Académique Documents

Professionnel Documents

Culture Documents

Order in The Matter of Amrit Projects (N. E.) Limited

Transféré par

Shyam SunderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Order in The Matter of Amrit Projects (N. E.) Limited

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

Page 1 of 13

WTM/SR/GLO/58/08/2014

BEFORE THE SECURITIES AND EXCHANGE BOARD OF INDIA, MUMBAI

CORAM: S. RAMAN, WHOLE TIME MEMBER

ORDER

U!"# S"$%&'( 11, 11)4*, 11A +! 11B ', %-" S"$.#&%&"( +! E/$-+0" B'+#! ', I!&+ A$%,

1112, & %-" 2+%%"# ', A2#&% 3#'4"$%( )N. E.* L&2&%"! +! &%( D&#"$%'#(, 5&6. S-#& 7+&8+(-

C-+! D.4+#& )DIN: 00928:42*, S-#& S+(+;+ R'< S+#;+# )DIN: 03345094*, S-#& B+#.

7.2+# D" )DIN: 05115240*, S-#& R+4+ 7.2+# C-'=!-.#< )DIN: 095112:5*, S-#& 7+8&

7&(-'#" B+0$-& )DIN: 009018:1*, S-#& N&(-+% 3#+;+(- )DIN: 00910:1:*, S-#& D">!+(

C-+%%"#4"" )DIN: 05112408*, S-#& S<"! 7+6&2 R+6+ )DIN: 051:2:20*, S-#& ?+2&8 A-2"!

F+#''@.& )DIN: 051:2:08* +! S-#& M+-+22+! A6+2 7-+ )DIN: 0144109:*.

1. Securities and Exchange Board of India ("SEBI") received a complaint on January !"

#!1$" from an investor alleging mo%ili&ation of funds %y 'mrit (ro)ects (*. E.) +imited

("A3NEL").

#.1 ,hereafter" SEBI vide letter dated -e%ruary 1#" #!1$" advised '(*E+ to furnish the

follo.ing information .ithin 1/ days from the date of receipt of the aforesaid letter" vi&.

0

i. 1opy of the 2emorandum and 'rticles of 'ssociation of the company3

ii. 1opy of 'udited 'nnual 'ccounts of the company for the last years3

iii. 1opies of 'nnual 4eturns filed %y the company for the last years3

iv. 1opies of 1ompliance 1ertificate filed %y the company for the last years3

v. *ame" addresses and occupation of all the promoters5directors of the company3

vi. *ames and details of the 6ey 2anagerial (ersonnel of the company3

vii. 7ther information in respect of every series of redeema%le preference shares

("R3S") issued %y the company" vi&. 0

a. 1opy of (rospectus54ed 8erring (rospectus5Statement in lieu of

(rospectus5Information 2emorandum filed .ith 4egistrar of 1ompanies

("ROC")3

%. 1onfirmation of having made an 'pplication for listing3

c. 1opy of -orm # filed .ith 4713

d. 9ate of opening and closing of the su%scription list3

Brought to you by http://StockViz.biz

Page 2 of 13

e. 9etails regarding the num%er of application forms circulated inviting

su%scription3

f. 9etails regarding the num%er of applications received3

g. 9etails regarding the num%er of allottees and list of such allottees" etc.3

h. *um%er of RPS allotted and value of such allotment against each allottee:s

name.

i. 9etails regarding su%scription amount raised3

). 9ate of allotment of RPS3

;. 1opies of the minutes of Board51ommittee meeting in .hich the resolution has

%een passed for allotment3

l. 9ate of dispatch of RPS 1ertificates3

m. 9etails of the total num%er of applicants for each of '(*E+:s scheme %esides

the list of final allottee3

n. 1opies of application forms" pamphlets" advertisements and other promotional

material circulated for issuance of RPS3

o. ,erms and conditions of the issue of RPS.

#.# '(*E+ replied to the a%ovementioned letter vide its letter dated -e%ruary #/" #!1$"

.herein .hile providing copy of the 2emorandum and 'rticles of 'ssociation" 'udited

'nnual 'ccounts for the last years" *ame5addresses of all its 9irectors" it inter alia

stated<

a. "We like to mention over here that the Company is not engaged in any Non Banking Finanial

ativity in any !ay. "he Company has never offered its shares to the p#$li for s#$sription vide any

sort of Prospet#s or Red %erring Prospet#s and !hatever money has $een raised are stritly on

private plaement $asis to meet the demand of long term apital investment of the ompany.

$. "he offer to iss#e preferene shares !as made to parti#lar addresses and !as made to parti#lar

addressees and !as meant to $e aepted only $y the said addressees. "h#s& there !ere as many

n#m$er of appliations reeived as there !ere n#m$er of allottees.

. 't is h#m$ly s#$mitted that the offer of preferene shares !ere the domesti onern of the Company

and !as meant only for those people to !hom it !as intended. 'n other !ords& it !as made to a

parti#lar addressee and !as meant to $e aepted only $y the said addressee. "h#s& the offer !as a

private offer !ithin the meaning of Setion ()*+) of the *Companies) ,t. 't is h#m$ly s#$mitted

that the shares of the Company !ere offered and allotments !ere made on private plaement $asis in

Brought to you by http://StockViz.biz

Page 3 of 13

d#e ompliane !ith the provisions of the Companies ,t& -./( and the provisions as ontained in

Setion )+ of the *Companies) ,t& !as not applia$le to the Company."

#. ,hereafter" SEBI" vide letter dated 2ay !" #!1$" once again sought the information

(sought vide its letter dated -e%ruary 1#" #!1$) from '(*E+. In this regard" '(*E+

replied vide letter dated June !" #!1$" .herein it provided details regarding the RPS

issued %y it.

