Académique Documents

Professionnel Documents

Culture Documents

Interim Order in The Matter of Wasankar Wealth Management LTD., Mr. Prashant Wasankar and Ors.

Transféré par

Shyam Sunder0 évaluation0% ont trouvé ce document utile (0 vote)

188 vues14 pagesSECURITIES and EXCHANGE BOARD of INDIA ORDER IN RESPECT OF WASANKAR WEALTH MANAGEMENT LIMITED and Mr. Prashant WASANKAR. Wasankar Wealth Management Limited is registered as a stock broker with inter connected stock exchange and also as sub-broker with BSE. As per the available records, Mr. Prashant WASANKAR has 60% shareholding while his wife, Ms. Bhagyashree wasan

Description originale:

Titre original

Interim order in the matter of Wasankar Wealth Management Ltd., Mr. Prashant Wasankar and Ors.

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentSECURITIES and EXCHANGE BOARD of INDIA ORDER IN RESPECT OF WASANKAR WEALTH MANAGEMENT LIMITED and Mr. Prashant WASANKAR. Wasankar Wealth Management Limited is registered as a stock broker with inter connected stock exchange and also as sub-broker with BSE. As per the available records, Mr. Prashant WASANKAR has 60% shareholding while his wife, Ms. Bhagyashree wasan

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

188 vues14 pagesInterim Order in The Matter of Wasankar Wealth Management LTD., Mr. Prashant Wasankar and Ors.

Transféré par

Shyam SunderSECURITIES and EXCHANGE BOARD of INDIA ORDER IN RESPECT OF WASANKAR WEALTH MANAGEMENT LIMITED and Mr. Prashant WASANKAR. Wasankar Wealth Management Limited is registered as a stock broker with inter connected stock exchange and also as sub-broker with BSE. As per the available records, Mr. Prashant WASANKAR has 60% shareholding while his wife, Ms. Bhagyashree wasan

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 14

Order in respect of Wasankar Wealth Management Limited and Mr.

Prashant Wasankar Page 1 of 14

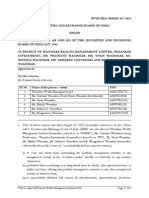

WTM/RKA/MIRSD/105/2014

SECURITIES AND EXCHANGE BOARD OF INDIA

ORDER

UNDER SECTION 11(1), 11(4), 11B AND 11D OF SECURITIES AND EXCHANGE

BOARD OF INDIA ACT, 1992 IN RESPECT OF WASANKAR WEALTH

MANAGEMENT LIMITED, WASANKAR INVESTMENTS, MR. PRASHANT

WASANKAR, MR. VINAY WASANKAR, MS. MITHILA WASANKAR, MR.

ABHIJEET CHAUDHARI AND MS. BHAGYASHREE WASANKAR.

1. Wasankar Wealth Management Limited (hereinafter referred to as WWML), is registered

as a stock broker with Inter Connected Stock Exchange Ltd. (SEBI Registration No.

INB241474130) and also as sub-broker with Bombay Stock Exchange Ltd. (BSE) since

March 06, 2013 and National Stock Exchange of India Ltd. (NSE) since January 29, 2013

having SEBI Registration Numbers INS01A552636 and INS23A550931, respectively.

WWML is also registered as an investment adviser with SEBI (SEBI Registration Number

INA000000219).

2. WWML was incorporated as a private limited company on July 16, 2008 with Mr. Prashant

Wasankar and Mr. Vinay Wasankar as its promoters. Subsequently, WWML converted into a

public limited company with effect from April 01, 2010. As per the available records, Mr.

Prashant Wasnkar has 60% shareholding while his wife, Ms. Bhagyashree Wasankar has

37% shareholding in WWML. Mr. Prashant Wasankar, Ms. Mithila Wasankar and Mr.

Abhijeet Chaudhari are the directors of WWML. The details of these promoters and

directors are enumerated hereunder:

Sl. No.

Names Designation PAN DIN

1 Mr. Prashant Wasankar Promoter/Director AAIPW1864A 02222183

2 Mr. Vinay Wasankar Promoter AALPW3215A 02217889

3 Ms. Mithila Wasankar Director ANFPM0123J 02748336

4 Mr. Abhijeet Chaudhari Director AIUPC8611M 02745525

3. Wasankar Investments (WI) is a proprietorship firm owned by Mr. Prashant Wasankar and

is also registered as sub-broker with NSE with trade name Wasankar Investments (WI),

(SEBI Registration Number INS236775719). As per the records, WWML and WI have the

common address at 247 Wasankar House, Shivaji Nagar, Nagpur 440010. For the sake of

brevity, WWML, WI, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila Wasankar,

Mr. Abhijeet Chaudhari and Ms. Bhagyashree Wasankar are hereinafter collectively referred

to as Mr. Prashant Wasankar and his connected/related entities or by their respective

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 2 of 14

names.

4. SEBI received complaints stating inter alia that WWML and WI are collecting money from

public in Nagpur promising a return of 300% on an investment for 48 months, a return of

250% on an investment for 30 months and a return of 125% return on an investment for 12

months. In this regard, SEBI sought copies of the complaints from the Economic Offences

Wing, Nagpur (EoW).

5. SEBI sought explanation from Mr. Prashant Wasankar as to whether he or his

connected/related entities have, directly or indirectly, collected money/deposit from the

public. In this regard, Mr. Prashant Wasankar, inter alia, stated that:

(a) He or his connected/related entities have not collected any money/deposit from the

public.

(b) Services offered by WWML or him are in the nature of facilitation of trading on NSE

and BSE, advisory services, equity portfolio evaluation and restructuring, stock specific

advice, etc. subject to the payment of membership fees.

(c) The membership fees is charged for the services rendered, subject to service tax and

other levies and returns filed in this regard with the respective tax departments.

(d) Neither WWML nor he has issued post-dated cheques to their clients or any other

individual.

6. During May 8-9, 2014, SEBI undertook an inspection at the offices of WWML and WI in

Nagpur. Some of the findings of the inspection are as under:

(1) WWML has other group companies, namely, Wasankar Agro Wealth Pvt. Ltd., H. &

W. Agro Pvt. Ltd., Om Bhagwate Capital Services Pvt. Ltd. and Paridhi Trading Co.

Pvt. Ltd. These entities are not registered with SEBI in any manner.

