Académique Documents

Professionnel Documents

Culture Documents

Hamid Apf Documents

Transféré par

Shahaan ZulfiqarDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Hamid Apf Documents

Transféré par

Shahaan ZulfiqarDroits d'auteur :

Formats disponibles

.

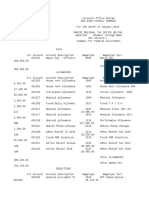

OFFICE OF THE

DEPUTY COMMISSIONER INLAND REVENUE,

WITHHOLDING TAX UNIT-01,

REGIONAL TAX OFFICE, MULTAN.

1. Tax Year 2013

2. National Tax Number 1835061-5

3. Name of the taxpayer & address M/s Asia Poultry Feeds (Pvt)Ltd.,

359-Shsamabad, Humayun

Road,Chungi No.9, Multan

4. Status Private Limited Company

5. Residential Status Resident

6. Income year ending 30

TH

June

7. Section of assessment U/S 161/205 of the Income Tax

Ord.2001

8. DCR No. ________

ORDER UNDER SECTION 161/205

This is the case of a private limited company earned income from operating business of

manufacturing/sale of poultry feeds. Income tax return for the tax year 2013 has been e. filed under

USAS on 18.01.2014 declaring total income of Rs.337,554,002/-. Being a withholding agent, the taxpayer

has legal obligation to deduct taxes u/s 149, 150, 161,152, 153(1)(a) & 233 of the Income Tax Ordinance,

2001 and having deposit in Government Treasury within seven days under Rule 43 of Income Tax Rules

2002 read with Section 169 of Income Tax Ordinance, 2001.

On scrutiny of return filed for the tax year under consideration, It was observed that the taxpayer

has failed to fulfill its legal obligation of deduct / deposit withholding tax on the payments made on

purchases of various heads which is actionable u/s 161/205 of the Income Tax Ordinance, 2001. The

taxpayer company was confronted through a notice bearing No.479 dated 04.02.2014 for compliance on

11.02.2014. On the due date Mr. ShahidMehmood, CFO of the company attend this office and furnished

required documents which have been examined and are available on record.

Perusal of reply filed by the taxpayer company reveals that the taxpayer company has not

deducted the withholding tax or deposited short payments of withholding taxes of the various supplier.

Oder u/s 161 of the Income Tax Ordinance 2001 is being finalized in the following manner:-

PURCHASE OF IMPORTED RAW MATERIAL: Rs.4221794542/-

The taxpayer company in his reply declared purchase of imported raw material amounting to

Rs.4089799595/-. The tax payer also explained that raw material was also purchased from the

commercial importers. The representative has also furnished bifurcation of the imported raw material

which is given below:-

Head Value Remarks

Imported raw

material

3,917,141,691 The tax payer has furnished copies of LCs which

have been examined and are available on record.

The tax payer contended that no tax was deductible

by the tax payer because it does not fall within the

provision of section 153 of the Income Tax

Ordinance. The explanation of the tax payer is

plausible hence accepted and no adverse inference

is drawn.

Imported raw

material purchased

from the importers

172,657,904 In support purchase from commercial importer tax

payer has furnished copies of invoices, undertakings

and bill of entries which have been examined and

are available on record. The tax payer plea

regarding tax deduction of withholding tax is

plausible hence accepted no adverse inference is

drawn.

The taxpayer company field proof of tax deduction challans u/s 148 alongwith bill of entries and stated

that tax has properly been deducted at the time of custom clearing by the Custom Authorities. The

contention of the taxpayer is verified and accepted, therefore no adverse inference is drawn.

PURCHASE OF LOCAL RAW MATERIAL RS.7,534,400,765/-

The tax payer explained that the actual purchases during the year are Rs.7837086773/- instead of

Rs.7,534,400,765/-. The amount confronted through show cause notice is cost of material consumed.

The break up is given below:-

Balance at beginning of the year Rs.230908453/-

Add Purchases during the year Rs.7837086773/-

Less closing stock/ Inter unit transfer Rs.533594461/-

Cost of raw material consumed Rs.7534400765/-

The tax payer has explained that income tax has properly been withheld against the payments where

ever applicable. In his support he furnished proof of payments which have been examined and are

available on record. Certain payments were made but tax was not withheld on the plea that the

withholdee produced exemption certificates. The tax payer has furnished copies of exemption certificates

which have been examined and are available on record. The tax payer also furnished details of products

purchased during the year which is given below:-

Product

name

Amount paid Exempt

amount

Taxable

amount

Remarks

Sun

Flower

Meal

76781172 76673092 108080 The tax payer explained that meal was purchased

from the solvent plants for consideration of

rs.76673092/- against which no tax has been

withheld. The taxpayer explained that suppliers has

furnished exemption certificate which were issued

by the concerned CIRs which have been examined

and observed that the plea of the tax payer

regarding non withholding of tax against these

payments is plausible hence no adverse inference

is drawn. Whereas the tax payer purchased meal

for consideration of Rs.108080/- against which tax

@ 3.5% has been withheld amounting to Rs.3783/-

which has been deposited in to Govt. Treasury.

Corn

Gluten

3133650 3133650

- The tax payer explained that Corn Gluten for

consideration of Rs.3133550/- was purchased from

M/s Rafhan Maize Products Co. Limited

Faisalabad. No tax was withheld against these

payments on the plea that the suppliers has

furnished exemption certificate which were issued

from the CIR Zone-I RTO Faisalabad which has

been examined and is available on record. The tax

payer plea regarding non withholding of tax against

these payments is plausible hence no adverse

inference is drawn.

Canola

Meal

795698567 625190197 170508370

The tax payer explained that meal was purchased

from the solvent plants for consideration of

Rs.625490197/- against which no tax has been

withheld. The taxpayer explained that suppliers has

furnished exemption certificate which were issued

by the concerned CIRs which have been examined

and observed that the plea of the tax payer

regarding non withholding of tax against these

payments is plausible hence no adverse inference

is drawn. Whereas the tax payer purchased meal

for consideration of Rs.17508370/- against which

tax @ 3.5% has been withheld amounting to

Rs.5967793/- which has been deposited in to Govt.