. ,he material availa%le on record i.e. correspondences exchanged %et.een SEBI and

'(*E+ along.ith the documents contained therein3 information o%tained from the

2inistry of 1orporate 'ffairs: .e%site i.e. 01C, 2- Portal0 along.ith information

for.arded %y the 471" Shillong& have %een perused. 7n an examination of the same" it

is o%served that 0

i. '(*E+ .as incorporated on July !=" #!!=" .ith 1I* *o. as

>$!1!1'S#!!=(+1!!?$#@. '(*E+:s 4egistered 7ffice is at /?" Shima (la&a" #nd

-loor" >lu%ari 1hariali" A. S. 4oad" Au.ahati" 'ssam0=?1!!=" India.

ii. ,he 9irectors in '(*E+ are Shri 6ailash 1hand 9u)ari" Shri Sasan;a 4oy Sar;ar"

Shri Barun 6umar 9e and Shri 4an)an 6umar 1ho.dhury. Shri 6ali 6ishore

Bagchi" Shri *ishant (ra;ash" Shri 9e%das 1hatter)ee" Shri Syed 6a&im 4a&a" Shri

Jamil 'hmed -arooBui and Shri 2ahammad '&am 6han" .ho .ere earlier

9irectors in '(*E+" have since resigned.

iii. '(*E+ issued "Redeema$le Preferene Shares" ("O,,"# ', R3S") in accordance .ith

inter alia the follo.ing terms and conditions 0

a. ",llotment of Redeema$le Preferene Shares !ill $e made !ithin +3 days from the date of

reeipt of appliation. "he 4etter of ,llotment5Redeema$le Preferene Share Certifiate*s) !ill

$e delivered to the First5Sole ,ppliation at the address given.

$. "he 6ffer is $eing made on a private plaement $asis and annot $e aepted $y any person other

than to !hom it has $een offered. F#rther& this 6ffer annot $e transferred or reno#ned in

anyone0s favo#r.

c. "his appliation is not an offer to the p#$li in general to s#$sri$e and this do#ment is m#st

for private ir#lation only for iss#e of instr#ments on private plaement $asis.

Brought to you by http://StockViz.biz

Page 4 of 13

d. "he payment of mat#rity amo#nt and all the ret#rns as mentioned in the do#ments are tentative

in nat#re."

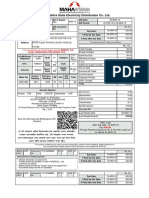

iv. ,he details of plan launched %y '(*E+ in respect of the 6ffer of RPS are as under 0

3LAN H2 A2 B2 D2 E2 G2

I((." 3#&$" A"# (-+#"

)*

1!! 1!! 1!! 1!! 1!! 1!!

R"!"2A%&' 3"#&'! 1 Cear Cears / Cears

D 2onths

= Cears 1! Cears 1/ Cears

R"!"2A%&' B+8." 1!@ 1$! #!! !! /!! 1!!!

S$-"2" M33S

)R"!""2 ' M'%-8< B+(&(*

C33S

)R"!""2 ' C.+#%"#8< B+(&(*

38+ O1 S1 T1 R1 U1 B1

I((." 3#&$" 3"# S-+#" 1!!! 1!!! 1!!! 1!!! 1!!! 1!!!

R"!"2A%&' 3"#&'! / Cears =

Cears

1! Cears / Cears = Cears 1! Cears

R"!"2A%&'

)M'%-/C.+#%"#*

@./! 1!.!! 1!.=/ #@.=/ 1./! $./!

M&&2.2 D"A'(&% $!!!! $!!!! $!!!! #/!!! #/!!! #/!!!

F&+8 R"!"2A%&'

A2'.% )=&%-

A!!&%&'+8 R"!"2A%&'

3#"2&.2*

11!! 11#! 11/! 11!! 11#! 11/!

v. It is o%served from the information su%mitted %y '(*E+ that it passed the

follo.ing resolutions at its Extra 7rdinary Aeneral 2eetings" for issuance of RPS.

D+%" ',

R"('8.%&'

T<A" ', M""%&0 N'. ', R3S %'

>" &((."!

F+$"

B+8." ',

S-+#" )*

A2'.%

) & C#'#"(*

!#E!$E#!!@

Extra 7rdinary Aeneral

2eeting

1D"!!! 1!!! 1.D

!/E!$E#!1! 1#"!!! 1!!! 1.#

!$E!$E#!11 #1"!!! 1!!! #.1

!=E!$E#!1# Extra 7rdinary Aeneral

2eeting

#"!!! 1!!! #.

"$!"!!! 1!! .$

Brought to you by http://StockViz.biz

Page 5 of 13

vi. '(*E+ issued RPS to a large num%er of investors during the -inancial Cears #!!@0

1!" #!1!011" #!1101# and #!1#01" details of .hich are provided %elo. 0

$.1 In the context of the a%ovementioned details of the 6ffer of RPS" the issue for

determination in the instant matter is .hether the mo%ili&ation of funds %y '(*E+

through the aforesaid" is in accordance .ith the provisions of the SEBI 'ct" 1@@#

("SEBI A$%")3 the 1ompanies 'ct" 1@/D read .ith the 1ompanies 'ct" #!1.

