Académique Documents

Professionnel Documents

Culture Documents

LCOE of PV, Feb 2014

Transféré par

kokeinCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LCOE of PV, Feb 2014

Transféré par

kokeinDroits d'auteur :

Formats disponibles

LCOE OF PV, FEBRUARY 2014 1

/ / / /

/ / / / / / / / / / / / / / / / / / / / / / / / / / / /

H1 2014 LEVELISED

COST OF ELECTRICITY

- PV

4 FEBRUARY 2014

JENNY CHASE

LCOE OF PV, FEBRUARY 2014 2

/ / / /

PV EXPERIENCE CURVE, 1976-2013 (2013 $/W)

Source: Paul Maycock, First Solar, Bloomberg New Energy

Finance Note: Prices inflation indexed to US PPI.

0.1

1

10

100

1 10 100 1,000 10,000 100,000 1,000,000

experience curve historic prices (Maycock)

Chinese c-Si module prices (BNEF) Thin-film experience curve

First Solar thin-film module cost

1976

1985

2003

2006

2012

Cost per

W

(2013 $)

1976

1985

2003

Q3

2013

2012

Cumulative

capacity (MW)

2013

LCOE OF PV, FEBRUARY 2014 3

/ / / /

AVERAGE EFFICIENCY OF 6 CRYSTALLINE SILICON

SOLAR CELLS, 2010-13 (%)

Source: Bloomberg New Energy

Finance

16.2%

16.8%

17.0%

17.6%

17.5%

18.2%

18.6%

18.9%

15.0%

15.5%

16.0%

16.5%

17.0%

17.5%

18.0%

18.5%

19.0%

2010 2011 2012 2013

6" multi-Si cell 6" mono-Si cell

0.0%

LCOE OF PV, FEBRUARY 2014 4

/ / / /

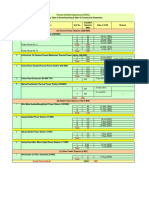

FORECAST COSTS FOR GROUND MOUNTED PV

PROJECTS, 2010-2020 (2013 $/W)

Source: Bloomberg New Energy Finance

Note: Based on experience curves for each component, with estimates for historical years from developer

documents. Methodology here http://bnef.com/Insight/1954 though charts updated January 2014

1.95

1.35

0.75

0.71 0.72

0.65

0.60

0.56

0.52

0.49 0.47

0.32

0.21

0.12

0.13 0.12

0.11

0.10

0.10

0.10

0.09

0.09

0.53

0.50

0.27

0.27

0.26

0.25

0.24

0.24

0.23

0.23

0.23

0.43

0.41

0.32

0.32

0.31

0.30

0.29

0.28

0.28

0.27

0.27

0.19

0.18

0.15

0.15

0.14

0.14

0.13

0.13

0.13

0.12

0.12

3.42

2.64

1.61

1.58

1.55

1.44

1.37

1.31

1.25

1.21

1.16

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Module Inverter Balance of plant EPC Other

LCOE OF PV, FEBRUARY 2014 5

/ / / /

LEVELISED COST OF ELECTRICITY H1 2014:

METHODOLOGY NOTES (1 OF 2)

Definition

The Bloomberg New Energy Finance definition of levelised cost of electricity (LCOE) is the long-term offtake price required to

achieve a required equity hurdle rate for the project. This report tracks the LCOEs of 24 technologies, all at utility-scale with the

exception of fuel cells. (For fuel cells, in lieu of offtake price, we consider the avoided cost of electricity.) The LCOE model is based

on a pro-forma project finance schedule which runs through the full accounting of the project, based on a set of project inputs. This

allows us to capture the impact on costs of the timing of cash flows, development and construction costs, multiple stages of

financing, interest and tax implications of long-term debt instruments and depreciation, among other drivers. The outputs of the

model include sponsor equity cash flows, allowing calculation of the internal rate of return.

LCOE ranges driven by regional variations

The LCOEs are given as a range, with a central scenario within that range. The range is composed of a number of region-specific

scenarios meant to represent key markets, with inputs corresponding to projects typical of those markets, while the central scenario

is made up of a blend of inputs from competitive projects in mature markets. For example, in the case of PV, the low scenario

corresponds to a typical Chinese project (including capex, capacity factors, and costs of debt typical in China); the high scenario

corresponds to a Japanese project (capex, capacity factor, cost of debt typical in Japan); and the central scenario reflects the LCOE

of a project with German capex, 17% capacity factor, and a Western European average cost of debt. The central scenario thus

does not reflect a project characteristic of any particular market, but rather incorporates a blend of inputs from a range of

competitive and active markets. Because we have used this methodology consistently since 2009, the central scenario can be

used to show how these costs of these technologies have evolved over time.

