Académique Documents

Professionnel Documents

Culture Documents

Accounting and Performance Review

Transféré par

hellome11291Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

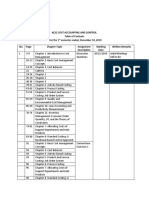

Accounting and Performance Review

Transféré par

hellome11291Droits d'auteur :

Formats disponibles

Executive Summary

The aim of this study is to present a detailed analysis of Tate and Lyle companys

performance over the last two years from an investors perspective. The analysis will be

done for the years 2012 and 2013 with the help of certain ratios that will assess its

profitability, debt to equity, liquidity and the overall performance of the company.

The financial performance of Tate and Lyle has not been promising in 2013 although the

revenue increased by 5.4%. Increased costs due to inefficient cost structure or inefficient

operations wiped the increased revenue and company reported a decrease in net profit

which fell by almost 2%. Further, the decrease in liability were off set by a larger decrease

in assets which further impacted the current ratio, quick ratio, return on assets etc. Tate

and Lyle has significant debts outstanding which may put additional pressure on the

company as it has to honour its debt payments irrespective of the financial performance.

In a nutshell, Tate and Lyle has performed compared to its competitors in industry on

certain parameters, however, its performance could have been better. It has continued to

manage the expectations of its shareholders by distributing increasing dividends on an

annual basis to its shareholders which is not normal particularly in food industry where

smaller dividends are paid.

Company brief

Tate and Lyle Plc is a multinational business based in the United Kingdom. It is listed on

the London Stock Exchange and it is also a FTSE 250 Index company. The company

came into existence in mid 1921 when two competitive sugar refineries Henry Tate & Sons

and Abram Lyle & Sons merged. The owners of two refineries were bitter rivals however

close proximity of their refineries were sighted as one of the key reasons for merger post

their deaths.

Tate and Lyle has two primary business units - Speciality Food Ingredients and Bulk

Ingredients. These two revenue generating segments are supported by innovation and

commercial development unit which drives long term growth and research within the group

(https://www.tateandlyle.com). The diagram below describes the structure of business

segments for Tate and Lyle.

Page of 1 20

In 2010, the company sold its European arm of sugar business to American giant for 1.2

billion resulting in cash surplus (Article published on FT.com). This sale resulted in a fresh

boom in share price after it had stagnated for many years. Further, outpouring some of the

key business functions including IT, Finance and Payroll to Poland resulted in substantial

cost savings and better business administration which further boosted the confidence

among investors resulting in share price growth.

Year 2013 brought some remarkable victories and significant increase in share prices for

Tate and Lyle with two major events. The company became a pioneer in manufacturing

high quality oats glucan without the use of chemicals, which had wide health benefits.

Also, it acquired majority shares in a Chinese food systems business that has given the

company a significant edge over its competitors in producing high quality cost efficient

products.

Page of 2 20

Figure 1, source: Tate and Lyle PLC Annual Report and Accounts 2013; pg 37

Investors Ratio Analysis

An analysis of the ratios important from investors point of view is carried out in this

section. The detailed calculations are presented in the appendix at the end of the report

and graphical representation of the ratios is presented here for reading convenience.

I. Revenue Ratios

The profitability ratios describes how much profit the company earned for every pound

spent. It explains the margin a company has on its sale and it is a good indicator to assess

its competitiveness in the market. The diagram below shows Tate and Lyles revenue over

the last five years and its net profit and operating margin in 2013:

-

Net Profit Margin

As per Albrecht, Steve, Stice and et al., Net profit margin provides clues to the company's

pricing policies, cost structure and production efficiency (2005, pp: 23). A lower margin

signals a small safety margin, which means reduction in sales may wipe out profits and

lead to net loss. Tate and Lyles net income fell by 10.28% despite a 5.44% gross revenue

increase (from 3,088 million in 2012 to 3,258 million in 2013). The reduced net profit

was a result of significant increase in operating costs which almost wiped out companys

profits.

This resulted in a decrease in net profit margin to 8.35% in 2013 from 9.88% in 2012. Also,

compared to the industry net profit margin of 9.3%, Tate and Lyles margin is less which

may be due to inefficient cost structure, production process or distribution channels. The

company should work towards optimum utilisation of its resources to increase net profit

margin and cash flow.

