Académique Documents

Professionnel Documents

Culture Documents

Convergence Under The Effects of Bilateral Trade - Draft

Transféré par

aqp_peruTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Convergence Under The Effects of Bilateral Trade - Draft

Transféré par

aqp_peruDroits d'auteur :

Formats disponibles

Convergence under the Effects of Bilateral Trade

Agreements

(1980-2005)

Abstract

This paper studies the linkage between international trade and income convergence across

countries. Different theories offer conflicting predictions regarding how they might affect

each other. This paper, using logistic regression during sample period 1980 to 2005 and

under a sample of 82 countries around the world, found that Bilateral Trade variable could

led to income convergence but its impact is small, but instead, the regional trade agreements

and regional effect will be higher and also significant.

Introduction

Income convergence across countries has been a fascinating subject of research for decades

in growth and development economics, especially after the seminal work of Solow (1956).

The original Solow model predicts that, due to decreasing returns to capital, income levels

across countries converge conditional on their saving rates, population growth and

technologies. Despite of the seemingly increasing income gaps across countries after the

World War II and the critiques from the new growth theory, the implications of the Solow

model for conditional income convergence has received strong empirical support. The

original Solow model, however, is in a closed economy setting and most of the early research

on income convergence neglects the role of trade. But, even the Solow model with

technology predicts that countries with a high rate of technological progress are likely to

grow faster.

Where in other side international trade, after the World War II has been increasing sharply

due to lower transportation costs and trade barriers. Trade not only fundamentally alters the

production and consumption patterns of trading nations, but also influences national

economies by imposing more rigorous competition, facilitating the spillover of technologies

and the exchange of ideas, constraining the governments domestic policies and harmonizing

international rules and institutions. It is important to understand whether and how

international trade might affect income convergence.

Different theories on their linkages, however, provide conflicting predictions

1

. It is largely an

empirical question how trade might affect income convergence. Similar to the theoretical

literature, the existing empirical studies also offer mixed results on the impact of trade on

income convergence.

1

Liu, Xuepeng (2009) Trade and Income Convergence: Sorting out the causality. Journal of International

Trade and Economic Development 18(1) 169-195 (pp.169)

In this paper, we adopt a bilateral trade analysis to address the causality problem between Trade

and Convergence. We use aggregate trade data by country and we take advantage of these data

that provide a convenient way to sort out the causality. The idea goes as follows. Using the

definition of Beta Convergence, formulated by Barro and Sala--Martin (1992), we created our

dependent variable convergence. Our independent variable will be averaged bilateral trade

divided by GDP-PPP for our defined rich countries

2

. We are going to test robustness of the

model using trade agreement (RTA) signed and enforced until 2003, as additional variable we

tested the regional effect as a dummy variable into the model.

The rest of this paper is organized as follows. In Section 2, we review the theoretical and

empirical literature on trade and income convergence. In Section 3, we discuss the methodology

and the strategies to resolve our problem between trade and convergence. Section 4 describes the

data and their sources. Section 5 shows the empirical results and some robustness checks are

performed too. Section 6 concludes.

2.-Literature review

In the existing theoretical literature, trade can affect income convergence; and the effect can

be positive or negative. The primary goal of this paper is to solve this causality relation under

a new perspective between them. Therefore the literature on their linkage in these directions

will be discussed.

Solow proposes to use the factor-price equalization (FPE) theorem which shows that free

trade tends to equalize (or converge) factor prices and endowments across countries

3

. Per

capita income convergence arises from per capita capital stock convergence. Those countries

concerned tend to move towards a similar capital-labor ratio and similar factor prices. Under

Solow perspectives Slaughter (1997) shows three possible ways that international trade likely

to have an impact on per capita income; enforcing the FPE theorem, mediating international

flows of technology, and trading capital goods. However, the FPE theory only addresses the

factor prices, not factor quantities. It does show outcomes in steady state free trade

equilibrium but not the process of trade liberalization. Empirical studies accommodate the

above issues in their analytical framework by considering proxies such as high levels of trade

between countries and the removal of obstacles to trade.

2

See Section 3.1

3

Solow, R, (1956) A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics

70(1):65-94

Bernard and Jones (1996) provide some evidence that free trade diverges income across

countries. They document that cross-country productivity levels (measured as either labor or

total-factor productivity) for individual manufacturing industries since 1970 have been either

not converging or even diverging. In contrast, since 1970 cross-country productivity levels in

services have been converging. To reconcile these facts Bernard and Jones hypothesize that

international trade might be causing the divergence: in the tradable-goods sectors,

comparative advantage leads to specialization, and to the extent that countries are producing

different goods, there is no a priori reason to expect the technologies of production to be the

same or to converge over time.

In contrast with these results, Ben-David (1993, 1996) and Sachs and Warner (1995) present

evidence linking trade to income convergence. These studies document historical episodes of

income convergence across a group of countries that were relatively open to each other

(Sachs and Warner, 1995), that liberalized trade policy among each other (Ben-David, 1993),

or that trade a lot with each other (Ben-David, 1996). The common conclusion of these

papers is that international trade causes convergence. These papers contribute to the

convergence literature by explicitly considering a role for trade. But their research design

leaves their evidence somewhat open to interpretation. Using several criteria addressing trade

and finance policies and outcomes, Sachs and Warner classify each country in 1970 as either

open or closed. From 1970 to 1989 only in the group of open countries did the poorer

countries in 1970 tend to grow faster over the next 19 years. They conclude that the open

economies display a strong tendency towards economic convergence . . . We suggest that the

most parsimonious reading of the evidence is that . . . the convergence club is the club of

economies linked together by international trade.

