombo Stock Exchange

on 26 July 2011.

BIL is a subsidiary of Brown & Co PLC. BIL invests in fast growing areas of the Sri Lankan economy.

BIL operates as the strategic investment vehicle of the Browns Group and may invest on its own

or in concert with other investors.

BIL holds 100% ownership in Browns Hotels & Resorts Ltd (formerly LOLC Leisure Ltd.) Browns

Hotels & Resorts owns and operates the five star Eden Resort & Spa as well as Dickwella Resort

& Spa. Browns Hotels & Resorts also has within its portfolio the properties, which were formerly

Riverina, Club Palm Garden and Tropical Villas. The first stage of the 367 roomed mega project

in the property housing the former Palm Gardens, Riverina and Tropical villas is progressing

according to plan. The 172-roomed hotel is nearing completion. The project site, which is

unique in nature, has the sea beach on the west with two water bodies in the north and south,

adjacent to the turtle hatchery. While this location is unique, negotiations are in the final stages

to have an international chain to manage this 5 star hotel.

BIL acquired a controlling interest in the Green Paradise Resort in Dambulla. This unique

property houses 67 rooms, include superior duplex, deluxe and garden suites. The property new

to the region complete with luxury finishes beautiful landscaped gardens and is within close

proximity to the cultural triangle and other tourist sites. BIL also acquired a controlling interest

in the Sun & Fun Resort in Passikudah. The resort is still under construction and it will be a 71

roomed luxury resort.

BILs policy in managing hotels is a hybrid, being relatively new to the leisure sector. Some

properties are managed and operated by the group. Other properties would be managed

by international chains to capitalize on their capabilities and skills in hotel management and

marketing.

In a strategic restructuring of sectors, the travel segment, under Brown and Company PLC is in

the BIL since year 2013. With over 45 years of experience in the travel industry and with expertise

in destination management, the Travel segment fully complements the work of the Leisure

sector. The travel segment through BG Air Services (Pvt) Ltd, acts as the general sales agents

(GSA) for Austrian Airlines and Scandinavian Airlines in addition to handling outbound travel

and inbound travel through Browns Tours (Pvt) Ltd. Inbound travel has been successful in

capturing the aviation market by providing assistance to airlines to obtain permission with the

Civil Aviation Authority in Sri Lanka to operate flights in and out of Colombo, SLOT clearance

from Sri Lankan Airlines, landing and parking clearance to park craft overnight, aircraft

catering services, customs and immigration formalities for crews etc. BIL is also building a name

in event management by providing the MICE (Meetings, Incentives, Conferences and Events)

market with specialized services.

www.randora.lk

~ 23 ~

BILs subsidiary Excel Global Holdings has a subsidiary called Millennium Development (Pvt) Ltd.

This subsidiary has leasehold rights to property termed Excel World. This is a well-known property

situated in the centre of Colombo with easy access. It is planned to build a one of a kind mix

mega development on this property. This property will include shopping, super marketing,

conferencing facilities, gymnasiums and spas as well as restaurants, pubs and entertainment

arcades. In the short term, the property has been upgraded and continues to operate as an

entertainment location as well as a conferencing facility. It also houses the popular KEG pub

and restaurant.

2013/2014

Unaudited

2012/2013

Audited

%

Revenue LKR 000 2,881,984 2,624,821 10%

Gross profit LKR 000 483,298 447,321 8%

Net Profits LKR 000 20,052 33,928 -41%

Earnings per share LKR 0.02 -0.02 >100%

Total Assets LKR 000 22,160,641 12,697,974 75%

Net Assets LKR 000 15,284,524 12,654,077 20%

Property Plant & Equipment LKR 000 10,679,978 2,881,570 >100%

Net assets per share LKR 5.72 5.73 -0.2%

Table 15 - BIL's financial indicators

Source: Annual Reports and Unaudited Financial Statements published as at the report date

On 10 June 2014, BIL has resolved to issue 1,860,000,000 ordinary voting shares via a rights issue

in the proportion of 1-for-1 based on the shareholding as at 5 August 2014. The rights issue will

raise LKR 2.325 Bn to settle debts of BIL. Lanka Century Investments PLC has in principle agreed

to invest LKR 465 Mn in this regard for its holding of 20% in BIL and is expected to be sourced

from external funding.