Treasury. The tax payer has discharged its tax

liability hence no adverse inference is drawn.

Bran

95958757 - 95958757

The tax payer has explained that Bran was

purchased through the brokers and commission

amounting to Rs.480564/- was paid and tax was

deducted amounting to Rs.48056/-. He has

furnished proof of tax withheld and deposited in to

Govt. Treasury which has been examined and is

available on record. As the tax payer has

discharged its tax liability hence no adverse

inference is drawn.

Guar

Meal

191400180 - 191400180

The tax payer explained that meal was purchase

from various parties for consideration of

Rs.191400180/- and tax waswithheld amounting to

Rs.6699006 and deposited in to Govt. Treasury.

Proof in this regard has been provided which has

been examined and is available on record. As the

tax payer has discharged its tax liability hence no

adverse inference is drawn.

Salt

3130726 - 3130726

The tax payer explained that salt was purchased

from various parties for consideration of

Rs.313726/- and tax @ 3.5% has been withheld

amounting to Rs. 109575 which has been

deposited in to Govt. Treasury. The tax payer has

furnished proof of tax deposited in to Govt.

Treasury which has been examined and is

available on record. As the tax payer has

discharged its tax liability hence no adverse

inference is drawn.

Chips

5848803 - 5848303

The tax payer has explained that chips was

purchase from various parties for consideration of

Rs.5848803/- and tax was not withheld against

these payments. The tax payer has not furnished

plausible explanation in this regard. Hence tax @

3.5% is chargeable amounting to Rs.204708/-

which is now charged.

Molasses

18444366 - 18444366

The tax payer explained that purchases for

consideration of Rs.18444366/- was purchase

from only one party namely Muhammad Tariq

Faisalabad and tax @ 3.5% was withheld and

deposited in to Govt. Treasury. The tax payer has

furnished proof of tax deposited which has been

examined and is available on record. As the tax

payer has discharged its tax liability hence no

adverse inference is drawn.

Maize 5693638324

- 569363832

4

The tax payer has explained that commission

amounting to Rs.28266790/- was paid to the

brokers against purchase of maize for

consideration of Rs. 5693638324/- and tax @ 10%

was withheld amounting to Rs.2826679/- and

deposited in to Govt. Treasury. The tax payer has

furnished proof in this regard which has been

examined and is available on record. As the tax

payer has discharged its tax liability hence no

adverse inference is drawn.

Wheat

271402511 - 271402511

The tax payer explained that purchases for

consideration of Rs.271402511/- was purchase

from various parties and commission was paid

amounting to Rs.1181836/- against which tax @

3.5% was withheld amounting to Rs.118184/-

which was deposited in to Govt. Treasury. The tax

payer has furnished proof in this regard which has

been examined and is available on record. As the

tax payer has discharged its tax liability hence no

adverse inference is drawn.

Paddi

354162843 354162843

The tax payer has explained that purchases were

made for consideration of Rs.249047479/- against

which commission was paid amounting to

Rs.2006820/-. The tax payer has withheld tax @

10% amounting to Rs.200682/- and furnished proof

of tax deposited amounting to Rs.178383/-.

Balance amount of Tax Rs.22299/- is recoverable

from taxpayer.

Millet

249047479 249047479

The tax payer explained that purchases were made

for consideration of Rs.249047479/- from various

parties and commission was paid to the brokers

amounting to Rs.1223977/- against which tax @

10% was withheld and deposited in to Govt.

Treasury. The tax payer has furnished proof in this

regard which has been examined and is available

on record. The tax payer has discharged its tax

liability hence no adverse inference is drawn.

Peas

22122661 22122661

The tax payer explained that payments against the

purchases were made for consideration of

Rs.22122661/- and commission was paid to the

brokers amounting to Rs.108304/-. The tax payer

explained that tax @ 10% was withheld Rs.10830/-

and was deposited in to Govt. Treasury. Proof in

this regard has been provided which has been

examined and is available on record. As the tax

payer has discharged its tax liability hence no

adverse inference is drawn

Jawar

3108835 3108835

The tax payer explained that payments against the

purchases were made for consideration of

Rs.3108835/- and commission was paid to the

brokers amounting to Rs.16831/-. The tax payer

explained that tax @ 10% was withheld Rs.1683/-

and deposited in to Govt. Treasury. Proof in this

regard has been provided which has been

examined and is available on record. As the tax

payer has discharged its tax liability hence no

adverse inference is drawn

Day Old

Chicks

7135500 7135500

The tax payer has claimed exemption under SRO

586(I)/91 against the payments made under the

head Day old chicks. The exemption claimed is

under the law hence is allowed.

Freight

14593374 14593374

The payer has explained that payment under the

head Freight was paid Rs.14593374/-. Income tax

@ 2% has been withheld and deposited in to Govt.

Treasury. Proof in this regard has been provided

which has been examined and is available on

record.

SALARIES & WAGES: Rs.115747041/-

Tax able salary Exempt salary Remarks

11101600 87356897 In his reply the taxpayer company declared

expenses under the head salary & wages at

Rs.115747041/-. The taxpayer company also filed annual

employer statement u/s 149 of the Income Tax

Ordinance, 2001 as see Rule 44(1) within time. Perusal

of annual salary statement reveals that the taxpayer

company has declared taxable salary amounting to

Rs.11101600/- and withheld income tax amounting to

Rs.186475. Statements filed as well as documents/salary

sheets provided have been examined and observed that

tax against the taxable salary was deductible amounting

to Rs.211446/- hence there is short deduction of tax

amounting to Rs.25171/-. Now the same is charged and

recovered.

The tax payer also furnished detail of salaries which was

not liable to withholding tax. In view of the details, salary

paid to each employee is below the threshold limit of

withholding tax. Details have been examined and are

available. The tax payer plea regarding non-withholding

of tax is plausible hence accepted and no adverse

inference is drawn.

