Académique Documents

Professionnel Documents

Culture Documents

E Finance

Transféré par

Anand SinghTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

E Finance

Transféré par

Anand SinghDroits d'auteur :

Formats disponibles

E-Finance

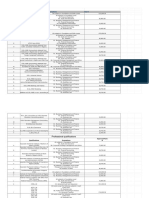

INDEX

SR.NO. CONTENTS PAGE NO.

2. Introduction on E-Finance 2-09

3. What E-Finance Is? 10-11

4.

The Transformation or Traditional Business Issues

12-13

. ! "uic# $efinition %f E-Finance 14-1

&. '()

&22- *. +T,-'.+ 1/

/. +WIFT 19

9. Electronic Fund Transfer 21

10. %nline Ban#in0 22-23

11. $a1 Tradin0 24-2

12. +mart 'ard 2&-2/

13. (ise of E-Finance and Electronic Tradin0 29-31

14. The E-$imension 32

1. Im2lementation issues 3-3*

1&. The 3lo4al $imension 3*-4&

1*. +ur5e1 (e2ort 4*-49

19. Bi4lio0ra2h1 0

- 1 - Sunny Agnihotri, T.Y.BBI

E-Finance

INTRODUCTION

Internet has touched almost all as2ects of our li5es. The emer0ence of e-

commerce has re5olutioni6ed the 7a1 7e li5e8 sho28 entertain and interact.

Therefore8 it should not come as a sur2rise if it tries to influence the 7a1 7e sa5e

and the 7a1 7e in5est. Toda18 7hen the customer is #in0 and the ser5ice

2ro5iders are rushin0 to 2a1 o4eisance to the #in08 financial ser5ice 2ro5iders

cannot 4e left 4ehind. In their 9uest to differentiate their ser5ices and 0ain

com2etiti5e ad5anta0e o5er their com2etitors8 the financial ser5ice 2ro5iders are

tr1in0 to 2ro5ide their ser5ices to the customers in the comfort of their homes.

The Internet has emer0ed as a con5enient channel for these ser5ice 2ro5iders.

.i5in0 in India8 7e mi0ht find these ideas too far fetched 4ut the truth is that

Internet has chan0ed the 7a1 these ser5ices are deli5ered8 2articularl1 in

countries 7here the Internet 2enetration is hi0h. The different 7a1s in 7hich

Internet is tr1in0 to re5olutioni6e the deli5er1 of the financial ser5ices and

2roducts are 0i5en 4elo7: -

1. Internet Banking

2. Electronic Bill Payment

3. Online Brokerages

4. Online Delivery o !inancial Pro"#cts like $ortgages

- 2 - Sunny Agnihotri, T.Y.BBI

E-Finance

INTERNET BAN%ING

T7o distinct trends can 4e discerned in the realm of Internet Ban#in0. %n one

hand8 Ban#s and Financial Institutions are tr1in0 to enter into ne7 areas and

consolidate their hold on the entire financial sector. %n the other hand8 ne7 $ot

'oms are enterin0 the financin0 4usiness and challen0in0 the 4an#s. It could 4e

said that t7o o22osite thin0s are ha22enin0 at the same time. The 4an#s8 5ia

their consolidation mo5es are tr1in0 to 2reser5e their stron0holds8 7hile the $ot

'oms are tr1in0 to fra0ment the mar#et 41 2ro5idin0 su2erior ser5ices. Ban#s

and Financial Institutions are tr1in0 to le5era0e their Brands and their 2osition

in the industr1. While8 the $ot 'oms are usin0 their com2etenc1 in su2erior

ser5ice desi0n and e;2erience of com2etin0 in this hi0hl1 unsta4le

en5ironment. !ll the 2la1ers share the same o4<ecti5es: ac9uirin0 customers8

2ro5idin0 them 7ith ne7 financial information8 ser5ices8 and 2roducts8 and

doin0 so in a 7a1 that enhances the 5alue 2ro2osition of their 2roducts and

ser5ices.

Internet Ban#in0 allo7s the Ban#s =and other Financial +er5ice 2ro5iders> to

o5ercome the tradeoff 4et7een content and reach. With the use of Internet8

4an#s can 2ro5ide their ser5ices to a much 7ider audience then the1 could do

7ithout it. E5en 4efore the comin0 of Internet8 com2etition had shifted from

2roducts to ser5ices. This 7as due8 in lar0e 2art8 to the ad5ent of ,ri5ate +ector

Ban#s.

- 3 - Sunny Agnihotri, T.Y.BBI

E-Finance

Before the entr1 of these 4an#s8 the retail 4an#in0 7as more of a commodit1

7ith hardl1 an1 differentiation on the 4asis of 2roducts or ser5ices. Ban#s

offered similar 2roducts and similar ser5ice. But the ne7 2ri5ate sector 4an#s

chan0ed the scenario 41 differentiatin0 on the 4asis of ser5ice. The1 started

2ro5idin0 Tele2hone 4ased 4an#in0 and introduced the conce2t of home

4an#in0. The su2erior ser5ice 4ein0 2ro5ided 41 these 4an#s 7as the main

reason for their ra2id 0ro7th. But their reach 7as limited due to lo0istics of

settin0 u2 4ranches and increasin0 the reach of their ser5ice. !n1 attem2t to

increase the 4ranch net7or# 7ould ha5e increased their o5erheads and an1

attem2t to 7iden the areas 4ein0 ser5ed 41 a 4ranch 7as li#el1 to lead to

deterioration in the ser5ice le5els. In other 7ords8 these 4an#s 7ere cau0ht in a

dilemma as the1 faced the (each and content tradeoff. With the ad5ent of

Internet these 4an#s ha5e 4een a4le to o5ercome this tradeoff.

B1 usin0 the Internet8 these 4an#s can e;2and their reach as 7ell as maintain

the standards of their ser5ices.

- 4 - Sunny Agnihotri, T.Y.BBI

E-Finance

&. E'ECTRONIC BI'' PA($ENT

From the 2oint of 5ie7 of Ban#s8 Electronic Bill ,a1ment =EB,>

re2resentssomethin0 of a threat8 in that it could lead to customer attrition and

reduce re5enue. !mon0 other re5enue streams8 the follo7in0 sources of funds

for the 4an#s

could 4e affected:

Float associated 7ith 2rocessin0 in the 2h1sical form8

'ash )ana0ement +er5ices

The Ban#s can 2rotect itself 41 2ro5idin0 this ser5ice to their customers. But

EB, also has an im2ortant strate0ic dimension8 as it can 4ecome an inte0ral

2art of a 4an#?s 2ortfolio of ser5ices. EB, can attract customers to the 4an# 41

ma#in0 transactions more efficient and ena4lin0 customers to access their

financial information more easil1. )oreo5er8 online interactions allo7 use of

such tools as e-'() to create a more intimate relationshi2 7ith the customer

and 2romote and deli5er other online 2roducts and ser5ices.

If the Ban#s do not esta4lish control on EB,8 the1 are li#el1 to loose customers

to the ne7 2ro5iders of financial ser5ices8 thus affectin0 other sources of

re5enue. In India8 @$F' Ban#8 I'I'I Ban# and 'iti4an# are tr1in0 setu2 an

EB, 2ortal. I'I'I has alread1 started a 2ortal called BillAunction.com. Ban#s

are 2lannin0 to use the Bet for 2a1ment of utilit1 4ills. The1 are enterin0 into

tie-u2s 7ith utilities li#e )TB.8 !irtel8 %ran0e8 and B,. )o4ile etc. (i0ht

no78 a customer 7ho?s recei5ed a 4ill in the 2h1sical form lo0s into the

net7or# in order to ma#e an online 2a1ment.

- 5 - Sunny Agnihotri, T.Y.BBI

E-Finance

'onsumers and Businesses can deri5e economic 4enefit on account of

reduction in transaction costs and a reduction in the float resultin0 from

2h1sical 2rocessin0 of the Bills. In addition8 man1 are li#el1 to ado2t it mainl1

for the con5enience. The1 can 2a1 4ills electronicall1 in the same 7a1 the1 do

toda18 4ut 41 consolidatin0 their 4ills8 the1 can reduce the effort in5ol5ed in

the 7hole 2rocess. The1 can also access their account at the same time. The1

can con5enientl1 access all 4illers from a sin0le 2ortal that also 2ro5ides them

4an#in0 facilities. This 7ould ena4le them to 5ie7 their account 4alance 7hile

2a1in0 4ills. For 2ortals or the intermediaries that consolidate 4ills from

multi2le 4illers at a sin0le online location EB, is a tool to ac9uire customers

and 2ro5ide them other financial ser5ices also. $ominance of the EB, mar#et

can lead to an entr1 into other financial ser5ices mar#ets such as credit or de4it

card 2a1ments8 or indeed into a much 4roader ran0e of e-commerce mar#ets8

such as 2a1ments 0ate7a1s.

). ON'INE BRO%ERAGE

%nline Bro#in0 is emer0in0 as another field 7here traditional ser5ice 2ro5iders

are li#el1 to face tou0h com2etition from the $ot 'oms. In Tai7an and Corea8

30D of the stoc# tradin0 has alread1 mo5ed online. This is 2osin0 a threat to

the traditional Full-+er5ice Bro#era0es. B1 le5era0in0 the 2o7er of the 7e48

'harles +ch7a4 has emer0ed as a ma<or threat to Full-+er5ice 4ro#ers li#e

)errill .1nch. In order to 2reem2t the mo5es into these areas 41 ne7 2la1ers8

man1 Ban#s ha5e alread1 tied u2 7ith %nline Bro#era0es.

- 6 - Sunny Agnihotri, T.Y.BBI

E-Finance

The Ban#s ha5e entered the e-tradin0 4usiness. +ince man1 4an#s are also

$e2ositar1 2artici2ants8 the1 ha5e tied u2 7ith e-traders so that a customer is

a4le to 4u1 or sell shares online and ma#e and recei5e 2a1ments throu0h the

Bet. In India8 @$F' Ban# has tied u2 7ith In5estsmart.com and is offerin0 its

ser5ices to all the clients of the 4ro#era0e. I'I'I Ban# has 0one a ste2 ahead

and launched I'I'I$irect.com. These 4an#s ha5e 4ecome e;clusi5e 2ro5iders

of 4an#in0 and de2ositar1-custodial ser5ices to the clients of these online

4ro#era0es.

