Académique Documents

Professionnel Documents

Culture Documents

University of Saint Anthony's Guide to Economic Growth

Transféré par

Ally Gelay0 évaluation0% ont trouvé ce document utile (0 vote)

130 vues20 pagesThe document discusses economic growth and its measurement. It defines economic growth as an increase in the market value of goods and services produced over time, usually measured as the percent change in real GDP. Growth can occur through intensive growth from more efficient use of inputs or extensive growth from increases in inputs like capital and population. An economy experiences growth when its production possibility frontier shifts outward due to factors like new technology, investment, specialization, and increasing its labor force or resources.

Description originale:

Economics

Titre original

Economic Growth

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document discusses economic growth and its measurement. It defines economic growth as an increase in the market value of goods and services produced over time, usually measured as the percent change in real GDP. Growth can occur through intensive growth from more efficient use of inputs or extensive growth from increases in inputs like capital and population. An economy experiences growth when its production possibility frontier shifts outward due to factors like new technology, investment, specialization, and increasing its labor force or resources.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

130 vues20 pagesUniversity of Saint Anthony's Guide to Economic Growth

Transféré par

Ally GelayThe document discusses economic growth and its measurement. It defines economic growth as an increase in the market value of goods and services produced over time, usually measured as the percent change in real GDP. Growth can occur through intensive growth from more efficient use of inputs or extensive growth from increases in inputs like capital and population. An economy experiences growth when its production possibility frontier shifts outward due to factors like new technology, investment, specialization, and increasing its labor force or resources.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 20

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

Economic growth

- is the increase in the market value of the goods and services produced by

an economy over time. It is conventionally measured as the percent rate of increase in real gross

domestic product, or real GDP. Of more importance is the growth of the ratio of GDP to

population (GDP per capita), which is also called per capita income. An increase in growth

caused by more efficient use of inputs is referred to as intensive growth. GDP growth caused

only by increases in inputs such as capital, population or territory is called extensive growth.

Growth is usually calculated in real terms to eliminate the distorting effect of inflation on

the price of goods produced. Measurement of economic growth uses national income

accounting. In economics, "economic growth" or "economic growth theory" typically refers to

growth of potential output. As an area of study, economic growth is generally distinguished

from development economics. The former is primarily the study of how countries can advance

their economies. The latter is the study of the economic aspects of the development process in

low-income countries. Since economic growth is measured as the annual percent change of gross

domestic product (GDP), it has all the advantages and drawbacks of that measure. For example,

GDP only measures the market economy, which tends to overstate growth during the change

over from a farming economy with household production. An adjustment was made for food

grown on and consumed on farms, but no correction was made for other household production.

Also, there is no allowance in GDP calculations for depletion of natural resources.

Economic growth has two meanings:

Firstly, and most commonly, growth is defined as an increase in the output that an

economy produces over a period of time, the minimum being two consecutive quarters.

The second meaning of economic growth is an increase in what an economy can produce

if it is using all its scarce resources. An increase in an economys productive potential can

be shown by an outward shift in the economys production possibility frontier (PPF).

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

The simplest way to show economic growth is to bundle all goods into two basic

categories, consumer and capital goods. An outward shift of a PPF means that an economy has

increased its capacity to produce.

What creates growth?

When using a PPF, growth is defined as an increase in potential output over time, and

illustrated by an outward shift in the curve. An outward shift of a PPF means that an economy

has increased its capacity to produce all goods. This can occur when the economy undertakes

some or all of the following:

Employs new technology

Investment in new technology increases potential output for all goods and services

because new technology is inevitably more efficient than old technology. Widespread

'mechanisation' in the 18th and 19th centuries enabled the UK to generate vast quantities of

output from relatively few resources, and become the world's first fully industrialised economy.

In recent times, China's rapid growth rate owes much to the application of new technology to the

manufacturing process.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

An economy will not be able to grow if an insufficient amount of resources are allocated

to capital goods. In fact, because capital depreciates some resources must be allocated to capital

goods for an economy to remain at its current size, let alone for it to grow.

Employs a division of labour, allowing specialization

A division of labour refers to how production can be broken down into separate tasks,

enabling machines to be developed to help production, and allowing labour to specialize on a

small range of activities. A division of labour, and specialization, can considerably improve

productive capacity, and shift the PPF outwards.

Employs new production methods

New methods of production can increase potential output. For example, the introduction

of team working to the production of motor vehicles in the 1980s reduced wastage and led to

considerable efficiency improvements. The widespread use of computer controlled production

methods, such as robotics, has dramatically improved the productive potential of many

manufacturing firms.

Increases its labour force

Growth in the size of the working population enables an economy to increase its potential

output. This can be achieved through natural growth, when the birth rate exceeds the death rate,

or through net immigration, when immigration is greater than emigration.

Discovers new raw materials

Discoveries of key resources, such as oil, increase an economys capacity to produce.

