Académique Documents

Professionnel Documents

Culture Documents

Calculation of KSE 100 Index

Transféré par

Adnan SethiDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Calculation of KSE 100 Index

Transféré par

Adnan SethiDroits d'auteur :

Formats disponibles

KSE Index Computation

COMPUTATION METHOD

1. OBJECTIVE & DESCRIPTION

The primary objective of the KSE100 index is to have a benchmark by which

the stock price performance can be compared to over a period of time. In

particular, the KSE 100 is designed to provide investors with a sense of how

the Pakistan equity market is performing. Thus, the KSE100 is similar to other

indicators that track various sector of the Pakistan economic activity such as

the gross national product, consumer price index, etc.

2. COMPOSITION OF THE KSE100 INDEX

The KSE100 contains a representative sample of common stock that trade on

the Karachi Stock Exchange. The KSE stocks that comprise the index have a

total market value of around Rs. 1,197 Billion compared to total market value

of Rs. 1,365 Billion for over 679 stocks listed on the Karachi Stock Exchange.

This means that the KSE100 Index represents 88 percent of the total market

capitalization of the Karachi Stock Exchange, as of 27th February, 2004.

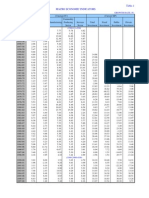

LIST OF SECTORS

1. Open-end Mutual Funds 19. Oil & Gas Marketing Companies

2. Close-end Mutual Funds 20.

Oil & Gas Exploration

Companies

3. Modarabas 21. Engineering

4. Leasing Companies 22. Automobile Assembler

5.

Investment Banks/Investment

Cos./Securities Cos.

23. Automobile Parts & Accessories

6. Commercial Banks 24. Cable & Electrical Goods

7. Insurance 25. Transport

8. Textile Spinning 26. Technology & Communication

9. Textile Weaving 27.  Fertilizer

10. Textile Composite 28. Pharmaceuticals

11. Woollen 29. Chemical

12. Synthetic & Rayon 30. Paper & Board

13. Jute 31. Vanaspati & Allied Industries

14. Sugar & Allied Industries 32. Leather & Tanneries

15. Cement 33. Food & Personal Care Products

16. Tobacco 34. Glass & Ceramics

17. Refinery 35. Miscellaneous

18. Power Generation & Distribution

3. STOCK SELECTION RULES

The selection criteria for stock inclusion in the recomposed KSE100 Index

are:

Rule # 1: Largest market capitalisation in each of the 34 Karachi Stock

Exchange sectors excluding open-end Mutual Fund Sector.

Rule # 2: The remaining index places (in this case 66) are taken up by the

largest market capitalisation companies in descending order.

A number of the 34 top sector companies may also qualify for inclusion on

the basis of their market capitalisation. In other words, companies may

qualify solely under rule 1, solely under rule 2, or under both.

The fact that the sector rule is identified as Rule 1 does not imply that it is

more important, only that the nature of the selection process is such that it

is the screening that is done first.

4. CALCULATION METHODOLOGY *

In the simplest form, the KSE100 index is a basket of price and the number

of shares outstanding. The value of the basket is regularly compared to a

starting point or a base period. In our case, the base period is 1st

November, 1991. To make the computation simple, the total market value

of the base period has been adjusted to 1000 points. Thus, the total market

value of the base period has been assigned a value of 1000 points.

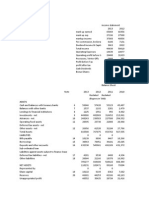

An example of how the KSE100 Index is calculated can be demonstrated

by using a three-stock sample. Table 1 illustrates the process. First, a

starting point is selected and the initial value of the three-stock index set

equal to 1000.

Taking stock A's share price of Rs. 20 and multiplying it by its total common

shares outstanding of 50 million in the base period provides a market value

of one billion Rupees. This calculation is repeated for stocks B and C with

the resulting market values of three and six billion Rupees, respectively.

The three market values are added up, or aggregated, and set equal to

1000 to form the base period value. All future market values will be

compared to base period market value in indexed form.

CALCULATING THE KSE100

Step 1: The Base Period Day 1 TABLE 1

Stock

Share Price (in Pak

Rs.)

Number of Shares (in

Rs.)