Empirical data sourcing

For the most competitive PV and onshore wind markets, we use proprietary price indexes to build bottom-up capex assumptions,

paired with region-specific data for financing, macroeconomics, and resource quality. For example, for UK onshore wind, we derive

the LCOE using the BNEF Wind Turbine Price Index for the UK, along with operations and maintenance (O&M) figures from our

Wind O&M Index. The full capex also accounts for regional permitting and land acquisition costs. For PV and onshore wind

projects in less competitive markets, and for all other technologies, we use a combination of reported project-level costs (as

captured in our Industry Intelligence database), local input from our regional analysts, and data from publicly available primary

research.

LCOE OF PV, FEBRUARY 2014 6

/ / / /

LEVELISED COST OF ELECTRICITY H1 2014:

METHODOLOGY NOTES (2 OF 2)

Exclusion of subsidies

The LCOEs shown in this report represent the gross cost of building, operating and financing electricity generation technologies.

As such the analysis excludes all subsidies and incentives (eg accelerated depreciation, grants, production tax credits) but

includes conventional taxes such as corporation tax. This approach enables a direct comparison of the cost of generating

electricity from different sources. These LCOEs are therefore from the price at which a developer may wish to sell the electricity,

as the sale price would be net of any subsidies.

Lumpy nature of certain technologies

While cost evolutions can be tracked consistently for widely deployed technologies such as PV and onshore wind creating a

coherent time series this may not be the case for other less mature technologies such as solar thermal and marine. Heavy

dependency on support mechanisms and highly localised costs means that central scenarios reflecting current costs for these

projects may move erratically as the geographic centres of deployment shift over time.

Macroeconomics and universal assumptions

For each individual country scenario, we apply the markets standard corporate tax rate and an inflation rate equal to the average

of the IMFs forecasted CPI rate for that country, or the previous five years of actual inflation if a forecast is unavailable. For our

central scenario, we have necessarily made certain simplifying assumptions: a single corporate tax rate of 35% and an annual

inflation of 2%. We also assume that all projects are depreciated using a straight line approach. LCOEs are calculated assuming a

development timeline that commences today. Todays LCOE is then inflated each year to reflect that project revenues are typically

inflation-linked. This analysis is done in nominal dollars.

The use of debt

A key driver of the LCOEs for all renewable energy technologies is the cost of finance, and specifically the cost of debt finance.

The cost and availability of debt is a function of project risk and market conditions. The technology-independent portion of debt

costs is the level of the underlying interest rate from which debt costs are calculated. The specific market in which a project is

being financed can also have an effect on debt spreads through lenders perception of market-specific sovereign, policy, regulatory

or economic conditions. The higher the perceived risk, the higher the cost of debt.

LCOE OF PV, FEBRUARY 2014 7

/ / / /

LEVELISED COST OF ELECTRICITY, H1 2014 ($/MWH)

Source: Bloomberg New Energy Finance

Note: LCOEs for coal and CCGTs in Europe and Australia assume a carbon price of $20/t. No carbon prices are

assumed for China and the US.

0 100 200 300 400 500

Nuclear

CHP

Coal fired

Natural gas CCGT

Small hydro

Large hydro

Biomass - anaerobic digestion

Landfill gas

Geothermal - flash plant

Wind - onshore

Municipal solid waste

Biomass - incineration

Geothermal - binary plant

PV - c-Si tracking

PV - c-Si

PV - thin film

Biomass - gasification

STEG - tower & heliostat

STEG - LFR

STEG - parabolic trough

Wind - offshore

Marine - tidal

Marine - wave

Regional scenarios H1 2014 central

844

1037

US China Europe Australia

Fossil technologies:

LCOE OF PV, FEBRUARY 2014 8

/ / / /

COPYRIGHT AND DISCLAIMER

This publication is the copyright of Bloomberg New Energy Finance. No portion of this document may be

photocopied, reproduced, scanned into an electronic system or transmitted, forwarded or distributed in any

way without prior consent of Bloomberg New Energy Finance.

The information contained in this publication is derived from carefully selected sources we believe are

reasonable. We do not guarantee its accuracy or completeness and nothing in this document shall be

construed to be a representation of such a guarantee. Any opinions expressed reflect the current judgment of

the author of the relevant article or features, and does not necessarily reflect the opinion of Bloomberg New

Energy Finance, Bloomberg Finance L.P., Bloomberg L.P. or any of their affiliates ("Bloomberg"). The opinions

presented are subject to change without notice. Bloomberg accepts no responsibility for any liability arising

from use of this document or its contents. Nothing herein shall constitute or be construed as an offering of

financial instruments, or as investment advice or recommendations by Bloomberg of an investment strategy or

whether or not to "buy," "sell" or "hold" an investment.