An inward shift of a PPF

A PPF will shift inwards when an economy has suffered a loss or exhaustion of some of

its scarce resources. This reduces an economy's productive potential.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

A PPF will shift inwards if:

Resources run out

If key non-renewable resources, like oil, are exhausted the productive capacity of an

economy may be reduced. This happens more quickly as a result of the application of ultra-

efficient production methods, and when countries over-specialise in producing goods from non-

renewable resources.

Sustainable growth means that the current rate of growth is not so fast that future

generations are denied the benefit of scarce resources, such as non-renewable resources, and a

clean environment.

Failure to invest

A failure to invest in human and real capital to compensate for depreciation will reduce

an economy's capacity. Real capital, such as machinery and equipment, wears out with use and

its productivity falls over time. As the output from real capital falls, the productivity of labour

will also fall. The quality and productivity of labour also depends on the acquisition of new

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

skills. Therefore, if an economy does not invest in people and technology its PPF will slowly

move inwards.

Erosion of infrastructure

A military conflict is likely to destroy factories, people, communications, and

infrastructure.

Natural disaster

If there is a natural disaster, such as the 2005 boxing-day tsunami, or the Haiti earthquake

of 2010, an economys PPF will shift inwards.

Investment and economic growth

Allocating scarce funds to capital goods, such as machinery, is referred to as

realinvestment. If an economy chooses to produce more capital goods than consumer goods, at

point A in the diagram, then it will grow by more than if it allocated more resources to consumer

goods, at point B, below.

To achieve long run growth the economy must use more of its capital resources to

produce capital rather than consumer goods. As a result, standards of living are reduced in the

short run, as resources are diverted away from private consumption. However, the increased

investment in capital goods enables more output of consumer goods to be produced in the long

run. This means that standards of living can increase in the future by more than they would have

if the economy had not made such as short-term sacrifice. Hence economies face a choice

between high levels of consumption in the short run and the long run.

Investment

If an economy chooses to produce more capital goods than consumer goods, at point A in

the diagram, then it will grow by more than if it allocated more resources to consumer goods, at

point B.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

There is a trade-off between the short and the long run. In the short run, the economy

must use resources to produce capital rather than consumer goods. Standards of living are

reduced in the short run, as resources are diverted away from private consumption. However, in

the longer run the increased investment in capital goods enables more output of consumer goods

to be produced. This means that standards of living can increase by more than they would have if

the economy had not made the short-term sacrifice.

Asymmetric growth

An economy can grow because of an increase in productivity in one sector of the

economy - this is called asymmetric growth.

For example, an improvement in technology applied to industry Y, such as motor

vehicles, but not to X, such as food production, would be illustrated by a shift of the PPF from

the Y-axis only.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

Factor mobility

If workers, or other resources, are moved from one sector to another, then the position of

the PPF will change, with an increase in the maximum output in the industry receiving the

resources, and a fall in the maximum output of the industry losing resources.

Other Factors Affecting Economic Growth

1. Productivity

Increases in productivity have historically been the most important source of real per

capita economic growth. Increases in productivity lower the cost of goods, which is called a shift

in supply. Over the 20th century the real price of many goods fell by over 90%. Lower prices

create an increase in aggregated demand, but demand for individual goods and services is subject

to diminishing marginal utility.

Historical sources of productivity growth

Economic growth has traditionally been attributed to the accumulation of human and

physical capital, and increased productivity arising from technological innovation.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

Before industrialization, technological progress resulted in an increase in population,

which was kept in check by food supply and other resources, which acted to limit per capita

income, a condition known as the Malthusian trap. The rapid economic growth that occurred

during the Industrial Revolution was remarkable because it was in excess of population growth,

providing an escape from the Malthusian trap. Countries that industrialized eventually saw their

population growth slow, a condition called demographic transition.

Increases in productivity are the major factor responsible for per capita economic growth

this has been especially evident since the mid-19th century. Most of the economic growth in

the 20th century was due to reduced inputs of labor, materials, energy, and land per unit of

economic output (less input per widget). The balance of growth has come from using more

inputs overall because of the growth in output (more widgets or alternately more value added),

including new kinds of goods and services (innovations).

During the Industrial Revolution, mechanization began to replace hand methods in

manufacturing, and new processes streamlined production of chemicals, iron, steel, and other

products. Machine tools made the economical production of metal parts possible, so that parts

could be interchangeable.

During the Second Industrial Revolution, a major factor of productivity growth was the

substitution of inanimate power for human and animal labor. Also there was a great increase

power as steam powered electricity generation and internal combustion supplanted limited wind

and water power. Since that replacement, the great expansion of total power was driven by

continuous improvements in energy conversion efficiency. Other major historical sources of

productivity were automation, transportation infrastructures (canals, railroads, and

highways), new materials (steel) and power, which includes steam and internal combustion

engines and electricity. Other productivity improvements included mechanized agriculture and

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

scientific agriculture including chemical fertilizers and livestock and poultry management, and

the Green Revolution. Interchangeable parts made with machine tools powered by electric

motors evolved into mass production, which is universally used today.

Productivity lowered the cost of most items in terms of work time required to purchase.

