Académique Documents

Professionnel Documents

Culture Documents

HE9091 Lecture 5

Transféré par

Đức Long NguyễnCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HE9091 Lecture 5

Transféré par

Đức Long NguyễnDroits d'auteur :

Formats disponibles

HE9091

Principles of Economics

Lecture 5

Externalities, Property Rights

and Economics of

Information

Tan Khay Boon

Email: khayboon@ntu.edu.sg

Office: HSS-04-25

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Topics

External Costs and Benefits

The Coase Theorem

Property Rights and the Tragedy of the

Commons

Optimal Amount of Information

Asymmetric Information

Adverse Selection and Moral Hazard

Reference: FBLC, chapters 10 & 11

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

External Costs and Benefits

An external cost is a cost of an activity that falls

on people other than those who pursue the

activity

Also called a negative externality

An externality is the name given to an external

cost or external benefit of an activity

An external benefit is a benefit of an activity

received by people other than those who pursue

the activity

Also called a positive externality

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Externalities Affect Resource

Allocation

Externalities reduce economic efficiency

Solutions to externalities may be efficient

When efficient solutions to externalities are not

possible, government intervention or other collective

action may be used

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Honeybee Keeper Scenario 1

Phoebe harvests and sells honey from her bees

Bees pollinate the apple orchards

No payments made to Phoebe

The bees provide a free service to the local

farmers

Phoebe is giving away a service

Private costs are equal to private benefits

Social costs are less than social benefits

When external benefits exist,

maximizing private profits produces less

than the social optimum

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Honeybee Keeper Scenario 2

Phoebe harvests and sells honey from her bees

People at a neighboring school and nursing

home are bothered by bee stings

The bees are a nuisance to the neighbors

Phoebe is not paying all the costs of her honeybees

Private costs are equal to private benefits

Social costs are greater than social benefits

When external costs exist,

maximi zing private profits produces more

than the social optimum

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

External Cost

Quantity (tons/year)

12,000

1.3

P

r

i

c

e

(

$

0

0

0

s

/

t

o

n

)

D

Private

MC

$1,000/ton

External Costs

P

r

i

c

e

(

$

0

0

0

s

/

t

o

n

)

No External Cost

Quantity (tons/year)

12,000

1.3

D

Private

MC

Private

Equilibrium

Deadweight loss from

pollution = $2 M/yr

Social

Optimum

2.3

Social MC

2.0

8,000

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Positive Externality for

Consumers

Deadweight loss from

positive externality

XB

MB

PVT

+XB

Social

Demand

MB

SOC

Q

SOC

P

r

i

c

e

Quantity

Private Demand

MC

Q

PVT

MB

PVT

Private

Equilibrium

Social

Optimum

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Effects of Externalities

With externalities,

private market outcomes

do not achieve

the largest possible economic surplus

Cash is left on the table

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Remedying Externalities

With externalities, private market outcomes do

not achieve the largest possible economic

surplus

Consider monopolies where output is lower and

price is higher than perfect competition

Introduction of coupons and rebates expands the

market

With externalities, actions to capture the surplus

are likely

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Abercrombie the Polluter

Scenario 1

Abercrombies company dumps toxic waste in the

river

Fitch cannot fish the river

No one else is harmed

Abercrombie could install a filter to remove the

harm to Fitch

Filter imposes costs on Abercrombie

Filter benefits Fitch

Parties do not communicate

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Abercrombie's Filter Options