(2) WWML and Mr. Prashant Wasankar solicited and mobilised funds/deposits from

clients and general public for making investment primarily in the following two

manners:

A. First Method of mobilisation of funds from public-

(a) Mr. Prashant Wasankar and his connected/related entities solicited and mobilised

funds/deposits from their clients and other investors in the form of cash or cheque

for making investments.

(b) The clients/investors gave the cheques in the names of Mr. Prashant Wasankar and

his connected/related entities.

(c) In addition to these funds, the investors also paid the membership fees to WWML,

WI or Mr. Prashant Wasankar.

(d) In respect of such investments, Mr. Prashant Wasankar would issue a promissory

note on the letter head of WI alongwith a certificate of investment in the name of WI

acknowledging such investment by the investor.

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 3 of 14

(e) Mr. Prashant Wasankar would also issue post dated refund cheque(s) on the day of

investment.

(f) The promissory note would contain details like the terms and conditions of the

schemes. It would be signed by Mr. Prashant Wasankar and bear the stamp of WI.

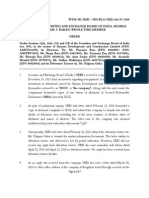

(g) The details of the various schemes for which funds were collected by Mr. Prashant

Wasankar and his connected/related entities are as under :-

B. Second Method of mobilisation of funds from public

(a) The investor would give funds for investment partly in cash and partly in cheque.

The cheque would be drawn in favour of the stock broker ISE Securities & Services

Ltd. and a receipt for the cash as well as cheque would be issued to the investors by

WWML.

(b) Mr. Prashant Wasankar would issue promissory notes to the investors containing

details like maturity of the scheme and payment of the scheme amount.

(c) WWML collected funds/deposits from the investors even during the period when it

was not registered as an intermediary.

(3) There are instances where payments have been made to the clients/investors by Mr.

Rate of interest

Plans Members Non Members Minimum inv.

Double 33 Months 48 Months 50K

Triple 48 Months NA 5LK

Yearly Pay Out

25%, 27.5%, 30%, 32.5%

48 Months NA 5LK

40% 18 Months 24 Months 50K

Yearly 25% 18% 50K

90 Days 5.25% 3.75% 1LK

Quarterly For 2 Years 5.25% 3.75% 1LK

Monthly 1.60% NA 5LK

Terms and Conditions

Loan Facility will be available to Members Only

Pre-Mature withdrawal: For Non Members 4.00% For Members 2.5%. No spot charges

with one month notice.

If the document is misplaced, FIR and Indemnity process has to be completed and the final

payment or renewed documents will only be made/issued after Six months of maturity.

The above rates are subject to change without any prior notification

OFFICE TIMINGS: MONDAY TO FRIDAY (10.30 AM TO 6 PM) SATURDAY (10.30

AM TO 4 PM) SUNDAY (10.30 AM TO 1 PM)

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 4 of 14

Prashant Wasankar and his connected/related entities.

(4) Some of the post dated cheques issued by Mr. Prashant Wasankar for the payment of

the maturity amount to the investors were observed to have been dishonoured.

(5) WWML paid an amount of `74.57 lakhs as incentives to its employees for the

financial year 2012-13.

(6) WWML gave loans to certain individuals/entities as Inter Corporate Deposits to the

tune of `11.78 crore during the period April, 2012 to March 2014.

(7) Mr. Prashant Wasankar and his connected/related entities have 63 bank accounts in

various banks. The credits in these 63 bank accounts for the period April 2013 to May

20, 2014 amount to `111 crore (approx).

(8) There are 56 instances of cash deposits amounting to `1.61 crore in the 10 bank

accounts of Mr. Prashant Wasankar and his connected/related entities in the Indian

Overseas Bank.

(9) Mr. Prashant Wasankar is having 13 bank accounts in various banks and an amount of

`40.23 crore has been deposited in his accounts.

(10) WWML has 10 bank accounts and an amount of `20.38 crore has been deposited

during the period from April 01, 2013 to May 20, 2014 in its accounts.

(11) Mr. Prashant Wasankar has not traded in cash market.

(12) WWML has traded to the tune of `9.08 crore in F&O segment for proprietary trading

from April 01, 2013 to May 20, 2014.

(13) The amount of deposits seen in the bank accounts is much more than the turnover

during the period.

(14) The data maintained by WWML revealed that Mr. Prashant Wasankar and his

connected/related entities collected the funds/deposits mostly from senior citizens

and women from the states of Maharashtra, Andhra Pradesh, Bihar, Chhattisgarh,

Chandigarh, Delhi, Columbus, Gujarat, Haryana, Himachal Pradesh, Jammu and

Kashmir, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Orissa, Panjab, Tamil

Nadu, Tripura, Uttar Pradesh, West Bengal. They also collected funds/deposits from

some investors in the United Arab Emirates and the United States of America.

(15) There was huge mismatch in the data provided by WWML with regard to the number

of clients and the fee collected from them. Prior to inspection, WWML had submitted

that it had collected fee amounting to `16.02 crores from 2560 clients.

(16) However, as per the data maintained by WWML in its computer, WWML started

collecting fees from the clients from the financial year 2008-09 onwards when it was

not even a SEBI registered intermediary. One of files maintained by WWML in its

computer has a list of 9576 clients/investors names and their mobile numbers. On its

website, WWML claims to have a client base of more than 5000. The details as

submitted by WWML and the details of the number of clients and the amount of fee

collected by WWML as per the records in its computer are as under:

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 5 of 14

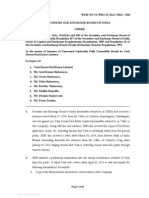

Sl. No. Year Number of clients Membership fee collected (In `)

Submitted

by WWML

In computer Submitted by

WWML

In computer

1 2008-09 Nil 286 28,30,000

2 2009-10 678 1502 2,84,75,000 3,11,84,000

3 2010-11 732 1258 4,28,15,000 4,34,75,000

4 2011-12 405 604 4,17,60,000 3,97,85,000

5 2012-13 745 722 4,72,03,874 7,22,61,250

6 2013-14 Nil 232 1,03,86,250

TOTAL 2560 4604 16,02,53,874 19,99,21,500

(17) WWML did not maintain proper records pertaining to the investment advisory

services provided to the clients.

(18) WWML offered various discount schemes for senior citizens.

