Académique Documents

Professionnel Documents

Culture Documents

10 - Inventory Management #

Transféré par

Sivanesan KupusamyCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

10 - Inventory Management #

Transféré par

Sivanesan KupusamyDroits d'auteur :

Formats disponibles

Dr.

Weria Khaksar

Email: weria@uniten.edu.my

Room No.: BN-03-08

10.1. Overview

An is a stock or store of goods.

Manufacturing firms carries supplies of raw material, purchased

parts, partially finished items and finished goods as well as

spare parts for machines, tools and other supplies.

A typical firm probably has about 30% of its current assets and

perhaps as much as 90% of its working capital invested in

inventory.

As the amount of inventory reduces, the return on investment rate

(ROI) increases.

In U.S, one economical measures for a firm is the ratio of

investments to sales.

10.1. Overview

- To meet anticipated customer demand.

- To smooth production requirements.

- To decouple operations.

- To protect against stockouts.

- To take advantage of order cycles.

- To hedge against price increases.

- To permit operations.

10.1. Overview

- Raw materials and purchased parts.

- Partially completed goods, called work-in-process (WIP).

- Finished-goods inventories.

- Tools and supplies.

- Maintenance and repair (MRO) inventory.

- Goods-in-transit to warehouses, distributions or customers.

10.2. Inventory Management System

1. To establish a system of keeping track of items in inventory.

2. To make decisions about how much and when to order.

1. A system to keep track of the inventory on hand and on order.

2. A reliable forecast of demand.

3. Knowledge of lead times and lead time variability.

4. Reasonable estimates of inventory holding costs, ordering costs

and shortage costs.

5. A classification system for inventory items.

10.2. Inventory Management System

1. A system to keep track of the inventory on hand and on order.

Inventory Counting Systems

Periodic system: A physical count of items in inventory is made at

periodic intervals (Weekly or monthly).

Perpetual (continual) system: Keeps track of removals from

inventory on a continuous basis.

10.2. Inventory Management System

2. A reliable forecast of demand.

3. Knowledge of lead times and lead time variability.

Demand forecasts and lead-time information

It is essential to have reliable estimates on the amount and timing

of demand.

Lead-Time: The time interval between submitting an order and

receiving it.

10.2. Inventory Management System

4. Reasonable estimates of inventory holding costs, ordering costs

and shortage costs.

Inventory Costs

Holding or carrying costs

Ordering costs

Shortage costs

10.2. Inventory Management System

5. A classification system for inventory items.

Classification system

Items held in inventory are not of equal importance in terms of dollars

invested, profit potential, sales or usage volume, or stockout penalties.

The A-B-C Approach: classifies inventory items according to some

measures of importance, usually annual dollar value.

A (very important): 10%-20% of number of items, but 60%-70% of the

annual dollar value.

C (least important): 50%-60% of number of items, but 10%-15% of the

annual dollar value.

B (moderately important): The rest of the items.

10.2. Inventory Management System

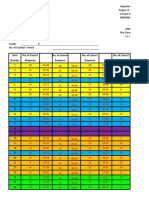

The A-B-C Approach: Example

Item

Number

Annual

Demand

Unit

Cost

=

Annual

Dollar Value

1 2,500 $ 360 $ 900,000

2 1,000 70 70,000

3 2,400 500 1,200,000

4 1,500 100 150,000

5 700 70 49,000

6 1,000 1,000 1,000,000

7 200 210 42,000

8 1,000 4,000 4,000,000

9 8,000 10 80,000

10 500 200 100,000

7,591,000

10.2. Inventory Management System

This model identifies the optimal order quantity by minimizing the

sum of certain annual costs that vary with order size.

Three order size models:

1. The basic Economic Order Quantity Model (EOQ).

2. The Economic Production Quantity Model (EPQ).

3. The Quantity Discount Model.

10.2. Inventory Management System

1. The basic Economic Order Quantity Model (EOQ).

This model is used to identify a fixed order size that will minimize

the sum of the annual costs of holding inventory and ordering

inventory.

Basic assumptions of EOQ model:

1. Only one product is involved.

2. Annual demand requirements are known.

3. Demand is spread evenly throughout the year so that the

demand rate is reasonably constant.

4. Lead time does not vary.

5. Each order is received in a single delivery.

6. There are no quantity discount.

10.2. Inventory Management System

1. The basic Economic Order Quantity Model (EOQ):

The inventory cycle

10.2. Inventory Management System

1. The basic Economic Order Quantity Model (EOQ):

A balance between Holding (Carrying) costs and ordering costs

Annual Ordering cost =

,

where:

= Demand,

(usuallyin units per year)

= Ordering cost

Annual Holding cost =

2

,

where:

= Order quantity in units

= Holding carrying cost per unit

10.2. Inventory Management System

1. The basic Economic Order Quantity Model (EOQ):

A balance between Holding (Carrying) costs and ordering costs

The minimum of TC happens when holding and ordering costs are equal:

, =

10.2. Inventory Management System

1. The basic Economic Order Quantity Model (EOQ):

Example: A local distribution for a national tire company expects

to sell approximately 9,600 tires of a certain size next year.