Real food prices fell due to improvements in transportation and trade, mechanized

agriculture, fertilizers, scientific farming and the Green Revolution. Great sources of productivity

improvement in the late 19th century were railroads, steam ships, horse-pulled reapers and

combine harvesters, and steam-powered factories. The invention of processes for making

cheap steel were important for many forms of mechanization and transportation. By the late 19th

century both prices and weekly work hours fell because less labor, materials, and energy were

required to produce and transport goods. However, real wages rose, allowing workers to improve

their diet, buy consumer goods and afford better housing.

2. Demographic changes

Demographic factors influence growth by changing the employment to population ratio

and the labor force participation rate. Because of their spending patterns the working age

population is an important source of aggregate demand. Other factors affecting economic growth

include the quantity and quality of available natural resources, including land.

Industrialization creates a demographic transition in which birth rates decline and the

average age of the population increases. Women with fewer children and better access market

employment tend to join the labor force in higher percentages. There is a reduced demand for

child labor and children spend more years in school.

3. Income equality

Inequality in wealth and income is negatively correlated with subsequent economic

growth. A strong demand for redistribution will occur in societies where much of the population

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

does not have access to productive resources. Rational voters have to internalize this dynamic

problem of social choice. 2013 Economics Nobel prize winner Robert J. Shillersaid that rising

inequality in the United States and elsewhere is the most important problem.

Increasing inequality harms economic growth. High and persistent unemployment, in

which inequality increases, has a negative effect on subsequent long-run economic growth.

Unemployment can harm growth not only because it is a waste of resources, but also because it

generates redistributive pressures and subsequent distortions, drives people to poverty, constrains

liquidity limiting labor mobility, and erodes self-esteem promoting social dislocation, unrest and

conflict. Policies aiming at controlling unemployment and in particular at reducing its inequality-

associated effects support economic growth.

Theories popular from the 1970s to 2011 incorrectly stated that inequality had a positive

effect on economic development. Savings by the wealthy, which increases with inequality, was

thought to offset reduced consumer demand. The International Monetary Fund determined that

the analysis based on comparing yearly equality figures to yearly growth rates was flawed and

misleading because it takes several years for the effects of equality changes to manifest in

economic growth changes.

The credit market imperfection approach, developed by Galor and Zeira (1993),

demonstrates that inequality in the presence of credit market imperfections has a long lasting

detrimental effect on human capital formation and economic development.

The political economy approach, developed by Alesina and Rodrik (1994) and Persson

and Tabellini (1994), argues that inequality is harmful for economic development because

inequality generates a pressure to adopt redistributive policies that have an adverse effect on

investment and economic growth.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

Evidence

A study by Perotti (1996) examines of the channels through which inequality may affect

economic growth. He shows that in accordance with the credit market imperfection approach,

inequality is associated with lower level of human capital formation (education, experience,

apprenticeship) and higher level of fertility, while lower level of human capital is associated with

lower growth and lower levels of economic growth. In contrast, his examination of the political

economy channel refutes the political economy mechanism. He demonstrates that inequality is

associated with lower levels of taxation, while lower levels of taxation, contrary to the theories,

are associated with lower level of economic growth

.

4. Business cycle

Economists distinguish between short-run economic changes in production and long-run

economic growth. Short-run variation in economic growth is termed the business cycle. The

business cycle is made up of booms and drops in production that occur over a period of months

or years.Generally, economists attribute the ups and downs in the business cycle to fluctuations

in aggregate demand. In contrast, economic growth is concerned with the long-run trend in

production due to structural causes such as technological growth and factor accumulation. The

business cycle moves up and down, creating fluctuations around the long-run trend in economic

growth.

Theories and Models

1. Classical Growth Theory

In classical (Ricardian) economics, the theory of production and the theory of growth are

based on the theory or law of variable proportions, whereby increasing either of the factors of

production (labor or capital), while holding the other constant and assuming no technological

change, will increase output, but at a diminishing rate that eventually will approach zero. These

concepts have their origins in Thomas Malthuss theorizing about agriculture. Malthuss

examples included the number of seeds harvested relative to the number of seeds planted

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

(capital) on a plot of land and the size of the harvest from a plot of land versus the number of

workers employed.

Criticisms of classical growth theory are that technology, the most important factor in

economic growth, is held constant and that economies of scale are ignored.

2. The neoclassical model

The notion of growth as increased stocks of capital goods was codified as the Solow-

Swan Growth Model, which involved a series of equations that showed the relationship between

labor-time, capital goods, output, and investment. According to this view, the role

of technological change became crucial, even more important than the accumulation of capital.

This model, developed by Robert Solow

[55]

and Trevor Swan

[56]

in the 1950s, was the first

attempt to model long-run growth analytically. This model assumes that countries use their

resources efficiently and that there are diminishing returns to capital and labor increases. From

these two premises, the neoclassical model makes three important predictions. First, increasing

capital relative to labor creates economic growth, since people can be more productive given

more capital. Second, poor countries with less capital per person grow faster because each

investment in capital produces a higher return than rich countries with ample capital. Third,

because of diminishing returns to capital, economies eventually reach a point where any increase

in capital no longer creates economic growth. This point is called a steady state.