(19) Some of the details regarding the discount schemes offered by WWML and as

enumerated in one of the files named Anniversary Offer in its computer are as under:

"Membership Discount for Limited period:

i. Age 55 65 year - 50% off for 1 year @ 25000 and 3 year @ 62500 membership.

ii. Age 65 years and above - 75% off for 1 year @ 12500 and 3 year @ 31250

membership.

iii. For Family Member of Existing Member (below 55 years) - 25% off for 1 year and 3

year membership.

iv. Also Avail Complimentary Membership.

v. New Liquid Fund with flexibility available.

vi. Kindly RESTRUCTURE your Portfolio for better performance.

(20) Similarly, a file named "Calling Script" in the computer of WWML, purportedly meant

for its wealth management activities, contained details as under:

"Being anniversary, its also time to thank you for the trust shown for last 24 years. Weve introduced

special offers exclusively for our members and their immediate family. (Confirm with the client if

someone has already called in this regard, if the client says no, continue as under:

i. We are offering Membership Discount for Limited period (Till 10th November 2013)

ii. Age 55-65 year - 50% off for 1 year @ 25000 and 3 year @ 62500 Membership (This offer

has witnessed a great response since introduction in July 2013).

iii. Age 65 years and above -75% off for 1 year @ 12500 and 3 year @ 31250 Membership.

iv. For Family Member of Existing Member (below 55 years) - 25% off for 1 year and 3 year

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 6 of 14

Membership. **

v. Also Avail Complimentary Membership.**

vi. "If invest 15 lacs (Age 55-65 years)- Complimentary Membership and If invest 10 lacs (Age 65

years and above) - Complimentary Membership."

vii. "We have Liquid Plan we can invest any amount and can withdraw anytime.(If client wants to

know more about it then say that for more information will ask Wealth Manager to call)."

viii. "Even can Restructure your Portfolio for better performance. (If client wants to know more about

it then say that for more information will ask Wealth Manager to call)."

ix. "We have Some New Plans. (If client wants to know more about it then say that for more

information will ask Wealth Manager to call)."

7. While SEBI was examining the matter, the EoW registered an FIR on May 09, 2014 against

Mr. Prashant Wasankar, Ms. Bhagyashree Wasankar and other directors of WWML pursuant

to a complaint by an investor for collecting huge funds from the said complainant and other

investors by luring them into making investments and promising to pay higher returns on

deposits. The said complainant also claimed to have been cheated by Mr. Prashant Wasankar

and his connected/related entities who allegedly misappropriated the funds/deposits of the

investors and refused to return principal amounts to the investors. The complainant has

claimed to have been cheated by Mr. Prashant Wasankar and his connected/related entities

to the tune of `2,74,36,000/-.

8. I find that the complaints by the clients/investors and/or other general investors of Mr.

Prashant Wasankar and his connected/related entities regarding the collection of money by

them and the investment certificates, promissory notes, the post dated cheques issued by Mr.

Prashant Wasankar promising his investors guaranteed high return and details of various

schemes as found in the computer of WWML are sufficient grounds to conclude that Mr.

Prashant Wasankar and his connected/related entities had been collecting money from the

public in the form of deposit schemes. The facts brought out above prima facie indicate that:

(a) WWML solicited and collected funds/deposits from its clients/other investors for

making investments on their behalf even when it was neither registered as a sub-broker

nor as any other intermediary and as such acted in contravention of section 12(1) of the

Securities and Exchange Board of India Act, 1992 (the SEBI Act) read with regulation

11(1) of the SEBI (Stock Brokers and Sub-brokers) Regulations, 1992 (the Stock Brokers

Regulations).

(b) Mr. Prashant Wasankar and his connected/related entities solicited and collected

funds/deposits from their clients and other investors to make investment in certain

schemes of WWML and WI that were in the nature of portfolio management schemes

without obtaining registration as a portfolio management services as required in terms of

section 12(1) of the SEBI Act read with regulation 3 of the SEBI (Portfolio Managers)

Regulations, 1993 (the Portfolio Managers Regulations).

(c) WWML, being a registered intermediary indulged in fund based activities involving

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 7 of 14

personal financial liability, which it cannot undertake, being a member of a recognised

stock exchange and SEBI registered stock broker, sub-broker and as such contravened

rule 8(3)(f) of the Securities Contracts (Regulation) Rules, 1957 (the SCRR).

(d) WWML and WI had dealt with other stock brokers for proprietary trading without

obtaining prior permission from the stock exchanges and therefore did not comply with

the requirements of SEBI Circular no. SEBI/MIRSD/Cir-06/2004 dated January 13,

2004.

(e) During the course of inspection, Mr. Prashant Wasankar and his connected/related

entities furnished in-correct information to SEBI regarding their bank accounts thereby

violated the provisions of regulation 21, and clauses A(1), A(2), A(3) and A(5) of the

Code of Conduct for Stock Brokers read with regulations 9 and clauses A(1), A(2) and

D(4) of the Code of Conduct for Sub-Brokers read with regulation 15 of the Stock

Brokers Regulations.

(f) WWML did not maintain proper records regarding the investment advisory services

provided to its clients and therefore contravened the provisions of regulation 19 and

clauses 1 and 2 of the Code of Conduct specified in Schedule III read with regulation

15(9) of the SEBI (Investment Advisers) Regulations, 2013 (the Investment Advisers

Regulations).

9. I find that the schemes devised/offered and operated by Mr. Prashant Wasankar through his

connected/related entities, namely, WWML, WI, Mr. Vinay Wasankar, Ms. Mithila Wasankar

and Mr. Abhijeet Chaudhari and his wife, Ms. Bhagyashree Wasankar were with their

complete knowledge and as such they were not only responsible for misleading the clients of

WWML and WI and other general investors from the public but also for collecting funds

from them and promising unrealistic returns and for other contraventions as mentioned

hereinabove. The relevant provisions of the SEBI Act, the SCRR and the Regulations are

reproduced as following:-

Section 12(1) of the SEBI Act, 1992

Registration of stock brokers, sub-brokers, share transfer agents, etc

12. (1) No stock broker, sub-broker, share transfer agent, banker to an issue, trustee of trust deed, registrar to an

issue, merchant banker, underwriter, portfolio manager, investment adviser and such other intermediary who may

be associated with securities market shall buy, sell or deal in securities except under, and in accordance with, the

conditions of a certificate of registration obtained from the Board in accordance with the regulations made under this

Act:

The SEBI (Stock Brokers and Sub-Brokers) Regulations, 1992

Conditions of registration.