PAYMENT FOR POWER: Rs.136150475/- & Gas Rs.11893719/-

The taxpayer company filed detail of electricity bills paid during the financial year and tax

u/s 235 of the Income Tax Ordinance, 2001 has already been deducted. The taxpayer company

has also provided copies of Sui Gas bills. The contention of the taxpayer company is verifiable

alongwith copies of ledger account therefore, no adverse inference is drawn.

PAYMENT AGAINST OTHER FUEL RS.119227925/-

Head Taxable

amount

Exempt amount Remarks

Diesel 30964999 The tax payer explained that petroleum

products are exempt from charge

withholding tax under clause 43A and 43C

of Part IV of 2

nd

schedule to the Income

Tax Ordinance, 2001. The explanation of

the tax payer is plausible hence accepted

and no adverse inference is drawn.

Furnace Oil 30701540 The tax payer explained that petroleum

products are exempt from charge

withholding tax under clause 43A and 43C

of Part IV of 2

nd

schedule to the Income

Tax Ordinance, 2001. The explanation of

the tax payer is plausible hence accepted

and no adverse inference is drawn.

Wood

Purchased

46986838 The tax payer explained that purchases

were made for consideration of

Rs.46986838/- from various parties and

commission was paid to the brokers

amounting to Rs.803781/-. The tax payer

explained that tax @10% has been

withheld amounting to Rs.89378/-. The tax

payer failed to produce the proof of tax

deposited. It has been observed that tax

was withheld but not deposited now the

same is charged.

Generator

fuel

expenses

4250000 1404856 The tax payer explained that payment

against generator were made to Insight

Engineering Karachi for consideration of

Rs.4250000/- and tax @ 6% was withheld

amounting to Rs.255000/- which has been

deposited in to Govt. Treasury. The tax

payer further explained that payment of

Rs.1404856/- was made for purchase of

petroleum product from the petrol pumps

hence no tax was withheld being exempt

under clause 43A and 43C of Part IV of 2

nd

schedule to the Income Tax Ordinance,

2001. The tax explanation of the tax payer

is plausible hence accepted and no

adverse inference is drawn.

Electricity

bills

4919692 Payment made against WAPDA bills is not

liable to withholding tax. Hence no tax has

been withheld. The plea of the tax payer

regarding non withholding of tax is

plausible hence accepted and no adverse

inference is drawn.

STORES & SPARES: Rs.461435473/-

Head Taxable

amount

Exempt

amount

Remarks

Packing

Material

Thread

Cone

Packing

Farms

Repair &

Maintenance

Rs.1104000/-

Rs.2328695/-

Rs.5160405/-

Rs.34396250/-

Rs.127989006/-

Rs.520000/-

1.The tax payer explained that tax has been

withheld amounting to Rs.38640/- against

the payment of Rs.1104000/- and deposited

in to Govt. Treasury. Proof provided which

has been examined and is available on

record.

2. The tax payer explained that payment of

Rs.127989006/- were made to various

parties and tax was not withheld. In his

support he furnished copies of exemption

certificates which were issued from the CIRs

concerned in favour of the suppliers which

have been examined and are available on

record. The tax payer plea regarding non

withholding of tax against these payments is

plausible hence accepted and no adverse

inference is drawn.

Tax deducted @ 3.5% amounting to

Rs.81504/- and deposited in to Govt.

Treasury. The tax payer has filed annual

withholding statement which shows the

deposit of tax.

1.Tax deducted @ 3.5% amounting to

Rs.180614/-/- and deposited in to Govt.

Treasury. The tax payer has filed annual

withholding statement which shows the

deposit of tax.

2.The tax payer explained that payment of

Rs.520000/- was made to commercial

imported and tax was withheld. In his

support his furnished copies of invoices and

undertaking which have been examined and

is available on record. The tax payer in this

regarding is plausible hence accepted and

no adverse inference is drawn.

1.The tax payer explained that payment was

made for consideration of Rs.34396250/-.

The taxpayer has withheld income against

payment of Rs.847893/- @ 6% Rs.50874/-.

Medicine

Rs.2045121/-

Rs.17417630/-

Rs.2453484/-

2.The tax payer explained that payments

amounting to Rs.33548355/-. Income tax @

3.5% was deductible amounting to

Rs.1174192/- whereas the tax payers has

deposited income tax amounting to

Rs.1079804/-. Balance tax of Rs.94388/-

not deposited. Now the same is charged

along with default surcharge.

The tax payer explained that these

payments were made under following head:-

1.Commercial imports.Rs.6621511/-

2.Self ImportsRs.8830072/-

3. Petroleum products.Rs.1966047/-

In his support the tax payer has furnished

invoices and undertakings which have been

examined and are available on record. In

support of self import the tax payer has

furnished copies of LCs which confirm the

self import the tax payers. Where as in

support of payments made and tax was

deductible under clause 43C of Part IV of

2

nd

schedule of the Income Tax Ordinance,

2001, furnished details of parties which

have been examined and are available on

record. The tax payer plea regarding non

withholding of tax against payment of

Rs.17417630/- is plausible hence accepted

and no adverse inference is drawn.

1.The tax payer explained that payment of

Rs.2045121/- was made to various parties

and tax @ 3.5% was withheld amounting to

Rs.71579/- which was deposited in to Govt.

Treasury. Proof in this regard has been

furnished and is available on record. As the

tax payer has discharged its tax liability

hence no adverse inference is drawn.

2. The tax payer explained that payment of

Rs.2453484/- was made to various parties

but tax was not deductible. In his support

he furnished copies of invoices and

undertakings which were issued by the

commercial importers. The documents

provided have been examined and are

available on record. The Tax payer plea in

this regard is plausible hence accepted and

no adverse inference is drawn.

Vaccination Rs.2089116/-

Rs.622247/- 1. The tax payer explained that payment

under this head of Rs.2089116/-to various

parties out of which Rs.61711/- were paid

through petty cash and were not liable to

withholding tax. Whereas the balance

payment of Rs.2027405/- was paid and tax

@ 3.5% was withheld amounting to

Rs.70959/- and deposited in to Govt.

