Académique Documents

Professionnel Documents

Culture Documents

Impossible Trinity

Transféré par

Rupendra Gopalbanshi0 évaluation0% ont trouvé ce document utile (0 vote)

93 vues2 pagesEconomics

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentEconomics

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

93 vues2 pagesImpossible Trinity

Transféré par

Rupendra GopalbanshiEconomics

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

The Impossible Trinity and Dilemma of

Nepals Monetary Policy

The impossible trinity is achieving three things at the same time: exchange rate

stability, free fow of

international capital and an autonomous monetarypolicy (which means the ability

to target infation and/

or interest rates). t is not possible for straightforward reasons: if capital is free to

move in and out, and the

exchange rate is !xed, then money can swing in and out in huge "uantities and

play havoc with domestic

infation and interest rates # which then rules out an autonomous monetary policy.

$imilarly if interest rate

is targeted, monetary aggregates might move beyond desired level (depending

upon interest elasticity of

money or credit demand) having its implication for external sector balances. n a

perfectly open economy

case, excess or de!cient money supply would then change the course of capital

fows, ultimately

thwarting the target of interest rate level.n developing countries, monetary policy

has

become increasingly important in recent years, even though capital accounts have

been progressively

liberali%ed. The reason is that the large movements in global capital during the late

&''(s forced many

of these countries to abandon !xed or closely managed exchange rate regimes.

$uch recent

developments have put a new face on an older, deeper lesson: namely that freely

mobile capital,

independent monetary policy, and !xed exchange rates form an impossible trinity.

t is opined that it is

possible to have any two of these policies, but not all three.

There is a view that real interest rate has to be positive in order to encourage

!nancial savings

mobili%ation. $o there is a temptation to control interest rate along with targeting

monetary aggregates.

Targeting an infation of less than ) per cent and attempting to maintain interest

rate at a level close to

that in ndia means that both interest rates and money supply have to be at the

disposal of the authorities.

n a mar*et related monetary and !nancial structure, this cannot be attained

through direct interventions

Ta*e the exchange rate case next. The central ban* has traditionally tried to

defend the peg with ndian

currency. That policy still holds, which means that the central ban* wants one of

the legs of the trinity:

stable exchange rates. +t a time of high capital fows, more fre"uent interventions

have to be made to

defend the current peg. ,on-sterili%ed interventions in the foreign exchange

mar*et then have serious

implications for monetary aggregates which impinge upon prices and balance of

payments.

Tal*ing about the third aspect of the impossible trinity that is free fow of capital,

,epal has so far

loosely maintained capital control. .ut institutional capital fows mainly through

the ban*ing system and

from the private sector individuals towards ndia remains unregulated. Thus, if the

domestic rupee is

ruling stronger than what the central ban* would li*e, and if there is cross border

di/erence in interest rates

even in !xed exchange rate regime, there is a possibility of strong capital fows

from/to the

country which would a/ect directly the exchange rate or would indirectly a/ect

the same through the

balance of payments. n an economy with shallow domestic !nancial

system and high potential for capital fows, monetary targeting for infation control

and exchange rate

targeting to defend the peg would be a di/icult tas* for the central ban*. n the

similar vain, defending a

peg would imply a loss of autonomy in monetary operation. This means that ,0.

has perhaps some

times in future to ma*e a hard choice between brea*ing the peg and loosing

monetary autonomy

Vous aimerez peut-être aussi

- International Finance Ass2Document12 pagesInternational Finance Ass2ferrbrix100% (1)

- Monetary PolicyDocument10 pagesMonetary PolicyMuhammad Asim IsmailPas encore d'évaluation

- Capital Flows Exchange Rate Monetary PolicyDocument22 pagesCapital Flows Exchange Rate Monetary PolicyPankaj PatilPas encore d'évaluation

- Literature Review On Exchange Rate RegimeDocument8 pagesLiterature Review On Exchange Rate Regimegw2cgcd9100% (1)

- Monetary PolicyDocument18 pagesMonetary Policymodasra100% (2)

