Académique Documents

Professionnel Documents

Culture Documents

DMB Booklet FH14 Version English

Transféré par

sodbayargCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DMB Booklet FH14 Version English

Transféré par

sodbayargDroits d'auteur :

Formats disponibles

1

THE DEVELOPMENT

BANK OF MONGOLIA

SUMMARY REPORT

FOR THE FIRST-HALF OF 2014

2

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014 3

4

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

TYPES OF DEVELOPMENT BANKS

Policy bank a type of bank that is exists in countries

such as Japan, the PRC, the Republic of Korea and

Malaysia, and which directly supports government

economic policies and planning.

Special-purpose financial institution an entity that has

a specific organisational structure and duties such as

small- and medium-enterprise development (Thailand),

agricultural intensification (India), infrastructure

(Malaysia), environmental protection (the Federal Republic

of Germany), housing (in most countries), etc.

Universal bank a type of bank that concurrently grants

multiple types of financing in addition to development

policy financing (Philippines, Indonesia and India).

Commercial development bank a bank that operates

under purely commercial principles and supports economic

development (Singapore).

A DEVELOPMENT BANK IS A

FINANCIAL INSTITUTION WHICH

IS OBLIGATED TO PROVIDE WITH

REQUIRED FINANCING AND

PROFESSIONAL ADVICES FOR

ACHIEVING THE SOCIO-ECONOMIC

DEVELOPMENT OBJECTIVES OF A

PARTICULAR COUNTRY.

WHAT IS A

DEVELOPMENT BANK?

THE DEVELOPMENT BANK

OF MONGOLIA IS

A POLICY BANK.

5

As loans granted by domestic commercial banks have had

a relatively high interest rate, were shorttermed and

imposed limits on the maximum amount of loans being

granted, financing opportunities for major projects which

would support economic development were limited. Also,

as the foreign trade balance of our country is in deficit,

and our infrastructure development is relatively weak, it

has been necessary to create a development bank.

On 20 July 2010, the Government of Mongolia decided to

establish the Development Bank of Mongolia. Following

that, on 10 February 2011, the Parliament of Mongolia

enacted the Law on the Development Bank of Mongolia,

stipulating that the Development Bank will be a

state-owned for-profit legal entity with the specific

functions of conducting activities aimed at financing

major projects and programmes for the development of

Mongolia.

When raising financial sources, the Development Bank

operates in accordance with approval obtained the scope

of guarantee by the Government.

TO BE A LEADING INSTITUTION

INSTIGATING FINANCIAL

SOLUTIONS WHICH ENSURE

AND DIVERSIFY SUSTAINABLE

ECONOMIC DEVELOPMENT IN

MULTIPLE SECTORS, SUPPORT

MANUFACTURING OF VALUE

ADDED PRODUCTS, AND

CONSOLIDATE AND IMPLEMENT

THE COUNTRYS DEVELOPMENT

POLICIES.

TO MAKE MONGOLIA A

DEVELOPED COUNTRY RANKING

HIGH IN COMPETITIVENESS AND

ECONOMIC STRENGTH.

VISION

MISSION

THE DEVELOPMENT

BANK OF MONGOLIA

6

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

HOW BIG IS THE DEVELOPMENT BANK OF MONGOLIA?

THE TOTAL CAPITAL OF BANKS; BANKS ASSETS AS OF THE FIRST-HALF OF 2014

The Development Bank of Mongolia

Trade and Development Bank

Khan Bank

Golomt Bank

Xac Bank

UB City Bank

Capital Bank

Chinggis Khaan Bank

Capitron Bank

National Investment Bank

Erel Bank

Trans Bank

Credit Bank

State Bank

1.000 2.000 3.000 4.000 5.000 6.000

INVESTMENTS MADE BY THE DEVELOPMENT

BANK OF MONGOLIA EXCEED INVESTMENTS

BY THE STATES BUDGET FUNDS. THIS

INDICATES THE DEVELOPMENT BANKS

MAJOR ROLE IN OUR COUNTRYS ECONOMY.

In billion MNT

billion MNT billion MNT

EXPENSES OF

INVESTMENTS BY THE

STATES BUDGET FUNDS

(2013)

LOANS AND

ADVANCES GRANTED

BY THE DEVELOPMENT

BANK (2013)

1,447 1,686

SOURCE: The National Statistical Office

7

12 May 2011

Launched its

operations

31 December 2011 31 December 2012 31 December 2013 Since 2014

CORPORATE

GOVERNANCE

THE DEVELOPMENT BANKS FINANCIAL STATEMENTS AND REPORTS

ARE VERIFIED BY INDEPENDENT AUDITING EACH YEAR AND IT IS

FOUND THAT THE BANK COMMITTED NO VIOLATION OR BREACH,

AND ITS LOAN FINANCING IS ENSURED WITH COLLATERAL AND

GUARANTEES IN EXCESS OF THE APPLICABLE REQUIREMENTS.

Nomination Subcommittee

Remuneration Subcommittee

Internal Audit Subcommittee

Executive Management Committee

Assets and Liabilities Committee

Loan Committee

Risk Management Committee

SHAREHOLDERS MEETING

(The Government of Mongolia)

BOARD OF MANAGEMENT

EXECUTIVE MANAGEMENT

Assets and Liabilities

Management Department

Risk Management

Department

Monitoring &

Administrative Department

Investment

Department

Loan Department

THE DEVELOPMENT BANK OF MONGOLIA WILL GRANT LOANS FOR FINANCING MAJOR PROJECTS AND PROGRAMMES

FOR THE COUNTRYS DEVELOPMENT APPROVED BY THE PARLIAMENT OF MONGOLIA. DURING ITS SPRING SESSION

EACH YEAR THE PARLIAMENT WILL APPROVE A LIST OF PROJECTS AND PROGRAMMES TO BE FINANCED.

