Académique Documents

Professionnel Documents

Culture Documents

ch03 Part6

Transféré par

Sergio HoffmanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ch03 Part6

Transféré par

Sergio HoffmanDroits d'auteur :

Formats disponibles

EXERCISE 3-22 (Continued)

Ed Bradley Co.

Balance Sheet

April 30, 2014

Assets

Current Assets

Cash ................................................................ $18,972

Accounts receivable ...................................... 6,920

Prepaid rent .................................................... 2,280

Total current assets .............................. 28,172

Property, plant, and equipment

Equipment ...................................................... $18,050

Accumulated depreciation

equipment ....................................................

(4,895)

13,155

Total assets ...................................................................... $41,327

Liabilities and Stockholders Equity

Current liabilities

Notes payable ................................................ $ 5,700

Accounts payable .......................................... 4,472

Interest payable ............................................. 83

Total current liabilities ......................... 10,255

Stockholders equity

Common Stock .............................................. 34,960

Retained earnings .......................................... (3,888) 31,072*

Total liabilities and Stockholders equity ....................... $41,327

*Beg. Balance Dividends + Net Income = Ending Balance

$1,000 $6,650 + $1,762 = ($3,888)

Copyright 2013 J ohn Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only) 3-31

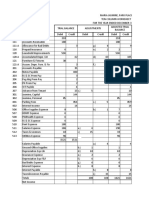

*EXERCISE 3-23 (1015 minutes)

Jurassic Park Co.

Worksheet (partial)

For Month Ended February 28, 2014

Trial

Balance

Adjustments

Adjusted

Trial Balance

Income

Statement

Balance

Sheet

Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Supplies 1,756 (a) 1,041 715 715

Accumulated

depreciation

equipment

6,939

(b)

257

7,196

7,196

Interest

payable

150

(c)

50

200

200

Supplies

expense

(a)

1,041

1,041

1,041

Depreciation

expense

(b)

257

257

257

Interest

expense

(c)

50

50

50

The following accounts and amounts would be shown in the February

income statement:

Supplies expense $1,041

Depreciation expense 257

Interest expense 50

3-32 Copyright 2013 J ohn Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only)

TIME AND PURPOSE OF PROBLEMS

Problem 3-1 (Time 2535 minutes)

Purposeto provide an opportunity for the student to post daily transactions to a T account ledger,

take a trial balance, prepare an income statement, a balance sheet and a statement of owners equity,

close the ledger, and take a post-closing trial balance. The problem deals with routine transactions of a

professional service firm and provides a good integration of the accounting process.

Problem 3-2 (Time 3540 minutes)

Purposeto provide an opportunity for the student to prepare adjusting entries, and prepare financial

statements (income statement, balance sheet, and statement of retained earnings). The student also is

asked to analyze two transactions to find missing amounts.

Problem 3-3 (Time 2530 minutes)

Purposeto provide an opportunity for the student to prepare adjusting entries. The adjusting entries

are fairly complex in nature.

Problem 3-4 (Time 4050 minutes)

Purposeto provide an opportunity for the student to prepare adjusting entries and an adjusted trial

balance and then prepare an income statement, a retained earnings statement, and a balance sheet. In

addition, closing entries must be made and a post-closing trial balance prepared.

Problem 3-5 (Time 1520 minutes)

Purposeto provide the student with an opportunity to determine what adjusting entries need to be

made to specific accounts listed in a partial trial balance. The student is also required to determine the

amounts of certain revenue and expense items to be reported in the income statement.

Problem 3-6 (Time 2535 minutes)

Purposeto provide the student with an opportunity to prepare year-end adjusting entries from a trial

balance and related information presented. The problem also requires the student to prepare an

income statement, a balance sheet, and a statement of owners equity. The problem covers the basics

of the end-of-period adjusting process.

Problem 3-7 (Time 2535 minutes)

Purposeto provide an opportunity for the student to figure out the year-end adjusting entries that were

made from a trial balance and an adjusted trial balance. The student is also required to prepare an

income statement, a statement of retained earnings, and a balance sheet. In addition, the student

needs to answer a number of questions related to specific accounts.

Problem 3-8 (Time 2535 minutes)

Purposeto provide an opportunity for the student to figure out the year-end adjusting entries that were

made from a trial balance and an adjusted trial balance. The student is also required to prepare an

income statement, a statement of retained earnings, and a balance sheet. In addition, the student

needs to answer a number of questions related to specific accounts.