Ben-David (1996) hypothesizes that countries which trade with each other a great deal, tend

to converge. BD1996 further analyses the relationship between trade liberalization and

income convergence and suggests that it is the former that produces the latter, rather than the

other way around.

Ben-David (1993) analyzes five episodes of post-1945 trade liberalization, and finds that per

capita income dispersion among liberalizing countries generally shrank after liberalization

started. Ben-Davids primary evidence that liberalization causes convergence is that during

liberalizations, countries converged. He does make some comparisons of post-liberalization

convergence either to the pre-liberalization experience of liberalizers or to a set of control

countries. But these comparisons give only limited information.

Recent literature tends to focus its evidence on globalization to international income

convergence while Pritchett (1997), Baddeley (2006) and Ghose (2004) arrived at mixed

results. Pritchett (1997) and Baddeley (2006) showed that wealthier countries grew faster

than poor countries and the current era of globalization has not been associated with

convergence in economic outcomes. In contrast Ghose (2004) concludes that improved

performance stemming from trade liberalization stimulated growth across those countries

concerned, and reduced international inequality without reducing inter-country inequality.

The convergence hypothesis says that poor economies within regional trade agreements

(RTAs) are expected to grow faster than wealthier economies in the process of regional

integration. There are three arguments from the literature survey to support this. First, poor

economies can easily adopt existing technologies that pioneers previously developed. Trade

raises factor prices for rich economies and thus per capita income. Second, because growth

theory assumes diminishing returns to factor inputs, capital productivity is higher among

poor countries who are subjected to scarce capital. The expectation is that the capital-labor

ratio converges across a region and thus per capita income converges. Third, workers are

likely to move from low productivity agricultural activities to various ranges of high

productivity manufacturing and service sectors where there are cost advantages (

Jayanthakumaran, K. and Verma, R, 2008).

These arguments are subject to criticism as wealthier countries in the region have (a) their

accumulated experience of developing leading edge technologies, (b) poor economies tend to

adopt labor-intensive technology instead of capital-intensive technology and, (c) accessing

increasing returns to factor inputs (Slaughter 1997; Ghose 2004). The convergence

hypothesis can not only be interpreted in terms of the growth aspect but also as distributional

outcomes, widely known as the income trickledown effect. It is expected that the higher the

integration across a region, the higher will be the trickledown effect as regionally oriented

trade and investment reforms tend to allocate resources internally in response to comparative

advantages, and then incomes trickledown over time to the respective growing sectors.

In summary, the existing empirical studies estimating the impact of trade on convergence are

large and differ from one to another.

3.-Methodology

The primary purpose for this project is to provide a descriptive relationship between trade

and income disparity. The contribution of this paper is solely within the realm of empirically

ascertaining the existence of such a relationship. The bilateral trade between countries as well

as the RTAs (Regional Trade Agreements) and regional effect will be the key evidence for

examining the impact on income convergence differentials.

The method applied to investigate causal relation between the binary convergence variable

and the bilateral trade will be Logistic Procedure. The basic principle of Logistic regression

is predicting a dichotomous outcome (see Appendix B).

3.1 Dependent Variable Convergence:

There are two main concepts of convergence: The first one is that convergence applies if

poor economies tend to grow faster than rich ones. That is to say that a poor country tends to

catch up with a rich one in terms of the level of per-capita income. Barro and Sala-i-Martin

(2004) called this phenomenon | Convergence, but this processed is offset by new

disturbances that tend to increase dispersion. This concept is what we are interested in

explaining under our hypothesis.

The second concept of convergence is related to the dispersion in the world distribution of

income. This concept is usually called sigma-convergence. We say that this type of

convergence exist if the standard deviation of real GDP per-capita for a group of economies

is falling over time. Nevertheless, this second concept of convergence will be not part of this

project.

In order to build our dependent variable, we used the following argument:

We defined a richer country as one that has a higher GDP per capita in the initial period

0

1980 t = . After defining which country is richer, we ranked the list of countries based on

GDP per capita 1980 for each country, where the first country will be the richest country of

our sample (see appendix A for ranking of countries).

The Convergence exists if only if for each pair of countries the follow relation is true:

,2005 ,2005

,1980 ,1980

R P

R P

GDP GDP

GDP GDP

<

We will find only two possible values:

1 if exist convergence between Rich and Poor

o.w.

Convergence

O

=

The final matrix of convergence for these years will be one of 82 rows and 82 columns,

where each cell represents the convergence relationship between two countries, one poor the

other rich.

3.2 Explanatory Variables

3.2.1. Bilateral Trade

In order to observe the volume of trade between each pair of countries during the period 1980

to 2000 we need to identify a variable that measure the relationship of trade between two

countries

4

.

Such measure is the average ratio of volume of trade respect to total income of rich country,

where the idea is measure the trade relation between two countries, in average, weighted by

the richest of them.

( )

2000

1980

,

Bilateral Trade between two coutries diveded the GPD of rich country at period

Export of Country ith to country jth

ij ji

t

Richest i j

t

ij ji

X M

GDP

Bilateral Trade

N

Bilateral Trade t

X M

=

| |

+

|

|

\ .

=

=

+ =

( )

plus Import from country jth to country ith

Total number of periods 1980,1985,1990,1995, 2000 N =

Finally, we will finish at one matrix called Bilateral Trade with 82 rows and 82 columns.