Page of 3 20

Gross Margin -

Net prot margin 8.35

Operating margin 10.26

-

Operating Margin

Operating profit margin measures what proportion of a company's revenue is left over,

after deducting direct costs and overhead and before taxes and other indirect costs such

as interest (Zane, Kane and Marcus, 2004, pp: 459). Tate and Lyles operating profit

margin decreased by 17.33% (from 404 million in 2012 to 334 million in 2013). As the

sales revenue and operations of the company grew, ideally the fixed costs and overheads

should have resulted in a smaller fraction of the total costs resulting in an operating profit

margin increase. However, the opposite occurred for the company. Compared to the

industry average of 13.24%, Tate and Lyles operating profit margin of 10.26% is

significantly low signalling a higher burden of fixed and other costs on sale which is not

healthy for the organisation.

II. Protability Ratios

Profitability ratios are, a class of financial metrics that are used to assess a business's

ability to generate earnings as compared to its expenses and other relevant costs incurred

during a specific period of time (Gary, 2000, pp: 47). Generally, a firms ratios are

compared with that of competitors ratio or its own previous periods ratios to analyse how

well the firm is performing. The diagram below shows Tate and Lyles net income over the

last five years and percentage of return on assets, equity and investment in year 2013.

-

Return on Assets (ROA)

Return on Assets gives an idea as to how efficient management is at using its assets to

generate earnings (Douglas, 1998, pp: 81). The net income in 2013 fell by 10.82% for Tate

and Lyle which resulted in a 1.34% decrease in the ROA to become 9.16% in 2013. The

decrease in ROA can be attributed to decrease in operating income by 10.28% and the net

Page of 4 20

Return on assets -

Return on equity 26.29

Return on investment 11.61

assets also decreased by 4.09% in 2013. Further, compared to the average industry return

of 13.84%, Tate and Lyles return is lower at 9.16% which indicates that compared to its

competitors the company is not able to better utilise its assets to generate more cash,

despite being larger than many competitors and multinational operations.

-

Return on Equity (ROE)

This ratio is widely used by investor community. It measures the earning performance of a

company. As per Houston, Joel and Eugene, it measures a firm's efficiency at generating

profits from every unit of shareholders' equity (2009, pp: 90). Tate and Lyles ROE is

26.29% in 2013, almost 4% lower from 2012 at 30.76%. Generally a ROE figure of

between 15% and 20% is considered promising for investing in a company. And therefore,

Tate and Lyles ROE of 26% is above average and signals a good investment opportunity

for investors.

However, compared to 2013, the ROE in 2012 stood significantly higher at 30% (debt is

not considered for calculating this ratio). A closer analysis of the balance sheet revealed

that in 2012 debt element was higher which was reduced in 2013. This reduced debt

played a role in reporting higher ROE figure for 2012 which was subsequently reduced as

the debt was partially paid and equity was increased. Hence, considering Tate and Lyles

ROE in isolation may not reflect the true picture and should be interpreted on the basis of

its debt-equity proportion.

-

Return on Investment (ROI)

ROI is one of the most common yardstick for investors to assess the company. According

to Kaplan, Robert and Bruns, the purpose of the ROI metric is to measure, per period,

rates of return on money invested in an organisation to decide whether or not to undertake

an investment or if funds are already invested to assess its performance (1987, pp: 129).

The ROI for Tate and Lyle increased from 10.96% in 2012 to 11.61% in 2013 mainly due to

availability of funds for distribution as dividend. The increase in revenue and improved

operational efficiency resulted in higher payout to shareholders which is a positive sign for

the business. Generally, ROI for the industry stands closer to 5% as many food

manufacturers pay less dividends. Hence, almost the double rate of dividend payment

should attract investors towards Tate and Lyle. It is important to note here that increase in

ROI due to higher margins may affect the sales as this industry is highly competitive.

Hence, firms generally rely on better ROA to strengthen profitability.

Page of 5 20

III. Growth Ratios

As the name suggests, the growth ratio indicates the rate at which a firm is growing. The

most common and important ratios are Dividend per share and Earning per share .

-

Dividend per Share (DPS)

Dividends per share are the amount of dividends that a publicly-traded company pays per

share of common stock, over their reporting period, that they have issued (Mocciaro,

Picone & Min, 2012, pp: 91). It is interesting to note here that some firms do not pay

dividends instead reinvest the profits in the business to grow it further. Year on year growth

of approximately 5.22% in dividends for Tate and Lyle is a promising trend as only few

firms in food processing industry pay dividends.

Also, a steady increase in dividend over years reflects continuous growth in the company.

A reduction in amount of dividend per share may signal firms poor financial performance

and many investorss may sell their shares out of fear for losing their money. Additionally,

DPS for the last five years when annualised is in-line with the industry average for Tate

and Lyle. The diagram below shows Tate and Lyles DPS over the last five years.

