Académique Documents

Professionnel Documents

Culture Documents

Altos Research - Realiq: December 2009: Real-Time Housing Market Update

Transféré par

Houston ChronicleDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Altos Research - Realiq: December 2009: Real-Time Housing Market Update

Transféré par

Houston ChronicleDroits d'auteur :

Formats disponibles

ALTOS RESEARCH | REALIQ: December 2009: REAL-TIME HOUSING MARKET UPDATE

Real-Time Housing Market Update

Published by Altos Research & Real IQ

December 8, 2009

Highlights

The Altos Research 10-City Composite Price was down by 0.4% in November and

The Altos 10-City 0.8% during the most recent three-month period.

The Composite effectively bottomed out in January at $470,017 and climbed

Composite presents throughout the first half of the year to $509,030 in July before returning to a gradual

the most current downward trend. Prices are likely to continue showing modest declines throughout

perspective on

the seasonally weak fall and winter months of 2009.

Asking prices increased in just one of 26 markets - Miami. The previously strong

housing market California markets all showed price declines during November.

conditions across The largest monthly drop in asking prices occurred in San Diego with prices falling

3.1%, followed closely by Salt Lake City which showed a 2.9% decline. Salt Lake

the country. The City experienced the steepest quarterly drop in asking prices – down 6.1%.

Composite median Listed property inventory declined in 22 of 26 markets tracked. The inventory

declines were largest in Boston and the Bay Area markets of San Francisco and San

price fell by 0.4% in Jose.

November 2009. All markets except San Francisco and San Jose had a median days-on-market of 100

or more in November. By far, the market with the slowest rate of inventory

turnover was Miami with a median of 225 days-on-market or more than seven

months.

November Home Price Trends

The 10-City Composite Index was down 0.4% during November and 0.8% for the most

recent three-month period. The Index started the year in January at $470,017 and reached a

yearly high of $509,030 in July before falling to $499,267 in November. The downturn

would likely have been worse were it not for historically low mortgage rates and the federal

government’s home buyer tax credit which was recently extended beyond its November

expiration date.

Listing prices fell in 25 of 26 markets during November with Miami being the only

exception. The largest monthly declines occurred in San Diego and Salt Lake City with

asking prices down 3.1% and 2.9% respectively. Prices fell by more than one percent during

the month in 10 other markets. The rate of decline has slowed in Las Vegas but that market

continues to show the largest decline during the downturn. In November, 2007, the median

asking price was $347,597 but it fell to just $168,162 in November, 2009.

Asking prices increased in just one of 26 markets - Miami - with an increase of 1.0% for

November and 1.3% during the most recent three-month period.