The source used for the construction of this variable was the IMF as stated under the

Direction of Trade Statistics

5

. The IMF provides the volume of Bilateral Trade between

4

We consider the period 1980-2000 because we want to avoid global distortions as Iraq War.

5

http://www2.imfstatistics.org/DOT/

countries in millions of U.S dollars. The GDP per country was obtained by Penn World

Table version 6.3

6

.

For our purposes we want to see how the predictor variable (Trade) will affect our binary

response (Convergence).

3.2.2. Regional Trade Agreement (RTA)

The second independent variable will be the RTA between two countries. The source for this

variable was the Participation of Regional Trade Agreements (Goods and Services)

7

provided

by the World Trade Organization.

RTA variable was constructed as a matrix where if a trade agreement exist between two

countries and was enforce during the period 1980 to 2003, we considered the variable as with

the value of one, otherwise the variable will have a value of zero.

Each cell of this matrix will represent the existence or not of RTA between two countries.

3.2.5 Interaction Term

The interaction term tries to capture the joint effect between bilateral trade and RTA

variables. This variable is merely the product of these other two variables; if the joint effect

is significant under our hypothesis then it will be not possible to identify the main effect for

each variable (RTA and Bilateral Trade) individually.

3.2.4 Dummy Regional Effect:

This variable is a measure of the regional effect over the income convergence variable.

We used eight regions defined by IMF Direction of Trade Statistics

8

. Each one of our

countries belongs to one of these regions.

The construction of our dummy variables was using pair-wise relation between our 8 regions:

8

Total Dummies= 8 36

2

| |

+ =

|

\ .

These 36 possible dummies will show the relation from one country that belong to a specific

region AND other country that belongs to the same or different region, in both cases we

collect this information as one for each country, zero for the others (See Appendix A).

6

http://pwt.econ.upenn.edu/php_site/pwt_index.php

7

http://www.wto.org/english/tratop_e/region_e/rta_participation_map_e.htm?country_selected=GHA&sense=b

8

A=Asia (14), E=Europe (21) , NA= North America (3), CAC=Central America/ Caribbean (6), SA=South

America (9), AF=Africa/Sub-Sahara (15), NAME=North Africa/Middle East (12), AU=Australia/Oceania

(2). Total of (82) countries

From the 36 possible dummies variables we select one as our control, this was South

America to South America

Summarizing or dummy variables, they try to measure, in the most efficient way, the effect

that each region will have into convergence between a pair of countries.

3.3 Model

Our model will be answering the question to see if bilateral trade agreement will lead us to

income convergence in the period 1980 to 2005.

Under the previous hypothesis we defined our model under Logistic distribution as:

( ) ( )

0 1

1 P Convergence F X | | = = +

Where F represents the CDF (cumulative density function) of the logistic distribution and the

matrix of explanatory variables, called X will be:

{ } , , , Re X BilateralTrade RTA Interaction Dummy gions =

The full model represented in a linear form will be

And, the reduced model will be

( )

( ) ( )

( )

: Convergence between countries ,

1: Averaged Bilateral Trade between countries , diveded by GDP Rich country among ,

: Regional trade agreement between countries ,

: Interaction

Conv i j

BT i j i j

RTA i j

INT ( ) ( )

( ) ( )

ij

term between countries ,

: Regional dummy for countries , on regions ,

: Error term

1 to 82

1 to 82

1 to 8

1 to 8

BTxRTA i j

DR i j k l

i

j

k

l

c

=

=

=

=

The reduced model intended to answer what will be the total relationship that Bilateral Trade

had over convergence, using Bilateral Trade as unique explanatory variable.

We know that Logistic Regression is special case of GLM (General Linear Model) with

Binomial distribution on the dependent variable and it is not linear. Then, in order to solve

the non-linear equation we are going to use Maximum Likelihood Estimators (MLE)

technique, using SAS version 9.2 as our computational tool.

In order to test the diagnostic of the model we are going to test a goodness of fit

( )

2 2

Pseudo- as well as Chi-Square test R

o

_ for the Logistic Models (see appendix B).

4.- The Data

Some countries converge between them under particular. For example, we can say that many

countries of the OECD could present Income Convergence between them, given certain

particular characteristics as its the case with their volume of bilateral trade which has

increased over the time. One factor that could explain this increase in international trade

could be that trade barriers between them are reduced over time because Regional Trade

Agreements are increasing, or that some other special characteristics exist like regional

effects in many countries members, for example.

Our countries sample size was based on the need for all countries from 1980 to 2005 that

have data for each country have been recognized as a country before 1980 and to not have

dissolved between 1980 and 2005. At the same time, these countries had to have to submit

official trade statistics to IMF Trade section. We gathered data on the GDP PPP per capita

for 1980 and 2005. The same was done for the Bilateral Trade and the Regional Trade

Agreements between them to analyze the link between the convergence and trade

9

.

In order to define our sample size of countries, we started using all countries reported by

Penn World Tables v.6.3, which totaled 146 countries

10

. After discard countries that were

dissolved before 2005, new countries created after 1980, countries with incomplete

information over GDP for the period (1980-2005) and countries that did not reported official

information to IFM-DOTS during the same time period, we finished with a sample size of 82

countries from eight different regions. The countries are listed in Appendix A.