(Clause 8.1, Article 8, Section 2, the Law on the Development Bank of Mongolia)

Audited twice Twice

8

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

THE DEVELOPMENT BANK OF MONGOLIA

THE STATE AND CIVIL SOCIETY REPRESENTATIVES

INTERNATIONAL FINANCIAL INSTITUTIONS

SUPPORT ECONOMIC DEVELOPMENT

THE BANK IS UNDER DUTY TO FINANCE PROJECTS RELATED TO THE

SECTORS THAT ARE ESSENTIAL FOR ECONOMIC DEVELOPMENT

FUNDINGS FROM THE ISSUE OF BONDS AND SOFT LOANS MAINLY

RAISED FROM INTERNATIONAL FINANCIAL MARKETS AS WELL AS

FUNDINGS FROM OTHER INTERNATIONAL FINANCIAL INSTITUTIONS

LOANS INTEREST RATE IS LOWER AND AMOUNT IS GREATER

LOANS ARE GRANTED IRRESPECTIVE OF TIME FRAME

FLEXIBLE REQUIREMENTS IN TERMS OF COLLATERAL

MEDIUM AND/OR LONG-TERM FINANCIAL CAPACITY

THE AIM

BUSINESS OPPORTUNITIES

LOAN TERMS

STUDIES

REGARDING PROJECTS

FUNDINGS

SOURCES

SUPERVISION

9

COMMERCIAL BANKS

MANAGEMENT BY THE BANK ITSELF AS WELL AS BY THE MONGOLBANK

LOAN AMOUNT LIMITATION AND HIGH INTEREST RATE

SHORT OR MEDIUM-TERM LOANS ARE GRANTED

STRICT REQUIREMENTS IN TERMS OF COLLATERAL

BALANCE AND FINANCIAL STATEMENTS AS WELL AS

FINANCIAL CAPACITY OF BORROWERS

SEEK TO INVEST IN PROFITABLE

BUSINESSES

MAINLY CURRENT AND SAVINGS ACCOUNTS

BUSINESS PROFIT

AS FAR AS THE DEVEL-

OPMENT BANK IS CON-

CERNED, ECONOMIC,

SOCIAL AND ECOLOGICAL

PARAMETERS ARE IMPORT-

ANT IN ADDITION TO

PROFIT.

AS FOR FINANCE, EARN-

ING THE MAXIMUM PROFIT

IS NOT OUR PRIMARY

PURPOSE IN COMPARISON

WITH OTHER FINANCIAL

INSTITUTIONS.

10

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

CHRONOLOGY

The official opening of the

Development Bank of Mongolia

took place and its operations

commenced.

12 May 2011

The Development Bank of Mongolia

successfully issued USD580 million

bonds.

The Bank organised meetings with

investors in Hong Kong, Singapore

and London, the world financial

market centres, and for the

first time via open subscription,

traded 5year bonds, guaranteed

by the Government of Mongolia,

of USD580 million in value at

an interest rate of 5.75% in the

international markets.

21 March 2012

The Development Bank of

Mongolia granted its first

financing to road projects.

In accordance with

Government Resolutions

Nos.47, 110, 106, 336, 124

and 105 dated 2012, the

Development Bank granted

MNT202,5 billion in total

to road projects in 2012,

enabling the commencement

of construction of 1,280 km

of roads.

6 August 2012

The Development Bank of

Mongolia received an award

from the Bloomberg Television

Mongolia.

During the closing ceremony

of the economic forum

of Mongolia 2012, the

Bloomberg Television granted

its Best Debut Bond award

to the Development Bank

team that had successfully

issued the bonds, guaranteed

by the Government of

Mongolia, in the international

markets for the first time.

31 December 2012

The Development Bank of Mongolia

and the Korea Development Bank

entered into a Management

contract. An open international

bid was announced by the State

Property Committee for competitive

selection of an experienced

team to implement the executive

management of the Development

Bank of Mongolia, resulting in the

selection of the Korea Development

Bank. It was decided that the Banks

executive management would be

implemented by a joint team from

the Development Bank of Mongolia

and the Korea Development Bank

that had been selected through the

international bid.

30 August 2011

The Development Bank of

Mongolia granted financing to

the housing-purpose soft loan

project. Under Government

Resolution No.55 dated 2012

and for the programme

Project for granting housing-

purpose soft loans to citizens

at an interest rate of up to 6%

per annum, the Development

Bank of Mongolia granted

MNT50 billion to the State

Bank in 2012.

15 June 2012

Under Government Resolution

No.148 dated 2012, the

Development Bank of

Mongolia granted USD100

million financing to Erdenes

Tavantolgoi JSC. The projects

activities will lead to the

development of the mining,

energy and other economic

sectors.

5 October 2012

MIAT JSC (Mongolian Civil Aviation

Corporation) purchased an aircraft of

767300R model in May 2013. This

purchase is of significant importance in

supporting Mongolias aviation industry

development by increasing MIAT JSCs

operational effectiveness. Considering

the significance of this purchase, the

Development Bank of Mongolia lent in

total USD83,9 million including USD5,34

million toward the aircrafts advance

payment on 20 June 2012 and a bridge

loan of USD78,55 million on 7 May

2013 toward the principal payment, in

accordance with Government Resolution

No.137.