*. ON'INE DE'I+ER( O! !INANCIA' PRODUCTS

The Ban#s ha5e started offerin0 4an#in0 ser5ices li#e chec#in0 1our account

status fund transfer8 orderin0 demand drafts and 7ritin0 out che9ues8 5ia the

net. +oon these 7ill form onl1 a small 2art of the total arra1 of ser5ices 4ein0

offered 41 them. These Ban#s ha5e em4ar#ed on a num4er of ne7 initiati5es to

2rotect their stron0hold and to le5era0e the net. The1 are offerin0 5alue-added

ser5ices to their customers and at the same time are tr1in0 to 0et into B2' and

B2B e-commerce. The1 are e5en tr1in0 to 0et their fin0er into 5arious

transactions 4et7een the 3o5ernment on one side and the 4usiness and the

customer on the other. Ban#s are tr1in0 to 4ecome a 2art of the online 5alue

chain. For e;am2le8 the1 are tr1in0 to tie u2 7ith cor2orate so as to 4ecome a

2art of their su22l1 chain and ena4le electronic transfer of funds 4et7een the

different com2onents of the +u22l1 'hain. The1 are doin0 this 41 actin0 as an

intermediar1 4et7een the cor2orations and their 5endors 41 ena4lin0 online

transactions at one 2lace.

- 7 - Sunny Agnihotri, T.Y.BBI

E-Finance

+ome Ban#s are tr1in0 to setu2 2ortals for routin0 2a1ments li#e E;cise $ut1

and +ales Ta;. Bot content 7ith that Ban#s are settin0 u2 secure 2a1ment

0ate7a1s to ta2 the B2' online mar#et.

Ban#s ha5e ta#en the a22lication 2rocess for 2ersonal loans8 car loans8 and

mort0a0e8 online. The1 2lan to offer other financial 2roducts li#e Bonds and

)utual Funds throu0h their financial ser5ice 2ortal. This strate01 is aimed 41

2re-em2tin0 the entr1 of ne7 startu2s into this 4usiness.

!nother 4it of the Bet strate018 in5ol5es 2ro5idin0 infrastructure for B2' as

7ell as B2B e-commerce. Ban#s are settin0 u2 secure 2a1ment 0ate7a1s that

7ill allo7 online retail sho2s to o4tain instant credit card 5erifications. %nce the

4u1er hits the 2a1 4utton at a B2' 2ortal8 the 4u1er?s credit card details 7ill 0et

encr12ted and tra5el securel1 to the Eisa or )aster'ard a22ro5al s1stem

throu0h the 4an#?s 2a1ment 0ate7a1.

The 4an#s are also settin0 u2 their o7n sho22in0 2ortals. @$F' has a sta#e in a

2ortal called eas124u1.com 7here @$F' 4an# customers can 4u1 usin0 their

4an# account num4er. Federal Ban# has similar arran0ements 7ith (ediff.com

and Fa4mart.com. I'I'I has setu2 )a0iccart.com8 an e-tailin0 site.

!t the B2B end8 Ban#s are offerin0 Bet Ban#in0 ser5ice that allo7s electronic

fund transfers amon0 a com2an18 its 5endors and dealers. !nother ser5ice 4ein0

tar0eted at this se0ment is cash mana0ement. This 7ill reduce the float8 7hich

is 2resent in 2h1sical 2rocessin0 of the 2a1ments.

- - Sunny Agnihotri, T.Y.BBI

E-Finance

The Ban#s are also tr1in0 to inte0rate their s1stems 7ith the E(,-+u22l1 'hain

s1stem of their clients. This 7ill ena4le the 4an# to 4enefit from the mo5ement

to7ards e-2rocurement. E-,rocurement in5ol5es ma#in0 transactions online

and 2rocessin0 the 2a1ment electronicall1.

Intro"#ction to E,!inance

What e-finance is?

The rise of e-finance

The transformation or traditional 4usiness issue

- ! - Sunny Agnihotri, T.Y.BBI

E-Finance

-.AT IS E,!INANCE/

The role of IT in finance is 5ast8 and the ans7er to this 9uestion can 5ar1

de2endin0 u2on 7ho the res2ondent is and in 7hich area of the financial

ser5ices industr1 he or she 7or#s. To ta#e a fe7 e;am2les: e-finance can

ran0e from the IT s1stems 0o5ernin0 the com2le; o2erations of a 4an# or

s2eciali6ed su4sets of the acti5it1 such as secure chi2 cardsF 2urchases o5er

the internetF soft7are ena4lin0 the com2ilation of )I+ dash4oard re2ortsF or

use of the Internet to o4tain information8 diffuse information8 or for research

2ur2oses. The field 4roadens 7hen 7e consider the 5arious electronic

net7or#s ran0in0 from ! T)s to +WIFT for funds transfer8 B%.E(% for

trade finance8 and the ne7 areas of We4 sites for e-commerce8 da1 tradin08

and e-finance. The term e-finance 4asicall1 includes all these facilities8 and in

this 7or# 7e 7ill 4e loo#in0 at some of the technolo0ical de5elo2ments in

these areas.

Bu667ords circulatin0 in the s2eciali6ed 2ress include terms such as

electronic commerce8 di0ital mone18 online tradin08 We4 4an#in08 strai0ht

throu0h 2rocessin08 customer relationshi2 mana0ement8 securit18 encr12tion8

electronic 2urse8 $@T).8 relational data4ases8 etc. These ne7 terms

re2resent the 4asic elements of 21

st

centur1 4usiness that ?ire 0oin0 to

re5olutioni6e the 7a1 7e conduct our 4usiness and lead our li5es8 and in this

7or# 7e 7ill 4ecome familiar 7ith them.

The su4<ect is 5ast and interrelated8 hut if 7e concentrate on e-finance 7e

7ill see that it focuses on all that relates to the sale of 0oods and ser5ices

o5er electronic net7or#s8 and the 2rocessin0 of orders and 2a1ments o5er8

- 1" - Sunny Agnihotri, T.Y.BBI

E-Finance

those net7or#s. These ne7 channels re2resent the Gdemateriali6ationG of

traditional modes of distri4ution in fa5or of electronic =.e. GIntan0i4leG>

net7or#s. $es2ite the nascent state of technolo0ical de5elo2ments to date8

this ste2 u2 the e5olutionar1 ladder 2romises to 4e nothin0 less than

re5olutionar1.

Electronic 4an#in08 tradin08 and finance - these technolo0ical de5elo2ments

ha5e a direct im2act on the area of 4usiness #no7n an electronic commerce

=or e-commerce>. E-commerce is 4ein0 made 2ossi4le due to a uni9ue 4lend

of Inc follo7in0 three elements:

Technolo01 is ena4lin0 4usiness to accelerate the transaction c1cle 41

demateriali6in0 it and to do so in a more secure manner.

'reati5it1 is ena4lin0 entre2reneurs to find ne7 7a1s and method of doin0

4usiness outside of traditional structures and methods

Be7 methods of raisin0 ca2ital ha5e ena4led these inno5ati5e 4usinesses to

a5ail themsel5es of nuance.

These three elements cou2led 7ith the trend to7ards dere0ulation of the

financial mar#ets8 mean that the? 0lo4al economic and financial landsca2e and

the financial ser5ices industr1 are 0oin0 throu0h chan0es that 7ill affect all

2la1ers: 2ro5iders8 users8 re0ulators8 in5estors8 and consumers. The ad5ent of e-

finance means that ne7 2atterns of manufacturin08 distri4ution8 and

consum2tion 7ill come into effect. E-finance also means that careful

consideration 7ill need to he 0i5en to7ards formulatin0 cor2orate strate0ies

and definin0-2urchasin0 the electronic infrastructures necessar1 to 4ecome a

successful 2la1er..

- 11 - Sunny Agnihotri, T.Y.BBI

E-Finance

TRANS!OR$ATION O! TRADITIONA' BUSINESS $ODE'S

,rior to the rise of the ,' and the Internet durin0 the 1990s8 4usiness models

7ere 0enerall1 confined to the standard - lin#in0 traditional 2rocesses of

manufacturin0 2roduction8 and ser5ices to lo0istics8 resource ac9uisition8

desi0n8 in5entor1 control8 2rocessin08 shi22in0 - all of 7hich re9uired a lar0e

cor2orate infrastructure. With the internet it has 4ecome 2ossi4le for small as

7ell as lar0e entities to 2ro5ide small and lar0e customers 7ith electronic

access to a 4road ran0e of information8 0ood:F8 and ser5ices at a chea2er 2rice

and 7ith 0reater efficienc1 and trans2arenc1. Businesses are therefore a4le to

use the Internet to reach a lar0er and more 0eo0ra2hicall1 di5erse set of

customers at 5er1 little incremental cost. In addition8 the1 ha5e 4een a4le to

le5era0e technolo01 to e;2and their 4usinesses 5er1 9uic#l1.

+uch are the main characteristics of the nascent field of e-commerce and 41

lo0ical e;tension8 e-finance. It is 7orth notin0 that e-commerce is not strictl1

a4out sellin0 0oods and ser5ices throu0h the We4. This 5ie7 onl1 sees the ti2 of

the ice4er0. E finance is a4out usin0 technolo01 fundamentall1 to chan0e

4usiness 2rocesses und indeed8 4uild ne7 4usiness 2rocesses8 412assin0

traditional entr1 4arriers and 4ein0 a4le to achie5e s2eed8 efficienc18 inno5ation8

and customer 5alue8

Earious industr1 studies 41 I$' and Forrester (esearch note that 7hile in 199&

H+ ecommerce accounted f=; some %. 03D n=3$,. 41 200I H+ c-commerce is

e;2ected to account for *.-10D of 3$,8 and to continue to 0ro7 e5en more.

While the H+! has 4een the 2ace setter in e-commerce8 accountin0 for &*D of

all 4usiness-to 4usiness e-commerce re5enues and *&D of 4usiness-to-

- 12 - Sunny Agnihotri, T.Y.BBI

E-Finance

consumer e-commerce re5enues in 19998 other countries8 2articularl1 in Euro2e

and !sia8 are increasin0 their 2artici2ation and narro7in0 the 0a2. Forei0n e-

commerce 7ill therefore he all im2ortant com2onent of 0lo4al out2ut in the

comin0 1earsF indeed. I$' 2redicts that 41 20048 &2D of e-commerce

transactions 7ill come from outside the H+8 7ith Western Euro2e and Aa2an

accountin0 for the lar0est shares =3GD and 1&D of the total8 res2ecti5el1>.

The ne7 econom1 and its successful e-commerce firms are characteri6ed 41

im2lementation of ne7 decentrali6ed JT technolo018 real-time e;ecution and

fulfillment8 net7or#s of alliances and 2artnershi2s 7ith other ne7 econom1

2artners8 distri4uted 7or# 2rocesses8 and 2ersonated8 interacti5e '() s1stems.