9

The GDP PPP p-c was collected from Penn World Tables. For Bilateral Trade we used the data base IMF

DOTS (Directional of Trade Statistics) in millions of dollars. For Regional Trade Agreements we used

World Trade Organization-Participation in Regional Trade Agreements.

10

Penn World Tables Information document

Economic Performance

4.1 Convergence

Our response variable called convergence was created using the levels of productivity per

capita from 1980 and 2005 presented in the Penn World Tables for 2011. We created a match

pair matrix with dimensions 82 rows and 82 columns, where the upper matrix is the same as

the bottom, under the principal diagonal. Every cell in this particular matrix was filled with a

binary response; zero if was not possible to find convergence and one if convergence existed.

When a country is richer than another, that country will show a higher ranking. This ranking

was the result after sorting the GDP per capita for 1980, where a country that has the biggest

GDP per capita will show ranking one and the country that presents the lowest GDP per

capita will show ranking 82.

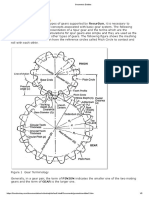

The next graph shows the total points of convergence for each country during the period of

interest. Qatar, ranked 1, present 77 points of convergence, Kuwait, ranked at 2, as well as

China ranked 77 present 76 points of convergence, the country with lowest level is Ethiopia

ranked 80 with only 11 points of convergence. Recall that countries are ranked based of its

GDP per capita 1980. The average number of convergence between countries is 38.

Source: Penn World Table v.6.3. Relation country versus points of convergence

31

43

32

33

35

30

26

37

46

22

33

45

76

33

34

21

36

34

38

60

29

11

35

41

51

42

29

37

40

25

28

32

29

63

58

47

28

32

37

35

40

24

48

76

21

43

40

43

40

34

30

33

46

37

34

26

21

38

54

32

37

27

33

38

77

22

28

36

35

57

37

55

28

60

32

50

46

37

36

29

35

49

Algeria

Argentina

Australia

Austria

Bangladesh

Benin

Bolivia

Brazil

Bulgaria

Cameroon

Canada

Chile

China

Colombia

Costa Rica

Cote d`Ivoire

Cyprus

Denmark

Ecuador

Egypt

El Salvador

Ethiopia

Finland

France

Gabon

Germany

Ghana

Greece

Guatemala

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran

Ireland

Israel

Italy

Japan

Jordan

Kenya

Korea

Kuwait

Malawi

Malaysia

Malta

Mauritius

Mexico

Mongolia

Morocco

Mozambique

Nepal

Netherlands

New Zealand

Nigeria

Norway

Oman

Pakistan

Panama

Peru

Philippines

Poland

Portugal

Qatar

Senegal

Singapore

South Africa

Spain

Sri Lanka

Sweden

Switzerland

Tanzania

Thailand

Trinidad &Tobago

Tunisia

Turkey

Uganda

United Kingdom

United States

Uruguay

Venezuela

Convergence Between Countries

By grouping the countries based on regions at which each country belongs to (see appendix

A), then the levels of convergence for each region will be:

Source: WTO Where A: Asia with 14 countries, E: Europe with 21, NA: North America with 3, CAC: Central

America/ Caribbean with 6 members, SA: South America with 9 countries, AF: Africa/Sub-Sahara have 15

samples, NAME: North Africa/Middle East with 12, AU: Australia/Oceania with 2 countries.

The graphs show that almost all regions present a percent convergence between 40 to 60

percent, except by Africa region. North Africa-Middle East presents the highest level of

convergence given the high influence of countries as Kuwait and Qatar.

4.2 Bilateral Trade

Later we calculated the bilateral trade volume between two countries as we explain in section

3.2.1. In order to test our hypothesis about convergence leaded by trade, we consider the

averaged bilateral trade between the 82 countries during 1980 and 2005. The information

required to construct Bilateral Trade variable between the 82 countries was obtained from

IMF-DOTS.

The next graph represents the average volume of bilateral trade for each country expressed in

terms of the one richest country.

From this graph we observed that almost all countries present the same percent of bilateral

trade with respect to real GDP. The highest variation between years is presented by

Singapore. It was also evident that countries as Hong Kong and Singapore present the highest

volume of trade during 1980 to 2000. Still, Ethiopia remained the country with the lowest

percent (0.18 percent)

A AF AU CAC E NA NAME SA

56%

35%

40%

39%

44%

41%

59%

46%

% Convergence per Region

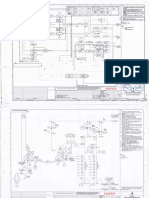

4.3 Regional Trade Agreements

The RTA variable was build using the World Trade Organization data set and represented as

1 if exist RTA between country i and country j

o.w.

i j

RTA

O

=

We consider only RTAs that were signed before or during 1980 and at least enforced until

2003.

The Regional Trade Agreements graph shows than countries as Mexico, Morocco and

Tunisia present the higher number of RTA signed and enforced during our period. Countries

as Malta, Poland not present any RTA because they were integrated to European Community

in 2004, before of that not exist a register of RTA for this countries.