© 2009 Altos Research LLC and Real IQ -1-

ALTOS RESEARCH | REALIQ: December 2009: REAL-TIME HOUSING MARKET UPDATE

Altos Research Price Composite

% Change

September October November % Change Over 3

MSA 2009 2009 2009 Last Month Months

10 City

$ 503,401 $ 501,377 $ 499,267 -0.4% -0.8%

Composite

San Diego $ 872,654 $ 864,465 $ 837,981 -3.1% -4.0%

Salt Lake City $ 396,139 $ 382,970 $ 371,930 -2.9% -6.1%

Charlotte $ 263,205 $ 259,884 $ 254,956 -1.9% -3.1%

Denver $ 401,214 $ 396,686 $ 389,681 -1.8% -2.9%

Portland $ 341,382 $ 336,025 $ 330,504 -1.6% -3.2%

Atlanta $ 235,250 $ 232,721 $ 229,262 -1.5% -2.5%

Phoenix $ 317,796 $ 311,050 $ 307,114 -1.3% -3.4%

Austin $ 306,473 $ 303,015 $ 299,233 -1.2% -2.4%

Cleveland $ 176,061 $ 174,298 $ 172,301 -1.1% -2.1%

Houston $ 241,075 $ 237,333 $ 234,723 -1.1% -2.6%

Las Vegas $ 172,068 $ 169,958 $ 168,162 -1.1% -2.3%

Minneapolis $ 301,595 $ 300,629 $ 297,707 -1.0% -1.3%

Seattle $ 414,177 $ 410,989 $ 407,592 -0.8% -1.6%

Tampa $ 227,176 $ 223,872 $ 222,149 -0.8% -2.2%

San Jose $ 811,798 $ 819,535 $ 813,365 -0.8% 0.2%

Los Angeles $ 734,941 $ 719,884 $ 714,473 -0.8% -2.8%

Chicago $ 326,339 $ 322,994 $ 320,571 -0.8% -1.8%

Detroit $ 159,339 $ 157,229 $ 156,066 -0.7% -2.1%

Indianapolis $ 174,052 $ 172,317 $ 171,195 -0.7% -1.6%

Washington, DC $ 457,239 $ 452,910 $ 450,281 -0.6% -1.5%

Dallas $ 248,803 $ 246,135 $ 245,045 -0.4% -1.5%

New York $ 654,959 $ 653,117 $ 650,536 -0.4% -0.7%

Boston $ 495,628 $ 492,942 $ 491,091 -0.4% -0.9%

San Francisco $ 815,291 $ 823,931 $ 820,903 -0.4% 0.7%

Philadelphia $ 351,185 $ 350,202 $ 349,549 -0.2% -0.5%

Miami $ 484,045 $ 485,472 $ 490,197 1.0% 1.3%

© 2009 Altos Research LLC and Real IQ -2-

ALTOS RESEARCH | REALIQ: December 2009: REAL-TIME HOUSING MARKET UPDATE

November Housing Supply Trends

During November, the inventory of properties listed for sale declined by 2.9% across the 10-

City Composite Index markets. Inventory declined in 22 of 26 markets.

Inventory fell by the largest amount in Boston down 10.0% and San Francisco where it

contracted by 9.7%. Decreasing inventory is typical during the seasonally slow fall and

winter months. The limited but widespread decline in listed-property inventory should help

moderate near-term price declines.

Inventory increased by the largest amount in San Diego – up 3.9% - followed by Phoenix

and New York – up 2.9% and 2.1% respectively.

Listing Inventory

% Change

% Change

MSA September October November Over 3

Last Month

2009 2009 2009 Months

10 City Composite 262,150 253,186 245,893 -2.9% -6.2%

Boston 16,233 15,652 14,086 -10.0% -13.2%

San Francisco 7,979 7,535 6,806 -9.7% -14.7%

San Jose 4,030 3,732 3,473 -6.9% -13.8%

Minneapolis 17,178 16,304 15,203 -6.8% -11.5%

Chicago 59,521 56,835 53,319 -6.2% -10.4%

Denver 13,668 13,043 12,250 -6.1% -10.4%

Austin 11,025 10,491 9,858 -6.0% -10.6%

Detroit 32,208 29,407 27,754 -5.6% -13.8%

Seattle 23,359 22,415 21,196 -5.4% -9.3%

Washington, DC 20,256 19,615 18,674 -4.8% -7.8%

Indianapolis 13,808 13,295 12,699 -4.5% -8.0%

Dallas 32,229 30,852 29,566 -4.2% -8.3%

Cleveland 13,736 13,209 12,671 -4.1% -7.8%

Philadelphia 25,497 24,475 23,569 -3.7% -7.6%

Portland 13,639 13,149 12,670 -3.6% -7.1%

Salt Lake City 7,434 7,167 6,928 -3.3% -6.8%

Houston 31,848 30,586 29,836 -2.5% -6.3%

Charlotte 15,315 14,956 14,596 -2.4% -4.7%

Atlanta 38,750 37,292 36,420 -2.3% -6.0%

Los Angeles 31,001 30,107 29,448 -2.2% -5.0%

Miami 30,497 29,292 28,906 -1.3% -5.2%

© 2009 Altos Research LLC and Real IQ -3-

ALTOS RESEARCH | REALIQ: December 2009: REAL-TIME HOUSING MARKET UPDATE

Las Vegas 20,488 20,437 20,331 -0.5% -0.8%

Tampa 19,124 18,909 19,143 1.2% 0.1%

New York 54,838 52,822 53,950 2.1% -1.6%

Phoenix 26,574 26,616 27,395 2.9% 3.1%

San Diego 6,885 7,088 7,365 3.9% 7.0%

November Housing Market Demand Trends

During November every market except San Francisco and San Jose had a median days-on-

market of 100 or more. By far, the market with the slowest rate of inventory turnover was

again Miami, now at a median of 225 days-on-market or more than 7 months. That reflects a

substantial decline from 251 days-on-market in September and 244 in October. San

Francisco experienced the fastest rate of inventory turnover at a median of 89 days-on-

market.