This ne7 model not onl1 threatens e;istin0 2rocesses 4ut is in constant

e5olution as it shins from a nascent technolo01 to the ne7 future mainstream

econom1F commerce and e-finance are 4rea#in0 esta4lished 2atterns of doin0

4usiness and definin0 t-he Gne7 econom1.G To traditional com2anies8 this is a

threat K+ the1 are 4ein0 forced to ada2t to ne7 circumstances and restructure

4usiness 2rocesses lon0 considered as the sacred co7s. To ne7 entrants8 it

offers the 2romise of circum5entin0 hitherto surmounta4le entr1 4arriers.

- 13 - Sunny Agnihotri, T.Y.BBI

E-Finance

E,!INANCE

E-finance can 4e defined as:

G!ll 7hich relates to the lin#in0 of 4usiness8 finance8 and 4an#in0 5ia electronic

means8 encom2assin0 information 0atherin08 2rocessin08 retrie5al8 and

transmission of data as 7ell as the transmission8 2urchase8 and sellin0 of 0oods

and ser5ices. But the definition 4roadens 7hereL 7e loo# at the ne7

2ossi4ilities offered 41 technolo01. 'om2uters and the use of one time data

entr1 and relational data4ases means that online real-time data a4out a

com2an1?s 4usiness and accounts can 4e 0enerated8 ena4lin0 mana0ers to

mana0e their com2anies in ne7 and more 2roacti5e 7a1s. ! case in 2oint is the

use of customer relationshi2 mana0ement ='()> techni9ues arisin0 from the

use of client-dri5en =as o22osed to accountin0-dri5en> relational data4ases.

'() can assist in 2ro5idin0 a more 4es2o#e and 2ersonali6ed ser5ice to

clients8 7hich in turn im2acts on issues of mar#etin0 strate01 and 4randin0 of

2roducts and ser5ices.

! 2rime e;am2le of this is the online 4oo#store !ma6on.com. Technolo01 at

the ser5ice of a traditional industr1 has re5olutioni6ed the hitherto staid hoc#

industr1 and ena4led the creation of the !ma6on G4randG 7hich is merel1 the

fruit of IT and relational data4ases 7ith sa551 mar#etin0. The field of e-finance

ho7e5er is 4roader 7hen 7e consider other factors such as the use of

encr12tion and securit1 at the ser5ice of Gdi0ital financeG - a 4road term 7e

define to include an1 t12e of electronic financial ser5ice or 2roduct8 7hile

di0ital finance has 4een in e;istence for man1 1ears8 and certainl1 2redates the

commercial 5ersion of the Internet8 =e.0. the international han#Ms 2a1ment

- 14 - Sunny Agnihotri, T.Y.BBI

E-Finance

net7or# +WIFT), the use of ne7 technolo0ies and encr12tion is ena4lin0 a

7ider 2ro2a0ation of the conce2t. The 2henomenon of Ge-finance8? li#e Gne7

econom18 e-commerce? or Ge-4usiness.G is at 2resent in a nascent state8 onl1

hintin0 at the future net7or#s and ser5ice that 7ill he on offer.

3lo4ali6ation and internationali6ation are accom2anied 41 ne7 o22ortunities

and challen0es8 as 7ell as costs8 ris#s8 and threats. The 2rocess of e-finance is

not a 2anacea in itself: it is necessar1 for de5elo2ment and 0ro7th8 4ut it is not

enou0h. From the 2ers2ecti5e of de5elo2in0 or transition economies8 the Gne7

econom1G -e-commerce8 e-4usiness8 e-finance8 etc. - could 2ose a Gdeadl1

threatG 7hich mi0ht ma#e these countries secondar1 or e5en mar0inal.

@o7e5er8 under certain circumstances8 the a4o5e mentioned 2henomena ma1

also stand for e;traordinar1 o22ortunities and the Internet ma1 4ecome the

en0ine of economic 0ro7th and de5elo2ment.

The su4<ect is 5ast 4ut can 4e di5ided into se5eral areas that 7e co5er under the

follo7in0 headin0s:

'()

+T,-'.+

+WIFT

Electronic Fund Transfer

%nline Tradin0 and $a1 Tradin0

+mart 'ards

- 15 - Sunny Agnihotri, T.Y.BBI

E-Finance

CR$

The ne7 econom1 is characteri6ed 41 com2anies that ha5e learned ho7 to

inte0rate all of their channels - includin0 the Internet - into one seamless and

2o7erful source for mar#etin0 to8 sellin0 to8 su22ortin08 and ser5icin0

customers. These entities are 4lendin0 technolo01 and strate01 in ne7 7a1s to

antici2ate customer needs8 fulfill demands8 4uild mar#et share8 and increase

2rofits. In other 7ords8 the1 are de5elo2in0 customer relationshi2 mana0ement

s1stems. What e;actl1 is '()?

'() is the seamless coordination 4et7een sales8 customer ser5ice8 )ar#etin08

field su22ort8 and other customer-touchin0 functions. +im2l1 2ut. '()

inte0rates 2eo2le8 2rocess and technolo01 to ma;imi6e relationshi2s 7ith

customers and 2artners8 e-customers8 traditional customers8 distri4ution channel

mem4ers8 internal customers8 and su22liers. What com2rises the critical areas

of '()? +ome of them are defined as follo7s:

01 Strategic master plan: $e5elo2in0 a clear and decisi5e 2lan to address the

com2le; 2eo2le8 2rocess8 and technolo01 issues of '().

01 CRM-enabling technologies: $e5elo2in0 4est 2ractices for desi0nin0

fle;i4le infrastructures and le5era0in0 e;istin0 technolo0ies.

=> Customer-centric e-business platform: $esi0nin0 and im2lementin0 a

customer-facin0 solution that is inte0rated 7ith traditional channels 41

attendin0 this ho7-to8 ste2-41-ste2 2ro0ram.

- 16 - Sunny Agnihotri, T.Y.BBI

E-Finance

01 Customer contact center (CCC) customer-centric business strategy:

Inte0ratin0 customer contact center technolo01 7ith e;istin0 '()

initiati5es.

01 Contact center technology: 'ommunicatin0 7ith 1our customers 5ia their

2referred channel =We4-4ased communication. e-mail interacti5e 5oice

res2onse8 2hone and fa;>.

- 17 - Sunny Agnihotri, T.Y.BBI

E-Finance

C'S

Contin#o#s linke" settlement it 7as founded 7ith the o4<ect of eliminatin0

settlement ris#8 7hich is inherent in all forei0n e;chan0e transactions usin0

current settlement methods. The

Ban# of International +ettlements8 in its re2ort on +ettlement (is# in Forei0n

E;chan0e Transactions of )arch 199&. $efines settlement ris# as follo7s:

+ettlement of a forei0n e;chan0e =FNO trade re9uires the 2a1ment of one

currenc1 and the recei2t of another. In the a4sence of a settlement arran0ement

that ensures that the final transfer of the other currenc1 7ill occur if and onl1 if

the final transfer of the other currenc1 also occurs8 one 2art1 to an FN trade

could 2a1 out the currenc1 it sold 4ut not recei5e the currenc1 it 4ou0ht. This

2rinci2al ris# in the settlement of forei0n e;chan0e transactions is 5ariousl1

caned forei0n e;chan0e settlement ris# or cross-currenc1 settleil1ent ris#.G

! ris# associated 7ith settlement ris# is li9uidit1 ris#. It can he differentiated

into t7o forms:

=> Market liquiity risk, 7hich arises 7hen a firm is una4le to conclude a lar0e

transaction in a 2articular instrument at an1thin0 near the current mar#et 2rice.

=> !uning liquiity risk" 7hich is defined as the ina4ilit1 to o4tain funds to

meet cash flo7 o4li0ations.

- 1 - Sunny Agnihotri, T.Y.BBI

E-Finance

S-I!T

Backgro#n"

+WIFT8 the +ociet1 for World7ide Inter4an# Financial Telecommunications is

the 7orld7ide 4an#in0 telecommunications net7or# founded 41 international

4an#s I in 19*3 in direct com2etition 7ith the tele; and 2ri5ate net7or#s.

+WIFT?+ 4usiness is to su22ort the financial dat3 communication and

2rocessin0 needs of financial institutions. Its mar#ets are financial institutions

conductin0 4usiness in 2a1ments8 forei0n e;chan0e8 mone1 mar#ets8 securities

tradin08 and trade finance.

+WIFT 2ro5ides financial data communications and e;chan0es that are secure

and relia4le. With 2roducts and ser5ices su22orted 41 an or0ani6ation of 1200

2rofessionals 4ased in #e1 financial centers around the 7orld8 +WIFT has 4een

at the forefront of automatin0 the financial ser5ices .- industr1 for 1ears.

'ustomer 4enefits are G re2lacement of 2a2er-4ased 2rocessin0 throu0h

automated 2rocedures usin0 +WIFT standardsF and G increased 2roducti5it18

cost reductions8 control of financial ris#8 and e;2osure throu0h inte0rated end-

to-end transaction 2rocessin0 4et7een financial institutions and their o7n

customers.

- 1! - Sunny Agnihotri, T.Y.BBI

E-Finance

Develo2ment

The net7or# ori0inall1 4e0an o2erations 7ith the +WIFT I ser5ice 7hich 7as

desi0ned in the earl1 19*0s. !s transaction 5olumes 0re78 the ori0inal net7or#

7as u20raded and ne7 ser5ices 7ere added.

+WIFT II 7as the second 0eneration of net7or# ser5ices8 the main feature of

this s1stem and the +WIFT trans2ort net7or# 7as the a4ilit1 to handle the e5er-

0ro7in0 5olume of users? messa0es 9uic#l18 effecti5el18 and securel1. The

s1stem 7as made u2 of a num4er of acti5e com2onents =in the form of

com2uters or other intelli0ent de5ices> lin#ed to0ether 41 communications lin#s

to form a 0lo4al net7or#.

- 2" - Sunny Agnihotri, T.Y.BBI

E-Finance

E'ECTRONIC !UND TRANS!ER

Electronic fund transfers8 automatic teller machines8 de4it and smart cards8

2oint-of-sale mechanisms8 home ,' 4an#in0-tradin0 ser5ices8 and di0ital

securities transfers ha5e 4een a 2art of the financial landsca2e for decades. For

instance8 consumers and 4usinesses ha5e 4een accustomed to transferrin0 funds

di0itall18 rather than 2h1sicall18 for man1 1ears8 de4itin0 and creditin0 accounts

5ia com2uters rather than 2h1sicall1 7ithdra7in0 and red 2ositin0 currenc1.