The model also notes that countries can overcome this steady state and continue growing

by inventing new technology. In the long run, output per capita depends on the rate of saving, but

the rate of output growth should be equal for any saving rate. In this model, the process by which

countries continue growing despite the diminishing returns is "exogenous" and represents the

creation of new technology that allows production with fewer resources. Technology improves,

the steady state level of capital increases, and the country invests and grows. The data do not

support some of this model's predictions, in particular, that all countries grow at the same rate in

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

the long run, or that poorer countries should grow faster until they reach their steady state. Also,

the data suggest the world has slowly increased its rate of growth.

Criticisms of the neo-classical growth model are that:

1.) it does not account for differing rates of return for different capital investments, and

2.) increasing capital creates a growing burden of depreciation. It is also noted that the

economic life of capital assets has been declining.

3. Salter cycle

The Salter cycle is one of economies of scale and learning-by-doing that lowers

production costs. Lowered cost increases demand, resulting in another cycle of new capacity

which leads to greater economies of scale and more learning by doing. The cycle repeats until

markets become saturated due to diminishing marginal utility.

4. Endogenous growth theory

Growth theory advanced again with theories of economist Paul Romer and Robert Lucas,

Jr. in the late 1980s and early 1990s.

Unsatisfied with Solow's explanation, economists worked to "endogenize" technology in

the 1980s. They developed the endogenous growth theory that includes a mathematical

explanation of technological advancement. This model also incorporated a new concept

of human capital, the skills and knowledge that make workers productive. Unlike physical

capital, human capital has increasing rates of return. Therefore, overall there are constant returns

to capital, and economies never reach a steady state. Growth does not slow as capital

accumulates, but the rate of growth depends on the types of capital a country invests in. Research

done in this area has focused on what increases human capital (e.g. education) or technological

change.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

Heterodox views

There are also various heterodox theories that downplay or reject the neo-classical model

and classical growth theory.

5. Energy consumption and efficiency theories

Energy economic theories emphasize the role of energy consumption and energy

efficiency as important historical causes of economic growth. Increases in energy efficiency

were an portion of the increase in Total factor productivity. Some of the most technologically

important innovations in history involved increases in energy efficiency. These include the great

improvements in efficiency of conversion of heat to work, the reuse of heat, the reduction in

friction and the transmission of power, especially through electrification.

6. Unified growth theory

Unified growth theory was developed by Oded Galor and his co-authors to address the

inability of endogenous growth theory to explain key empirical regularities in the growth

processes of individual economies and the world economy as a whole. Endogenous growth

theory was satisfied with accounting for empirical regularities in the growth process of

developed economies over the last hundred years. As a consequence, it was not able to explain

the qualitatively different empirical regularities that characterized the growth process over longer

time horizons in both developed and less developed economies. Unified growth theories are

endogenous growth theories that are consistent with the entire process of development, and in

particular the transition from the epoch of Malthusian stagnation that had characterized most of

the process of development to the contemporary era of sustained economic growth.

7. The big push

One popular theory in the 1940s was the Big Push, which suggested that countries needed

to jump from one stage of development to another through a virtuous cycle, in which large

investments in infrastructure and education coupled with private investments would move the

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

economy to a more productive stage, breaking free from economic paradigms appropriate to a

lower productivity stage.

8. Schumpeterian growth

Schumpeterian growth is an economic theory named after the 20th-

century Austrian economist Joseph Schumpeter. Unlike other economic growth theories, his

approach explains growth by innovation as a process of creative destruction that captures the

dual nature of technological progress: in terms of creation, entrepreneurs introduce new products

or processes in the hope that they will enjoy temporary monopoly-like profits as they capture

markets. In doing so, they make old technologies or products obsolete.

This is the creative destruction referred to by Schumpeter, which could also be referred to

as the annulment of previous technologies, which makes them obsolete, and "...destroys the rents

generated by previous innovations." (Aghion 855) A major model that illustrates Schumpeterian

growth is the Aghion-Howitt model.

Institutions and Growth

According to Acemolu, Simon Johnson and James Robinson, the positive correlation

between high income and cold climate is a by-product of history. Europeans adopted very

different colonization policies in different colonies, with different associated institutions. In

places where these colonizers faced high mortality rates, they could not settle permanently, and

they were thus more likely to establish extractive institutions, which persisted after

independence; in places where they could settle permanently (e.g. those with temperate

climates), they established institutions with this objective in mind and modeled them after those

in their European homelands. In these 'neo-Europes' better institutions in turn produced better

development outcomes. Thus, although other economists focus on the identity or type of legal

system of the colonizers to explain institutions, these authors look at the environmental

conditions in the colonies to explain institutions. For instance, former colonies have inherited

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

corrupt governments and geo-political boundaries (set by the colonizers) that are not properly

placed regarding the geographical locations of different ethnic groups, creating internal disputes

and conflicts that hinder development. In another example, societies that emerged in colonies

without solid native populations established better property rights and incentives for long-term

investment than those where native populations were large.

