Académique Documents

Professionnel Documents

Culture Documents

Defination of Banking

Transféré par

KR Burki0 évaluation0% ont trouvé ce document utile (0 vote)

201 vues17 pages5.3 Ratios analysis:

Ratio Analysis enables the business owner/manager to spot trends in a business and to compare its performance and condition with the average performance of similar businesses in the same industry. To do this compare your ratios with the average of businesses similar to yours and compare your own ratios for several successive years, watching especially for any unfavorable trends that may be starting. Ratio analysis may provide the all-important early warning indications that allow you to solve your business problems before your business is destroyed by them.

Ratio means “one number expressed in term of another a ratio is statistical yardstick by mean of which relationship between two or various figures can be compared or measured. Here we are going to explain the ratio analysis of NBP (bank) which is little bit different from other organizations.

Profitability Ratios:

Profitability means “Measure of the ability of business to generate returns for the business or for the owner” or “Overall effectiveness of the management is known as profitability”

Here we will calculate Solvency ratios of NBP to evaluate its financial position.

To calculate this ratios we needed these items Operating profit, net profit, operating fixed assets, total assets, total investments with in business, operating fixed assets.

Earnings Ratios

2007 2008 2009

ROA 2.72% 1.96% 2.07%

ROE 19.20% 14.13% 16.41%

ROD 3.48% 2.54% 2.70%

Critical Analysis:

The earnings ratios of NBP were higher in 2007 but due to economic crisis return decreases but now the economic activities are accelerating that’s why the NBP returns also increases that Is the good symbol for the future of NBP

Debt Management.

Debt Management

2007 2008 2009

Debt to Equity 6.05 6.22 6.94

Debt to Assets 0.86 0.86 0.87

Deposits times Capital 5.52 5.56 6.09

Critical Analysis

These above ratios of NBP have no effect of recession and bank maintained as well as improves the above ratios that show the efficiency of the NBP activities.

Liquidity Ratios

Liquidity Ratios

2007 2008 2009

Earning Assets To Assets 0.75 0.74 0.75

Advance to Deposits 0.60 0.62 0.66

Critical Analysis

Earning assets of the NBP almost have no effect of the world recession but the improvement in advances against the deposit reflects that the people of Pakistan have less money to deposit and they are encourage to get loan from the bank.

Growth Rates

Growth Rates

2007 2008 2009

Profits After Tax 11.82% -18.78% 17.81%

Return on Assets -2.95% -28.71% 5.64%

Net Interest income(before provision) 11.53% 10.20% 3.78%

Critical Analysis

This table of ratios is telling about the future of banking sector in Pakistan. In 2007 all the world was under the recession and it also affects the economy of Pakistan. Banks are the industry that was hardly hit by this recession and the profits of all banks convert into negatives but in 2009 hope for bright future arises because now the NBP come back on the track and generating the profit.

Market Value Ratio

Market Value Ratio

2007 2008 2009

Average Share Price for the Year 251.46 174.76 72.60

Analysis

As the above data shows the average price of shares of NBP is very high in 2007 but later it trend to decline and in 2009 the price of share is less than three times as compare to the 2007. It is due to the economic recession that effect badly to the banking sector.

Solvency Ratios:

Solvency Ratios

2007 2008 2009

Equity to Assets 14.19% 13.85% 12.60%

Equity to Deposits 18.13% 17.98% 16.43%

Earning Assets to Deposits 0.96 0.96 0.97

Critical Analysis

Due to the recession the equity to assets and to deposits ratios of the NBP are declining over the period but the earning assets to deposits ratio was maintained by the bank and in 2009 it is rising.

Composition of Earning Assets

2007 2008 2009

Lending to Financial Institutions 4.23% 3.29% 2.80%

Investments 33.34% 32.51% 29.58%

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document5.3 Ratios analysis:

Ratio Analysis enables the business owner/manager to spot trends in a business and to compare its performance and condition with the average performance of similar businesses in the same industry. To do this compare your ratios with the average of businesses similar to yours and compare your own ratios for several successive years, watching especially for any unfavorable trends that may be starting. Ratio analysis may provide the all-important early warning indications that allow you to solve your business problems before your business is destroyed by them.

Ratio means “one number expressed in term of another a ratio is statistical yardstick by mean of which relationship between two or various figures can be compared or measured. Here we are going to explain the ratio analysis of NBP (bank) which is little bit different from other organizations.

Profitability Ratios:

Profitability means “Measure of the ability of business to generate returns for the business or for the owner” or “Overall effectiveness of the management is known as profitability”

Here we will calculate Solvency ratios of NBP to evaluate its financial position.

To calculate this ratios we needed these items Operating profit, net profit, operating fixed assets, total assets, total investments with in business, operating fixed assets.

Earnings Ratios

2007 2008 2009

ROA 2.72% 1.96% 2.07%

ROE 19.20% 14.13% 16.41%

ROD 3.48% 2.54% 2.70%

Critical Analysis:

The earnings ratios of NBP were higher in 2007 but due to economic crisis return decreases but now the economic activities are accelerating that’s why the NBP returns also increases that Is the good symbol for the future of NBP

Debt Management.

Debt Management

2007 2008 2009

Debt to Equity 6.05 6.22 6.94

Debt to Assets 0.86 0.86 0.87

Deposits times Capital 5.52 5.56 6.09

Critical Analysis

These above ratios of NBP have no effect of recession and bank maintained as well as improves the above ratios that show the efficiency of the NBP activities.

Liquidity Ratios

Liquidity Ratios

2007 2008 2009

Earning Assets To Assets 0.75 0.74 0.75

Advance to Deposits 0.60 0.62 0.66

Critical Analysis

Earning assets of the NBP almost have no effect of the world recession but the improvement in advances against the deposit reflects that the people of Pakistan have less money to deposit and they are encourage to get loan from the bank.

Growth Rates

Growth Rates

2007 2008 2009

Profits After Tax 11.82% -18.78% 17.81%

Return on Assets -2.95% -28.71% 5.64%

Net Interest income(before provision) 11.53% 10.20% 3.78%

Critical Analysis

This table of ratios is telling about the future of banking sector in Pakistan. In 2007 all the world was under the recession and it also affects the economy of Pakistan. Banks are the industry that was hardly hit by this recession and the profits of all banks convert into negatives but in 2009 hope for bright future arises because now the NBP come back on the track and generating the profit.

Market Value Ratio

Market Value Ratio

2007 2008 2009

Average Share Price for the Year 251.46 174.76 72.60

Analysis

As the above data shows the average price of shares of NBP is very high in 2007 but later it trend to decline and in 2009 the price of share is less than three times as compare to the 2007. It is due to the economic recession that effect badly to the banking sector.

