Académique Documents

Professionnel Documents

Culture Documents

Pakistan Power Sector

Transféré par

WisuwatYaikwawongCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pakistan Power Sector

Transféré par

WisuwatYaikwawongDroits d'auteur :

Formats disponibles

N.A.

ZUBERI

MANAGING DIRECTOR

PRIVATE POWER & INFRASTRUCTURE BOARD

February 27, 2014

6

th

PAKISTAN ENERGY FORUM 2014

Pakistan Power Sector Investment Opportunities and

New Initiatives to address power shortages

1

C O N T E N T S

2

Overview of Power Sector of Pakistan

Private Power Projects in Operations

Portfolio of Upcoming Private Power Projects

Bridging demand supply gap A challenge

New initiatives taken to reduce power shortages

Gaddani Power Park

Imported Coal Based Projects at Port Qasim

Sindh Engro Coal Mining Project

Initiatives by Government of Punjab and GoKPK

Incentives for Investors in development of power projects

Investment Opportunities

MW %

Public Sector

Hydel 6,844 29

Thermal 4,829 21

Nuclear 802 3

Total 12,475 53

PAKISTAN POWER SECTOR

TOTAL INSTALLED CAPACITY

3

Public Sector

Hydel, 6844,

29%

Public Sector

Thermal, 4829,

21%

Nuclear, 802,

3%

Private Sector,

11011, 46.88%

Private Sector

IPPs 8,630 37

KESC 2,381 10

Total 11,011 47

Total Installed Capacity 23,486 MW

Private Sector

IPPs 8,630 37

KESC 2,381 10

Total 11,011 47

MARDAN

WARSAK

BANNU

DAUDKHEL

BURHAN

NEW RAWAT

I.S.P.R

MANGLA

TARBELA

GAKHAR

SAHOWALA

K.S.KAKU

RAVI

JAPAN

KEL

N.ABAD

SABA

YOUSAF WALA

VEHARI

KAPCO

ROUSCH

UCH

AES

N.G.P.S M.GARH

GUDDU

LIBERTY

DADU

HALARD

LAKHRA

JAMSHORO

KOTRI

HUBCO

KDA-33

(KESC)

500 kV Grid Station

220 kV Grid Station

500/220 kV Grid Station

Hydel Power Station

Thermal Power Station

IPPs at 220, 500 kV

IPPs at 132 kV

500 kV T/LINE

220 kV T/LINE

(240)

(3408)

(1000)

(107)

(120)

(195)

(1350)

(310)

CHEP

(184)

(355)

(1348)

(695)

HCPC

(126)

(548)

(1655)

(212)

(150)

(850)

(174)

(1200)

GAZI BAROTHA

(1450)

CHASNUPP

GATTI

BUND RD:

M.GARH GUDDU

JAMSHORO

TAPAL

G.AHMAD

PAKISTAN POWER SECTOR TRANSMISSION SYSTEM

4

Gaddani Power

Park

5

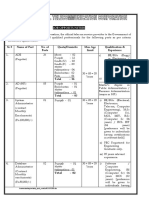

PRIVATE POWER PROJECTS IN OPERATION

Number of Capacity Investment

Projects (MW) (Million US$)