Treasury. Proof in this regard has been

provided which have been examined and is

available on record. As the taxpayer has

discharged its tax liability hence no adverse

inference is drawn.

2. The taxpayer has made payments of

Rs.622247/- to various parties and not

withheld tax. The tax payer explained that

the suppliers were commercial importers

who were not liable withholding of tax. In his

support he furnished invoices and

undertaking which have been examined and

are available on record. The tax payer

explanation is plausible hence accepted and

no adverse inference is drawn.

Rent Rates, and Taxes Rs.1012838/-

The tax payer explained that the payment comprised of following payments:-

Building rent paid to

Mrs. Rashida Chaudhry Rs.900000/-

ZikriyaGulshan-e-Hadeed, Karachi. Rs.47600/-

Property tax paid. Rs.65238/-

The tax payer explained that tax amounting to Rs.88500/- has been withheld against the

payments of Rs.900000/- made to Mrs. Rashida Chaudhry and deposited in to Govt.Treasury.

Whereas the payment made to ZikriyaGulshan-e-Hadeed Karachi Rs.47600/- is below the

threshold limit of withholding tax hence tax not liable to be withheld. The tax payer has

discharged its tax liability hence no adverse inference is required.

PURCHASE OF FURNISHED GOODS Rs.13483177/-

The tax payer explained that this is not a purchase but a difference of finished goods (poultry

feed) at beginning and end of the year as mentioned in Annexure-H-I which has been brought

on face of return at Serial No.311 and is made up as follows:-

Inventory balance at Beginning of the year Rs.59667629/-

Inventory balance at end of the year Rs.(46184452)

Balance Rs.13483177/-

The tax payer explained that the above figures are not subject to withholding tax. The

explanation of the tax payer is accepted and no adverse inference is drawn.

PROFIT AND LOSS EXPENSES

SALARIES & WAGES: Rs.30561286/-

Taxable amount Exempt

amount

Remarks

8466400

12577881

In his reply the taxpayer company declared expenses

under the head salary & wages Rs.30561286/-. The

taxpayer company also filed annual employer statement

u/s 149 of the Income Tax Ordinance, 2001 as see Rule

44(1) within time. Perusal of annual salary statement

reveals that the taxpayer company has declared taxable

salary and tax was properly deducted and deposited. The

taxpayer company filed detail of salary and wages paid to

production and other staff which are below the monitoring

threshold limit. As per details the tax payer has paid

taxable salary Rs.8466400/- against which income tax

was deductible amounting to Rs.305686/- whereas the

tax payer has deposited Rs.287240/-. Hence there is

short payment of Rs.18446/-which is now recovered.

TRAVELLING EXPENSES: Rs.13007002/-

Head Taxable

amount

Exempt

amount

Remarks

Vehicle running

and maintenance

10235126 The tax payer explained that these

expenses were paid against purchase of

petroleum products for running of vehicles.

No tax was deducted on the plea that the

petroleum products are exempt from

withholding of tax under clause 43A and

43C of Part IV of 2

nd

schedule to the

Income Tax Ordinance, 2001. The

explanation filed has been examined and

is available on record. The plea of the tax

payer regarding non withholding of tax

against petroleum products is plausible

hence accepted and no adverse inference

is drawn.

Travelling

expenses

165918 2605958 The tax payer explained that payment of

Rs.2605958/- was paid against which no

tax was deductible. In view of details

provided payments of Rs.1112325/- were

made to Travel Channel against purchase

of Air Tickets. The tax payer explained that

no tax was deductible against purchase of

air tickets. Further explained that

Rs.1082717/- were paid against fair

charges for tours of the marketing staff for

journey station to station. These payments

were made on petty cash basis and no tax

was deductible. Further explained that

payment of Rs.165918/- was made to

Sheza In hotel and Smart Hotel. Against

these payments tax @ 6% was withheld

and deposited in to Govt. Treasury. The

explanation filed by the tax payer is

plausible hence accepted and no adverse

inference is drawn.

PAYMENT FOR POWER: Rs.2418845/-

The taxpayer company filed detail which comprise of electricity, Gas, Water , Sanitation, Diesel,

LPG Gas Cylinders.. Payments made against these heads are not liable to withhelding tax. Diesel , LPG

Cilinders are also exempt from withholding of tax being petroleum products under clause 43A and 43C of

Part IV of 2

nd

Scheduele to the Income tax Ordinace, 2001. The tax payer has furnished details against

the payments and observed that the explanation of the tax payer is plausible hence accepted and no

adverse inference is drawn.

COMMUNICATION CHARGES Rs.4019953/-

The tax payer explained that these expenses comprise of various head i.e Telephone, Cyber Internet

Services, Multinent Pakistan Pvt. Ltd., Sherazi Trading Pvt. Ltd. TCS Pvt. Ltd. Leopard CourioerServces,

and Electro Technich. The tax payer has explained that the payments made to these parties are expempt

from charge of withholding tax. In his support he furnished copies of exemption certificates issued from

the companies which have been examined and are available on record. However, while examining the

payments it has been observed that tax amounting to Rs.1103/- was to be withheld but the same was

been withheld and deposited. Now the same is recoverable. For rest of the mount the explanation of the

tax payer is plausible hence accepted and no adverse inference Is drawn.

Rs.1103/-

REPAIR AND MAINTENANCE Rs.1588342/-

Head Taxable

amount

Exempt

amount

Remarks

Amjad Traders

Multan.

17537

Tax deducted @ 3.5% amountingto

Rs.614/-and deposited in to Govt.

Treasury. Proof in this regard has been

provided which has been examined and

is available on record.

Bashir Electric

Store Multan.

Cyber Internet

Koldkraft Pvt.

Ltd. Lahore

M.A Qadir

Hardware Store

Multan.

Ruby Electric

S.H.Steel Mills

Lahore.

Shirazi Trading

Co.. Pvt. Ltd.

Syed

Enterprises

Multan.

