Académique Documents

Professionnel Documents

Culture Documents

Taxation of Income Derived From Electronic Commerce

Transféré par

sohalsingh1Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Taxation of Income Derived From Electronic Commerce

Transféré par

sohalsingh1Droits d'auteur :

Formats disponibles

Taxation of income derived from

electronic commerce

The paper was contributed by Mr. Rashmin Sanghvi for the IFA Congress 2!

he"d at San Francisco.

This report is divided into two parts#

I. $%isting Indian &aw on the sub'ect.

II. A fresh review of the concepts invo"ved.

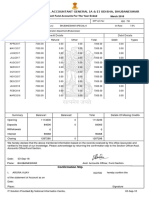

Circular No. 23 of 1969 issued by CBDT, India

Circular No. 1-2004 issued by CBDT, India

India Report

National Reporter

Rashmin C. Sanghvi.

Part I (ac) to Content * +e%t

1. Introduction

!.! For the purposes of this cahier, $"ectronic - Commerce or $-Commerce

has been defined to cover - .commercia" transactions in which the order is

p"aced e"ectronica""y and the goods or services are de"ivered in tangib"e or

e"ectronic /digitised0 form1.

!.2 In India, Income-ta% Act and Ru"es ma)e no specific provision for

e"ectronic commerce. A"" transactions are ta%ed or not ta%ed irrespective of

how the order is p"aced and how the goods are de"ivered. A"" authorities -

Ta% 2fficers, Courts and Authority for Advance Ru"ings determine the

ta%abi"ity of any transaction independent"y of whether the same wi"" be

covered by any )nown definition of e"ectronic commerce or not.

!.3 As can be seen "ater in this report, India has a very fair and practica"

ta% system for non-residents.

!.4 5overnment of India has appointed a .6igh 7owered Committee1 to

consider the issues arising because of $"ectronic Commerce. The

committee is to consider a"" issues and recommend if necessary,

modifications in the e%isting Income-ta% Act /I.T. Act0, ru"es, and 8oub"e

Ta% Avoidance Conventions /8TCs0. It is not )nown when the committee

wi"" submit its report. Any action may be ta)en by the 5overnment on"y

after the presentation of the report.

2. Scope of Discussion

2.! 7art I of this report is strict"y within the scope prescribed by IFA. This

part on"y discusses transactions that wou"d be covered under the

definition of e"ectronic commerce as given above. 9ithin this scope, there

is further "imitation of discussion to the fo""owing area#

2.2 The report on"y discusses income of the supp"ier of goods or services

and no other intermediaries in the e"ectronic commerce transactions - "i)e

internet service providers, web site hosts etc. Further, the report on"y

considers issues arising from .source of income1 and not from .residentia"

status1 of the assessee.

2.3 In India Income-ta% is "evied on"y by the Centra" 5overnment and not

by any other State 5overnment or Municipa"ities. 6ence the discussion

concentrates on"y on nationa" "eve" ta%ation.

2.4 This part of the report does not cover issues arising because of

permanent estab"ishment and discussion on Characterisation of Income is

ept to the minimum.

2.: For the purpose of this discussion, re"iance is p"aced on the Indian

Income-ta% Act, ru"es, 8oub"e Ta% Avoidance Treaties signed by

5overnment of India, and the Indian case "aw.

!. "lectronic Commerce and Source#$ased Taxation under

Income#tax %ct.

3.! There can be severa" grounds based on which a 5overnment can assert

its right to ta% /Ta% ;urisdiction0. And there can be severa" grounds based

on which the ta% payor can dispute 5overnment<s right to ta%. $"ectronic

commerce raises a who"e range of points of disputes = differences of

opinion. For the purpose of this report however, we are restricting

ourse"ves to issues re"ated to .source1.

7aragraph 3 discusses the provisions under the Act.

3.2 >nder the Indian Income-ta% Act ? Ru"es there is no specific provision

described as .source ru"es1. In this report, the provisions that have the

effect of .source ru"es1 are treated as .source ru"es1.

3.3 Section : of the Income-ta% Act prescribes the @Scope of Tota" Income<

or, in other words, 5overnment<s ;urisdiction to ta%.

The section provides that in case of an Indian resident, his wor"d income is

ta%ab"e in India. In case of a non-resident, the section does not use the

word @Source of Income<. Instead, it uses the fo""owing "anguage#

.A the tota" income of a non#resident inc"udes a"" income from whatever

source derived which -

a.

is received or is deemed to be received in India in such year by or

on beha"f of such personB or

b.

accrues or arises or is deemed to accrue or arise to him in India

during such year.1

3.4 The above definition means that if any income is received in India,

irrespective of the residentia" status and source of income, the same wi"" be

ta%ab"e in India. A"so, an income which is accruing or arising in India /may

be considered as .sourced in India1 and hence0 is ta%ab"e in India. The

section empowers the 5overnment to ma)e deeming provisions in the "aw

and e%tend the scope of .source1.