As at 11 July 2014, BILs share is trading at LKR 1.80 and during the past one year have

generated a negative price return of LKR 30.20%. BILs annualized return volatility during the

past year is 52.95%.

Figure 6- BIL One year price trend

Source: Colombo Stock Exchange

1.00

1.50

2.00

2.50

3.00

3.50

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

12-Jul 12-Aug 12-Sep 12-Oct 12-Nov 12-Dec 12-Jan 12-Feb 12-Mar 12-Apr 12-May 12-Jun 12-Jul

P

r

i

c

e

V

o

l

u

m

e

s

www.randora.lk

~ 24 ~

4. Taprobane Holdings PLC

Taprobane Holdings PLC incorporated in September 2006 was formed with the vision of

becoming a leading investment powerhouse by generating a large fund base and mobilizing

such funds, by investing in the government securities market, debt securities market, equity

market and real estate market. Marking our presence in the investment market as a company

with integrity and honesty in its dealings, Taprobane is known for its flair for creativity in

mobilizing funds and identifying strategic investment options.

The special feature of this fund is that it provides investors with unique combinations of risk and

return options through various combinations of asset classes. In May 2012, Taprobane was

successfully listed on the Diri Savi Board of the Colombo Stock Exchange, boosting and

strengthening stakeholder confidence.

The myriad of financial services offered by its group companies, which includes Money

Brokering, Stock Brokering, Margin Trading and Corporate Finance is well supplemented by the

extensive expertise into the government securities market, possessed in-house. Apart from its

notable investments into the financial services sector, the groups investment strategy

implements a multi-disciplinary approach, marking presence in an array of sectors, including

real estate and commercial property management.

Figure 7- Taprobane Group Structure

Source: Company Profile

Brief description of the Taprobane group of companies

1. Heron Agro Products (Pvt) Ltd A farming project mainly involved in estate management.

2. Taprobane Securities (Pvt) Ltd A licensed Stockbroker of the Colombo Stock Exchange.

3. Capital Trust Partners (Pvt) Ltd - An investment holding company that has sizable

investment.

4. Taprobane Investments (Pvt) Ltd A licensed Money broker of the Central Bank of Sri Lanka.

5. Lexinton Holdings (Pvt) Ltd Involved in property management which extends to

maintaining commercial property. The subsidiaries of this company includes;

Lexinton Financial Services (Pvt) Ltd A Licensed Margin Provider of the SEC engaged

in Margin Trading activities

Lexinton Resorts (Pvt) Ltd Involved in real estate management

www.randora.lk

~ 25 ~

Taprobane Plantations Ltd Involved in managing sports and recreational activity

centres of Excel World Entertainment Park

6. Taprobane Wealth Plus (Pvt) Ltd The Corporate Finance arm of the group primarily

involved in equity and debt issue management.