The electronic fund transfer =EFT> - a mechanism used to send Gdi0ital mone1G

across the 7ire from one account to another - has 4een in 7ides2read use for

decades and forms the core of electronic 2a1ments 4et7een com2anies8

0o5ernments8 and other institutions. )ore than P turn in electronic 2a1ments

occurs e5er1? da1 - includin0 P 2turn that is transferred 4et7een 4an#s: lar0e

5alue electronic 2a1ment s1stems and clearin0 houses such as +WIFT8 '@I,+8

!'@8 '@!,+8 B!3+8 and others are a fundamental com2onent of the

electronic 2a1ment net7or#. %ther electronic mechanisms for o4tainin0 cash8

mo5in0 funds8 and com2letin0 2urchases ha5e 4een in use for 1ears and are

7ell entrenched in toda1?s societ1. 'onsumers ha5e acti5el1 used automatic

teller machines =!T)s> since the 19/0s8 accessin0 cash8 de2ositin0 fund and

transferrin0 4alances 7ith their !T) cards. Thou0h !T)s G?o# more than 1

1ears to 4ecome firml1 esta4lished in consumer 4an#in08 the1 are no7 an

indis2ensa4le 2art of retail finance: !T)s currentl1 account for 0D of all

cash-4ased 4an#in0 transactions and ha5e re2laced man1 of the functions

2re5iousl1 handled 41 4ranch-4ase tellers.

- 21 - Sunny Agnihotri, T.Y.BBI

E-Finance

ON'INE BAN%ING

The histor1 of 2hone 4an#in0 and ,' dial-u2 ser5ices dates 4ac# some 20

1ears. Throu0h 4asic technolo018 customers ha5e 4een a4le to mana0e funds

and 2a1ments usin0 2hone #e12ads and com2uters. This 5ariant of e-finance8

ho7e5er8 is 2rimiti5e com2ared 7ith the future 2romises of this technolo018

7hich 7ill ena4le a far more 2roacti5e in5ol5ement and richer functionalit1 to

the end-user than has hitherto 4een 2ossi4le.

,'-4ased online 4an#in0 started in the late 19*0s and earl1 19/0s 7ith

2ro2rietar1 dial-u2 ser5ices. Ban#s such as 'hemical and 'iti4an# offered8 for a

monthl1 fee8 a 4asic home-4ased ,' 4an#in0 ser5ice 7hich included 4alance

loo#-u2. fund transfers. and 4ill 2a1ment. The efforts to 2romote these ser5ices8

ho7e5er8 ne5er reall1 too# off due to hi0h user fees and cum4ersome interfaces

7hich 7ere further handica22ed 41 slo7 res2onse times8 com2licated access

2rocedures8 and uncertain securit1.

Gro3t4 o Online Banking

- 22 - Sunny Agnihotri, T.Y.BBI

E-Finance

In the mid 19/0s soft7are com2anies such as Intuit introduced third-2art1

soft7are solutions to act as an interface8 lin#in0 customers and 4an#s.

'ustomers could use the 2latform to access account information8 transfer funds

and 2a1 4ills. 'ustomers could also authori6e the 2a1ment of funds to a 0i5en

merchant. "uic#en 7ould then 2rocess the customer a22ro5al and determine 5ia

Intuit +er5ices 'or2oration =I+%> if the merchant 7as 2art of the Federal

(eser5e?s !utomated 'learin0 @ouse. If so8 I+% 7ould effect an electronic

2a1ment throu0h the !'@ and8 if not8 7ould mail a chec# to the merchant

- 23 - Sunny Agnihotri, T.Y.BBI

E-Finance

DA( TRADING

+ecurities transactions includin0 stoc# and 4ond tradin0 ha5e also 4een dri5en

41 technolo01 for the 2ast fe7 decades While it has 4een common for man1

1ears to 2ass stoc#-4ond orders throu0h 4ro#ers8 7ho then transmit 5er4al or

electronic information to an e;chan0e and then re5ert 7ith a22ro2riate de4its

and credits to cash and securities accounts actual 2h1sical 2ossession of the

securities is 2racticall1 non-e;istent Instead8 man1 securities no7 e;ist 0nl1 in a

demateriali6ed electronic form and arc transferred 4et7een seller and 4u1er 41

com2uter.

$iscount 4ro#era0e com2anies8 such as +ch7a48 started offerin0 4asic ,'

tradin0 ca2a4ilities 5ia 2ro2rietar1 soft7are accessin0 ser5ices 5ia a dial-u2

connection 7ith an I+, =!%.8 'om2u+er5e> in the mid-to-late 19/0. The

increasin0 com2le;it1 of soft7are and the need for au0mented data ?feeds no7

means that ideall1 an I+$B connection is needed to en0a0e in online da1

tradin0.

$a1 tradin0 is the 4u1in0 and sellin0 of stoc# in such a 7a1 that at the end of

each da1 1ou ha5e no holdin0s. In other 7ords8 1ou ?close 1our 2ositionG and

sell 7hate5er securities 1ou 4ou0ht 4efore the close of the da1. This is the 2ure

definition and ma1 not al7a1s 4e either 2ossi4le or feasi4le. There ma1 4e

times 7hen 1ou ma1 either accidentall1 or on 2ur2ose find 1ourself holdin0

o5erni0ht. If 1ou do this more often than not 1ou then 4ecome a Gshort time

traderG and if 1ou hold e5en lon0er8 1ou 4ecome an Gin5estor.G

The uni9ueness of da1 tradin0 is that 1ou are sim2l1 2la1in0 a0ainst other da1

- 24 - Sunny Agnihotri, T.Y.BBI

E-Finance

traders and could not care less a4out the com2an18 7hat 4ro#erMs thin# a4out the

stuc#8 or e5en 7hat the com2an1 does. The da1 trader is merel1 concerned 7ith

the mo5ement of the stoc# durin0 the da1 and 2rofitin0 from it. What do 1ou

need to 4e a da1 trader?

QL ! 4ro#era0e account. ?There are numerous e-4ro#era0e accounts. )an1 of

these We4sites can 4e accessed o5er the Internet.

QL 'om2uter 7ith We4 access. +ome ma1 sa1 this is not needed and the1 7ould

technicall1 he ri0ht8 4ut it is 5er1 hard to 2la1 this 0ame 7ithout one. $a1

tradin0 relies on s2eedF s2eed of 0ettin0 information and s2eed on reactin0 to

information8 and a com2uter <ust ma#es it faster. The facilities 1ou 7ill he

accessin0 include.

QL Be7s8 stoc# 9uotes8 charts etc. and

QL Rour 4ro#er - 1ou can 0et in and out of stoc#s 9uic#er online- than 1ou can

41 2hone.

QL ,ro2rietar1 soft7are8 )an1 of the e-4ro#era0es 7ill 2ro5ide 1ou 7ith

s2eciali6ed soft7are to 4e a4le to e;ecute the- trades directl1 on 1our screen

+ome e-4ro#era0es e5en 2ro5ide s2eciali6e trainin0 ser5ice to familiari6e

no5ices 7ith the mechanics of da1 tradin0 and the features of the soft7are

+ome soft7are ma1 re9uire s2ecial 0ra2hics cards in the ,' in order to ha5e a

t7o-monitor dis2la1 that can contain the se5eral user screens re9uired for the

tradin0 acti5it1.

- 25 - Sunny Agnihotri, T.Y.BBI

E-Finance

S$ART CARDS

+mart cards and stored 5alue cards =monetar1 and to#en-4ased>8 em4edded8

7ith inte0rated circuits =I's> and ca2a4le of holdin0 identities8 authori6ations8

certificates8 records8 and monetar1 5alue are of another si0nificant feature of e-

finance. The1 7ere ori0inall1 in5ented S 41 (oland )oreno in France8 and 7ere

de5elo2ed 41 Bull 'om2uters I in France. $e5elo2ed in the late 19&0s the1

4e0an to a22eal in < G7or#a4leG form in the late 19*0s. The1 ha5e 0raduall1

increased in I 2o2ularit1 since that time - 2articularl1 in Euro2e8 7here more

than S 100 million 7ere in8 circulation at the end of the 1990s. Their is ran0es

from sim2le 2hone cards to credit cards8 and8 ? no7 e5en cards to -access

medical ser5ices8 em4edded 7ith #e1 data a4out the cardholder. !nother

e;am2le - smart cards can 4e used for 2a1-TE su4scri2tions.

The smart card is one of the de5elo2ments from the 7orld of < information

technolo01 that 7ill ha5e a si0nificant im2act on e-finance. -T +imilar in si6e to

toda1?s 2lastic credit card8 the smart card has a micro2rocessor or memor1 chi2

em4edded in it. The chi2 stores electronic data and 2ro0rams that are 2rotected

41 ad5anced securit1 features. When cou2led 7ith a reader8 the smart card has

the 2rocessin0 2o7er to ser5e man1 different a22lications such as secure

transactions o5er electronic net7or#s =e.0. +WIFT>. +mart cards can also act as

an access-control de5ice8 to ensure that 2ersonal and 4usiness data8 or indeed

secure offices or facilities8 are a5aila4le onl1 to authori6ed users.

+mart cards can also store Gdi0ital cashG or Gelectronic mone1G to ena4le users

to effect 2urchases or e;chan0e 5alue o5er electronic net7or#s. ,ro5idin0 data

- 26 - Sunny Agnihotri, T.Y.BBI

E-Finance

2orta4ilit18 securit18 and con5enience8 smart cards come in t7o 5arieties:

memor1 cards and micro2rocessor cards. )emor1 cards sim2l1 store data and

can 4e 5ie7ed as a data stora0e de5ice 7ith o2tional securit18 7hile

micro2rocessor cards can add8 delete8 and mani2ulate information in its

memor1 on the card. There are different t12es of securit1 mechanisms - those

necessar1 for a memor1 card are less so2histicated than those for a

micro2rocessor card. !ccess to the information contained in a smart card is

controlled t7o 7a1s:

QL Who can access the information =e5er14od18 the cardholder or a s2ecific

third 2art1>F and

QL @o7 the information can 4e accessed =read onl18 added to8 modified or

erased>.

%ne form of 2rotection is ci2herin08 7hich is li#e translatin0 the information

into some un#no7n forei0n lan0ua0e. +ome smart cards arc ca2a4le of

ci2herin0 and deci2herin0 =translatin0 4ar# to an easil1 understood form> so the

stored information can 4e transmitted 7ithout com2romisin0 confidentialit1.