Source: IFM-DOTS for Bilateral 1980 to 2000 and Penn-World Tables

0.0000 0.0500 0.1000 0.1500 0.2000 0.2500 0.3000 0.3500 0.4000 0.4500 0.5000

ALGERIA

ARGENTINA

AUSTRALIA

AUSTRIA

BANGLADES

BENIN

BOLIVIA

BRAZIL

BULGARIA

CAMEROON

CANADA

CHILE

CHINA

COLOMBIA

COSTA RICA

COTE' IVOIRE

CYPRUS

DENMARK

ECUADOR

EGYPT

EL SALVADOR

ETHIOPIA

FINLAND

FRANCE

GABON

GERMANY

GHANA

GREECE

GUATEMAL

HONDURAS

HONG KONG

HUNGARY

ICELAND

INDIA

INDONESIA

IRAN

IRELAND

ISRAEL

ITALY

JAPAN

JORDAN

KENYA

KOREA

KUWAIT

MALAWI

MALAYSIA

MALTA

MAURITIUS

MEXICO

MONGOLIA

MOROCCO

MOZAMBIQ

NEPAL

NETHERLAN

NEW ZEAL

NIGERIA

NORWAY

OMAN

PAKISTAN

PANAMA

PERU

PHILIPPINES

POLAND

PORTUGAL

QATAR

SENEGAL

SINGAPORE

SOUTH AFRICA

SPAIN

SRI LANKA

SWEDEN

SWITZERL

TANZANIA

THAILAND

TRIN&TOB

TUNISIA

TURKEY

UGANDA

UNITED KINGDOM

UNITED STATES

URUGUAY

VENEZUELA

Averaged Bilateral Trade with Respecto to Rich

Country

Source: WTO RTA in force until 2003

34

31

2

22

35

32

31

33

0

31

5

36

4

31

6

4

0

22

31

42

6

5

22

22

1

22

32

22

4

4

0

0

21

32

30

31

22

30

22

1

24

6

34

7

8

30

0

8

55

0

50

33

4

22

2

32

21

7

34

1

33

33

0

22

7

4

36

17

22

32

22

21

35

30

30

50

29

6

22

4

17

31

Algeria

Argentina

Australia

Austria

Bangladesh

Benin

Bolivia

Brazil

Bulgaria

Cameroon

Canada

Chile

China

Colombia

Costa Rica

Cote d`Ivoire

Cyprus

Denmark

Ecuador

Egypt

El Salvador

Ethiopia

Finland

France

Gabon

Germany

Ghana

Greece

Guatemala

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran

Ireland

Israel

Italy

Japan

Jordan

Kenya

Korea

Kuwait

Malawi

Malaysia

Malta

Mauritius

Mexico

Mongolia

Morocco

Mozambique

Nepal

Netherlands

New Zealand

Nigeria

Norway

Oman

Pakistan

Panama

Peru

Philippines

Poland

Portugal

Qatar

Senegal

Singapore

South Africa

Spain

Sri Lanka

Sweden

Switzerland

Tanzania

Thailand

Trinidad &Tobago

Tunisia

Turkey

Uganda

United Kingdom

United States

Uruguay

Venezuela

Regional Trade Agreements

4.4 Descriptive Statistics

The first analysis of our variables is represented by the next table:

Our data sets are balanced, each variable have the same number observations 6642 for the 82

countries ( ) 82 82 82 x .

We found a level of income convergence for almost 47% of the observations (i.e. 3118

observations found convergence). When looking at Average Bilateral Trade weighted by

Rich country GDP 1980-2000 the biggest result is in the Standard Deviation (0.00297) which

compared to its Mean shows a high variation around the mean. The RTA variable shows that

in average our sample present almost 25% (i.e.1642 observations present RTA).

5.- Empirical Analysis

Table 2 describes regression based on reduced model equation

11

. The Column refers to

Convergence as a function of Average Bilateral Trade by Rich. The Maximum Likelihood

Estimator is positive which suggest a positive influence in convergence between countries,

but our Pseudo R-Square value

( )

2

0.0028 R = suggest AVGBTR as not important variable to

explain by itself convergence.

11

Reduced Model section 3.3

Table1-Variables

Variable Name Source

Mean Variance Lower Upper

CONVERG Convergence 1980-2005

Penn-Worl d tabl es v.6.3 (growth

GDP per capi ta from 1980 to

2005)

0.4694369 0.2491034 0.4574318 0.4814421

BTAVGR

Average Bi l ateral Trade by ri ch

country 1980-2000

I MF-DOTS (Mi l l i ons of Dol l ars) 0.000671647 8.80E-06 0.000600302 0.000742992

RTA

Regi onal Trade Agreement 1980-

2003

WTO- Parti ci pati on of RTA 0.2472147 0.1861276 0.2368374 0.257592

I_BTAVGR_RTA I nteracti on Term by country Author 0.000388144 7.55E-06 0.000322041 0.000454247

Confidence Interval

Table 3 present the effect of the rest of the variables into the model.

Models (2) to (5) were building after add additional variables. All models are well specified

under Likelihood Ratio but the impact to explain our dependent variable is quite small. The

effect of the regional dummy variable overall will have a high impact to explain convergence

between countries for our sample period but the individual dummy impact is not clear given

the structure of regional dummy variable (i.e. interaction between regions).

The RTA variable is statistic significant and says that when RTA increases for one unit the

odds of Income Convergence is 1.3 to 0.7 times.

The Interaction has a consistent significant impact over Convergence for our sample period.

Observing Odds value for Interaction term it will be almost zero, which suggest that working

together both variables will is significant to explain Convergence but the impact to increase

the levels of convergence is small.