Human capital and growth

One ubiquitous element of both theoretical and empirical analyses of economic growth is

the role of human capital. The skills of the population enter into both neoclassical and

endogenous growth models. The most commonly used measure of human capital is the level of

school attainment in a country, building upon the data development of Robert Barro and Jong-

Wha Lee. This measure of human capital, however, requires the strong assumption that what is

learned in a year of schooling is the same across all countries. It also presumes that human

capital is only developed in formal schooling, contrary to the extensive evidence that families,

neighborhoods, peers, and health also contribute to the development of human capital. To

measure human capital more accurately, Eric Hanushek and Dennis Kimko introduced measures

of mathematics and science skills from international assessments into growth analysis. They

found that quality of human capital was very significantly related to economic growth. This

approach has been extended by a variety of authors, and the evidence indicates that economic

growth is very closely related to the cognitive skills of the population.

The Power of Exponential Growth

The large impact of a relatively small growth rate over a long period of time is due to the

power of exponential growth. A growth rate of 2.5% per annum leads to a doubling of the GDP

within 29 years, while a growth rate of 8% per annum leads to a doubling of GDP within 9 years.

Thus, a small difference in economic growth rates between countries can result in very different

standards of living for their populations if this small difference continues for many years.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

Quality of Life

Happiness has been shown to increase with a higher GDP per capita, at least up to a level

of $15,000 per person.

Economic growth has the indirect potential to alleviate poverty, as a result of a

simultaneous increase in employment opportunities and increase labour productivity.

Increases in employment without increases in productivity leads to a rise in the number

of working poor, which is why some experts are now promoting the creation of "quality" and not

"quantity" in labour market policies. This approach does highlight how higher productivity has

helped reduce poverty in East Asia, but the negative impact is beginning to show. The ODI study

showed that other sectors were just as important in reducing unemployment, as manufacturing.

The services sector is most effective at translating productivity growth into employment

growth. Agriculture provides a safety net for jobs and economic buffer when other sectors are

struggling. This study suggests a more nuanced understanding of economic growth and quality of

life and poverty alleviation.

Negative Effects

A number of arguments have been raised against economic growth. It may be that

economic growth improves the quality of life up to a point, after which it doesn't improve

the quality of life, but rather obstructs sustainable living.

Many earlier predictions of resource depletion, such as Thomas Malthus' 1798

predictions about approaching famines in Europe, The Population Bomb (1968), and the Simon

Ehrlich wager (1980) have not materialized. Diminished production of most resources has not

occurred so far, one reason being that advancements in technology and science have allowed

some previously unavailable resources to be produced. In some cases, substitution of more

abundant materials, such as plastics for cast metals, lowered growth of usage for some metals. In

the case of the limited resource of land, famine was relieved firstly by the revolution in

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

transportation caused by railroads and steam ships, and later by the Green Revolution and

chemical fertilizers, especially the Haber process for ammonia synthesis.

Environmental impact

Critics such as the Club of Rome argue that a narrow view of economic growth,

combined with globalization, is creating a scenario where we could see a systemic collapse of

our planet's natural resources.

Concerns about possible negative effects of growth on the environment and society led

some to advocate lower levels of growth. This led to the ideas of uneconomic growth and de-

growth and Green parties that argue that economies are part of a global society and global

ecology, and cannot outstrip their natural growth without damaging those.

Those more optimistic about the environmental impacts of growth believe that, though

localized environmental effects may occur, large-scale ecological effects are minor. The

argument, as stated by commentator Julian Lincoln Simon, states that if these global-scale

ecological effects exist, human ingenuity will find ways to adapt to them.

Equitable Growth

While acknowledging the central role economic growth can potentially play in human

development, poverty reduction and the achievement of the Millennium Development Goals, it is

becoming widely understood amongst the development community that special efforts must be

made to ensure poorer sections of society are able to participate in economic growth. The effect

of economic growth on poverty reduction - the Growth elasticity of poverty - can depend on the

existing level of inequality. While economic growth is necessary, it is not sufficient for progress

on reducing poverty.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

Conclusion:

If price levels increase significantly, then the nominal GDP may increase but the real

GDP is unchanged. For economic growth to be helpful to the population, the price level must

remain relatively unchanged. In other words, the real GDP must increase. When the economy

can grow significantly and inflation is held stable, the increased income is spread to the

population. This often results in an increase in the standard of living. An increase in the standard

of living entails that people are better off because they have more money to spend on goods and

services sold at a relatively stable price level. When a number of economies are examined over

time, an interesting phenomenon becomes evident. Groups of countries seem to converge in

terms of real GDP per capita. Instead of the rich getting richer and the poor getting poorer, in

terms of economies, similarly organized economies approach one another in the long run.

Within and between economies, economic growth is very important because it directly

affects the well being of the people involved in these economies. Different factors introduced in

this research is important to economic growth. Through a grounding in these subjects, a better

understanding of how the economy grows over time is within reach.