3.: It may be noted that whi"e the section e%tends the scope of source

to &receipts in India'( it does not e%tend the scope to&pa)ments from

India'.

3.C Section D of the Income-ta% Act ma)es necessary provisions to

determine which incomes sha"" be deemed to have accrued or arisen in

India. The re"evant provisions are brief"y stated be"ow.

3.E Section D/!0/i0 provides that a"" income accruing or arising to a non-

resident from a *+usiness connection, in India sha"" be deemed to have

accrued or arisen in India. In other words, such income sha"" be covered

within the scope of ta%ab"e income. Any person from whom the non-

resident is in receipt of income in India becomes the business connection -

section !C3/!0/c0. 7"ease a"so see section !C/!0/i0 and section !C!. The

Indian person who becomes the business connection is treated as an agent

of the non-resident. The agent is responsib"e to deduct ta% at source and

pay the same to the 5overnment of India. /Chapter FG - ."iabi"ity in

specia" cases1.0

Note # >nder section !C3, it is not important whether the income is

received in India or outside India. The fact that the non-resident has

received income from a person in India is sufficient to ma)e him "iab"e to

ta% in India provided that it is attributab"e to operations carried out in

India. Consider an i""ustration, A non-resident Mr. + provides services in

India to an Indian resident Mr. I. Mr. I pays to Mr. + from his ban)

account in ;ersey. Sti"", the payment wou"d be covered under S.!C3/!0/c0.

3.H This provision is circumscribed by a proviso that the scope of the tota"

income sha"" e%tend on"y to income reasona+l) attri+uta+le

to the operations carried out in India. ISection D/!0/i0/a0J Thus, income

attributab"e to operations carried on outside India are not covered within

the scope of ta%ab"e income. This is a broad princip"e for attri+ution

of income.

3.D Centra" (oard of 8irect Ta%es has issued a circu"ar /+umber 23 dated

23

rd

;u"y, !DCD0 c"arifying that non-resident exporters of goods sha"" not

be "iab"e to ta% in India 'ust because they have e%ported goods to India and

received e%port proceeds from India. This circu"ar is based on Supreme

Court decision in R. 8. Agarwa" :C ITR 2 and other decisions.

>nfortunate"y, the circu"ar covers on"y e%port of goods and not e%port of

services. 6owever, re"iance may be p"aced on the re"evant court decisions

to draw an inference that even in case of services, non-resident e%porters

of services sha"" not be "iab"e to ta% in India e%cept where a specific

deeming provision covers their income.

3.! In most cases of e"ectronic commerce transactions, the non-resident supp"ier of the goods ? services may not carry out any

transactions in India. In such cases, if his income is covered on"y by the category .business income1 then he may not be ta%ab"e in

India.

3.!! 6owever, section D and section : are two different provisions. If an income is covered under section : /the income is received

by the non-resident or his agent in India0, then the same wi"" be ta%ab"e in India irrespective of where the business operations are

carried on - Circu"ar 23 wi"" not app"y. 6ence non-residents p"an their affairs to receive their amounts direct"y outside India.

3.!2 Summar) of the Indian I.T. %ct. Provisions-

+on-Resident is "iab"e to ta% in India if the income is covered in any of the fo""owing categories#

3.!2.! Section D - /!0/i0 6e has carried out operations in IndiaB and

6e has earned net profits out of revenues that can be attributab"e to the above referred operationsB

3.!2.2 Section D/!0/vi0 6e has received roya"ties or technica" )now-how fees ? /vii0 from an Indian residentB or a non-resident in

prescribed circumstances.

3.!2.3 Section : - /20 The income is received in India irrespective of the sourceB

2R

The income is accruing or arising in India.

In a"" the above referred cases, a permanent estab"ishment in India is not necessary for ta%abi"ity in India.

3.!2.4 For non-business incomes "i)e sa"aries, interest, etc. section D ma)es specific provisions. 6owever, the same are not

re"evant to e"ectronic commerce and hence not discussed in this report.

The above discussion is on some of the provisions of Indian Income-ta% Act. In the fo""owing paragraphs position under 8TC is

discussed.

4.

Some Case .a/ # narrated very brief"y without comments.

4.! Credit Card Compan).

Authority for Advance Ru"ings. 7. +o. 3 of !DDD. 23H ITR 2DC.

$rief 0acts # Assume a ban) /say, American $%press (an)0 has a subsidiary in India providing credit card faci"ities. The

American $%press (an) - /A$(0 provides computer /hardware and software0 "ocated in >.S.A. for co""ection ? ana"ysis of credit

card re"ated data. Its subsidiary in India /A$( India0 can access this information through internet for a charge.

Issue # Is the amount paid by A$( India to A$( - a business income or roya"tyK Is it ta%ab"e in IndiaK

Ruling # The amount is roya"ty income and hence ta%ab"e in India on the gross amount at a f"at rate as per Indo->.S. treaty.