Table-2: Convergence Regression Analysis

Dependent Variable: Convergence between countries 1980 to 2005

Variable Estimators (1)

MLE 42.3232

Odd rati o >999.999

P-val ue (0.0001)**

Chi -Square 18.3695

P-val ue (0.0001)**

Pseudo R-Square 0.0028

Observati ons 6642

The P-val ue correspond to Chi -Square to each esti mator appear i n parenthesi s

*Si gni fi cant at 5%

**Si gni fi cant at 1%

BTAVGR

Li kel i hood Rati o

We have tested different ways of our covariance matrix. Instead of RTA as ones or zeros we

weighted by the number of years of pair of countries signed and enforced the agreement.

Our Bilateral Trade variables was measure as averaged against poor countries instead of rich

as consequence our interaction variables was changed too. But all results not show any

different result as before. Results are showed in Appendix A.

6.-Conclusions

This paper provides a new method to sort out the causality between bilateral trade and income

convergence by using averaged bilateral trade by rich countries data. Although our bilateral trade

variable per itself not explain quite well the levels of convergence between countries we found

that additional covariance as Regional Trade Agreements helps to explain our bilateral

convergence but still is not quite enough to explain the biggest change in our convergence

variable, is the regional effect that explain better the convergence between countries under the

period 1980 to 2005.

Table-3: Convergence Analysis

Dependent Variable: Convergence between countries 1980 to 2005

Variable Estimators (2) (3) (4) (5)

MLE 33.5797 271.6 123.1

Odd rati o >999.999 >999.999 >999.999

P-val ue (0.002)** (0.0001)** (0.0006)**

MLE 0.2828 0.2459 0.3696 -0.2658

Odd rati o 1.327 1.279 1.447 0.767

P-val ue (0.0001)** (0.0001)** (0.0001)** (0.0003)**

MLE -267.6 -122

Odd rati o <0.001 <0.001

P-val ue (0.0001)** (0.0009)**

MLE

Odd rati o YES

P-val ue

Chi -Square 24.6544 36.2849 96.2757 1327.5446

P-val ue (0.0001)** (0.0001)** (0.0001)** (0.0001)**

Pseudo R-Square 0.0037 0.0054 0.0144 0.1812

Observati ons 6642

The Chi -Square val ues appear i n parenthesi s

*Si gni fi cant at 5% and ** Si gni fi cant at 1%

SA_SA Control Regi on Dummy

BTAVGR

RTA

I _BTAVGR_RTA

Region_Dummy

(35)

Li kel i hood Rati o

Bibliography

Liu, Xuepeng Trade and Income Convergence: Sorting Out the causalityJournal of

International Trade and Economic Development, Vol. 18, No. 1 pp. 169-195, 2009 .

Jayanthakumaran, K. and Verma, R. International Trade and Regional Income

Convergence. The ASEAN-5 EvidenceASIAN Economic Bulletin Vol.25, No2 pp 179-

194, 2008

Slaughter, M. Per Capita Income Convergence and the Role of International TradeThe

American Economic Review, Vol.87 No2 pp. 194-199, 1997

Slaughter, M. Trade liberalization and per capita income convergence: a difference-in-

differences analysis Journal of International Economics Vol.55, Issue 1,

pp.203228, 2001

Barro, R.J., Sala-i-Martin, X.,. Convergence Journal of Political Economy Vol.100

No.2,pp. 223251, 1992

Ben-David, D., Equalizing exchange: trade liberalization and income convergence.

..Quarterly Journal of Economics Vol.108 Issue 3, pp. 653-679, 1993

Ben-David, D., Trade and convergence among countries. ..Journal of International

Economics Vol.40 Issue 3-4, 279298, 1996

Bernard, A.B., Jones, C.I., Comparing apples to oranges: productivity convergence and

measurement across industries and countries American Economic Review, Vol.86, No.5

12161238, 1996

Pritchett, L., Divergence, big time... Journal of Economic Perspectives Vol.11, No. 3, pp.

3-17, 1997.

Baddeley. M. Convergence or divergence? The impacts of globalization on growth and

inequality in less developed countries International Review of Applied Economics Vol.

20 No. 3, pp. 391-410, 2006

Ghose. A, K. Global inequality and International trade Cambridge Journal of

Economics Vol.28, No. 2, pp. 229-52, 2004.

A. Appendix

Countries List

Countries ranked under GDP PPP per capita 1980

12

12

A=Asia (14), E=Europe (21) , NA= North America (3), CAC=Central America/ Caribbean (6),

SA=South America (9), AF=Africa/Sub-Sahara (15), NAME=North Africa/Middle East (12),