9. Any registration granted by the Board under regulation 6 shall be subject to the following conditions, namely,-

(a)..............................

...................................

(f) he shall at all times abide by the Code of Conduct as specified in Schedule II; and

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 8 of 14

...................................

Registration as sub-broker.

11. (1) No sub-broker shall act as such unless he holds a certificate granted by the Board under these regulations.

..................................

General obligations and inspection.

15. (1) The sub-broker shall

(a)................................

(b) abide by the Code of Conduct specified in Schedule II;

...................................

Obligations of stock-broker on inspection by the Board.

21. (1) It shall be the duty of every director, proprietor, partner, officer and employee of the stock-broker, who is

being inspected, to produce to the inspecting authority such books, accounts and other documents in his custody or

control and furnish him with the statements and information relating to the transactions in securities market within

such time as the said officer may require.

(2) The stock-broker shall allow the inspecting authority to have reasonable access to the premises occupied by such

stock-broker or by any other person on his behalf and also extend reasonable facility for examining any books,

records, documents and computer data in the possession of the stock-broker or any other person and also provide

copies of documents or other materials which, in the opinion of the inspecting authority are relevant.

(3) The inspecting authority, in the course of inspection, shall be entitled to examine or record statements of any

member, director, partner, proprietor and employee of the stockbroker.

(4) It shall be the duty of every director, proprietor, partner, officer and employee of the stock broker to give to the

inspecting authority all assistance in connection with the inspection, which the stock broker may reasonably be

expected to give.

Code of Conduct for Stock Brokers

"A. General

(1) Integrity: A stock-broker, shall maintain high standards of integrity, promptitude and fairness in the conduct

of all his business.

(2) Exercise of due skill and care : A stock-broker shall act with due skill, care and diligence in the conduct of all

his business.

(3) Manipulation: A stock-broker shall not indulge in manipulative, fraudulent or deceptive transactions or

schemes or spread rumours with a view to distorting market equilibrium or making personal gains.

(5) Compliance with statutory requirements: A stock-broker shall abide by all the provisions of the Act and the

rules, regulations issued by the Government, the Board and the Stock Exchange from time to time as may be

applicable to him."

Code of Conduct for Sub-Brokers

" A. General

(1) Integrity: A sub-broker, shall maintain high standards of integrity, promptitude and fairness in the conduct of

all investment business.

(2) Exercise of due Skill and Care: A sub-broker, shall act with due skill, care and diligence in the conduct of all

investment business.

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 9 of 14

............................................................................................................................................

D. Sub-Brokers vis-a vis regulatory Authorities

(4) Manipulation: A sub-broker shall not indulge in manipulative, fraudulent or deceptive transactions or schemes

or spread rumours with a view to disturbing market equilibrium or making personal gains."

SEBI (Portfolio Managers) Regulations, 1993

Regulation 3

"No person shall act as portfolio manager unless he holds a certificate granted by the Board under these

regulations: ."

The Securities Contracts (Regulation) Rules, 1957

Qualifications for membership of a recognised stock exchange.

8. The rules relating to admission of members of a stock exchange seeking recognition shall inter alia provide that:

..............................................

(3) No person who is a member at the time of application for recognition or subsequently admitted as a member

shall continue as such if

..................................................................................................................

(f) he engages either as principal or employee in any business other than that of securities or commodity derivatives

except as a broker or agent not involving any personal financial liability, provided that -

.................................................

SEBI Circular no. SEBI/MIRSD/Cir-06/2004 dated January 13, 2004:

...........................

3.1 A stock broker/ sub broker of an exchange cannot deal with brokers/sub brokers of the same exchange either

for proprietary trading or for trading on behalf of clients, except with the prior permission of the exchange. The

stock exchanges while giving such permission, shall consider the reasons stated by the brokers/sub brokers for

dealing with brokers/sub brokers of the same exchange and after carrying out due diligence allow such brokers/sub

brokers to deal with only one stock broker/sub broker of the same exchange.

3.2 A stock broker/sub broker of an exchange can deal with only one broker/sub broker of another exchange for

proprietary trading after intimating the names of such stock broker/sub broker to his parent stock exchange.

The SEBI (Investment Advisers) Regulations, 2013

GENERAL OBLIGATIONS AND RESPONSIBILITIES

General responsibility.

15(9) An investment adviser shall abide by Code of Conduct as specified in Third Schedule.

Maintenance of records.

19(1) An investment adviser shall maintain the following records,-

(a) Know Your Client records of the client;

(b) Risk profiling and risk assessment of the client;

(c) Suitability assessment of the advice being provided;

(d) Copies of agreements with clients, if any;

(e) Investment advice provided, whether written or oral;

(f) Rationale for arriving at investment advice, duly signed and dated;

(g) A register or record containing list of the clients, the date of advice, nature of the advice, the products/securities

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 10 of 14

in which advice was rendered and fee, if any charged for such advice.

CODE OF CONDUCT FOR INVESTMENT ADVISER

1. Honesty and fairness

An investment adviser shall act honestly, fairly and in the best interests of its clients and in the integrity of the

market.

2. Diligence

An investment adviser shall act with due skill, care and diligence in the best interests of its clients and shall ensure

that its advice is offered after thorough analysis and taking into account available alternatives.

10. By their acts and omissions, Mr. Prashant Wasankar and his connected/related entities have

solicited, enticed and induced their clients and other investors to deal in securities and have

also collected funds and deposits from their clients and other general investors through

misrepresentation and allurement of high returns through various schemes to such clients

and investors when in reality Mr. Prashant Wasankar and his connected/related entities had

defaulted in making repayments/refunds to their clients and investors. They also solicited

investments from the clients and other investors claiming to give high returns even when

WWML was not a SEBI registered intermediary. This prima facie appears to be a

representation made in a reckless and careless manner. In my view the modus operandi of Mr.

Prashant Wasankar and his connected/related entities indicates a scheme, plan, device or

artifice or contrivance that is, besides being in contraventions of the SEBI Act, the SCRR,

the Regulations and the circular as discussed above, is 'fraudulent' as defined in regulation

2(1)(c) of the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to

Securities Market) Regulations, 2003 (hereinafter referred to as "the PFUTP Regulations")

which reads as under:-

Definition of fraud Regulation 2(1)(c).