$.# I note that the )urisdiction of SEBI over various provisions of the 1ompanies 'ct in the

case of pu%lic companies" .hether listed or unlisted" .hen they issue and transfer

securities" flo.s from the provisions of Section //' of the 1ompanies 'ct. Fhile

examining the scope of Section //' of the 1ompanies 'ct" 1@/D" the 8on:%le Supreme

1ourt of India in S+-+#+ I!&+ R"+8 E(%+%" C'#A'#+%&' L&2&%"! D O#(. 5(. SEBI

)C&5&8 AAA"+8 '. 1813 ', 2011* )?.!02"% !+%"! A.0.(% 31, 2012* (hereinafter

referred to as the "S+-+#+ C+("")& had o%served that<

"We& therefore& hold that& so far as the provisions en#merated in the opening portion of Setion //, of

E"+# T<A" ',

S"$.#&%<

D+%" ', A88'%2"% N'. ',

S"$.#&%&"(

N'. ',

A88'%%""(

T'%+8 A2'.%

)*

#!!@ 0 1!

4edeema%le

(reference

Shares

1.!.#!1!

1/$?

1?/

1/$?!!!

#!1! 0 11

1.!.#!11

11?D#

1$@

11?D#!!!

#!11 0 1#

1.!.#!1#

#!@D?

##@

#!@D?!!!

#!1# 0 1

1.!.#!1

##!!!

1!!!

##!!!!!!

1.!.#!1

/$1!

$=!

/$1!!!

T'%+8

5033

103854000

Brought to you by http://StockViz.biz

Page 9 of 13

the Companies ,t& so far as they relate to iss#e and transfer of se#rities and non7payment of dividend is

onerned& S8B' has the po!er to administer in the ase of listed p#$li ompanies and in the ase of

those p#$li ompanies !hih intend to get their se#rities listed on a reogni9ed stok e:hange in 'ndia."

$. In this regard 0

i. 4eference is also made to Sections D=(1) and D=() of the 1ompanies 'ct" 1@/D"

.hich are reproduced as under<

"(). *-) ,ny referene in this ,t or in the artiles of a ompany to offering shares or de$ent#res to

the p#$li shall& s#$;et to any provision to the ontrary ontained in this ,t and s#$;et also to the

provisions of s#$7setions *+) and *<)& $e onstr#ed as inl#ding a referene to offering them to any

setion of the p#$li& !hether seleted as mem$ers or de$ent#re holders of the ompany onerned or

as lients of the person iss#ing the prospet#s or in any other manner.

*2) ...

*+) No offer or invitation shall $e treated as made to the p#$li $y virt#e of s#$7 setion *-) or s#$7

setion *2)& as the ase may $e& if the offer or invitation an properly $e regarded& in all the

ir#mstanes7

*a) as not $eing al#lated to res#lt& diretly or indiretly& in the shares or de$ent#res $eoming

availa$le for s#$sription or p#rhase $y persons other than those reeiving the offer or invitation= or

*$) other!ise as $eing a domesti onern of the persons making and reeiving the offer or invitation

>

3#'5&!"! that nothing ontained in this s#$7setion shall apply in a ase !here the offer or

invitation to s#$sri$e for shares or de$ent#res is made to fifty persons or more?

3#'5&!"! ,.#%-"# that nothing ontained in the first proviso shall apply to non7$anking finanial

ompanies or p#$li finanial instit#tions speified in setion <, of the Companies ,t& -./( *- of

-./().@

ii. Fhile examining the scope of Section D= of the 1ompanies 'ct" 1@/D" the 8on:%le

Supreme 1ourt of India in the Sahara Case o%served that<

"Setion ()*-) deals !ith the offer of shares and de$ent#res to the p#$li and Setion ()*2) deals

!ith invitation to the p#$li to s#$sri$e for shares and de$ent#res and ho! those e:pressions are to

$e #nderstood& !hen referene is made to the ,t or in the artiles of a ompany. "he emphasis in

Setion ()*-) and *2) is on the Asetion of the p#$li@. Setion ()*+) states that no offer or

Brought to you by http://StockViz.biz

Page : of 13

invitation shall $e treated as made to the p#$li& $y virt#e of s#$setions *-) and *2)& that is to any

setion of the p#$li& if the offer or invitation is not $eing al#lated to res#lt& diretly or indiretly& in

the shares or de$ent#res $eoming availa$le for s#$sription or p#rhase $y persons other than those

reeiving the offer or invitation or other!ise as $eing a domesti onern of the persons making and

reeiving the offer or invitations. Setion ()*+) is& therefore& an e:eption to Setions ()*-) and *2).

'f the ir#mstanes mentioned in la#ses *-) and *$) of Setion ()*+) are satisfied& then the

offer5invitation !o#ld not $e treated as $eing made to the p#$li.

"he first proviso to Setion ()*+) !as inserted $y the Companies *,mendment) ,t& 2333 !.e.f.

-+.-2.2333& !hih learly indiates& nothing ontained in S#$7setion *+) of Setion () shall apply

in a ase !here the offer or invitation to s#$sri$e for shares or de$ent#res is made to fifty persons or

more. >

Res#ltantly& if an offer of se#rities is made to fifty or more persons& it !o#ld $e deemed to $e a

p#$li iss#e& even if it is of domesti onern or proved that the shares or de$ent#res are not availa$le

for s#$sription or p#rhase $y persons other than those reeived the offer or invitation. >

' may& therefore& indiate& s#$;et to !hat has $een stated a$ove& in 'ndia that any share or

de$ent#re iss#e $eyond forty nine persons& !o#ld $e a p#$li iss#e attrating all the relevant

provisions of the S8B' ,t& reg#lations framed there#nder& the Companies ,t& pertaining to the

p#$li iss#e. >"

iii. In the instant matter" for ascertaining .hether the 6ffer of RPS is a pu%lic issue or an

issue on private placement %asis in accordance .ith Section D= of the 1ompanies

'ct" 1@/D" the num%er of su%scri%ers is of utmost importance.

a. In its replies to SEBI" '(*E+ has contended that the 6ffer of RPS is %eing

made on a private placement %asis and is therefore" a private offer .ithin the

meaning of Section D=() of the 1ompanies 'ct" 1@/D. I find it difficult to

accept the aforesaid contention since under the 6ffer of RPS& '(*E+ allotted

RPS to a total of /! individuals5investors and mo%ili&ed funds amounting to

approximately 1!.? 1rores during the -inancial Cears #!!@01!" #!1!011"

#!1101# and #!1#01. ,hese facts prima faie indicate that the num%er of

persons to .hom the 6ffer of RPS .as made" .as a%ove the limit of forty0nine

persons as prescri%ed under Section D=() of the 1ompanies 'ct" 1@/D i.e.

several times over the threshold for a private placement.