- Research Title:: "The Role of Monetary Policy On Inflation in Developing Country"Document14 pagesResearch Title:: "The Role of Monetary Policy On Inflation in Developing Country"Zaina RathorePas encore d'évaluation

- CH 03Document17 pagesCH 03Shahab AzizPas encore d'évaluation

- Appendix II: Fixed Vs Flexible Exchange RatesDocument4 pagesAppendix II: Fixed Vs Flexible Exchange RatesMasara OwenPas encore d'évaluation

- Mc-Sse 8 Macroeconomics: Group Vi: (Monetary Policy)Document16 pagesMc-Sse 8 Macroeconomics: Group Vi: (Monetary Policy)Maria Cristina ImportantePas encore d'évaluation

- Monetary and Fiscal PolicyDocument18 pagesMonetary and Fiscal PolicyEmuyePas encore d'évaluation

- Flexible Exchange-Rate SystemDocument19 pagesFlexible Exchange-Rate SystemRaj SinghPas encore d'évaluation

- Midiendo La Tasa NaturalDocument17 pagesMidiendo La Tasa NaturalLeidy Patricia CLAUDIO CUYUBAMBAPas encore d'évaluation

- AFW 3331 T1 Answers1Document7 pagesAFW 3331 T1 Answers1Zhang MengPas encore d'évaluation

- Exchange Rate Theory - A ReviewDocument43 pagesExchange Rate Theory - A Revieweric3215Pas encore d'évaluation

- Privatization Is The Process of Transferring OwnershipDocument17 pagesPrivatization Is The Process of Transferring OwnershipIndraveer SinghPas encore d'évaluation

- In Simple TermsDocument5 pagesIn Simple Termszkharuri7220Pas encore d'évaluation

- Floating Exchange RateDocument2 pagesFloating Exchange RateMuhammad FaizanPas encore d'évaluation

- Journal of Asian Economics: Reuven Glick, Michael HutchisonDocument20 pagesJournal of Asian Economics: Reuven Glick, Michael HutchisonAndreea LiviaPas encore d'évaluation

- Obstfeld and Rogoff 1995 The Mirage of Fixed Exchange RatesDocument42 pagesObstfeld and Rogoff 1995 The Mirage of Fixed Exchange RatesJéssicaPas encore d'évaluation

- Exchange-Rate Regime: FloatDocument15 pagesExchange-Rate Regime: FloatRuth LopesPas encore d'évaluation

- F F E R: Peter B. KenenDocument5 pagesF F E R: Peter B. KenenmarumonikPas encore d'évaluation

- Currency Regimes TheoryDocument7 pagesCurrency Regimes TheoryTimea DemeterPas encore d'évaluation

- Efficiency of Monetary Policy in Price InstabilityDocument11 pagesEfficiency of Monetary Policy in Price InstabilityHussainul Islam SajibPas encore d'évaluation

- Monetary PolicyDocument6 pagesMonetary Policypremsid28Pas encore d'évaluation

- Monetary Policy in JamaicaDocument37 pagesMonetary Policy in JamaicaMarie NelsonPas encore d'évaluation

- Monetary Policy Notes PDFDocument18 pagesMonetary Policy Notes PDFOptimistic Khan50% (2)

- The Supply of MOneyDocument8 pagesThe Supply of MOneyRuthie Jill PendonPas encore d'évaluation

- Exchange Rate DeterminationDocument5 pagesExchange Rate DeterminationSakshi LodhaPas encore d'évaluation

- Should A Country Adopt Fixed or Flexible Exchange Rate System?Document8 pagesShould A Country Adopt Fixed or Flexible Exchange Rate System?Zakaria CassimPas encore d'évaluation

- Capital ControlDocument2 pagesCapital ControlMichel TayarPas encore d'évaluation

- Ch8 Parity Conditions in International Finance and Currency ForecastingDocument27 pagesCh8 Parity Conditions in International Finance and Currency ForecastingMohammed HabibPas encore d'évaluation

- Thesis Exchange RateDocument5 pagesThesis Exchange Ratetheresasinghseattle100% (2)