(c)fraud includes any act, expression, omission or concealment committed whether in a deceitful manner or not by

a person or by any other person with his connivance or by his agent while dealing in securities in order to induce

another person or his agent to deal in securities, whether or not there is any wrongful gain or avoidance of any loss,

and shall also include

(1) a knowing misrepresentation of the truth or concealment of material fact in order that another person may act

to his detriment;

(2) a suggestion as to a fact which is not true by one who does not believe it to be true;

(3) an active concealment of a fact by a person having knowledge or belief of the fact;

(4) a promise made without any intention of performing it;

(5) a representation made in a reckless and careless manner whether it be true or false;

(6) any such act or omission as any other law specifically declares to be fraudulent;

(7) deceptive behaviour by a person depriving another of informed consent or full participation;

(8) a false statement made without reasonable ground for believing it to be true;

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 11 of 14

(9) the act of an issuer of securities giving out misinformation that affects the market price of the

security, resulting in investors being effectively misled even though they did not rely on the statement itself

or anything derived from it other than the market price.

And fraudulent shall be construed accordingly;

.

11. In the light of the aforesaid observations, I, prima facie, find that Mr. Prashant Wasankar and

his connected/related entities not only contravened the provisions of the SEBI Act, the

SCRR, the Portfolio Managers Regulations, the Stock Brokers Regulations, the Investment

Advisers Regulations and SEBI circular as discussed hereinabove but have also acted in

fraudulent and deceitful manner which attracts prohibitions enshrined in section 12A (a) (b)

and (c) of the SEBI Act and regulation 3 (b), (c) and (d) and regulation 4(1) and 4(2) (k) of

the PFUTP Regulations which read as following:-

Section 12A of the SEBI Act-

"Prohibition of manipulative and deceptive devices, insider trading and substantial

acquisition of securities or control.

12A. No person shall directly or indirectly -

(a) use or employ, in connection with issue, purchase or sale of any security listed or proposed to be listed in a

recognized stock exchange, any manipulative or deceptive device or contrivance in contravention of the provisions of

this Act or the rules or the regulations made thereunder;

(b) employ any device, scheme or artifice to defraud in connection with issue or dealing in securities which are listed

or proposed to be listed on a recognised stock exchange;

(c) engage in any act, practice, course of business which operates or would operate as fraud or deceit upon any

person, in connection with the issue, dealing in securities which are listed or proposed to be listed on a recognised

stock exchange, in contravention of the provisions of this Act or the rules or the regulations made thereunder;"

Regulation 3 of the PFUTP Regulations -

"3. Prohibition of certain dealings in securities

No person shall directly or indirectly

(a)

(b) use or employ, in connection with issue, purchase or sale of any security listed or proposed to be listed in a

recognized stock exchange, any manipulative or deceptive device or contrivance in contravention of the provisions of

the Act or the rules or the regulations made there under;

(c) employ any device, scheme or artifice to defraud in connection with dealing in or issue of securities which are

listed or proposed to be listed on a recognized stock exchange;

(d) engage in any act, practice, course of business which operates or would operate as fraud or deceit upon any

person in connection with any dealing in or issue of securities which are listed or proposed to be listed on a

recognized stock exchange in contravention of the provisions of the Act or the rules and the regulations made there

under."

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 12 of 14

"4. Prohibition of manipulative, fraudulent and unfair trade practices

(1) Without prejudice to the provisions of regulation 3, no person shall indulge in a fraudulent or an unfair trade

practice in securities.

(2) Dealing in securities shall be deemed to be a fraudulent or an unfair trade practice if it involves fraud and

may include all or any of the following, namely:

(k) an advertisement that is misleading or that contains information in a distorted manner and which may

influence the decision of the investors;

"

12. Since the conduct of Mr. Prashant Wasankar and his connected/related entities is not in the

interest of investors in the securities market, necessary action has to be taken against them

immediately, else it may lead to loss of investors trust in the securities market. I find that Mr.

Prashant Wasankar and his connected/related entities made unrealistic claims of high returns

as discussed earlier and by nature of their acts and omissions, they tried to solicit, entice and

induce investors to deal in securities. They also solicited and collected funds/deposits from

the public for making investment in securities market when they were not registered as an

intermediary with SEBI. As a regulator of the capital markets, SEBI has the duty to

safeguard the interest of the investors and protect the integrity of the securities market. I am

convinced that this is a case where effective and expeditious action is required to be taken

not only to prevent any further harm to investors but also to send a stern message to prevent

any person from indulging in acts as observed in this case.

13. In addition to the contraventions as mentioned above, WWML was found to be engaged in

fund mobilising activity from the public, through the issue of non-convertible preference

shares and as such vide an ad-interim ex-parte order dated July 31, 2014, Mr. Prashant

Wasankar and his connected/related entities were, inter alia, debarred from accessing the

securities market. In my view, repeated fraudulent acts and delinquent behaviour of these

entities does not bode well for the integrity, orderly development and smooth functioning of

the securities market.

14. Considering the above, I, in exercise of powers conferred upon me by virtue of section 19

read with sections 11(1), 11(4), 11B and 11D of the SEBI Act by way of this ex-parte order:

(i) direct Wasankar Wealth Management Limited (SEBI Stock Broker Registration no.

INB241474130, Sub-Broker Registration No. INS01A552636 and INS23A550931, and

Investment Adviser Registration No. INA000000219), Wasankar Investments (SEBI

Sub-Broker Registration No. INS236775719), Mr. Prashant Wasankar, Mr. Vinay

Wasankar, Ms. Mithila Wasankar, Mr. Abhijit Wasankar and Ms. Bhagyashree Wasankar

to cease and desist from undertaking the portfolio management activities or any

unregistered activity in the securities market, directly or indirectly, in any manner

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 13 of 14

whatsoever;

(ii) prohibit Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant

Wasankar, Mr. Vinay Wasankar, Ms. Mithila Wasankar, Mr. Abhijit Wasankar and Ms.

Bhagyashree Wasankar from mobilizing or pooling funds from its clients, other general

investors or public and from offering any portfolio management activities or any other

unregistered activity, in whatever form;

(iii) direct Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant

Wasankar, Mr. Vinay Wasankar, Ms. Mithila Wasankar, Mr. Abhijit Wasankar and Ms.

