Académique Documents

Professionnel Documents

Culture Documents

Fama French Page 1

Transféré par

Valerie MarquezCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fama French Page 1

Transféré par

Valerie MarquezDroits d'auteur :

Formats disponibles

,l-r I

- .il

f# turc

:'

:

lChlplcr

o: Hsk. ftetur n. rnd th. Crpitrl Assct Prlcirrll !lo,tcl

';t-tt

i

and.French digcovered thrt small firms carn con)istcntl)'lri6lrcr irvcrirgc rctrrrns llr,rrt hrgc

firms and, slntllarly, that flrms with high book-to-markc"t r;rtios earn highcr rcturns lhrl

flrmsrvith low'book-to-market ratios. Controlling for lhese trvo cffccts, Farna rnd Frcnth

foupd almost no rclatlonship betwcen bcta and returns. In other words, thc. Sl"ll- rr,as n()t

just'.too flat'; li was completely flat.

t

Wherc does all df this leave'us? Fronr an ocrdemic point of view, ihc arrsrvcr is unccr-

tain. The empirlcal anrt theoretical shortcqrring, ,,f ih.' CAPM lrc by now rvell .lo.u-

mented, and though the literature offers several alternrtivu'a.sset pricing nrocleJs, rtone hits

emerged as the CAPM's clear heir apparent. As a matter o[practice, however, the CAPivt

still reigns supreme in the corporate finance rcalm.

Just

as n)ost U.S. firnrs took to the

CAPM to estimate the required return on their shares, most brokerage and investntent

.advisory

firms still offer estimates of betas as part of their service package. lVhether this

will be the case in another l0 or 20 years is anyonei guess. Tojrepare you for that unccr-

tain future, we now briefly review the leading alternativc to tlic CRPiU: the Farn:r-French

(F-F) three-factor model.

Sl{ARIFrnance

What does it mean to say that early tests of the CAPM indicated that the Slr4L rvas

-too

flat'?

Suppose that, on average, individuals become more risk averse during reces-

sions and less risk averse during economic booms. How might this complicate

tests of the CAPl,4?

6.6 THp Fnua-FRENCH i\,lonrr

\\Ie have alreadv mentioneci the criticisms leveled ai the CAP\{ bf i:i,,rg.-nc lram;r anJ irrt

French in their series o[papers beginning in the early 1990s. It is one thing to criticize,r

theoretical model, but it is another thing entirelY to suggest a n improve rnrnt. Fcrtunr:e,v,

Fama and French did both. Fama and French (i992, 1996, 2A0h) sought to er:lair.i

"ine

cross-section ofexpected returns," or u'hy son:e stocks earn higher ivc'rage reiurns tll;.

oihers. They make two key points in attacking the CAPIl and prrs5g6llng.their alieria'

tive. The first point is that two factors, the size of a firm and the ratio of its equity's book

value to its market value, are systematically related to returns. Looking back through the

'

historical record, Fama and French find that small 6rms earn higher returns than large

'.

firms, even after holding beta ccnstant, and that firms rvith=[igh book-to-market ratios

(value

stocks) outperform firms with low book-to-market rati;(glamour stocks)- The sec:

ond point is that, controlling for firm size and market-to-book ratio, beta has little or no

impact on returns, Why then did early tests of the CAPM indicate that high-beta stoclis

.

earned higher returns than low-beta stocks? Perhaps high-beta stock tend to originate

,' with small firms with high book-to-market ratios. Fama and French argue that.if you'look

at a group of 6rms of similar size (and similar book-to-market ratio), then within that

gouP thehigh&:ta stocks earn about the same returns as low-beta stocks.

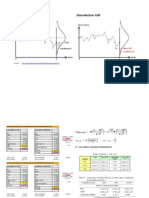

The mathematical expression of the Fama-French

(F-D modet is

..

:.

":

. . :

t

'

,,..y,-

Rr= a+ p,r(R^-

R){

fla(R*r-

R*) +

frrt\,nr-

Rr*)

the risk premium on stock i equals a constant term, o, plus a risk premium that depends

cl the stock's sensitivity to each factor and the risk premiurn for each factor. Tlre lerm

P,,

lThctuit

ntltt!tttva/

Jra Cillb\

fi

'i.":iti

14.