The imperial

Rs.10090/-

318084/-

Rs.4660/-

Rs.71363/-

Rs.23094/-

Rs.25000/-

Rs.31304/-

Rs.21216/-

Rs.128400/-

Tax deducted @ 3.5% amounting to

Rs.354/- and deposited in to Govt.

Treasury. Proof in this regard has been

provided which has been examined and

is available on record.

Exemption Certificate provided which has

been issued by the CIR Zone-IV RTO

Lahore. The certificate has been

examined and observed that the plea of

the tax payer regarding non withholding of

tax is plausible hence accepted.

Tax deducted @ 3.5% amounting to

Rs.11133/- and deposited in to Govt.

Treasury. Proof in this regard has been

provided which has been examined and

is available on record.

Tax deducted @ 3.5% amounting to

Rs.164/- and deposited in to Govt.

Treasury. Proof in this regard has been

provided which has been examined and

is available on record.

Tax deducted @ 3.5% amounting to

Rs.2498/- and deposited in to Govt.

Treasury. Proof in this regard has been

provided which has been examined and

is available on record.

Exemption Certificate provided which has

been issued by the CIR Zone-IV RTO

Lahore. The certificate has been

examined and observed that the plea of

the tax payer regarding non withholding of

tax is plausible hence accepted.

The tax payer explained that the supplier

is a Commercial importer hence no tax

was deductible. In his support he has

furnished copy of invoices which has been

examined and are available on record.

Tax deducted @ 3.5% amounting to

Rs.809/- and deposited in to Govt.

Treasury. Proof in this regard has been

provided which has been examined and

is available on record.

The tax payer explained that the supplier

Electric

Company

Lahroe

Unique Display

Centre Multan.

WAPDA

PAYMENT

Rs.67715/-

Rs.426670/-

is a Commercial importer hence no tax

was deductible. In his support he has

furnished copy of invoices which has been

examined and are available on record.

Tax deducted @ 3.5% amounting to

Rs.2370/- and deposited in to Govt.

Treasury. Proof in this regard has been

provided which has been examined and

is available on record.

MEPCO payments of Rs.372370/- and

Rs.54300/- which is paid under the head

demand notice and security. The

payments are not liable to withholding tax.

hence no adverse inference is drawn.

STATIONARY/OFFICE SUPPLIES RS.1434673

The tax payer has furnished detail of parties from whom stationary was purchased

during the year. The details provided is given below:-

Particulars Amount Tax

deducted

@ 3.5%

Tax

deposited

Balance payable.

Shirazi Trading Co. Pvt.

Ltd.

87810 3073 3073 -

I.A Printers Multan 494380 17303 17303

-

Chawala Stationers Multan 177290 6205 6205

-

Printing & Stationery BTL 675193

BTL BTL

The tax payer has

explained that payments

were made to various

parties for purchase of

stationary and photo

copies bill and no tax was

deductible. The tax payer

failed to furnish proof in

this regard. Therefore, tax

against these payment @

3.5% is charged which

comes to Rs.23671/-.

Total

26581

-

The tax payer has furnished detail of Rs.675193/- which shows that payments were made to various

parties and each party payment is below the threshold limit of withholding tax. Details have been

examined and are available on record. The explanation of the tax payer for non withholding of tax is

plausible and accepted.

PROFESSIONAL CHARGES RS.1079682/-

Taxable

amount

Exempt

amount

Remarks

500000

579682

The tax payer explained that expenses claimed under this head

comprise of Fees & subscription, Professional tax paid to Punjab

Govt., legal Mortgage charges Form 32A, M. Karim Arshad Advocate

and Stamp papers. The tax payer explained that these payments are

not liable to withhelding tax being govt. dues. However, against the

payment of Rs.500000/- paid under the head Auditor Remuneration

were liable to withhelding tax amounting to Rs.30000/-. The tax payer

has withheld tax and deposited in to Govt. Treasury. In his support

he has furnished copy of paid challan which has been examined and

is available on record. The explanation of the tax payer is plausible

hence accepted and no adverse inference is drawn.

SELLING EXPENSES RS.58928177/-

The tax payer has explained that the expenses claimed comprised of following heads:-

1. Staff Salaries & Benefits Rs.19290174/-

2. Communication Expenses Rs.1108084/-

3. Vehicle running & Maintenance Rs.21479771/-

4. Travelling & Conveyance Exp. Rs.2362729/-

5. Unloading & Vaccination charges. Rs.14171035/-

6. Advertisement Expenses Rs.293717/-

7. Miscellaneous Expenses Rs.222667/-

The tax payer further furnished explanation regarding the mentioned heads which is given as

under:-

Taxable salaries Rs.10660000/-

Non Taxable salaries. Rs.7675270/-

Bonus. Rs.954904/-

The taxpayer has furnished annual withholding statement e-filed under section 149 of the

Income Tax Ordinance as well as copies of paid challans. Against the nontaxable salaries, the

tax payer has furnished salaries sheets which show that the salaries paid amounting to

Rs.7675270/- to various employees are not liable to withheld tax because the salary paid to

each employee is below the threshold limit of monitoring of withholding tax. Details have been

examined and are available on record. However, while examining the taxable salaries it has

been observed that there is short deduction of withholding tax amounting to Rs.34509/-. The

explanation of the tax payer is plausible hence accepted and no adverse inference is drawn.

COMMUNICATION EXPENSES RS.1108084/-

The tax payer explained that these expenses comprise of telephone bill, mobile bills. These

payments against bills are not liable to withholding tax. In his support he has furnished copies of

bills which have been examined and are available on record. The explanation of the tax payer is

plausible hence accepted.

VEHICLE RUNNING AND MAINTENANCE RS.21479771/-

The tax payer has explained that these expenses comprise of purchase of Petrol/Diesel for

running of vehicle owned by the company. The petroleum products are exempt for charge of

withholding tax. In his support he has furnished detail which has been examined and is available

on record. The explanation of the tax payer is plausible hence accepted and no adverse

inference is drawn.