With Filter Without Filter

Abercrombie's Gains $100 / day $130 / day

Fitch's Gains $100 / day $50 / day

Total Gains $200 / day $180 / day

Abercrombie does not install the filter

Marginal cost of filter to Abercrombie is $30 per day

The marginal benefit to Fitch is $50 per day

There is a net welfare loss of $20 per day

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Abercrombie the Polluter

Scenario 2

Communication changes the outcome

Fitch pays Abercrombie between $30 and $50 per

day to use the filter

Net gain in total surplus of $20 per day

With Filter Without Filter

Abercrombie's Gains $100 / day $130 / day

Fitch's Gains $100 / day $50 / day

Total Gains $200 / day $180 / day

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

The Coase Theorem

The Coase Theorem says that if people can

negotiate the right to perform activities that cause

externalities, they can always arrive at efficient

solutions to problems caused by externalities

Negotiations must be costless

Sometimes those harmed pay to stop pollution

Fitch pays Abercrombie

Sometimes polluter buys the right to pollute

Abercrombie pays Fitch

The adjustment to the externality is usually done by

the party with the lowest cost

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Abercrombie the Polluter

Scenario 3

Abercrombies company produces toxic waste

Laws prohibit dumping the waste in the river

UNLESS Fitch agrees

New gains matrix

With Filter Without Filter

Abercrombie's Gains $100 / day $150 / day

Fitch's Gains $100 / day $70 / day

Total Gains $200 / day $220 / day

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Abercrombie the Polluter

Scenario 3

Abercrombie can pay Fitch up to $50 per day for

the right to pollute

Fitch will accept any offer over $30 per day

In this scenario, polluting is the right thing to do

With Filter Without Filter

Abercrombie's Gains $100 / day $150 / day

Fitch's Gains $100 / day $70 / day

Total Gains $200 / day $220 / day

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Laws Can Change the Outcome

Suppose the law makes polluters liable for the

cost of cleaning up their pollution

Polluters get lower incomes

Non-polluters get higher incomes

With Filter Without Filter

Abercrombie's Gains $100 / day $150 / day

Fitch's Gains $100 / day $70 / day

Total Gains $200 / day $220 / day

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Shared Living

Ann and Betty are evaluating housing options

2-bedroom apartment for $600 per month OR

1-bedroom apartment for $400 per month each

If the costs were the same, Ann and Betty would be

indifferent between the two arrangements

The externality here is Ann's telephone usage is high

She would pay up to $250 per month to be able to

use the phone whenever she wants

Betty would pay up to $150 per month to get better

phone access

No second phone line is possible

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

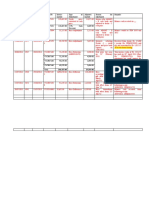

Benefits and Costs of Shared

Living

$800 per month $600 per month $200 per month

Total Cost of Separate

Apartments

Total Cost of

Shared Apartment

Rent Savings

from Sharing

Live together if the benefits exceed the costs

Problem

Ann's Cost of

Solving the

Problem

Betty's Cost of

Solving the

Problem

Least-Cost

Solution

Ann's phone

usage

Pay Ann $250 to

decrease usage

Pay Betty $150

to tolerate Ann

Ann pays Betty

$150 per

month

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Net Benefit of Shared Living

Ann and Betty will live together

$200 per month $150 per month $50 per month

Rent Savings

Cost of Phone

Accommodation

Gain in Surplus

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Dividing the Rent

Betty would spend $400 per month to live alone

Cost of tolerating Ann's phone use is $150 per month

Betty willing to pay up to $250 = $400 - $150 to live

with Ann. Above $250, she will live alone

Ann is willing to pay up to $400 per month, the

cost of living alone

Betty's maximum rent is $250

Ann's maximum rent is $400

If they divide the surplus ($50) equally,

Betty pays $225 = $250 $25

Ann pays $375 = $400 25

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Legal Remedies for

Externalities

If negotiation is costless, the party with the lowest

cost usually makes the adjustment

Private solution is generally adequate

When negotiation is not costless laws may be

used to correct for externalities

The burden of the law can be placed on those who

have the lowest cost

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Legal Remedies for Externalities

Noise regulations (cars, parties, honking horns)