- Câu Hỏi KTQTDocument4 pagesCâu Hỏi KTQTTran Tien ThanhPas encore d'évaluation

- AssignmentDocument5 pagesAssignmentAditya SahaPas encore d'évaluation

- Monetary PolicyDocument9 pagesMonetary PolicyNathan MacayananPas encore d'évaluation

- Presidents of European Bank For Reconstruction and Development (EBRD)Document12 pagesPresidents of European Bank For Reconstruction and Development (EBRD)kath_ahyenPas encore d'évaluation

- Exchange Rate Dissertation TopicsDocument4 pagesExchange Rate Dissertation TopicsCustomizedPaperPortland100% (1)

- Question: Define and Describe Monetary Analysis and Real Rate of Interest? Monetary AnalysisDocument6 pagesQuestion: Define and Describe Monetary Analysis and Real Rate of Interest? Monetary AnalysisPrecious PearlPas encore d'évaluation

- Exchange Rate and It's TypeDocument4 pagesExchange Rate and It's Typeanish-kc-8151Pas encore d'évaluation

- Monetary Policy Transmission MechanismDocument29 pagesMonetary Policy Transmission MechanismVenkatesh SwamyPas encore d'évaluation

- Banking OperationDocument5 pagesBanking OperationenobbePas encore d'évaluation

- Exchange Rate Regimes: Classification and ConsequencesDocument22 pagesExchange Rate Regimes: Classification and ConsequencesMuhammad Arslan UsmanPas encore d'évaluation

- CODE: AIM 1007: Name: Tan Geok LianDocument16 pagesCODE: AIM 1007: Name: Tan Geok LianWindy TanPas encore d'évaluation

- Monetary Policy in an Uncertain World: Ten Years After the CrisisD'EverandMonetary Policy in an Uncertain World: Ten Years After the CrisisPas encore d'évaluation

- Monetary Policy Operations: Demand-Supply CurveDocument2 pagesMonetary Policy Operations: Demand-Supply CurveNeha MahmoodPas encore d'évaluation

- How International Currency Excharge Rate WorksDocument6 pagesHow International Currency Excharge Rate Worksggi2022.1928Pas encore d'évaluation

- Monetary Policy in A World of CryptocurrenciesDocument34 pagesMonetary Policy in A World of CryptocurrenciesHưng Duy DaoPas encore d'évaluation

- The Effects of Monetary Policy On Inflation in Ghana.Document9 pagesThe Effects of Monetary Policy On Inflation in Ghana.Alexander DeckerPas encore d'évaluation

- The Indian Fiscal-Monetary Framework: Dominance or Coordination?Document19 pagesThe Indian Fiscal-Monetary Framework: Dominance or Coordination?vicky.sajnaniPas encore d'évaluation

- Arellano 20101Document45 pagesArellano 20101Jessica VillacísPas encore d'évaluation

- MACRO Economics AssignmentDocument35 pagesMACRO Economics AssignmentRamjanul AhsanPas encore d'évaluation

- Sistemul Monetar in ArgentinaDocument9 pagesSistemul Monetar in ArgentinaAde GalesPas encore d'évaluation

- International Monetary System Term PaperDocument18 pagesInternational Monetary System Term PaperDarshan GaragPas encore d'évaluation

- Exchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesDocument27 pagesExchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesSanchit AroraPas encore d'évaluation

- Thesis Monetary PolicyDocument6 pagesThesis Monetary Policycgvmxrief100% (2)

- Inflation Targeting in AfricaDocument7 pagesInflation Targeting in AfricaAhmad AtandaPas encore d'évaluation

- Bagian ADocument3 pagesBagian AMaria DevinaPas encore d'évaluation

- Monetary Economics UZ AssignmentDocument7 pagesMonetary Economics UZ AssignmentMilton ChinhoroPas encore d'évaluation

- An Interesting Theory -Why Interest Rates are Important but not for the Reasons Commonly AssumedD'EverandAn Interesting Theory -Why Interest Rates are Important but not for the Reasons Commonly AssumedPas encore d'évaluation

- Financial Markets and Economic Performance: A Model for Effective Decision MakingD'EverandFinancial Markets and Economic Performance: A Model for Effective Decision MakingPas encore d'évaluation