TRAVELLING & CONVEYANCE RS.2362729/-

The tax payer has explained that these expenses represent actual re-imbursement of expenses

incurred by marketing staff. In his support he has furnished details which have been examined

and are available on record. The taxpayer explanation regarding non withholding of tax against

these payments is plausible hence no adverse inference is drawn.

LOADING AND UNLOADING EXPENSES RS.14171035/-

The tax payer explained that these are non-cash payment expenses representing incentives to

the farmers which have been shown on the invoices of the company. The tax payer explained

that these expenses are paid Rs.1/- per bag for unloading and Rs.1/- for vaccination. The tax

payer has furnished details which have been examined and are available on record.

Advertisement Expenses Rs.293717/-

The tax payer has explained that these expenses were paid to various parties and each party

payment remain below the threshold limit of withholding tax hence no tax has been withheld. In

his support he has not furnished party wise details. Hence tax @ 6% is charged which comes

to Rs.17623/-.

Misc. Expenses Rs.222667/-

The tax payer has explained that these expenses were paid to various parties and each party

payment remain below the threshold limit of withholding tax hence no tax has been withheld. In

his support he has not furnished party wise details. Hence tax @ 3.5% is charged which comes

to Rs.7793/-.

In view of the facts of the case demand of withholding tax is

determined as under:-

S U M M A R Y

HEAD OF EXPENSE TAX PAYABLE U/S 161

Raw material (local) Rs.227007/-

Salary&wages(manufacturing) Rs.25171/-

Store & Spares Rs.94389/-

Salary & wages

(Admin)

Rs.18446/-

Printing & Stationary Rs.23632/-

Advertisement. Rs.17623/-

Misc. Expenses. Rs.7793

Communication

charges

Rs.1103/-

Salaries and benefits(selling) Rs.34509/-

Wood purchased Rs.89378/-

TOTAL:-

Rs.539051/-

Total default tax payable u/s 161 Rs.539051/-

Add default surcharge u/s 205 (days of default 273) Rs.72573 /-

Total Tax Payable u/s 161/205 of the Income Tax

Ordinance, 2001 Rs.611624/-

Issue demand notice, copy of the order along with challan for payment.

Dated: (ABID RASOOL KHAN)

DEPUTY COMMISSIONER

Vous aimerez peut-être aussi

- Ito New Delhi Vs M S Paragon XT New Delhi On 14 March 2019Document29 pagesIto New Delhi Vs M S Paragon XT New Delhi On 14 March 2019ashish poddarPas encore d'évaluation

- 2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioDocument7 pages2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioThe Chartered Professional NewsletterPas encore d'évaluation

- Section 14A Disallowance if No Exempt IncomeDocument3 pagesSection 14A Disallowance if No Exempt IncomeRatnaPrasadNalamPas encore d'évaluation

- INCOME TAX AND GST. JURAZ-Module 4Document8 pagesINCOME TAX AND GST. JURAZ-Module 4TERZO IncPas encore d'évaluation

- Income Tax 2074-75 TransDocument9 pagesIncome Tax 2074-75 TransbinuPas encore d'évaluation

- 2004 SLD 288 (Input Tax Allowance Based Upon Invoice)Document3 pages2004 SLD 288 (Input Tax Allowance Based Upon Invoice)Zayn ShaukatPas encore d'évaluation

- Green Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFDocument42 pagesGreen Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFKriszan ManiponPas encore d'évaluation

- Payment Basis (Revised As at 30 January 2014) PDFDocument29 pagesPayment Basis (Revised As at 30 January 2014) PDFNasTikPas encore d'évaluation

- CIR v. Negros Del NorteDocument2 pagesCIR v. Negros Del NortePatrick ManaloPas encore d'évaluation

- Composition Under GSTDocument12 pagesComposition Under GSTSHAMBHU DAYALPas encore d'évaluation

- Income Tax 2075-2076Document8 pagesIncome Tax 2075-2076binuPas encore d'évaluation

- Third Division: Republic of Philippines Court of Tax Appeals QuezonDocument8 pagesThird Division: Republic of Philippines Court of Tax Appeals Quezonنيسريو جينوPas encore d'évaluation

- Professional Updates 1Document25 pagesProfessional Updates 1Nitin Mohan KashyapPas encore d'évaluation

- R.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Document7 pagesR.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Prabhash ChandPas encore d'évaluation

- Grounds of Appeal TY-16Document2 pagesGrounds of Appeal TY-16wasim nisarPas encore d'évaluation

- Taxpayer refund status for food manufacturerDocument1 pageTaxpayer refund status for food manufacturerM Hassan BrohiPas encore d'évaluation

- TDS Year of Receipt 26asDocument8 pagesTDS Year of Receipt 26asDr G D PadmahshaliPas encore d'évaluation

- Uganda Tax Appeals Tribunal rules on VAT refund disputeDocument14 pagesUganda Tax Appeals Tribunal rules on VAT refund disputeJoshua Kato KalibbalaPas encore d'évaluation

- Statement of Submissin of Audit Report in Form-704Document704 pagesStatement of Submissin of Audit Report in Form-704Suruchi Kejriwal GoyalPas encore d'évaluation

- Benefits of GST ImplementationDocument6 pagesBenefits of GST ImplementationMinhans SrivastavaPas encore d'évaluation

- Tax Law - Penal ProvisionsDocument23 pagesTax Law - Penal ProvisionsArsalan Ahmad100% (1)

- Tax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Document16 pagesTax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Nikhil PahariaPas encore d'évaluation

- 15 04 16 Case2Document26 pages15 04 16 Case2tamanna.vkacaPas encore d'évaluation

- Ita 255-366-B11 PDFDocument22 pagesIta 255-366-B11 PDFBalu AnandPas encore d'évaluation

- Neeraj Jawla & Associates: Chartered AccountantsDocument2 pagesNeeraj Jawla & Associates: Chartered AccountantsSandeep TyagiPas encore d'évaluation

- Cir VS Luzon DrugDocument9 pagesCir VS Luzon DrugYvon BaguioPas encore d'évaluation