15.

i..inr:ic

say ilat

lo caa-

cpcr:ed

,re

OVef i

J;

s fould

':

- , .i.:

lse6 tie ;

,'ll9:;

t

)ngU.5.;i,

9

',.-.:

il CFOs'

.j

: fluctuatd

.., .:. .

itimatest(

'ation-

,:' i

redict rvhni

er, Eugene

of *xplain-.,

ofthe firm

'rti&Fama

(Eq.63!

Xenneti [renc!r. l)artnouth

Coi!ege

'Thc

threc-Jactor nodel is an

oppliiation ol thc arbitragc

pricing thcorl-'

See lhe endre interview at

,* -:,-. I -

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Experience (6 Months)Document1 pageExperience (6 Months)Valerie MarquezPas encore d'évaluation

- A Few Points On Effective WritingDocument15 pagesA Few Points On Effective WritingValerie Marquez100% (5)

- Job Order Cost Accounting: True-False StatementsDocument48 pagesJob Order Cost Accounting: True-False StatementsValerie Marquez100% (4)

- Ais903 Hall 2007 Ch04 The Revenue CycleDocument16 pagesAis903 Hall 2007 Ch04 The Revenue CyclewichupinunoPas encore d'évaluation

- On The Job Trining (Ojt)Document21 pagesOn The Job Trining (Ojt)Valerie MarquezPas encore d'évaluation

- Bandaging TechniquesDocument1 pageBandaging TechniquesValerie MarquezPas encore d'évaluation

- Financial Reporting and Management Reporting SystemsDocument44 pagesFinancial Reporting and Management Reporting SystemsValerie MarquezPas encore d'évaluation

- Letter of St. Paul To The Galatians and PhilippiansDocument21 pagesLetter of St. Paul To The Galatians and PhilippiansValerie MarquezPas encore d'évaluation

- Hist (Edited)Document12 pagesHist (Edited)Valerie MarquezPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- ALM AssignmentDocument8 pagesALM AssignmentAbdul RaheemPas encore d'évaluation

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBADocument7 pagesIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- 999dice - BotDocument30 pages999dice - BotSMGPas encore d'évaluation

- SSSHHHDocument7 pagesSSSHHHDarwinQuevedoPas encore d'évaluation

- PS 2 Fall2022Document4 pagesPS 2 Fall20221227352812Pas encore d'évaluation

- Varianza 28-04-2020Document14 pagesVarianza 28-04-2020KAROL DIANE RIVERA PENAPas encore d'évaluation

- تأثير الأزمات المالية على عائد ومخاطر المحفظة المالية الدولية - - حالة مجموعة من بورصات الأسهم المتطورة والناشئة 2007-2012 -Document16 pagesتأثير الأزمات المالية على عائد ومخاطر المحفظة المالية الدولية - - حالة مجموعة من بورصات الأسهم المتطورة والناشئة 2007-2012 -MohamedPas encore d'évaluation

- BFIN525 - Chapter 6 - Solution ManualDocument3 pagesBFIN525 - Chapter 6 - Solution ManualZahraaPas encore d'évaluation

- Backtest - Garufi (Recuperado Automaticamente)Document44 pagesBacktest - Garufi (Recuperado Automaticamente)Ederson EdyPas encore d'évaluation

- AssignmentDocument5 pagesAssignmentHabiba KausarPas encore d'évaluation

- Hadi IsmantoDocument13 pagesHadi IsmantorifkaindiPas encore d'évaluation

- Momentum - 1927 - 2014 Partial View of Data in SpreadsheetDocument1 pageMomentum - 1927 - 2014 Partial View of Data in SpreadsheetpedroPas encore d'évaluation

- Marginal VaRDocument1 pageMarginal VaRsarafbisesh1Pas encore d'évaluation

- Homework #7Document2 pagesHomework #7Ryan Ben SlimanePas encore d'évaluation

- 2799-Article Text-13347-1-10-20220701Document13 pages2799-Article Text-13347-1-10-20220701Firas Taqiyyah Al FakhirahPas encore d'évaluation