The im2ortant thin0 a4out smart cards is that the1 are e5er1da1 o4<ects that

2eo2le can carr1 in their 2oc#ets8 1et the1 ha5e the ca2acit1 to retain and

2rotect critical information stored in electronic form. The 2roliferation of this

technolo01 is e5ident 7hen one considers that the same electronic function can

4e 2erformed 41 em4eddin0 similar circuits in other e5er1da1 o4<ects8 such as

#e1 rin0s8 7atches8 0lasses8 rin0s8 and earnin0s.

- 27 - Sunny Agnihotri, T.Y.BBI

E-Finance

'ontacts less card technolo01 also offers si0nificant 2otential in that it calls

ena4le the mani2ulation of Gta0s.G Ta0s function li#e contact less smart cards

4ut are in the form of a rin08 stic#er8 or 4a00a0e la4el. The1 can 4e attached to

o4<ects such as 0as 4ottles8 cars or animals8 and can hold and 2rotect

information concernin0 that o4<ect. This allo7s the o4<ect to 4e mana0ed 41 an

information s1stem or customer relationshi2 mana0ement s1stem 7ithout an1

manual data handlin0. The 2ossi4ilities of such s1stems in areas such as

in5entor1 control and trade finance are limitless.

The current state of de5elo2ment of smart cards is relati5el1 ne78 and has

alread1 made a si0nificant im2act in increasin0 the securit1 of transactions and

dramaticall1 limitin0 the incidence of fraudulent transactions. For e;am2le8 in

France8 7hich has ado2ted the smart card as the standard 2a1ment mechanism

of choice for credit cards8 the rate of fraudulent use 2lummeted from se5eral

2ercent =3-D unofficiall1> to under %.D8-radicall1 reducin0 the cost of fraud

to han#s. %ther countries such as the H+ and the HC ha5e 1et to ado2t this

French de5elo2ed technolo018 no dou4t for reasons of national 2reference. The

mart card is in its infanc1 and it 2romises ultimatel1 to influence the 7a1

4usiness8 data 2rocessin0 and c-finance are conducted.

- 2 - Sunny Agnihotri, T.Y.BBI

E-Finance

RISE O! E,!INANCE AND E'ECTRONIC TRADING

$iscount 4ro#er +ch7a4 4e0an 2ro5idin0 its customers 7ith a rudimentar1 ,'

tradin0 access in 19/4. The ser5ice 7as 4asic and cum4ersome and routed

throu0h relati5el1 slo7 dial-u2 access. True online tradin0 4e0an in the H+! in

199 7hen the first initial 2u4lic offerin0 =I,%> of a com2an1 7as 2laced 5ia

the Internet. %5er 300 in5estors 2urchased shares8 mar#in0 this the first time

securities had actuall1 4een sold 5ia the We4.

The +ecurities K E;chan0e 'ommission =+E'> 7as concerned a4out this ne7

acti5it1 and the 2otential 2recedent it mi0ht esta4lishF it therefore in5esti0ated

the initial offerin0 and the on0oin0 secondar1 tradin0. The +E' su4se9uentl1

issued a Gno-action letterG sanctionin0 the transaction8 effecti5el1 0i5in0 the

0reen li0ht to true Internet-4ased- tradin0. This led to other 2la1ers 4e0innin0

tradin0. @ere are some of these.

QL We4 +treet +ecurities8 EUTrade8 +ch7a48 !meritrade8 and $ate#8 7ho

altered their e;istin0 discount 4ro#era0e o2erations in the same 1ear and

mi0rated to the Internet.

QL We4 +treet +ecurities8 a G2ure 2la1G =i.e. one 7hich e;ists onl1 in a

com2uteri6ed state 7ith no traditional G4ric#s and mortarG offices or

infrastructure>8 commenced its o2erations in 199& 41 offerin0 customers a full-

ser5ice information and e;ecution 2latform.

+ch7a4 also 4e0an o2erations in 199& 41 4uildin0 its We4-4ased 2latform

and offerin0 inno5ati5e online ser5ices and com2etiti5e 2ricin0.

- 2! - Sunny Agnihotri, T.Y.BBI

E-Finance

Full ser5ice 4ro#ers8 such as )errill .1nch8 )or0an +tanle1 $ean Witter8 and

,aine Wetter8 in contrast8 2referred to 7ait and see the results. B1 2000 +ch7a4

had 3. million acti5e online accounts =e9ual to 0D of its total client 4ase> and

7as e;ecutin0 nearl1 2808000 trades 2er da1 $iscount 4ro#ers8 7hich had

alread1 em4raced technolo01 such as 2hone 4an#in0 and ,' 4an#in0 durin0 the

I 9/0s8 too# ad5anta0e of these crum4lin0 entr1 4arriers and 7ere 2articularl1

successful in ada2tin0 to the Internet.

Internet 4an#in0 also came to the? fore: the first true Internet 4an# 7as +ecurit1

First Bet7or# Ban# =+FBB>8 created in !tlanta in 199. In that 1ear the %ffice

of Thrift +u2er5ision a22ro5ed the 2ro2osal to chan0e First Federal 4usiness

focus from that of a sa5in0s institution to a 2ure 2la1 electronic 4an#. Finance

com2an1 'ardinal recei5ed a22ro5al in mid-1998 chan0ed the 4an#?s name to

+FBB and commenced o2erations 41 offerin0 We4-4ased 4alance loo#-u28

unlimited third-2art1 4ill 2a1in08 funds transfers8 loans8 and Federal $e2osit

Insurance 'or2oration =F$I'> insured de2osits.

!s is t12ica1 in the field of 4an#in0 information technolo018 soft7are and e-

finance infrastructure s1stems de5elo2ed for in-house uses ha5e a22lications in

other industr1 sectors and can8 in turn8 4e sold to defra1 de5elo2ment costs and

0enerate 2rofits. @ence8 2la1ers 7ho ha5e de5elo2ed We4 2latforms can in turn

for0e lin#s com4inin0 their 2ro2rietar1 technolo01 solutions 7ith other

solutions 2ro5iders in the IT s2here. @ence8 ne7 entities arise 7hich can offer

financial institutions an Internet turn#e1 2roduct for online 4an#in0.

- 3" - Sunny Agnihotri, T.Y.BBI

E-Finance

With 5er1 fe7 e;ce2tions8 the 7orld?s lar0est financial institutions ha5e

0enerall1 failed to act as inno5ators and mo5ers in We4-4ased finance8 and ha5e

-dela1ed their offerin0s until ne7 inno5ati5e start-u2s had 4uilt considera4le

mar#et shares and 4rand identification. The initial lac# of interest or foresi0ht of

ma<or 2la1ers meant that man1 of them found themsel5es chasin0 the u2starts

durin0 the late 1990s. %nce it 4ecame clear that Internet-4ased commerce 7as a

ne7 force that 7as here to sta18 the ma<or 2la1ers8 7ith dee2 2oc#ets8 4e0an to

chan0e their tune and 2a1 attention to the de5elo2ments and issues 4ein0 raised

41e-commerce and e-finance. In other 7ords8 institutions mo5ed from den1in0

the need to ha5e an Internet 2resence and usin0 the internet as a medium to

diffuse G4rochure 7are8 to em2lo1in0 it as an a00ressi5e8 transaction-ena4led

4usiness-0atherin0 tool. These institutions also reali6ed that the Internet

allo7ed them to create a ne7 Ghi0h tech ima0e8 offer ne7 2roducts-ser5ices8

and enlar0e reach-2resence 7ithout ha5in0 to s2end additional ca2ital on

2h1sical e;2ansion. Full ser5ice 4ro#ers such as )errill .1nch and )or0an

+tanle1 $ean Witter hence rushed to redefine heir 4usiness models and 2ro5ide

customers 7ith ser5ices that more Internet-a00ressi5e firms such as +ch7a4

and !meritrade 7ere alread1 su22l1in0.

)errill .1nch moreo5er had to 4ac# out of the comer it had 2ainted itself into in

late 199/ 7hen it declared that Gthe do-it-1ourself model of in5estin08 centered

on Internet tradin08 should 4e considered as a serious threat to !mericanMs

financial li5es.G It is 2articularl1 ironic that lar0e Wall +treet securities firms8

7hich 2ride themsel5es on 4ein0 ade2t8 d1namic8 and res2onsi5e as8 in fact8

the1 are - 7ere una4le to ada2t to the ne7 4usiness 2aradi0m 7ith the same

a0ilit1.

- 31 - Sunny Agnihotri, T.Y.BBI

E-Finance

T4e E,Dimension

The le0ac1 s1stem and mi0ration issuesF

Entr1 4arriers to e-financeF and

Im2lementation issues.

ENTR( BARRIERS TO E,!INANCE

While e-finance offered ne7 2la1ers the a4ilit1 to circum5ent traditional entr1

4arriers to the financial ser5ices industr18 as it matures it is de5elo2in0 its o7n

set of industr1 s2eciali6ations and criteria. E-finance is demolishin0 traditional

entr1 4arriers al1d 4usiness models 4ut it is also creatin0 ne7 ones. The erosion

of entr1 4arriers can occur due to a 5ariet1 of factors - 4usiness8 technolo0ical8

and re0ulator1. Bota4le chan0es in the re0ulator1 en5ironment8 for e;am2le8

include:

G4i0 4an0G - the dere0ulation of the .ondon stoc# mar#et in 19/& =eliminatin0

fi;ed commissions and dissol5in0 the distinction 4et7een 4ro#ers and <o44ers

VdealersWF

,assa0e of the (ie0le Beal !ct in 1994 =allo7in0 H+ 4an#s to ser5e customers

across state lines>F

$ere0ulation of tile To#1o stoc# mar#et in the 1990s =eliminatin0 fi;ed

commissions and allo7in0 the creation of discount 4ro#ers>F

Erosion of the 3lass-+tea0all !ct in the late 1990s =di5idin0 the 4an#in0

industr1 into in5estment and commercial 4an#s8 allo7in0 them to 2artici2ate in

each other?s mar#ets>F and

3lo4ali6ation and financial dere0ulation.

- 32 - Sunny Agnihotri, T.Y.BBI

E-Finance

These de5elo2ments8 cou2led 7ith technolo0ical inno5ation8 ha5e led to a

4lurrin0 4et7een traditional and e-finance en5ironments. !s dere0ulation

continues to ma#e its 7a1 around the 7orld and ne7 entrants enter 2articular

areas of the financial ser5ices industr18 com2etition in finance 7ill accelerate.

For 4etter or 7orse8 formida4le entr1 4arriers ha5e historicall1 2rotected the

finance industr1. Be7 entrants to the financial mar#ets ha5e needed stron0

mana0ement =includin0 net7or#s and contacts>8 a dee2 #no7led0e of le0al8

o2erational8 transaction8 and credit ris#8 su4stantial financial resources8 efficient

customer ser5ice8 and technolo0ical 2ro7ess.

