Académique Documents

Professionnel Documents

Culture Documents

Bussiness Analysis and Valuation

Transféré par

andrewkyler92Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bussiness Analysis and Valuation

Transféré par

andrewkyler92Droits d'auteur :

Formats disponibles

Bussiness Analysis and Valuation

Case Study 1

The Role of the capital market intermediaries in the Dot Com Crash of 2000

1) Objectives of the Case

This case presents to us the situation surrounding the initial growth of Tech

companies and their impact on the wall street during the hay days of the

internet boom and the eventual downfall and the circumstances leading up to

the dot com bust of 2000. One of the major objectives of this case study is to

present facts and realities about every major component in a successful business

endeavor i.e. right from the entrepreneurs who nurture the idea to the various

intermediaries who cast and mold it into a successful and well-functioning

business to the investors who gain from letting go their investments.

2) Observations from the case

3) Need for Intermediaries

Capital Markets primarily function to link institutions with need for funds to the

individual with need to invest but these markets can be huge for an individual

investor to meet the right kind of investment which matches his own

sensibilities. The absence of a right navigator to connect the individual and the

institution led to the evolution of intermediaries. They are of two type financial

intermediaries and information intermediaries. With these intermediaries

interests aligned with the profits of their customers a perfect stream of

information and financial services is created.

4) Consequence of intermediaries

In this particular case intermediaries played an important role as to how the

markets behaved during the time leading up to the bust. An in-depth analysis of

the case will show us how each intermediary influenced the market. Every

intermediary was involved in the expansion of the bubble knowingly and

unknowingly and paid heavily when the market corrected itself .

5) Who are the intermediaries stated in this case ?

Financial Intermediaries

a. Venture Capitalists

b. Investment bank underwriters

c. Sell- Side analyst

d. Buy side analyst and Portfolio Managers

Information Intermediaries

e. Accounting

f. FASB Regulator

6) The intended function of each

a. Venture Capitalist: These were the people who selected ideas which best could

be made into a profitable business franchise. They provide seed funding to kick

start a company. They help in establishing a dependable and high performance

management team. They guide and nurture these companies till they can stand

on their own two feet i.e. showing profits and ultimately going public. Being a VC

is a high risk high reward job which requires skimming through huge number of

ideas and be able to select the right one which could eventually pull of huge

profits for the VCs

b. Investment bank underwriters: When a company goes public these investment

banks act as financial consultants taking care of every job related to the IPO and

in turn take a cut from the total money raised. Hen huge investment banks back

these companies they find buyers for the IPOs from individuals and institution

alike. So in a way Investment banks buy the shares of a company for a short

while with a promise to sell it off to the open market at a predefined price.

c. Sell Side analyst: Sell Side analyst work with investment banks. They are tasked

with researching companies and providing with their recommendation. A high

profile and well respected analyst could single handedly decide the swing of the

market. They help during the IPO buy providing research and key information to

the buy side. This helps in creating public confidence in the IPO.

d. Buy Side analyst and Portfolio Managers: Portfolio managers work in huge

Mutual funds, Hedge funds and other such institution which manage a huge

amount of wealth. They make decisions about investments with the help of the

research and recommendation form the buy side analyst. A wrong decision by

these managers and analysts generally leads to huge losses for the investors.

e. Accounting: The accountants are the information intermediaries who provide to

the general public the current financial standing and health of the firm. Any

manipulation in the accounting practices leads to a conclusion which might be in

the favor of the company but may not be in favor of the investors. Incorrect

accounting practices could mean a wrongful portrayal of the company which

means cheating the investors.

f. FASB Regulators: To regulate the accounting practices we have the Financial

Accounting Standards Board (FASB) . The FASB pitches in during an accounting

dilemma and sets a general rule that is to be followed by all the auditors. FASB

reprimands inappropriate accounting practices and sets guidelines for future

auditing standards.

7) How each player is rewarded?

a. Venture Capitalist: They invest in the companies in nascent stage and in turn

own a percentage. If the company turns out to be profitable and goes public the

Venture Capitalists sell their ownership and move on to nurture the next big

idea.

b. Investment Bank Underwriters: After a successful IPO the investment banks take

a certain amount of the money raised (usually 7%) as fee.

c. Sell Side analyst: Sell side analyst are employed by the investment banks and are

paid according to the profitability of their recommendation and performance of

their selected stock.

d. Buy Side analyst and Portfolio Managers : Just like sell side analyst the buy side

analyst are paid according to the profitability of their recommendation and the

performance of their selected stock and the Managers rewards are tied up to the

actual performance of the fund

what consequences of the compensation function are?

The compensation for all the intermediaries depended upon how good the stock

performed. A positive response from the investors meant an influx of money for

the entrepreneurs, Venture capitalists, Investment bankers and every other

intermediary involved. A positive response shown by the market in the time

leading up to the bust was due to the high performance nature of the tech

stocks. Anybody who could not deliver a promising tech stock to the investors

was missing out on some serious chunk of cash flow for their clients. With the

intermediaries compensations tied down by the market they did everything to

yield positive results even if it meant venturing in the grey area of legality. Many

experts believe that this compensation relationship between the intermediaries

and the markets was the main reason for the dot com bubble crash of 2000

why is it that the high-priced intermediaries were so powerless to correct the behavior of the

individual investors

Most of intermediaries involved introducing the tech companies to the market

had a responsibility to see the long term repercussions along with the short term profits . The

high flying VCs chose to invest in companies with no proper management team and the

investment bankers backed companies without any revenue stream . The analyst both buy side

and sell side made recommendation based on the positive growths in their past without looking

at the current financial standings. Portfolio managers and Accountants presented a rosy picture

to the clients to yield immediate results and the regulators where not capable enough to

forecast the debacle caused by these intermediaries .

