Académique Documents

Professionnel Documents

Culture Documents

Mstar Anip 13 10

Transféré par

derek_2010Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mstar Anip 13 10

Transféré par

derek_2010Droits d'auteur :

Formats disponibles

Release date 10-03-2013 | FINRA Members: For internal use or client reporting purposes only.

Page 1 of 1

ANI Pharmaceuticals Inc(USD) ANIP

ANI Pharmaceuticals Inc is a specialty pharmaceutical

company engaged in the development of products for

female sexual health, menopause, contraception and

male hypogonadism.

Morningstar Rating

Last Close $

Sales $Mil

Mkt Cap $Mil

Industry

Currency

$10.86

$4

$104

Biotechnology

USD

Fair Value

Uncertainty

Fair Value

Economic Moat

Style

Sector

Small Growth

Healthcare

162.00 392.04 217.08 172.80 288.00 210.60 97.20

59.40 141.12 97.92 54.36 91.80 29.16 37.08

None

90.00 144.72 44.28

46.44 13.68 6.48

10.99

4.80

1:6

1:6

210 Main Street West

Lincolnshire, MN 56623

Phone: +1 218 634-3500

Website: http://www.biosantepharma.com

1,856.0 Trading Volume Ten

42.0

Growth Rates Compound Annual

Grade: F

Revenue %

Operating Income %

Earnings/Share %

Dividends %

Book Value/Share %

Stock Total Return

+/- Industry

+/- Market

1 Yr

3 Yr

5 Yr

10 Yr

428.7

-38.1

0.6

-38.9

-17.7

22.3

-7.0

-43.8

-73.4

-59.8

36.1

-29.6

-41.0

-57.9

-52.3

-2.1

-9.9

-21.3

-31.0

-28.5

Ind

Mkt

Profitability Analysis

Grade: F

Current 5 Yr Avg

Return on Equity %

-105.9 -186.0

Return on Assets %

-79.1 -102.4

Revenue/Employee $K 333.4

93.9

Fixed Asset Turns

1.4

3.8

Inventory Turns

0.2

*

17.6

20.0

8.3

8.1

1015.3

4.2

7.1

1.4

11.5

Gross Margin %

Operating Margin %

Net Margin %

Free Cash Flow/Rev %

R&D/Rev %

81.7

20.7

17.4

11.4

26.9

86.5

89.9

-693.0 -3743.8

-879.4 -3834.0

734.1 2799.4

42.8

19.5

13.8

11.7

Financial Position (USD)

Grade: D

12-12 $Mil

06-13 $Mil

35

35

0

39

1

8

11

0

11

28

13

3

6

24

5

13

42

2

0

6

0

6

35

Cash

Inventories

Receivables

Current Assets

Fixed Assets

Intangibles

Total Assets

Payables

Short-Term Debt

Current Liabilities

Long-Term Debt

Total Liabilities

Total Equity

Annual Price High

Low

Recent Splits

Price Volatility

262.0

Monthly High/Low

85.0

Rel Strength to S&P 500

27.0 52 week High/Low $

11.34-4.80

8.0

10 Year High/Low $

2.0

392.04-4.80

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

YTD

Stock Performance

23.6

-5.1

-13.6

56

32.4

21.5

19.8

101

-33.4

-38.3

-44.8

71

-24.1

-39.9

-25.5

65

36.5

31.0

40.9

103

-73.5

-36.5

-66.3

27

45.0

18.5

38.5

98

13.1

-2.0

9.2

157

-69.4

-71.5

-79.2

62

-59.2

-75.2

-89.6

31

47.2

27.5

2.5

104

Total Return %

+/- Market

+/- Industry

Dividend Yield %

Market Cap $Mil

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

TTM

Financials (USD)