Project prior to 1994 Power Policy 1 1,292 1,608

Projects under 1994 Power Policy 14 3,113 3,479

Project privatized from public sector 1 1,638 1,583

Project under 1995 Hydel Policy 1 84 215

Projects under 2002 Power Policy 12 2,530 2,754

Total 29 8,657 9,639

Altern Energy Ltd, Attock 29 Jun 2001

Japan Power Generation, Lahore 135 Jan 2000

Kohinoor Energy Ltd., Lahore 131 Jun 1997

Southern Electric Co., Lahore 136 Jul 1999

Saba Power Company, Lahore 125 Dec 1999

AES Lalpir Ltd., Multan 362 Nov 1997

AES Pak Gen, Multan 365 Feb 1998

Fauji Kabirwala Co., Multan 157 Oct 1999

Rousch Power, Multan 450 Dec 1999

KAPCO, Muzaffargarh 1638 Jun 1996

Attock Gen, Rawalpindi 165 Mar 2009

Atlas Power Ltd., Sheikhupura 225 Nov 2009

Nishat Power Ltd., Lahore 200 Nov 2009

Saif Power Ltd., Sahiwal 229 Apr 2010

Orient Power Ltd., Balloki, Kasur 229 May 2010

Nishat Chunian Power Ltd., Lahore 200 Jul 2010

Sapphire Electric Co. Ltd., Muridke 225 Oct 2010

Liberty Power Tech Ltd. 200 Jan 2011

HUB Power Company Limited, Narowal 220 Apr 2011

Halmore Power Generation Co. Ltd. 225 June 2011

Hub Power Project, Hub 1292 Mar 1997

Uch Power Ltd., Uch 586 Oct 2000

Habibullah Coastal, Quetta 140 Sep 1999

TNB Liberty Power Ltd., Daharki 235 Jun 2001

Tapal Energy Ltd., Karachi 126 Jun 1997

Gul Ahmed Energy Ltd., Karachi 136 Nov 1996

Engro Powergen Qadirpur Ltd., Dakarki 227 Mar 2010

Foundation Power Co. (Daharki) Ltd. 185 May 2011

PUNJAB

BALOCHISTAN

SINDH

Tot. Capacity: 8,657 MW

AZAD JAMMU & KASHMIR

New Bong Escape Hydropower Project 84 Mar 2013

PRIVATE SECTOR PROJECTS IN OPERATION

6

7

Description/ Year

Hydel Coal

Gas/ Dual

Fuel

Oil

Total

(MW)

No. of

Projects

MW No. MW No. MW No. MW No.

2014 - - - - 404 1 - - 404 1

2016 - - - - - - 163 1 163 1

2017 147 1 - - - - - - 147 1

2018 100 1 - - - - - - 100 1

2019 230 2 - - - - - - 230 2

2020 1,560 2 - - - - - - 1,560 2

2022 2,240 3 - - - - - - 2,240 3

Project at FS

Stage

548 1 - - - - - - 548 1

Other Projects 2,123 5 1,200 1 120 1 - - 3,443 7

Grand Total 6,948 15 1,200 1 524 2 163 1 8,835 19

PPIBs PORTFOLIO OF UPCOMING PRIVATE

POWER PROJECTS (IPPs)

BRIDGING DEMAND-SUPPLY GAP A CHALLENGE

8

WAPDA (NTDC) Power Planning has projected a demand of 31,757 MW

by the year 2020.

During Summer 2012, Maximum Power Supply has remained at 14,756

MW (August 2012). Hence an additional 17000 MW shall be required by

the year 2020.

An Investment of USD 20.40 Billion is required within a span of Six Years

(Using the thumb rule of USD 1.2 Million/MW)

Arranging this amount is a very difficult task for GOP/Provincial

Governments, even if other sectors such as health, education etc. are

compromised.

Consolidated efforts needed both from Public & Private Sectors to

bridge Demand- Supply Gap in the System

NEW INITIATIVES TAKEN TO REDUCE POWER

SHORTAGES

9

6,600 MW Pakistan

Power Park, Gaddani

Balochistan

PAKISTAN POWER PARK SALIENT FEATURES

11

The Prime Minister of Pakistan approved the concept of 6,600 Pakistan

Power Park at Gaddani on July 26, 2013

The Pakistan Power Park will have

Dedicated deep sea jetty

2x 660 MWs in Public Sector

8x 660 MWs in Private Sector as IPPs

Transmission Network for evacuation of Power

Common infrastructure facilities of coal conveyer system,

cooling water, switchyard, ash disposal, and residential facilities

etc

Future

Expansions

Future

Expansions

Jetty

660 MW

Public Sector

H

o

u

s

i

n

g

&

A

m

e

n

i

t

i

e

s

C

o

m

m

o

n

S

w

i

t

c

h

y

a

r

d

660 MW

IPP

660 MW

IPP

660 MW

IPP

660 MW

IPP

660 MW

IPP

Common Water Supply

A

s

h

D

i

s

p

o

s

a

l

a

n

d

R

e

c

y

c

l

i

n

g

i

t

i

n

t

o

U

s

e

f

u

l

B

y

P

r

o

d

u

c

t

s

Cooling Water Intake

660 MW

Public Sector

660 MW

IPP

Shipping and

Coal Supplier

S

e

p

a

r

a

t

e

C

o

a

l

S

t

o

r

a

g

e

s

(

L

i

v

e

)

f

o

r

e

a

c

h

I

P

P

(

m

a

i

n

t

a

i

n

e

d

b

y

e

a

c

h

I

P

P

s

e

p

a

r

a

t

e

l

y

)

Pakistan Power

Park: Typical

Configuration

Subject to

Consultants

review.

B

r

e

a

k

w

a

t

e

r

660 MW

IPP

660 MW

IPP

CONCEPTUAL VIEW OF POWER PARK

About 5000

acres of land

will be

required for

Pakistan

Power Park.

GOB to

provide land

as equity in

Project

company.