Annual holding cost is $16 per tire and ordering cost is $75. the

distribution operates 288 days a year.

a. What is the EOQ?

b. How many tires per year does the store reorder?

c. What is the length of an order cycle?

d. What is the total annual cost if the EOQ is ordered?

a. Q

0

=

2 9,600 75

16

= 300 tires

b. Number of orders per year =

D

Q

=

9,600 tires

300 tires

=32

c. Length of order cycle=

Q

D

=

1

32

of a year which is

288

32

= 9 workdays

d. TC =

300

2

16 +

9,600

300

75 = $4,800

10.2. Inventory Management System

2. The Economic Production Quantity Model (EPQ).

In this model, the manufacturer periodically produces items in

batches or lots instead of producing continually.

Basic assumptions of EOQ model:

1. Only one item is involved.

2. Annual demand is known.

3. The usage rate is constant.

4. Usage occurs continually, but production occurs periodically.

5. The production rate is constant

6. Lead time does not vary.

7. There are no quantity discount.

10.2. Inventory Management System

2. The Economic Production Quantity Model (EPQ).

10.2. Inventory Management System

2. The Economic Production Quantity Model (EPQ).

The number of runs or batches per year =

The annual setup cost =

TC

min

= Holding cost + Setup cost =

2

+

, where

=Maximum inventory.

The economic run inventory is

=

2

( )

where, = Production or delivery rate and = Usage rate

Cycle time =

(

, Run time =

(

2

=

2

10.2. Inventory Management System

2. The Economic Production Quantity Model (EPQ).

Example: A toy manufacturer uses 48,000 rubber wheels per year

for its popular dump truck series. The firm makes its own wheels,

which it can produce at a rate of 800 per day. Toy trucks are

assembled uniformly over the entire year. Holding cost is $1 per

wheel a year. Setup cost for a production run of wheels is $45. the

firm operates 240 days per year. Determine the

a. Optimal run size.

b. Minimum total annual cost for holding and setup.

c. Cycle time for the optimal run size.

d. Run time.

a. Q

p

=

2 800 48,000 45

1(800200)

= 2,400 wheels

b. I

max

=

2,400

800

800 200 = 1,800 wheels

TC

min

=

1,800

2

$1 +

48,000

2,400

$45 = $1,800

c. Cycle time=

2,400 wheels

200 wheels per day

= 12 days

d. Run time

2,400 wheels

800 wheels per day

= 3 days

10.2. Inventory Management System

3. The Quantity Discount Model.

In this model, price is reduced for large orders to induce the

customers to buy in large quantities.

The buyer must weigh the potential benefits of reduced purchase

price and fewer orders against the increase in holding. The buyers

goal with quantity discount is to select the order quantity that will

minimize total cost including holding cost, ordering cost and

purchasing cost.

TC = Holding cost +Ordering cost +Purchasing cost

TC =

2

H +

+

where is the unit price.

10.2. Inventory Management System

3. The Quantity Discount Model.

10.2. Inventory Management System

3. The Quantity Discount Model.

Example: The maintenance department of a large hospital uses 816

cases of liquid cleanser annually. Ordering costs are $12, holding costs

are $4 per case a year and new price schedule indicates that orders of

less than 50 cases will cost $20 per case, 50 to 79 cases will cost $18

per case, 80 to 99 cases will cost $17 per case and larger orders will

cost $16 per case. Determine the optimal order quantity and the total

cost.

= 816 cases per year

S = $12

H = $4 per case per year

Range Price

1 to 49 ..

50 to 79 ..

80 to 99 ..

100 or more

$20

18

17

16

1. Compute the common minimum =

2

=

2 816 12

4

= 69.67 70 .

2. The 70 cases can be bough at $18 per case. Hence, the total cost will be:

TC

70

=(70/2)4+(816/70)12+18(816)=$14,968

3. Because lower range exist, each must be checked against the minimum cost

resulting from 70 cases at $18 each.

In order to buy at $17 per case, at least 80 cases must be purchased. (WHY?)

TC

80

=(80/2)4+(816/80)12+17(816)=$14,154

In order to buy at $16 per case, at least 100 cases must be purchased.

TC

100

=(100/2)4+(816/100)12+16(816)=$13,354

Therefore, because 100 cases per order yields the lowest total cost, 100 cases is

the overall optimal order quantity.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- 15 15umc Items 159 160ashraeDocument34 pages15 15umc Items 159 160ashraeSivanesan KupusamyPas encore d'évaluation

- Dopet Doha Petroleum Construction Company Application FormDocument3 pagesDopet Doha Petroleum Construction Company Application FormSivanesan Kupusamy100% (1)

- Malaysian Standard OnlineDocument5 pagesMalaysian Standard OnlineSivanesan Kupusamy100% (1)

- Ms 1183 Part 2 1993-Code of Practice For Fire Precautions-730104Document92 pagesMs 1183 Part 2 1993-Code of Practice For Fire Precautions-730104Sivanesan Kupusamy50% (2)