Market Value

A 20.00 50,000,000 1,000,000,000.00

B 30.00 100,000,000 3,000,000,000.00

C 40.00 150,000,000 6,000,000,000.00

Total Market Capitalisation 10,000,000,000.00

Note: Base Period Value/Base Divisor = Rs. 10,000,000,000.00 = 1000.00

Base Period Value/Base Divisor = Rs. 10,000,000,000.00 = 1000.00 * All

figures taken are only hypothetical

Step 2: Index Value as on Day 2 TABLE 2

Stock

Share Price (in Pak

Rs.)

Number of Shares (in

Rs.)

Market Value

A 22.00 50,000,000 1,100,000,000.00

B 33.00 100,000,000 3,300,000,000.00

C 44.00 150,000,000 6,600,000,000.00

Total Market Capitalisation 11,000,000,000.00

Index = (11,000,000,000.00/10,000,000,000.00)*1000= 1.10 * 1000 = 1100

Thus, the formula for calculating the KSE100 Index is :

{(Sum of Shares Outstanding * Current Price)/Base Period Value}*1000

OR

(Market Capitalization/Base Divisor) * 1000

Base Divisor

The KSE100 Index calculation at any time involves the same multiplication

of share price and shares outstanding for each of the KSE100 Index

component stocks. The aggregate market value is divided by the base

value and multiplied by 1000 to arrive at the current index number.

5. RECOMPOSITION OF THE KSE-100 INDEX

Maintenance of the index over time will require an on-going semi-annual

recomposition process, internal and external- buffer files of shares that

exceed (shares outside the index) or fall below (shares inside the index)

the above criteria will be maintained under the jurisdiction of the

recomposition committee.

Maintaining adequate representation of the under-lying stock market

through all of its future development and changes is dependent upon the

establishment of an appropriate recomposition process. Recomposition

rules fall into two general categories: Sector rules and market capitalisation

rules.

5.1 Sector Rules

Sector rules govern the selection (or deletion) of companies on the basis of

being the top capitalisation stock in each of the 34 KSE sectors. Two rules

are recommended to undertake selection in this area-one, a time based

rule and the other a value-based rule. Application can be triggered by

compliance with either rule.

5.1.1 Time-based rule:

A company (not in the index) which becomes the largest in its sector (by

any amount of value) will enter the index after maintaining its position as

largest in the sector for two consecutive recomposition periods (i.e., one

year).

5.1.2 Value-based rule:

A company (not in the index) which becomes the largest in its sector by a

minimum of 10% greater in capitalisation value than the present largest in

the sector (in the index) will enter the index after one recomposition period

(i.e., 6 months).

5.2 Capitalisation Rule Capitalisation Rule

Capitalisation rules govern the selection (or deletion) of companies on the

basis of being among the largest capitalisation companies in the stock

market. Only one rule applies here-time based rule.

5.2.1 Time-based rule:

A company (not in the index) may qualify for entry if it exceeds the market

cap value of the last stock in the index selected on the basis of market cap

for two recomposition periods (i.e. one year). A qualifying company

automatically pushes out the lowest cap selected stock in the index.

5.3 Rules for new issues:

A newly listed company or a privatized company shall qualify to be included

in the existing index (after one recomposition period) if the market

capitalisation of the new or privatized company is at least 2% of the total

market capitalization.

5.4 Recomposition Time table

The recomposition committee will meet semi-annually, with meetings

scheduled to take place at least two weeks before the end of the last

trading day of the month in which they occur. This is to allow for a minimum

announcement period of two weeks, commencing the day following the

recomposition meeting, when the results of the meeting are made public, at

the end of the last trading day of the month, when changes are

implemented into the index.

5.5 Recomposition Committee

The recomposition committee has two broad function:

1. Overseeing implementation of the index rules at the semi-

annual recomposition sessions.

2. Reviewing the index rules and altering them as necessary.

AN EXAMPLE OF THE RECOMPOSTION OF THE KSE100

The base divisor adjustment process can easily be understood by an

example mentioned below. It is important to understand that all divisor

adjustment are made after the close of trading.