THE PROJECT SITE

Pakistan Power Management

Company

- Jetty

- Cooling Water

- Land

- Switch Yard

IPPs

CPPA

Coal

Supplier

Service Sharing Agreement

IA

PPA

CSA

GoB

Land

GoP

NTDC

Transmission Line

CSA: Coal Supply Agreement

PPA: Power Purchase Agreement

IA: Implementation Agreement

BUSINESS MODEL

15

Pakistan Power Park: Major Components

Jetty and related marine infrastructure USD 500 700 million

Parks onshore infrastructure USD 100 million

Transmission Line USD 3 4.43 billion

2x660 MW Project in public sector USD 1.8 billion

8x660 MW Projects in private sector USD 7.2 billion

Total USD 13.8 billion

Note: These are very Preliminary and Rough Estimates and will change

considerably as design is finalized and costs are firmed up.

INDICATIVE INVESTMENT ESTIMATES

16

LATEST DEVELOPMENTS

17

The interest of the sponsors in Pakistan Power Park is increasing

Recently the following companies have aggressively pursued their interest in

development of projects in Pakistan Power Park:

Power China and Al Mirqab Qatar (QINVEST) 2 x 660 MW (1

st

Phase)

Samsung C & T Corporation, Seoul, Korea 2 x 660 MW

China Gezhouba Group Corporation , China 3 x 660 MW

Bestway Cement 1x 660 MW

ANC Holding of UAE 1x 660 MW

NUROL Group, Turkey (for BOT) 2 x 660 MW

MOU with QINVEST & China Gezhouba have already been signed

PPIB is also carrying out pre-qualification process of QINVEST for

issuance of LOI for 2x660 MW IPP projects at Gadani Power Park

PAKISTAN POWER PARK FEASIBILITY STUDY

18

NESPAK is at advanced stage of finalizing feasibility study for

Pakistan Power Park

Land survey, topographic survey and revenue mapping of the site

has been completed

Work on hydraulic studies, geotechnical investigations and marine

works is also progressing

Master plan for Pakistan Power Park is being finalized by NESPAK in

collaboration with specialist foreign and local firms

PAKISTAN POWER PARK INVESTMENT OPPORTUNITIES

19

8 x 660 MW power plants in IPP mode on Build, Own &

Operate basis

Construction of deep sea jetty and marine infrastructure

Development of infrastructure of Pakistan Power Park

Construction of Transmission Line

Construction of access roads

2 x 660 MW IMPORTED COAL BASED POWER

PROJECT AT PORT QASIM, KARACHI BY

POWER CHINA-AL MIRQAB CAPITAL (QINVEST)

2 x 660 MW POWER PROJECT AT PORT QASIM, KARACHI

21

A joint venture of Power Construction Corporation of China (Power

China) and Al Mirqab Capital of Doha, Qatar has submitted a proposal

to PPIB for development of 2 x 660 MW imported coal based power

project at Port Qasim, Karachi

The proposed project site is located on the east side of the existing Bin

Qasim Power Station in Eastern Industrial Zone of Port Qasim, Karachi

Currently, the sponsors are in process of completing their Statements

of Qualification (SOQs) for completing pre-qualification formalities

required for obtaining Letter of Intent (LOI) from PPIB.

2 x 660 MW POWER PROJECT AT PORT QASIM, KARACHI

22

Salient Features

Capacity of Power Plant

1,320 MW (Gross Capacity)

1,221 MW (Net Capacity)

No of Units and Configuration

2 x 660 MW (Gross Capacity)

Fuel

Sub Bituminous and Bituminous coal imported from Indonesia, South Africa,

Botswana and Australia

Efficiency

41 % (Gross Efficiency)

38 % (Net Efficiency)

Annual Availability

90%

23

THAR COAL

MINING AND POWER GENERATION PROJECTS

THAR COAL BASED POWER PROJECTS

24

Sindh Engro Coal Mining Company (SECMC) Open Pit Mining at

Thar Coal - Block II

Feasibility completed by SECMC in 2010

Total Lignite reserve in Block II - 2 Billion tons

Exploitable Reserve - 1.57 Billion tons

Average striping ratio is 6.2:1

Investment Estimate - US $ 800 Million

2 x 330 MW Power Generation Project at Thar by SECMC

Interested investors may approach SECMC which is actively

searching for equity partners for the development of 2 x 330 MW

power project

INITIATIVES BY THE GOVERNMENT OF PUNJAB

INITIATIVES BY THE GOVERNMENT OF PUNJAB

26

Government of Punjab has planned adding approximately 6,000

MW in the medium term (3-5 years) to the national grid through

private or public investment in imported coal based power plants

Potential projects include:

2 x 660 MW coal power project at following sites:

Qadirabad (Sahiwal),

Bhikki (Sheikhupura),

Haveli Bahadur Shah (Jhang),

Balloki (Kasur),

Trinda Saway (Rahim Yar Khan)

Mouza Saddan Wali (Muzaffargarh)