/ / / / / / / / / / / / / / / / / / / / / / / / / / / /

Subscription-based news, data

and analysis to support your

decisions in clean energy, power

and water and the carbon markets

info@bnef.com

MARKETS

Renewable Energy

Carbon Markets

Energy Smart Technologies

Renewable Energy Certificates

Carbon Capture & Storage

Power

Water

Nuclear

SERVICES

Insight: research, analysis & forecasting

Industry Intelligence: data & analytics

News & Briefing: daily, weekly & monthly

Applied Research: custom research & data mining

Knowledge Services: Summit, Leadership Forums, Executive Briefings &

workshops

PV LCOE

JENNY CHASE, JCHASE12@BLOOMBERG.NET

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- 100 KWP Solar Power Plant Technical Proposal PDFDocument24 pages100 KWP Solar Power Plant Technical Proposal PDFRabindra SinghPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hydrogen Fuel Engine-Ppt AbstractDocument7 pagesHydrogen Fuel Engine-Ppt AbstractVijay RaghavanPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Comparison Between Traditional and Modern Fuel VehiclesDocument16 pagesComparison Between Traditional and Modern Fuel VehiclesNaina AgrawalPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Heating and Cooling With Geothermal EnergyDocument34 pagesHeating and Cooling With Geothermal EnergyJuan Carlos Sanchez FloresPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- 01 - Introduction To PV Systems - NEWDocument35 pages01 - Introduction To PV Systems - NEWnoudjuhPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Akshay UrjaDocument56 pagesAkshay UrjasilverbirddudePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Solar Fans PDFDocument3 pagesSolar Fans PDFMohammed ShakilPas encore d'évaluation

- Sources of EnergyDocument2 pagesSources of EnergyglechohPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Solar Photovoltaic System DesignDocument9 pagesSolar Photovoltaic System DesignJay RanvirPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Solar Energy and ApplicationsDocument20 pagesSolar Energy and ApplicationsSanath ReddyPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Total 200: Present Installed Capacity of CSPGCLDocument1 pageTotal 200: Present Installed Capacity of CSPGCLajjuPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Renewable Energy Sources in FiguresDocument88 pagesRenewable Energy Sources in FiguresJayson LauPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Review of Related LiteratureDocument4 pagesReview of Related LiteratureMaria Blessie Navarrete100% (1)

- Proposed PV System Electricity Generation and Electricity RateDocument3 pagesProposed PV System Electricity Generation and Electricity RateSangeet BhandariPas encore d'évaluation

- Wind Energy and Wind Turbine PDFDocument13 pagesWind Energy and Wind Turbine PDFE Cos LopezPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- ModelQuestions EEE305Document2 pagesModelQuestions EEE305John TauloPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Exergetic Analysis of A New Design Photovoltaic and Thermal (PV/T) SystemDocument5 pagesExergetic Analysis of A New Design Photovoltaic and Thermal (PV/T) SystemBranislavPetrovicPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Non Conventional Energy ResourcesDocument27 pagesOn Non Conventional Energy ResourcesPhani Kiran83% (6)

- No. 1/2006 - Vol. 25Document68 pagesNo. 1/2006 - Vol. 25vdmoorthy123Pas encore d'évaluation

- Environmental Controls I/IG Environmental Controls I/IGDocument28 pagesEnvironmental Controls I/IG Environmental Controls I/IGRUSHALI SRIVASTAVAPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- USGeothermal Education&Training Guide Oct2010Document15 pagesUSGeothermal Education&Training Guide Oct2010Ardhymanto Am.TanjungPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- U.S. Solar Market Insight: Executive SummaryDocument22 pagesU.S. Solar Market Insight: Executive SummaryScott WhitePas encore d'évaluation

- Questions You Might Be Afraid To Ask About Off Grid Solar SystemDocument2 pagesQuestions You Might Be Afraid To Ask About Off Grid Solar Systema0ftrou651Pas encore d'évaluation

- Lehigh Solar Business LetterDocument2 pagesLehigh Solar Business Letterapi-329298798Pas encore d'évaluation

- Mrhkli: Beam Pro Training and ExaminationDocument68 pagesMrhkli: Beam Pro Training and ExaminationSimon LawPas encore d'évaluation

- New Microsoft Word DocumentDocument4 pagesNew Microsoft Word DocumentAshwini KumarPas encore d'évaluation

- Monocrystalline - 50Wp - 200Wp: 50W - 200W 17.20V - 30.10V 27.5A - 7.85A 21.10V - 36.10V 2.95A - 8.34ADocument2 pagesMonocrystalline - 50Wp - 200Wp: 50W - 200W 17.20V - 30.10V 27.5A - 7.85A 21.10V - 36.10V 2.95A - 8.34AsuryarisPas encore d'évaluation

- TNB HANDBOOK A4 - FinalDocument104 pagesTNB HANDBOOK A4 - FinalSharin Bin Ab GhaniPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- SOC 3101: Society, Technology and Engineering Ethics: Lecture On Renewable EnergyDocument10 pagesSOC 3101: Society, Technology and Engineering Ethics: Lecture On Renewable EnergyMd. Sahriar SabbirPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)