7 May 2013

11

Government Resolution No.180

dated 18 May 2013 approved the

finance of a togrog equivalent

of up to USD14 million required

for implementation of the project

Housing construction industrial

complex1 within the scope

of the medium-term target

programme New Development

and the work to provide citizens

with housing by way of entering

into a direct loan contract in

2013, and financing through the

Development Bank with the capital

raised via Government securities

trading.

18 May 2013

During the official visit of Altankhuyag N.,

Prime Minister of Mongolia, in Japan on

912 September 2013, the Bank signed a

Memorandum of Understanding with the

Japan Bank for International Cooperation

(JBIC), which led to Mongolias successful

launch of fund raising in yen in Japans

capital market, and trading of JPY30 billion

industrial bonds Samurai, guaranteed by

the Government of Mongolia and the JBIC, in

Japans capital market at an interest rate of

1,52 % per annum, and receipt of the funds in

its yen account with the Mongolbank.

6 January 2014

The Bank signed cooperation

memoranda with thirteen

banks in total in connection

with granting loans to 888

projects for export promotion

and import substitution

manufacturing with its own

resources through commercial

banks.

22 April 2014

The Development Bank of Mongolia

has signed a Memorandum

of Understanding with the

Vnesheconombank of the Federation

of Russia, and is cooperating with

the Russian bank towards the

re-financing of a turbo generator

required for the project to Increase

and expand the capacity of the

Combined power and heat plant

IV along with its accompanying

fittings. Going forward, the Bank is

planning to cooperate in financing

goods, services and equipment to

be purchased from the Federation

of Russia.

24 April 2014

From 18 November 2013 to 1 February 2014,

jointly with the Bloomberg Television Singapore,

the Development Bank of Mongolia organised

an advertising campaign Inside Mongolia.

This aimed at raising Mongolias international

reputation, introduction to the investment

environment and creating a positive impression

with investors. Within the scope of this work,

90-second short editorial broadcasts for

investors covering five topics and 30-second

commercials were cast. These resulted in over

2,887,500 comments being received via the

www.bloomberg.com website.

The Bank granted USD12,8 million for

financing the purchase of main and

auxiliary equipment of a factory with

a capacity to manufacture 100,000

tons of steel products, which is a

project to be implemented by Beren

Group LLC in Orkhon province,

within the scope of Government

Resolution No.256 dated 2013

regarding the supporting of metal

production.

18 November 2013 16 April 2014

In 2012 the Development Bank

granted USD61,3 million loans in total

for financing the project to increase

the capacity of the Khutul cement

factory. The factorys construction

and assembly, and equipment

installation were completed, a trial

production was successful and the

factory has been fully commissioned

into operation as per Basement

LLCs plan.

14 May 2014

12

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

THE TOTAL ASSETS OF

THE DEVELOPMENT

BANK OF MONGOLIA

WAS MNT4,493.8

BILLION AS OF 30 JUNE

2014, A 1.4-FOLD RISE

COMPARED TO THE END

OF THE PREVIOUS YEAR.

FINANCIAL

INDICATORS

In billion MNT

0

50

100

150

200

49

67

143,8

175,1

2011 2012 2013

In billion MNT

(halfyear)

(halfyear)

0

1.000

2.000

3.000

4.000

2011 2012 2013 2014

2014

77

888

3,231

4,493.8

TOTAL ASSETS

TOTAL EQUITY

13

(halfyear)

(halfyear)

2014

2014

2,799.6

In billion MNT

In billion MNT

0

1.000

500

1.500

2.000

2.500

2011 2012 2013

494

2,180

-10

0

10

20

30

27

31,3

(6)

(1)

2011 2012 2013

LOANS AND ADVANCES

NET PROFIT AFTER TAX

BY INVESTING IN

PROFITABLE PROJECTS,

THE DEVELOPMENT

BANK MADE A PROFIT OF

MNT31,3 BILLION IN THE

FIRST-HALF OF 2014.

14

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

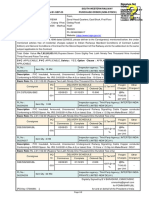

THREE-YEAR FINANCIAL INDICATORS

* The Development bank paid MNT 23,4 billion in full, to the states budget, in incorporate income tax imposed as of the first-half of 2014.

The first-half

of 2014 2013 2012 2011

TOTAL ASSETS 4,493.8 3,230.9 888.1 76.9

Cash and cash equivalents 937.8 379.5 216.5 75.8

Bank deposits 709.7 652.3 168.9 0.0

Loans and advances 2,799.6 2,179.6 493.6 0.0

Investment 10.0 - - -

Other assets 11.3 6.0 2.3 0.0

Current income tax prepayment - 3.8 0.0 0.0

Fixed assets 0.6 0.6 0.2 0.2

Intangible assets 0.8 0.8 0.7 0.8

Deferred tax assets 24.0 8.2 5.9 0.0

TOTAL LIABILITIES 4,318.6 3,087.0 821.1 27.8

Customer accounts 23.0 16.3 0.0 0.0

Customer accounts 2.2 0.4 0.5 1.1

Current income tax payable* 15.2 0.0 3.3 0.0

Due to other banks 57.3 111.0 0.0 0.0

Bonds 1,698.2 972.1 817.3 26.6

Borrowings 2,522.7 1,987.2 0.0 0.0

TOTAL EQUITY 175.1 143.9 67.0 49.1

Contributed capital 143.8 123.3 73.3 49.7

Retained earnings 31.3 20.6 (6.3) (0.6)

TOTAL LIABILITIES AND EQUITY 4,493.8 3,230.9 888.1 76.9

BALANCE INDICATORS (In billion MNT)