Solvency Ratios:

Solvency Ratios

2007 2008 2009

Equity to Assets 14.19% 13.85% 12.60%

Equity to Deposits 18.13% 17.98% 16.43%

Earning Assets to Deposits 0.96 0.96 0.97

Critical Analysis

Due to the recession the equity to assets and to deposits ratios of the NBP are declining over the period but the earning assets to deposits ratio was maintained by the bank and in 2009 it is rising.

Composition of Earning Assets

2007 2008 2009

Lending to Financial Institutions 4.23% 3.29% 2.80%

Investments 33.34% 32.51% 29.58%

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

201 vues17 pagesDefination of Banking

Transféré par

KR Burki5.3 Ratios analysis:

Ratio Analysis enables the business owner/manager to spot trends in a business and to compare its performance and condition with the average performance of similar businesses in the same industry. To do this compare your ratios with the average of businesses similar to yours and compare your own ratios for several successive years, watching especially for any unfavorable trends that may be starting. Ratio analysis may provide the all-important early warning indications that allow you to solve your business problems before your business is destroyed by them.

Ratio means “one number expressed in term of another a ratio is statistical yardstick by mean of which relationship between two or various figures can be compared or measured. Here we are going to explain the ratio analysis of NBP (bank) which is little bit different from other organizations.

Profitability Ratios:

Profitability means “Measure of the ability of business to generate returns for the business or for the owner” or “Overall effectiveness of the management is known as profitability”

Here we will calculate Solvency ratios of NBP to evaluate its financial position.

To calculate this ratios we needed these items Operating profit, net profit, operating fixed assets, total assets, total investments with in business, operating fixed assets.

Earnings Ratios

2007 2008 2009

ROA 2.72% 1.96% 2.07%

ROE 19.20% 14.13% 16.41%

ROD 3.48% 2.54% 2.70%

Critical Analysis:

The earnings ratios of NBP were higher in 2007 but due to economic crisis return decreases but now the economic activities are accelerating that’s why the NBP returns also increases that Is the good symbol for the future of NBP

Debt Management.

Debt Management

2007 2008 2009

Debt to Equity 6.05 6.22 6.94

Debt to Assets 0.86 0.86 0.87

Deposits times Capital 5.52 5.56 6.09

Critical Analysis

These above ratios of NBP have no effect of recession and bank maintained as well as improves the above ratios that show the efficiency of the NBP activities.

Liquidity Ratios

Liquidity Ratios

2007 2008 2009

Earning Assets To Assets 0.75 0.74 0.75

Advance to Deposits 0.60 0.62 0.66

Critical Analysis

Earning assets of the NBP almost have no effect of the world recession but the improvement in advances against the deposit reflects that the people of Pakistan have less money to deposit and they are encourage to get loan from the bank.

Growth Rates

Growth Rates

2007 2008 2009

Profits After Tax 11.82% -18.78% 17.81%

Return on Assets -2.95% -28.71% 5.64%

Net Interest income(before provision) 11.53% 10.20% 3.78%

Critical Analysis

This table of ratios is telling about the future of banking sector in Pakistan. In 2007 all the world was under the recession and it also affects the economy of Pakistan. Banks are the industry that was hardly hit by this recession and the profits of all banks convert into negatives but in 2009 hope for bright future arises because now the NBP come back on the track and generating the profit.

Market Value Ratio

Market Value Ratio

2007 2008 2009

Average Share Price for the Year 251.46 174.76 72.60

Analysis

As the above data shows the average price of shares of NBP is very high in 2007 but later it trend to decline and in 2009 the price of share is less than three times as compare to the 2007. It is due to the economic recession that effect badly to the banking sector.

Solvency Ratios:

Solvency Ratios

2007 2008 2009

Equity to Assets 14.19% 13.85% 12.60%

Equity to Deposits 18.13% 17.98% 16.43%

Earning Assets to Deposits 0.96 0.96 0.97

Critical Analysis

Due to the recession the equity to assets and to deposits ratios of the NBP are declining over the period but the earning assets to deposits ratio was maintained by the bank and in 2009 it is rising.

Composition of Earning Assets

2007 2008 2009

Lending to Financial Institutions 4.23% 3.29% 2.80%

Investments 33.34% 32.51% 29.58%

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 17

DEFINATION OF BANKING:

"Banks do business of money. Rather banks do business of lending and borrowing

loans."

"Banks are guardian distributor of cash money."

"Banker or a Bank or a person or company carrying on the business receiving money and

collecting drafts for customers subject to the obligation of honoring cheques drawn upon

them from time to time by the customer to the extent of the amount available on their

current accounts."

http://wonderfulengineering.com/give-your-dead-ups-battery-a-second-

life-using-this-cheap-and-simple-trick/

Evaluation of Banking:

It has not so far been decided as to how the word bank originated. Some authors opine

that this word is derived from the word ban cues or banque which mean a bench.

The explanation of this origin is attributed to the fact that the Jews in Lombardy transacted

the business of money exchange on benches in the market-place; nad hewn thebusiness failed, the

banco was destroyed by the people incidentally the word bankrupt is said to have been evolved

from this practice the opponents oh this opinion argue that if it was so, then how is it that the Italians

money changer were never called Banchierei in the middle ages? Other authorities hold the opinion

that the word bank in derived from the German word back which means joint stock fund latter

on when the Germans occupied major part of Italy the word back was Italianized into bank'. It is

therefore not possible to decide as to which of the opinions is correct, for no records available to

ascertain the validity of any of the opinions.

Modern Banking:

Banking in its modern form and structure stared in Britain when many of

the Lombardy merchants came to England in the fourteenth century and settled in the

parts of the city of the London now called Lombard Street. The king Edward III

established the Office of Royal Exchanger for changing foreign money at a profit

for the benefit of the Crown. In 1854 the joint Stock Companies Act opened an era

of corporations; and the Limited Liability Act, 1855, restricted the liability of the

share holder of the limited company.

Types of Banks:

Primarily all banks gather temporarily idle money for the purpose of lending to

other and i nvest ment gai n i n t he for m of ret urn, profi t s and di vi dends et c.

however, due t o t he verity of resources of money and the diversity in lending

and investment operations, banks have been place in various categories, such as

Commercial bank

Savings bank

Merchant banks

Mortgage banks

Consumer bank

Investment bank

Central bank

Commercial Bank:

The commercial banks received deposits from the general public, which

are repayable on demand upon written orders of the depositors. As their most

distinctive feature the commercial banks maintain the checking accounts for the

constitutions. The commercial banks are also distinguished for providing short -

term finance to trade, commerce and industry to enable these sectors to expand their

productive activities

Merchant Banks:

Mer c hant ba nks ar e t hos e, whi ch ha ve bee n mai nl y f i nanci ng

t he domes t i c andi nternat i onal t rade. Duri ng t he l at e 18

the and e ar l y 19th centuri es t he t rade bet ween countries was financed by bill of

exchange by well-reputed merchants houses for which they would charges a commission

for their services

Savings Banks:

The basic purpose of these banks is to inculcate the habit of saving in the

people the savings bank' s deposits are not repayable upon only the written order

of depositor but t he depos i t or of hi s a gent has t o a ppear per s onal l y at

t he s a vi ng ba nks t o ma ke withdrawal and for this purpose he must present a

pass book a certificate of deposit or some similar documents to prove his

right to receive his payments. Post office savings banks and savings accounts at

national saving organizations are well known national saving banks in Pakistan.