-

Earnings per Share (EPS) and Price-Earning Ratio (P/E)

EPS is the pound value of earnings per each outstanding share of a company's common

stock (Weygandt, Kieso, & Kell, 1996, pp: 801). The EPS for Tate and Lyle fell by 15.92%

in the year 2013 compared to that of in 2012 (from 0.64 EPS in 2012 to 0.54 EPS in

2013). The fall correspondents to decrease in net income by 10.82% and issuance of

additional equity shares in 2013.

Page of 6 20

On the other hand, the P/E ratio indicates the level of premium investors are willing to pay

for a stock. The P/E ratio also includes the future growth expectations. As a result, a low

P/E suggests that the investors are not willing to pay a premium for the stock whereas a

high P/E ratio suggests payment of premium for shares which may be based on future

potential earnings. The P/E ratio of 11% in 2013 was a result of almost 20% increase in P/

E for 2012 i.e. 9%. This could be potentially due to the fact that Tate and Lyle signed a joint

venture deal with a Chinese company which could potentially mean lower cost of

production and higher profits in future.

In a nutshell, lower EPS in one year should not be analysed in isolation and other factors

such as DPS and P/E ratio should also be considered before taking investment decisions.

The growth ratios for Tate and Lyle looks healthy and investor friendly.

IV. Liquidity Ratios

Liquidity ratio represents a firms ability to honour it short term debts obligations. From an

investors perspective higher the value of liquidity ratio, better the safety margin of that

Generally, the higher the value of the ratio, the larger the margin of safety that the firm to

pay off its short term debts (Kaplan, Robert and Bruns, 1987). The key liquidity ratios

include current ratio and quick ratio. The diagram below represents the current and quick

ratio for Tate and Lyle over five years with values calculated for 2013:

Page of 7 20

-

Current ratio

The current ratio is an indication of a firm's market liquidity and ability to meet creditor's

demands (Albrecht, Steve, Stice and et al., 2005, pp: 29). Although the acceptable value

of this ratio differs from sector to sector, normally values between 1.5 and 2.5 are

considered healthy. Value less than 1 may signal firms inability to meet its short term debt

obligations whereas values above 3 indicates inefficient use of firms current assets of

short term financing facilities.

The current ratio for Tate and Lyle for 2013 is 2.41 times which is higher than 2012s figure

of 2.25 times. Although the absolute value of total assets is declining steadily over the

years, it does not raise alarm as the liabilities are reducing faster that increase in the

assets. Tate and Lyles current ratio is better than that of its industry counterparts which

stands at 1.89 times. This can be partially due to efficient management of its assets and

repayment of its debts in recent financial year. However, the company should be careful as

any further increase in the value of its current ratio may signal inefficient use of financing

facilities.

-

Quick ratio

As per Houston, Joel and Eugene, Quick ratio measures the ability of a company to use

its near cash or quick assets to extinguish or retire its current liabilities immediately (2009,

pp: 97). A ratio of less than 1 suggest that firm can not meet its short term debt obligations.

Tate and Lyles quick ratio is 1.78 lower than 1.98 which was the ratio for 2012. Although

the quick ratio has decreased in a years time, it is still healthy and particularly when

compared to industry average of 1.25, Tate and Lyle has an encouraging quick ratio.

However, quick ratio should not be the sole basis for making investment decisions as it

does not give a full picture about firms health. For example, if debtors are due after 180

days but operational expenses and creditors are due for immediate payment, quick ratio

may suggest that firm is in good health whereas in reality it may be running of cash. To

summarise, Tate and Lyles quick ratio seems healthy and balanced.

Page of 8 20

V. Debt to Equity Ratio

Debt to Equity ratio refers to measure of a company's financial leverage calculated by

dividing its total liabilities by stockholders' equity representing the proportion of equity and

debt used by a company to finance its assets (Zane, Kane and Marcus, 2004, pp: 468). It

is a benchmark to assess what quantum of debt a firm has undertaken versus equity

issuance. Generally, debt to equity ratio between 0.5 and 2.0 is considered healthy. Tate

and Lyles ratio is 0.83 which is significantly lower from 2012s figure of 0.93 times. The

improvement is primarily due to repayment of partial debt and issuance of new shares in

the year 2013.

Also, compared to food processing industrys average ratio of 2.68, Tate and Lyles ratio is

much better. This signals that the company has wisely managed its financial requirements.