Unaudited

15

The first-half

of 2014 2013 2012 2011

NET INTEREST INCOME/(EXPENSE) 53.2 42.0 (0.8) 0.1

Interest income 152.4 131.1 12.9 0.3

Interest expense (99.2) (89.1) (13.7) (0.1)

Provision for loan impairment 4.4 (6.2) - -

Gains less losses from trading in foreign currencies 0.5 2.0 0.0 -

Foreign exchange translation gain/losses (15.4) 1.9 (5.8) 0.0

Administrative and other operating expenses (3.8) (4.6) (1.7) (0.7)

PROFIT/(LOSS) BEFORE TAX 38.9 35.1 (8.3) (0.6)

Income tax (expenses)/return (7.6) (8.2) 2.6 -

PROFIT/(LOSS) FOR THE YEAR 31.3 26.9 (5.7) (0.6)

INCOME STATEMENT INDICATORS

The first-half

of 2014 2013 2012 2011

Return on equity (R) 23.41% 18.7% -8.5% -1.2%

Return on assets (R) 0.81% 0.8% -0.6% -0.8%

Net interest margin (NIM) 1.39% 2.4% -0.2% 3.0%

Capital adequacy ratio (CAR) 11.59% 12.8% 18.3% 8.9%

KEY FINANCIAL RATIOS

(In billion MNT)

Unaudited

16

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

THE DEVELOPMENT BANK IS UNDER DUTY

TO RAISE FUNDS, TO A CERTAIN EXTENT,

FOR FINANCING MAJOR PROJECTS AND

PROGRAM FOR THE DEVELOPMENT OF

MONGOLIA. THROUGH COOPERATION

WITH FINANCIAL INSTITUTIONS OF

INTERNATIONAL REPUTE, THE BANK

SUCCESSFULLY RAISED THE REQUIRED

FUNDS IN THE PAST.

IN JANUARY 2014, THE

DEVELOPMENT BANK OF MONGOLIA

SUCCESSFULLY TRADED JPY30

BILLION BONDS TERMED FOR

10 YEARS GUARANTEED BY THE

GOVERNMENT OF MONGOLIA

AND THE JAPAN BANK FOR

INTERNATIONAL COOPERATION

(JBIC) TO JAPANESE INVESTORS,

FURTHER STRENGTHENING ITS

SUCCESS WITH THE 2011 MEDIUM-

TERM USD BONDS.

INDUSTRIAL BONDS

SAMURAI

FUND RAISING

OPERATIONS

17

FINANCING BY THE EX-IM BANK OF THE USA

The Development Bank granted in total USD83,9 million

which is bridge financing and an advance required for the

payment of an aircraft of Boeing767 300R model to

be purchased by MIAT SOJSC from Boeing company

of the USA, in the first phase, within the scope of the

Mongolian Governments Action Plan for 20122016 and

the state policies in relation to the civil aviation sector for

the period until 2020. Also, the Bank jointly organised the

re-financing, using long-term funds guaranteed by the

Ex-Im Bank of the USA.

THE GUARANTEE ISSUANCE BY THE JAPAN BANK

FOR INTERNATIONAL COOPERATION (RATING: S&P/

MOODYS AA-/AA3) FOR 95% OF THE PRINCIPAL

AND INTEREST PAYMENTS FOR THE INDUSTRIAL

BONDS OF THE DEVELOPMENT BANK OF MONGOLIA

ENABLED FIXING THE COUPON INTEREST OF THE

DEVELOPMENT BANK BONDS AT 1.52% PER ANNUM,

I.E., AT A RELATIVELY LOWER RATE THAN THE

INTEREST RATE OF OTHER COUNTRY BONDS.

FINANCING BY THE COMMERZBANK

The Bank entered into a contract with the Commerzbank

on 28 April 2014 in order to raise EUR13,1 million, which

was required for implementation of the project Housing

construction industrial complex1 within the scope of

the medium-term target programme New Development

and the work to provide citizens with housing.

Bond issuer The Development Bank of Mongolia

Guarantor The Ministry of Finance on behalf of

the Government of Mongolia, and

the Japan Bank for International

Cooperation

Total amount JPY30 billion

Maturity 10 years

Coupon interest 1.52% per annum (fixed)

Bond issuance purposes Support the industrial sector

Investment banks Daiwa Securities Co. Ltd.

Nomura Securities Co. Ltd.

Legal consultant entity International law firm Shimazaki

18

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

LENDING AND

FINANCING

OPERATIONS

Within the scope of the resolution

enacted by the Government of Mongolia

regarding the financing through

the Development Bank, loans have

been granted to the road, railway,

manufacturing, mining, power plant,

aviation and infrastructure investment

sectors as well as housing finance

and small- and medium-enterprise

development funds, on terms whereby

they are repayable from the states

budget, and also from proceeds of the

projects. Such financing was granted to

projects in implementation within the

scope of the economic development

policies for increasing export,

substituting import and supporting

industrialisation.