Bhagyashree Wasankar to immediately withdraw and remove all advertisements,

representations, literatures, brochures, materials, publications, documents, websites, etc.

in relation to the portfolio management activities or any unregistered activity in the

securities market;

(iv) direct Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant

Wasankar, Mr. Vinay Wasankar, Ms. Mithila Wasankar, Mr. Abhijit Wasankar and Ms.

Bhagyashree Wasankar to refund the monies so collected from their clients and other

investors in its various schemes alongwith income, profits or returns promised to them

under such schemes or interest at the rate of 10% per annum, whichever is higher, from

the date of investment till the date of refund, within a period of seven days from the date

of this order (i.e., by September 03, 2014) and submit a repayment report to SEBI in the

following format:

Sl.

No.

Name

of the

Client /

Investor

PAN of

Client /

Investor

Address

of

Client/

Investor

Refund Details

From To Amount

(`) Cheque

No./Demand

Draft/

NEFT

details

Name

of

Bank

Cheque

No./

Demand

Draft/

NEFT

details

(v) prohibit Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant

Wasankar, Mr. Vinay Wasankar, Ms. Mithila Wasankar, Mr. Abhijit Wasankar and Ms.

Bhagyashree Wasankar from transferring the funds/deposits mobilised from the clients

or other investors or from disposing of or alienating any asset that has been created from

the funds/deposits received from their clients or other investors for purposes other than

refund as directed hereinabove;

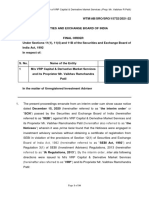

(vi) restrain the following entities from buying, selling or dealing in the securities market,

either directly or indirectly, in any manner whatsoever, till further directions:

Brought to you by http://StockViz.biz

Order in respect of Wasankar Wealth Management Limited and Mr. Prashant Wasankar Page 14 of 14

Sl. No. Name of the person / entity PAN

1. Wasankar Wealth Management Ltd. AAACW8073C

2. Mr. Prashant Wasankar (Wasankar

Investments)

AAIPW1864A

3. Mr. Vinay Wasankar AALPW3215A

4. Ms. Mithila Wasankar ANFPM0123J

5. Mr. Abhijeet J. Chaudhari AIUPC8611M

6. Ms. Bhagyashree Wasankar AALPW3274H

15. The above directions are without prejudice to the right of SEBI to take any other action that

may be initiated against Wasankar Wealth Management Limited, Wasankar Investments, Mr.

Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila Wasankar, Mr. Abhijeet Chaudhari and

Ms. Bhagyashree Wasankar and in accordance with law including the action in accordance

with section 12 of the SEBI Act, 1992 and the provisions of the SEBI (Intermediaries)

Regulations, 2008.

16. This order shall come into force with immediate effect. The stock exchanges and the

depositories are directed to ensure that the above directions are strictly enforced.

17. A copy of the Order shall also be forwarded to the Enforcement Department, the Financial

Intelligence Unit, the Economic Offences Wing and the Income Tax Department for taking

further necessary action at their end, if any.

18. The entities/persons against whom this Order is being passed may file their objections, if

any, within twenty one (21) days from the date of this Order and, if they so desire, may avail

themselves of an opportunity of personal hearing before the Securities and Exchange Board

of India at its Head Office at SEBI Bhavan, Plot No. C4-A, G Block, Bandra Kurla

Complex, Bandra (East), Mumbai- 400051 on a date and time to be fixed on a specific

request in writing, to be received in this behalf from the entities/persons.

DATE: AUGUST 27

th

, 2014 RAJEEV KUMAR AGARWAL

PLACE: MUMBAI WHOLE TIME MEMBER

SECURITIES AND EXCHANGE BOARD OF INDIA

Brought to you by http://StockViz.biz

Vous aimerez peut-être aussi

- Annuity and Perpetuity HandoutsDocument3 pagesAnnuity and Perpetuity HandoutsKen AguilaPas encore d'évaluation

- Statement)Document10 pagesStatement)Dilli Kumar ChokkalingamPas encore d'évaluation

- Resignation and F&F Process Ver1.0Document7 pagesResignation and F&F Process Ver1.0Piyush SinhaPas encore d'évaluation

- Property - 493 Balite Vs LimDocument5 pagesProperty - 493 Balite Vs LimXing Keet LuPas encore d'évaluation

- Major Bank Fraud Cases: A Critical ReviewD'EverandMajor Bank Fraud Cases: A Critical ReviewÉvaluation : 4.5 sur 5 étoiles4.5/5 (6)

- Order in The Matter of M/s Weird Infrastructure Corporation Ltd.Document14 pagesOrder in The Matter of M/s Weird Infrastructure Corporation Ltd.Shyam SunderPas encore d'évaluation

- Hacking: Don't Learn To Hack - Hack To LearnDocument26 pagesHacking: Don't Learn To Hack - Hack To Learndineshverma111Pas encore d'évaluation

- Swot AnalysisDocument21 pagesSwot AnalysisEvan SenPas encore d'évaluation

- STFC NCD ProspectusOCT 13 NCDDocument47 pagesSTFC NCD ProspectusOCT 13 NCDPrakash JoshiPas encore d'évaluation

- Western Union PDFDocument40 pagesWestern Union PDFRobin Hoodxii100% (1)

- Islamic Banking And Finance for Beginners!D'EverandIslamic Banking And Finance for Beginners!Évaluation : 2 sur 5 étoiles2/5 (1)

- Order in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarDocument6 pagesOrder in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarShyam SunderPas encore d'évaluation

- Interim Order in The Matter of Real Vision International Limited.Document13 pagesInterim Order in The Matter of Real Vision International Limited.Shyam SunderPas encore d'évaluation

- Interim Order in The Matter of VPS Advisory Services - PMS ActivitiesDocument13 pagesInterim Order in The Matter of VPS Advisory Services - PMS ActivitiesShyam SunderPas encore d'évaluation

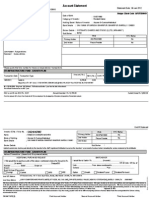

- Account Statement: Unique Client Code:MFUTIB0049Document1 pageAccount Statement: Unique Client Code:MFUTIB0049Saurabh ShankhdharPas encore d'évaluation

- Order in The Matter of Yash Dream Real Estate LTDDocument16 pagesOrder in The Matter of Yash Dream Real Estate LTDShyam SunderPas encore d'évaluation

- Mannapuram Application Form DetailsTNCDocument47 pagesMannapuram Application Form DetailsTNCTejas Pradyuman JoshiPas encore d'évaluation