Firms with high debt to equity ratio are considered vulnerable to changes in business

cycles as it has to meet its debt obligations irrespective of the sales levels. Whereas a

larger proportion of equity adds confidence to investors for it is considered as a measure

of financial strength.

Activity Based Costing (ABC)

ABC is a costing methodology that identifies activities in an organisation and assigns the

cost of each activity with resources to all products and services according to the actual

consumption by each (Weston, 1990, pp: 295). An ABC system establishes a relationship

between difference parameters such as products, costs and activities. And based on this

relationship allocates indirect costs which can not be generally identified to a particular

cost centre to products more logically than conventional costing methods (Hicks, 1998).

Page of 9 20

Key components of ABC

The key component of this method of costing is identification of critical activities or cost

drivers. According to Weygandt, Kieso, & Kell, ABC involves matching costs with activities

(called cost drivers) that cause those costs (1996, pp: 835).

The underlying principles of ABC are:

-

Activities are the result of product manufacturing/ service offering

-

Activities are responsible for consuming resources and not products

-

Activities drive costs

-

Activities are not classified based on production volume. Instead of assigning costs to

traditional cost centres such as finance, administration, marketing and manufacturing,

ABC assigns costs both direct and indirect to various organisational activities such as

setting up a machine, resolving customer complaints, order processing etc.

The importance of ABC has grown in past few years due to

-

Significant increase in production costs and overheads

-

Production costs can no longer be bifurcated based on machine hours or direct labour

hours

-

Product ranges have grown and there are more diverse range than ever before

-

Customers demands have grown diversely and manufacturing wide range of one

product is common

-

There are no standard batch manufacturing system i.e. some products are bulk

produced, while many others are manufactured in small quantities

Conventional Costing

The traditional approach to allocating costs comprises of three steps which includes

accumulating costs within a unit, apportioning the non -production cost to production units

and allocating the updated costs to final products/ services or the end customers

(Mocciaro, Picone & Min, 2012).The costs allocated to various processes using traditional

costing may many a times provide distorted picture for the decision making and it may not

reflect the true cost level. For example, the traditional costing system allocates the idle

capacity of the machinery to products, as a result the costing of those products increased

due to resources that they did not use.

Page of 10 20

Analysing ABC and traditional costing techniques

Normally, manufacturing firms adopt traditional costing to assign production costs to the

units produced. Traditional costing uses one volume scale such as machine hours or direct

labour hours for assigning the costs to each unit. The downside of this approach is that

non manufacturing costs such as administrative and marketing costs are also allocated on

the basis of production overheads which may give a distorted picture as not all the

products would require same level of administrative or marketing activities (Weston, 1990).

In the current era, traditional systems are considered outdated for both manufacturing as

well as non manufacturing industries as sophisticated tools are available for better cost

allocation.

On the other hand, ABC follows a more systematic and logic process to assign

manufacturing costs to products. As per Kaplan, Robert and Bruns, Unlike traditional

costing that simply assigns costs based on the machine work hours, the ABC assigns

costs first to the activities and processes that cause the overhead (1987, pp: 219). These

overheads are assigned only to those products that require performance of these

activities. To summarise, following are the key differences between the two types of

costing methods:

!

The traditional costing gives importance to the production structure instead of processes

whereas ABC assigns costs based on processes than on structure

!

The changing manufacturing sector and heavy use of advanced technology has made

use of traditional costing redundant and most large organisations and businesses adopt

ABC for appropriately assigning costs

!

Compared to traditional costing, the ABC assigns costs more accurately and logically

!

In traditional costing all types of products will be allocated same costs whether such

costs were needed for manufacturing the product or not. However, for ABC, only the

activities that were required for manufacturing the products will be assigned to the

product.

Impact of ABC costing

Implementing ABC is costly and complex. However, due to its advantages many big

organisations from both manufacturing as well as service industry are resorting to ABC as

it accurately allocates costs and provides a true profitability picture of products.

Page of 11 20

ABC can provide various benefits to firms and aid in strategic management decision

making process. As per Houston, Joel and Eugene, the basic role of ABC is to provide

management with detailed information for decision making so that management can better

streamline processes, eliminate waste, and reduce costs (2009, pp: 151). For ABC to be

successful, in-depth information about various products, their costs and profits should be

used for reducing wastes, un-necessitated costs and improving firms overall performance.

One of the key reasons for using ABC is increased use of technology which results in

significant indirect costs, which if allocated traditionally will result in distorted picture.

