Académique Documents

Professionnel Documents

Culture Documents

Commercial Banking

Transféré par

mohit21mankaniCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Commercial Banking

Transféré par

mohit21mankaniDroits d'auteur :

Formats disponibles

Commercial Banking

Index

Definition

Evolution of commercial bank

Structure of Banking Industry in India

Function of Commercial Bank

Scope of Commercial Banking

Conclusion

Definition of a Bank

The term Bank has been dened in different ways by different economists.

A few denitions are:

According to Walter Leaf A bank is a person or corporation which holds itself out to receive from the

public, deposits payable on demand by cheque. Horace White has dened a bank, as a manufacture of

credit and a machine for facilitating exchange.According to Prof. Kinley, A bank is an establishment

which makes to individuals such advances of money as may be required and safely made, and to which

individuals entrust money when not required by them for use.

Origin of the word Bank

The name bank derives from the Italian word banco "desk/bench", used during the Renaissance era

by Florentine bankers, who used to make their transactions above a desk covered by a green tablecloth.

The Banking Companies Act of India denes Bank as

A Bank is a nancial institution which accepts money from the public for the purpose of lending or

investment repayable on demand or otherwise withdrawable by cheques, drafts or order or

otherwise.Thus, we can say that a bank is a nancial institution which deals in debts and credits. It

accepts deposits, lends money and also creates money. It bridges the gap between the savers and

borrowers. Banks are not merely traders in money but also in an important sense manufacturers of money

Investopedia Definition of 'Commercial Bank'

A financial institution that provides services, such as accepting deposits, giving business loans and auto

loans, mortgage lending, and basic investment products like savings accounts and certificates of deposit.

The traditional commercial bank is a brick and mortar institution with tellers, safe deposit boxes, vaults

and ATMs. However, some commercial banks do not have any physical branches and require consumers

to complete all transactions by phone or Internet. In exchange, they generally pay higher interest rates on

investments and deposits, and charge lower fee.

Com-mer-cial bank

Noun: A bank that offers services to the general public and to companies

Meaning

A commercial bank is a prot-seeking business rm, dealing in money and credit. It is a nancial

institution dealing in money in the sense that it accepts deposits of money from the public to keep them in

its custody for safety. So also, it deals in credit, i.e., it creates credit by making advances out of the funds

received as deposits to needy people. It thus, functions as a mobiliser of saving in the economy. A bank

is, therefore like a reservoir into which ow the savings, the idle surplus money of households and from

which loans are given on interest to businessmen and others who need them for investment or productive

uses.

Evolution of Commercial Banking in India

The commercial banking industry in India started in 1786 with the establishment of the Bank of Bengal

in Calcutta. The Indian Government at the time established three Presidency banks, viz., the Bank of

Bengal (established in 1809), the Bank of Bombay (established in 1840) and the Bank of Madras

(established in 1843). In 1921, the three Presidency banks were amalgamated to form the Imperial Bank

of India, which took up the role of a commercial bank, a bankers' bank and a banker to the Government.

The Imperial Bank of India was established with mainly European shareholders. It was only with the

establishment of Reserve Bank of India (RBI) as the central bank of the country in 1935, that the quasi-

central banking role o fthe Imperial Bank of India came to an end.

In 1860, the concept of limited liability was introduced in Indian banking, resulting in the establishment

of joint-stock banks. In 1865, the Allahabad Bank was established with purely Indian shareholders.

Punjab National Bank came into being in 1895. Between 1906 and 1913, other banks like Bank of India,

Central Bank of India, Bank of Baroda, Canara Bank, Indian Bank, and Bank of Mysore were set up.

After independence, the Government of India started taking steps to encourage the spread of banking in

India. In order to serve the economy in general and the rural sector in particular, the All India Rural

Credit Survey Committee recommended the creation of a state-partnered and state-sponsored bank

taking over the Imperial Bank of India and integrating with it, the former state-owned and state-

associate banks. Accordingly, State Bank of India (SBI) was constituted in 1955. Subsequently in 1959,

the State Bank of India (subsidiary bank) Act was passed, enabling the SBI to take over eight former

state-associate banks as its subsidiaries.

To better align the banking system to the needs of planning and economic policy, it was considered

necessary to have social control over banks. In 1969, 14 of the major private sector banks were

nationalized. This was an important milestone in the history of Indian banking. This was followed by the

nationalisation of another six private banks in 1980. With the nationalization of these banks, the major

segment of the banking sector came under the control of the Government. The nationalisation of banks

imparted major impetus to branch expansion in un-banked rural and semi-urban areas, which in turn

resulted in huge deposit mobilization, thereby giving boost to the overall savings rate of the economy. It

also resulted in scaling up of lending to agriculture and its allied sectors. However, this arrangement also

saw some weaknesses like reduced bank profitability, weak capital bases, and banks getting burdened

with large non-performing assets.