0

0

0

100.0 100.0 100.0

-6

-12

-9

-9231.3 -15749.5 -3600.6

14

100.0

3

23.8

0

4

1

2

0

2

4

100.0 100.0

76.2

89.1

88.5

95.9

86.5

-9

-18

-47

-44

-51

-23

-28

-1760.3 -476.5 -3769.8 -1762.5 -11703.0 -1007.1 -693.0

Revenue $Mil

Gross Margin %

Oper Income $Mil

Operating Margin %

-6

-12

-10

-8

-17

-48

-46

-52

-28

-32

-19.44

0

23.08

-25.20

0

31.14

-18.00

1

12.65

4.68

1

27.84

-10.80

1

39.37

-23.04

1

18.14

-50.40

1

8.46

-25.20

2

7.22

-18.72

3

11.00

-7.62

4

6.81

-23.07

3.72

-6

0

-6

-10

0

-11

-8

0

-8

-5

0

-5

1

0

1

-16

-1

-16

-18

0

-19

-40

0

-40

-48

-1

-49

-25

-1

-26

-27

-1

-27

Oper Cash Flow $Mil

Cap Spending $Mil

Free Cash Flow $Mil

2003

2004

2005

2007

2008

2009

2010

2011

2012

TTM

Profitability

2006

-77.2

-87.7

-70.4

-89.6

-97.7

-84.9

0.01

0.01

0.02

-9099.1 -15427.9 -3735.6

1.1

1.1

1.4

17.5

22.4

0.90

19.3

1.2

-28.3

-71.2 -175.7 -113.8 -96.3

-54.8

-79.1

-31.7

-80.0 -320.5 -264.2 -181.2 -84.0 -105.9

0.02

0.15

0.05

0.06

0.01

0.05

0.09

-1538.3 -460.9 -3777.9 -1867.1 -11859.7 -1204.7 -879.4

1.1

1.3

2.3

2.3

1.6

1.4

1.2

Net Income $Mil

Earnings Per Share $

Dividends $

Shares Mil

Book Value Per Share $

Return on Assets %

Return on Equity %

Asset Turnover

Net Margin %

Financial Leverage

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

06-13

Financial Health (USD)

16

16

18

18

30

29

0

14

12

17

16

1.05

27

17

19

0.91

32

17

38

0.46

51

0

28

25

0

35

18

Long-Term Debt $Mil

Total Equity $Mil

Debt/Equity

Working Capital $Mil

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

TTM

Valuation

-7.7

0.0

714.3

6.5

-8.3

-7.8

0.0

1250.0

6.3

-9.0

-7.3

277.8

10.4

-8.5

21.3

4.1

3.6

-11.9

-12.6

0.0

196.1

3.5

129.9

-1.6

0.0

7.2

2.0

-1.8

-1.0

0.0

39.1

6.2

-2.7

-2.3

0.0

43.7

8.2

-2.7

-1.0

113.6

1.6

-1.0

-1.0

0.0

11.6

1.1

-1.1

-0.5

0.0

3.8

2.9

-0.6

Price/Earnings

P/E vs. Market

Price/Sales

Price/Book

Price/Cash Flow

Valuation Analysis

Current 5 Yr Avg

Price/Earnings

Forward P/E

Price/Cash Flow

Price/Free Cash Flow

Dividend Yield %

Price/Book

Price/Sales

PEG Ratio

-0.5

-46.5

-0.6

-0.5

2.9

3.8

-1.4

-1.8

-1.8

3.8

43.0

*3Yr Avg data is displayed in place of 5 Yr Avg

Ind

Mkt

47.4

51.5

103.1

0.4

8.1

8.4

17.0

21.4

10.2

36.2

2.2

2.4

2.8

2.4

Quarterly Results (USD)