Most traffic and traffic-related laws

Car emission standards and inspections

Zoning laws for schools

Building height regulations

Air and water pollution laws

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Optimal Amount of Negative

Externalities

Quantity of Pollution

MC & MB

MC

Q

MC =MB

MB

Optimal amount

of pollution

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Taxes and Subsidies

When transaction costs prohibit negotiation:

Negative externalities result in overproduction

Positive externalities result in underproduction

A per unit tax on output can move the market to

the socially optimal output when there is a

negative externality

A per unit subsidy on output can move the

market to the socially optimal output when there

is a positive externality

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Quantity (tons/year)

P

r

i

c

e

(

$

0

0

0

s

/

t

o

n

)

D

Private MC

12,000

1.3

Pollution Tax

$1,000 / ton

Taxing a Negative Externality

Tax

Private MC +Tax

2.3

2.0

8,000

2.0

8,000

Quantity (tons/year)

P

r

i

c

e

(

$

0

0

0

s

/

t

o

n

)

D

Private

MC

1.3

12,000

No Pollution Tax

Private

Equilibrium

Social

Optimum

After Tax

Equilibrium

Before Tax

Equilibrium

Social MC

XC

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Subsidizing a Positive

Externality

12

Quantity

(000s tons/year)

P

r

i

c

e

(

$

/

t

o

n

)

Private

Demand

MC

8

No Subsidy

XB

Social

Demand

14

10

16

Quantity

(000s tons/year)

P

r

i

c

e

(

$

/

t

o

n

)

Subsidy

Private

Demand

MC

Subsidized

Demand

Subsidy

12

8

14

10

16

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Tragedy of Commons

When use of a communally owned resource has

no price, the costs of using it are not considered

Use of the property will increase until MB = 0

This is known as the tragedy of the commons

Suppose 5 villagers own land suitable for grazing

Each can spend $100 for either a steer or a

government bond that pays 13%

Villagers know what everyone before them has done

Steer graze on the commons

Value of the steer in year 2 depends on herd size

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Payoff For a Steer

Using the information in the table below, each

villager makes a decision

The fourth is indifferent between the two assets

He buys a steer

The fifth buys a bond

# Steers Selling Price per Steer Income per Steer

1 126 26

2 119 19

3 116 16

4 113 13

5 111 11

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

What the Villagers Did

The village has 4 steer feeding on the commons

for one year

At the end of the year, 4 steer sell for $113 each

Total revenue for the village is (5) (113) = $565

Outcome is the same as 5 bonds

They could have done better

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

A Better Choice

# Steer

Selling

Price

Income per

steer

Total Cattle

Income

Marginal

Income

1 126 26 26 26

2 119 19 38 12

3 116 16 48 10

Net income from one bond after one year is $13

Buy a steer only if its marginal benefit is at least $13

First villager buys a steer and all others buy bonds

Total net income is 26 +(4) (13) =$78

A net gain of $13 compared to the first scenario of $65

Tragedy of the commons is the tendency for a resource that has

no price to be used until its marginal benefit is zero

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

The Effect of Private Ownership

The villagers decide to auction off the rights to

the commons

Auction makes the highest bidder consider the

opportunity cost of grazing additional steer

Villagers can borrow and lend at 13%.

One steer is the optimal number

Winning bidder pays $100 for the right to use the

commons

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

The Effect of Private Ownership

The winning bidder starts the year

Spends $100 in savings to buy a yearling steer

Borrows $100 at 13% to get control of commons

The winning bidder ends the year

Sells the steer for $126

Gets original $100 back

$13 opportunity cost of buying a steer

$13 interest on loan for the commons

Economic surplus of the village is

(4 x $13) + $26 = $78

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Information and Invisible Hand

Perfect competition assumes perfect information

where all parties have all relevant information

The outcome is socially efficient

Without free and perfect information, market

results are not efficient

In reality, information is imperfect and can only

be obtained with a cost via research or

middleman

Parties must decide how much information to

gather

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Consumer Choice: Buying

DSLR Camera

Best Denki recommends $1,200 Nikon D7100

DSLR camera

Sales rep seems knowledgeable

Your next move is

Thank them and do more research

Trust the sales rep and buy them

Go home and buy at the best price online ($950)

Sales representatives supply information to

buyers

Information makes markets more efficient

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Selling Product Online

Koh wants to sell a Win the War stamp.

