Académique Documents

Professionnel Documents

Culture Documents

Limited Liability Partnership

Transféré par

Rajiv ShahCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Limited Liability Partnership

Transféré par

Rajiv ShahDroits d'auteur :

Formats disponibles

1

Meaning

A corporate business vehicle that enables professional expertise and entrepreneurial

initiative to combine and operate in flexible, innovative and efficient manner, providing

benefits of limited liability while allowing its members the flexibility for organizing their

internal structure as a partnership.

In short LLP is a business structure that has elements of both partnership and

corporate firms but combines the limited liability benefits of a company with the

flexibility of a partnership.

LLP has a separate legal entity, liable to the full extent of its assets, the liability of the

partners would be limited to their agreed contribution in the LLP. Further, no partner

would be liable on account of the independent or un-authorized actions of other

partners, thus allowing individual partners to be shielded from joint liability created by

another partners wrongful business decisions or misconduct.

By Rajiv Shah - Cell 9824031476

2

Advantage

Renowned and accepted form of business

Low cost of Formation.

Easy to establish.

Easy to manage & run.

No requirement of any minimum capital contribution.

No restrictions as to maximum number of partners.

LLP & its partners are distinct from each other.

Partners are not liable for Act of partners.

Audit requirement only in case of contributions exceeding Rs. 25 lakh or

turnover exceeding Rs. 40 lakh.

No exposure to personal assets of the partners except in case of fraud.

Less requirement as to maintenance of statutory records.

Less Government Intervention.

Easy to dissolve or wind-up.

Professionals can form Multi-disciplinary Professional LLP, which was not

allowed earlier.

No requirement as to Minimum Alternate Tax.

By Rajiv Shah - Cell 9824031476

Conditions3 Partnership Company LLP

Prevailing Law Partnership is prevailed by

The Indian Partnership Act,

1932 and various Rules

made there under

Companies are prevailed by

Companies Act, 1956

Limited Liability Partnership

are prevailed by The

Limited Liability Partnership

Act, 2008 and various

Rules made there under

Registration Registration is optional Registration with Registrar

of LLP required.

Registration with Registrar

of LLP required.

Distinct entity Not a separate legal entity Is a separate legal entity

under the Companies Act,

1956.

Is a separate legal entity

under the Limited Liability

Partnership Act, 2008.

Name of Entity Any name as per choice Name to contain 'Limited' in

case of Public Company or

'Private Limited' in case of

Private Company as suffix.

Name to contain 'Limited

Liability Partnership' or 'LLP'

as suffix.

Perpetual Succession It does not have perpetual

succession as this depends

upon the will of partners

It has perpetual succession

and members may come

and go.

It has perpetual succession

and partners may come and

go

Comparison of LLP with different business Models

3 By Rajiv Shah - Cell 9824031476

Conditions4 Partnership Company LLP

Legal Proceedings Only registered partnership

can sue third party

A company is a legal entity

which can sue and be sued

A LLP is a legal entity can

sue and be sued

Foreign Participation Foreign Nationals can not

form Partnership Firm in

India

Foreign Nationals can be a

member in a Company.

Foreign Nationals can be a

Partner in a LLP.

Number of Members Minimum 2 and Maximum 20 2 to 50 members in case of

Private Company and

Minimum 7 members in case

of Public Company.

Minimum 2 partners and their

is no limitation of maximum

number of partners.

Ownership of Assets Partners have joint

ownership of all the assets

belonging to partnership firm

The company independent of

the members has ownership

of assets

The LLP independent of the

partners has ownership of

assets

Liability of

Partners/Members

Unlimited. Partners are

severally and jointly liable for

actions of other partners and

the firm and liability extend to

their personal assets.

Generally limited to the

amount required to be paid

up on each share.

Limited, to the extent their

contribution towards LLP,

except in case of intentional

fraud or wrongful act of

omission or commission by

the partner.

Tax Liability Income of Partnership is

taxed at a Flat rate of 30%

plus education cess as

applicable.

Income of Company is Taxed

at a Flat rate of 30% Plus

surcharge as applicable.