Close Competitors

Revenue $Mil

Sep

Dec

Mar

Jun

Most Recent

Previous

0.0

0.0

1.0

0.0

0.0

0.0

6.0

5.0

Rev Growth %

Most Recent

Previous

Earnings Per Share $

Most Recent

Previous

Sep

Dec

Mar

Jun

-39.6

256.1

1620.3

-20.0

27.2

100.0

18.6

6303.2

Sep

Dec

Mar

Jun

-1.62

-4.32

-0.78

-1.44

-0.54

-3.24

-6.02

-2.16

Mkt Cap $Mil

Rev $Mil

P/E

ROE%

Major Fund Holders

% of shares

Bridgeway Ultra-Small Company Market

Vanguard Total Stock Mkt Idx

Vanguard Instl Ttl Stk Mkt Idx InstlPls

2013 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the confidential and proprietary information of Morningstar, (2) may include, or be derived from, account

information provided by your financial advisor which cannot be verified by Morningstar, (3) may not be copied or redistributed, (4) do not constitute investment advice offered by Morningstar, (5) are provided solely for

informational purposes and therefore are not an offer to buy or sell a security, and (6) are not warranted to be correct, complete or accurate. Except as otherwise required by law, Morningstar shall not be responsible for any

trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. This report is supplemental sales literature. If applicable it must be preceded or accompanied

by a prospectus, or equivalent, and disclosure statement.

0.57

0.44

0.35

Vous aimerez peut-être aussi

- Why Moats Matter: The Morningstar Approach to Stock InvestingD'EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingÉvaluation : 4 sur 5 étoiles4/5 (3)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Practice Technicals 1Document75 pagesPractice Technicals 1tiger100% (1)

- Mogen, Inc. Case StudyDocument18 pagesMogen, Inc. Case StudyAirlangga Prima Satria MaruapeyPas encore d'évaluation

- Relative Valuation - Ashwath DamodaranDocument130 pagesRelative Valuation - Ashwath DamodaranJigs PadPas encore d'évaluation

- Crox 20110728Document2 pagesCrox 20110728andrewbloggerPas encore d'évaluation

- Investor Relations: Katherine A. OwenDocument29 pagesInvestor Relations: Katherine A. OwenalexonowlinPas encore d'évaluation

- Jonathan P Gertler MD Managing Director Head, Biopharma Investment BankingDocument20 pagesJonathan P Gertler MD Managing Director Head, Biopharma Investment BankingSotiri Fox0% (1)

- Thomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)Document6 pagesThomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)sinnlosPas encore d'évaluation

- Momentum Growth & Value: (F) (F) (F) (F)Document3 pagesMomentum Growth & Value: (F) (F) (F) (F)api-254669145Pas encore d'évaluation

- 100 Best Companies To WorkDocument4 pages100 Best Companies To WorkjovihodrialPas encore d'évaluation

- GRVY Compustat ReportDocument15 pagesGRVY Compustat ReportOld School ValuePas encore d'évaluation

- STJ Write UpDocument5 pagesSTJ Write Upmunger649Pas encore d'évaluation

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipPas encore d'évaluation

- MSDocument36 pagesMSJason WangPas encore d'évaluation

- Fidelity SnapshotDocument1 pageFidelity SnapshotAnanya DasPas encore d'évaluation

- Thomson Reuters Company in Context Report: Bank of America Corporation (Bac-N)Document6 pagesThomson Reuters Company in Context Report: Bank of America Corporation (Bac-N)sinnlosPas encore d'évaluation

- Eros Intl - Media MKT Cap (Rs MN) 46,720 CMP (RS) 16-Jun-15 505 Annual Trend in Topline and Bottom LineDocument8 pagesEros Intl - Media MKT Cap (Rs MN) 46,720 CMP (RS) 16-Jun-15 505 Annual Trend in Topline and Bottom LineKCPas encore d'évaluation

- Whitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Whitehall & CompanyPas encore d'évaluation

- Mstar Anss 14 01Document1 pageMstar Anss 14 01derek_2010Pas encore d'évaluation

- Inquirer Briefing by Cielito HabitoDocument47 pagesInquirer Briefing by Cielito Habitoasknuque100% (2)