Top 20 Shareholders as at 30 June 2014

Name of Shareholder No. of Shares %

1. SEYLAN BANK PLC/ARC CAPITAL (PVT) LTD 355,526,332 35.46

2. MR. - ISHARA CHINTHAKA NANAYAKKARA 225,920,922 22.53

3. BROWNS INVESTMENTS PLC 200,587,305 20.00

4. SEYLAN BANK PLC/PUBUDHU SARANGA WIJAYAKUMARI

RUPASINGHE SEYLAN 84,497,064 8.43

5. COMMERCIAL BANK CEYLON PLC/ARC CAPITAL (PVT) LTD 51,190,106 5.11

6. SEYLAN BANK LIMITED/RUWAN PRASANNA

SUGATHADASA/ 18,241,706 1.82

7. WALDOCK MACKENZIE LIMITED/MRS.A.C.JAYASINGHE/ 18,241,669 1.82

8. L.A.C. HOLDINGS (PVT) LTD 12,702,671 1.27

9. MR. - RAJANIK ROSHAN ANTONY 8,629,762 0.86

10. MRS. - TERUNI MARIA WIKRAMANAYAKE 5,073,000 0.51

11. MR. - DHARSHAN ASHANTHA BANDARA DASSANAYAKE 4,046,465 0.40

12. SIERRA TELECOMMUNICATIONS PRIVATE LIMITED 2,095,238 0.21

13. SEYLAN BANK PLC/R.P.L. EHELIYAGODA & S.U.R.

EHELIYAGODA SEYLAN BANK 2,000,000 0.20

14. ENTRUST LIMITED 1,211,476 0.12

15. SEYLAN BANK PLC /CAPITAL TRUST HOLDINGS LIMITED 1,076,481 0.11

16. MR. - NADARAJAH MURALEE PRAKASH 1,047,619 0.10

17. SPRINGCARE HOLDINGS (PRIVATE) LIMITED 1,047,619 0.10

18. Mr CHARITHA PRASANNA DE SILVA 997,333 0.10

19. MR. - NICHOLAS ANDREW FOLEY 759,592 0.08

20. SAMPATH BANK PLC/CAPITAL TRUST HOLDINGS LIMITED 750,809 0.07

Table 16- Top 20 Shareholders as at 30 June 2014

www.randora.lk

~ 26 ~

5. The Valuations

Free Cash Flow (FCF) valuation

The FCF valuation is based on the projected income statements and balance sheets of Lanka

Century Investments PLC and its subsidiary Companies provided by the respective companies,

senior management discussions and assumptions provided. We have derived the FCF to the

equity holders of Lanka Century Investments PLC and its companies and discounted them by

the relevant weighted average cost of capital to derive the value of equity. Then the

calculated equity value is taken into consideration based on the shareholding of the

respective company to calculate the Equity Value of Lanka Century Investments PLC.

The result of such FCF calculations are given in Table 17 below.

Entity

Enterprise value

LKR 000

Value of Equity

LKR 000

% of

holding

Value to GREG

LKR 000

GREG 361,233 355,927 100.00% 355,927

CLPL 1,026,382 878,079 91.39% 802,476

DPL 1,737,641 1,352,509 65.51% 886,029

RFPL 1,434,602 1,046,142 49.49% 517,736

SAT 7,014,891 5,901,073 86.08% 5,079,644

CCH 249,208 223,946 66.40% 148,700

OLAN 204,730 38,331 93.15% 35,705

PALL 23,332 - 55.19% -

BIL 20.00% -

Equity Value 7,826,217

Number of share 349,367

FCF value per share 22.40

Status of offer price Lower

Table 17- Results of FCF valuation

The forecasts and the respective assumptions of Browns Investments PLC was not made

available for Merchant Bank of Sri Lanka PLC as at the reporting date to calculate the Free

Cash flow Valuations and Equity Value of BIL. Lanka Century Investments PLC holds 20%

shareholding of BIL. Therefore, FCF valuations are excluding the value arising from BIL.

SATs previous control through CLPL of 51.55% and the direct control by GREG of 8.09% will

effectively change via a rights issue of 8:1 at a price of LKR 0.10 to CLPLs control of 80.39% and

GREGs direct control to 12.61%. Therefore, GREGs effective control will change from 55.19%

to 86.08% after the rights issues. The set of assumptions used in this valuation is listed below.

No sale of any assets or discontinuation of businesses of any companies during the next

five years.

The 347,721,600 Warrants of GREG outstanding will not be converted at the exercise

price of LKR 39.00 in year 2015.

The risk free rate is 8.93%, the 5 year bond rate

The expected market return is 12.50%.

Perpetual Growth rate of all the considered companies after the fifth year is 0.00%.

The projections for the FCF valuations were provided by the respective companies and

senior management of GREG.

www.randora.lk

~ 27 ~

The total non-current liabilities were considered when arriving at the value of debt as

at today.