Income of LLP is taxed at a

Flat rate of 30% plus

education cess as applicable.

Comparison of LLP with different business Models

4 By Rajiv Shah - Cell 9824031476

Conditions5 Partnership Company LLP

Transfer / Inheritance

of Rights

Not transferable. In case of

death the legal heir receives

the financial value of share.

Ownership is easily

transferable.

Regulations relating to

transfer are governed by the

LLP Agreement .

Transfer of Share /

Partnership rights in

case of death

In case of death of a partner,

the legal heirs have the right

to get the refund of the

capital contribution + share in

accumulated profits, if any.

Legal heirs will not become

partners

In case of death of member,

shares are transmitted to the

legal heirs.

In case of death of a partner,

the legal heirs have the right

to get the refund of the

capital contribution + share in

accumulated profits, if any.

Legal heirs will not become

partners

Dissolution By agreement, mutual

consent, insolvency, certain

contingencies, and by court

order.

Voluntary or by order of

National Company Law

Tribunal.

Voluntary or by order of

National Company Law

Tribunal.

Transferability of

Interest

A partner can transfer his

interest subject to the

Partnership Agreement

A member can freely transfer

his interest

A partner can transfer his

interest subject to the LLP

Agreement

Admission as partner /

member

A person can be admitted as

a partner as per the

partnership Agreement

A person can become

member by buying shares of

a company.

A person can be admitted as

a partner as per the LLP

Agreement

Cessation as partner /

member

A person can cease to be a

partner as per the agreement

A member / shareholder can

cease to be a member by

selling his shares.

A person can cease to be a

partner as per the LLP

Agreement or in absence of

the same by giving 30 days

prior notice to the LLP.

Comparison of LLP with different business Models

5 By Rajiv Shah - Cell 9824031476

Conditions6 Partnership Company LLP

Voting Rights It depends upon the

partnership Agreement

Voting rights are decided as

per the number of shares held

by the members.

Voting rights shall be as

decided as per the terms of

LLP Agreement.

Remuneration of

Managerial Personnel

for day to day

administration

The firm can pay

remuneration to its partners

Company can pay

remuneration to its Directors

subject to law.

Remuneration to partner will

depend upon LLP

Agreement.

Contracts with

Partners/Director

Partners are free to enter

into any contract.

Restrictions on Board

regarding some specified

contracts, in which directors

are interested.

Partners are free to enter into

any contract.

Audit of accounts Partnership firms are only

required to have tax audit of

their accounts as per the

provisions of the Income Tax

Act

Companies are required to

get their accounts audited

annually as per the provisions

of the Companies Act, 1956,

All LLP except for those

having turnover less than

Rs.40 Lacs or Rs.25 Lacs

contribution in any financial

year are required to get their

accounts audited annually as

per the provisions of LLP Act

2008.

Compromise /

arrangements / merger

/ amalgamation

Partnership cannot merge

with other firm or enter into

compromise or arrangement

with creditors or partners.

Companies can enter into

Compromise / arrangements /

merger / amalgamation

LLPs can enter into

Compromise / arrangements

/ merger / amalgamation

Comparison of LLP with different business Models

6 By Rajiv Shah - Cell 9824031476

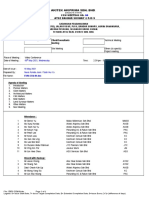

7 By Rajiv Shah - Cell 9824031476

1. For registration of Limited Liability Partnership including conversion of a firm or a private

company or an unlisted public company into Limited Liability Partnership: (a) Limited Liability Partnership

whose contribution does not exceed Rs. 1 Lakh Rs. 500/-

(b) Limited Liability Partnership whose contribution exceeds Rs. 1 lakh but does not exceed Rs. 5 lakhs

Rs. 2000/-

(c) Limited Liability Partnership whose contribution exceeds Rs. 5 lakhsbut does not exceed Rs. 10 lakhs

Rs. 4000/-

(d) Limited Liability Partnership whose contribution exceeds Rs. 10 lakh Rs. 5000/-

2. The difference between the fees payable on the increased slab of contribution and the fees paid on

the preceding slab of contribution shall be paid through Form 3.