- Local Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Document19 pagesLocal Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Rushbh PatilPas encore d'évaluation

- David Hsu SME2008Document18 pagesDavid Hsu SME2008msoliman66Pas encore d'évaluation

- Stock Up - Overstock - Com UpgradedDocument5 pagesStock Up - Overstock - Com UpgradedValuEngine.comPas encore d'évaluation

- ValuEngine Weekly Newsletter July 27, 2012Document9 pagesValuEngine Weekly Newsletter July 27, 2012ValuEngine.comPas encore d'évaluation

- October 7, 2011: Market OverviewDocument11 pagesOctober 7, 2011: Market OverviewValuEngine.comPas encore d'évaluation

- MonsantoDocument7 pagesMonsantozbarcea99Pas encore d'évaluation

- Ciena Thompson Hold+Document6 pagesCiena Thompson Hold+sinnlosPas encore d'évaluation

- $MO (NYSE) : BUY Nov 23, 2014Document13 pages$MO (NYSE) : BUY Nov 23, 2014chrisngblogPas encore d'évaluation

- Analyst Consensus Rating: About Aetna IncDocument8 pagesAnalyst Consensus Rating: About Aetna IncLeon P.Pas encore d'évaluation

- Gilead Sciences Inc (Gild-O) : Average ScoreDocument12 pagesGilead Sciences Inc (Gild-O) : Average ScoreInvest StockPas encore d'évaluation

- OSIMDocument6 pagesOSIMKhin QianPas encore d'évaluation

- Gold Market Update April - GSDocument16 pagesGold Market Update April - GSVictor KerezovPas encore d'évaluation

- Warren Buffett ReportDocument15 pagesWarren Buffett ReportsuleymonmonPas encore d'évaluation

- Gluskin Sheff + Associates, Inc. (TSX:GS) : Key Statistics Key Executives and ProfessionalsDocument1 pageGluskin Sheff + Associates, Inc. (TSX:GS) : Key Statistics Key Executives and ProfessionalsXi HuangPas encore d'évaluation

- Growing Sustainably: Hindustan Unilever LimitedDocument164 pagesGrowing Sustainably: Hindustan Unilever LimitedFarid PatcaPas encore d'évaluation

- Weekly Foreign Holding Update - 11 01 2013Document2 pagesWeekly Foreign Holding Update - 11 01 2013ran2013Pas encore d'évaluation

- Apollo Hospitals Enterprise LTD: Q4FY11 First CutDocument7 pagesApollo Hospitals Enterprise LTD: Q4FY11 First CutVivek YadavPas encore d'évaluation

- Atlas BankDocument145 pagesAtlas BankWaqas NawazPas encore d'évaluation

- Econ SnapshotDocument1 pageEcon SnapshotThe Dallas Morning NewsPas encore d'évaluation

- ValuEngine Weekly Newsletter February 17, 2012Document10 pagesValuEngine Weekly Newsletter February 17, 2012ValuEngine.comPas encore d'évaluation

- Aci Reuters BuyDocument6 pagesAci Reuters BuysinnlosPas encore d'évaluation

- Simfund MF OverviewDocument26 pagesSimfund MF OverviewRama ChandranPas encore d'évaluation

- Selected Financial Highlights Years Ended December 31 2005 2004 2003Document31 pagesSelected Financial Highlights Years Ended December 31 2005 2004 2003Michael KanemotoPas encore d'évaluation

- DMX Technologies: OverweightDocument4 pagesDMX Technologies: Overweightstoreroom_02Pas encore d'évaluation

- S&P Midcap 400Document7 pagesS&P Midcap 400amitalwarPas encore d'évaluation

- GfiDocument17 pagesGfiasfasfqwePas encore d'évaluation

- Smith and Nephew Investor Presentation - FinalDocument42 pagesSmith and Nephew Investor Presentation - FinalmedtechyPas encore d'évaluation