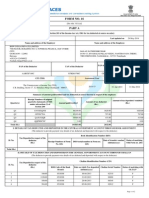

- 22 Stock Audit Report FormatDocument15 pages22 Stock Audit Report FormatSaptarshi CoomarPas encore d'évaluation

- Khalid Nail Factory PlantDocument25 pagesKhalid Nail Factory Plantmuluken walelgn100% (1)

- Bank Audit Guidance Note 2021Document975 pagesBank Audit Guidance Note 2021Arif AhmedPas encore d'évaluation

- Wind Farm Project Finance: Financing and Technical RequirementsDocument19 pagesWind Farm Project Finance: Financing and Technical RequirementsRahul Kumar AwadePas encore d'évaluation

- Accountancy Worksheet PracticeDocument4 pagesAccountancy Worksheet PracticeChandni JeswaniPas encore d'évaluation

- What Is CapitalismDocument5 pagesWhat Is Capitalismapi-293361169Pas encore d'évaluation

- Saving, Investment, and The Financial System: ConomicsDocument32 pagesSaving, Investment, and The Financial System: ConomicsZahara Riri ZakiaPas encore d'évaluation

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiPas encore d'évaluation

- Chapter 8 SMDocument34 pagesChapter 8 SMYber LexPas encore d'évaluation

- Business Apprenticeship: Project DescriptionDocument40 pagesBusiness Apprenticeship: Project DescriptioncitizenschoolsPas encore d'évaluation

- Cost of Capital-1Document1 pageCost of Capital-1tajdarh4Pas encore d'évaluation

- Slash Harmonic Pattern Trading StrategyDocument9 pagesSlash Harmonic Pattern Trading StrategyBabbli SinghPas encore d'évaluation

- Global Wealth Databook 2018Document167 pagesGlobal Wealth Databook 2018José DíazPas encore d'évaluation

- Ritika GugnaniDocument17 pagesRitika GugnanimansiPas encore d'évaluation

- 1571033148046Document3 pages1571033148046Manoj RautPas encore d'évaluation

- 8.8 Projected Balance Sheet Statement Assets Debit Credit Current AssetsDocument2 pages8.8 Projected Balance Sheet Statement Assets Debit Credit Current AssetsCzarmel Anne CBPas encore d'évaluation

- CFPB Building Block Activities Playing-Investment-game WorksheetDocument2 pagesCFPB Building Block Activities Playing-Investment-game WorksheetAbdullah ShaikhPas encore d'évaluation

- Unit TrustDocument35 pagesUnit TrustHelmi MohrabPas encore d'évaluation

- 2021.04.22 - Amortisation VS, DepreciationDocument9 pages2021.04.22 - Amortisation VS, Depreciationtautvydas snieskaPas encore d'évaluation

- Alan Freeman - Value and The Foundation of Economic DynamicsDocument20 pagesAlan Freeman - Value and The Foundation of Economic DynamicsSebastián HernándezPas encore d'évaluation

- Maybank SR2015Document84 pagesMaybank SR2015de_stanszaPas encore d'évaluation

- The Takeover Panel: Kraft Foods Inc. ("Kraft")Document6 pagesThe Takeover Panel: Kraft Foods Inc. ("Kraft")1Pas encore d'évaluation

- Module 3 InvestmentDocument12 pagesModule 3 Investmenttite ko'y malake100% (1)

- ITI Multi Cap Fund SIDDocument48 pagesITI Multi Cap Fund SIDRAHULPas encore d'évaluation

- A Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Document36 pagesA Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Kshitij ThakurPas encore d'évaluation

- Baker&Mckenzie-International Joint Ventures HandbookDocument153 pagesBaker&Mckenzie-International Joint Ventures HandbookGnopake EttusiahPas encore d'évaluation

- Neft Ecs, EftDocument2 pagesNeft Ecs, EftSankalp GuptaPas encore d'évaluation

- TDS & TCSDocument107 pagesTDS & TCSSANDEEP CHAUREPas encore d'évaluation

- Time Value of MoneyDocument76 pagesTime Value of Moneyrhea agnesPas encore d'évaluation