Projects name Using funds

from the issue of

Chinggis bonds

From the

Development

Banks resources

Total financing

Repayable from the states

budget revenues

596.7 371.1 967.7

Roads 396.8 364.6 761.3

The Street project 54.8 0 54.7

Infrastructure 145.1 3.8 148.8

The Mongolian Stock

Exchange

- 2.7 2.7

Repayable from proceeds

of the projects

767.1 1.026.6 1.793.6

Roads 0 170.6 170.5

Power plants 33.4 146.0 179.4

Railway 324.1 41.1 365.1

Housing finance - 106.6 106.6

Industrial Complex

Sainshand

- 6.3 6.2

SME Development Fund - 45.8 45.7

Aviation 5.3 0 5.2

Mining 23.4 381.9 405.2

Housing construction 84.7 14.3 98.9

Agriculture & light industry 270.7 0 270.7

Construction materials 25.5 114.1 139.6

TOTAL 1.363.8 1.397.6 2.761.4

THE DEVELOPMENT BANKS

TOTAL LOANS AND ADVANCES (as of 30 June 2014)

In billion MNT

19

LOAN FINANCING

SOURCES

PROJECTS FINANCED USING LOAN SOURCES

BORROWED FROM THE GOVERNMENT

(Funds from the issue of Chinggis bonds)

Road

38.4%

Power plants

10.5%

Construction

materials

8.0%

Housing program

finance

7.7%

Housing

construction

6.2%

Infrastructure

10.6%

Others

8.0%

Other

6.8%

Agriculture &

light Industry

19.8%

Road

33.0%

Railway

23.7%

Mining

27.4%

PROJECTS FINANCED WITH THE DEVELOPMENT

BANKS OWN RESOURCES

1,397.6

billion MNT

1,363.7

billion MNT

20

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

PROJECTS BEING FINANCED WITH FUNDS FROM THE ISSUE OF CHINGGIS

BONDS AND THE DEVELOPMENT BANKS OWN RESOURCES

ROADS

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014*

1.600

1.800

1.400

1.200

1.000

800

600

400

200

209.3

billion MNT

BALANCE

FINANCED

157

724

1.020

at the end of the first-half of 2014

km

km

km

535.2

billion MNT

THE DEVELOPMENT BANK

396.8

billion MNT

CHINGGIS BONDS

km

TOTAL FINANCING APPROVED BY

GOVERNMENT RESOLUTIONS

IN TOTAL

billion MNT

1141.3

The Development Banks

concurrent financing for

road projects along with

their monitoring consultancy

companies will lead to the

increase of the effectiveness

of those projects and the road

quality improvement.

IN TOTAL

billion MNT

932.0

assumption

FINANCED WITH

FUNDS FROM THE

ISSUE OF CHINGGIS

BONDS AND THE

DEVELOPMENT BANKS

OWN RESOURCES

FINANCED WITH

OTHER SOURCES

S

RAILWAY

200

FINANCING WAS

GRANTED FOR THE

DEVELOPMENT OF THE

PROJECT NEW RAILWAY

MILLION

USD

22.5

THE DEVELOPMENT BANK

million USD million USD

177.5

USING THE FUNDS FROM THE ISSUE OF CHINGGIS BONDS

With the Tavantolgoi-

Gashuunsukhait railroad

being brought into operation

in 2016, transport costs will

be reduced by 50% and the

competitiveness in export of

raw materials of

mining-origin will increase.

21

22

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

URAL ROAD

PROJECTS IN

IMPLEMENTATION

FINANCED BY THE

DEVELOPMENT

BANK OF

MONGOLIA

PROJECTS BEING FINANCED

BY FUNDS FROM THE ISSUE OF

CHINGGIS BONDS

128 kmAltai

Bayankhongor road

Budgeted costs: 54.4

100 kmMankhan

Darvi road

Budgeted costs: 42.9

100 kmUlaangom

Khyargas road

Budget costs: 45.0

67 kmTosontsengel

Uliastai road

Budgeted costs: 38.2

90 km Ulaangom

Naranbulag road

Budgeted costs: 49.5

Naranbulag

Songgino

Myangad

Bulgan

Bugat

Buutsagaan

Durvuljin

Khovd

Ulaangom

Altai

Ulaanbaishint

Artssuuri

K

Dayan

Burgastai

Durgun

Darvi

Shiveekh

Gurvantes

Tsagaankhairkhan

Delger

Tugrug

Bayanleg

Bogd

Numrug

Telmen

Uyench

Gurvanbulag

Tsagaannuur

Ulgii

Khandgait

Mankhan

Uliastai

23

Bayan-Uul

Baruun-Urt

Rashaant

Teshig

Basengel

Arshaan

Arvaikheer

Murun

Erdenet

Darkhan

Ulaanbaatar

Sainshand

Mandalgovi

Dalanzadgad

Choibalsan

Baga-Ilenkh

Khankh

Altanbulag

Ereentsav

Ulikhan

Khavirga

Zamiin-Uud

Gashuun-Sukhait

Kharkhorin

setserleg

Munkhkhaan

Tushig

Zelter

huren

Sukhbaatar

Buregkhangai

Zuunmod

Tarialan

Airag

Erdene

Undur-Ulaan

Nariinteel

Tsogsetsii

Nalaikh

Baganuur

Bagakhangai

luut

Lun

Norovlin

Bayan-Ovoo

nkhongor

Tsogt-Ovoo

Undurkhaan

Chuluunkhoroo

296 kmMandalgovi

Dalanzadgad road

Budgeted costs: 137.3

107 kmArvaikheer

Bayankhongor road

Budgeted costs: 45.4

177.9 kmUndurkhaan

Munkhkhaan

Baruun urt road

Budgeted costs: 87.8

104 kmUlaanbaatar

Mandalgovi road

Budgeted costs: 49.1

238.4 km Undurkhaan

Choibalsan road

Budgeted costs: 111.3

165.3 km Murun

Tarialan road

Budgeted costs: 82.6

127.1 km Tsakhir

Tosontsengel road

Budgeted costs: 62.9

100 kmKhanzanburgedei

Solongot road

Budgeted costs: 46.4

Projects in implementation

Projects completed as end of 2013

A

M

24

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

PROJECTS FINANCED WITH FUNDS FROM THE ISSUE OF CHINGGIS

BONDS AND THE DEVELOPMENT BANKS OWN RESOURCES

POWER AND HEATING PLANTS

EXPANSION OF THE COMBINED

HEAT AND POWER PLANT III

EXPANSION OF THE COMBINED

HEAT AND POWER PLANT IV

31.5 48.5

MILLION USD

This expansion will enable a

50 megawattcapacity, which

is higher than the Darkhan

CHPs. When it is operational, 1

kW-power generation costs will

reduce from MNT74.7 to MNT36.