To create a strong and competitive banking system, a number of reform measures were initiated in early

1990s. The thrust of the reforms was on increasing operational efficiency, strengthening supervision

over banks, creating competitive conditions and developing technological and institutional

infrastructure. These measures led to the improvement in the financial health, soundness and efficiency

of the banking system.

Types of Commercial Banking

Overview on the Banking structure in India

Scheduled Banks:

Scheduled banks in India are those that are listed in the Second Schedule of the Reserve Bank of India

Act, 1934. RBI includes only those banks in this schedule which satisfy the criteria as laid down vide

section 42 (6) (a) of the Act.

Unscheduled Banks:

Non-scheduled banks also function in the Indian banking space, in the form of Local Area Banks (LAB). As

at end-March 2009 there were only 4 LABs operating in India. Local area banks are banks that are set up

under the scheme announced by the government of India in 1996, for the establishment of new private

banks of a local nature; with jurisdiction over a maximum of three contiguous districts. LABs aid in the

mobilization of funds of rural and semi urban districts.

Scheduled Commercial Bank

A commercial bank (or business bank) is a type of retail bank that provides services, such as accepting

deposits, giving business loans and basic investment products.

Public Sector Banks

These are banks where majority stake is held by the Government of India.

Examples of public sector banks are: SBI, Bank of India, Canara Bank, etc.

Private Sector Banks

These are banks majority of share capital of the bank is held by private individuals. These banks are

registered as companies with limited liability.

Examples of private sector banks are: ICICI Bank, Axis bank, HDFC, etc.

Foreign Banks

These banks are registered and have their headquarters in a foreign country but operate their branches

in our country.

Examples of foreign banks in India are: HSBC, Citibank, Standard Chartered Bank, etc.

Regional Rural Banks

These Banks were established under the provisions of an Ordinance promulgated on the 26th

September 1975 and the RRB Act, 1976 with an objective to ensure sufficient institutional credit for

agriculture and other rural sectors.

Prathama bank is the first Regional Rural Bank in India located in the city Moradabad in Uttar Pradesh.

Other Scheduled Commercial Bank

Any other bank being a bank included in the Second Schedule to the Reserve Bank of India Act, 1934 (2

of 1934), but does not include a co-operative bank"

Scheduled Cooperative Bank

A co-operative bank is a financial entity which belongs to its members, who are at the same time the

owners and the customers of their bank. Co-operative banks are often created by persons belonging to

the same local or professional community or sharing a common interest.

Co-operative banks function on the basis of "no-profit no-loss".

Anyonya Co-operative Bank Limited (ACBL) is the first co-operative bank in India located in the city of

Vadodara in Gujarat.

Rural Cooperative Banks

There are located in rural region and classified as short term and long terms based on the duration of

credit needs for rural India, mainly for agriculture sector.

Urban Cooperative Banks

As the name suggest they are located in urban India and based on their geographical reach and credit

providing capacity they are classified as signal or multi state co-operatives

Statistics about Commercial Bank in India

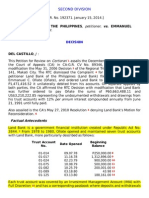

TABLE NO. 1.1 PROGRESS OF COMMERCIAL BANKING AT A GLANCE

IMPORTANT

INDICATORS

June

1969

March

2003

March

2004

March

2005

March

2006

March

2007

March

2008

March

2009

March

2010

March

2011

1 2 3 4 5 6 7 8 9 10

No. of Commercial

Banks

89 294 291 288 222 183 175 170 169 169

(a) Scheduled

Commercial Banks

73 289 286 284 218 179 171 166 165 165

Of which : Regional

Rural Banks

- 196 196 196 133 96 91 86 82 82

(b) Non-Scheduled

Commercial Banks

16 5 5 4 4 4 4 4 4 4

Number of Offices of

Scheduled

Commercial Banks in

India ^

8262 66535 67188 68355 69471 71839 76050 80547 85393 90263

(a) Rural 1833 32303 32121 32082 30579 30551 31076 31667 32624 33683

(b) Semi-Urban 3342 14859 15091 15403 15556 16361 17675 18969 20740 22843

(c) Urban 1584 10693 11000 11500 12032 12970 14391 15733 17003 17490

(d) Metropolitan 1503 8680 8976 9370 11304 11957 12908 14178 15026 16247

Population per office

(in thousands)