Further, inappropriate costing technique can result in substantial losses to organisations

due to inaccurate costing and product pricing, underestimating costs, non detection of

processes that are not productive etc.

Although, the initial cost involved in implementing ABC may stop many firms to adopt it, in

the long run it is better for understanding more accurate financial performance of the firm.

Further, due to its popularity, many computer softwares are being developed and marketed

which significantly reduce the cost of adoption. ABC enables organisations to focus on

profitable products and eliminate any non value adding activities and processes.

Furthermore, it plays a critical role in determining the pricing for each product accurately

which is important for deciding the minimum order size.

Adoption of ABC for Tate and Lyle

Tate and Lyle is divided into two key segments and many sub segments which focusses on

a specific product and offering. At the moment, it is using traditional method of costing for

allocating costs among various products which may provide a distorted picture. Hence, the

firm should adopt ABC for better understanding the performance of each product. Since it

is a public limited company, it has higher responsibility for giving accurate results and

accounts to its shareholders. At the same time, it will help the company to eliminate any

waste, non productive activities or loss making products. It will give a benchmark for

company to assess the accurate performance of its products, therefore switching to ABC

method of costing would be beneficial for company and it will also increase the confidence

of its shareholders as ABC is a logical and more accurate costing technique.

Page of 12 20

Conclusion

As per the analysis of Tate and Lyles financial performance and statements for the last

two years 2012 and 2013, it is clear that the firm has a mixed performance over the last

two years. Its revenue increased, however, its net income decreased which was primarily

attributed to the inefficient cost structure and operational inefficiency. The firms debt

reduced during the year whereas, the company issued new common stock to public. This

resulted in increased confidence from shareholders as firms reliance on debt reduced and

in times of financial difficulties, the company has lesser obligations to pay its debts. Also,

the company managed the expectations of its shareholders well with continuous

distribution of dividends which was higher compared to its competitors in the industry.

Also, the study about ABC and conventional costing techniques revealed that the former

technique of costing is better for allocating costs accurately and identifying non productive

activities in the production process. The costs can be logically divided between various

products based on the number of units, batch activities, product activities etc.

Organisations can assign indirect costs more accurately by adopting ABC method. Unlike

traditional costing, ABC enables firms to identify activities required for manufacturing a

product and apportion costs proportionate to the activities used. More importantly the

activity based analysis provides the basis for correcting the distortions which are inherently

present in the traditional costing techniques.

Adoption of ABC by Tate and Lyle could provide a better picture of each products

performance. Also, it could determine and apportion indirect costs more sophisticatedly

and systematically. ABC can provide deeper insights to the cost structure which may make

the firm competitive and provide an edge over competition. Therefore, Tate and Lyle

should switch to ABC as it can better assess performance of various products and

activities.

References

Albrecht, W. Steve, James D. Stice, Earl Kay Stice, and Monte Swain. Financial

Accounting. Thomson South-Western, 2005.

Page of 13 20

Bodie, Zane; Alex Kane and Alan J. Marcus (2004). Essentials of Investments, 5th ed.

McGraw-Hill Irwin. p. 459. ISBN 0-07-251077-3.

Cokins, Gary. "Overcoming the Obstacles to Implementing Activity-Based Costing." Bank

Accounting and Finance. Fall 2000.

Hicks, Douglas T. Activity-Based Costing: Making it Work for Small and Mid-Sized

Companies. 1998.

Houston, Joel F.; Brigham, Eugene F. (2009). Fundamentals of Financial Management.

[Cincinnati, Ohio]: South-Western College Pub. p. 90. ISBN 0-324-59771-1.

Kaplan, Robert S. and Bruns, W. Accounting and Management: A Field Study Perspective

(Harvard Business School Press, 1987) ISBN 0-87584-186-4

Lobo, Yane R.O., and Paulo C. Lima. "A New Approach to Product Development Costing."

CMAThe Management Accounting Magazine. March 1998.

Mocciaro Li Destri A., Picone P. M. & Min A. (2012), Bringing Strategy Back into Financial

Systems of Performance Measurement: Integrating EVA and PBC, Business System

Review, Vol 1., Issue 1. pp.85-102

Sapp, Richard, David Crawford and Steven Rebishcke "Article title?" Journal of Bank Cost

and Management Accounting (Volume 3, Number 2), 1990.

Tate and Lyle PLC Annual Report and Accounts 2013, retrieved from http://

www.tateandlyle.com/InvestorRelations/Documents/Annual%20Reports/Annual%20Report

%202013.pdf

Weygandt, J. J., Kieso, D. E., & Kell, W. G. (1996). Accounting Principles (4th ed.). New

York, Chichester, Brisbane, Toronto, Singapore: John Wiley & Sons, Inc. p. 801-802.