His reservation price is $300

An ad in the local newspaper cost $5

eBay cost is 5% of the Internet auction price

The maximum price in the local market is $400

Two eBay shoppers have secret reservation prices

of $800 and $900, respectively

Rule of eBay is that the highest bidder secured the

product but pay the second highest price

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Selling Win the War stamp

Benefits of eBay

Card sells for $800 on eBay less $40 commission

Ellis nets $760, $460 above his reservation price

Buyer surplus is $100

Local option is inferior

Card sells for $400 less $5 cost of ad

Koh nets $395, $95 more than his reservation price

Buyer surplus is $0

Economic surplus is increased when a product

goes to the person who values it the most

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

$

/

u

n

i

t

Units of information

MB

The Optimal Amount of

Information

More information is better than less

Gathering information has a cost

Marginal benefit starts high, then falls rapidly

Low-Hanging Fruit Principle

Marginal cost starts low,

then increases

Optimal amount of

information is I* where

MC = MB

MC

I

*

Optimal

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Free Rider Problem

A free-rider problem exists when non-payers

cannot be excluded from consuming a good

Interferes with incentives

Market quantity is below social optimum

Stores bear the cost of training sales reps on

merchandise

Shoppers use sales reps as information source

Then some shoppers buy elsewhere

Store is unable to capture some of the value it

delivered to the shopper: a free-rider problem

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Rational Search Guidelines

Additional search time is more likely to be

worthwhile for expensive items than cheap ones

Apartment search in Taipei, Tawian involves less

time than Tokyo, J apan

Taipei has lower rents and narrower price range

Prices paid will be higher when the cost of a

search is higher

Two buyers of piano, only one with a car

Buyer with the car will look at more pianos before

buying

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Gamble Inherent in Search

Additional search has costs that are certain

Benefits are uncertain benefits

Additional search has elements of a gamble

A gamble has a number of possible outcomes

Each outcome has a probability that it will occur

The expected value of a gamble is the sum of

(the possible outcomes times their respective

probability)

A fair gamble has an expected value of zero

A better-than-fair gamble has a positive expected

value

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Risk Preferences

A risk-neutral person would accept any gamble

that is fair or better-than-fair

A risk-averse person would refuse any fair

gamble

A risk-seeking person would accept any

gamble that is less than fair

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

The Gamble in the Search

You need a one-month sublet in Hong Kong

One type of apartment rents for $400 and it is 80%

of the available market

The other type rents for $360 and makes up 20% of

the market

You must visit the apartment to get the rental rate

Cost per visit is $6

You are risk-neutral

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Hong Kong Apartment Search

The first apartment you visit is the $400 version

Try the next apartment if the gamble is at least fair

Two outcomes to the gamble

You find a lower-priced apartment and your net benefit is

$34 with 20% probability

You find another $400 apartment and your net benefit is

$6 with 80% probability

Expected value of the gamble is

($34) (0.20) +( $6) (0.80) =$2

Gamble is more than fair. Accept the gamble and

keep searching

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Commitment Problems and Search