Average Days on Market

% Change

September October November % Change Over 3

MSA 2009 2009 2009 Last Month Months

10 City Composite 156 156 154 -1.1% -1.4%

Miami 251 244 225 -7.8% -10.3%

Chicago 177 180 187 3.7% 5.7%

Atlanta 181 177 174 -1.7% -3.9%

Charlotte 179 176 178 1.1% -0.4%

Detroit 172 171 174 2.0% 1.4%

Tampa 162 163 156 -4.4% -3.5%

New York 152 155 144 -7.4% -5.2%

Cleveland 153 155 158 2.3% 3.5%

Philadelphia 141 148 153 2.9% 8.3%

Washington, DC 149 147 153 4.1% 2.6%

Indianapolis 133 134 138 2.7% 4.0%

Denver 132 134 139 3.9% 5.1%

Phoenix 135 133 128 -3.8% -5.2%

Seattle 129 132 138 4.4% 6.5%

Minneapolis 129 130 135 3.8% 4.8%

Portland 121 127 129 1.5% 6.3%

© 2009 Altos Research LLC and Real IQ -4-

ALTOS RESEARCH | REALIQ: December 2009: REAL-TIME HOUSING MARKET UPDATE

Los Angeles 125 120 121 0.4% -2.9%

Houston 118 120 122 1.5% 3.4%

Dallas 113 117 120 2.3% 6.1%

Austin 112 117 120 3.2% 7.6%

Las Vegas 117 114 115 0.6% -1.8%

Boston 110 112 116 3.9% 5.3%

Salt Lake City 118 107 112 4.8% -5.1%

San Diego 108 104 109 5.4% 1.5%

San Jose 111 103 99 -4.0% -11.3%

San Francisco 88 85 89 5.2% 1.4%

Methodology

The Altos Research—Real IQ Real-Time Housing Report provides data on current housing

market conditions in major markets around the country. Unlike other data sources that lag

several months behind the market, this report summarizes metrics associated with active

residential property listings to present the only real-time view of the housing market.

Each ―market‖ measured in this report is equivalent to the Census Bureau's Metropolitan

Statistical Area (MSA) dominated by the city listed. Properties analyzed in this data included

repeat sales of single-family homes. Condominiums and town homes are not included in the

data set. New construction is not included in the data set. The Altos Research Price Index is a

statistical compilation of property prices highly correlated with the S&P/Case Shiller®

Index. The Altos 10-City Composite is based on single family homes in Boston, Chicago,

New York, Los Angeles, San Diego, San Francisco, Miami, Las Vegas , Washington D.C,

Denver. For more information visit AltosResearch.com.

© 2009 Altos Research LLC and Real IQ -5-

ALTOS RESEARCH | REALIQ: December 2009: REAL-TIME HOUSING MARKET UPDATE

About Real IQ

Real IQ provides housing market analysis and consulting services to leading mortgage and

real estate companies including: Bank of America, Realogy, Weichert, Long & Foster,

LendingTree and others. More information about Real IQ is located at www.realiq.com.

About Altos Research

Altos Research LLC pioneered real-time real estate market research. Founded in 2005, the

company's information products serve investors, derivatives traders, and thousands of real

estate professionals. The company publishes analytical reports and data feeds each week for

thousands of zip codes including all 20 S&P/Case Shiller markets summarized in this report.

The Altos Research—Real IQ Housing Market Update is jointly produced by Real IQ™ and

Altos Research. If you have any questions regarding this report, please contact Stephen

Bedikian or Michael Simonsen.

Michael Simonsen

CEO & Co-Founder

Altos Research LLC

Tel: 888-819-7775

Web: www.altosresearch.com

Email: mike@altosresearch.com

© 2009 Altos Research LLC and Real IQ -6-

Vous aimerez peut-être aussi

- 2024 2025 Proficiency Screening Teachers 20 Feb 2024 (1)Document31 pages2024 2025 Proficiency Screening Teachers 20 Feb 2024 (1)Houston ChroniclePas encore d'évaluation

- R4 Tee TimesDocument2 pagesR4 Tee TimesHouston ChroniclePas encore d'évaluation

- NCAA Women's BracketDocument1 pageNCAA Women's BracketHouston Chronicle100% (1)