AU=Australia/Oceania (2). Total of (82) countries

Rank Region Country Rank Region Country Rank Region Country

74 A Bangladesh 37 CAC Costa Rica 51 NAME Algeria

77 A China 55 CAC El Salvador 66 NAME Egypt

20 A Hong Kong 45 CAC Guatemala 52 NAME Iran

73 A India 60 CAC Honduras 23 NAME Israel

65 A Indonesia 50 CAC Panama 43 NAME Jordan

15 A Japan 25 CAC Trinidad &Tobago 2 NAME Kuwait

48 A Korea 57 NAME Morocco

44 A Malaysia 9 E Austria 27 NAME Oman

69 A Mongolia 53 E Bulgaria 70 NAME Pakistan

76 A Nepal 33 E Cyprus 1 NAME Qatar

58 A Philippines 14 E Denmark 54 NAME Tunisia

26 A Singapore 17 E Finland 56 NAME Turkey

64 A Sri Lanka 12 E France

61 A Thailand 11 E Germany 29 SA Argentina

18 E Greece 59 SA Bolivia

78 AF Benin 32 E Hungary 38 SA Brazil

62 AF Cameroon 6 E Iceland 41 SA Chile

63 AF Cote d`Ivoire 24 E Ireland 49 SA Colombia

80 AF Ethiopia 16 E Italy 46 SA Ecuador

31 AF Gabon 36 E Malta 47 SA Peru

75 AF Ghana 8 E Netherlands 35 SA Uruguay

67 AF Kenya 5 E Norway 28 SA Venezuela

79 AF Malawi 40 E Poland

42 AF Mauritius 30 E Portugal

72 AF Mozambique 22 E Spain

71 AF Nigeria 13 E Sweden

68 AF Senegal 3 E Switzerland

39 AF South Africa 19 E United Kingdom

82 AF Tanzania

81 AF Uganda 7 NA Canada

34 NA Mexico

10 AU Australia 4 NA United States

21 AU New Zealand

Table: Dummy Regions Variables

A_A AF_AF AU_AU CAC_CAC E_E NA_NA NAME_NAME

A_AF AF_AU AU_CAC CAC_E E_NA NA_NAME NAME_SA

A_AU AF_CAC AU_E CAC_NA E_NAME NA_SA

A_CAC AF_E AU_NA CAC_NAME E_SA

A_E AF_NA AU_NAME CAC_SA

A_NA AF_NAME AU_SA

A_NAME AF_SA

A_SA

Table: Aditional Convergence Analysis

Dependent Variable: Convergence between countries 1980 to 2005

Variable Estimators (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) (16) (17)

MLE 5.3652 9.7312 10.7705 5.6341 10.6431 10.7285

Odd rati o 213.836 >999.999 >999.999 279.807 >999.999 >999.999

P-val ue **(0.0011) **(0.0001) 0.0001 **(0.0006) **(0.0001) **(0.0005)

MLE 29.73 158.8 75.4752

Odd rati o >999.999 >999.999 >999.999

P-val ue **(0.0059) **(0.0001) **(0.0018)

MLE 0.5147 0.4864 0.5813 -0.2109 0.5147 0.4589 0.6051 -0.2176

Odd rati o 1.673 1.626 1.788 0.81 1.673 1.582 1.831 0.804

P-val ue **(0.0001) **(0.0001) **(0.0001) (0.062) **(0.0001) **(0.0001) **(0.0001) *(0.0535)

MLE 0.2828 0.2647 0.3146 -0.281

Odd rati o 1.327 1.303 1.37 0.755

P-val ue **(0.0001) **(0.0001) **(0.0001) **(0.0001)

MLE -13.2944 -12.908

Odd rati o <0.001 <0.001

P-val ue **(0.0014) **(0.0049)

MLE -185.3 -92.8133

Odd rati o <0.001 <0.001

P-val ue **(0.001) **(0.0022)

MLE -9.7403 -9.0268

Odd rati o 0.001 <0.001

P-val ue **(0.004) *(0.0247)

MLE

Odd rati o

P-val ue

MLE

Odd rati o

P-val ue

MLE

Odd rati o

P-val ue

MLE

Odd rati o YES YES YES

P-val ue

Chi -Square 37.3521 49.2384 59.7768 1315.9817 37.3521 46.4715 87.1555 1310.292 24.6544 37.7246 46.3052 1326.6653

P-val ue **(0.0001) **(0.0001) **(0.0001) **(0.0001) **(0.0001) **(0.0001) **(0.0001) 0.0001 **(0.0001) **(0.0001) **(0.0001) '**(0.0001)

Pseudo R-Square 0.0056 0.0074 0.009 0.1797 0.0056 0.007 0.013 0.179 0.0037 0.0057 0.0069 0.1811

Observati ons 6642 6642 6642

The Chi -Square val ues appear i n parenthesi s

*Si gni fi cant at 5% and ** Si gni fi cant at 1%

SA_SA Control Regi on Dummy

I _BTP_RTA

I _BTR_RTA

BTAVGR

RTA

I _BTAVGR_RTA

Region_Dummy

(35)

Li kel i hood Rati o

BTAVGP

RTAW

I _BTAVGP_RTAW

I _BTAVGR_RTAW

I _BTAVGP_RTA

Appendix B.

Logistic Regression

The Logistic Equation can be represented in terms of the probability of success versus

probability of failure, in natural logarithms.

^

0 1 ^

ln

1

P

X

P

| |

(

(

= +

(

Where, theoretically we can compute the Parameter P as the expected probability that

our dependent variable equal one for a given value of X.

( )

( )

^

0 1

0 1

exp

1 exp

X

P

X

| |

| |

+

=

+ +

Because of these complicated algebraic translations, our regression coefficients are not as easy to

interpret. Our old maxim that | represents "the change in Y with one unit change in X" is no

longer applicable. Instead, we have to translate using the exponent function. And, as it turns out,

when we do that we have a type of "coefficient" that is pretty useful. This coefficient is called the

odds ratio.

The odds ratio is equal to ( ) exp B . So, if we take the exponent constant (about 2.72) and raise it

to the power of | , we get the odds ratio. For example, if the printout indicates the regression

slope is .75, the odds ratio is approximately 2.12 ( ( ) exp .75 2.12 = ). This means that the

probability that Y equals 1 is twice as likely (2.12 times to be exact) as the value of X is increased

one unit. An odds ratio of .5 indicates that Y=1 is half as likely with an increase of X by one unit

(so there is a negative relationship between X and Y). An odds ratio of 1.0 indicates there is no

relationship between X and Y.