Mortgage Banks:

These banks mainly deal in loans for acquisition or construction of real

estate against the securities of mortgage.

Consumer Banks :

Thes e ba nks pr ovi di ng f i nance f or pur c has i ng cons umpt i on g

oods f or t he us e of Brewers

Investment Banks:

These banks assists business houses and governmental bodies to raise money

through the sale of stocks and bond for usually long term purposes

these banks perform theus ual f unct i ons of r ai s i ng depos i t s of i dl e mon

e y f r om t he publ i c and f i nance t he business houses other bodies.

Central Banks:

Central banks occupy the unique position in banking structure of a country

because they have been interested with the responsibility of controlling the

money supply, interest rate, and financial market of a country for the purpose of

economic development.

Islamic Banking:

Islamic banks appeared on the world scene as active players over two

decades ago. But "many of the principles upon which Islamic banking is based

have been commonly accepted all over the world, for centuries rather than decades".

Roughly 20% of the world's population is Islamic. While some in the Western

world t hi nk t hi s popul at i on i s onl y i n t he Mi ddl e East , t he rel i gi on i s

t rul y gl obal : from t he Mi ddl e East , t o Af ghani st an, t o t he US, t o

Indonesi a, and ever ywhere i n bet ween. Attention to Islamic finance obviously

accelerated since 9-11, but it is worthy to note that an Islamic finance meeting was

actually scheduled for 9-12 in the WTC and that the Islamic Finance movement

was already growing very rapidly. According to estimates in the Wall Street Journal

Islamic finance is roughly a $150 billion dollar market.

Sharia:

An Islamic Economy is an economy that is regulated by a set of rules based on

outlines set by the Islamic Sharia" Sharia is the set of guidelines mentioned in the

Quran.

Islamic Financing:

Is a concept that emerged in scientific manners in the second half of the

past century. With the expanding role that the banking system and money

handling, many Muslim communities were faced with a problem over the concept of

INTEREST.

In Islamic Sharia, there is a straight forward and definite rule that has to be

obeyed, i.e. NO RIBA.

Riba:

By Definition, Riba is an Arabic word that literally means extra "In regards to

Islamic Sharia, Riba means the lending of money for a specific time whereupon the

lender receives his money with an EXTRA amount agreed upon. It was what

most people in finance call interest.

Banks with No Interest:

A bank that neither charges nor pays an interest is an intriguing

concept. Especially if we consider the existing (and dominate) global banking system

(that is interwoven with all the daily aspects of our life) is based on interest.

Three forms of financing:

Modaraba (Participation Financing)

Morabaha (Financing Resale of Goods)

Ijara (Lease financing)

Modarba:

Modaraba (Participation Financing) falls under three categories

Demand Deposits

Mutual Investment Deposits

Special Investment Deposits

Morabaha:

Another form of a relationship between a customer and an Islamic bank

is that of buyer and seller. This contract is known as Morabaha (Financing Resale of

Goods).The bank buys goods or products from its owner directly on the request of the

customer and then resells it to the customer, at a selling price higher than the purchase

price. The cust omer t hen pays any consi derat i on t o t he goods he purchased

on an i nst al l ment basis, as per an agreed repayment schedule.

Ijara:

The third method, or Ijara (leasing), requires an Islamic bank to

purchase equipment and lease them to the customer for a specific period of time. At the

end, in most cases, the Bank will transfer the title to the customer either by executing a

sale agreement for a normal value or by way of donations.

INTRODUCTION ABOUT BANKING SECTOR:

Banking is the business of providing financial services to consumers and businesses. The

basic services a bank provides are checking accounts, which can be used like money to

make payments and purchase goods and services; savings accounts and time deposits that

can be used to save money for future use; loans that consumers and businesses can use to

purchase goods and services; and basic cash management services such as check cashing

and foreign currency exchange. Four types of banks specialize in offering these basic

banking services: commercial banks, savings and loan associations, savings banks, and

credit unions.

A broader definition of a bank is any financial institution that receives, collects,

transfers, pays, exchanges, lends, invests, or safeguards money for its customers. This

broader definition includes many other financial institutions that are not usually

t hought of as banks but whi ch nevert hel ess provi de one or more of t hese

broadl y defined banking

services. These institutions include finance companies, investment

companies, investment banks, insurance companies, pension funds,

security brokers and dealers, mortgage companies, and real estate investment trusts.

INTRODUCTION AND HISTORY OF FAYSAL BANK:

Faysal Bank started operations in Pakistan in 1987, first as a branch set-up of

FaysalIslamic Bank of Bahrain and then in 1995 as a locally incorporated Pakistani bank

under the present name of Faysal Bank Limited. On January 1, 2002, Al Faysal

Investment Bank Limited, another group entity in Pakistan, merged into Faysal Bank

Limited which resulted in a larger, stronger and much more versatile institution. In fact it

has the highest share capital amongst private banks in Pakistan and is amongst the largest

in terms of equity. Faysal Bank Limited is a full service banking institution offering

consumer, corporate and investment banking facilities to its customers. The Banks

widespread and growing network of branches in the four provinces of the country and

Azad Kashmir, together with its corporate offices in major cities, provides efficient

services in an effective manner. The strength and stability of Faysal Bank Limited is

evident through the Credit Rating assigned by JCR-VIS Credit Rating Company Limited

of AA (Double A)for long to medium term and A-1+ (A One Plus)for short term.

The majority share holding of Faysal Bank Limited is held by Ithmaar Bank B.S.C an

investment bank listed in Bahrain. faysal bank was introduced in D.I.Khan in 2011.

Group Information:

Ithmaar Bank B.S.C. is licensed by the Central Bank of Bahrain and listed on

theBahrain Stock Exchange (ITHMR). It has a paid-up capital of US$360 million, total

equity of US$1.1 billion and is a full investment bank with its direct business covering

the Middle East and North Africa (MENA) region, as well as South Asia, Asia-Pacific

and Europe. Besides holding significant investments in the banking, financial services

and real estate sectors in different markets, the main activities of the Bank include under

writing (equity and other financings), private equity (structuring, participation and port

folio management), Islamic financing, private banking, and advisory services covering

project financing, investments, capital markets and mergers & acquisitions.