- ITAT Delhi upholds Rs 146 cr AMP adjustment for confectionery firmDocument18 pagesITAT Delhi upholds Rs 146 cr AMP adjustment for confectionery firmramitkatyalPas encore d'évaluation

- Dell International Services India PVT LTD Vs The IIL2022040522170528204COM311728Document30 pagesDell International Services India PVT LTD Vs The IIL2022040522170528204COM311728Rıtesha DasPas encore d'évaluation

- Unit 4Document16 pagesUnit 4Abhishek Kumar GuptaPas encore d'évaluation

- CENTURION UNIVERSITY GSTDocument32 pagesCENTURION UNIVERSITY GSTBANANI DASPas encore d'évaluation

- (2010) 328 ITR 169 (Punjab & Haryana) (19-08-2009) Commissioner of Income-Tax vs. Mandeep SinghDocument2 pages(2010) 328 ITR 169 (Punjab & Haryana) (19-08-2009) Commissioner of Income-Tax vs. Mandeep SinghkalravPas encore d'évaluation

- Supreme Court rules against BIR in tax case against Philippine Daily InquirerDocument2 pagesSupreme Court rules against BIR in tax case against Philippine Daily InquirerJoseph SalidoPas encore d'évaluation

- Form-704 NewDocument251 pagesForm-704 NewHusaina NasikwalaPas encore d'évaluation

- INCOME TAX DEPT OFFICE ASSESSMENTDocument3 pagesINCOME TAX DEPT OFFICE ASSESSMENTGeetu DhimanPas encore d'évaluation

- _2023__150_taxmann_com_227__Rajasthan__30_10_2018__Principal_Commissioner_of_Income_tax_vs_ (1)Document11 pages_2023__150_taxmann_com_227__Rajasthan__30_10_2018__Principal_Commissioner_of_Income_tax_vs_ (1)Abhishek JainPas encore d'évaluation

- Protest Letter Against 2012 Tax AssessmentDocument4 pagesProtest Letter Against 2012 Tax AssessmentPatrice Noelle Ramirez90% (10)

- Form 704Document704 pagesForm 704Dhananjay KulkarniPas encore d'évaluation

- GST 2 Marks answersDocument6 pagesGST 2 Marks answersObaid AhmedPas encore d'évaluation

- Appeal SummaryDocument49 pagesAppeal Summarymaapitambraenterprises700Pas encore d'évaluation

- 2020 P T D Trib 614Document8 pages2020 P T D Trib 614haseeb AhsanPas encore d'évaluation

- GST PresentationDocument18 pagesGST PresentationShivam SahniPas encore d'évaluation

- Unit 4 GSTDocument13 pagesUnit 4 GSTViral OkPas encore d'évaluation

- 2017LHC1658 - Advance TaxDocument13 pages2017LHC1658 - Advance TaxMuhammad ZameerPas encore d'évaluation

- CIR v. Perf Realty Corp. G.R. No. 163345, July 4, 2008 (Filing of ITR and Indicating of Option) FactsDocument12 pagesCIR v. Perf Realty Corp. G.R. No. 163345, July 4, 2008 (Filing of ITR and Indicating of Option) FactsTokie TokiPas encore d'évaluation

- H4 - GST at GVC: Spark For The DayDocument5 pagesH4 - GST at GVC: Spark For The DayKenny PhilipsPas encore d'évaluation

- VAT Booklet for FY 2012-13 by Dhirubhai Shah & CoDocument20 pagesVAT Booklet for FY 2012-13 by Dhirubhai Shah & Coankur2706Pas encore d'évaluation

- Withholding Taxes SeminarDocument99 pagesWithholding Taxes SeminarLeilani Delgado Moselina0% (1)

- Subject: Representation Under Section 7 of Federal Board of Revenue Act, 2007 Filed by M/S Saleem and CompanyDocument7 pagesSubject: Representation Under Section 7 of Federal Board of Revenue Act, 2007 Filed by M/S Saleem and CompanyUmar ChowdhariPas encore d'évaluation

- Taxpayers CharterDocument3 pagesTaxpayers CharterShahaan ZulfiqarPas encore d'évaluation

- Taxation Cases On Remedies (1) DigestDocument77 pagesTaxation Cases On Remedies (1) DigestGuiller MagsumbolPas encore d'évaluation

- GST-603 Unit 5Document3 pagesGST-603 Unit 5GauharPas encore d'évaluation

- Unit 4 - GST Liability & Input Tax CreditDocument13 pagesUnit 4 - GST Liability & Input Tax CreditPrathik PsPas encore d'évaluation

- Case Law Relating To Section 153C of Income Tax ActDocument3 pagesCase Law Relating To Section 153C of Income Tax Actyegawo4725Pas encore d'évaluation

- TDS 2074-75Document3 pagesTDS 2074-75binuPas encore d'évaluation

- Tax RemediesDocument56 pagesTax RemediesElaiza RegaladoPas encore d'évaluation

- Cta DecisionsDocument10 pagesCta DecisionsKimboy Elizalde PanaguitonPas encore d'évaluation

- Input Tax CreditDocument5 pagesInput Tax CreditSowmya GuptaPas encore d'évaluation

- 1614324619-ITA 5044 Arya Process EquipmentDocument6 pages1614324619-ITA 5044 Arya Process Equipmentakhil layogPas encore d'évaluation

- Taxation Reviewer On VATDocument10 pagesTaxation Reviewer On VATlchieSPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarPas encore d'évaluation

- Revised PM PACKAGEDocument14 pagesRevised PM PACKAGEShahaan ZulfiqarPas encore d'évaluation

- Certificate EmanDocument1 pageCertificate EmanShahaan ZulfiqarPas encore d'évaluation

- Para No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Dependency and No Marriage CertificatesDocument5 pagesDependency and No Marriage CertificatesShahaan ZulfiqarPas encore d'évaluation

- Summary Position of RTO Multan with Amounts Pointed Out, Recovered and PendingDocument6 pagesSummary Position of RTO Multan with Amounts Pointed Out, Recovered and PendingShahaan ZulfiqarPas encore d'évaluation