Power generation will increase by

over 500,000,000 kW.h, and heat

generation by 400,000 Gcal/h

these equate to 10% of the current

consumption.

THE TAVANTOLGOI

POWER PLANT

THE EG RIVER

HYDROELECTRIC PLANT

14.8

3.5

Value added products will be manufactured

using thermal coal from the Erdenes

Tavantolgoi and Ukhaa Khudag mines, and

energy for the Oyutolgoi Project will be

supplied with domestic sources.

Mongolia will have a regime adjustment and

emergency backup capacity, thereby achieving

diversification in terms of the power regime.

Also, USD10 million cash flow, which is paid

annually to the power grid of the Federation

of Russia will be retained in Mongolia.

25

HOUSING, CONSTRUCTION AND ASSEMBLY

THE SOHCS MICRO-DISTRICT

BUYANTUKHAA I

RESIDENTIAL BUILDINGS ADJACENT

TO THE YARMAG BRIDGE

THE HOUSING CONSTRUCTION

INDUSTRIAL COMPLEX1

THE RESIDENTIAL MICRO-

DISTRICT NEW YARMAG

14.2 84.7

NT50 billion financing

contract between the

Ministry of Finance

and the State Bank

Through the project,

150,000 m concrete

components will be

manufactured per annum, which

will be sufficient to supply for

5,000-household residences.

A Guarantee for USD83,9 million

loans under a contract between New

Yarmag Housing Project LLC and the

ExportImport Bank of the PRC

Through opening an unfunded letter of credit, the Development

Bank is financing EUR13,1 million in total by borrowing from

the mmerzbank of Germany and sub-lending it to Erel LLC.

This is within the scope of the project to renovate Erel LLCs

Housing construction industrial complex1 (HCIC1) within the

work to provide citizens of cities and settled areas with housing.

THE 1,152-HOUSEHOLD

RESIDENTIAL MICRO-DISTRICT

billion

MNT

billion

MNT

THE STATE BANKS HOUSING

LOANS AT AN INTEREST RATE OF 6%

80

billion

MNT

Individuals of target groups will be

able to purchase at a price 40%

cheaper than the market rate, i.e.,

MNT1,28 million per square metre.

1.280.000

26

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

PROJECTS FINANCED WITH FUNDS FROM THE ISSUE OF CHINGGIS

BONDS AND THE DEVELOPMENT BANKS OWN RESOURCES

AGRICULTURE AND LIGHT INDUSTRY

40.1%

26.2%

16.1%

9.7%

7.9%

SUPPORT THE WOOL

AND CASHMERE

INDUSTRY

MILK AND DAIRY

PRODUCT FACTORY

GREENHOUSE

FARMING

WOOLPROCESSING

AND WASHING

SEWN PRODUCT

FACTORY

BEING GRANTED

THROUGH

GOLOMT BANK

270.7

BILLION MNT

FINANCING WITH FUNDS FROM

THE ISSUE OF CHINGGIS BONDS

27

OTHER PROJECTS FINANCED WITH FUNDS FROM THE ISSUE OF CHINGGIS

BONDS AND THE DEVELOPMENT BANKS OWN RESOURCES

200

54.4

18.6

1.5

148.3

89.6

MIAT SOJSCS

AIRCRAFT

61.3

BASEMENT LLC

(KHUTUL CEMENT)

48.9

SMALL AND MEDIUM

ENTERPRISE DEVELOPMENT

6.3

INDUSTRIAL COMPLEX

SAINSHAND

ERDENES TAVANTOLGOI JSC

MILLION USD

THE STREET PROJECT

TECHNICAL REFURBISHMENT OF

BAGANUUR JSC

THE MONGOLIAN STOCK EXCHANGE

BILLION MNT

BILLION MNT

MILLION USD

MILLION USD

MILLION USD

BILLION MNT

BILLION MNT

INFRASTRUCTURE

BILLION MNT

Mongolias aviation sector development will be supported through

increasing MIAT JSCs operational efficiency and updating the aircraft

fleet with additions.

With the financing granted by the Development Bank of Mongolia to

Erdenes Tavantolgoi JSC, loan interest expenses that the company paid

were reduced by 50%.

With the provision of the engineering infrastructure, lines and pipelines network

projects, it will become possible to construct residential towns, micro-districts, schools,

kindergartens and hospitals in 1,210,4 ha areas in seven locations in the capital city.

The indirect socio-economic benefits of the eighteen junctions and two roads that

were expanded and refurbished in 2013 are MNT20 billion.

The coal crushing and loading capacity will grow reaching

4,5 million tons per year and continuity of coal supply to heating plants

and ger district households will be ensured.

The finance granting will contribute, to a certain extent, to making the

Mongolian Stock Exchanges operations internationally accepted and ensuring

its conformity to the applicable standards.

With granting soft loans to 62 small and medium enterprise-

manufacturers for expanding their factories and plants, job opportunities

will increase and the populations livelihood will improve.