Brought to you by http://StockViz.biz

Page 8 of 13

%. -urther" '(*E+ is not stated to %e a nonE%an;ing financial company or a

pu%lic financial institution .ithin the meaning of Section $' of the 1ompanies

'ct" 1@/D and therefore" is not covered under the seond proviso to Section D=()

of the 1ompanies 'ct" 1@/D.

c. In vie. of the a%ove" the 6ffer of RPS %y '(*E+ .ould prima faie Bualify as a

pu%lic issue under the first proviso to Section D=() of the 1ompanies 'ct"

1@/D. In this regard" it is pertinent to note that %y virtue of Section //' of the

1ompanies 'ct" Section D= of that 'ct" so far as it relates to issue and transfer

of securities" shall also %e administered %y SEBI.

$.$ I note that 0

i. -rom the a%ovementioned" it .ill follo. that since the 6ffer of RPS is a pu%lic issue

of securities" such securities shall also have to %e listed on a recogni&ed stoc;

exchange" as mandated under Section = of the 1ompanies 'ct" 1@/D. In this regard"

reference is made to Sections = of the 1ompanies 'ct" 1@/D" of .hich su%ESections

(1)" (#) and () are relevant for the instant case" .hich is reproduced as under<

")+. *-) 8very ompany intending to offer shares or de$ent#res to the p#$li for s#$sription $y the

iss#e of a prospet#s shall& $efore s#h iss#e& make an appliation to one or more reognised stok

e:hanges for permission for the shares or de$ent#res intending to $e so offered to $e dealt !ith in the

stok e:hange or eah s#h stok e:hange.

*-,) >

*2) Where the permission has not $een applied #nder s#$setion *-) or s#h permission having $een

applied for& has not $een granted as aforesaid& the ompany shall forth!ith repay !itho#t interest all

moneys reeived from appliants in p#rs#ane of the prospet#s& and& if any s#h money is not repaid

!ithin eight days after the ompany $eomes lia$le to repay it& the ompany and every diretor of the

ompany !ho is an offier in defa#lt shall& on and from the e:piry of the eighth day& $e ;ointly and

severally lia$le to repay that money !ith interest at s#h rate& not less than fo#r per ent and not

more than fifteen per ent& as may $e presri$ed& having regard to the length of the period of delay in

making the repayment of s#h money.

*+) ,ll moneys reeived as aforesaid shall $e kept in a separate $ank ao#nt maintained !ith a

Shed#led Bank - B#ntil the permission has $een granted& or !here an appeal has $een preferred

against the ref#sal to grant s#h. permission& #ntil the disposal of the appeal& and the money

Brought to you by http://StockViz.biz

Page 1 of 13

standing in s#h separate ao#nt shall& !here the permission has not $een applied for as aforesaid

or has not $een granted& $e repaid !ithin the time and in the manner speified in s#$7 setion *2)C=

and if defa#lt is made in omplying !ith this s#$7 setion& the ompany& and every offier of the

ompany !ho is in defa#lt& shall $e p#nisha$le !ith fine !hih may e:tend to five tho#sand r#pees.@

ii. In the Sahara Case" the 8on:%le Supreme 1ourt of India also examined Section = of

the 1ompanies 'ct" 1@/D" .herein it o%served that 0

"Setion )+*-) of the ,t asts an o$ligation on every ompany intending to offer shares or

de$ent#res to the p#$li to apply on a stok e:hange for listing of its se#rities. S#h ompanies

have no option or hoie $#t to list their se#rities on a reogni9ed stok e:hange& one they invite

s#$sription from over forty nine investors from the p#$li. 'f an #nlisted ompany e:presses its

intention& $y ond#t or other!ise& to offer its se#rities to the p#$li $y the iss#e of a prospet#s& the

legal o$ligation to make an appliation on a reogni9ed stok e:hange for listing starts. S#$7setion

*-,) of Setion )+ gives indiation of !hat are the parti#lars to $e stated in s#h a prospet#s.

"he onseD#enes of not applying for the permission #nder s#$7setion *-) of Setion )+ or not

granting of permission is learly stip#lated in s#$7setion *+) of Setion )+. 6$ligation to ref#nd the

amo#nt olleted from the p#$li !ith interest is also mandatory as per Setion )+*2) of the ,t.

4isting is& therefore& a legal responsi$ility of the ompany !hih offers se#rities to the p#$li&

provided offers are made to more than /3 persons."

iii. In the facts of the instant case" since the 6ffer of RPS .as made to fifty persons or

more %y '(*E+" the same .ill attract the reBuirement of compulsory listing %efore

a recogni&ed stoc; exchange in terms of Section =(1) of the 1ompanies 'ct" 1@/D.