Therefore, the FCF value is significantly above the offer price of LKR 11.00 offered by Taprobane

Holdings PLC through the voluntary offer.

If the FCF valuation of BIL was calculated and incorporated in the FCF valuation of GREG, it

will have a positive impact on FCF valuation.

www.randora.lk

~ 28 ~

Relative valuations

Sector based valuation

The sector based relative valuations are calculated based on the Price to book value multiples

of the Investment Trust sector. As at date there are nine listed companies (including GREG)

operating in this sector. The Price to Earnings ratio is not considered since GREG incurred a loss

during the financial year ended 31 March 2014.

The basic snapshot of the offer is given in Table 18 below.

Offer Price LKR 11.00

Group's net profit LKR "000" (304,179)

Groups EPS LKR (0.89)

Price Earnings ratio Times N/A

Group's Net assets ("000") LKR "000" 8,855,891

Group's Net assets per share 31 March 2014 LKR 22.08

Price to Book value based on offer price Times 0.50

No of Ordinary shares "000" 349,367

Table 18 - GREG Offer details

Price to book value based valuations

The valuation used in this methodology is the overall sector based net assets compared to the

sector market capitalization. Based on Table 19, below the offer price made on the voluntary

offer is significantly lower than the valuation presented from the sector based valuation.

Sector Investment Trust

Sector Price to book value 1.10

Sector PBV based valuation 24.30

Status of offer price Lower

Table 19 - GREG Sector PBV Valuation

Market based valuation

The valuation methodology used is the overall market net assets compared to the overall

market capitalization. Based on the Table 20 below, the offer price made on the voluntary

offer is significantly lower than the value presented from the sector based valuation.

Market

Market PBV as at 16 June 2014 2.07

Market PBV based valuation 45.70

Status of offer price Significantly lower

Table 20 - GREG Market PBV Valuation

www.randora.lk

~ 29 ~

Peer based valuation

The valuation methodology used is the peer based net assets compared to the peer market

capitalization. Based on Table 21 below, the offer price made on the voluntary offer is

significantly lower than the valuation presented from the peer based valuation.

Peer Company Ascot Holdings PLC

Price as at 13 Jul 2014 LKR 105.00

Net assets per share LKR 69.93

Price to Book value Times 1.50

Peer Company

Ceylon Guardian

Investment Trust PLC

Price as at 13 Jul 2014 LKR 192.30

Net assets per share LKR 166.93

Price to Book value Times 1.15

Average Peer Price to Book Value Times 1.33

GREG net assets value 31 March 2014 LKR 22.08

GREG value based on Peer PBV LKR 29.26

Status of offer price Significantly lower

Table 21 - Peer based PBV valuation

www.randora.lk

~ 30 ~

Market Price based valuation

The average of closing prices for the last one-year commencing from 12 July 2013 to 11 July

2014 is considered to calculate the average market prices of GREG. Given in Table 22 below,

the offer price made on the voluntary offer is lower than the average closing prices for the last

1-year and last three months.

Starting date

12-Jul-13

Ending period

11-Jul-14

Number of trading days

240

Highest closing price

LKR 15.60

Highest traded price

LKR 16.00

Lowest closing price

LKR 10.00

Lowest traded price

LKR 9.90

Average daily price return/(loss)

% -0.09

Total Price return/(loss)

% -21.94

Annualized Volatility

% 38.33

One year average closing price

LKR 12.90

Three months average closing price

LKR 11.40

Status of offer price

Lower

Table 22 - GREG price statistics

Figure 8- GREG One year price trend

Source: Colombo Stock Exchange

8.00

9.00

10.00

11.00

12.00

13.00

14.00

15.00

16.00

17.00

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

Jul-13 Aug-

13

Sep-13 Oct-13 Nov-13 Dec-

13

Jan-14 Feb-14Mar-14 Apr-14 May-

14

Jun-14 Jul-14

P

r

i

c

e

V

o

l

u

m

e

s

www.randora.lk

~ 31 ~

Market Value of Investments

The net realizable value (NRV) of assets is usually computed when the liquidation approach is

used to value a company. Marketable securities will be considered at the present value

considering a sale and other assets at the book values.