Problem 3-9 (Time 3040 minutes)

Purposeto provide an opportunity for the student to prepare adjusting, and closing entries. This

problem presents basic adjustments including a number of accruals and deferrals. It provides the

student with an integrated flow of the year-end accounting process.

Problem 3-10 (Time 3035 minutes)

Purposeto provide an opportunity for the student to prepare adjusting and closing entries from a trial

balance and related information. The student is also required to post the entries to T accounts.

Copyright 2013 J ohn Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only) 3-33

Time and Purpose of Problems (Continued)

*Problem 3-11 (Time 3540 minutes)

Purposeto provide an opportunity for the student to prepare and compare (a) cash basis and accrual-

basis income statements, (b) cash-basis and accrual-basis balance sheets, and (c) to discuss the

weaknesses of cash basis accounting.

*Problem 3-12 (Time 4050 minutes)

Purposeto provide an opportunity for the student to complete a worksheet and then prepare a

classified balance sheet. In addition, adjusting and closing entries must be made and a post-closing

trial balance prepared.

3-34 Copyright 2013 J ohn Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only)

SOLUTIONS TO PROBLEMS

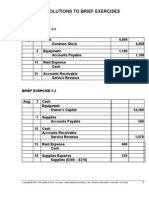

PROBLEM 3-1

(a) (Explanations are omitted.) and (d)

Cash Equipment

Sept. 1 20,000 Sept. 4 680 Sept. 2 17,280

8 1,690 5 942

20 980 10 430

18 3,600 Owners Capital

19 3,000 Sept. 19 3,000 Sept. 1 20,000

30 1,800 30 6,007

30 85 Bal. 30 23,007

30 Bal 12,133

Accounts Receivable

Sept. 14 5,820 Sept. 20 980

25 2,110 Accounts Payable

Bal. 30 6,950 Sept. 18 3,600 Sept. 2 17,280

Bal. 30 13,680

Rent Expense

Sept. 4 680 Sept. 30 680

Supplies Service Revenue

Sept. 5 942 Sept. 30 330 Sept. 30 9,620 Sept. 8 1,690

Bal. 30 612 14 5,820

25 2,110

9,620 9,620

Office Expense Accumulated DepreciationEquipment

Sept. 10 430 Sept. 30 515 Sept. 30 288

30 85

515 515

Salaries and Wages Expense

Sept. 30 1,800 Sept. 30 1,800

Supplies Expense

Sept. 30 330 Sept. 30 330

Copyright 2013 J ohn Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only) 3-35

PROBLEM 3-1 (Continued)

Depreciation Expense Income Summary

Sept. 30 288 Sept. 30 288 Sept. 30 680 Sept. 30 9,620

30 515

30 1,800

30 330

30 288

30 Inc. 6,007

9,620 9,620

(b) YASUNARI KAWABATA, D.D.S.

Trial Balance

September 30

Debit Credit

Cash ......................................................................... $12,133

Accounts Receivable .............................................. 6,950

Supplies ................................................................... 612

Equipment ............................................................... 17,280

Accumulated DepreciationEquipment ............... $ 288

Accounts Payable ................................................... 13,680

Owners Capital ....................................................... 17,000

Service Revenue ..................................................... 9,620

Rent Expense .......................................................... 680

Office Expense ........................................................ 515

Salaries and Wages Expense ................................. 1,800

Supplies Expense ................................................... 330

Depreciation Expense ............................................. 288

Totals ............................................................. $40,588 $40,588

3-36 Copyright 2013 J ohn Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only)

Vous aimerez peut-être aussi

- Strategic Factor Analysis Summary (Marvel - Case Study)Document31 pagesStrategic Factor Analysis Summary (Marvel - Case Study)Surjit Puruhutjit100% (8)

- Solution Manual For Financial Accounting 9th Edition by WeygandtDocument22 pagesSolution Manual For Financial Accounting 9th Edition by Weygandta540142314100% (3)

- MASDocument13 pagesMASchloe maePas encore d'évaluation

- Nahmias Chapter 3 SolutionsDocument9 pagesNahmias Chapter 3 SolutionsDiego Andres Vasquez100% (1)

- Adjusting entries for McGee CompanyDocument139 pagesAdjusting entries for McGee Companybeenie manPas encore d'évaluation

- Voltas Organizational Study ReportDocument88 pagesVoltas Organizational Study ReportJAY Solanki100% (1)

- Bangladesh Customs DepartmentDocument22 pagesBangladesh Customs DepartmentMir Tebrak Hossain100% (1)

- p176 Maria JasmineDocument9 pagesp176 Maria JasmineIsaiah Valencia100% (1)