It therefore prima faie appears that '(*E+ has violated the provisions of Section

=(1) of the 1ompanies 'ct" 1@/D" since it has failed to ensure listing .ith a

recognised stoc; exchange of the securities issued under the 6ffer of RPS.

iv. 's per Section =(#) of the 1ompanies 'ct" 1@/D" the o%ligation to refund the

amount .ith interest that .as collected from investors under the 6ffer of RPS is

mandatory on '(*E+. In this regard" there is no evidence on record to indicate

.hether or not '(*E+ has paid interest to the investors .here such RPS are not

allotted .ithin ? days under the 6ffer of RPS& as per the aforesaid Section. In vie. of

the same" I find that '(*E+ has prima faie not complied .ith the provisions of

Section =(#) of the 1ompanies 'ct" 1@/D.

Brought to you by http://StockViz.biz

Page 10 of 13

v. Section =() of 1ompanies 'ct" 1@/D" says that all moneys received shall %e ;ept in

a separate %an; account maintained .ith a Scheduled Ban; and if default is made in

complying .ith this su%ESection" the company" and every officer of the company

.ho is in default" shall %e punisha%le .ith fine .hich may extend to five thousand

rupees. In the instant case" there is no evidence on record to indicate .hether or not

funds received from the investors under the 6ffer of RPS has %een ;ept in separate

%an; account %y '(*E+. In vie. of the same" I find that '(*E+ has prima faie not

complied .ith the provisions of Section =() of 1ompanies 'ct" 1@/D.

$./ >nder Section #(D) read .ith Section D! of the 1ompanies 'ct" 1@/D" a company needs

to register its prospectus .ith the 471" %efore ma;ing a pu%lic offer or issuing the

prospectus. 's per the aforesaid Section #(D)" Aprospet#s@ means any document

descri%ed or issued as a prospectus and includes any notice" circular" advertisement or

other document inviting deposits from the pu%lic or inviting offers from the pu%lic for

the su%scription or purchase of any shares in" or de%entures of" a %ody corporate. 's

mentioned a%ove" since the 6ffer of RPS .as made to fifty persons or more" it has to %e

construed as a pu%lic offer. 8aving made a pu%lic offer" '(*E+ .as reBuired to register

a prospectus .ith the 471 under Section D! of the 1ompanies 'ct" 1@/D. Based on the

material availa%le on record" I find that '(*E+ has not complied .ith the provisions of

Section D! of 1ompanies 'ct" 1@/D.

$.D >nder Section /D(1) of the 1ompanies 'ct" 1@/D" every prospectus issued %y or on

%ehalf of a company" shall state the matters specified in (art I and set out the reports

specified in (art II of Schedule II of that 'ct. -urther" as per Section /D() of the

1ompanies 'ct" 1@/D" no one shall issue any form of application for shares in or

de%entures of a company" unless the form is accompanied %y a%ridged prospectus"

contain disclosures as specified. Based on the material availa%le on record" I find that

'(*E+ has not complied .ith the provisions of Section /D(1) and /D() of the

1ompanies 'ct" 1@/D and therefore" has prima faie violated the aforesaid provisions.

$.= 's per Section $D/(1) of the 1ompanies 'ct" #!1" the 1ompanies 'ct" 1@/D" "shall stand

repealed". 8o.ever" Section $D/(#)(i) of the 1ompanies 'ct" #!1" provides that<

"*2)Not!ithstanding the repeal #nder s#$7setion *-) of the repealed enatments&E

Brought to you by http://StockViz.biz

Page 11 of 13

*a) anything done or any ation taken or p#rported to have $een done or taken& inl#ding any r#le&

notifiation& inspetion& order or notie made or iss#ed or any appointment or delaration made or any

operation #ndertaken or any diretion given or any proeeding taken or any penalty& p#nishment&

forfeit#re or fine imposed #nder the repealed enatments shall& insofar as it is not inonsistent !ith the

provisions of this ,t& $e deemed to have $een done or taken #nder the orresponding provisions of this

,t="

$.? In addition to the a%ove" the follo.ing may also %e noted 0

i. -rom the information availa%le on the 01C, 2- Portal0& it is o%served that '(*E+ has

not filed the 4eturn on 'llotments (-orm #) for the -inancial Cears #!!@01!" #!1!011"

#!1101# and #!1#01.

$.@ >pon a consideration of the aforementioned paragraphs" I am of the vie. that '(*E+

is prima faie engaged in fund mo%ilising activity from the pu%lic" through the 6ffer of RPS

and a result of the aforesaid activity has violated the aforementioned provisions of the

1ompanies 'ct" 1@/D (Section /D" Section D! read .ith Section #(D)" Section =) read

.ith Section $D/ of the 1ompanies 'ct" #!1.

/. (rotecting the interests of investors is the foremost mandate for SEBI. -or this purpose"

SEBI can exercise its )urisdiction under Sections 11(1)" 11'" 11B and 11($) of the SEBI

'ct read .ith Section //' of the 1ompanies 'ct" 1@/D and Section $D/ of the

1ompanies 'ct" #!1" over companies .ho issue securities to fifty persons or more" %ut

do not comply .ith the applica%le provisions of the aforesaid 1ompanies 'cts. In the

instant matter" steps have to %e ta;en to ensure only legitimate fund raising activities are

carried on %y 2I+ and no investors are defrauded. In light of the same" I find there is no

other alternative %ut to ta;e recourse through an interim action against 2I+ and its past

and present 9irectors" for preventing that company from further carrying on .ith its

fund mo%ilising activity under the 6ffer of RPS.