DIVISOR CHANGES

KSE-100 Index as on Day 2 = 1100

Index Market Capitalization on Day 2 = 11,000,000,000.00

Divisor as on Day 2 = 10,000,000,000.00

Revised Market Capitalization due to addition and Delition of companies on

the basis of Sector Base

Rule and Market Capitalization Rule.- Say = Rs. 12,000,000,000.00

As mentioned earlier the Revised Market Capitalization are the market

capitalization of those companies which would constitute the KSE-100

Index on the next day (Day 3). The Revised Market Capitalization

calculated after the end of closing of trading session of Day 2 by using

closing prices of the same day.

The key to making this adjustment, as with any divisor adjustment, is that

the index value is temporarily 'frozen' at the close of trading, while the

divisor is adjusted for the increase or decrease in market value of the

numerator in the formula.

As the Formula for KSE-100 Index is:

Market Capitalization

Index = x 1000

Divisor

Therefore, in order to get the new divisor than formula is reframed as:

Revised Market Cap.

New Divisor = x 1000

Index (Day 2)

12,000,000,000

= x 1000

1100

= 10,909,090,909

Note: The formula for Re-composition of the KSE100 Index is same as

mentioned in Table 2, except that the treatment of Base Divisor changes

from Base Period Value to an arbitrary number, set such that there is no

break in the index series. This will be adjusted for any capital changes in

indexed stocks.

5. RECOMPOSITION OF THE KSE-100 INDEX

Maintenance of the index over time will require an on-going semi-annual

recomposition process, internal and external- buffer files of shares that

exceed (shares outside the index) or fall below (shares inside the index)

the above criteria will be maintained under the jurisdiction of the

recomposition committee.

Maintaining adequate representation of the under-lying stock market

through all of its future development and changes is dependent upon the

establishment of an appropriate recomposition process. Recomposition

rules fall into two general categories: Sector rules and market capitalisation

rules.

5.1 Sector Rules

Sector rules govern the selection (or deletion) of companies on the basis of

being the top capitalisation stock in each of the 34 KSE sectors. Two rules

are recommended to undertake selection in this area-one, a time based

rule and the other a value-based rule. Application can be triggered by

compliance with either rule.

5.1.1 Time-based rule:

A company (not in the index) which becomes the largest in its sector (by

any amount of value) will enter the index after maintaining its position as

largest in the sector for two consecutive recomposition periods (i.e., one

year).

5.1.2 Value-based rule:

A company (not in the index) which becomes the largest in its sector by a

minimum of 10% greater in capitalisation value than the present largest in

the sector (in the index) will enter the index after one recomposition period

(i.e., 6 months).

5.2 Capitalisation Rule Capitalisation Rule

Capitalisation rules govern the selection (or deletion) of companies on the

basis of being among the largest capitalisation companies in the stock

market. Only one rule applies here-time based rule.

5.2.1 Time-based rule:

A company (not in the index) may qualify for entry if it exceeds the market

cap value of the last stock in the index selected on the basis of market cap

for two recomposition periods (i.e. one year). A qualifying company

automatically pushes out the lowest cap selected stock in the index.

5.3 Rules for new issues:

A newly listed company or a privatized company shall qualify to be included

in the existing index (after one recomposition period) if the market

capitalisation of the new or privatized company is at least 2% of the total

market capitalization.

5.4 Recomposition Time table

The recomposition committee will meet semi-annually, with meetings

scheduled to take place at least two weeks before the end of the last

trading day of the month in which they occur. This is to allow for a minimum

announcement period of two weeks, commencing the day following the

recomposition meeting, when the results of the meeting are made public, at

the end of the last trading day of the month, when changes are

implemented into the index.

5.5 Recomposition Committee

The recomposition committee has two broad function:

1. Overseeing implementation of the index rules at the semi-

annual recomposition sessions.

2. Reviewing the index rules and altering them as necessary.

AN EXAMPLE OF THE RECOMPOSTION OF THE KSE100

The base divisor adjustment process can easily be understood by an

example mentioned below. It is important to understand that all divisor

adjustment are made after the close of trading.