An industrial zone will be created, providing over 2,700 individuals in

rural areas with job opportunities and increasing export substantially.

Will supply approximately 40% of domestic cement demands.

28

THE DEVELOPMENT BANK OF MONGOLIA

PROJECTS AND PROGRAMMES

FINANCED WITHIN THE SCOPE OF

THE EXPORT PROMOTION AND

IMPORT SUBSTITUTION POLICIES

Increase the export of coal from

the Tavantolgoi deposit

Increase the export of wet

iron ore concentrate

500.1

FINANCING AIMED AT THE

CAPITAL CITYS SOCIO-

ECONOMIC DEVELOPMENT

Create new electricity and heat

sources in the capital city

Increase housing supply

844.1

FINANCINGAIMED AT

THE SOCIO-ECONOMIC

DEVELOPMENT IN RURAL AREAS

Support stable employment

in rural areas

Connect rural areas to

national and foreign markets

697.0

790.2

230.4

45.1

160.7

892.1

258.9

45.3

234.5

846.9 580.8

44.6

IN TOTAL

959.7

BILLION MNT

CHINGGIS BONDS:

CHINGGIS BONDS:

CHINGGIS BONDS:

IN TOTAL

891.3

BILLION MNT

IN TOTAL

626.3

BILLION MNT

29

FINANCED PROJECTS AND PROGRAMMES (IN THREE MAINLINES OF BUSINESS)

Increase the export of

non-mineral resources

Substitute the import of

construction materials

Substitute the import of

processed and industrial products

Improve housing ownership capability of

medium-income individuals

Support stable employment

in the capital city

Prioritise road traffic jam, air pollution

and smoke-related problems

432.4

Support urbanisation

in rural areas

277.3

131.8

274.5

176.5

275.5

33.0

90.0

82.2

31.1

90.0

0.4

57.2

417.8

6.6

135.7

703.4

THE DEVELOPMENT BANK:

THE DEVELOPMENT BANK:

THE DEVELOPMENT BANK:

approved granted

THE DEVELOPMENT

BANK OF MONGOLIA

GRANTS FINANCING

TO ANY PROJECTS AND

PROGRAMMES BASED

ON THEIR ACTUAL WORK

PROGRESS.

30

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

With the Development Banks financing, the project to

expand the capacity of the Combined heat and power

KHUTUL CEMENT

AND LIME JSC

With the Development Banks loans, the dry method plant

will increase the Khutul cement production capacity to

1,000,000 TONS

per year. The plant was fully commissioned and brought

into operation in May 2014.

With the Development Banks financing, construction

work of

SOME MAJOR PROJECTS

SUCCESSFULLY COMPLETED WITH THE

DEVELOPMENT BANKS FINANCING IN

THE FIRST-HALF OF 2014

BAGANUURJSC

THE COMBINED HEAT

AND POWER PLANT III ROADS

plant III bysuccessfully implemented,

commissioned and brought into

operation on 16 June 2014.

The coal crushing and loading capacity

has increased to 4,500,000 tons per year

and enabled the continuous coal supply to

heating plants and ger district households.

50

267 KM

4.5

This plant is able to supply

40%

of the UlaanbaatarMandalgovi

Dalanzadgad road has been completed

and is ready to be handed over to the

State Commissioning Authority.

km

megawatts

of domestic cement demands.

31

32

THE DEVELOPMENT BANK OF MONGOLIA

SUMMARY REPORT FOR THE FIRST-HALF OF 2014

www.dbm.mn www.dbm.mn

Floor 2, Max Tower Floor 2, Max Tower

Juulchin Street 4/4 Juulchin Street 4/4

Ulaanbaatar 15170, Mongolia Ulaanbaatar 15170, Mongolia

Tel: 70130512 Tel: 70130512

Fax: 70130602 Fax: 70130602

MediaRelations@dbm.mn MediaRelations@dbm.mn

THE DEVELOPMENT BANK OF MONGOLIA

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Avligaas Uridchilan Sergiileh TuluvluguuDocument7 pagesAvligaas Uridchilan Sergiileh TuluvluguusodbayargPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Development Bank of MongoliaDocument68 pagesDevelopment Bank of MongoliasodbayargPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Audited Report 2014.12.31 EngDocument73 pagesAudited Report 2014.12.31 EngsodbayargPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- FS - DBM - ENG - 14 06 30 - UB JP - v12 - Clean - Final - 2015.01.26Document62 pagesFS - DBM - ENG - 14 06 30 - UB JP - v12 - Clean - Final - 2015.01.26sodbayargPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Annual Report ENGDocument84 pagesAnnual Report ENGsodbayargPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Printed DBM Fs Eng Dec 5 Last To PublicDocument64 pagesPrinted DBM Fs Eng Dec 5 Last To Publicsodbayarg100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Gerchilgee 2013Document1 pageGerchilgee 2013sodbayargPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- DBM Annual Report 2013 VEngDocument115 pagesDBM Annual Report 2013 VEngsodbayargPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A-74 MUHB-nii 2014 Onii Avligaas Uridchilan Sergiileh TuluvluguuDocument4 pagesA-74 MUHB-nii 2014 Onii Avligaas Uridchilan Sergiileh TuluvluguusodbayargPas encore d'évaluation

- Resolution 238 - OfficialDocument1 pageResolution 238 - OfficialsodbayargPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Development Bank of Mongolia: General UpdateDocument22 pagesDevelopment Bank of Mongolia: General Updatesodbayarg100% (1)