D. In vie. of the foregoing" I" in exercise of the po.ers conferred upon me under Sections

11" 11($)" 11' and 11B of the SEBI 'ct" here%y issue the follo.ing directions 0

i. '(*E+ shall not mo%ili&e funds from investors through the 6ffer of RPS or through

the issuance of eBuity shares or any other securities" to the pu%lic and5or invite

Brought to you by http://StockViz.biz

Page 12 of 13

su%scription" in any manner .hatsoever" either directly or indirectly till further

directions3

ii. '(*E+ and its 9irectors" vi&. Shri 6ailash 1hand 9u)ari (9I*< !!D#?=$#)" Shri

Sasan;a 4oy Sar;ar (9I*< !$/!D$)" Shri Barun 6umar 9e (9I*< !/1@/#$!)" Shri

4an)an 6umar 1ho.dhury (9I*< !D/1@#=/) including its past 9irectors" vi&. Shri

6ali 6ishore Bagchi (9I*< !!D!1?=@)" Shri *ishant (ra;ash (9I*< !!D1!=1=)" Shri

9e%das 1hatter)ee (9I*< !/1@#$!?)" Shri Syed 6a&im 4a&a (9I*< !/1=#=#!)" Shri

Jamil 'hmed -arooBui (9I*< !/1=#=!?) and Shri 2ahammad '&am 6han (9I*<

!1$$@!D=)" are prohi%ited from issuing prospectus or any offer document or issue

advertisement for soliciting money from the pu%lic for the issue of securities" in any

manner .hatsoever" either directly or indirectly" till further orders3

iii. '(*E+ and the a%ovementioned past and present 9irectors" are restrained from

accessing the securities mar;et and further prohi%ited from %uying" selling or

other.ise dealing in the securities mar;et" either directly or indirectly" till further

directions3

iv. '(*E+ shall provide a full inventory of all its assets and properties3

v. ,he a%ovementioned past and present 9irectors of '(*E+ shall provide a full

inventory of all their assets and properties3

vi. '(*E+ and its present 9irectors shall not dispose of any of the properties or

alienate or encum%er any of the assets o.ned5acBuired %y that company through the

6ffer of RPS" .ithout prior permission from SEBI3

vii. '(*E+ and its present 9irectors shall not divert any funds raised from pu%lic at

large through the 6ffer of RPS" .hich are ;ept in %an; account(s) and5or in the

custody of '(*E+.

=. ,he a%ove directions shall ta;e effect immediately and shall %e in force until further

orders.

?. ,he prima faie o%servations contained in this 7rder are made on the %asis of the material

availa%le on record i.e. correspondences exchanged %et.een SEBI and '(*E+

along.ith the documents contained therein3 information o%tained from the 2inistry of

1orporate 'ffairs: .e%site i.e. 01C, 2- Portal0 along.ith information for.arded %y the

471" Shillong. In this context" '(*E+ and its a%ovementioned past and present

9irectors may" .ithin #1 days from the date of receipt of this 7rder" file their reply" if

any" to this 7rder and may also indicate .hether they desire to avail themselves an

Brought to you by http://StockViz.biz

Page 13 of 13

opportunity of personal hearing on a date and time to %e fixed on a specific reBuest made

in that regard.

@. ,his 7rder is .ithout pre)udice to the right of SEBI to ta;e any other action that may %e

initiated against '(*E+ and its a%ovementioned past and present 9irectors in

accordance .ith la..

38+$": M.2>+& S. RAMAN

D+%": A.0.(% 22, 2014 WHOLE TIME MEMBER

SECURITIES AND EXCHANGE BOARD OF INDIA

Brought to you by http://StockViz.biz

Vous aimerez peut-être aussi

- Concise trial balance correctionsDocument9 pagesConcise trial balance correctionsArcherAcs86% (7)

- Project Intake FormDocument6 pagesProject Intake Formjamespeterson02Pas encore d'évaluation

- Insolvensi Borang Penyataan Hal EhwalDocument20 pagesInsolvensi Borang Penyataan Hal EhwalMahadi Marop Dee100% (1)

- Financial Management for Entrepreneurs & Executives SeminarDocument3 pagesFinancial Management for Entrepreneurs & Executives SeminarMabsPas encore d'évaluation

- Republic of The Philippines Court of Tax Appeals Quezon: DecisionDocument10 pagesRepublic of The Philippines Court of Tax Appeals Quezon: DecisionPGIN Legal OfficePas encore d'évaluation

- Final PPT UmppDocument13 pagesFinal PPT UmppDhritiman PanigrahiPas encore d'évaluation

- Order in The Matter of Greentouch Projects Ltd.Document15 pagesOrder in The Matter of Greentouch Projects Ltd.Shyam Sunder0% (1)

- Interim Order in The Matter of Progress Cultivation Limited.Document12 pagesInterim Order in The Matter of Progress Cultivation Limited.Shyam SunderPas encore d'évaluation

- Order in The Matter of Weird Industries LimitedDocument18 pagesOrder in The Matter of Weird Industries LimitedShyam SunderPas encore d'évaluation

- Interim Order Against Falkon Industries India Limited.Document11 pagesInterim Order Against Falkon Industries India Limited.Shyam SunderPas encore d'évaluation

- Sbi - Loan Application FormDocument4 pagesSbi - Loan Application FormRaghav BihaniPas encore d'évaluation

- Adjudication Order in The Matter of B&A Packaging LTDDocument8 pagesAdjudication Order in The Matter of B&A Packaging LTDShyam SunderPas encore d'évaluation

- Appraisal Note - APMC YEOLADocument25 pagesAppraisal Note - APMC YEOLADipak PrasadPas encore d'évaluation

- Tender Document of Internal Control Proc 2007Document21 pagesTender Document of Internal Control Proc 2007lightknowPas encore d'évaluation

- Core Banking Solutions RFPDocument45 pagesCore Banking Solutions RFPsudheerPas encore d'évaluation

- Application for Retail Outlet Staff PositionsDocument11 pagesApplication for Retail Outlet Staff Positionsvenkat12350Pas encore d'évaluation

- Rednotes Legal FormsDocument26 pagesRednotes Legal FormsEmer MartinPas encore d'évaluation