DIVISOR CHANGES

KSE-100 Index as on Day 2 = 1100

Index Market Capitalization on Day 2 = 11,000,000,000.00

Divisor as on Day 2 = 10,000,000,000.00

Revised Market Capitalization due to addition and Delition of companies on

the basis of Sector Base

Rule and Market Capitalization Rule.- Say = Rs. 12,000,000,000.00

As mentioned earlier the Revised Market Capitalization are the market

capitalization of those companies which would constitute the KSE-100

Index on the next day (Day 3). The Revised Market Capitalization

calculated after the end of closing of trading session of Day 2 by using

closing prices of the same day.

The key to making this adjustment, as with any divisor adjustment, is that

the index value is temporarily 'frozen' at the close of trading, while the

divisor is adjusted for the increase or decrease in market value of the

numerator in the formula.

As the Formula for KSE-100 Index is:

Market Capitalization

Index = x 1000

Divisor

Therefore, in order to get the new divisor than formula is reframed as:

Revised Market Cap.

New Divisor = x 1000

Index (Day 2)

12,000,000,000

= x 1000

1100

= 10,909,090,909

Note: The formula for Re-composition of the KSE100 Index is same as

mentioned in Table 2, except that the treatment of Base Divisor changes

from Base Period Value to an arbitrary number, set such that there is no

break in the index series. This will be adjusted for any capital changes in

indexed stocks.

Vous aimerez peut-être aussi

- Free Cash FlowsDocument8 pagesFree Cash FlowsParvesh AghiPas encore d'évaluation

- Fedex AssignmentDocument20 pagesFedex AssignmentAibak Irshad100% (2)

- A Practical Guide to ETF Trading Systems: A systematic approach to trading exchange-traded fundsD'EverandA Practical Guide to ETF Trading Systems: A systematic approach to trading exchange-traded fundsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Valuations 1: Introduction To Methods of ValuationDocument17 pagesValuations 1: Introduction To Methods of ValuationNormande RyanPas encore d'évaluation

- Gebiz SUPPLY HeadsDocument14 pagesGebiz SUPPLY HeadsYam BalaoingPas encore d'évaluation

- Ali FcoDocument6 pagesAli FcoKILIMANI METALSPas encore d'évaluation

- Case Study Dot Com CrashDocument2 pagesCase Study Dot Com CrashElaineKongPas encore d'évaluation

- SK Resolution BACDocument7 pagesSK Resolution BACDeo Montero OrquejoPas encore d'évaluation

- Method Nifty 50Document16 pagesMethod Nifty 50Richard JonesPas encore d'évaluation

- RA 7916 - The Special Economic Zone Act of 1995 (IRR)Document23 pagesRA 7916 - The Special Economic Zone Act of 1995 (IRR)Jen AnchetaPas encore d'évaluation

- Contract of Employment For Call Center AgentDocument10 pagesContract of Employment For Call Center Agentbantucin davooPas encore d'évaluation

- Kse-100 Index: Investment Portfolio ManagementDocument48 pagesKse-100 Index: Investment Portfolio Managementchemeleo zapsPas encore d'évaluation

- Noroz Khan 54171 Date: 09-11-2010Document14 pagesNoroz Khan 54171 Date: 09-11-2010noroz_nkPas encore d'évaluation

- Kse 100 IndexDocument49 pagesKse 100 IndexayazPas encore d'évaluation

- Recomposition of The Kse-100 IndexDocument5 pagesRecomposition of The Kse-100 IndexAbdul HafeezPas encore d'évaluation

- Assignment INVESTMENTDocument3 pagesAssignment INVESTMENTfariaPas encore d'évaluation

- Lec 5.1Document4 pagesLec 5.1sqshah080Pas encore d'évaluation

- Karachi Stock Exchange: AssignmentDocument13 pagesKarachi Stock Exchange: AssignmentAbeera IslamPas encore d'évaluation

- Calculation Methof of KSE-100 IndexDocument23 pagesCalculation Methof of KSE-100 Indexamina_rabia100% (2)

- KSE100 - Market Capitalization Calculation MethodDocument24 pagesKSE100 - Market Capitalization Calculation MethodsuhailkiyaniPas encore d'évaluation

- KSE 100 INDEX Presentation by Azam KhalidDocument17 pagesKSE 100 INDEX Presentation by Azam Khalidms.AhmedPas encore d'évaluation

- Index Number Formation in The Chittagong Stock ExchangeDocument12 pagesIndex Number Formation in The Chittagong Stock ExchangeSakibSourovPas encore d'évaluation