Stake of

GREG

No of

shares

Market

Price

Control

Premium

LKR "000"

CLPL

Voting Shares 91.39% 31,284,589 68.00 N/A 2,127,352

Warrant - 2014 73.65% 18,411,702 0.60 N/A 11,047

Warrant 2015 73.65% 18,411,702 3.00 N/A 55,235

BIL 20% 372,000,000 2.30 N/A 855,600

DPL 58.36% 42,163,000 12.00 505,956

PHAR 66.40% 845,159 520.00 20% 527,379

Textured Jersey Lanka PLC

Turn over (LKR) Bn 12.725

Market Cap (LKR) Bn 13.1

South Asia Textile Industries Lanka (Pvt) Limited 12.61% N/A 627,921

Turnover -(LKR) 4.873 Bn

Net Realizable Values from GREG - 31 March 2014

Cash & Cash Equivalents 346,423

Other assets 20,798

Total Net Realizable Value of assets 5,077,711

No of shares 349,367

Value per share 14.53

Status of offer price Lower

Table 23- Realizable Market Values

Market price as at 21 July 2014 except for BIL which is as at 6 June 2014 in order to adjust for

prices before the rights issue.

South Asia Textile Industries Lanka (Pvt) Limited has been valued based on Textured

Jersey Lanka PLCs Market capitalization weighted on turnover for the year ended 31 March

2014.

www.randora.lk

~ 32 ~

6. Independent Opinion

The objective of this independent opinion is to examine whether the offer price of LKR 11.00

offered by Taprobane Holdings PLC for the existing shareholders of Lanka Century Investments

PLC is reasonable and fair. Merchant Bank of Sri Lanka PLC has adopted the following

valuation methodologies included in section 5 of this report with the detailed valuations. The

valuation outcomes of such methodologies are given below in Table 24.

Valuation method Value Status

Free Cash flow based 22.40 Lower

Sector Price to book value based

24.30 Lower

Market Price to book value based

45.70 Significantly lower

Peer Price to book value based 29.26 Significantly lower

One year Average market price based 12.90 Lower

Market Value of Investment 14.53 Lower

Table 24- Summary of valuations

Considering the valuation outcomes given Table 24 above, we are of the opinion that the offer

price of LKR 11.00 made by Taprobane Holdings PLC to the remaining shareholders of Lanka

Century Investments PLC is not attractive as the offer price is at a discount against all the

valuations methodologies adopted as at the valuation date 28 July 2014.

Risk Factors specifically associated with the offer

Shareholders who accepts the offer:

The share price of GREG will change in secondary market based on many factors. If a

shareholder accepts this offer and sell his shares and thereafter if the share price surge

in the secondary market, such shareholders will experience a lost opportunity of

retaining a higher capital gain.

After accepting the offer, if the Company declare dividends to its shareholder, such

shareholders who accepted this offer may not receive such dividends.

Shareholders who reject the offer

The share price of GREG will change in secondary market based on many factors. If a

shareholder rejects this offer and thereafter if the share price decline in the secondary

market, such shareholders may incur a capital loss.

www.randora.lk

~ 33 ~

7. Declaration to the Shareholders and Directors of GREG

28 July 2014

DECLARATION BY THE INDEPENDENT ADVISOR, MERCHANT BANK OF SRI LANKA PLC

We, Merchant Bank of Sri Lanka PLC (MBSL) of No. 28, St. Michaels Road, Colombo 03 being

the Independent Advisor to the Voluntary offer made by Taprobane Holdings PLC (Offeror) to

acquire the remaining Ordinary Voting Shares, not already owned by Taprobane Holdings PLC

or any person acting in concert with Taprobane Holdings PLC, of Lanka Century Investments

PLC (Offeree) do hereby declare and confirm that we do not act as the financial advisor to

the Offeror Company nor we have any interest in or financial connection with either the

Offeror or the Offeree.