Weston, J. (1990). Essentials of Managerial Finance. Hinsdale: Dryden Press. p. 295.

ISBN 0-03-030733-3.

Page of 14 20

http://www.tateandlyle.com/

http://markets.ft.com/research/Markets/Tearsheets/Financials?s=TATE:LSE

Page of 15 20

Appendix

Page of 16 20

Page of 17 20

Page of 18 20

Figures in millions

Particulars 2013 2012

Revenue 3256 3088

Net Income 272 305

Net Prot Maargin 8.35% 9.88%

Operating Prot 334 404

Operating Prot Margin 10.26% 13.08%

Total Assets 2787 2906

ROA 9.16% 10.5%

Average Equity 1034.5 991.5

ROE 26.29% 30.76%

Total Debt 896 946

Total Equity 1036 1033

Debt to Equity 0.83 0.93

Page of 19 20

Particulars 2013 2012

Current Assets 1363 1389

Current Liabilities 590 691

Current Ratio 2.41 2.25

Quick Assets 1050 1136

Quick Ratio 1.78 1.98

Page of 20 20

Vous aimerez peut-être aussi

- Financial Analysis of Reliance Steel and Aluminium Co. LTDDocument4 pagesFinancial Analysis of Reliance Steel and Aluminium Co. LTDROHIT SETHIPas encore d'évaluation

- Danish - FinancialDocument5 pagesDanish - FinancialAtul GirhotraPas encore d'évaluation

- Costco Wholesale Corporation Financial AnalysisDocument14 pagesCostco Wholesale Corporation Financial Analysisdejong100% (1)

- Tunku Puteri Intan Safinaz School of Accountancy Bkal3063 Integrated Case Study FIRST SEMESTER 2020/2021 (A201)Document14 pagesTunku Puteri Intan Safinaz School of Accountancy Bkal3063 Integrated Case Study FIRST SEMESTER 2020/2021 (A201)Aisyah ArifinPas encore d'évaluation

- Star River - Sample ReportDocument15 pagesStar River - Sample ReportMD LeePas encore d'évaluation

- GIT - Principles of Managerial Finance (13th Edition) - Cap.3 (Pág.85-90)Document8 pagesGIT - Principles of Managerial Finance (13th Edition) - Cap.3 (Pág.85-90)katebariPas encore d'évaluation

- May 10 FA MAN2907L Marking SchemeDocument15 pagesMay 10 FA MAN2907L Marking SchemesidPas encore d'évaluation

- Assignment Next PLCDocument16 pagesAssignment Next PLCJames Jane50% (2)

- Financial Accounting and The Financial StatementsDocument10 pagesFinancial Accounting and The Financial StatementsRajiv RankawatPas encore d'évaluation

- Financial Analysis - Martin Manufacturing CompanyDocument15 pagesFinancial Analysis - Martin Manufacturing CompanydjmondiePas encore d'évaluation

- Ratio Analysis of P GDocument8 pagesRatio Analysis of P GSelebriti Takaful PerakPas encore d'évaluation

- Ratio Analysis of ITCDocument22 pagesRatio Analysis of ITCDheeraj Girase100% (1)

- Why Are Ratios UsefulDocument11 pagesWhy Are Ratios UsefulKriza Sevilla Matro100% (3)

- Profitability Turnover RatiosDocument32 pagesProfitability Turnover RatiosAnushka JindalPas encore d'évaluation

- 8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresDocument28 pages8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresNeeraj BhartiPas encore d'évaluation

- What Is Return On AssetsDocument5 pagesWhat Is Return On AssetsIndah ChaerunnisaPas encore d'évaluation

- 03 CH03Document41 pages03 CH03Walid Mohamed AnwarPas encore d'évaluation

- Vladi FAF Financial ReportDocument4 pagesVladi FAF Financial ReportVladi DimitrovPas encore d'évaluation

- Case Study 3Document13 pagesCase Study 3ArthurPas encore d'évaluation

- Analiza Premierfoods - Dec11Document3 pagesAnaliza Premierfoods - Dec11Tudor OprisorPas encore d'évaluation

- Article 2 Roe Breakd Dec 12 5pDocument5 pagesArticle 2 Roe Breakd Dec 12 5pRicardo Jáquez CortésPas encore d'évaluation