UNIVERSITY OF SAINT ANTHONY

(Dr. Santiago G. Ortega Memorial)

City of Iriga

A Research Activity

on

Submitted by:

Allyssa Gillianne P. Almazan

BSBA-3 Major in Economics

Submitted to:

Mrs. Maria Joy I. Idian, MBA

Vous aimerez peut-être aussi

- Dispute Settlement in WtoDocument23 pagesDispute Settlement in Wtorishabhsingh261Pas encore d'évaluation

- Fiscal PolicyDocument19 pagesFiscal PolicyShreya SharmaPas encore d'évaluation

- International Economics I - Lecture NotesDocument2 pagesInternational Economics I - Lecture NotesMeer Hamza100% (1)

- Problems of Nepalese EconomyDocument16 pagesProblems of Nepalese EconomyChakraKhadkaPas encore d'évaluation

- Economics General Price LevelDocument15 pagesEconomics General Price LevelNeelam FartyalPas encore d'évaluation

- Behavioral Public Finance - Chapter 1Document29 pagesBehavioral Public Finance - Chapter 1Russell Sage FoundationPas encore d'évaluation

- Free Trade & ProtectionDocument14 pagesFree Trade & ProtectionHeoHamHốPas encore d'évaluation

- Theory On Public ExpenditureDocument33 pagesTheory On Public ExpenditureDrRam Singh KambojPas encore d'évaluation

- Assignment On Public FinanceDocument21 pagesAssignment On Public Financepadum chetry100% (1)

- Compare and Contrast The Neo - Classical Understanding of The Economy With Marxist Political EconomyDocument5 pagesCompare and Contrast The Neo - Classical Understanding of The Economy With Marxist Political EconomyJay TharappelPas encore d'évaluation

- Mergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureDocument24 pagesMergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureImran AliPas encore d'évaluation

- Importance of Price Elasticity of Demand and SupplyDocument2 pagesImportance of Price Elasticity of Demand and SupplyMyra AbbasiPas encore d'évaluation

- Capital FormationDocument20 pagesCapital FormationNupoorSharmaPas encore d'évaluation

- Neo-Classical Economics Cannot Provide Solutions To The Problems We Face Today. DiscussDocument10 pagesNeo-Classical Economics Cannot Provide Solutions To The Problems We Face Today. DiscussAdada Mohammed Abdul-Rahim BaturePas encore d'évaluation

- Exchange Rate RegimesDocument31 pagesExchange Rate RegimesDrTroy100% (1)

- Measurement of Economic DevelopmentDocument10 pagesMeasurement of Economic DevelopmentFaisal ShafiquePas encore d'évaluation

- Regulations in IndiaDocument8 pagesRegulations in IndiaHimanshu GuptaPas encore d'évaluation

- Government SpendingDocument11 pagesGovernment SpendingRow TourPas encore d'évaluation

- History of GattDocument38 pagesHistory of GattAdil100% (3)

- Global Production and Supply Chain StrategiesDocument19 pagesGlobal Production and Supply Chain Strategiesrain06021992Pas encore d'évaluation

- Challenges of Tax Administration in GhanaDocument69 pagesChallenges of Tax Administration in GhanaJohn Bates Blankson0% (1)

- Household Behavior and Consumer ChoiceDocument1 pageHousehold Behavior and Consumer ChoiceJollybelleann MarcosPas encore d'évaluation

- Economic Growth and DevelopmentDocument26 pagesEconomic Growth and DevelopmentShofia BaluPas encore d'évaluation

- Rationale For Public Sector InterventionDocument44 pagesRationale For Public Sector Interventionhafsa1989Pas encore d'évaluation

- US-China Trade Conflict - The Bottom Line PDFDocument8 pagesUS-China Trade Conflict - The Bottom Line PDFMurad Ahmed NiaziPas encore d'évaluation

- Dfi 306 Public FinanceDocument134 pagesDfi 306 Public FinanceElizabeth MulukiPas encore d'évaluation

- Government Budget Objectives and ImpactDocument21 pagesGovernment Budget Objectives and ImpactSireen IqbalPas encore d'évaluation

- International Trade Policy NOTES For Professor William J. Davey's CourseDocument35 pagesInternational Trade Policy NOTES For Professor William J. Davey's CourseLewis GPas encore d'évaluation

- Globalization and Environmental Degradation of Developing CountriesDocument22 pagesGlobalization and Environmental Degradation of Developing CountriesMd. Badrul Islam100% (2)

- Public Expenditure Classified by Function, Type & BenefitsDocument7 pagesPublic Expenditure Classified by Function, Type & Benefitsbcomh01097 UJJWAL SINGHPas encore d'évaluation

- MODULE 8 - The Foreign Exchange MarketDocument6 pagesMODULE 8 - The Foreign Exchange Marketkarloncha4385Pas encore d'évaluation

- Tariffs and Trade BarriersDocument7 pagesTariffs and Trade BarriersVara PrasadPas encore d'évaluation

- Managerial Economics Practice Problem SetDocument7 pagesManagerial Economics Practice Problem SetAkshayPas encore d'évaluation

- Indian Takeover CodeDocument10 pagesIndian Takeover CodeMoiz ZakirPas encore d'évaluation