- George Soros, S SecretsDocument21 pagesGeorge Soros, S Secretscorneliusflavius7132Pas encore d'évaluation

- ValuEngine Weekly Newsletter June 29, 2012Document9 pagesValuEngine Weekly Newsletter June 29, 2012ValuEngine.comPas encore d'évaluation

- Ib Newsletter - As of Jun 302011Document5 pagesIb Newsletter - As of Jun 302011Anshul LodhaPas encore d'évaluation

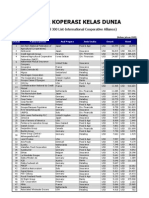

- 12 - 2010 - Daftar Koperasi Kelas DuniaDocument7 pages12 - 2010 - Daftar Koperasi Kelas DuniaTrianto Budi UtamaPas encore d'évaluation

- Piramal Life Sciences StockDocument2 pagesPiramal Life Sciences Stockdrsivaprasad7Pas encore d'évaluation

- BAM Balyasny 200809Document6 pagesBAM Balyasny 200809jackefellerPas encore d'évaluation

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAK_Chavan100% (1)

- Maverick Contest - TrinityDocument6 pagesMaverick Contest - TrinityJeewant SinghPas encore d'évaluation

- ValuEngine Free Weekly Newsletter Has Been PostedDocument8 pagesValuEngine Free Weekly Newsletter Has Been PostedValuEngine.comPas encore d'évaluation

- July Seasonality - Global Interest Rates: Changes Since End of JuneDocument3 pagesJuly Seasonality - Global Interest Rates: Changes Since End of Juneapi-245850635Pas encore d'évaluation

- Seven Shooting Star Stocks For A Volatile Market: Intuitive Surgical's Vital Statistics..Document8 pagesSeven Shooting Star Stocks For A Volatile Market: Intuitive Surgical's Vital Statistics..jpcotePas encore d'évaluation

- MBA Mid-Year Mortgage Servicer RankingsDocument20 pagesMBA Mid-Year Mortgage Servicer RankingsThe Partnership for a Secure Financial FuturePas encore d'évaluation

- Stock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCPas encore d'évaluation

- Clearsight Monitor - Professional Services Industry UpdateDocument9 pagesClearsight Monitor - Professional Services Industry UpdateClearsight AdvisorsPas encore d'évaluation

- HW20Document18 pagesHW20kayteeminiPas encore d'évaluation

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Bmi C Amer 17 09 PDFDocument13 pagesBmi C Amer 17 09 PDFderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Bmi C Amer 17 07Document13 pagesBmi C Amer 17 07derek_2010Pas encore d'évaluation

- Bmi Brazil 17 10Document9 pagesBmi Brazil 17 10derek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Bmi Andean 19 05Document13 pagesBmi Andean 19 05derek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Bmi Brazil 16 03Document9 pagesBmi Brazil 16 03derek_2010Pas encore d'évaluation

- Bmi Brazil 16 04Document9 pagesBmi Brazil 16 04derek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Bmi Venez 18 07Document13 pagesBmi Venez 18 07derek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- BUY BUY BUY BUY: Pepsico IncDocument5 pagesBUY BUY BUY BUY: Pepsico Incderek_2010Pas encore d'évaluation

- Important Notice:: DisclaimerDocument17 pagesImportant Notice:: Disclaimerderek_2010Pas encore d'évaluation

- BUY BUY BUY BUY: TJX Companies IncDocument5 pagesBUY BUY BUY BUY: TJX Companies Incderek_2010Pas encore d'évaluation

- BUY BUY BUY BUY: Novo Nordisk A/SDocument5 pagesBUY BUY BUY BUY: Novo Nordisk A/Sderek_2010Pas encore d'évaluation

- BUY BUY BUY BUY: Medtronic PLCDocument5 pagesBUY BUY BUY BUY: Medtronic PLCderek_2010Pas encore d'évaluation