MBSL as the independent advisor has given and not withdrawn the consent to the publication

of the report to the Board of Directors and shareholders of Lanka century Investments PLC

Yours faithfully,

MERCHANT BANK OF SRI LANKA PLC

--------------------------------------- --------------------------------------------

Mr A M A Cader Ms Lalangi Goonawardena

Deputy General Manager Manager

Corporate Advisory & Capital Markets Corporate Advisory

www.randora.lk

~ 34 ~

28 July 2014

The Board of Directors

Lanka Century Investments PLC

No. 10,

5th Floor, Gothami Road,

Colombo 08.

Dear Sir / Madam

INDEPENDENT ADVISORS REPORT ON THE OFFER MADE BY TAPROBANE HOLDINGS PLC TO THE

SHAREHOLDERS OF LANKA CENTURY INVESTMENTS PLC

At the request of the Board of Directors, we have carried out the valuation of the ordinary

shares of Lanka Century Investments PLC for the above purpose and pleased to submit

herewith our opinion in compliance with the rules and regulations contained in the Company

Takeovers and Mergers code 1995 (as amended in 2003) of the Securities and Exchange

Commission of Sri Lanka.

Thanking You

Yours faithfully

MERCHANT BANK OF SRI LANKA PLC

------------------------- ------------------------------------

Mr A M A Cader Ms Lalangi Goonawardena

Deputy General Manager Manager

Corporate Advisory & Capital Markets Corporate Advisory

www.randora.lk

Vous aimerez peut-être aussi

- Ageing Management and Long Term Operation of Nuclear Power Plants: Data Management, Scope Setting, Plant Programmes and DocumentationD'EverandAgeing Management and Long Term Operation of Nuclear Power Plants: Data Management, Scope Setting, Plant Programmes and DocumentationPas encore d'évaluation

- EagleBurgmann TS1000 enDocument6 pagesEagleBurgmann TS1000 enkeyur1109Pas encore d'évaluation

- IBM Maximo Asset Configuration Manager A Complete Guide - 2020 EditionD'EverandIBM Maximo Asset Configuration Manager A Complete Guide - 2020 EditionPas encore d'évaluation

- PB Thermal Station CostsDocument20 pagesPB Thermal Station CostsJosé SánchezPas encore d'évaluation

- 1 Useful LifeDocument12 pages1 Useful LifeDon HaffisPas encore d'évaluation

- Using The Economy of Sukari Gold Mine To Prove The Potential Economy of Hamama Gold Project, Eastern Desert, EgyptDocument8 pagesUsing The Economy of Sukari Gold Mine To Prove The Potential Economy of Hamama Gold Project, Eastern Desert, EgyptPremier Publishers100% (1)

- Asesmen Chemistry Cycle by EPRIDocument14 pagesAsesmen Chemistry Cycle by EPRIAbdul KadirPas encore d'évaluation

- Electrical System Safety RulesDocument82 pagesElectrical System Safety RulesMichael EscalantePas encore d'évaluation

- Gunes Bacasi Santrali Verimlilik1 s2.0 S2213138821008213 MainDocument31 pagesGunes Bacasi Santrali Verimlilik1 s2.0 S2213138821008213 MainEren P.Pas encore d'évaluation

- Renewable 0 Energy 0 ReportDocument94 pagesRenewable 0 Energy 0 ReportTara Sinha100% (1)

- Current Business Models in LithiumDocument68 pagesCurrent Business Models in LithiumyaklyPas encore d'évaluation

- Performance Evaluation and Economic Analysis of A Gas Turbine Plant Final PaperDocument10 pagesPerformance Evaluation and Economic Analysis of A Gas Turbine Plant Final Papernabil160874Pas encore d'évaluation