!s financial ser5ices ha5e 0ra5itated to the Internet some of these 4arriers to

entr1 ha5e alread1 4een erodedF ho7e5er8 man1 of the s2ecific s#ills relatin0 to

the financial ser5ices industr1 need to 4e honed and de5elo2ed further. For

e;am2le8 ris# mana0ement needs to 4ecome more ro4ust in the face of

increasin0 s2eed and 5olatilit1 in the mar#ets. This need translates into the need

for efficient data4ase mana0ement8 one time data entr1 at deal ca2ture8 and the

2roduction of online real time mana0ement information s1stems re2orts.

'i5#i"ity an" risk management

!nother matter of concern to start-u2s is ensurin0 that sufficient ca2ital is

a5aila4le to su22ort the entire ran0e of 4usiness and o2eratin0 ris#sF insufficient

ca2ital can still act as entr1 4arrier and im2act li9uidit1 for on0oin0 o2erations.

(is# can assume 5arious formsF classic credit ris# from loans8 deri5ati5es ris#8

interest rate ris#8 and currenc1 rate ris#8 le0al ris#8 documentation ris#8 and

com2liance ris#. +ufficient li9uidit1 is therefore essential in ensurin0 that the

- 33 - Sunny Agnihotri, T.Y.BBI

E-Finance

com2an1 can 7eather mar#et 5olatilit1. Entr1 4arriers can 4e made more

difficult 41 Issues of 4rand name8 ima0e and Gtrust8G - intan0i4les 7hich all ta#e

time to esta4lish.

While ma<or financial institutions 7ith Xdee2 2oc#etsG can theoreticall1 afford

to #ee2 fundin0 a loss-ma#in0 Internet 5enture until it 4e0ins to 0enerate

2rofits8 smaller entities ans7era4le to 5enture ca2italists or other in5estors do

not ha5e this lu;ur1. The1 must 4e0in to 0enerate a return for in5estors 7ithin a

short-term time frame 4efore de2letin0 the seed mone1 =the G4um rateG>.

It should also 4e noted that since financial 2roducts are relati5el1 0eneric8 the

differentiatin0 factor is lar0el1 2erformance-related. !ccordin0l18 the financial

sector has traditionall1 4een stron0l1 reliant on8 and a hea51 in5estor in8

information -technolo01 infrastructure in order to achie5e 4usiness ad5anta0e in

5arious sectors8 includin0 deli5er18 tradin08 re2ortin08 2rocessin08 and control.

These hea51 in5estments also tend to act as an entr1 4arrier8 althou0h the

ad5ent of e-finance has made it easier for ne7 2la1ers lac#in0 a G4ric#s and

mortarG infrastructure to mount a challen0e to esta4lished 2la1ers. With the

e;ce2tion of 4rand name and ima0e8 5irtuall1 all other hurdles are 9uite

surmounta4le.

,la1ers in e-finance ne5ertheless ha5e found the com2etiti5e en5ironment

difficult to na5i0ate. )an1 s2eciali6ed 2la1er8 such as Bean6 =electronic mone1

or to#ens>8 ha5e discontinued o2erations. Thou0h 4arriers to entr1 are lo7er8

ada2tin0 financial ser5ices to the We4 remains a com2le; tas#.

- 34 - Sunny Agnihotri, T.Y.BBI

E-Finance

I$P'E$ENTATION ISSUES

The im2lementation issues facin0 4an#s are often dift1cult and contradictor1.

+1stems can 4e im2lemented in a 5ariet1 of 7a1s8 and include a ran0e of issues8

of 7hich the follo7in0 are? e;am2les.

=> !rom scratch - This a22roach is ad5anta0eous8 as state of the art s1stems

can 4e desi0ned on a clean slate8 there41 usin0 recent technolo01 and ensurin0

future e5olution. The strate01 is 2ossi4le in cases of han#s 4uildin0 u2 ne7

s1stems such as in Eastern Euro2e. It can8 ho7e5er8 4e un-cost effecti5e in

mature han#s 7here le0ac1 s1stem issues arise.

=> #n top of e$isting systems - This is the usual case in mature mar#ets 7here

le0ac1 s1stems re2resentin0 considera4le in5estments art-2resent.

Im2lementin0 s1stems en to2 of e;istin0 s1stems re9uires inte0ration s#ills and

5alue-added com2etencies. @ere the im2lementation issues faced 41 the

hard7are and soft7are teams reside 2rimaril1 on s1stem inte0ration s#ills.

%ften solutions re2resent either a corn 2romise or are cum4ersome8 7ith the use

of emulator and con5ersion 2rocesses for data4ases.

=> Role of consultants - The1 are usuall1 4rou0ht in to e;amine the client?s

e;istin0 IT infrastructures and to anal16e their needs8 and then formulate

hard7are and soft7are recommendations as 7ell as the im2lementation

strate01. The ad5anta0e is that a 5endor inde2endent o2inion is theoreticall1

2ossi4le the disad5anta0e is that 1ou are dealin0 7ith 0eneralists as o22osed to

s2eciali6ed e;2erts.

- 35 - Sunny Agnihotri, T.Y.BBI

E-Finance

=> %fter-sales support - ! Gnon-technicalG issue 4ut ne5ertheless crucial in the

lon0 run. !fter-sales su22ort do5etails 7ith 5endor reliance8 and a close loo# at

the 5endor?s 2roduct de5elo2ment strate01 and lon0-term 5ia4ilit1 should 4e

made. !fter-sales su22ort can also include factors such as the financial situation

of the com2an18 its? 2roduct de5elo2ment strate018 its adherence to or su22ort of

industr1 standards8 its 0eo0ra2hical co5era0e8 etc.

Traditionall18 4an#in0 mana0ement ill 0eneral and8 in 2articular8 at the 4usiness

function le5el =head office or 4ranch> has 4een dismissi5e or e5en hostile to the

on0oin0 role of IT and IT consultants in their 4usiness. Enli0htened

mana0ement has8 ho7e5er8 alread1 reali6ed that further de2lo1ment of IT at the

4ranch and indi5idual user le5els is not onl1 useful for cuttin0 costs 4ut it is

also 5ital as a strate0ic 7ea2on to increase 5alue-added ser5ices8

com2etiti5eness8 and customer lo1alt1. This difference is li#el1 to 4e at the core

of the com2etiti5eness ena4lin0 com2an1 success or failure. Enli0htened

mana0ement 7ill also ha5e reali6ed that in5estment in a22ro2riate IT s1stems

7ill 4e central to an1 effort to transform 4an#s from 2roduct-dri5en to

customer-dri5en or0ani6ations8 in 2articular at the 4ranch le5el

- 36 - Sunny Agnihotri, T.Y.BBI

E-Finance

T4e Glo6al Dimension

In5estment 4an#in0 and cor2orate 4an#in0 ser5icesF

Electronic forums in in5estment 4an#in0F

'or2orate 4an#in08 includin0 +T,8 clearin08 and settlementF

+)E issues =small-to-medium 4usiness>F

(etail 4an#in08 includin0 online tradin0 and 4an#in0F

E-cash and electronic 2ursesF and

'ritical issues for e-finance.

The com4inin0 of the 0ro7th in the Internet and ne7 technolo0ies 7ith the

trends of economic 0lo4ali6ation8 mer0ers8 and concentration

antinationali6ation of the financial ser5ices industr18 is leadin0 to numerous

si0nificant de5elo2ments in the arena of the finance. E-finance is a 4road field

and it is im2ossi4le to descri4e technical de5elo2ments in meanin0ful detail at

the macro le5el. These de5elo2ments are im2actin0 5arious s2eciali6ed sectors

or su4sets of the financial ser5ices industr1. We therefore8 loo# at some discrete

industr1 sectors and see ho7 the im2act of e-technolo01 has affected them:

In5estment 4an#in0 and cor2orate 4an#in0 ser5ices

Electronic forums in in5estment 4an#in0

'or2orate 4an#in0

%ther ser5ices: +T,8 clearin0 and settlement8 +)EMs

(etail 4an#in0

%nline tradin0

%nline 4an#in0

- 37 - Sunny Agnihotri, T.Y.BBI

E-Finance

E-cash and electronic 2urses.

IN+EST$ENT BAN%ING AND CORPORATE BAN%ING

SER+ICES

While in5estment 4an#in0 is still8 at its core8 a relationshi2 4usiness dri5en 41

2ersonal contacts and face-to-face ne0otiations8 certain as2ects of the disci2line

are no7 4ein0 conducted electronicall1.

A, )or0an 'hase has de5elo2ed a dedicated We4 2latform for its in5estment

4an#in0 clients #no7n as 'hase+2ace. This is 4asicall1 an ela4orate 4rochure

7are We4site diffusin0 'hase documentation such as research8 streamin0

audio-5ideo re2orts8 mar#et commentar18 securities 2rices8 and other deal-

related information. )ost other ma<or 4an#s ha5e also set u2 similar ela4orate

G4rochure 7areG sites.

The de5elo2ment of We4sites ena4lin0 actual tradin08 ho7e5er8 is another stor1.

)uch 2ro0ress remains to 4e done in this area o7in0 to cultural reticence and

securit1 concerns. +ome de5elo2ments ha5e occurred in the secondar1 loan

mar#et tradin0 area. %ther #e1 areas of online in5estment 4an#in0 center on

matchin0 4u1er and sellers of 4usinesses or loans8 and lin#in0 users and

2ro5iders of 2ri5ate ca2ital. We shall consider each of these cases.

- 3 - Sunny Agnihotri, T.Y.BBI

E-Finance

CORPORATE BAN%ING

'or2orate 4an#in0 has 4een a hea51 user of IT. In order to 2ro5ide 4es2o#e and

2ersonali6ed ser5ices to ma<or cor2orate clients8 ma<or 4an#s in certain cases

ha5e 2artnered 7ith technolo01 2ro5iders to create dedicated cor2orate 4an#in0

ser5ices. For e;am2le8 'iti4an# and Bottomline Technolo01 ha5e 2roduced an

online cor2orate 4illin0 s1stemF and Ban# %ne has 2artnered 7ith E$+ to

2roduce a <oint in5oice-2a1ment solution. @ere are some e;am2les of facilities

offered 41 indi5idual 4an#s.

'iti4an# offers its cor2orate customers 4illin08 cash mana0ement8 custod18 and

trade finance ser5ices.

$eutsche Ban# offers cash mana0ement8 2ortfolio mana0ement8 and custod1

a22lications.

'hase offers loan s1ndication8 2urchasin08 trade finance8 0lo4al custod18 and

treasur1 mana0ement ser5ices.