- Media Release For Free and Reduced-Price MealsDocument2 pagesMedia Release For Free and Reduced-Price MealsHouston ChroniclePas encore d'évaluation

- Blacklock Dissent On Crane vs. McLaneDocument4 pagesBlacklock Dissent On Crane vs. McLaneHouston ChroniclePas encore d'évaluation

- Printable 2024 March Madness NCAA Men's Basketball Tournament BracketDocument1 pagePrintable 2024 March Madness NCAA Men's Basketball Tournament BracketHouston Chronicle100% (1)

- Rachel Hooper InvoicesDocument35 pagesRachel Hooper InvoicesHouston ChroniclePas encore d'évaluation

- Ed Anderson TranscriptDocument53 pagesEd Anderson TranscriptHouston ChroniclePas encore d'évaluation

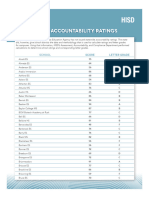

- HISD 2023 School Accountability RatingsDocument10 pagesHISD 2023 School Accountability RatingsHouston ChroniclePas encore d'évaluation

- Houston Astros 2024 Spring Training RosterDocument1 pageHouston Astros 2024 Spring Training RosterHouston Chronicle100% (1)

- NFL Statement On Denzel PerrymanDocument1 pageNFL Statement On Denzel PerrymanHouston ChroniclePas encore d'évaluation

- Astroworld Tragedy Final Report (Redacted)Document1 266 pagesAstroworld Tragedy Final Report (Redacted)Houston ChroniclePas encore d'évaluation

- FB23 TDECU Stadium Pricing MapDocument1 pageFB23 TDECU Stadium Pricing MapHouston ChroniclePas encore d'évaluation

- HISD Board of Managers ApplicantsDocument4 pagesHISD Board of Managers ApplicantsHouston Chronicle100% (1)

- 2023 Preseason All-Big 12 Football TeamDocument1 page2023 Preseason All-Big 12 Football TeamHouston ChroniclePas encore d'évaluation

- Minton Letter To TexasDocument2 pagesMinton Letter To TexasHouston ChroniclePas encore d'évaluation

- Hecht Dissent On Crane vs. McLaneDocument16 pagesHecht Dissent On Crane vs. McLaneHouston ChroniclePas encore d'évaluation

- 2023 NCAA Tournament BracketDocument1 page2023 NCAA Tournament BracketHouston Chronicle100% (1)

- Liberty Center's 2020 Tax ReturnDocument14 pagesLiberty Center's 2020 Tax ReturnHouston ChroniclePas encore d'évaluation

- TDECU Stadium Pricing MapDocument1 pageTDECU Stadium Pricing MapHouston ChroniclePas encore d'évaluation

- Davis EmailDocument3 pagesDavis EmailHouston ChroniclePas encore d'évaluation

- Houston Astros 2023 Spring Training ScheduleDocument1 pageHouston Astros 2023 Spring Training ScheduleHouston ChroniclePas encore d'évaluation

- Houston Astros Preliminary 2023 Spring Training RosterDocument1 pageHouston Astros Preliminary 2023 Spring Training RosterHouston ChroniclePas encore d'évaluation

- Davis Response To MintonDocument2 pagesDavis Response To MintonHouston ChroniclePas encore d'évaluation

- Mark Stephens' 2020 Report On Voter Fraud InvestigationDocument84 pagesMark Stephens' 2020 Report On Voter Fraud InvestigationHouston ChroniclePas encore d'évaluation

- New Watson PetitionDocument11 pagesNew Watson PetitionHouston ChroniclePas encore d'évaluation

- Steven Hotze's 2022 DepositionDocument23 pagesSteven Hotze's 2022 DepositionHouston ChroniclePas encore d'évaluation

- Sally Yates Report To U.S. Soccer FederationDocument319 pagesSally Yates Report To U.S. Soccer FederationHouston ChroniclePas encore d'évaluation

- Beard Notice of TerminationDocument1 pageBeard Notice of TerminationHouston ChroniclePas encore d'évaluation

- NBA Phoenix Suns/Robert Sarver ReportDocument43 pagesNBA Phoenix Suns/Robert Sarver ReportHouston ChroniclePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- General Separator 1636422026Document55 pagesGeneral Separator 1636422026mohamed abdelazizPas encore d'évaluation

- Corn MillingDocument4 pagesCorn Millingonetwoone s50% (1)