- Stock MarketDocument12 pagesStock MarketMuhammad Saleem SattarPas encore d'évaluation

- Index Methodology LibreDocument9 pagesIndex Methodology Librem.naveed.ashraf.k8400Pas encore d'évaluation

- Strategy Paper: Enhancing Kse-100 Index To Free Float MethodologyDocument24 pagesStrategy Paper: Enhancing Kse-100 Index To Free Float MethodologysakiaslamPas encore d'évaluation

- Kse - 30 Index Based On Free-Float: The Karachi Stock Exchange (Guarantee) LimitedDocument21 pagesKse - 30 Index Based On Free-Float: The Karachi Stock Exchange (Guarantee) LimitedJan Muhammad MemonPas encore d'évaluation

- KSE - 30 IndexDocument21 pagesKSE - 30 IndexNadeem uz Zaman100% (1)

- SENSEX - The Barometer of Indian Capital Markets: Index SpecificationDocument25 pagesSENSEX - The Barometer of Indian Capital Markets: Index SpecificationsathwickbPas encore d'évaluation

- PSX Indices AssDocument7 pagesPSX Indices AssFlourish edible CrockeryPas encore d'évaluation

- BrochureBK TI IdxDocument22 pagesBrochureBK TI IdxShakeel IqbalPas encore d'évaluation

- JS Mometum Factor Index: PakistanDocument8 pagesJS Mometum Factor Index: PakistanHadia SarwarPas encore d'évaluation

- Chapter 6Document5 pagesChapter 6kamma1Pas encore d'évaluation

- Name: Syed Abdul Haseeb Course: Introduction To Financial Market ID# 13853 Semester: 07Document3 pagesName: Syed Abdul Haseeb Course: Introduction To Financial Market ID# 13853 Semester: 07SYED ABDUL HASEEB SYED MUZZAMIL NAJEEB 13853Pas encore d'évaluation

- Stock Market IndicesDocument2 pagesStock Market IndicesbijubodheswarPas encore d'évaluation

- Indian Stock Exchanges and How Their Indices Are CalculatedDocument30 pagesIndian Stock Exchanges and How Their Indices Are CalculatedKirron ThakurPas encore d'évaluation

- Sen SexDocument4 pagesSen Sexvaibs14Pas encore d'évaluation

- Online Trading On Bse and NseDocument58 pagesOnline Trading On Bse and NseShaikh JahirPas encore d'évaluation

- Indian TreasuryDocument16 pagesIndian TreasuryPrakhar GuptaPas encore d'évaluation

- StockindexDocument37 pagesStockindexrock_on_rupz99Pas encore d'évaluation

- 02 Micronotes 070907Document21 pages02 Micronotes 070907Arash MojahedPas encore d'évaluation

- Policies and Programmes: Streamlining of The Disclosure and Investor Protection GuidelinesDocument8 pagesPolicies and Programmes: Streamlining of The Disclosure and Investor Protection GuidelinesSubramanyam MutyalaPas encore d'évaluation

- Policies and ProgrammesDocument59 pagesPolicies and ProgrammesrakeshPas encore d'évaluation

- Index Derivatives: H.R.College of Commerce and Economics T.Y.B.F.MDocument23 pagesIndex Derivatives: H.R.College of Commerce and Economics T.Y.B.F.Madi809herePas encore d'évaluation

- INDICES of Mauritius Stock Exchange IndexesDocument10 pagesINDICES of Mauritius Stock Exchange IndexesAli ShahPas encore d'évaluation

- Markit Itraxx TotaReturn RulesDocument9 pagesMarkit Itraxx TotaReturn Rulesyxz043000857Pas encore d'évaluation

- Question Bank EEFA 2 MarksDocument9 pagesQuestion Bank EEFA 2 MarksSathish KrishnaPas encore d'évaluation

- CAPMDocument5 pagesCAPMpraveenbtech430Pas encore d'évaluation

- IM HsieDocument15 pagesIM HsieJuan Manuel FigueroaPas encore d'évaluation

- SEBI Circular SM-DRP-POLICY-CIR-042000Document7 pagesSEBI Circular SM-DRP-POLICY-CIR-042000Sanjeev Kumar ChoudharyPas encore d'évaluation