- Cost Models For Current and Future Hydrogen Production: January 2007Document44 pagesCost Models For Current and Future Hydrogen Production: January 2007Zakiah Darajat NurfajrinPas encore d'évaluation

- Information Visualization Chaomei ChenDocument17 pagesInformation Visualization Chaomei ChenMécia SáPas encore d'évaluation

- Commitment Statement For CanberraDocument2 pagesCommitment Statement For CanberraJajaPas encore d'évaluation

- On-Line Predictive Condition Monitoring System For Coal PulverizersDocument71 pagesOn-Line Predictive Condition Monitoring System For Coal PulverizersbwelzPas encore d'évaluation

- State Sustainable Supply Chains MIT CSCMPDocument50 pagesState Sustainable Supply Chains MIT CSCMPWarehouse ShipyardPas encore d'évaluation

- AnnuAl GlobAl PiPeline Integrity SummitDocument7 pagesAnnuAl GlobAl PiPeline Integrity SummitAnonymous rPV6LRE1Pas encore d'évaluation

- Kpi S For The Electricity Sector in The Kingdom of Saudi ArabiaDocument32 pagesKpi S For The Electricity Sector in The Kingdom of Saudi ArabiaatmmmmmmmmyPas encore d'évaluation

- AsiaPhos Preliminary Offer Document PDFDocument558 pagesAsiaPhos Preliminary Offer Document PDFInvest StockPas encore d'évaluation

- ECSA Discipline-Specific Training Guideline For Candidate Engineers in Metallurgical EngineeringDocument7 pagesECSA Discipline-Specific Training Guideline For Candidate Engineers in Metallurgical EngineeringMoosewanger01Pas encore d'évaluation

- Assignment On Feasibility Study of A SunDocument7 pagesAssignment On Feasibility Study of A SunI Tech Services KamranPas encore d'évaluation

- Simulation Techniques in Oyu Tolgoi Underground Development SchedulingDocument9 pagesSimulation Techniques in Oyu Tolgoi Underground Development SchedulingNIEVES MORALES SUBIABREPas encore d'évaluation

- Biokinetics II FinalDocument100 pagesBiokinetics II FinalZilvinas DorofejusPas encore d'évaluation

- Idaho Cobalt ProjectDocument218 pagesIdaho Cobalt ProjectCatalina LunaPas encore d'évaluation

- Digital Quality Management in ConstructionDocument275 pagesDigital Quality Management in ConstructionChrisPas encore d'évaluation

- CA Gas Project Feasibility 2002-03!11!600!02!010DCRDocument70 pagesCA Gas Project Feasibility 2002-03!11!600!02!010DCRhakway100% (1)

- Paper Chalmers On Allocation Principles For Biomass in BFDocument25 pagesPaper Chalmers On Allocation Principles For Biomass in BFLeandro DijonPas encore d'évaluation

- Philippines Eiti 2017 Validation Initial Assessment On Data Collection and Stakeholder ConsultationDocument206 pagesPhilippines Eiti 2017 Validation Initial Assessment On Data Collection and Stakeholder Consultationcarlos-tulali-1309Pas encore d'évaluation

- The Role of Build Operate Transfer in Promoting RES Projects December 2003Document7 pagesThe Role of Build Operate Transfer in Promoting RES Projects December 2003Harjot SinghPas encore d'évaluation

- Draft Nepra Hse Code 2021Document68 pagesDraft Nepra Hse Code 2021Syed Fawad ShahPas encore d'évaluation

- 2014 Fact Book LRDocument40 pages2014 Fact Book LRYul Armand OrtigasPas encore d'évaluation

- List of Papers and Posters PDFDocument32 pagesList of Papers and Posters PDFSilvia TudorPas encore d'évaluation

- Flexible Operation of Thermal Power Plants - NTPCDocument57 pagesFlexible Operation of Thermal Power Plants - NTPCmarishankar46115Pas encore d'évaluation

- PW Engineering IntroductionDocument20 pagesPW Engineering IntroductionSerban IonescuPas encore d'évaluation