- Advanced Public Finance and TaxationDocument30 pagesAdvanced Public Finance and TaxationAhmedPas encore d'évaluation

- Indian Fiscal PolicyDocument2 pagesIndian Fiscal PolicyBhavya Choudhary100% (1)

- Fiscal FunctionsDocument3 pagesFiscal FunctionsAshashwatmePas encore d'évaluation

- National IncomeDocument4 pagesNational Incomesubbu2raj3372Pas encore d'évaluation

- Mangerial EconomicsDocument55 pagesMangerial EconomicsSandeep GhatuaryPas encore d'évaluation

- GDPDocument5 pagesGDPANNEPas encore d'évaluation

- Micro Economic PolicyDocument472 pagesMicro Economic PolicyMir Shoboocktagin Mahmud Dipu100% (6)

- Public Sector Reform MauritiusDocument2 pagesPublic Sector Reform MauritiusDeva ArmoogumPas encore d'évaluation

- Tax Avoidance and Evasion Impact on Nigeria's Economic GrowthDocument13 pagesTax Avoidance and Evasion Impact on Nigeria's Economic GrowthChe DivinePas encore d'évaluation

- The Heckscher-Ohlin Model + Leontief Paradox SummaryDocument2 pagesThe Heckscher-Ohlin Model + Leontief Paradox SummaryAnaPaperina0% (1)

- Keynesian TheoryDocument98 pagesKeynesian TheorysamrulezzzPas encore d'évaluation

- Origin and Development of World Trade Organisation (WTO) : By: Dr. Piyush ChaubeyDocument8 pagesOrigin and Development of World Trade Organisation (WTO) : By: Dr. Piyush ChaubeyVirendraPas encore d'évaluation

- International Trade TheoriesDocument6 pagesInternational Trade TheoriesQueenie Gallardo AngelesPas encore d'évaluation

- Miller and Modigliani Theory ArticleDocument7 pagesMiller and Modigliani Theory ArticleRenato WilsonPas encore d'évaluation

- Introduction to Macroeconomics: Understanding Aggregates and the Economy (ECON605Document58 pagesIntroduction to Macroeconomics: Understanding Aggregates and the Economy (ECON605Divyankar VarmaPas encore d'évaluation

- Cba 102 Prelim LecturesDocument10 pagesCba 102 Prelim LecturesguevarrarsmPas encore d'évaluation

- Trade: Free Trade Is A Source of Economic GrowthDocument16 pagesTrade: Free Trade Is A Source of Economic GrowthCetty RotondoPas encore d'évaluation

- Public Finance - SyllabusDocument6 pagesPublic Finance - SyllabusJosh RamuPas encore d'évaluation

- 1 WtoDocument16 pages1 WtoPrashant SharmaPas encore d'évaluation

- Infrastructure FundingDocument32 pagesInfrastructure FundingJoseDanielPas encore d'évaluation

- Role of WtoDocument7 pagesRole of Wtomuna1990Pas encore d'évaluation

- Assignment-2 Public Procurement: 1. Part ADocument13 pagesAssignment-2 Public Procurement: 1. Part AAtisha RamsurrunPas encore d'évaluation

- Effects of Tax Avoidance To The Economic Development in Taraba StateDocument75 pagesEffects of Tax Avoidance To The Economic Development in Taraba StateJoshua Bature SamboPas encore d'évaluation

- Claire Angela P. Almazan: ObjectiveDocument2 pagesClaire Angela P. Almazan: ObjectiveAlly GelayPas encore d'évaluation

- Elements of Short StoryDocument4 pagesElements of Short Storykristofer_go18Pas encore d'évaluation

- Cathlyn Nicole I. Lin: ObjectiveDocument2 pagesCathlyn Nicole I. Lin: ObjectiveAlly GelayPas encore d'évaluation

- Environmental Impacts Worksheet - Teacher NotesDocument31 pagesEnvironmental Impacts Worksheet - Teacher NotesAlly GelayPas encore d'évaluation

- 10 1 1 419 2211Document116 pages10 1 1 419 2211Ally GelayPas encore d'évaluation

- HistoryDocument4 pagesHistoryAlly GelayPas encore d'évaluation

- Predicting OutcomesDocument3 pagesPredicting OutcomesAlly GelayPas encore d'évaluation

- Rizal as an Eye Doctor in Hong Kong (1891-1892Document33 pagesRizal as an Eye Doctor in Hong Kong (1891-1892Sherly PabellanoPas encore d'évaluation

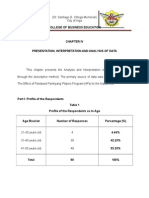

- Chapter IVDocument18 pagesChapter IVAlly GelayPas encore d'évaluation

- Communitychange FinalDocument548 pagesCommunitychange FinalAndreiChertes0% (1)

- Joseph Alois SchumpeterDocument46 pagesJoseph Alois SchumpeterAlly GelayPas encore d'évaluation

- Social Policy: Guidelines and Activities that Affect Living ConditionsDocument2 pagesSocial Policy: Guidelines and Activities that Affect Living ConditionsAlly GelayPas encore d'évaluation