- CRaigielaw 3 With SolutionDocument3 pagesCRaigielaw 3 With SolutionSelin PusatPas encore d'évaluation

- Financial Statement Analysis of Target and TescoDocument15 pagesFinancial Statement Analysis of Target and TesconormaltyPas encore d'évaluation

- Financial Statement Analysis Tesco TargetDocument6 pagesFinancial Statement Analysis Tesco Targetnormalty100% (3)

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- DuPont Ratio AnalysisDocument3 pagesDuPont Ratio AnalysisNayan ChudasamaPas encore d'évaluation

- Common Size AnalysisDocument5 pagesCommon Size Analysissu2nil0% (2)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Pas encore d'évaluation

- Accounts AssignmentDocument15 pagesAccounts AssignmentAman SainiPas encore d'évaluation

- Star River Assignment-ReportDocument15 pagesStar River Assignment-ReportBlessing Simons33% (3)

- Ratio Analysis of Renata Limited PPPDocument32 pagesRatio Analysis of Renata Limited PPPmdnabab0% (1)

- Deconstructing Roe: Improving Efficiency An Important Parameter While Investing in CompaniesDocument5 pagesDeconstructing Roe: Improving Efficiency An Important Parameter While Investing in CompaniesAkshit GuptaPas encore d'évaluation

- Financial Accounting Week 11Document28 pagesFinancial Accounting Week 11Nashmia KhurramPas encore d'évaluation

- Dmp3e Ch05 Solutions 02.28.10 FinalDocument37 pagesDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1Pas encore d'évaluation

- Anamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaDocument24 pagesAnamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaAnamika ChakrabartyPas encore d'évaluation

- Return On AssetsDocument9 pagesReturn On AssetsKirsten MontefalcoPas encore d'évaluation

- Case No.4Document9 pagesCase No.4Dipali SinghPas encore d'évaluation

- Finance Henry BootDocument19 pagesFinance Henry BootHassanPas encore d'évaluation

- Mba Fa IV Sem 406 (B) Strategic Profit ModelDocument13 pagesMba Fa IV Sem 406 (B) Strategic Profit Model462- gurveen SinghPas encore d'évaluation

- Interpretations:: Return of Capital EmployedDocument3 pagesInterpretations:: Return of Capital EmployedabrashablePas encore d'évaluation

- Final Report - Jeema Modified - SangeethaDocument43 pagesFinal Report - Jeema Modified - SangeethaTisha ThomasPas encore d'évaluation

- Ratios NoteDocument24 pagesRatios Noteamit singhPas encore d'évaluation

- 24 AYC2 CompanyF2Document3 pages24 AYC2 CompanyF2adrien.graffPas encore d'évaluation

- Tata Motors Ratio AnalysisDocument12 pagesTata Motors Ratio AnalysisVasu AgarwalPas encore d'évaluation

- Final Project - FA Assignment Financial Analysis of VoltasDocument26 pagesFinal Project - FA Assignment Financial Analysis of VoltasHarvey100% (2)

- Financial AnalysisDocument8 pagesFinancial AnalysisNor Azliza Abd RazakPas encore d'évaluation

- SAR-MAR-210422-1227PM - RR - 034-COPY 1.editedDocument12 pagesSAR-MAR-210422-1227PM - RR - 034-COPY 1.editedJishnu ChaudhuriPas encore d'évaluation

- Ratio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesDocument3 pagesRatio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesSapcon ThePhoenixPas encore d'évaluation

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - SampleTestPas encore d'évaluation

- Topic 8ำำำำำำำำำำำำDocument5 pagesTopic 8ำำำำำำำำำำำำTaylor Kongitti PraditPas encore d'évaluation

- Royal Sun Alliance FIBD Report 2Document9 pagesRoyal Sun Alliance FIBD Report 2Amila Maduranga PereraPas encore d'évaluation

- Constellation Software Inc.: A. Historical Figures Restated To Comply With Revised DefinitionDocument8 pagesConstellation Software Inc.: A. Historical Figures Restated To Comply With Revised DefinitionsignalhucksterPas encore d'évaluation

- ACCO Brands Q2-Earnings Release - Final 07.31.13Document13 pagesACCO Brands Q2-Earnings Release - Final 07.31.13paolomcpakiPas encore d'évaluation

- Ratio AnalysisDocument11 pagesRatio Analysisdanita88Pas encore d'évaluation

- Promotion Development 2012 Annual ReportDocument76 pagesPromotion Development 2012 Annual ReportKristen NallanPas encore d'évaluation