INITIATIVES BY THE GOVERNMENT OF SINDH

INITIATIVES BY THE GOVERNMENT OF SINDH

28

Development of 2 x 660 MW coal based power project at Keti Bunder,

Sindh to be scaled upto 5,000 MW

Salient Features

Projects to be developed in IPP mode

Sponsors will be responsible for planning, design, construction,

ownership, operation, financial management and facility

management of the power plant

Development of smaller jetty at the site with transhipping concept

and allied facilities

200 + km rail track from Thar to Keti Bunder

Transmission line from Keti Bunder to Thatta to Jamshoro

Interested sponsors may approach initially GOS and then PPIB for IPPs

for 2 x 660 MW projects

INITIATIVES BY THE GOVERNMENT OF KPK

INITIATIVES BY THE GOVERNMENT OF KPK

30

Government of Khyber Pakhtunkhwa has initiated development of

457 MW hydropower projects at Sharmai, Shushgai, Shogosin and

Koto through PHYDO

One (01) MOU has been signed by Government of Khyber

Pakhtunkhwa for 1,000 MW hydropower projects at different sites in

the following areas:

Swat

Malakand

Hazara

Chitral

Government of Khyber Pakhtunkhwa has initiated around 300 small

Hydro Power plants in the province

Exemption from Corporate Income Tax, Turnover Tax and Withholding Tax, no

Sales Tax, only 5% concessionary Import Duty on plant & equipment not

manufactured locally

GOP Guarantees obligations of power purchaser and provinces

GOP provides protection against Political Force Majeure, change in law and

Change in duties & taxes

Power Purchaser to bear hydrological risk for hydropower projects

GOP allows 20% ROE for indigenous coal based power projects, and 17%

ROE on hydro power projects

Payment of compensation in case of termination due to GOP Event of Default

Tariff adjustments for variation in currency exchange rates and fuel prices

Tariff indexation for inflation (US CPI & Pak WPI)

Government ensures conversion of Pak Rupee & remittance of foreign

exchange for project-related payments

INCENTIVES FOR INVESTORS INTERESTED IN

DEVELOPMENT OF POWER PROJECTS

31

OPPORTUNITIES FOR INVESTORS

Pakistan Power Park at Gaddani, Balochistan

Thar Coal Mining and Power Generation project

Initiatives by Government of Punjab on Coal based projects and

Government of KPK on Hydropower Projects

International Competitive Biddings for establishment of:

100 MW Kotli Hydropower Project

58 MW Turtonas-Uzghor Hydropower Project

80 MW Neckerdim Paur Hydropower Project

Key Projects requiring support in areas of Equity Participation, EPC

Contract, O&M Contract, Electro-Mechanical Equipment Supply, Lenders/

Financiers

640 MW Azad Pattan Hydropower Project

500 MW Chakothi Hattian Hydropower Project

548 MW Kaigah Hydropower Project

32

BACKUP SLIDES

34

35

LAYOUT MAP OF

KOTLI PROJECT

Distance from

Islamabad= 165km

Kotli Town = 0km

SALIENT FEATUES OF KOTLI HPP

General

Project Name : Kotli Hydropower Project

Project Consultants : MWH (USA)

Location : District Kotli, AJ&K

River : Poonch

Project Cost : US$ 169.6 Million as per Feasibility Study

Technical

Capacity : 100 MW

Energy : 475 GWh

Gross Head : 84.6 m

Levelized Tariff : US 5.45/KWh (as per Feasibility Study for 30 years)

Current Status

EPC level tariff negotiations between Sponsors and NTDC is in process

37

Project advertised on Dec 2, 2013

PARTICIAPTION REQUIRED:

Project Sponsors through International Competitive Bidding

(ICB)

CURRENT STATUS Kotli Hydro Power Project

LAYOUT PLAN OF TURTONAS-UZGHOR HPP

38

Weir/Dam

Powerhouse

City/ Town

Tunnel

Legend

SALIENT FEATURES OF TURTONAS-UZGHOR

HYDROPOWER PROJECT

General:

Project Name Turtonas Uzghor Hydropower Project

Location Golen Gol River near Uzghor Village

(around 33 km from Chitral Town)

Technical:

Capacity 58 MW

Gross Head 351 m

Mean Annual Energy 254 GWh

Project Type Run-of-River

Design Discharge 20.0 m

3

/sec

Plant Factor 50%

Estimated Cost 87 Mill US$

39

40

Project is expected to be advertised by end of Dec 2013

PARTICIAPTION REQUIRED:

Project Sponsors through International Competitive Bidding (ICB)

CURRENT STATUS TURTONAS UZGHOR HPP

LAYOUT PLAN OF NECKERDIM-PAUR HPP

41

Powerhouse

City/ Town

Legend

General

Project Name : Neckerdim-Paur HPP (Raw Site)