Capital and Ownership:

Ithmaar Bank B.S.C, an investment Bank in Bahrain is the ultimate holding

company of Faysal Bank. The remaining shareholders comprise of general public,

NIT and other Pakistani institutions.

VISION STATEMENT

To be the bank of first choice with the highest ethical principles as our guiding force.

MISSION STATEMENT

To excel in providing innovative, value based banking solutions to meet

changing needs of customers and to strengthen the image of trust and reliability.

OPENING DOORS TO LIMITLESS POSSIBILITIES:

We open door t o l i mi t l ess possi bi l i t i es for our st akehol ders by pro

vi di ng banki ngsolutions that deliver results through meticulous planning,

focus on specific objectives, set t i ng pri ori t i es ri ght , and put t i ng i n pl ace

st rat egi es and processes t hat hel p yi el d better growth with higher return.

OUR VALUES:

INTEGRITY

We will hold fast to the highest standards of ethical conduct to meet our

commitments to your customers, employees and shareholders. above all, we will hold

true to our person a commitment and conviction to the truth.

Our Integrity: Our Identity Corporate governance:

Our goal is to respond a rapidly changing business environment in a

timely manner to improve corporate citizenship and transparency by reinforcing our

ethical standards and building a relationship of trust with customers and stakeholders.

Corporate social responsibility:

We bel i e ve t hat t he hi ghes t s t andar ds of e nga ge ment mus t no

t be onl y wi t h our stakeholders, employees or customers but also within the

community in which we work and live. We abide by the laws of Pakistan in which

we do business, we strive to be a good corporate citizen and take full responsibility of

all our actions.

Teamwork:

As a team, we play to win from the smallest unit to the enterprise as a whole. We

achieve far more as a team than as individuals.

Our Team: Our Assets Respect:

We appreciate our diversity and believe that respect for our employees,

customers, stakeholders, and all those with whom we interact are an essential element of

all positive and productive business relationships. We treat everyone as we wish to be

treated with dignity and respect.

Our Respect: Our Values

PRODUCTS AND SERVICES:

We are a progressi ve bank st ri vi ng t o offer i nnovat i ve product s,

easy accessi bi l i t y, qual i t y s er vi ce & conveni e nce t o our cus t omer s .

We of f er cus t omi zed f i nanci ng solutions with flexible criteria and convenient

loan tenures. You can avail car, home and personal l oans t hrough our vari ous

branches. We al so offer a host of Corporat e &Invest ment Banki ng Servi c

es t o our cl i ent s, whi ch i ncl ude fi nanci al and corporat eadvisory services,

along with a wide array of tools to help them achieve their goals.

Deposit Accounts

Faysal Saving Account

Rozana Munafa Plus Account

Basic Banking Account

Faysal Moavin

Faysal Premium

Faysal Izafa

Mahfooz Sarmaya

FCY Saving Plus

Consumer Loans

Cat Finance

House Finance

Faysal Finance

Corporate & Investment Banking

Corporate Financing

SME Finance

Trade Financing

Treasury & Capital Markets

Investment Banking

Cash Management

Services

Pocket Mate VISA debit card

Traveler Cheques

Transfer of funds

Safe Deposit Locker

Non-stop Banking

CUSTOMER SERVICES DEPARTMENT:

Requirements for Account Opening and closing of Account: Terms and Conditions

Account opening requires things:

National id card of the customer and introducer

Introducer

Visiting card or employment certificate.

Customer:

Customer is the person who comes with the purpose of opening the account

Introducer:

Introducer is a person having the account in same branch and gives

guarantee about t he cust omer. If t he i nt roducer i s not proper t han st at e

bank char ges RS 5000/ - per head from that employee of the bank who has

opened the account of the customer on the request of the introducer.

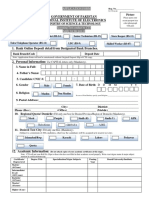

Procedure of Account Opening:

First of all, the customer is required to fill an application form. Then he

attaches the photocopy of his identity card and fills the signatory cards. Now he

fills the pay-in slip and deposits money on the counter. Bank allotted an account

number within one day after confirming from the head office which is at Mall road

Lahore. Now he fills the pay-in slip and deposits money on the counter.

Following things are needed for opening of account:

Account opening form

Specimen Signature card

Next of kin

Letter of thanks

Issuances of cheque book

Account Opening Form:

Account opening form consist of

Category of account

Currency

Title of account

Account number

Customer information

Initial deposit

Authorized person in case of customer death

Specimen Signature Card:

The signature card included the name and specimen signature of the customer

Next of Kin:

In the next of kin the customer authorized the bank to pay the

proceedings of his/her PLS/ Cur r e nt f or ei gn cur r enc y acc ount t o t he r

el at ed per s on by des cr i bi ng t he relationship of the person with the customer

after the death of the customer.

Letter of Thanks:

Letter of thanks is the latter issued by the bank to the customer for two purposes

1st purpose is to say thanks to the customer for opening the account in their bank.

2nd purpose is to confirm the address provided by the customer while opening

the account.

Issuance of Cheque Book:

Cheque book i s i ssued t o t he cust omer aft er sendi ng t he l et t er of

t hanks when t he customer comes with the latter of thanks and requests for the

issuance of the cheque book. A cheque book (usually having 25 leaves) is issued to the

customer.

Closing of Account:

The customer can close the account. The customer is required to submit an

application for closing the account. The account is closed out and his balance is

paid to him after deducting the closing charges.

There are many reasons for closing of account

Account holder Owen request

Death of account holder

Closing of account due to the bad manners of account holder

Required Procedure for Opening an Account:

Fi r s t of al l , t he cus t omer get s an appl i cat i on f r om t he bank,

whi c h r e qui r es al l i nfor mat i on necessar y for openi ng account and al so

t he document s requi red. An account can be opened as:

An i ndi vi dual acc ount

J o i n t a c c o u n t

Pr opr i et or s hi p ac count

Li mi t e d c ompany a cc ount

P a r t n e r s h i p

Cl ub, soci et y, associ at i on and t rust

Information Required by the Bank:

Name

Address

Telephone No.

Currency of Account

Nature of Business

Country of Residency

Special instructions regarding the account

Signatures

Documentation In case of limited company accounts:

Photocopy of National Identity Card of each director

Application form

Copy of companys memorandum and articles of association

List of directors

Copy of board resolution

Certificate of incorporation

Their signature cards

Certificate to commence business

Documentation In case of Partnership Account:

Application form

A copy of partnership deed

Signature cards of partners

Registration certificate copy

A copy of National Identity Card of each partner

Documentation In case of Club, Society, Association or Trust:

Application form

Copy of rules

Certified copy of resolution

Signature cards

When the concerned officer is satisfied then he opens the account and gives an

account number that will be used in all communications with the bank in

regard to the account and when making deposits and withdrawals.