- Order Against Infinity Realcon LimitedDocument18 pagesOrder Against Infinity Realcon LimitedShyam SunderPas encore d'évaluation

- Interim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedDocument16 pagesInterim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedShyam SunderPas encore d'évaluation

- 1674028336-9254-2019-HI Quality FoodDocument8 pages1674028336-9254-2019-HI Quality FoodArulnidhi Ramanathan SeshanPas encore d'évaluation

- Order in The Matter of Asurre Agrowtech LimitedDocument44 pagesOrder in The Matter of Asurre Agrowtech LimitedShyam SunderPas encore d'évaluation

- Order in The Matter of Prism Infracon LimitedDocument15 pagesOrder in The Matter of Prism Infracon LimitedShyam SunderPas encore d'évaluation

- Interim Order in The Matter of Eris Energy LimitedDocument15 pagesInterim Order in The Matter of Eris Energy LimitedShyam SunderPas encore d'évaluation

- In Respect of Promotech Infratech Limited, Its Directors MR - Anukul Maiti, SMT - Kanika Maiti, MR - Swapan Roy, MR - Samar Mustafi and MR - Atanu Halder and Its Debenture Trustee MR - Pulak RoyDocument23 pagesIn Respect of Promotech Infratech Limited, Its Directors MR - Anukul Maiti, SMT - Kanika Maiti, MR - Swapan Roy, MR - Samar Mustafi and MR - Atanu Halder and Its Debenture Trustee MR - Pulak RoyShyam SunderPas encore d'évaluation

- Order in The Matter of Shree Sai Spaces Creations LimitedDocument20 pagesOrder in The Matter of Shree Sai Spaces Creations LimitedShyam SunderPas encore d'évaluation

- Interim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedDocument11 pagesInterim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedShyam SunderPas encore d'évaluation

- Interim Order in The Matter of Vishwamitra International Infra LimitedDocument29 pagesInterim Order in The Matter of Vishwamitra International Infra LimitedShyam SunderPas encore d'évaluation

- Interim Order Cum Show Cause Notice in The Matter of Swasata Cement LimitedDocument14 pagesInterim Order Cum Show Cause Notice in The Matter of Swasata Cement LimitedShyam SunderPas encore d'évaluation

- Final Order in The Matter of VRP Capital & Derivative Market Services (Prop. Mr. Vaibhav R Patil)Document16 pagesFinal Order in The Matter of VRP Capital & Derivative Market Services (Prop. Mr. Vaibhav R Patil)Pratim MajumderPas encore d'évaluation

- HassanDocument17 pagesHassanDiv SinghPas encore d'évaluation

- Wa0010.Document16 pagesWa0010.sujikannan792Pas encore d'évaluation

- Interim Order in Respect of Ambitious Diversified Projects Management LimitedDocument15 pagesInterim Order in Respect of Ambitious Diversified Projects Management LimitedShyam SunderPas encore d'évaluation

- Ecurities and Xchange Oard of Ndia Umbai RderDocument31 pagesEcurities and Xchange Oard of Ndia Umbai Rderradhikabihani18Pas encore d'évaluation

- New Pension Scheme For Staff Members: Axis BankDocument9 pagesNew Pension Scheme For Staff Members: Axis BankBavya MohanPas encore d'évaluation

- WTM/AB/WRO/WRO/14741/2021-22: Final Order in The Matter of Cash Cow Broking & Advisory SolutionsDocument20 pagesWTM/AB/WRO/WRO/14741/2021-22: Final Order in The Matter of Cash Cow Broking & Advisory SolutionsAarnav SinghPas encore d'évaluation

- Interim Order Cum Show Cause Notice in The Matter of BNP Real Estate and Allied LimitedDocument18 pagesInterim Order Cum Show Cause Notice in The Matter of BNP Real Estate and Allied LimitedShyam SunderPas encore d'évaluation

- Prospectus MT PR UscDocument362 pagesProspectus MT PR Uschakimali45Pas encore d'évaluation

- Order Against M/s Sai Praksah Properties Development Ltd. and Its Directors/promotersDocument22 pagesOrder Against M/s Sai Praksah Properties Development Ltd. and Its Directors/promotersShyam SunderPas encore d'évaluation

- Ad Interim Ex-Parte Order in The Matter of Blue Chip Corporation Pvt. Ltd.Document23 pagesAd Interim Ex-Parte Order in The Matter of Blue Chip Corporation Pvt. Ltd.Shyam SunderPas encore d'évaluation

- Interim Order in The Matter of Sukhchain Hire Purchase LimitedDocument18 pagesInterim Order in The Matter of Sukhchain Hire Purchase LimitedShyam SunderPas encore d'évaluation

- Prospectus of Shahjibazar Power Co - LTDDocument101 pagesProspectus of Shahjibazar Power Co - LTDMainul HasanPas encore d'évaluation

- Interim Order - Cell Industries LimitedDocument16 pagesInterim Order - Cell Industries LimitedShyam SunderPas encore d'évaluation

- Interim Order in The Matter of Ms Kassa Finvest Private LimitedDocument8 pagesInterim Order in The Matter of Ms Kassa Finvest Private LimitedShyam SunderPas encore d'évaluation

- The Aforesaid Noticees Are Hereinafter Referred To by Their Respective Name / Noticee Number and Collectively Referred To As "Noticees", Unless The Context Specifies OtherwiseDocument41 pagesThe Aforesaid Noticees Are Hereinafter Referred To by Their Respective Name / Noticee Number and Collectively Referred To As "Noticees", Unless The Context Specifies OtherwisePratim MajumderPas encore d'évaluation

- Order in The Matter of Suvidha Farming and Allied Ltd.Document24 pagesOrder in The Matter of Suvidha Farming and Allied Ltd.Shyam SunderPas encore d'évaluation

- Form Ca Submission of Claim by Financial Creditors in A ClassDocument2 pagesForm Ca Submission of Claim by Financial Creditors in A ClassSuraj SawantPas encore d'évaluation

- NTPCTax Free Bonds Prospectus September 172015 FinalDocument832 pagesNTPCTax Free Bonds Prospectus September 172015 FinalKTSivakumar100% (1)

- Kosamattam Finance Limited Prospectus AprilDocument287 pagesKosamattam Finance Limited Prospectus Aprilmehtarahul999Pas encore d'évaluation