With logistic regression, instead of

2

R as the statistic for overall fit of the model, we have

deviance instead. We use chi-square as a measure of model fit here in a similar way. It is the fit of

the observed values (Y) to the expected values

^

Y

| |

|

\ .

. The bigger the difference (or "deviance") of

the observed values from the expected values, the poorer the fit of the model. So, we want a small

deviance if possible. As we add more variables to the equation the deviance should get smaller,

indicating an improvement in fit.

Instead of using the deviance (2LL) to judge the overall fit of a model, however, another statistic

is usually used that compares the fit of the model with and without the predictor(s). This is similar

to the change in

2

R when another variable has been added to the equation. But here, we expect the

deviance to decrease, because the degree of error in prediction decreases as we add another

variable. To do this, we compare the deviance with just the intercept (2LLnull referring to 2LL of

the constant-only model) to the deviance when the new predictor or predictors have been added

(2LLk referring to 2LL of the model that has k number of predictors). The difference between

these two deviance values is often referred to as G for goodness of fit (important note: Gs

referred to as "chi-square in SAS printouts).

( ) ( )

( )

2

model w/o variable model w. variable

2 2

null k

G D D LL LL _ = = =

Where the ratio

null

D is the evidence for the constant only model an

k

D is the deviance for

the model containing K number of predictors. An equivalent formula is

2

2

null

k

L

G Ln

L

_

| |

= =

|

\ .

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Vitus Bering, Centre For Higher Education: Jens Bertelsen & Jens Peder PedersenDocument50 pagesVitus Bering, Centre For Higher Education: Jens Bertelsen & Jens Peder PedersenAnca IscruPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- County Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Document60 pagesCounty Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Mamello PortiaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- KINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25Document329 pagesKINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25http://secwatch.comPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Managerial Economics - 1Document36 pagesManagerial Economics - 1Deepi SinghPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Geometric Entities: Basic Gear TerminologyDocument5 pagesGeometric Entities: Basic Gear TerminologyMatija RepincPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Sap On Cloud PlatformDocument2 pagesSap On Cloud PlatformQueen VallePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- LESSON - STEM-based Research ProblemsDocument49 pagesLESSON - STEM-based Research ProblemsLee JenoPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Attachment 05 - BFD, ELD and P&I Diagrams-PearlDocument77 pagesAttachment 05 - BFD, ELD and P&I Diagrams-Pearlum er100% (1)

- CV Rafi Cargill, GAR, MCR, AM GROUP and Consultancy EraDocument6 pagesCV Rafi Cargill, GAR, MCR, AM GROUP and Consultancy EranorulainkPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Valery 1178Document22 pagesValery 1178valerybikobo588Pas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- AutoCAD Civil 3D Performance Optimization 2Document5 pagesAutoCAD Civil 3D Performance Optimization 2Renukadevi RptPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Foreclosure of REMDocument10 pagesForeclosure of REMShanelle NapolesPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- JKR SPJ 1988 Standard Specification of Road Works - Section 1 - GeneralDocument270 pagesJKR SPJ 1988 Standard Specification of Road Works - Section 1 - GeneralYamie Rozman100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Philippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14Document89 pagesPhilippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14PortCalls50% (4)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- BSC IT SyllabusDocument32 pagesBSC IT Syllabusஜூலியன் சத்தியதாசன்Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- GRE Computer Science SyllabusDocument2 pagesGRE Computer Science SyllabusSameer Ahmed سمیر احمدPas encore d'évaluation

- Kajian Sistematik: Strategi Pembelajaran Klinik Di Setting Rawat JalanDocument5 pagesKajian Sistematik: Strategi Pembelajaran Klinik Di Setting Rawat JalanrhiesnaPas encore d'évaluation

- Inv69116728 45926324Document1 pageInv69116728 45926324dany.cantaragiuPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- BSNL Project MBA NitishDocument92 pagesBSNL Project MBA NitishAnkitSingh0% (2)

- BancassuranceDocument41 pagesBancassuranceanand_lamaniPas encore d'évaluation

- Literature Review 2500 WordsDocument6 pagesLiterature Review 2500 Wordsvvjrpsbnd100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Trahar (2013) - Internationalization of The CurriculumDocument13 pagesTrahar (2013) - Internationalization of The CurriculumUriel TorresPas encore d'évaluation

- MC 10226555 0001Document7 pagesMC 10226555 0001Hema IbraPas encore d'évaluation

- Cyber Cafe Audience Profiling Nielsen 2009Document17 pagesCyber Cafe Audience Profiling Nielsen 2009mahi46452Pas encore d'évaluation

- Lesson For SpreadsheetsDocument69 pagesLesson For SpreadsheetsCrisna Rivera PundanoPas encore d'évaluation

- Introduction To GlobalizationDocument17 pagesIntroduction To Globalization21100959Pas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Mss 202 Practice 19-20Document2 pagesMss 202 Practice 19-20fayinminu oluwaniyiPas encore d'évaluation

- MF 660Document7 pagesMF 660Sebastian Vasquez OsorioPas encore d'évaluation

- Pivacare Preventive-ServiceDocument1 pagePivacare Preventive-ServiceSadeq NeiroukhPas encore d'évaluation

- Form DVAT 27A: Intimation of Deposit of Government DuesDocument2 pagesForm DVAT 27A: Intimation of Deposit of Government DueshhhhhhhuuuuuyyuyyyyyPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)