- Pakistan Stock Exchange Limited: Fee ScheduleDocument2 pagesPakistan Stock Exchange Limited: Fee ScheduleAwais kukooPas encore d'évaluation

- Kse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedDocument21 pagesKse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedAbdullah AbdullahPas encore d'évaluation

- Kse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedDocument21 pagesKse - 30 Index Based On Free-Float: Pakistan Stock Exchange LimitedAbdullah AbdullahPas encore d'évaluation

- Indian Stock Exchanges and How Their Indices Are CalculatedDocument30 pagesIndian Stock Exchanges and How Their Indices Are CalculatedAapnijche FakeidPas encore d'évaluation

- CCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomeDocument26 pagesCCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomegopalkpsahuPas encore d'évaluation

- Fair Value MeasurementDocument6 pagesFair Value MeasurementElaine LimPas encore d'évaluation

- Analysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadaviDocument24 pagesAnalysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadavimndeepikaPas encore d'évaluation

- Kosdaq 150 Methodology Guide: November 2020Document13 pagesKosdaq 150 Methodology Guide: November 2020Edwin ChanPas encore d'évaluation

- SENSEX - The Barometer of Indian Capital MarketsDocument7 pagesSENSEX - The Barometer of Indian Capital MarketsSachin KingPas encore d'évaluation

- Bond Index MethodologyDocument7 pagesBond Index MethodologyRRSPas encore d'évaluation

- Nifty, Sensex A Long Way From Truly Representing The EconomyDocument22 pagesNifty, Sensex A Long Way From Truly Representing The Economyharsh_monsPas encore d'évaluation

- KSE-30 Index Updated VersionDocument20 pagesKSE-30 Index Updated VersionHamza AbidPas encore d'évaluation

- SENSEX - The Barometer of Indian Capital MarketsDocument7 pagesSENSEX - The Barometer of Indian Capital MarketsSandeep S SalviPas encore d'évaluation

- Master Circular - Equity - 2022Document14 pagesMaster Circular - Equity - 2022Pramanshu RajputPas encore d'évaluation

- CRUDE OIL Hedge-StrategyDocument4 pagesCRUDE OIL Hedge-StrategyNeelesh KamathPas encore d'évaluation

- Trading Tactics in the Financial Market: Mathematical Methods to Improve PerformanceD'EverandTrading Tactics in the Financial Market: Mathematical Methods to Improve PerformancePas encore d'évaluation

- Stock Market Income Genesis: Internet Business Genesis Series, #8D'EverandStock Market Income Genesis: Internet Business Genesis Series, #8Pas encore d'évaluation

- Capital Budgeting AssignmentDocument6 pagesCapital Budgeting AssignmentAdnan SethiPas encore d'évaluation

- Section 1: Demographic InformationDocument2 pagesSection 1: Demographic InformationAdnan SethiPas encore d'évaluation

- Logic Bs-IIIDocument139 pagesLogic Bs-IIIAdnan Sethi0% (1)

- Section 1: Demographic InformationDocument2 pagesSection 1: Demographic InformationAdnan SethiPas encore d'évaluation

- MCB AnalysisDocument7 pagesMCB AnalysisAdnan SethiPas encore d'évaluation

- ARDLDocument10 pagesARDLAdnan SethiPas encore d'évaluation

- Guru AssignmentDocument3 pagesGuru AssignmentAdnan SethiPas encore d'évaluation

- PaperDocument4 pagesPaperAdnan SethiPas encore d'évaluation

- My Internship Report 13Document73 pagesMy Internship Report 13Adnan SethiPas encore d'évaluation

- B.F PaperDocument3 pagesB.F PaperAdnan SethiPas encore d'évaluation

- Rough Justification For PaperDocument2 pagesRough Justification For PaperAdnan SethiPas encore d'évaluation

- Book 1Document8 pagesBook 1Adnan SethiPas encore d'évaluation

- Guru AssignmentDocument3 pagesGuru AssignmentAdnan SethiPas encore d'évaluation

- Not All Contract Breach Are The Same The Interconnection of Social Exchange and Psychological Contract Processes in OrganizationsDocument1 pageNot All Contract Breach Are The Same The Interconnection of Social Exchange and Psychological Contract Processes in OrganizationsAdnan SethiPas encore d'évaluation