- ICICI Econet Internet and Technology Fund and Ors CB202108072116401927COM941408Document72 pagesICICI Econet Internet and Technology Fund and Ors CB202108072116401927COM941408Huzaifa SalimPas encore d'évaluation

- Interim Order in The Matter of Neesa Technologies LimitedDocument14 pagesInterim Order in The Matter of Neesa Technologies LimitedShyam SunderPas encore d'évaluation

- 1677472997-Ita 1063-22 DevampalayamDocument11 pages1677472997-Ita 1063-22 DevampalayamArulnidhi Ramanathan SeshanPas encore d'évaluation

- Bar Council Circular Related To Loan SchemeDocument3 pagesBar Council Circular Related To Loan SchemeKunchapu Vishnu VardhanPas encore d'évaluation

- Interim Order in The Matter of Neesa Technologies LimitedDocument14 pagesInterim Order in The Matter of Neesa Technologies LimitedShyam SunderPas encore d'évaluation

- United Western Bank - FinacialDocument219 pagesUnited Western Bank - FinacialMadhvi Patel NiranjanPas encore d'évaluation

- Mansi Patil Pancard Claim LimitedDocument2 pagesMansi Patil Pancard Claim LimitedHemant PatilPas encore d'évaluation

- Ann 10 01 2023Document4 pagesAnn 10 01 2023Istamsetty HanumantharaoPas encore d'évaluation

- Order in The Matter of Seashore Securities Ltd.Document17 pagesOrder in The Matter of Seashore Securities Ltd.Shyam SunderPas encore d'évaluation

- IobDocument98 pagesIobPrem KumarPas encore d'évaluation

- Noticee No. 1 Firm: Final Order in The Matter of Right Target Advisory ServicesDocument28 pagesNoticee No. 1 Firm: Final Order in The Matter of Right Target Advisory ServicesPratim MajumderPas encore d'évaluation

- Interim Order in The Matter Siyaram Development and Construction Ltd.Document17 pagesInterim Order in The Matter Siyaram Development and Construction Ltd.Shyam SunderPas encore d'évaluation

- Interim Order - Vikdas Industries LimitedDocument15 pagesInterim Order - Vikdas Industries LimitedShyam SunderPas encore d'évaluation

- DWDDocument2 pagesDWDCrystal EricksonPas encore d'évaluation

- Order in Respect of Greater Kolkata Infrastructure LimitedDocument19 pagesOrder in Respect of Greater Kolkata Infrastructure LimitedShyam SunderPas encore d'évaluation

- Ingvysya 1Document235 pagesIngvysya 1Prathyusha KoguruPas encore d'évaluation

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaD'EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Accounting 1 by HaroldDocument392 pagesFinancial Accounting 1 by HaroldRobertKimtaiPas encore d'évaluation

- IFCI Long Term Infra Bonds Application FormDocument2 pagesIFCI Long Term Infra Bonds Application FormPrajna CapitalPas encore d'évaluation

- Account STMTDocument2 pagesAccount STMTnazim.civilengrPas encore d'évaluation

- Chapter-5 Exchange Control in IndiaDocument2 pagesChapter-5 Exchange Control in IndiapravinsankalpPas encore d'évaluation

- Madina Book1 Arabic TextDocument7 pagesMadina Book1 Arabic TextChetan ChoudharyPas encore d'évaluation

- Cityam 2011-09-19Document36 pagesCityam 2011-09-19City A.M.Pas encore d'évaluation

- DicgcDocument11 pagesDicgcPranav ShahPas encore d'évaluation

- WWW TSPSC Gov inDocument22 pagesWWW TSPSC Gov inrameshPas encore d'évaluation

- CBSE Class 12 Reconstitution of PartnershipDocument7 pagesCBSE Class 12 Reconstitution of Partnershipajay yadavPas encore d'évaluation

- Sabarimala Up Ticket 2Document1 pageSabarimala Up Ticket 2Ravi PattabiramanPas encore d'évaluation

- Review Topic 8 PowerPoint IIDocument17 pagesReview Topic 8 PowerPoint IIValeria L. GiliPas encore d'évaluation

- Atty. Leon L. Asa, Et Al. vs. Atty. Pablito M. Castillo, Et AlDocument16 pagesAtty. Leon L. Asa, Et Al. vs. Atty. Pablito M. Castillo, Et AljafernandPas encore d'évaluation

- Water and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriaDocument4 pagesWater and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriakabirPas encore d'évaluation

- Sample Credit Control PolicyDocument21 pagesSample Credit Control PolicyMozitomPas encore d'évaluation

- Banfield Financial Documents 2 - 15 - 2024Document3 pagesBanfield Financial Documents 2 - 15 - 2024yourphdjPas encore d'évaluation

- UPI Swan294 ID Number 5421939 Group Number 17Document12 pagesUPI Swan294 ID Number 5421939 Group Number 17Suyangzi WangPas encore d'évaluation

- National Bank of PakistanDocument2 pagesNational Bank of PakistanAiman MaqsoodPas encore d'évaluation

- 11 November-2016 PDFDocument269 pages11 November-2016 PDFrahulPas encore d'évaluation

- Correction of Errors and The Suspense Account: Basic Transaction Used For Examples BelowDocument7 pagesCorrection of Errors and The Suspense Account: Basic Transaction Used For Examples BelowKashifntcPas encore d'évaluation

- 300+ REAL TIME E-Banking Objective Questions & AnswersDocument31 pages300+ REAL TIME E-Banking Objective Questions & Answersbarun vishwakarmaPas encore d'évaluation

- Final Year Project Chapter 2Document5 pagesFinal Year Project Chapter 2Vincent JaiPas encore d'évaluation

- Minicase - Term Structure Interest RateDocument2 pagesMinicase - Term Structure Interest RateTho ThoPas encore d'évaluation

- RatingsScale 2008 PDFDocument13 pagesRatingsScale 2008 PDFPradeep272Pas encore d'évaluation

- BRM ProjectDocument58 pagesBRM ProjectKirti BafnaPas encore d'évaluation

- "Role of SBI in The Indian Banking Sector" Presented By:-Karan Patel-201104100710010 Jignesh Mehta-201104100710048Document10 pages"Role of SBI in The Indian Banking Sector" Presented By:-Karan Patel-201104100710010 Jignesh Mehta-201104100710048Jignesh MehtaPas encore d'évaluation