- Chapter 9 Solutions - Inclass ExercisesDocument5 pagesChapter 9 Solutions - Inclass ExercisesSummerPas encore d'évaluation

- Principles of Accounting-Mid Term PaperDocument7 pagesPrinciples of Accounting-Mid Term PaperAbdullahPas encore d'évaluation

- ch03 Part9Document6 pagesch03 Part9Sergio HoffmanPas encore d'évaluation

- Chapter 20Document9 pagesChapter 20ezanswersPas encore d'évaluation

- Solutions To Problems Chapter 3Document23 pagesSolutions To Problems Chapter 3Kayla Julian0% (1)

- Self Study Solutions Chapter 3Document27 pagesSelf Study Solutions Chapter 3flowerkmPas encore d'évaluation

- Solutions To ExercisesDocument38 pagesSolutions To ExercisesAnh KietPas encore d'évaluation

- Acc.1 - HW Ch. 1+2+3 - 31-10-2023Document6 pagesAcc.1 - HW Ch. 1+2+3 - 31-10-2023samerghaith0Pas encore d'évaluation

- Weygandt FA PPB Ch3 v2 PDFDocument34 pagesWeygandt FA PPB Ch3 v2 PDFMuhammad SherazPas encore d'évaluation

- Hhtfa8e ch03 SMDocument119 pagesHhtfa8e ch03 SMharryPas encore d'évaluation

- Problem CHP 3 B MbaDocument18 pagesProblem CHP 3 B MbaAli Ahmad100% (2)

- Problems and Answers On ch.3, ACT 101Document19 pagesProblems and Answers On ch.3, ACT 101clara2300181Pas encore d'évaluation

- Financial and Managerial Accounting Group AssignmentDocument9 pagesFinancial and Managerial Accounting Group AssignmentDagmawit NegussiePas encore d'évaluation

- Exercise 4-10 1Document3 pagesExercise 4-10 1hoàng anh lêPas encore d'évaluation

- Chapter 9 SolutionsDocument6 pagesChapter 9 SolutionsmackkshellPas encore d'évaluation

- TT04 Closing ANSDocument7 pagesTT04 Closing ANSkhanhphamngoc1716Pas encore d'évaluation

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/31Marcel JonathanPas encore d'évaluation

- Adjusting Accounts and Preparing Financial Statements: QuestionsDocument74 pagesAdjusting Accounts and Preparing Financial Statements: QuestionsChaituPas encore d'évaluation

- PFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial StatementsDocument71 pagesPFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial Statementscalista sPas encore d'évaluation

- Key Chapter 4Document12 pagesKey Chapter 4JinAe NaPas encore d'évaluation

- ACCT500 (16) Answers To Seminar 6Document5 pagesACCT500 (16) Answers To Seminar 6rashid rahmanzada100% (1)

- Chapter 3 SolutionsDocument100 pagesChapter 3 SolutionssevtenPas encore d'évaluation

- Financial Accounting Ifrs 4e Chapter 4 SolutionDocument50 pagesFinancial Accounting Ifrs 4e Chapter 4 SolutionSana SoomroPas encore d'évaluation

- 4 5845855793034823826Document36 pages4 5845855793034823826Gena HamdaPas encore d'évaluation

- Prepare Financial StatementsDocument17 pagesPrepare Financial StatementsHayat AliPas encore d'évaluation

- Paf 3023 - Adjusting Entries Exercise SkemaDocument6 pagesPaf 3023 - Adjusting Entries Exercise SkemaLIM LEE THONGPas encore d'évaluation

- Level Four Code 3 Answer-1Document7 pagesLevel Four Code 3 Answer-1EdomPas encore d'évaluation

- Cambridge International AS & A Level: Accounting 9706/33Document20 pagesCambridge International AS & A Level: Accounting 9706/33Aimen AhmedPas encore d'évaluation

- Chapter 03 SMDocument67 pagesChapter 03 SMAthena LauPas encore d'évaluation

- Associate Level Material: Adjusting Entries, Posting, and Preparing An Adjusted Trial BalanceDocument8 pagesAssociate Level Material: Adjusting Entries, Posting, and Preparing An Adjusted Trial BalanceJean GilmorePas encore d'évaluation

- Level Four Code 4 AnswerDocument9 pagesLevel Four Code 4 AnswerbiniamPas encore d'évaluation

- CHAPTER 3 SolutionDocument1 pageCHAPTER 3 SolutionQuỳnh'ss Đắc'ssPas encore d'évaluation