- JSA - 0026 Chipping & Granite cutting and lying Work At PB-19Document2 pagesJSA - 0026 Chipping & Granite cutting and lying Work At PB-19Koneti JanardhanaraoPas encore d'évaluation

- MSDS FluorouracilDocument3 pagesMSDS FluorouracilRita NascimentoPas encore d'évaluation

- Module - No. 3 CGP G12. - Subong - BalucaDocument21 pagesModule - No. 3 CGP G12. - Subong - BalucaVoome Lurche100% (2)

- Wacker Neuson RTDocument120 pagesWacker Neuson RTJANUSZ2017100% (4)

- The Online Medical Booking Store Project ReportDocument4 pagesThe Online Medical Booking Store Project Reportharshal chogle100% (2)

- IMT Ghaziabad PGDM Timetable Term II 2020Document22 pagesIMT Ghaziabad PGDM Timetable Term II 2020Ved JhingranPas encore d'évaluation

- SWOT Analysis of Solar Energy in India: Abdul Khader.J Mohamed Idris.PDocument4 pagesSWOT Analysis of Solar Energy in India: Abdul Khader.J Mohamed Idris.PSuhas VaishnavPas encore d'évaluation

- IntroductionDocument34 pagesIntroductionmarranPas encore d'évaluation

- Clogging in Permeable (A Review)Document13 pagesClogging in Permeable (A Review)Chong Ting ShengPas encore d'évaluation

- FBCA Biomarkers and ConditionsDocument8 pagesFBCA Biomarkers and Conditionsmet50% (2)

- Neuropathology of Epilepsy: Epilepsy-Related Deaths and SUDEPDocument11 pagesNeuropathology of Epilepsy: Epilepsy-Related Deaths and SUDEPTeuku AvicennaPas encore d'évaluation

- Ks3 Science 2008 Level 5 7 Paper 1Document28 pagesKs3 Science 2008 Level 5 7 Paper 1Saima Usman - 41700/TCHR/MGBPas encore d'évaluation

- AE-Electrical LMRC PDFDocument26 pagesAE-Electrical LMRC PDFDeepak GautamPas encore d'évaluation

- Application D2 WS2023Document11 pagesApplication D2 WS2023María Camila AlvaradoPas encore d'évaluation

- Postnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoDocument11 pagesPostnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoRadha SriPas encore d'évaluation

- Henny Penny 500-561-600 TM - FINAL-FM06-009 9-08Document228 pagesHenny Penny 500-561-600 TM - FINAL-FM06-009 9-08Discman2100% (2)

- Judge Vest Printable PatternDocument24 pagesJudge Vest Printable PatternMomPas encore d'évaluation

- Honors Biology Unit 2 - Energy Study GuideDocument2 pagesHonors Biology Unit 2 - Energy Study GuideMark RandolphPas encore d'évaluation

- Ramdump Memshare GPS 2019-04-01 09-39-17 PropsDocument11 pagesRamdump Memshare GPS 2019-04-01 09-39-17 PropsArdillaPas encore d'évaluation

- Impact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisDocument5 pagesImpact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Unit 1 - International Banking Meaning: Banking Transactions Crossing National Boundaries Are CalledDocument6 pagesUnit 1 - International Banking Meaning: Banking Transactions Crossing National Boundaries Are CalledGanesh medisettiPas encore d'évaluation

- Driving Continuous Improvement by Developing and Leveraging Lean Key Performance IndicatorsDocument10 pagesDriving Continuous Improvement by Developing and Leveraging Lean Key Performance IndicatorskellendadPas encore d'évaluation

- Capacity PlanningDocument19 pagesCapacity PlanningfarjadarshadPas encore d'évaluation

- Obiafatimajane Chapter 3 Lesson 7Document17 pagesObiafatimajane Chapter 3 Lesson 7Ayela Kim PiliPas encore d'évaluation

- Exor EPF-1032 DatasheetDocument2 pagesExor EPF-1032 DatasheetElectromatePas encore d'évaluation

- Single-Phase Induction Generators PDFDocument11 pagesSingle-Phase Induction Generators PDFalokinxx100% (1)

- Desert Power India 2050Document231 pagesDesert Power India 2050suraj jhaPas encore d'évaluation

- A General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDocument37 pagesA General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDiego JesusPas encore d'évaluation