Types of Account:

Current account:

Faysal Sahulat (Pak Rupee Current account)

Faysal Sahulat is a transactional account specially designed for individuals or

business customers who want instant access to their funds with no restrictions on the

number of transaction.

Features:

Account can be opened with an initial deposit of Rs. 5,000.

Unlimited transaction facilities.

On maintaining an average balance of Rs. 300,000 following additional facilities

are provided.1. Unlimited cash deposit facility2. One small locker and one ATM

free.3. 365 Pay orders, 365 Demand Drafts, 365 cheque leaves per year free.

Access to account through on-line banking at all Faysal Bank branches across

Pakistan.

Basic Banking Account:

As per SBP prudential communicated via BPD circular No.30, Faysal Bank has

introduced the Basic Banking Account (BBA) to cater the needs of low income groups

having the following features.

Features:

Account can be opened with Rs. 1000/.

No requirement for maintaining a minimum balance

Maximum of two free deposits and withdrawals are allowed in a month.

Free of charge statement of account for customers once a year. In case more

statements are required than standard charges would be applicable.

Free ATM transactions on Faysal Bank ATM machines. However charges would

apply on non Faysal Bank ATM machines as per SOC.

Saving accounts:

Faysal Savings:

Faysal Savings is specially designed to cater to your hard earned savings.

Features:

Account can be opened with an initial deposit of Rs. 10,000/.

No restriction on the number of transactions.

Profit is calculated on monthly average balance.

Profit payment on six monthly basis.

Access to account through on-line banking at all Faysal Bank branches across

Pakistan.

Rozana Munafa Plus:

To provide the best possible returns for individual, corporate and business

customers, the Rozana Munafa Plus Account offers you the opportunity to earn profit

every day and get your profit month.

Features:

Account can be opened with an initial deposit of Rs. 100,000/ for individuals and

Rs. 500,000/ for corporate customers.

Profit is calculated on monthly average balance.

Profit payment on monthly basis.

Tiered profit structure providing an incentive to save more.

Access to account through on-line banking at all Faysal Bank branches across

Pakistan.

Faysal Premium:

Faysal Premium is a savings account specially designed for high value deposits

with attractive profit rates having the following features.

Features:

Account can be opened with an initial deposit of Rs. 5 million

Profit is calculated on monthly average balance.

Profit payment on monthly basis.

Tiered profit structure providing an incentive to save more.

Access to account through on-line banking at all Faysal Bank branches across

Pakistan.

Faysal Moavin Savings Account:

Faysal Moavin is a Savings account made for genuine individual savers like you.

Faysal Moavin offers the perfect combination of savings account matched with the

flexibility of a current account.

Features:

No minimum balance requirement

No restriction on the number of transactions.

Profit is calculated on monthly average balance.

Profit payment on monthly basis.

Tiered profit structure providing an incentive to save more.

Access to account through on-line banking at all Faysal Bank branches across the

country.

Easy access through cheque book an ATM/Debit card. The ATM/Debit card cane

used at over 2000 ATMs in the country.

Term deposit:

Faysal Izafa:

At Faysal Bank we realize that every customers financial needs are different. As

result, the Faysal Izafa Term Deposit is designed to provide individuals and corporate

customers an opportunity to grow their money securely and earn attractive profits.

Features:

Account can be opened with an investment as low as Rs. 25,000/.

Tenure from one year to five years.

Annual and monthly option available.

Financing facility of up to 90% of invested amount.

No annual fee for the ATM/ Debit card for the entire tenure.

First cheque book on investment of Rs. 300,000/ or more.

Foreign Currency Account:

Faysal Mahfooz Sarmaya:

Faysal Bank endeavors to build and strengthen customer relationships by

providing innovative banking products and services. To provide convenience and value to

customers with foreign currency related needs, Faysal Banks Mahfooz Sarmaya foreign

currency account offers attractive features:

Features:

Account can be opened in three major international currencies: US Dollars,

Pound Sterling and Euro.

Minimum balance for opening Mahfooz Sarmaya Foreign Currency Account

is1000 units of the currency in which the account is opened

Account can be opened in any of the following types:

Savings Account

Term Deposit Account

Current Account:

With Mahfooz Sarmaya Account, you become eligible for Pak Rupee financing

facility of up to 75 percent of the deposit in your account at very competitive financing

rate. With Mahfooz Sarmaya Account, you automatically qualify for special rates for car

and home financing.

FCY Saving Plus:

FCY Saving Plus is a new foreign currency savings account with attractive profit

rates where customers get their profit on a monthly basis.

Features:

Account can be opened in US Dollars, Pound Sterling and Euro currency.

Minimum balance for opening FCY Saving Plus is 500 units of the currency

Profit is calculated on monthly average balance.

Profit is disbursed on monthly basis.

Tiered profit structure providing an incentive to save more.

No FCY cash deposit charge son maintaining the monthly average balance

equivalent to USD 50k or above, the following additional facilities are provided.

Free online banking

Priority Banking

Borrowing in PKR up to 90% of FCY

Preferential rates on consumer finance

Services:

Pocket Mate (Visa Debit Card):

Combining the wide acceptability of a credit card and the thoughtful prudence of

anatomy card, Faysal Bank Pocket Mate is the most convenient way to carry cash. No

more fear of overspending. No more searching for the nearest ATM. Pocket Mate Visa

Debit Card provides you with the freedom of worldwide acceptability at over 27 million

merchant outlets as an ATM card operative at all ATMs in Pakistan plus at over 1

Millionths worldwide bearing VISA logo.

Debit Card vs. Credit Card: Better Control on Expenses:

Pocket Mate Visa Debit Card gives customer a much better control over their

finances. In credit cards, there is a risk of spending more than the repayment capacity.

There arena such issues with Pocket Mate as the amount is directly debited from the bank

accountant there are no chances of overspending. All Pocket Mate transactions are

subject to authorization, which means whenever you do a transaction the status of your

account is checked.

No monthly installments:

Since with Pocket Mate you are using your own funds there is no risk of over

spending nor any worries to pay monthly bill on time.

No Minimum Income Requirement:

Unlike Credit Cards, the Pocket Mate is easy to obtain. There is no preset income

requirement to enjoy the benefits of this fast, convenient and safe debit card. All you

need to do is open and maintain an account with any of the branches of Faysal Bank.

Product Features: Worldwide Acceptance:

Travel the world and enjoy the freedom of using your Pocket Mate Visa Debit

Card. It gives you access to over 27 million shops and 1 million Visa ATMs all over the

world, giving you the freedom of payment anywhere in the world.