Details of fees to be paid for LLP

8

3. For filing, registering or recording any document, form, statement, notice, Statement of

Accounts and Solvency, annual return and an application alongwith the Statement for conversion

of a firm or a private company or an unlisted public company into LLP by this Act or by these

rules required or authorized to be filed, registered or recorded:

(a) Limited Liability Partnership whose contribution does not exceed Rs. 1 Lakh Rs. 50/-

(b) Limited Liability Partnership whose contribution exceeds Rs. 1 lakh but does not exceed Rs. 5 lakhs

Rs. 100/-

(c) Limited Liability Partnership whose contribution exceeds Rs. 5 lakhs but does not exceed Rs. 10 lakhs

Rs. 150/-

(d) Limited Liability Partnership whose contribution exceeds Rs. 10 lakh Rs. 200/-

By Rajiv Shah - Cell 9824031476

9

4. Fee for any application other than application for conversion of a firm or a private

company or an unlisted public company into LLP shall be as under:-

(a) An application for reservation of name u/s 16 Rs. 200/-

(b) An application for direction to change the name u/s 18 Rs. 10000/-

(c) Application for reservation of name under Rule 18(3) Rs. 10,000/-

(d) Application for renewal of name under rule 18(3) Rs. 5000/-

(e) Application for obtaining DPIN under rule 10(5) Rs.100/-

By Rajiv Shah - Cell 9824031476

10

5. Fee for inspection of documents or for obtaining certified copy thereof shall be as

under:-

(a) For inspection of documents of an LLP under section 36 Rs. 50/-

(b) For Copy or extract of any document under section 36 to be certified by Registrar Rs. 5/- per page or

fractional part thereof

6. Fee for filing any form or a Statement of Account and Solvency or a notice or a document

by foreign limited liability partnership

(a) For filing a document under rule 34(1) Rs.5000/-

(b) Any other form or Statement of Account and Solvency or notice or document Rs.1000/-

By Rajiv Shah - Cell 9824031476

11 By Rajiv Shah - Cell 9824031476

Income tax Implication

LLPs will be treated as Partnership Firms for the purpose of Income Tax w.e.f assessment year 2010-11

No surcharge will be levied on income tax.

Profit will be taxed in the hands of the LLP and not in the hands of the partners.

Minimum Alternate Tax and Dividend Distribution Tax will not be applicable for LLP.

Remuneration to partners will be taxed as Income from Business & Profession.

No capital gain on conversion of partnership firms into LLP.

Designated Partners will be liable to sign and file the Income Tax return.

LLP shall not be eligible for presumptive taxation.

Tax rate:

30% flat tax rate + 3% education cess

No Minimum Alternate Tax & Dividend Distribution Tax

12 By Rajiv Shah - Cell 9824031476

Services available from Rajiv Shah

1. Name Reservation Services

2. LLP Agreement drafting

3. Annual Filing Services

4. Other Services viz..

Conversion of Firms / Companies to LLP

Conversion of LLP to Company (under Part IX of the Companies Act,1956

Compromise, Arrangement or Reconstruction of Limited Liability Partnerships

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Laws and Regulations For Setting Up A Business in JapanDocument60 pagesLaws and Regulations For Setting Up A Business in JapanSantiago CuetoPas encore d'évaluation

- Corpo ReviewerDocument62 pagesCorpo ReviewerLorelie Sakiwat VargasPas encore d'évaluation

- Business Forms in BDDocument7 pagesBusiness Forms in BDPiana Monsur MindiaPas encore d'évaluation

- Brennan, Niamh and McCafferty, Jacqueline (1997) Corporate Governance Practices in Irish Companies, IBAR - Irish Business and Administrative Research 18: 116-135.Document26 pagesBrennan, Niamh and McCafferty, Jacqueline (1997) Corporate Governance Practices in Irish Companies, IBAR - Irish Business and Administrative Research 18: 116-135.Prof Niamh M. BrennanPas encore d'évaluation