River : Yarkun-a tributary of Mastuj River

Location : Project area is 70 km from Mastuj town

Distance : 178km from Chitral town

Technical

Capacity : 80 MW

Energy : 321 GWh

Project Type : Run-of-River

Design Discharge : 30 m

3

/s

Gross Head : 341 m

Plant Factor : 45.8 %

Estimated Cost : 120 Mill US$

SALIENT FEATURES NECKERDIM-PAUR HPP

42

43

Project is expected to be advertised by end of Dec 2013

PARTICIAPTION REQUIRED:

Project Sponsors through International Competitive Bidding

(ICB)

CURRENT STATUS NECKERDIM - PAUR HPP

Investors Support in Equity Debt

Financing , EPC and O & M contracts

LOCATION OF AZAD PATTAN

ON JEHLUM RIVER

Mangla

PH

N

Garhi

Habibullah

640 MW Azad

Pattan HPP

720 MW

Karot HPP

500 MW

Chakothi Hattian

HPP

PUNJAB

Khyber Pakhtunkhwa

AJ&K

147 MW

Patrind HPP

M

a

h

l

R

i

v

e

r

45

General

Project Company : Alamgir Power Pvt Ltd

Project Sponsors : Alamgir Power (Pvt.) Ltd (Main),

Project Cost : US$ 1446.7 Million as per Feasibility Study

Project Consultant : Scott Wilson

Technical

Capacity : 640 MW

Energy : 3075 GWh

Levelized Tariff : US 7.7125/kWh (as per Feasibility Study for 30 years)

Expected COD : June 2020

SALIENT FEATURES OF AZAD PATTAN HPP

46

47

Tariff negotiated b/w Sponsors and NTDC; and is under approval

by NEPRA

PARTICIAPTION REQUIRED:

Equity Partners

Debt Financing

EPC Contractor

Detailed Design Consultants

Equipment Suppliers

O & M Contractor

CURRENT STATUS-AZAD PATTAN HPP

LOCATION OF CHAKOTHI HATTIAN

ON JEHLUM RIVER

Mangla

PH

N

Garhi

Habibullah

640 MW Azad

Pattan HPP

720 MW

Karot HPP

500 MW

Chakothi Hattian

HPP

?

PUNJAB

Khyber Pakhtunkhwa

AJ&K

147 MW

Patrind HPP

M

a

h

l

R

i

v

e

r

48

General

Project Sponsors : Suhail Jute Mills Ltd.,

Colony Sarhad Textile Mills

Project Cost : US$ 1176.5 Million as per Feasibility Study

Technical

Capacity : 500 MW

Energy : 2410 GWh

Levelized Tariff : US 7.89/kWh (negotiated F.S for 30 yrs.)

Expected COD : December 2020

SALIENT FEATURES OF

CHAKOTHI HATTIAN HPP

49

50

Tariff has been negotiated b/w Sponsors and NTDC; which tariff is

under approval be NEPRA (Regulator)

PARTICIAPTION REQUIRED:

Equity Partners

Debt Financing

EPC Contractor

Detailed Design Consultants

Equipment Suppliers

O & M Contractor

CURRENT STATUS-CHAKOTHI HATTIAN HPP

LOCATION MAP OF KAIGAH HPP

Kandiah River

Weir

LOCATION MAP OF KAIGAH HPP

General

Project Sponsors : Telecom Valley Pvt Ltd (Main Sponsors)

Associated Technologies (Pvt) Ltd

Project Cost : US$ 822 Million (Estimated)

Technical

Capacity : 548 MW

Energy : 2170 GWh (Estimated)

Levelized Tariff : X

Expected COD : December 2020

SALIENT FEATURES - KAIGAH HPP

Feasibility Study in progress

INVESTORS PARTICIAPTION

Equity Partners

Debt Financing

EPC Contractor

Detailed Design Consultants

Equipment Suppliers

O & M Contractor

CURRENT STATUS - KAIGAH HPP

INVESTMENT IN PAKISTAN POWER SECTOR -

A PROMISING OPPORTUNITY

55

Due to growing power demand, there is dire need of power capacity

addition

Pakistan has successfully attracted investment worth billions of dollars

from private sector for power generation

World renowned power players are already operating in Pakistan.