- You're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowDocument6 pagesYou're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowJosin JosePas encore d'évaluation

- Cir Vs Sony Philippines Inc (GR 178697 November 17 2010)Document11 pagesCir Vs Sony Philippines Inc (GR 178697 November 17 2010)Brian BaldwinPas encore d'évaluation

- HDFC Bank Home LoanDocument30 pagesHDFC Bank Home LoanMark MurphyPas encore d'évaluation

- BER-PBD 2010 - FINAL DRAFT Edited Mmo 080614 final-Guide-MehanDocument18 pagesBER-PBD 2010 - FINAL DRAFT Edited Mmo 080614 final-Guide-MehanJeric IsraelPas encore d'évaluation

- Order in Respect of Venture Business Advisors P. Ltd. and Its Director, Mr. Vineet KumarDocument13 pagesOrder in Respect of Venture Business Advisors P. Ltd. and Its Director, Mr. Vineet KumarShyam SunderPas encore d'évaluation

- NBG Format-20.11.13Document6 pagesNBG Format-20.11.13Srinivas MaheshwariPas encore d'évaluation

- Section-IV Qualification CriteriaDocument6 pagesSection-IV Qualification CriteriaYohannes GebrePas encore d'évaluation

- Technical BidDocument50 pagesTechnical BidPerkresht PawarPas encore d'évaluation

- Kenya Methodist University: Faculty of Business & Management StudiesDocument15 pagesKenya Methodist University: Faculty of Business & Management StudiesAlice WairimuPas encore d'évaluation

- 1.garcia Vs SSSDocument20 pages1.garcia Vs SSSLexter CruzPas encore d'évaluation

- Application For Survey During Construction and For Classification and List of Certificates and Services Requested To RinaDocument4 pagesApplication For Survey During Construction and For Classification and List of Certificates and Services Requested To RinaArafat HussainPas encore d'évaluation

- PANAMA COC For Naval PersonnelDocument3 pagesPANAMA COC For Naval PersonnelPayasam Abhilash100% (1)

- "Whole Sale Banking Operations" in Axis Bank: A Project Report ONDocument49 pages"Whole Sale Banking Operations" in Axis Bank: A Project Report ONPatricia JosephPas encore d'évaluation

- D Package Scheme of Incentives-2007Document7 pagesD Package Scheme of Incentives-2007banavaram1Pas encore d'évaluation

- All CA KRI 14.10Document2 pagesAll CA KRI 14.10manishluv13Pas encore d'évaluation

- Order Under Sections 11 and 11B Against Acme Craft P. Ltd. and Its Directors, Viz. Mr. Jigar Jagdish Pandya and Mr. Akash GanachariDocument23 pagesOrder Under Sections 11 and 11B Against Acme Craft P. Ltd. and Its Directors, Viz. Mr. Jigar Jagdish Pandya and Mr. Akash GanachariShyam SunderPas encore d'évaluation

- Indo-Australian Career Boosting Gold Fellowships Referee ReportDocument3 pagesIndo-Australian Career Boosting Gold Fellowships Referee ReportNandini_KotharkarPas encore d'évaluation

- REM Digests Set1 1.7Document46 pagesREM Digests Set1 1.7Jose Emilio Miclat TevesPas encore d'évaluation

- Letter Formats 1Document46 pagesLetter Formats 1Shivaramvarma MandapatiPas encore d'évaluation

- Model 2 Contract de FinantaretDocument7 pagesModel 2 Contract de FinantaretViorel EnitaPas encore d'évaluation

- CV of Shyamtanu SenguptaDocument3 pagesCV of Shyamtanu SenguptaArvind RoyPas encore d'évaluation

- CIR vs. LSCECDocument4 pagesCIR vs. LSCECFroilan Villafuerte Faurillo100% (2)

- Kenya Methodist University: Faculty of Business & Management StudiesDocument17 pagesKenya Methodist University: Faculty of Business & Management StudiesAlice WairimuPas encore d'évaluation

- 474 07 Exchange Rate DeterminationDocument15 pages474 07 Exchange Rate Determinationjordi92500Pas encore d'évaluation

- Accounting Group Study 1Document13 pagesAccounting Group Study 1ahmustPas encore d'évaluation

- Order Passed in Respect of Mr. Bajrang BafnaDocument10 pagesOrder Passed in Respect of Mr. Bajrang BafnaShyam SunderPas encore d'évaluation

- NRRD VacanciesDocument6 pagesNRRD VacanciesstabrahamPas encore d'évaluation

- Final Contract of Bauxite of Tirth - Vittrag 30.1.13Document8 pagesFinal Contract of Bauxite of Tirth - Vittrag 30.1.13akash_shah_42Pas encore d'évaluation

- Ad No. 8 Without F.o-25!08!14Document10 pagesAd No. 8 Without F.o-25!08!14engg.satyaPas encore d'évaluation

- Form No.16: Part ADocument5 pagesForm No.16: Part APradeep KumarPas encore d'évaluation

- Director of Lands Vs BuycoDocument15 pagesDirector of Lands Vs BuycoAbigail DeePas encore d'évaluation

- APPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesDocument4 pagesAPPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesKevin JacobPas encore d'évaluation

- Ofn Bid Document 2nd Ph. On 4.11.13Document107 pagesOfn Bid Document 2nd Ph. On 4.11.13Matthew JarvisPas encore d'évaluation

- BPI VsDocument2 pagesBPI VsHao Wei WeiPas encore d'évaluation

- Letters of Credit CasesDocument21 pagesLetters of Credit CasesbalbasjuliusPas encore d'évaluation

- Ajara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi MargDocument32 pagesAjara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi Margpramesh1010Pas encore d'évaluation