Countrywide Acceptance:

Your Pocket Mate Visa Debit Card is accepted at over 40,000 merchant

establishments in Pakistan i.e. restaurants, department stores, grocery stores, petrol

pumps, etc. Besides, you can use it conveniently at more than 2,000 ATMs all over

Pakistan.

Maximum Security:

The Pocket Mate Visa Debit Card contains additional security features, it can

only be used Electronically, which means lesser probability of fraudulent attempts on

the card.

Easy Traveling:

Your Pocket Mate Visa Debit Card saves from carrying cash or writing cheques.

It means customers no longer have to stock up on travelers cheques or cash when they

travel.

24-Hour Customer Service:

Our 24-Hours Customer Service is there to help you with your requests. Our

well-trained and qualified Customer Service team will assist you in answering your

queries, registering and resolving your complaints, reporting a lost or stolen card and

activating your card.

Overview of Expenses:

Each single charge and each withdrawal of cash at ATM made using your Pocket

Mate shall be clearly itemized on your bank statement enabling you to easily check the

status of your account.

Three Supplementary Cards:

Pocket Mate also gives you the facility of having up to 3 supplementary cards

issued against one primary card. All supplementary cardholders will be able to conduct

ATM or Debit transactions within the limits of the primary card account.

Lost Card Protection:

Card is safer than cash! Feel safe even in the event of losing your card!! All

you need to do is to call our 24-hour Customer Care, and a new card would be issued to

you within a week. You are protected from any financial liability arising from any

purchase transaction made on your lost card after it has been reported lost.

How to Apply

Existing Faysal Bank Debit Card holders have to fill a simple application form to

obtain Pocket Mate. Existing account holders not possessing any card presently can also

apply for Pocket Mate by submitting the application form. To be a part of Pocket Mate

family ,one must have a Current or Saving account at Faysal Bank.

Delivery of Pocket Mate:

Your Pocket Mate will be delivered to your branch within 5-7 days of your

application submission.

FAYSAL FINANCING DEPARTMENT:

Faysal Car Finance

Faysal Home Finance

Consumer Loan Faysal Car Finance:

Faysal Car Finance is the most flexible product designed to meet customer needs.

Features:

Car Financing for locally manufactured new and used cars and imported cars.

Car Financing up to five years

Down payment only 20% of the car value

Minimum documentation charges.

Fast processing.

Option to prematurely terminate the facility.

Eligibility:

Now you can swiftly, easily and cost effectively owns a car if you are:

A Pakistani National holding the New Computerized Identity Card (NADRA)

Minimum 20 years of age at the time of financing.

A Businessman or Self-Employed with a minimum of one year experience in the

same business and profession.

A Salaried person with at least two years employment history.

Housing Finance:

Faysal Housing Finance gives you so much more than great financing rates - We

help you all the way to make your next move in an easy and timely manner. Whether you

want to build a new home or are in a hurry to move into a ready built house or just want

to renovate your existing home or even transfer your existing expensive mortgage finance

balance, it is time to come to us for help and advice. We offer you the following

Housing Finance Packages:

Buy a Home

Build a House

Home Renovation

Balance Transfer Facility

Features:

Flexible repayment options

Option to partially or fully terminate the facility.

Financing tenor up to 20 years!!!

Fast processing.

Minimum processing charges

Enhancement option available

Financing available up to 80% of the market value of the property.

Eligibility:

A Pakistani Resident and National holding the New Computerized Identity

Card(NADRA) or Non-Resident Pakistani holding a NICOP.

Aged between 25 to 60 years if you are a salaried person and of 65 years if you

are in business

In continuous employment for 3 years and at least 1 year with the existing

employer.

In business with at least 3 years of business or professional experience

Corporate and Investment

Corporate investment

Faysal Bank Limited is fully geared to meet the changing economic challenges

present in Pakistan. We are ever striving to build meaningful relationships with our

customers and become partners in their growth and progress by acting as financial

advisors and consultants as well as financiers. Our Corporate Finance Group extends both

short and long term financing facilities designed to fulfill the individual need of each

corporate customer.

Investment Banking:

With the everchanging business environment in Pakistan, companies need expert

partners with a keen understanding of business to help achieve profit objectives. At

Faysal Bank, we offer the leaders of businesses and institutions, corporate advisory

services and a wide array of tools to help them accomplish their goals. We advise and

facilitate the arrangement of commercial paper, syndications, mergers, acquisitions and u

nder writing arrangements amongstmany others. Whether the customers require financing

of a project or managing of investments, we can guide them through the markets and

tailor a solution to meet their specific needs.

Agricultural Financing:

Faysal Bank offers specialized products for the agricultural sector. Our branches

located in agricultural areas of Pakistan are all equipped to help the local farmers improve

their yield and methods of farming by offering timely and affordable modes of financing

to suit their needs. To increase its outreach into agricultural regions of Pakistan, Faysal

Bank has entered into strategic alliances with other specialized banks through which it

will be financing the needs of farmers.

Cash Management:

Faysal Bank's Cash Management department has emerged as one of the leading

cash management solution providers in strategic markets such as local corporate, multi-

national companies, and mid-tier markets. Faysal Bank's role in these segments spanthe

entire spectrum of services including but not limited to Strategic Receivables/Payables

Management, Corporate Electronic Banking, Payroll and Fund Management services,

Dividend processing, and Process Re-engineering. Success of cash management services

is primarily attributed to its focus on providing stream lined and customized solution that

add value to business process of its clients.

Online Facility:

Now the bank gives you the absolute convenience of instant access to a host of

banking facilities and personalized services 24 hours a day, 7 days a week, 365 days a

year. Simplify the way you bank and experience a higher level of convenience.

Features Online:

Faysal Bank now offers free online banking to its customers on Faysal Sahulat

Current Account. The account is specially designed to address the needs of those

individual(joint, salaried, retired) and business customers who seek instant access to their

fund sat any Faysal Bank Branch across Pakistan.

Check your account balances

Transfer funds between your own accounts and to a third party account

You can use your card for loan account payments

Check transaction history of your accounts

Get your account statement through fax

Receive information on various FAYSAL bank products and services

Find out status of your card or loan application

Request balance or reference certificate

Get currency exchange rates

Issue stop payment instruction

Report loss of your cheque book

Request change in address and telephone numbers

Internet Banking:

Banking at consumer fingertips Internet Banking offers the customers

convenience to manage and control his banking and finances when he wants, where he

wants! It's Simple, Convenient, Secure and Faster. So, just by clicking one can enjoy this

facility. Features of internet banking

24x7 Access

The customers now have access to your account 24 hours a day, 7days a

week. They can transfer funds or even pay bills even if it's a holiday.

Secure and Faster

Secured & encrypted with latest tools and technologies, internet

banking is the choice for secure and fast Internet Banking.