One-Window facility provided at Federal level by PPIB

Federal Government guarantees the performance of the power

purchaser and provinces

Federal Government provides protection against political force Majeure

and change in law

Concessionary import duties and tax free regime for power plants

developed under the Policy

CONCLUSION

56

You are welcome to avail investor-friendly

profitable business opportunities in

Pakistans Power Sector

STEPS REQUIRED TO TACKLE POWER SHORTAGES

57

Short Term Solutions

Medium Term Solutions

Long Term Solutions

58

GOVERNANCE/ MANAGEMENT MEASURES

Electricity bills of provinces and defence installations be adjusted at

source with federal government

Development of Integrated Energy Plan

Strict Implementation of the decisions through proper coordination

and harmonized efforts by various energy sector entities and

stakeholders especially provincial and federal governments

National Energy Efficiency Standards may be developed with the

consensus of relevant stakeholders including but not limited to

Enercon, NEPRA, OGRA, etc. in order to promote efficient usage and

reduce wastage of energy resources in general and electricity in

particular

Reduction in system losses / improvements in revenue collection

SHORT TERM

59

GOVERNANCE/ MANAGEMENT MEASURES

Permanent resolution of Circular Debt issue through strict

implementation of measures like:

Narrowly target tariff subsidies only to lifeline consumers who

consume up to 100 units per month and provide this subsidy in

the federal budget

Notify electricity tariffs according to the average system-wide

cost

Power dispatch to be strictly according to plant efficiency and

generation cost

Supply gas to all power plants that can run on natural gas to

minimize generation on expensive fuels

Reduce distribution and transmission losses and improve

collection rates

Improvement in Law & Order situation

SHORT TERM

60

Key to resolution of circular debt is to reduce reliance oil and conversion

of oil based capacity to coal (70% imported and 30% local) for which:

GENCOs be directed to convert their steam based units to coal as

Planning Commission has already approved the concept clearance

NEPRA may announce tariff for coal conversion for interested IPPs

Industrial sector be encouraged to use coal as a fuel instead of oil &

gas

Captive Power Units should be incentivized to switch from oil/gas to

coal

SHORT TERM CONVERSION OF STEAM TURBINES

OPERATING ON FURNACE OIL TO COAL

61

Hydel based IPPs be supported through:

Feasibility Studies (including Engineering Design)

Creation of a Hydro Development Fund

Sugar Mills Co-generation Policy, recently approved by the GoP and

being administered by AEDB, be widely circulated and marketed to

obtain the desired results i.e. tapping of above 2,000 MW power

generation potential of sugar mills

Upfront Tariff announced by NEPRA for local/ imported coal based

power projects be reviewed to make it realistic

MEDIUM TERM

62

CONTROL OF LINE LOSSES

Technical: Too much high Technical Line Losses due to dilapidated

transmission and distribution system are not only wasting a lot of

power generated but adding a lot in building up of Circular debt.

Attention is needed towards system repair, replacement (where

necessary) and augmentation

Theft: Losses due to alleged theft are also resulting in building up of

circular debt and wastage. Metering cum Mapping of areas based on

power supply and revenue collection coupled with community

involvement (mass feeder disconnection cum higher level load-

shedding in low revenue areas) added by smart grid and pre-paid

meters by practiced

MEDIUM TERM

63

Development of bigger dam cum power generation

projects in public sector

Expeditious development of 6,600 MW imported coal

based Pakistan Power Park at Gaddani, Balochistan

Expeditious development of Thar coal based power

projects

LONG TERM

64

For 6,600 MW Pakistan Power Park and other upcoming

projects in southern part of the country including Thar coal

based power projects, power evacuation would be the major

issue therefore construction of new transmission lines is

envisaged

GoP is expected to announce an investor friendly Private

Transmission Lines Policy to promote development of power

evacuation network in private sector

LONG TERM POWER EVACUATION NETWORK

REVIEW OF UPFRONT TARIFF

65

66

SUMMARY OF UPFRONT COAL TARIFF

Levelized Tariff

Imported Coal

Cents/kWh

Local Coal

Cents/kWh

Foreign

Financing

Local

Financing

Foreign

Financing

Local

Financing

200 MW 8.2753 9.6042 8.2927 9.6448

600 MW 7.7784 9.1554 7.7931 9.1992

1000 MW 7.4922 8.7421 7.4900 8.7552

This tariff is applicable uptil June 30, 2019

Project life is 30 Years

Tariff for small coal based power plants (upto 50 MW) will be announced later

REVIEW OF UPFRONT TARIFF BY NEPRA

67

On 6

th

June 2013, NEPRA announced following Upfront Tariffs for coal projects.

The investors have reported that capital costs, operating & maintenance costs

are low and efficiency assumed by NEPRA under various scenarios is too high.