Ban# of !merica features treasur1 mana0ement and ca2ital mar#ets ser5ices.

(o1al Ban# of +cotland offers 2a1ment reconciliation8 e;2ort collection8 letter

of credit8 and cash mana0ement ser5ice.

+5ens#a @andels4an#en and !BB !)B(% after treasur1 and trade-related

ser5ices.

In 2001 a 4an#in0 consortium includin0 Banco +antander'@8 'ommer6-4an#.

(o1al Ban# of +cotland8 +an ,aoio I)I8 and +ociete 3enerate introduced an

online 2latform for cor2orate 'ustomers 7ho allo7s them to deal in treasur1

and ca2ital mar#ets 2roducts =includin0 FN8 s1ndicated loans8 and interest rate

deri5ati5es>.

- 3! - Sunny Agnihotri, T.Y.BBI

E-Finance

S$E clients

The +)E =small-to-medium 4usiness> sector is also 4ecomin0 an im2ortant

focal 2oint for 5arious 7e4- 4an#in0 ser5ice 2ro5iders. )an1 esta4lished

institutions ha5e reali6ed that +)E We4 4an#in0 re2resents an im2ortant8 and

lar0el1 unta22ed8 se0ment of the industr1. The small 4usiness 4an#in0 mar#et is

alread1 technolo0icall1 7ired =7ith Internet 2enetration that e;ceeds *0D> and

lends itself to hi0her fees and lar0er 4alances than the retail mar#et8 ma#in0 it a

2otentiall1 attracti5e source of re5enues. Industr1 research indicates that there

are rou0hl1 23 million +)E accounts in the H+! that can 4e readil1 mi0rated

to the We4.

)ost +)E We4-4an#in0 2latforms offer 4asic ser5ices such as cash

mana0ement8 treasur1 mana0ement8 accounts recei5a14le mana0ement8 etc.

Esta4lished financial institutions such as 'hase8 'iti4an#8 Barc1a1s8 $eutsche

Ban#8 @+B'8 +ociete 3enerale8 and Bational !ustralia Ban# ha5e tailored their

storefront 2latforms to cater e;clusi5el1 to small 4usiness. The si0nificant issue

here is that e-finance8 7hich u2 until no7 has meant electronic ser5ices for

ma<or cor2orate clients8 is no7 mo5in0 to7ards the +)E sector.

- 4" - Sunny Agnihotri, T.Y.BBI

E-Finance

RETAI' BAN%ING

(etail 4an#in0 acti5ities ha5e 4een si0nificantl1 im2acted 41e-finance

technolo01. From the 4e0innin08 7hen ! T)s and tele2hone 4an#in0 made the

initial inroads8 the mar#et has e5ol5ed to more direct modes of contact 7ith

clients.

Online tra"ing

%nline tradin0 has re5olutioni6ed and 2o2ulari6ed the conce2t of We4-4ased

retail financial ser5ices. Thou0h electronic 4an#in0 e;isted on home ,'s 7ell

4efore the Internet 4ecame 2art of the mainstream8 it 7as the de5elo2ment of

useful8 fle;i4le8 and secure online tradin0 mechanisms that created consumer

interest in We4-4ased financial ser5ices. %nline tradin0 has 4rou0ht e-finance

into the mass mar#et and is the #e1 Vactor in ensurin0 the customer lo1alt1 that

is necessar1 for most 4usiness models.

This mass enthusiasm is hardl1 sur2risin0 in that it has em2o7ered indi5idual

in5estors to mana0e their in5estment and retirement assets more 2roacti5el1.

This occurs a0ainst the 4ac#dro2 of concern o5er future state retirement

schemes and the li4erali6ation of in5estment rules allo7in0 for more fle;i4le

and acti5e 2artici2ation 41 indi5iduals. )an1 in5estors ha5e ta#en a ?do-it-

1ourself a22roach to financial mana0ement8 reducin0 their reliance on financial

2lanners8 ad5isers8 and 4ro#ers8 and conductin0 their tradin0 acti5ities 5ia

ser5ice 2ro5iders such as +ch7a4 and E-Trade.

- 41 - Sunny Agnihotri, T.Y.BBI

E-Finance

3ro7th areas include mature8 de5elo2ed mar#ets such as +7eden8 3erman18

France8 and +7it6erland. In most cases online tradin0 in the H+ is still limited

to the H+ mar#ets8 unless s2ecial arran0ements or alliances are concluded 7ith

other international 5entures8 or indi5idual su4sidiaries8 are esta4lished in local

mar#ets. To offer customers international access8 it 4ecomes necessar1 to create

se2arate su4sidiaries to deal in those mar#ets.

Features offered 41 most online tradin0 2latforms include real-time 9uotes8

trade e;ecution8 research alerts8 I,% access8 2ortfolio trac#in08 stoc# filterin08

financial 2lannin08 2osition u2dates8 4u1in0 2o7er notification8 trade histor18

2rofit and loss accountin08 multi2le account access8 and headline ne7s. Trade

e;ecution modules t12ical11 let in5estors select the t12e8 of 4u1-sell order

desired8 includin0 limit orders =e;ecutin0 at a s2ecified 2rice>8 mar#et orders

=e;ecutin0 at the 2re5ailin0 2rice>8 mar#eta4le limit orders =e;ecutin0 at no

7orse than the 2rice s2ecified>8 0ood-till-cancelled orders =#ee2in0 an order

Gali5eG until it is e;ecuted or cancelled>8 till-or-#ill orders =tillin0 the entire

order or none at all>8 and so on. $a1 tradin08 in 7hich in5estors e;ecute do6ens8

or hundreds8 of trades in the ho2e of ca2turin0 small s2reads8 has 4een in

e;istence since the earl1 19/0s. )ost G2rofessionalG da1 traders8 7ho t12icall1

trade in 00-1000 share 4loc#s8 ha5e historicall1 relied on electronic direct

access tradin0 =E$!T> 2latforms that include dedicated communications lines8

0uaranteed instant access to a mar#et2lace and rich8 real-time 9uotes. 'ertain

dedicated retail 4ond tradin0 ser5ices ha5e also emer0ed8 includin0 5entures

such as Bonds online8 Bondtrac8 BondE;-chan0e8 and BondE;2ress. With more

than 100 online tradin0 firms in o2eration in the H+8 and a similar num4er

- 42 - Sunny Agnihotri, T.Y.BBI

E-Finance

acti5e a4road8 com2etition is considera4le.

OnlineBanking

%nline 4an#in0 is a 4road sector that co5ers chec#in0-sa5in0s-de2osits8 4alance

information8 fund transfers8 2a1ments8 and credit ser5ices. Earious models are

used to deli5er online 4an#in0 ser5ices to the 2u4lic. With 0ro7in0 demand for

such ser5ices8 ne7 and esta4lished institutions ha5e 4een de5elo2in0 their

online offerin0s in order to meet customer e;2ectations. +olutions 2ro5iders

ha5e also stri5en to u20rade IT infrastructure to cater to the e;2ected need for

online 4an#in0. +ome e-finance models are:

QL 'or2orate storefront model =7here indi5idual financial institutions 2ro5ide

clients 7ith 2ro2rietar1 4an#in0 2roducts-ser5ices>F

QL Eertical 2ortal model =7here 5ertical 2ortals o2erated 41 han#s or non-4an#s

2ro5ide customers 7ith 4an#in0 ser5ices in 2arallel 7ith other ser5ices>F and

QL 'ertain se0ments of online 4an#in08 includin0 mort0a0es and loans8 also

ma#in0 use of the mar#et2lace model.

Thou0h man1 ma<or 4an#s no7 feature so2histicated transaction-ena4led

ser5ices8 most ha5e had to re5am2 their 2latforms as their 4usiness model

chan0es. )oreo5er8 certain cultural characteristics 2ersist - some certain

industr1 studies su00est that 2urchasers of lon0-term de2osits often li#e to

conduct their 4usiness in 2erson8 rather than o5er the We4F the same is true for

customers ta#in0 on lar0e financial commitments8 such as mort0a0es and home

e9uit1 loans. It 7ill ta#e time 4efore these consumers 0ain 0reater confidenc

- 43 - Sunny Agnihotri, T.Y.BBI

E-Finance

7ith the Internet.

While total re5enues deri5ed from online o2erations remain relati5el1 small at

2resent8 the1 are e;2ected to increase o5er time as more 4usiness is conducted

5ia the We4. It is e;2ected that this 7ill 4e the case sim2l1 due to the economic

facts of lo7ered transaction costs once the fi;ed costs relatin0 to the creation of

the infrastructure are co5ered. Earious industr1 studies confirm that this 0ro7th

7ill 4e stron0 in the H+!: Au2iter estimates that 2 million accounts 7ill 4e

o2erational in 20038 7hile I$' forecasts some 40 million accounts. The main

H+ han#s such as Ban# of !merica8 'iti4an#8 Ban# %ne8 and 'hase ha5e made

considera4le 2ro0ressF 41 2000 the We4 2latforms of 'iti4an# and Ban# of

!merica had 4et7een 008000 and 2 million accounts each.

%nline 4an#in0 is also 0ro7in0 in Euro2e8 'anada8 and !ustralia. In contrast to

the H+ ho7e5er8 there are 5er1 fe7 G2ure 2la1G han#sF most are 5entures set u2

41 esta4lished 4an#s that 2ercei5e this de5elo2ment as a threat8 and therefore

feel the need to 4e ?2resent. Earious industr1 studies also confirm that e;2ected

0ro7th in Euro2e 7ill 4e stron08 7ith the main mar#ets 4ein0 the HC8

3erman18 France8 +7it6erland8 Benelu;8 and +candina5ia. +ome of these online

4an#s carr1 the 2arent or0ani6ation?s 4rand 7hilst others are ne7 4rands.

Electronic 2a1ments are an increasin0l1 im2ortant area of focus for 4an#s. The

Internet has made it theoreticall1 2ossi4le for households to e;tend similar

functionalit1 to mana0e the electronic 2a1ment of 4ills and the electronic

transfer of small 5alue 2a1ments.

- 44 - Sunny Agnihotri, T.Y.BBI

E-Finance

CRITICA' ISSUES !OR E,!INANCE

Com2#ter sec#rity

Toda1?s securit1 issue is 2articularl1 trou4lesome 4ecause of the 5ast-ness of the

Internet8 the ease of access8 and the lac# of central control. +ecurit1 is e;2ected

to im2ro5e as chi2 cards 2ro5ide a 2rotected mechanism for electronic funds.