- Twitter Feed Discussing Life LessonsDocument28 pagesTwitter Feed Discussing Life LessonsAlly GelayPas encore d'évaluation

- Ang Totoong "SORRY", Walang Kasunod Na "KASI".: Pinoy QuotesDocument47 pagesAng Totoong "SORRY", Walang Kasunod Na "KASI".: Pinoy QuotesAlly GelayPas encore d'évaluation

- Milton Snavely HersheyDocument10 pagesMilton Snavely HersheyAlly GelayPas encore d'évaluation

- 360 DegreeDocument14 pages360 DegreeJeevan Anthony100% (4)

- Interactive Class ExerciseDocument4 pagesInteractive Class ExercisePage NumberPas encore d'évaluation

- Change Management AssignmentDocument3 pagesChange Management AssignmentAyeshaZahidPas encore d'évaluation

- Abrego v. Baker Landscaping CorporationDocument3 pagesAbrego v. Baker Landscaping CorporationMatthew Seth SarelsonPas encore d'évaluation

- Meriluhill Letter of Interest Pa EducatorDocument1 pageMeriluhill Letter of Interest Pa Educatorapi-356683264Pas encore d'évaluation

- Resume - ManikandanDocument4 pagesResume - ManikandanBaskaran NarayanamoorthyPas encore d'évaluation

- Introducing Advanced Macroeconomics: Growth and Business Cycles (Second)Document832 pagesIntroducing Advanced Macroeconomics: Growth and Business Cycles (Second)anthonyhong78% (41)

- MCQs on OSHC 2020 CodeDocument19 pagesMCQs on OSHC 2020 CodeAMLAN PANDA80% (10)

- Chua Qua Case DigestDocument3 pagesChua Qua Case DigestMarisseAnne CoquillaPas encore d'évaluation

- Construction Industry KPI Report FINAL PDFDocument78 pagesConstruction Industry KPI Report FINAL PDFAbdulrahmanPas encore d'évaluation

- Chapter 13 Managing Human ResourDocument21 pagesChapter 13 Managing Human ResourAbeer AlshebamiPas encore d'évaluation

- Child Labour Within The Framework of Economic Development in CameroonDocument18 pagesChild Labour Within The Framework of Economic Development in CameroonMbua NyanshiPas encore d'évaluation

- RMD Precautions & OptionsDocument2 pagesRMD Precautions & OptionsDoug PotashPas encore d'évaluation

- Bir 1902Document1 pageBir 1902Marc Howard Detera PanganibanPas encore d'évaluation

- Recitals: Sales ContractDocument5 pagesRecitals: Sales ContractIfeOluwaPas encore d'évaluation

- Mobile Tech Resume 3 31 2017Document2 pagesMobile Tech Resume 3 31 2017api-353252492Pas encore d'évaluation

- Quiz - 1Document5 pagesQuiz - 1Nazifa TaslimaPas encore d'évaluation

- Valuation for Interim Payment Certificates GuideDocument7 pagesValuation for Interim Payment Certificates GuideNomanPas encore d'évaluation

- Burden of Proof and PresumptionsDocument34 pagesBurden of Proof and PresumptionsCrnc NavidadPas encore d'évaluation

- D-Man Mech 1st Sem TT-EngDocument174 pagesD-Man Mech 1st Sem TT-Engbal al56Pas encore d'évaluation

- Cost Study Notes on Cost Accounting FundamentalsDocument27 pagesCost Study Notes on Cost Accounting FundamentalsLkjiklPas encore d'évaluation

- Hotel Food and Beverage Controls Term ProjectDocument67 pagesHotel Food and Beverage Controls Term Projectjtbrown4593100% (2)

- NREB internship activities logDocument21 pagesNREB internship activities logflojerz100% (2)

- Method StudyDocument50 pagesMethod StudyArp JainPas encore d'évaluation

- Seemon FinalDocument101 pagesSeemon FinalanujPas encore d'évaluation

- HRM3023 Chapter 8 - Decision Making and Final MatchDocument43 pagesHRM3023 Chapter 8 - Decision Making and Final MatchDKPas encore d'évaluation

- Hbo Finals ReviewerDocument6 pagesHbo Finals ReviewerMargaveth P. BalbinPas encore d'évaluation

- Written Assignment Format: Name: Ankita Joshi Due Date / Day: 14-9-2010 Class: Div A Roll No: 2703111 Subject: T& DDocument6 pagesWritten Assignment Format: Name: Ankita Joshi Due Date / Day: 14-9-2010 Class: Div A Roll No: 2703111 Subject: T& DPranav SabharwalPas encore d'évaluation

- FORM IX-A Abstract Under The Minimum Wages Act, 1948 (English Version)Document2 pagesFORM IX-A Abstract Under The Minimum Wages Act, 1948 (English Version)Abhishek ChaurasiaPas encore d'évaluation

- Choosing Techniques and Capital Intensity in DevelopmentDocument12 pagesChoosing Techniques and Capital Intensity in DevelopmentShruthi ThakkarPas encore d'évaluation