By the time the stock started trading at the exchange they were significantly above the par

value which attracted anybody with a little cash a lot of time to spare . This led to the advent of

the day traders . They lacked knowledge of the analysts and funds of an investment banker or a

portfolio manager. They traded based on market sentiments and gut feeling. As the number of

day traders increased the market swung in the direction of the sentiments of these uninformed

investors and huge intermediaries could only sit and watch. With major indices soaring at all

time high anybody pointing out at a possibility of a bubble was termed as a pessimist and

disregarded. In the dot com crash along with the intermediaries the investors were to be

equally blamed .

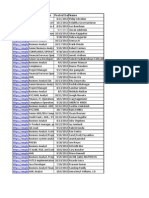

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Edelweiss - IIM CalcuttaDocument3 pagesEdelweiss - IIM CalcuttaPulkit SharmaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- EMBA ResumeBookDocument221 pagesEMBA ResumeBooknikunjhandaPas encore d'évaluation

- Case StudyDocument7 pagesCase StudyPayal PatelPas encore d'évaluation

- 2019 FinQuiz CFA Level II Smart Summaries PDFDocument267 pages2019 FinQuiz CFA Level II Smart Summaries PDFShivam Kapoor100% (2)

- Planning Strategy JP Morgan ChaseDocument26 pagesPlanning Strategy JP Morgan ChaseLaura Sofia Polo100% (1)

- No. 7 Investment Banking Spring Weeks PDFDocument7 pagesNo. 7 Investment Banking Spring Weeks PDFHasnainLakhaPas encore d'évaluation

- International Banking: © 2003 South-Western/Thomson LearningDocument36 pagesInternational Banking: © 2003 South-Western/Thomson LearningAbhishek AgarwalPas encore d'évaluation

- Chapter 3 Financial InstitutionsDocument38 pagesChapter 3 Financial InstitutionsLâm BullsPas encore d'évaluation

- UBS IBD Asia Pacific ViewDocument16 pagesUBS IBD Asia Pacific Viewvishwasmaheshwari10Pas encore d'évaluation

- FinalDocument42 pagesFinalumshzzPas encore d'évaluation

- ICICI Direct Balkrishna IndustriesDocument9 pagesICICI Direct Balkrishna Industriesshankar alkotiPas encore d'évaluation

- Calculadora Bonos en USD OnDocument198 pagesCalculadora Bonos en USD OnFrann ZanczukPas encore d'évaluation

- Govan Mbeki Municipality: General Valuation Roll (Sectional Title)Document72 pagesGovan Mbeki Municipality: General Valuation Roll (Sectional Title)WikusPas encore d'évaluation

- AqEx PitchDeck 20ainDocument25 pagesAqEx PitchDeck 20ainomidreza tabrizianPas encore d'évaluation

- Financial Services: Securities Brokerage and Investment BankingDocument16 pagesFinancial Services: Securities Brokerage and Investment BankingSta KerPas encore d'évaluation

- Star Publications (Malaysia) Berhad: Special Dividend Surprise - 13/10/2010Document2 pagesStar Publications (Malaysia) Berhad: Special Dividend Surprise - 13/10/2010Rhb InvestPas encore d'évaluation

- Kotak Mahindra TRAINING & DevelopmentDocument92 pagesKotak Mahindra TRAINING & Developmentprateek mishra86% (7)

- Zomato Limited IPO NoteDocument10 pagesZomato Limited IPO NoteAjish CJ 2015Pas encore d'évaluation

- Merchant Banking in IndiaDocument66 pagesMerchant Banking in IndiaNitishMarathe80% (40)

- Decision TreeDocument6 pagesDecision TreeNick SolankiPas encore d'évaluation

- Competitive Analysis of Stock Brokers ReligareDocument92 pagesCompetitive Analysis of Stock Brokers ReligareJaved KhanPas encore d'évaluation

- WSO Training Blur - 2Document10 pagesWSO Training Blur - 2mayorladPas encore d'évaluation

- Tugas 6 - Vania Olivine Danarilia (486211)Document5 pagesTugas 6 - Vania Olivine Danarilia (486211)Vania OlivinePas encore d'évaluation

- Marketview: A Global Perspective On Retail RevivalDocument6 pagesMarketview: A Global Perspective On Retail RevivalPrasad YadavPas encore d'évaluation

- Sources of Savings and InvestmentsDocument10 pagesSources of Savings and InvestmentsFradel FragioPas encore d'évaluation

- FINC6001Document28 pagesFINC6001fodskofkdsofkdsoPas encore d'évaluation

- List of Market Makers and Primary DealersDocument38 pagesList of Market Makers and Primary DealersJP Tarud-KubornPas encore d'évaluation

- Imu602 Islamic Banking Theory and PracticeDocument60 pagesImu602 Islamic Banking Theory and PracticeUmi Athirah RusdiPas encore d'évaluation

- Secondary Markets in IndiaDocument49 pagesSecondary Markets in Indiayashi225100% (1)

- DatabaseDocument4 pagesDatabaseMikey MessiPas encore d'évaluation