- Exam 1 AnswersDocument5 pagesExam 1 Answersmaica G.Pas encore d'évaluation

- Valuation of Mergers and AcquisitionsDocument41 pagesValuation of Mergers and Acquisitionscrazybobby007Pas encore d'évaluation

- Fsa AnswersDocument22 pagesFsa AnswersManan GuptaPas encore d'évaluation

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisRAKESH SINGHPas encore d'évaluation

- Stock Screener PDFDocument4 pagesStock Screener PDFchintanghadiyaliPas encore d'évaluation

- Test Bank For Investments Analysis and Management 14th Edition Charles P Jones Gerald R Jensen 2 Full DownloadDocument10 pagesTest Bank For Investments Analysis and Management 14th Edition Charles P Jones Gerald R Jensen 2 Full Downloadandrewwilsoncziqfwxgks100% (21)

- Determinants of P/E Ratio: A Study On Listed Engineering and Pharmaceutical & Chemical Companies in DSEDocument34 pagesDeterminants of P/E Ratio: A Study On Listed Engineering and Pharmaceutical & Chemical Companies in DSEMd Amit HasanPas encore d'évaluation

- Finance Interview QuestionsDocument15 pagesFinance Interview QuestionsJitendra BhandariPas encore d'évaluation

- Formule Corporate FinanceDocument6 pagesFormule Corporate FinanceБота Омарова100% (1)

- NTPC Ratio Analysis FinalDocument45 pagesNTPC Ratio Analysis FinalDaman Deep SinghPas encore d'évaluation

- Fin 201 Term Paper (Group L)Document33 pagesFin 201 Term Paper (Group L)omarsakib19984Pas encore d'évaluation

- P I Industries - A Niche Agri CSM Company - Initiating CoverageDocument11 pagesP I Industries - A Niche Agri CSM Company - Initiating CoverageshahavPas encore d'évaluation

- No. 13 EMHDocument33 pagesNo. 13 EMHayazPas encore d'évaluation

- Chapter 6 (Efficient Capital Market)Document44 pagesChapter 6 (Efficient Capital Market)Abuzafar Abdullah100% (1)

- TB Chapter03 Analysis of Financial StatementsDocument68 pagesTB Chapter03 Analysis of Financial StatementsReymark BaldoPas encore d'évaluation

- Stock Valuation DocuDocument4 pagesStock Valuation DocuCelestiaPas encore d'évaluation

- BNIS Short Notes: Poised For Stronger Growth AheadDocument5 pagesBNIS Short Notes: Poised For Stronger Growth AheadTarisya PermatasariPas encore d'évaluation

- FIN410 ProjectDocument44 pagesFIN410 ProjectMahmudul HasanPas encore d'évaluation

- KPIT Technologies 290813Document2 pagesKPIT Technologies 290813darshanmaldePas encore d'évaluation

- Practice Problems 263Document5 pagesPractice Problems 263GPas encore d'évaluation

- MA 3103 Market ApproachDocument7 pagesMA 3103 Market ApproachJacinta Fatima ChingPas encore d'évaluation

- StudentDocument79 pagesStudentSmartunblurrPas encore d'évaluation

- 310 CH 10Document46 pages310 CH 10Cherie YanPas encore d'évaluation

- Chapter 11Document4 pagesChapter 11محمد الجمريPas encore d'évaluation

- HDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Document5 pagesHDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Srini VasanPas encore d'évaluation

- Axax PDFDocument1 pageAxax PDFdevrishabhPas encore d'évaluation

- Vce Summmer Internship Program (Equity Research)Document9 pagesVce Summmer Internship Program (Equity Research)Annu KashyapPas encore d'évaluation

- Motherson Sumi Wiring India: Simplicity in Complexity Drives Supernormal ProfitsDocument22 pagesMotherson Sumi Wiring India: Simplicity in Complexity Drives Supernormal ProfitsbradburywillsPas encore d'évaluation