- ACCT1101 Ch 4 - Financial Accounting Assignment QuestionsDocument6 pagesACCT1101 Ch 4 - Financial Accounting Assignment QuestionsIvy KwokPas encore d'évaluation

- Ch08 Harrison 8e GE SM (Revised)Document102 pagesCh08 Harrison 8e GE SM (Revised)Muh BilalPas encore d'évaluation

- Ans. Basic Fin. AcctDocument13 pagesAns. Basic Fin. AcctHashimRazaPas encore d'évaluation

- (A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Document5 pages(A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Sergio NicolasPas encore d'évaluation

- Ch03 SM 9eDocument156 pagesCh03 SM 9ekmmkmPas encore d'évaluation

- Level 4 Code 1 Answer-1Document10 pagesLevel 4 Code 1 Answer-1biniam100% (1)

- S A Ipcc Nov 2011 - GR IDocument97 pagesS A Ipcc Nov 2011 - GR ISaibhumi100% (1)

- Solution CH.9Document8 pagesSolution CH.9Thanawat PHURISIRUNGROJPas encore d'évaluation

- BTE343MT 1 Winter 2010.solutionDocument16 pagesBTE343MT 1 Winter 2010.solutionishwarsumeetPas encore d'évaluation

- Last Final-Enter Openning Balance SQ3Document9 pagesLast Final-Enter Openning Balance SQ3BUNKHY LEMPas encore d'évaluation

- Master Budgeting: Solutions To QuestionsDocument22 pagesMaster Budgeting: Solutions To QuestionsHananAhmedPas encore d'évaluation

- 2023 Specimen Paper 4Document10 pages2023 Specimen Paper 4l PLAY GAMESPas encore d'évaluation

- Stat Cost MGT Midterms RevisedDocument7 pagesStat Cost MGT Midterms Revisedjoneth.duenasPas encore d'évaluation

- Projectinstruction20212022 02Document3 pagesProjectinstruction20212022 02Khairul AnamPas encore d'évaluation

- ACC211 Week 4-5 SIMDocument22 pagesACC211 Week 4-5 SIMIvan Pacificar BiorePas encore d'évaluation

- Current Liabilities and Payroll Accounting: QuestionsDocument56 pagesCurrent Liabilities and Payroll Accounting: QuestionsChu Thị Thủy100% (1)

- Group Test 2 W ASDocument10 pagesGroup Test 2 W ASmeeyaPas encore d'évaluation

- CH 4 SolutionDocument14 pagesCH 4 SolutionRody El KhalilPas encore d'évaluation

- Solutions to Bond ExercisesDocument31 pagesSolutions to Bond ExercisesMaha M. Al-MasriPas encore d'évaluation

- Analyzing Financial Statements ExerciseDocument4 pagesAnalyzing Financial Statements ExerciseVin MaoPas encore d'évaluation

- Answers S3T1P1Document7 pagesAnswers S3T1P1mananleo88Pas encore d'évaluation

- 2023 Specimen Paper 3Document14 pages2023 Specimen Paper 3l PLAY GAMESPas encore d'évaluation

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisD'EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisPas encore d'évaluation

- Sociology DefinitionsDocument21 pagesSociology DefinitionsSergio HoffmanPas encore d'évaluation

- Aging and Ageism Quiz ResultsDocument3 pagesAging and Ageism Quiz ResultsSergio HoffmanPas encore d'évaluation

- Sociology DefDocument2 pagesSociology DefSergio HoffmanPas encore d'évaluation

- 7Document3 pages7Sergio HoffmanPas encore d'évaluation

- 3Document4 pages3Sergio HoffmanPas encore d'évaluation

- 5Document3 pages5Sergio HoffmanPas encore d'évaluation

- 6Document3 pages6Sergio HoffmanPas encore d'évaluation

- 1Document4 pages1Sergio HoffmanPas encore d'évaluation

- 8Document3 pages8Sergio HoffmanPas encore d'évaluation

- 2Document4 pages2Sergio HoffmanPas encore d'évaluation

- 4Document4 pages4Sergio HoffmanPas encore d'évaluation

- Ladies Jeans Waist Conv ChartDocument1 pageLadies Jeans Waist Conv ChartSergio HoffmanPas encore d'évaluation

- ch03 Part13Document6 pagesch03 Part13Sergio HoffmanPas encore d'évaluation

- ch03 Part14Document6 pagesch03 Part14Sergio HoffmanPas encore d'évaluation

- ch03 Part12Document6 pagesch03 Part12Sergio HoffmanPas encore d'évaluation

- ch02 Part8Document5 pagesch02 Part8Sergio HoffmanPas encore d'évaluation

- Summary ReviewDocument21 pagesSummary ReviewSergio HoffmanPas encore d'évaluation