Simple and Convenient

Easier navigation and help provided at every step, so the customers can

have most out of this service. With convenience is just a click away. To use

Internet Banking, consumers should be a registered FAYSAL Bank

Accountholder with a valid ATM Card. If someone does not have an account, he

may visit any of the nearest branches and open his account and obtain an ATM

Card. Our friendly branch staff will help him open his account quickly.

Toll Free Number:

Connect to FAYSAL bank ONLINE by dialing from anywhere within Pakistan.

Your call costs you nothing because it is toll free. This just goes to show that we at

FAYSAL bank always put your interests first

Convenience:

Why visit the bank when you can better use your precious time to meet other co

mmitments? With ONLINE, our special discounted charges also offer you substantial

savings. Give yourself the advantage of breakthrough innovation and cutting edge and get

time on your side.

Reference: Zahoor Mahsood

Relation Manager

Vous aimerez peut-être aussi

- Islamic Banking And Finance for Beginners!D'EverandIslamic Banking And Finance for Beginners!Évaluation : 2 sur 5 étoiles2/5 (1)

- Manual On Financial Management of BarangayDocument37 pagesManual On Financial Management of BarangayPeriod Ampersand Asterisk80% (20)

- MBFI NotesDocument27 pagesMBFI NotesSrikanth Prasanna BhaskarPas encore d'évaluation

- Training ReportDocument71 pagesTraining ReportHardeep MalikPas encore d'évaluation

- Chapter:-1 Introduction of BankDocument54 pagesChapter:-1 Introduction of BankOmkar ChavanPas encore d'évaluation

- An Overview of BanksDocument11 pagesAn Overview of BanksgishaPas encore d'évaluation

- Unit IDocument11 pagesUnit IShahid AfreedPas encore d'évaluation

- Banks Finanl PresentationDocument31 pagesBanks Finanl PresentationADNANE OULKHAJPas encore d'évaluation

- Banking LawDocument22 pagesBanking LawRASHIKA TRIVEDIPas encore d'évaluation

- History of Bank: Prepired by Bdifatah SaidDocument5 pagesHistory of Bank: Prepired by Bdifatah SaidAbdifatah SaidPas encore d'évaluation

- What Is The Difference Between Commercial Banking and Merchant BankingDocument8 pagesWhat Is The Difference Between Commercial Banking and Merchant BankingScarlett Lewis100% (2)

- Indian BankingDocument7 pagesIndian BankingMONIKA RUBINPas encore d'évaluation

- Introduction To BankingDocument35 pagesIntroduction To Bankingকাশী নাথPas encore d'évaluation

- FINANCE - CreditDocument9 pagesFINANCE - CreditHoney GubalanePas encore d'évaluation

- Banking and InsuranceDocument115 pagesBanking and InsuranceLeonardPas encore d'évaluation

- The Banking System in Bangladesh: History of BankDocument7 pagesThe Banking System in Bangladesh: History of Bankmirmoinul100% (1)

- Money & Banking PresentationDocument54 pagesMoney & Banking PresentationmehmooddharalaPas encore d'évaluation

- History of Philippine BankingDocument11 pagesHistory of Philippine BankingMark Ceddrick MiolePas encore d'évaluation

- Chapter - 01 Introduction of BankDocument37 pagesChapter - 01 Introduction of BankJeeva JeevaPas encore d'évaluation

- History: Personal FinanceDocument9 pagesHistory: Personal FinanceAyush JainPas encore d'évaluation

- Anitha HDFCDocument84 pagesAnitha HDFCchaluvadiinPas encore d'évaluation

- Unit I Banking and Insurance Law Study NotesDocument12 pagesUnit I Banking and Insurance Law Study NotesSekar M KPRCAS-CommercePas encore d'évaluation

- Growth of Banking Sector in India IntroductionDocument12 pagesGrowth of Banking Sector in India IntroductionShaktee Varma0% (1)

- Philippine Banking SystemDocument9 pagesPhilippine Banking SystemJungkookie Bae100% (3)

- The Banking System in Bangladesh: Definition of BankDocument10 pagesThe Banking System in Bangladesh: Definition of BankmirmoinulPas encore d'évaluation

- An Overview of Banking Industry - Unit I: Lecture Notes SeriesDocument28 pagesAn Overview of Banking Industry - Unit I: Lecture Notes SeriesGame ProfilePas encore d'évaluation

- A Study On Risk Analysis On Personal Loans at Vijaya BankDocument90 pagesA Study On Risk Analysis On Personal Loans at Vijaya BankChethan.sPas encore d'évaluation

- Chapter 01 Power PointDocument37 pagesChapter 01 Power PointmuluPas encore d'évaluation

- 00000114-Banking Law Inculding Negotiable Instrument ActDocument47 pages00000114-Banking Law Inculding Negotiable Instrument Actakshay yadavPas encore d'évaluation

- Merchant BankingDocument10 pagesMerchant BankingSunita KanojiyaPas encore d'évaluation

- History of BankDocument10 pagesHistory of BankSadaf KhanPas encore d'évaluation

- Merchant Banking Vs Commercial BankingDocument73 pagesMerchant Banking Vs Commercial BankingUditSawantPas encore d'évaluation

- Lecture No.1 (Intro To Money & Banking)Document17 pagesLecture No.1 (Intro To Money & Banking)Usama MubasherPas encore d'évaluation

- BANKING AND INSURANCE (1) .Docx NewDocument59 pagesBANKING AND INSURANCE (1) .Docx Newsuganya100% (1)

- Fundamental of BankingDocument10 pagesFundamental of BankingAnonymous y3E7iaPas encore d'évaluation

- Merchant BankingDocument27 pagesMerchant Bankingapi-3865133100% (13)

- Importance of The Bank System To The EconomyDocument12 pagesImportance of The Bank System To The EconomyEmil SalmanliPas encore d'évaluation

- Nikhil Nilee - Project-1Document83 pagesNikhil Nilee - Project-1Vaibhav MohitePas encore d'évaluation

- Philippine Banking SystemDocument20 pagesPhilippine Banking SystempatriciaPas encore d'évaluation

- Introduction To BankingDocument17 pagesIntroduction To BankingmashalPas encore d'évaluation

- Lecture # 15: Role of Commercial BanksDocument46 pagesLecture # 15: Role of Commercial BanksMudassar NawazPas encore d'évaluation

- Merchant Banking NotesDocument24 pagesMerchant Banking NotesSharada KadurPas encore d'évaluation

- 1.1 Concept of BankingDocument12 pages1.1 Concept of BankingsidharthPas encore d'évaluation

- LPB Unit - IDocument17 pagesLPB Unit - ITony StarkPas encore d'évaluation

- Indian Banking SystemDocument42 pagesIndian Banking Systemdraun vashishtaPas encore d'évaluation