- DBM FS - Updated 18 Nov 15pmDocument63 pagesDBM FS - Updated 18 Nov 15pmsodbayargPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- PWC Audit 1Document1 pagePWC Audit 1sodbayargPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- PWC Audit 2Document5 pagesPWC Audit 2sodbayargPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- DBM FS - Updated 18 Nov 15pmDocument63 pagesDBM FS - Updated 18 Nov 15pmsodbayargPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Dirección de Catastro Municipal: Lic. Ma. Dolores Jáuregui Delgado Directora de CatastroDocument2 pagesDirección de Catastro Municipal: Lic. Ma. Dolores Jáuregui Delgado Directora de CatastroTijuana TijuanaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Fall 2013 IPG General CatalogDocument204 pagesFall 2013 IPG General CatalogIndependent Publishers GroupPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Kajokoto R0002Document104 pagesKajokoto R0002Jacob KasambalaPas encore d'évaluation

- Loyalty Card Plus: Application FormDocument2 pagesLoyalty Card Plus: Application FormRaisa GeleraPas encore d'évaluation

- THE JOKE by MILAN KUNDERA-CHARACTER ANALYSISDocument6 pagesTHE JOKE by MILAN KUNDERA-CHARACTER ANALYSISHanza FarzinPas encore d'évaluation

- Feeding Ecology and Positional Behavior of Western Lowland Gorillas (Gorilla Gorilla Gorilla) in The Central African RepublicDocument24 pagesFeeding Ecology and Positional Behavior of Western Lowland Gorillas (Gorilla Gorilla Gorilla) in The Central African Republicxoyat80279Pas encore d'évaluation

- Lepanto-Con-Mining-vs-IcaoDocument3 pagesLepanto-Con-Mining-vs-Icaojed_sindaPas encore d'évaluation

- Cenoz 2020 Pedagogical Translanguaging An IntroductionDocument25 pagesCenoz 2020 Pedagogical Translanguaging An IntroductionisamorePas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Module 21 Trade SecretsDocument11 pagesModule 21 Trade SecretsCarnal DesirePas encore d'évaluation

- UP Civil Court Staff Recruitment Admit Card DetailsDocument3 pagesUP Civil Court Staff Recruitment Admit Card Detailskapil kantPas encore d'évaluation

- KGB and CIA Was Controlled by RothschildsDocument1 pageKGB and CIA Was Controlled by RothschildsHindu.NationalistPas encore d'évaluation

- 19 C New PO 56235256201449 DT 01-SEP-23 On VINDHYA TELELINKS LIMITED-REWADocument8 pages19 C New PO 56235256201449 DT 01-SEP-23 On VINDHYA TELELINKS LIMITED-REWAManojPas encore d'évaluation

- Louis Dumont Homo Hierarchicus The Caste System and Its Implications 1988 PDFDocument271 pagesLouis Dumont Homo Hierarchicus The Caste System and Its Implications 1988 PDFJuan Ossio100% (2)

- PAMA931105MDFRNL13: Dr. Justino Eduardo Andrade Sanchez Director General de ProfesionesDocument1 pagePAMA931105MDFRNL13: Dr. Justino Eduardo Andrade Sanchez Director General de ProfesionesAlinCallowayPas encore d'évaluation

- 5 SHRM CP-SCP People - 5 - Total RewardsDocument54 pages5 SHRM CP-SCP People - 5 - Total RewardsPhan Nguyễn Đăng KhoaPas encore d'évaluation

- Learner Protection ILEP IPIDDocument1 pageLearner Protection ILEP IPIDJuan Guzmán InocheaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Fundamentals of Engineering Economic Analysis Assignment ExercisesDocument4 pagesFundamentals of Engineering Economic Analysis Assignment ExercisesdsadadadPas encore d'évaluation

- Sta Rosa v. AmanteDocument2 pagesSta Rosa v. AmanteSGOD HRDPas encore d'évaluation

- An IntroductionDocument2 pagesAn IntroductionCtctcttvtctcPas encore d'évaluation

- G02 Persons Digest Sept 7, 2018Document136 pagesG02 Persons Digest Sept 7, 2018Jappy AlonPas encore d'évaluation

- Partnership WorksheetDocument4 pagesPartnership WorksheetHamdan MushoddiqPas encore d'évaluation

- Case Digest Jaca V People - G.R. No. 166967 - Case DigestDocument2 pagesCase Digest Jaca V People - G.R. No. 166967 - Case DigestJamesHarvey100% (1)

- Sh240a4aab 120H0299 120H0300Document6 pagesSh240a4aab 120H0299 120H03000kphPas encore d'évaluation

- Makivik Corp. Appeal On Federal Court Decision Re: Nunavik Polar Bear QuotaDocument46 pagesMakivik Corp. Appeal On Federal Court Decision Re: Nunavik Polar Bear QuotaNunatsiaqNewsPas encore d'évaluation

- Communication Studies Journal Article on Climategate Conspiracy TheoryDocument23 pagesCommunication Studies Journal Article on Climategate Conspiracy Theorycarlos_fecsPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Alchemy - An Internal Auditing CaseDocument3 pagesAlchemy - An Internal Auditing CaseUsama malik0% (1)

- 0102-1905 Rev 01Document1 page0102-1905 Rev 01Jooel RamirezPas encore d'évaluation

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalPas encore d'évaluation

- Particulars As Furnished by The Shipper: Carrier'S ReceiptDocument1 pageParticulars As Furnished by The Shipper: Carrier'S ReceiptMOUSTAPHA gueyePas encore d'évaluation

- Board Games and Intellectual Property LawDocument7 pagesBoard Games and Intellectual Property LawChandrika MehtaPas encore d'évaluation