- ch03 Part7Document6 pagesch03 Part7Sergio HoffmanPas encore d'évaluation

- ch03 Part11Document6 pagesch03 Part11Sergio HoffmanPas encore d'évaluation

- ch03 Part3Document6 pagesch03 Part3Sergio HoffmanPas encore d'évaluation

- ch03 Part1Document6 pagesch03 Part1Sergio HoffmanPas encore d'évaluation

- ch03 Part10Document6 pagesch03 Part10Sergio HoffmanPas encore d'évaluation

- ch03 Part5Document6 pagesch03 Part5Sergio HoffmanPas encore d'évaluation

- ch03 Part2Document6 pagesch03 Part2Sergio HoffmanPas encore d'évaluation

- ch03 Part4Document6 pagesch03 Part4Sergio HoffmanPas encore d'évaluation

- ch02 Part7Document6 pagesch02 Part7Sergio HoffmanPas encore d'évaluation

- ch02 Part6Document6 pagesch02 Part6Sergio HoffmanPas encore d'évaluation

- Sethusamudram Shipping Channel Project: Who Is Responsible? - Naresh KadyanDocument93 pagesSethusamudram Shipping Channel Project: Who Is Responsible? - Naresh KadyanNaresh KadyanPas encore d'évaluation

- BSBFIM601 Manage FinanceDocument6 pagesBSBFIM601 Manage FinanceMichelle Tseng0% (2)

- GCMA BookDocument524 pagesGCMA BookZiaul Huq100% (5)

- Essar ReportDocument236 pagesEssar Reportasit kumar sahooPas encore d'évaluation

- Financial ReportingDocument22 pagesFinancial Reportingmhel cabigonPas encore d'évaluation

- Slice and DiceDocument153 pagesSlice and Dicejunohcu310Pas encore d'évaluation

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Financial Reporting QuestionDocument5 pagesFinancial Reporting QuestionAVNEET SinghPas encore d'évaluation

- The Cost of CapitalDocument23 pagesThe Cost of CapitalMuhammad AmmadPas encore d'évaluation

- Cre8 Corp's Organizational StructureDocument5 pagesCre8 Corp's Organizational StructureJhobelle JovellanoPas encore d'évaluation

- Keynesian ApproachDocument20 pagesKeynesian ApproachDeepikaPas encore d'évaluation

- Elgi Annual Report 2017 18 v2Document184 pagesElgi Annual Report 2017 18 v2sarvinpsgPas encore d'évaluation

- Case Study 1Document1 pageCase Study 1Pau AderinPas encore d'évaluation

- 1309870495asipac Study Revenue ShareDocument16 pages1309870495asipac Study Revenue ShareManoj ThandasseryPas encore d'évaluation

- Executive Summary ORGANIC FARMDocument8 pagesExecutive Summary ORGANIC FARMkenkimanthiPas encore d'évaluation

- Falcon Inc Case Study ROI AnalysisDocument19 pagesFalcon Inc Case Study ROI AnalysisDhaval100% (2)

- Cost Benefit AnalysisDocument11 pagesCost Benefit AnalysisTnek OrarrefPas encore d'évaluation

- FIN 440 Final ReportDocument17 pagesFIN 440 Final ReportAki Minh Thu NguyenPas encore d'évaluation

- Itc LTD: ValuationsDocument11 pagesItc LTD: ValuationsMera Birthday 2021Pas encore d'évaluation

- ACCT801 219 Assignment 2 TemplateDocument2 pagesACCT801 219 Assignment 2 TemplateAcademic ServicesPas encore d'évaluation

- POLICE POWER ReviewerDocument3 pagesPOLICE POWER ReviewerAyleen RamosPas encore d'évaluation

- Strategic Management of Resources (SMR) Practice Questions - APICS CPIMDocument17 pagesStrategic Management of Resources (SMR) Practice Questions - APICS CPIMCerticoPas encore d'évaluation

- Production and Waste Theory Explains Firm Behavior with FeesDocument29 pagesProduction and Waste Theory Explains Firm Behavior with FeesDSJohn27Pas encore d'évaluation

- Finance Chapter 15Document34 pagesFinance Chapter 15courtdubs100% (1)

- Factors Affecting The Choice of The Sourse of FundsDocument3 pagesFactors Affecting The Choice of The Sourse of Fundsmudey100% (2)