Ministry of Water and Power based on the feedback of investors have

requested NEPRA to review the Upfront Tariffs for following items of Tariffs:

For increase of Capital costs,

For Increase of Operation and maintenance costs,

For realistically lowering of Efficiency

Inclusion of Missing Items of Return on Equity During Construction

Reliance on Plant Factor of 84% instead of conventional 60%

Description

Local Financing Foreign Financing

200 MW 600 MW 1,000 MW 200 MW 600 MW 1,000 MW

Efficiency % 39.5 42 42 39.5 42 42

Project Cost (Million

USD / MW)

1.54 1.48 1.34 1.37 1.28 1.16

REVIEW OF UPFRONT TARIFF

68

Ministry of Water & Powers request (contaminating of 4 massive volumes) to

NEPRA under Section 31(4) of the NEPRA Act 1997 for review of Upfront Tariffs

has been relied on the following documents;

Updated Capital Cost Estimate for Utility Scale Electric Generating Plants April 2013

prepared by United States (US) Energy Information Administration (EIA)

Projected Costs of generating Electricity, 2010 Edition, by IEA/ NEA

Feasibility Study conducted by AES for 1200 MW coal based project at Gadani

NEPRA determined tariff for AES Project at Gadani on 26

th

November 2009

Feasibility Study conducted by Mitsui for imported coal based project at Gadani

Feasibility Study of Jamshoro 2x 660 MW Power Project

IEA Coal Advisory Board Report titled Power Generation from Coal

A Comparison of PC, CFB and IGCC Technologies for Basin Electric Power Cooperatives

Dry Fork Station by CHM2Hill

CMD paper titled Coal Power Technologies

the Gujarat Electricity Regulatory Commission (GERC) issued regulations for Terms and

Conditions of Tariff

EXAM OF PROPOSAL AND

PREQUALIFICATION OF

SPONSORS

FINANCIAL

CLOSING

NEGOTIATIONS / FINALIZATION OF

PROJECT AGREEMENTS

(IA, PPA, FSA/GSA)

APPROVAL BY

PPIB

REGISTRATION WITH PPIB

BY DEPOSITING $200

ISSUANCE OF LOI

BY PPIB

ISSUANCE OF LOS

BY PPIB

COMMERCIAL

OPERATIONS

SUBMISSION OF PROPOSAL

ALONG WITH FEES $20,000

SUBMISSION OF PG @ $1000 / MW

SUBMISSION OF

PG @ $5000 / MW (FOR LOS)

ALONG WITH FEES $80,000

TARIFF DETERMINATION &

ISSUANCE OF GENERATION LICENCE

BY NEPRA

SUBMISSION OF PETITIONS TO NEPRA FOR

(i) OPTING UPFRONT TARIFF,

(ii) GENERATION LICENCE

PROJECT IMPLEMENTATION PROCESS UNDER UPFRONT TARIFF REGIME

69

70

Reduction of demand through Energy Conservation and Load

Management

Priority of supplies of electricity be assigned by DISCOs with lower

load shedding in areas with improved collection and lower losses

Pilferage / Theft Reduction

Pre-paid smart meters be introduced in DISCOs

Import of electricity from Kyrgyz Republic/ Tajikistan (CASA-1000),

Iran and India

Creation of Infrastructure Fund with support of donors to provide

financing to private power projects

IMMEDIATE MEASURES TO ADDRESS POWER SHORTAGES

71

Many of the highly efficient power plants in private and public sector

are not being operated optimally primarily due to non-availability of

gas. Options of importing LNG/LPG for these plants through

SSGCL/SNGPL or directly by the power plants may be exercised on

priority

Sectoral allocation of natural gas to be done on the basis of

economic value. Power sector in general and most efficient CCGT

based power plants be given priority in firm allocation of gas

Private Sector be encouraged to not only participate in generation,

but also in transmission and distribution

IMMEDIATE MEASURES TO ADDRESS POWER SHORTAGES

72

Conversion of existing Oil Fired Thermal Power Stations on coal to

obtain cheaper electricity

New power projects be initiated in public, private sectors and public-

private partnership

Import of LNG to cater for gas shortages

IMMEDIATE MEASURES TO ADDRESS POWER SHORTAGES

73

Development of infrastructure for various sectors in general and

power sector in particular

Maximum utilization of indigenous energy resources (hydel, coal,

gas) for power generation

Development of Indigenous expertise in technology / manufacturing

Improvement of Law & Order situation

Resolution of Circular Debt issue on long term / sustainable basis

Deregulating and decentralizing the energy sector may be done by

allowing small power producers to sell power directly to consumers

through the distribution systems of DISCOs

A wholesale market for electricity may be created by decentralizing

and privatization

MEASURES TO ADDRESS POWER SHORTAGES

LONG TERM

Steering Committee

Overseeing

Under Prime Minister

Transmission Line

Gaddani-Lhr. Fsd 600 KV HVDC

NTDC

Power in Public Sector

2 x 660 MW & Import of Coal

Subsidiary of PPPMCL

Park Infrastructure & Common Facilities

Jetty, Cooling Water, Land

Development, Security,

Communications cum road

infrastructure, Drinking Water, etc

PPPMCL

Power in Private Sector

8 x 600 MW & Import of Coal

IPPs / PPIB

PAKISTAN POWER PARK

MONITORING

74

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Situations Vacant: Directorate General Pakistan Post Islamabad - Aspo / As MSTDocument24 pagesSituations Vacant: Directorate General Pakistan Post Islamabad - Aspo / As MSTyasirPas encore d'évaluation