- L21 TheDot ComBubbleDocument17 pagesL21 TheDot ComBubbleAdnan SethiPas encore d'évaluation

- Cash Flow StatementDocument10 pagesCash Flow StatementAdnan SethiPas encore d'évaluation

- Cost Management and Strategy - An Overview: QuestionsDocument29 pagesCost Management and Strategy - An Overview: QuestionsAdnan SethiPas encore d'évaluation

- 7.1 KSE 100 & General Index of All Shares: Sector NameDocument5 pages7.1 KSE 100 & General Index of All Shares: Sector NameZahid RehmanPas encore d'évaluation

- GDP GrowthDocument1 pageGDP GrowthAdnan SethiPas encore d'évaluation

- EconomicsDocument7 pagesEconomicsAdnan SethiPas encore d'évaluation

- EconomicsDocument7 pagesEconomicsAdnan SethiPas encore d'évaluation

- 1 Page EssayDocument1 page1 Page EssayAdnan SethiPas encore d'évaluation

- The Impact of Personality On Psychological ContractsDocument1 pageThe Impact of Personality On Psychological ContractsAdnan SethiPas encore d'évaluation

- Managment ArticlesDocument1 pageManagment ArticlesAdnan SethiPas encore d'évaluation

- Pioneer Cement FinalDocument48 pagesPioneer Cement FinalAdnan SethiPas encore d'évaluation

- Internship Report On Nishat MillsDocument45 pagesInternship Report On Nishat MillsSana KhanPas encore d'évaluation

- Process Costing Study GuideDocument14 pagesProcess Costing Study GuideTekaling NegashPas encore d'évaluation

- Engleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFDocument384 pagesEngleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFHarini SreedharanPas encore d'évaluation

- Section3 2Document80 pagesSection3 2aPas encore d'évaluation

- Kranthi Kiran VDocument1 pageKranthi Kiran VAbhinav JaganaPas encore d'évaluation

- Case StudiesDocument23 pagesCase StudiesShashank Varma0% (1)

- 100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryDocument6 pages100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryKristina Phillpotts-BrownPas encore d'évaluation

- JFC Annual Report 2017 PDFDocument118 pagesJFC Annual Report 2017 PDFNoel Cainglet100% (1)

- CSRDocument4 pagesCSRRISHAV CHOPRAPas encore d'évaluation

- Strengths WeaknessesDocument6 pagesStrengths WeaknessesSamrin HassanPas encore d'évaluation

- RBL Mitc FinalDocument16 pagesRBL Mitc FinalVivekPas encore d'évaluation

- Kumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeDocument3 pagesKumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeVanessa HernandezPas encore d'évaluation

- Customer Satisfaction Towards PAYtm ServicesDocument52 pagesCustomer Satisfaction Towards PAYtm ServicesTasmay EnterprisesPas encore d'évaluation

- Solutions GuideDocument10 pagesSolutions Guidepalak32Pas encore d'évaluation

- Final ResearchDocument60 pagesFinal ResearchLoduvico LopezPas encore d'évaluation

- CH 10 GREE Case StudyDocument15 pagesCH 10 GREE Case StudyPriyanka PiaPas encore d'évaluation

- Advance Financial Management - Stocks Valuation Self Test ProblemDocument2 pagesAdvance Financial Management - Stocks Valuation Self Test ProblemWaqar AhmadPas encore d'évaluation

- Simple Business Plan (Principle of Management)Document11 pagesSimple Business Plan (Principle of Management)ahyong81Pas encore d'évaluation

- Mechanics and Functionality in E-CommerceDocument9 pagesMechanics and Functionality in E-CommerceBBlUshUPas encore d'évaluation

- Development of The Clarence T.C. Ching Athletic ComplexDocument18 pagesDevelopment of The Clarence T.C. Ching Athletic ComplexHonolulu Star-AdvertiserPas encore d'évaluation

- f5 PDFDocument12 pagesf5 PDFSteffiPas encore d'évaluation

- Chapter 6 OrganizingDocument36 pagesChapter 6 OrganizingMohammed HussienPas encore d'évaluation

- Joint Stock CompanyDocument3 pagesJoint Stock CompanyBhoomi ShekharPas encore d'évaluation