!dditional de5elo2ments in encr12tion technolo018 fire7all s1stems8 and

sur5eillance s1stems 7ill further 2rotect Internet transactions. The securit1

issue8 althou0h e;tremel1 im2ortant8 is not the onl1 or the 4i00est issue to

address 7hen considerin0 the Internet for commercial use.

E+O'+ING TEC.NO'OG( O! E,!INANCE

To com2ete in the di0ital econom18 technolo01 architecture has to 4e fle;i4le8

scala4le8 relia4le8 and cost-effecti5e. Rou ha5e to 4e a4le to chan0e 9uic#l1 to

meet the demands of the mar#et. In the financial industr18 7ireless technolo01

2ro5ides a le5el of con5enience to e;tend to the indi5idual. @a5in0 a 7ireless

e;tension into the technolo01 4ac#4one is 0oin0 to 4e as im2ortant as ha5in0 an

Internet com2onent 7as three 1ears a0o.

+ometimes chan0e is ha22enin0 so fast that it can 4e almost o5er7helmin0. To

0ain some 2ers2ecti5e 7e need to ste2 4ac# and remem4er ho7 far 7e?5e come

in <ust a fe7 1ears.

- 45 - Sunny Agnihotri, T.Y.BBI

E-Finance

NE- TRENDS AND BUSINESS $ODE'S

+e5eral trends and 4usiness models are ha5in0 a 2rofound effect on the

financial industr1. The 0ro7in0 2o7er and cost-effecti5eness of

communications and com2utin0 technolo0ies8 includin0 the Internet8 are at the

heart of these chan0es. +ince 19/08 there ha5e 4een three ma<or 2aradi0m shifts.

QL Firstl18 the transition from the mainframe to the ,'8 7hich 4rou0ht

com2utin0 2o7er to the indi5idual.

QL Be;t8 the introduction of the 0ra2hical user interface alon0 7ith lo7er

2riced ,'s8 7hich made ,'s eas1 to use8 afforda4le and accessi4le to

consumers.

QL !nd thirdl18 the commerciali6ation of the Internet8 7hich connected all these

com2utin0 de5ices to a net7or#.

Toda18 net7or#s are out2acin0 the im2ortance of the ,'. The o2en nature of the

Internet and its commerciali6ation are #e1s to a re5olution in the 7a1 7e

communicate. It has allo7ed one-to-one communications in 7a1s that 7ere

2re5iousl1 im2ossi4le 4et7een t7o 2eo2le8 directl1 4et7een 4usiness and

customer8 directl1 4et7een 4usiness and 4usiness. Time and 0eo0ra2h1 harriers

ha5e disa22eared and ne7 mar#ets ne5er 4efore accessi4le ha5e o2ened.

@o7e5er8 Internet technolo01 is still in its infanc1 and considera4le

im2ro5ements in relia4ilit1 and confidentialit1 7ill need to he achie5ed 4efore

- 46 - Sunny Agnihotri, T.Y.BBI

E-Finance

it 4ecomes the natural medium for e-finance.

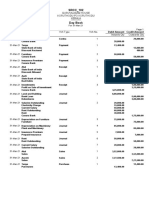

Sur&ey Report

%otak $a4in"raBank

T4e Bank7,

Esta4lished in 19/48 Cota# )ahindra is one of India?s leadin0 financial

institutions8 offerin0 com2lete financial solutions. From commercial 4an#in08 to

stoc# 4ro#in08 to mutual funds8 to life insurance8 to in5estment 4an#in08 the

0rou2 caters to the financial needs of indi5iduals and cor2orates. In Fe4ruar1

20038 Cota# )ahindra Finance .td8 the 0rou2?s fla0shi2 com2an1 7as 0i5en

the license to carr1 on 4an#in0 4usiness 41 the (eser5e Ban# of India =(BI>.

Cota# )ahindra Finance .td. is the first com2an1 in the Indian 4an#in0 histor1

to con5ert to a 4an#.

(ecentl18 Cota# )ahindra Ban# .td and @$F' Ban# ha5e si0ned a

)emorandum of Hnderstandin0 to share their !T) net7or#. This a0reement

7ill 0i5e customers of the t7o 4an#s access to o5er 1400 !T)s across the

countr1. While @$F' Ban# has 133 !T)s across 22/ locations in the countr18

Cota# )ahindra Ban# has * !T)s at 41 locations8 accessi4le 24 hours a da18

3& da1s a 1ear. Cota# )ahindra Ban# is offerin0 access to @$F' Ban# !T)

net7or# free of cost to most of its customers. The char0es for @$F' Ban#

customer for usin0 Cota# )ahindra?s !T)s are (s. 1/ for 'ash 7ithdra7als

and (s. * for "uer1-4ased transactions such as 4alance en9uir1.

- 47 - Sunny Agnihotri, T.Y.BBI

E-Finance

T4e Branc4 7,

The 4ranch is runnin0 on 100D core ri0ht from 7hen it started.

The 4ranch 2ro5ides ser5ices li#e:-

Electronic Fund Transfer

(eal Time 3ross +ettlement

+WIFT

Bet Ban#in0

,hone Ban#in0

+mart 'ards

Branch Ban#in0

(etail .oans

'or2orate Ban#in0

!sset )ana0ement

In5estment Ban#in0

Bro#in0

Treasur1

!sset (econstruction

.ife Insurance and etc.

The Ban# is noted for its inno5ati5e ser5ices and has acti5e in 2ioneerin0 ne7

initiati5es for its domestic-7ide clients. It introduced a 5ariet1 of financial

2roducts 5ia an increasin0 num4er deli5er1 channels li#e8 Branch Tellers8

!T)Ms and etc.

- 4 - Sunny Agnihotri, T.Y.BBI

E-Finance

With the li4erali6ation of the Indian econom1 in the 90Ms and re0ulator1

chan0es8 the 4an# e;tended its 2ortfolio of ser5ices in the area of in5estment

4an#in08 retail 4an#in08 treasur1 ser5ices and of course internet 4an#in0.

T4e C#stomer7,

Basicall1 the customers demand for EFTMs8 +WIFT8 +mart 'ard and etc.

!s the customers are 0enerall1 hi0h 2rofile there demands are also hi0h and the

4an# 4elie5es in 2ro5idin0 efficient ser5ices to there customers. Basicall1 there

is a demand for o5erseas transfer so the1 are 2ro5ided 7ith +WIFT.

If the demand for an inter 4an# transfer or a 4ranch to 4ranch the1 are 2ro5ided

41 (T3+ or 41 EFTMs. E5er1 customer is 4een 2ro5ided 41 a !T) card 7ell

#no7n as a de4it card8 a net 4an#in0 id and a 2hone 4an#in0 id as and 7hen he

o2ens an account in the 4an#. The current account holders are not se5ered 7ith

these ser5ices.

- 4! - Sunny Agnihotri, T.Y.BBI

E-Finance

Bi6liogra24y

Internet sites7

QL 777.!li4a4a.com

QL 777.4namericas.com

QL 777.4ondnet.com

QL 777.$e5elo2mentE;.com

QL 777.e4an.com

QL E2lus.com E9uit1 .in#.com

QL FT.com 0lo4al archi5es 3EN+.com 0lo4alfinanceonline.com

BOO%S

QL Insi0ht E(, E-Finance

- 5" - Sunny Agnihotri, T.Y.BBI

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Account Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueDocument22 pagesAccount Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueFerguson TchayaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- SWIFT Message To Initiate A Banking TransactionDocument3 pagesSWIFT Message To Initiate A Banking TransactionAboHsain AlshaikhPas encore d'évaluation

- Wells Fargo Way2Save SavingsDocument4 pagesWells Fargo Way2Save SavingsBrianPas encore d'évaluation

- Should Ranbaxy Launch An Energy Candy in IndiaDocument18 pagesShould Ranbaxy Launch An Energy Candy in IndiaAnand Singh100% (2)

- Accounting Policies & Procedures ManualDocument335 pagesAccounting Policies & Procedures ManualPlatonic100% (23)

- Test 1Document83 pagesTest 1Cam WolfePas encore d'évaluation

- Tai Tong Chuache & Co. V Insurance Commission, G.R. No. L-55397, February 29, 1988Document2 pagesTai Tong Chuache & Co. V Insurance Commission, G.R. No. L-55397, February 29, 1988Lyle BucolPas encore d'évaluation

- Final PNGDocument30 pagesFinal PNGAnand SinghPas encore d'évaluation

- Nurse Staffing Ratio PosterboardDocument1 pageNurse Staffing Ratio Posterboardapi-260974225100% (1)

- HUL Financial ModellingDocument21 pagesHUL Financial ModellingAnand SinghPas encore d'évaluation

- 1 Mega E Auction Dated 29-06-2019Document1 page1 Mega E Auction Dated 29-06-2019Anand SinghPas encore d'évaluation

- Excel ShortcutsDocument10 pagesExcel ShortcutsAnand SinghPas encore d'évaluation

- Annual Report Man DMDocument230 pagesAnnual Report Man DMAnand SinghPas encore d'évaluation

- Report WritingDocument9 pagesReport WritingAnand Singh100% (1)

- Ratio Analysis: Balance Sheet RatiosDocument2 pagesRatio Analysis: Balance Sheet RatiosAnand SinghPas encore d'évaluation

- Accesorries 3. ElectronicsDocument4 pagesAccesorries 3. ElectronicsAnand SinghPas encore d'évaluation

- LTM2Document1 pageLTM2Anand SinghPas encore d'évaluation

- Product Could Be Physical Good (Cereal), Service (Airline) EtcDocument10 pagesProduct Could Be Physical Good (Cereal), Service (Airline) EtcAnand SinghPas encore d'évaluation

- Group DynamicsDocument19 pagesGroup DynamicsAnand SinghPas encore d'évaluation

- Cet MockDocument32 pagesCet MockAnand SinghPas encore d'évaluation

- Foreign Exchange Market NNNDocument25 pagesForeign Exchange Market NNNAnand SinghPas encore d'évaluation

- Government DebtDocument23 pagesGovernment DebtAnand SinghPas encore d'évaluation

- My Internship Report Bank Alfalah Islamic Ltd. CompletedDocument63 pagesMy Internship Report Bank Alfalah Islamic Ltd. Completedanon_512862546Pas encore d'évaluation

- Source of Fund (Bank's Liability)Document6 pagesSource of Fund (Bank's Liability)sayed126Pas encore d'évaluation

- ICAN EXEMPTION FEE Sheet1Document3 pagesICAN EXEMPTION FEE Sheet1Niyi SeiduPas encore d'évaluation

- DHiCW Roles Dental HygienistDocument2 pagesDHiCW Roles Dental HygienistKukuhPas encore d'évaluation