- Common Size Analysis TOT: Click To EnlargeDocument7 pagesCommon Size Analysis TOT: Click To EnlargeWensen ChuPas encore d'évaluation

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Remodelers' Cost of Doing Business Study, 2020 EditionD'EverandRemodelers' Cost of Doing Business Study, 2020 EditionPas encore d'évaluation

- Chapter 6: Understanding Key Cost RelationshipsDocument19 pagesChapter 6: Understanding Key Cost RelationshipsShoaib ZaheerPas encore d'évaluation

- ABC AnalysisDocument8 pagesABC AnalysisSneha SinghPas encore d'évaluation

- Cost Accounting - Chapter 9Document2 pagesCost Accounting - Chapter 9JacePas encore d'évaluation

- Acma Assignment MaterialDocument12 pagesAcma Assignment MaterialHay Jirenyaa100% (8)

- SSRN Id644561Document12 pagesSSRN Id644561yoyo.yy614Pas encore d'évaluation

- ABC CostingDocument47 pagesABC CostingLina Levvenia RatanamPas encore d'évaluation

- Cost Accounting Name: - ActivitiesDocument2 pagesCost Accounting Name: - ActivitiesJosh AlvarezPas encore d'évaluation

- PDFDocument545 pagesPDFRenuka TekumudiPas encore d'évaluation

- WK 1 - Cost Accounting Techniques Part 1 - HandoutDocument27 pagesWK 1 - Cost Accounting Techniques Part 1 - HandoutEEPas encore d'évaluation

- CH 1 - Cost Management and StrategyDocument35 pagesCH 1 - Cost Management and StrategySuresh SelvamPas encore d'évaluation

- Multiple Choice QuestionsDocument23 pagesMultiple Choice QuestionsKim Audrey Jalalain0% (1)

- Case Study For Dakota Office Product (Suzi Revised1)Document27 pagesCase Study For Dakota Office Product (Suzi Revised1)Syarifah Nur Diana Abdul RashidPas encore d'évaluation

- Activity-Based Cost Systems For Manufacturing ExpensesDocument14 pagesActivity-Based Cost Systems For Manufacturing ExpensesJoão Paulo MilaneziPas encore d'évaluation

- Hilton MA 12e Chap005Document53 pagesHilton MA 12e Chap005Vân HảiPas encore d'évaluation

- Artikel ABM PDFDocument7 pagesArtikel ABM PDFmmmPas encore d'évaluation

- Appaloosa County Day Care Center Inc PDFDocument5 pagesAppaloosa County Day Care Center Inc PDFbashaePas encore d'évaluation

- Activity Based Costing, ABC AnalysisDocument19 pagesActivity Based Costing, ABC AnalysisLuis NashPas encore d'évaluation

- Ae22 Cost Accounting and Control-FinalsDocument4 pagesAe22 Cost Accounting and Control-FinalsAndriaPas encore d'évaluation

- Costing Methods: Syllabus Guide Detailed OutcomesDocument19 pagesCosting Methods: Syllabus Guide Detailed OutcomesLisa CorneliusPas encore d'évaluation

- Cost Accounting Hilton 6Document3 pagesCost Accounting Hilton 6vkdocPas encore d'évaluation

- Activity Based Costing Worked Example: Products TotalDocument8 pagesActivity Based Costing Worked Example: Products TotalAnn GelPas encore d'évaluation

- CAF 3 Activity Based Costing by Sir Saud Tariq ST AcademyDocument21 pagesCAF 3 Activity Based Costing by Sir Saud Tariq ST Academyrana hassan aliPas encore d'évaluation

- F5 Cenit Online Notes P1Document23 pagesF5 Cenit Online Notes P1Izhar MumtazPas encore d'évaluation

- Chapter 5 ABC CostingDocument19 pagesChapter 5 ABC CostingKarl Wilson GonzalesPas encore d'évaluation

- Rai BornDocument210 pagesRai BornJuliet Galupe AntimorPas encore d'évaluation

- Bab 2Document4 pagesBab 2imran sihalohoPas encore d'évaluation

- Activity Based Costing and ManagementDocument15 pagesActivity Based Costing and ManagementMark De JesusPas encore d'évaluation

- CA 06 - Activity-Based CostingDocument1 pageCA 06 - Activity-Based CostingJoshua UmaliPas encore d'évaluation

- Solution To WilkersonDocument5 pagesSolution To WilkersonChinee Natividad100% (2)

- Modern Approaches To ManagementDocument22 pagesModern Approaches To ManagementRunaway Shuji100% (1)