Some searches are for circumstances requiring

commitment over some period of time

Leasing an apartment or Taking a job

Contracts are used to bind parties together and may

carry penalties for breaking the arrangement

Search is costly and therefore limited

People end their searches when the marginal cost of

searching exceeds the marginal benefit

One party may rationally choose to terminate the

agreement and pay the penalties if better option

arises

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Asymmetric Information

Asymmetric information occurs when either the

buyer or seller Is better informed about the

goods in the market

Mutually beneficial trades

may not occur

The party with the additional

information may use to gain

at the expense of the other

party

Buyer Seller

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Private Sale of a Used Car

Akari's used car is in excellent condition

Akari reservation price is $10,000

Normal used car value is $8,000

Haruto wants to buy a used car

His reservation price is $13,000 for one in excellent

condition and $9,000 for one in average condition

Determining the condition of Akari's car has a cost

and the results are uncertain

Haruto cannot verify that Akari's car is superior

Haruto buys another used car for $8,000; Akari's

is unsold

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Surplus Loss and Asymmetric

Information

If Haruto can be convinced that Akaris car is

good, they can negotiate and agree at $11,000

Buying a normal car, Haruto's loss is $1,000

Pays $8,000 and has a gain of $1,000

Harutos loss from buying an average car instead of

Akari's = $13,000 $11,000 = $2,000

Haruto's net loss is $1,000

Akaris loss from losing Haruto as a customer is

$1,000

Total loss is $2,000

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

The Lemons Model

People who have below average cars (lemons),

are more likely to want to sell them

Buyers know that below average cars are likely to

be on the market and lower their reservation prices

Good quality cars (jewels) are withdrawn from

the market

Average quality decreases further and reservation

prices decrease again

The lemons model says that asymmetric

information tends to reduce the average quality

of goods for sale

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Naive Buyer

Two kinds of cars: good cars and lemons

Owners know what kind they have

Buyers can't determine a car's quality

Buyers are risk neutral

Buyer offer the expected value for a used car:

(0.90)($10,000)+(0.10)($6,000) = $9,600

Good car owner refuse to sell. Bad car owners

keen to sell. The buyer will get a lemon

Good Cars Lemons

Probability 90% 10%

Value $10,000 $6,000

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Credibility Problem

Parties gain if they find a way to communicate

information truthfully

If Akari can convince Haruto her car is in

excellent condition, Haruto will buy

Statements are not credible

Akari offers Haruto a six-month warranty on all car

defects at the time of purchase

A warranty for a lemon would cost more than the

economic surplus gained

Only sellers of good quality cars would offer the

warranty

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

The Costly-to-Fake Principle

To communicate information credibly, a signal

must be costly or difficult to fake

Sellers have an incentive to exaggerate the quality

of their product

Buyers value objective information about quality

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Costly Signals

Television advertising is expensive

Signals a company's commitment to its product and

a potential signal of quality

Educational institutions' brands and students'

grades signal quality

A

+

student from prestige institution more likely to be

offered a job than C student from average institution

Conspicuous Consumption

Consume branded goods cars signal success

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Statistical Discrimination

Statistical discrimination uses group

characteristics to infer individual characteristics

Example

Women in late twenties tend to have babies - High

cost in employment

Younger male drivers more likely to involve in car

accident Charge a higher insurance premium

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Adverse Selection

Adverse selection occurs because insurance

tends to be purchased more by those who are

most costly for companies to insure

Insurance is most valuable to those with many

claims

Adverse selection increases insurance

premiums

Reduces attractiveness of insurance to low-risk

customers

"Best" insurance risk customers opt out

Rates increase and drive out good customers

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Moral Hazard

Moral hazard is the tendency of people to expend

less effort protecting insured goods

People take more risk with insured goods or activities

Deductibles give policy holders an incentive to be

more cautious

Use co-payment to reduce moral hazard

Suppose a car owner has a $1,000 deductible

policy

The owner pays the first $1,000 of each claim

Strong incentive to avoid accidents

Claims less than $1,000 are not reported

Insurance premiums go down

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

C

lic

k

to

b

u

y

N

O

W

!