64.0 16.0 16.0 16.0 16.0 15.0 15.0 14.5 13.8 13.4

Source: RBI website

Functions of Commercial Banking

Commercial banks have to perform a variety of functions which are common to both developed and

developing countries. These are known as General Banking functions of the commercial banks. The

modern banks perform a variety of functions. These can be broadly divided into two categories: (a)

Primary functions and (b) Secondary function

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Document2 pagesAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanPas encore d'évaluation

- Standard Chartered Bank PakistanDocument19 pagesStandard Chartered Bank PakistanMuhammad Mubasher Rafique100% (1)

- BP, Reliance in $7.2 BN Oil Deal: Market ResponseDocument22 pagesBP, Reliance in $7.2 BN Oil Deal: Market ResponseAnkit PareekPas encore d'évaluation

- Assignment 2Document30 pagesAssignment 2fffffffffPas encore d'évaluation

- Day 12 Chap 7 Rev. FI5 Ex PRDocument11 pagesDay 12 Chap 7 Rev. FI5 Ex PRkhollaPas encore d'évaluation

- 15 Annual Report: ONGC Petro Additions LimitedDocument121 pages15 Annual Report: ONGC Petro Additions Limitedarjun SinghPas encore d'évaluation

- Oil and Gas Resources Andr Rights of ProvincesDocument16 pagesOil and Gas Resources Andr Rights of ProvincesKamran RazaPas encore d'évaluation

- Learnings From DJ SirDocument94 pagesLearnings From DJ SirHare KrishnaPas encore d'évaluation

- 2 Ac4Document2 pages2 Ac4Rafols AnnabellePas encore d'évaluation

- ADVANCED StrategiesDocument7 pagesADVANCED StrategiesMisterSimple100% (1)

- Hearings: Reauthorizing The Commodity Futures Trading CommissionDocument215 pagesHearings: Reauthorizing The Commodity Futures Trading CommissionScribd Government DocsPas encore d'évaluation

- Books of Prime Entry: The Cash BookDocument11 pagesBooks of Prime Entry: The Cash Bookأحمد عبد الحميدPas encore d'évaluation

- Sworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioDocument1 pageSworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioBryan WilleyPas encore d'évaluation

- 2018 - CSP - Sustainable Finance Capabilities of Private Banks - Report - #2Document47 pages2018 - CSP - Sustainable Finance Capabilities of Private Banks - Report - #2AllalannPas encore d'évaluation

- Assignment Banking ShivaniDocument25 pagesAssignment Banking ShivaniAnil RajPas encore d'évaluation

- Patti B Saris Financial Disclosure Report For 2010Document64 pagesPatti B Saris Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Capital Expenditure Review - Work ProgramDocument8 pagesCapital Expenditure Review - Work Programmarikb79Pas encore d'évaluation

- Coaching Assembly - Interview AnswersDocument4 pagesCoaching Assembly - Interview Answersmiraj93Pas encore d'évaluation

- Immovable Sale-Purchase (Land) ContractDocument6 pagesImmovable Sale-Purchase (Land) ContractMeta GoPas encore d'évaluation

- Chapter 12 13Document45 pagesChapter 12 13Jennifer N NguyenPas encore d'évaluation

- Duxbury Clipper 2010-30-06Document40 pagesDuxbury Clipper 2010-30-06Duxbury ClipperPas encore d'évaluation

- Land Bank of The PhilippinesDocument30 pagesLand Bank of The PhilippinesAdam WoodPas encore d'évaluation

- Real Estate TaxationDocument88 pagesReal Estate TaxationMichelleOgatis89% (9)

- Form Credit Application NewDocument2 pagesForm Credit Application NewRSUD AnugerahPas encore d'évaluation

- IGNOU ms04 AnsDocument12 pagesIGNOU ms04 AnsmiestalinPas encore d'évaluation

- Search Results For "Certification" - Wikimedia Foundation Governance Wiki PDFDocument2 pagesSearch Results For "Certification" - Wikimedia Foundation Governance Wiki PDFAdriza LagramadaPas encore d'évaluation

- CAREER POWER - No 09 Sbi CLRK PlrmsDocument59 pagesCAREER POWER - No 09 Sbi CLRK PlrmsrangulasivakasiPas encore d'évaluation

- Acs102 Fundamentals of Actuarial Science IDocument6 pagesAcs102 Fundamentals of Actuarial Science IKimondo King100% (1)

- Residency ReportDocument83 pagesResidency ReportaromamanPas encore d'évaluation

- (B) They Share A Majority of Their Common Assets and (C) They Have CommonDocument5 pages(B) They Share A Majority of Their Common Assets and (C) They Have CommonSab0% (1)