- Water Tank GuidelinesDocument11 pagesWater Tank GuidelinesSivanesan KupusamyPas encore d'évaluation

- Course Outline MESB323Document2 pagesCourse Outline MESB323Sivanesan KupusamyPas encore d'évaluation

- Coil Guarding PolicyDocument9 pagesCoil Guarding PolicySivanesan KupusamyPas encore d'évaluation

- Water WheelDocument4 pagesWater WheelSivanesan KupusamyPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- A Practical Guide To Transfer Pricing Policy Design and ImplementationDocument11 pagesA Practical Guide To Transfer Pricing Policy Design and ImplementationQiujun LiPas encore d'évaluation

- Financial Performance Report General Tyres and Rubber Company-FinalDocument29 pagesFinancial Performance Report General Tyres and Rubber Company-FinalKabeer QureshiPas encore d'évaluation

- Item AnalysisDocument7 pagesItem AnalysisJeff LestinoPas encore d'évaluation

- Wastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurDocument33 pagesWastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurSubhajit BagPas encore d'évaluation

- Fix List For IBM WebSphere Application Server V8Document8 pagesFix List For IBM WebSphere Application Server V8animesh sutradharPas encore d'évaluation

- Hanumaan Bajrang Baan by JDocument104 pagesHanumaan Bajrang Baan by JAnonymous R8qkzgPas encore d'évaluation

- ANI Network - Quick Bill Pay PDFDocument2 pagesANI Network - Quick Bill Pay PDFSandeep DwivediPas encore d'évaluation

- HDFC Bank-Centurion Bank of Punjab: Presented By: Sachi Bani Perhar Mba-Ib 2010-2012Document40 pagesHDFC Bank-Centurion Bank of Punjab: Presented By: Sachi Bani Perhar Mba-Ib 2010-2012Sumit MalikPas encore d'évaluation

- Curriculum Vitae: Personal InformationDocument2 pagesCurriculum Vitae: Personal InformationtyasPas encore d'évaluation

- CPGDocument9 pagesCPGEra ParkPas encore d'évaluation

- VIII and IXDocument56 pagesVIII and IXTinn ApPas encore d'évaluation

- Ulster Cycle - WikipediaDocument8 pagesUlster Cycle - WikipediazentropiaPas encore d'évaluation

- 6401 1 NewDocument18 pages6401 1 NewbeeshortPas encore d'évaluation

- Amt 3103 - Prelim - Module 1Document17 pagesAmt 3103 - Prelim - Module 1kim shinPas encore d'évaluation

- The Rise of Political Fact CheckingDocument17 pagesThe Rise of Political Fact CheckingGlennKesslerWPPas encore d'évaluation

- TIMELINE - Philippines of Rizal's TimesDocument46 pagesTIMELINE - Philippines of Rizal's TimesAntonio Delgado100% (1)

- Novedades Jaltest CV en 887Document14 pagesNovedades Jaltest CV en 887Bruce LyndePas encore d'évaluation

- Lifeline® Specialty: Fire Resistant QFCI Cable: Fire Resistant, Flame Retardant Halogen-Free Loose Tube - QFCI/O/RM-JMDocument2 pagesLifeline® Specialty: Fire Resistant QFCI Cable: Fire Resistant, Flame Retardant Halogen-Free Loose Tube - QFCI/O/RM-JMkevinwz1989Pas encore d'évaluation

- Prof. Monzer KahfDocument15 pagesProf. Monzer KahfAbdulPas encore d'évaluation

- Parts Catalog: TJ053E-AS50Document14 pagesParts Catalog: TJ053E-AS50Andre FilipePas encore d'évaluation

- Internal Rules of Procedure Sangguniang BarangayDocument37 pagesInternal Rules of Procedure Sangguniang Barangayhearty sianenPas encore d'évaluation

- Military - British Army - Clothing & Badges of RankDocument47 pagesMilitary - British Army - Clothing & Badges of RankThe 18th Century Material Culture Resource Center94% (16)

- 2's Complement Division C++ ProgramDocument11 pages2's Complement Division C++ ProgramAjitabh Gupta100% (2)

- Allen F. y D. Gale. Comparative Financial SystemsDocument80 pagesAllen F. y D. Gale. Comparative Financial SystemsCliffordTorresPas encore d'évaluation

- Seangio Vs ReyesDocument2 pagesSeangio Vs Reyespja_14Pas encore d'évaluation

- Result 1st Entry Test Held On 22-08-2021Document476 pagesResult 1st Entry Test Held On 22-08-2021AsifRiazPas encore d'évaluation

- Concordia: The Lutheran Confessions - ExcerptsDocument39 pagesConcordia: The Lutheran Confessions - ExcerptsConcordia Publishing House28% (25)

- Taxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghDocument32 pagesTaxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghjurdaPas encore d'évaluation

- CALIDocument58 pagesCALIleticia figueroaPas encore d'évaluation

- MELC5 - First ObservationDocument4 pagesMELC5 - First ObservationMayca Solomon GatdulaPas encore d'évaluation