P

D

F-XChang

e

w

w

w

.d

oc u-t r ac k

.c

o

m

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Authority To SellDocument1 pageAuthority To SellDanny Luces Torralba100% (10)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Bijak 23.05.2020Document7 pagesBijak 23.05.2020Akash DherangePas encore d'évaluation

- Chart Patterns - Trade MentorDocument11 pagesChart Patterns - Trade MentorN.a. M. TandayagPas encore d'évaluation

- Inner Circle Trader - TPDS 3Document9 pagesInner Circle Trader - TPDS 3Kasjan MarksPas encore d'évaluation

- Welcome: To The Start Your Own Business Business Planning WorkshopDocument38 pagesWelcome: To The Start Your Own Business Business Planning WorkshopSabeur DammakPas encore d'évaluation

- Assignment 4: Valuation of Intellectual Property in PharmaceuticalsDocument9 pagesAssignment 4: Valuation of Intellectual Property in PharmaceuticalsCP SinghPas encore d'évaluation

- Customer Analysis TetleyDocument4 pagesCustomer Analysis TetleySyed Muhammad Haider HasanPas encore d'évaluation

- An Investment Opportunity: Triumph's CryptocurrencyDocument25 pagesAn Investment Opportunity: Triumph's Cryptocurrency- hermanPas encore d'évaluation

- Tesla Strategy AnalysisDocument10 pagesTesla Strategy AnalysisVlad TiforPas encore d'évaluation

- Chapter 5, CVP AnalysisDocument3 pagesChapter 5, CVP AnalysisAhad SultanPas encore d'évaluation

- AMATH Index NumberDocument20 pagesAMATH Index NumberLenePas encore d'évaluation

- Chapter 6, Lesson 3: Pricing MethodsDocument12 pagesChapter 6, Lesson 3: Pricing MethodsJohn Ivan ManingoPas encore d'évaluation

- RD THDocument2 pagesRD THNatala WillzPas encore d'évaluation

- Ps 5Document34 pagesPs 5Anh Tran HoangPas encore d'évaluation

- Year 9 Objectives ECONOMICSDocument2 pagesYear 9 Objectives ECONOMICSpallavi shindePas encore d'évaluation

- Abbvie Inc. $148.47 Rating: NeutralDocument3 pagesAbbvie Inc. $148.47 Rating: Neutralphysicallen1791Pas encore d'évaluation

- Wealth-Insight - Sep 2020Document68 pagesWealth-Insight - Sep 2020Anonymous rjsnUw9xpUPas encore d'évaluation

- Chapter 4 Market Equilibrium - Market ApplicationDocument15 pagesChapter 4 Market Equilibrium - Market ApplicationHanna YasmeenPas encore d'évaluation

- Product Life Cycle PLC: Managing PLC For ITC-ScissorsDocument18 pagesProduct Life Cycle PLC: Managing PLC For ITC-ScissorspankajkapsePas encore d'évaluation

- Corporate Finance 3rd AssignmentDocument5 pagesCorporate Finance 3rd AssignmentMuhammad zahoorPas encore d'évaluation

- Saudi Construction Rates - 2021Document4 pagesSaudi Construction Rates - 2021BobPas encore d'évaluation

- Kernel PricingDocument3 pagesKernel PricingAndrea PazziniPas encore d'évaluation

- Commerce McqsDocument59 pagesCommerce McqsMuhammad AhsanPas encore d'évaluation

- Platts Du 01 Aout 2017Document21 pagesPlatts Du 01 Aout 2017Wallace YankotyPas encore d'évaluation

- The Great Crash of 1929Document3 pagesThe Great Crash of 1929I SPas encore d'évaluation

- CH 2Document10 pagesCH 2bikilahussen100% (1)

- Practice Exam - Part 3: Multiple ChoiceDocument4 pagesPractice Exam - Part 3: Multiple ChoiceAzeem TalibPas encore d'évaluation

- Summary - Reading 24Document4 pagesSummary - Reading 24derek_2010Pas encore d'évaluation

- Demand AnalysisDocument12 pagesDemand AnalysisSanchit MiglaniPas encore d'évaluation

- Inventory ModelsDocument9 pagesInventory ModelsSayiram GPas encore d'évaluation