- What Is A Bank ? Introduction: - CrowtherDocument29 pagesWhat Is A Bank ? Introduction: - CrowtherHarbrinder GurmPas encore d'évaluation

- Essentials of Banking and FinanceDocument32 pagesEssentials of Banking and FinanceAsadvirkPas encore d'évaluation

- Final Copy 1Document15 pagesFinal Copy 1gagana sPas encore d'évaluation

- Internship - Report 9097676765677Document80 pagesInternship - Report 9097676765677Abhijeet MohantyPas encore d'évaluation

- Internship Report Done at INDIAN BANK BRDocument80 pagesInternship Report Done at INDIAN BANK BRAbhijeet MohantyPas encore d'évaluation

- BankingDocument15 pagesBankingJyoti BhardwajPas encore d'évaluation

- Review of LiteratureDocument65 pagesReview of LiteratureRUTUJA PATILPas encore d'évaluation

- Review of LiteratureDocument64 pagesReview of LiteratureRUTUJA PATILPas encore d'évaluation

- Evolution of BankingDocument66 pagesEvolution of BankingMani KrishPas encore d'évaluation

- History of Banking IndustryDocument7 pagesHistory of Banking IndustryKimberly PasaloPas encore d'évaluation

- 1history 2etymology 3definition 4banking 4.1standard Activities 4.2range of Activities 4.3channelsDocument10 pages1history 2etymology 3definition 4banking 4.1standard Activities 4.2range of Activities 4.3channelsjohnsrs92Pas encore d'évaluation

- Fundamental F Banking Law-1Document88 pagesFundamental F Banking Law-1ramadhanamos620Pas encore d'évaluation

- Mendoza Lance - 1st AssignmentDocument5 pagesMendoza Lance - 1st AssignmentLance Jimwell MendozaPas encore d'évaluation

- Role of BankingDocument47 pagesRole of BankingMubashir QureshiPas encore d'évaluation

- The Impact of Brand Extension On Parent Brand ImageDocument10 pagesThe Impact of Brand Extension On Parent Brand ImageKR BurkiPas encore d'évaluation

- Internship Sindh BankDocument34 pagesInternship Sindh BankKR Burki100% (1)

- Title Page Qurtuba 2Document71 pagesTitle Page Qurtuba 2KR BurkiPas encore d'évaluation

- FINANCE Internship Report Guidelines MBA BBADocument2 pagesFINANCE Internship Report Guidelines MBA BBAMunira TurarovaPas encore d'évaluation

- IndictmentDocument14 pagesIndictmentLansingStateJournalPas encore d'évaluation

- San Miguel Corporation vs. Bartolome Puzon Jr.Document2 pagesSan Miguel Corporation vs. Bartolome Puzon Jr.RavenFoxPas encore d'évaluation

- Morgan Allen Position Description Operations and Comm DirectorDocument2 pagesMorgan Allen Position Description Operations and Comm Directorj_morgan_allen1528Pas encore d'évaluation

- ChallanFormDocument1 pageChallanFormAman GargPas encore d'évaluation

- Report of Collections and DepositsDocument3 pagesReport of Collections and DepositsReign Hernandez100% (1)

- Teresita Suson and Antonio Fortich Vs People of The Philippines GR NO. 152848 July 12, 2006Document7 pagesTeresita Suson and Antonio Fortich Vs People of The Philippines GR NO. 152848 July 12, 2006Francis V MartinezPas encore d'évaluation

- Ca No. Ge (E) /agr/ of 2021-22 Serial Page No: 01Document50 pagesCa No. Ge (E) /agr/ of 2021-22 Serial Page No: 01fakePas encore d'évaluation

- Tax July 21 SugesstedDocument28 pagesTax July 21 SugesstedShailjaPas encore d'évaluation

- 2017-Botswana Business Application Form - JennyDocument1 page2017-Botswana Business Application Form - JennyCalvawell MuzvondiwaPas encore d'évaluation

- Bouncing Checks LawDocument29 pagesBouncing Checks Lawrachel panlilio100% (1)

- Locker ModuleDocument32 pagesLocker ModulebinalamitPas encore d'évaluation

- Application Form NIE (MoS&T)Document3 pagesApplication Form NIE (MoS&T)Muhammad AslamPas encore d'évaluation

- Equiable Banking v. IACDocument1 pageEquiable Banking v. IACEr BurgosPas encore d'évaluation

- An Analysis On Cash Management at Standard PolymersDocument20 pagesAn Analysis On Cash Management at Standard PolymersSathish BillaPas encore d'évaluation

- Purpose: Fiscal Procedure F525 - Petty CashDocument6 pagesPurpose: Fiscal Procedure F525 - Petty CashVictor TucoPas encore d'évaluation

- Voucher For Mobilization AdvanceDocument2 pagesVoucher For Mobilization AdvanceSaroj AcharyaPas encore d'évaluation

- Your Branch DetailsDocument7 pagesYour Branch DetailsAartiPas encore d'évaluation

- April StatementDocument2 pagesApril StatementRAHUL SINGH50% (2)

- Sosa V Atty. MendozaDocument6 pagesSosa V Atty. MendozacyrinecalPas encore d'évaluation

- Lozano vs. Martinez Political Law Case DigestsDocument3 pagesLozano vs. Martinez Political Law Case DigestsJulia JumagdaoPas encore d'évaluation

- Chapter 1: Literature Review: Overview of Commercial BankDocument16 pagesChapter 1: Literature Review: Overview of Commercial BankThảo NgọcPas encore d'évaluation

- Meezan BankDocument50 pagesMeezan BankUsman NasirPas encore d'évaluation

- Psychology of MoneyDocument34 pagesPsychology of MoneyMiriam Columbro33% (3)

- Quijano v. Bartolabac Labor StandardsDocument229 pagesQuijano v. Bartolabac Labor StandardsPaula BitorPas encore d'évaluation

- Methodex - Sap FicoDocument4 pagesMethodex - Sap Ficon_ashok_2020Pas encore d'évaluation

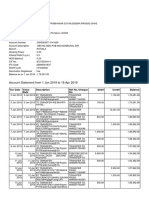

- Account Statement From 1 Jan 2019 To 18 Apr 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 1 Jan 2019 To 18 Apr 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceManoj PrabhakarPas encore d'évaluation

- Trial BalanceDocument3 pagesTrial BalanceFranca Okechukwu0% (2)

- Application For Convocation 37906 Gadage Sourabh ParmeshwarDocument2 pagesApplication For Convocation 37906 Gadage Sourabh ParmeshwarAshlesh KulkarniPas encore d'évaluation

- Interim PPT Abhinav KumarDocument18 pagesInterim PPT Abhinav Kumaramirana4uPas encore d'évaluation