- CogenDocument138 pagesCogenzubair1951100% (2)

- Southern Cross Information Memorandum 0031Document64 pagesSouthern Cross Information Memorandum 0031tomkoltaiPas encore d'évaluation

- Bankruptcy PredictionDocument33 pagesBankruptcy PredictionRagavi RzPas encore d'évaluation

- DesalinationDocument4 pagesDesalinationkaseproPas encore d'évaluation

- Chrome Ore Beneficiation Challenges & LISTODocument8 pagesChrome Ore Beneficiation Challenges & LISTOAlfredo V. Campa100% (1)

- Sample CHP Feasibility Study 080405Document49 pagesSample CHP Feasibility Study 080405Muhammad Junaid Anjum100% (1)

- Oyu Tolgoi Oct 2014Document547 pagesOyu Tolgoi Oct 2014Carlos A. Espinoza MPas encore d'évaluation

- Exhaust Gas Temperature Capabilities Now in System 1 SoftwareDocument2 pagesExhaust Gas Temperature Capabilities Now in System 1 Softwarescribdkhatn100% (2)

- Life Management and Maintenance For Power Plants Vol. 1Document404 pagesLife Management and Maintenance For Power Plants Vol. 1kp pkPas encore d'évaluation

- ETIPWind Roadmap 2020Document32 pagesETIPWind Roadmap 2020Francisco GoncastPas encore d'évaluation

- 243 Rupprecht PDFDocument6 pages243 Rupprecht PDFdonnypsPas encore d'évaluation

- TOC Feasibility Study Lowres V2 0Document269 pagesTOC Feasibility Study Lowres V2 0shahjada687013Pas encore d'évaluation

- Market Assessment For Promoting Energy Efficiency and Renewable Energy Investment in Brazil Through Local Financial InstitutionsDocument201 pagesMarket Assessment For Promoting Energy Efficiency and Renewable Energy Investment in Brazil Through Local Financial Institutionsalan_douglas_poolePas encore d'évaluation

- Business Dynamics and Diversification PlanningDocument6 pagesBusiness Dynamics and Diversification PlanningrannscribdPas encore d'évaluation

- IVCA Guide To Venture Capital PDFDocument64 pagesIVCA Guide To Venture Capital PDFNuwan Tharanga LiyanagePas encore d'évaluation

- Valuation of Aggregate Operations For Banking PurposesDocument18 pagesValuation of Aggregate Operations For Banking PurposesRodrigo DavidPas encore d'évaluation

- DellDocument3 pagesDellAneesh VarghesePas encore d'évaluation

- Effect of Lithium Battery On EnvironmentDocument4 pagesEffect of Lithium Battery On EnvironmentInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Giz2011 en Exploring Biogas Market Opportunities VietnamDocument92 pagesGiz2011 en Exploring Biogas Market Opportunities Vietnamlhphong021191Pas encore d'évaluation

- Level Control Guide For Feedwater Heaters - Moisture Separator - Reheaters - and Other EquipmentDocument148 pagesLevel Control Guide For Feedwater Heaters - Moisture Separator - Reheaters - and Other EquipmentSubrata Das100% (1)

- Case StudyDocument12 pagesCase Studyewalied2800Pas encore d'évaluation

- MRO On The Move: Outsourcing Maintenance, Repair and OperationsDocument12 pagesMRO On The Move: Outsourcing Maintenance, Repair and Operationssha_yadPas encore d'évaluation

- RE BIZZ Final ReportDocument123 pagesRE BIZZ Final ReportWessel SimonsPas encore d'évaluation

- Sec Office Investor Advocate Report On Objectives Fy2016Document52 pagesSec Office Investor Advocate Report On Objectives Fy2016CrowdfundInsiderPas encore d'évaluation

- Sample RFP Template 2Document28 pagesSample RFP Template 2Muhammad Khurram KhanPas encore d'évaluation

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkPas encore d'évaluation

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkPas encore d'évaluation

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkPas encore d'évaluation

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkPas encore d'évaluation