- Chapter 1 Introduction To Corporate Finance 2Document4 pagesChapter 1 Introduction To Corporate Finance 2Mrittika SahaPas encore d'évaluation

- LECTUREDocument12 pagesLECTURECriszia MaePas encore d'évaluation

- Akitek Akiprima Sdn. BHD.: 05 May 2021, WednesdayDocument4 pagesAkitek Akiprima Sdn. BHD.: 05 May 2021, WednesdayKevin LowPas encore d'évaluation

- Research ProposalDocument7 pagesResearch Proposalswarna sahaPas encore d'évaluation

- Lecture Note Business - Engineering Company RegistrationDocument9 pagesLecture Note Business - Engineering Company RegistrationDesmond shedrackPas encore d'évaluation

- Applied Economics Module Week 5Document5 pagesApplied Economics Module Week 5Billy Joe100% (1)

- Differences, Advantages and Disadvantages: LLP vs. LLCDocument12 pagesDifferences, Advantages and Disadvantages: LLP vs. LLCChintan PatelPas encore d'évaluation

- CA Inter Law MCQs CA Ravi AgarwalDocument193 pagesCA Inter Law MCQs CA Ravi AgarwalNeha periwalPas encore d'évaluation

- Business Laws and Regulations No. IiDocument131 pagesBusiness Laws and Regulations No. IiEdrian CabaguePas encore d'évaluation

- Transes RFBTDocument4 pagesTranses RFBTdave excellePas encore d'évaluation

- Business and New Economic Environment: UNIT-1Document36 pagesBusiness and New Economic Environment: UNIT-1YashaswiniPas encore d'évaluation

- Partnership (NCERT)Document51 pagesPartnership (NCERT)Jackson SidharthPas encore d'évaluation

- Applicability Doctrine Ultra ViresDocument3 pagesApplicability Doctrine Ultra ViresdrdineshbhmsPas encore d'évaluation

- Equity Securities MarketDocument6 pagesEquity Securities MarketAngelica DechosaPas encore d'évaluation

- PROBLEM 1 Audit of Shareholders EquityDocument6 pagesPROBLEM 1 Audit of Shareholders Equityaira nialaPas encore d'évaluation

- Company Law: The Nature of A Registered CompanyDocument7 pagesCompany Law: The Nature of A Registered CompanyKhadija JariwalaPas encore d'évaluation

- Index: Page NoDocument322 pagesIndex: Page NoDINESH BANSALPas encore d'évaluation

- Public EnterpriseDocument8 pagesPublic Enterpriseraiac047Pas encore d'évaluation

- Types of Business Ownership in MalaysiaDocument3 pagesTypes of Business Ownership in MalaysiaMardhiah Ramlan0% (1)

- Chapter 4: Types of Business Organization: Business Organisations: The Private SectorDocument10 pagesChapter 4: Types of Business Organization: Business Organisations: The Private SectorDhrisha GadaPas encore d'évaluation

- DMC College Foundation, Inc. Sta. Filomena, Dipolog City 1 Semester 2018-2019 School of Business and AccountancyDocument1 pageDMC College Foundation, Inc. Sta. Filomena, Dipolog City 1 Semester 2018-2019 School of Business and AccountancyEarl Russell S PaulicanPas encore d'évaluation

- Bản Sao Unit 5 Listening Stock Market for StudentsDocument3 pagesBản Sao Unit 5 Listening Stock Market for StudentsMai LêPas encore d'évaluation

- Business Organisation: BBA I SemDocument49 pagesBusiness Organisation: BBA I SemAnchal LuthraPas encore d'évaluation

- Type of BusinessDocument13 pagesType of BusinessDiana Patricia Soto OsorioPas encore d'évaluation

- Law Quiz PracticeDocument72 pagesLaw Quiz PracticeJyPas encore d'évaluation

- AgPart 925 - Memaid PartDocument10 pagesAgPart 925 - Memaid Partcezar delailaniPas encore d'évaluation