- Regularization Application To CCIRDocument7 pagesRegularization Application To CCIRShahaan ZulfiqarPas encore d'évaluation

- Chairman, Federal Board of Revenue, IslamabadDocument3 pagesChairman, Federal Board of Revenue, IslamabadShahaan ZulfiqarPas encore d'évaluation

- Slip 0232 01 2019Document513 pagesSlip 0232 01 2019Shahaan ZulfiqarPas encore d'évaluation

- Certificate UsmanDocument1 pageCertificate UsmanShahaan ZulfiqarPas encore d'évaluation

- R 0232 01Document357 pagesR 0232 01Shahaan ZulfiqarPas encore d'évaluation

- Assistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingDocument5 pagesAssistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingShahaan ZulfiqarPas encore d'évaluation

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedDocument5 pagesPara No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument5 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para NO Cases Under Process Amount Pointed Out by AuditDocument6 pagesPara NO Cases Under Process Amount Pointed Out by AuditShahaan ZulfiqarPas encore d'évaluation

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument5 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Clarification Note Guidelines Valuation Basis For Liabilities of Labuan General - 16112016Document2 pagesClarification Note Guidelines Valuation Basis For Liabilities of Labuan General - 16112016Azman IsmailPas encore d'évaluation

- CA Mohit Jain: Professional QualificationsDocument3 pagesCA Mohit Jain: Professional QualificationsThe Cultural CommitteePas encore d'évaluation

- Financial Modeling GuideDocument59 pagesFinancial Modeling GuideGhislaine TohouegnonPas encore d'évaluation

- Auditing and Reporting Social Performance 1Document12 pagesAuditing and Reporting Social Performance 1ROMAR A. PIGAPas encore d'évaluation

- Stirne, Richard Allen 1000822270 - ATL-12K - OfferDocument4 pagesStirne, Richard Allen 1000822270 - ATL-12K - OfferBartholomew SzoldPas encore d'évaluation

- Procurement Risk RegisterDocument3 pagesProcurement Risk RegisterYogender Singh Rawat100% (2)

- Conversion Costs: AccountingtoolsDocument1 pageConversion Costs: AccountingtoolsJazzmin Rae BarbaPas encore d'évaluation

- International Transfer Pricing Advance ArrangementsDocument30 pagesInternational Transfer Pricing Advance ArrangementsSen JanPas encore d'évaluation

- AT.1807 Preliminary Engagement Activities 1 PDFDocument7 pagesAT.1807 Preliminary Engagement Activities 1 PDFPia DumigpiPas encore d'évaluation

- Isms Iso 27001 Idocia - FCDocument1 pageIsms Iso 27001 Idocia - FCASTRI yuliaPas encore d'évaluation

- Module 3 Topic 3 in Cooperative ManagementDocument34 pagesModule 3 Topic 3 in Cooperative Managementharon franciscoPas encore d'évaluation

- Accounting in Business Management Ashley N. Beckom Westwood College BUS501: Quantitative Business Analysis October 14, 2010Document6 pagesAccounting in Business Management Ashley N. Beckom Westwood College BUS501: Quantitative Business Analysis October 14, 2010abeckomPas encore d'évaluation

- Narrative Description of Internal Control OnDocument2 pagesNarrative Description of Internal Control OnRenzo Melliza100% (1)

- Regulatory Framework For IBIs-ZahidDocument43 pagesRegulatory Framework For IBIs-Zahidski_leo82Pas encore d'évaluation

- PPM 2019 02 Ibrahim PDFDocument11 pagesPPM 2019 02 Ibrahim PDFasfand yar aliPas encore d'évaluation

- Conceptual Framework and Accounting Standards: OutlineDocument6 pagesConceptual Framework and Accounting Standards: OutlineMichael TorresPas encore d'évaluation

- Thompson Et Al.2022Document20 pagesThompson Et Al.2022hanieyraPas encore d'évaluation

- Legal Aspects of Business AccountingDocument5 pagesLegal Aspects of Business AccountingswaggerboxPas encore d'évaluation

- Attendance at The StocktakingDocument13 pagesAttendance at The StocktakingJohn RockefellerPas encore d'évaluation

- CS Form No. 212 Attachment - Work Experience SheetDocument2 pagesCS Form No. 212 Attachment - Work Experience SheetArnel Pablo100% (2)

- Divisible Profits Factors and PrinciplesDocument14 pagesDivisible Profits Factors and PrinciplesVeeresh SharmaPas encore d'évaluation

- Road Safety Audit in Denmark: Lárus Ágústsson Civ. Eng., M. Sc. Danish Road Directorate Ministry of Transport - DenmarkDocument15 pagesRoad Safety Audit in Denmark: Lárus Ágústsson Civ. Eng., M. Sc. Danish Road Directorate Ministry of Transport - DenmarkYogesh ShahPas encore d'évaluation

- Iqa Training SlidesDocument86 pagesIqa Training SlidesKranti BharatPas encore d'évaluation

- Auditing Important QuestionsDocument6 pagesAuditing Important QuestionssajithPas encore d'évaluation

- Types of Technical Writing For BusinessDocument7 pagesTypes of Technical Writing For BusinessJane Ericka Joy MayoPas encore d'évaluation

- Procurement and Accounts PayableDocument4 pagesProcurement and Accounts PayableHazel Cabarrubias MacaPas encore d'évaluation

- FAR101A-Financial Accounting and Reporting ADocument153 pagesFAR101A-Financial Accounting and Reporting AMark Juliah NaveraPas encore d'évaluation

- URP AM - FinalDocument28 pagesURP AM - FinalMorshedDenarAlamMannaPas encore d'évaluation

- Process Audit VDA 6.3Document9 pagesProcess Audit VDA 6.3Mike Paruszkiewicz100% (1)

- Audit Report of CompaniesDocument7 pagesAudit Report of CompaniesPontuChowdhuryPas encore d'évaluation