- Business LettersDocument38 pagesBusiness LettersDương ZeePas encore d'évaluation

- Nps Pran FormDocument4 pagesNps Pran FormdineshhissarPas encore d'évaluation

- Weed & Seed CFDFL 7-9-03Document6 pagesWeed & Seed CFDFL 7-9-03janiceandersonjPas encore d'évaluation

- ASSETS AND LIABILITIES SUMMARYDocument11 pagesASSETS AND LIABILITIES SUMMARYAmelia Butan50% (2)

- Marlow Application FormDocument7 pagesMarlow Application Formlewisbaut044262Pas encore d'évaluation

- Orld Rade Rganization: United States - Continued Suspension of Obligations in The Ec - Hormones DisputeDocument65 pagesOrld Rade Rganization: United States - Continued Suspension of Obligations in The Ec - Hormones DisputeFadlul Akbar HerfiantoPas encore d'évaluation

- Divided States: Strategic Divisions in EU-Russia RelationsD'EverandDivided States: Strategic Divisions in EU-Russia RelationsPas encore d'évaluation

- Steel & Precast Concrete Contractors World Summary: Market Values & Financials by CountryD'EverandSteel & Precast Concrete Contractors World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Water Well Drilling Contractors World Summary: Market Values & Financials by CountryD'EverandWater Well Drilling Contractors World Summary: Market Values & Financials by CountryPas encore d'évaluation

- v-Myb proteins and their oncogenic potential: A study on how two point mutations affect the interaction of v-Myb with other proteinsD'Everandv-Myb proteins and their oncogenic potential: A study on how two point mutations affect the interaction of v-Myb with other proteinsPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Meenu Chopra Income Tax BasicsDocument66 pagesMeenu Chopra Income Tax BasicsRvi Mahay100% (1)

- Abril Lagmay Alfiler Barawid (ALAB) Law Firm: Contract of LeaseDocument3 pagesAbril Lagmay Alfiler Barawid (ALAB) Law Firm: Contract of LeaseStephen MallariPas encore d'évaluation

- NRSP Credit RatingDocument5 pagesNRSP Credit RatingchqaiserPas encore d'évaluation

- Cheryl Samons Stern Employee DepoDocument122 pagesCheryl Samons Stern Employee DepopfranceschinaPas encore d'évaluation

- Light Bill Sept 2019Document1 pageLight Bill Sept 2019Sanjyot KolekarPas encore d'évaluation

- IMF and World Bank: Institutions for Economic CooperationDocument2 pagesIMF and World Bank: Institutions for Economic CooperationLucas QuarPas encore d'évaluation

- Module 3 Sources and Uses of Short Term and Long Term FundsDocument30 pagesModule 3 Sources and Uses of Short Term and Long Term FundsDenmark SantosPas encore d'évaluation

- GBF Unit - IVDocument50 pagesGBF Unit - IVKaliyapersrinivasanPas encore d'évaluation

- Training on Movable Collateral RegistryDocument18 pagesTraining on Movable Collateral Registrykeno ayana50% (2)

- AnswersDocument8 pagesAnswersTareq ChowdhuryPas encore d'évaluation

- Agencia Exquisite of Bohol, Inc. vs. Commissioner of Internal RevenueDocument15 pagesAgencia Exquisite of Bohol, Inc. vs. Commissioner of Internal RevenueHazel PantigPas encore d'évaluation

- Law On Partnership and Corporation (Notes)Document26 pagesLaw On Partnership and Corporation (Notes)Paul Dexter Go100% (6)

- European Conference For Education Research, University of HamburgDocument18 pagesEuropean Conference For Education Research, University of HamburgMano ShehzadiPas encore d'évaluation

- Value Investors Group PDFDocument11 pagesValue Investors Group PDFnit111100% (1)

- Financing Infrastructure in the Philippines: Assessing Fiscal Resources and OpportunitiesDocument64 pagesFinancing Infrastructure in the Philippines: Assessing Fiscal Resources and OpportunitiesCarmelita EsclandaPas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Why do Scherer and Palazzo (2011) argue that there is an increasingly public role for private business firms? What are some of the advantages vs. the disadvantages of firms adopting a stronger ‘public role’ e.g. in administration of public goods and services?Document14 pagesWhy do Scherer and Palazzo (2011) argue that there is an increasingly public role for private business firms? What are some of the advantages vs. the disadvantages of firms adopting a stronger ‘public role’ e.g. in administration of public goods and services?Smriti TalrejaPas encore d'évaluation

- Women Entrepreneurs and NetworkingDocument20 pagesWomen Entrepreneurs and NetworkingProf Dr Chowdari PrasadPas encore d'évaluation

- Delivery Receiving InstructionsDocument2 pagesDelivery Receiving InstructionsadilsyedPas encore d'évaluation

- Obligation and Contracts-ECEDocument45 pagesObligation and Contracts-ECECrisJoshDizon50% (6)

- ContractsDocument645 pagesContractsFRANCISCO CARRIZALES VERDUGO100% (4)

- Direct Taxation: CA M. Ram Pavan KumarDocument60 pagesDirect Taxation: CA M. Ram Pavan KumarSravyaPas encore d'évaluation

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razPas encore d'évaluation

- Ia1 MidtermDocument4 pagesIa1 Midtermsoccpresident.nfjpia2324Pas encore d'évaluation

- Sesbreno vs. CADocument5 pagesSesbreno vs. CALyNne OpenaPas encore d'évaluation

- Amaefule 12 PH DDocument343 pagesAmaefule 12 PH DIrene A'sPas encore d'évaluation

- Chapter 1 Introduction To Engineering EconomyDocument55 pagesChapter 1 Introduction To Engineering EconomyNadia IsmailPas encore d'évaluation