- PESA District Profile Umerkot Sindh PakistanDocument59 pagesPESA District Profile Umerkot Sindh Pakistanعلی احمد100% (1)

- Lecture - 2B - Seismic Zones of PakistanDocument5 pagesLecture - 2B - Seismic Zones of PakistanMuhammad Hussain AbbasPas encore d'évaluation

- Pma 147 All Centres McqsDocument37 pagesPma 147 All Centres McqsMuhammad Hassan RazaPas encore d'évaluation

- National Holidays in Pakistan For The 2017Document3 pagesNational Holidays in Pakistan For The 2017tessPas encore d'évaluation

- F4-15-2022 Inspector Customs, Intelligence OfficerDocument11 pagesF4-15-2022 Inspector Customs, Intelligence OfficerAdv Nayyar HassanPas encore d'évaluation

- Pakistan Basic (Pakmcqs)Document209 pagesPakistan Basic (Pakmcqs)Wahab Ahmed KhanPas encore d'évaluation

- Manual of ExaminationsDocument210 pagesManual of ExaminationsfahimafridiPas encore d'évaluation

- Building StoneDocument14 pagesBuilding StoneLala OwaisPas encore d'évaluation

- FCL 49 11dec2023 15dec2023 Revised 09dec2023Document141 pagesFCL 49 11dec2023 15dec2023 Revised 09dec2023qureshi586Pas encore d'évaluation

- SNGPLDocument4 pagesSNGPLAli HassanPas encore d'évaluation

- Ghuriakhel ShajrahDocument1 pageGhuriakhel ShajrahHaider AliPas encore d'évaluation

- South Asian Sociities Are Woven Not Around States But Around Plural Cultures and Indentities PDFDocument15 pagesSouth Asian Sociities Are Woven Not Around States But Around Plural Cultures and Indentities PDFCSS DataPas encore d'évaluation

- Jobs 1Document4 pagesJobs 1Qasim shahPas encore d'évaluation

- AD MechanicalDocument14 pagesAD MechanicalNATIONAL PRODUCTIVITY ORGANIZATION FAISALABADPas encore d'évaluation

- Lahore Bibliography 2001-2007Document21 pagesLahore Bibliography 2001-2007mairaxeroPas encore d'évaluation

- 01 2021 1 00044631 Application FormDocument2 pages01 2021 1 00044631 Application FormSher AfsarPas encore d'évaluation

- Struggle For Islamic State and Society: An Analysis of Syed Ahmad Shaheed'S Jihad MovementDocument14 pagesStruggle For Islamic State and Society: An Analysis of Syed Ahmad Shaheed'S Jihad MovementBaqirPas encore d'évaluation

- Hydel Potential in PakistanDocument112 pagesHydel Potential in PakistanpakinokiaPas encore d'évaluation

- Project Brief - Eco-Tourism Camping Villages July 2022Document3 pagesProject Brief - Eco-Tourism Camping Villages July 2022Leonardo MogollonPas encore d'évaluation

- Proposal For Smart Card System For Route PermitDocument5 pagesProposal For Smart Card System For Route PermitArshad Khan AfridiPas encore d'évaluation

- Khan Muhammad: PeshawarDocument3 pagesKhan Muhammad: PeshawarBilalKhanPas encore d'évaluation

- Federally Administered Tribal Areas of Pakistan: Ipri Paper 10Document50 pagesFederally Administered Tribal Areas of Pakistan: Ipri Paper 10KidsPas encore d'évaluation

- Writ Petition 1932-2015Document24 pagesWrit Petition 1932-2015Shehzad HaiderPas encore d'évaluation

- Null 4Document257 pagesNull 4farah nazPas encore d'évaluation

- 2-UC-wise Vacant Positions of PST (BPS-12) in District NOWSHERADocument2 pages2-UC-wise Vacant Positions of PST (BPS-12) in District NOWSHERAsadia bibiPas encore d'évaluation

- Parliamentarians' Tax DirectoryDocument19 pagesParliamentarians' Tax DirectoryAfreen MirzaPas encore d'évaluation

- Population Expansion in Pakistan A Historical Overview of Census DataDocument6 pagesPopulation Expansion in Pakistan A Historical Overview of Census DataAli Jan MemonPas encore d'évaluation

- Syllabus For Ma HistoryDocument14 pagesSyllabus For Ma Historymehak chacharPas encore d'évaluation

- PSP Notifications Dated 25-01-2024..Document8 pagesPSP Notifications Dated 25-01-2024..Life Lines Urdu Poetry Urdu Ghazal,Pas encore d'évaluation