4.2 Computerised Reservation S)stem 1CRS2 for airline +ooings.

/Since it is a department "eve" decision, it has not been reported.0

0acts # A CRS Company maintains computer hardware and software in country @A< outside India. Severa" air"ine companies

associate with the CRS company for se""ing their tic)ets through the system. The CRS company provides boo)ing services

throughout the wor"d to trave" agents. It has a subsidiary in India which provides "oca" hardware - @routers< and software to the

trave" agents.

The trave" agents use the computerised reservation system and boo) tic)ets.

Air "ine companies ma)e payments to the CRS company based on tic)ets boo)ed through the system.

Issue # Can the amounts paid outside India by non-resident air "ines, to the non-resident CRS company - be ta%ed in IndiaL

Decision +) the department.

The Income-ta% officer and the Commissioner Appea"s have decided that this amount is ta%ab"e in India.

Reasoning- In e"ectronic communication system, speeds are so high that @space co""apses< and @time stops<. The CRS company is

deemed to have a .virtua"1 presence in India. It has a permanent estab"ishment in India. It is "iab"e to ta% on the amounts

received from air"ine companies as business income.

Note- These are two e%treme i""ustrations of the )ind of prob"ems created in an attempt to app"y e%isting "aw to $-Commerce.

3. Dou+le Tax %voidance Conventions 4 Source

:.! India has a specia" c"ause in its treaties for technica" service fees. The definition under the treaties varies from country to

country. This report considers as an i""ustration, a norma" treaty "i)e Indo->.M. treaty. Artic"e !3 provides for both - roya"ties and

fees for technica" services /R ? T0.

:.2 $%tracts of the re"evant c"auses within the artic"e are reproduced be"ow#

%rticle 1!1!2 Definition of Ro)alt).

/30/a0 payments of any )ind received as a consideration for the use of, or the right to use, any copyright of a "iterary, artistic or

scientific wor), inc"uding cinematograph fi"ms or wor) on fi"ms, tape or other means of reproduction for use in connection with

radio or te"evision broadcasting, any patent, trade mar), design or mode", p"an, secret formu"a or process, or for information

concerning industria", commercia" or scientific e%perienceB and

/30/b0 payments of any )ind received as consideration for the use of, or the right to use, any industria", commercia" or scientific

eNuipment, other than income derived by an enterprise of a Contracting State from the operation of ships or aircraft in

internationa" traffic.

!3/40 Definition of fees for technical services.

For the purposes of paragraph 2 of this Artic"e, and sub'ect to paragraph : of this Artic"e, the term .fees for technica" services1

means payments of any )ind to any person in consideration for the rendering of any technica" or consu"tancy services /inc"uding

the provision of services of technica" or other personne"0 which#

AAA.

!3/:0 The definitions of fees for technica" services in paragraph 4 of this Artic"e sha"" not inc"ude amounts paid#

A

A

:/d0 for services for the private use of the individua" or individua"s ma)ing the paymentB

A

...

!3/E0 Roya"ties and fees for technica" services sha"" be deemed to arise in a Contracting State where the pa)er is that State

itse"f, a po"itica" sub-division, a "oca" authority or a resident of that State. 9here, however, the person paying the roya"ties or

fees for technica" services, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent

estab"ishment or a fi%ed base in connection with which the ob"igation to ma)e payments was incurred and the payments are

borne by that permanent estab"ishment or fi%ed base then the roya"ties or fees for technica" services sha"" be deemed to arise in

the Contracting State in which the permanent estab"ishment or fi%ed base is situated.

:.3 A provision simi"ar to section D under the I.T. Act is made in artic"e !3/E0. 6owever, this artic"e simp"y ma)es a deeming

provision that a R ? T payment wi"" be deemed to arise in India if the pa)or is an Indian resident. The concept

of utilisation in India is absent in the treaty. This wor)s both ways.

i. 2nce an Indian resident ma)es a payment, it is "iab"e to ta% in India under the treaty. $ven if it is not used in India,

sti"" the receiver remains "iab"e to ta%.

ii. If a non-resident ma)es payment to another non-resident for R ? T where the .uti"isation1 is in India, it may escape

the ta% under the Indo->.M. treaty.

/Note - In a simi"ar situation under Indo->.S. treaty, the amount wou"d be ta%ab"e in India. Artic"e !2/E0/b0 provides for ta%

based on*utilisation,. Such a provision is not made in Indo->.M. treaty.0

2. 6aving considered the broad princip"es, "et us consider specifica""y - roya"ties ? technica" service fees. +ow the Income-ta% Act,

the 8TCs and their interaction is discussed.

C.! Ro)alt) Section 51121vi2 of the Indian Income-ta% Act - fo""owing incomes are deemed to accrue or arise in India -

roya"tiespa)a+le by -

a. The 5overnment of IndiaB or

b. Any resident of India. 6owever, roya"ties paid for business etc. outside India is not deemed to be ta%ab"e in India.

c. Any non-resident of India - provided that the payment is made for business etc. in India.

C.2 Note # In case of payment by 5overnment of India, roya"ties are a"ways ta%ab"e in India. In case of a resident, the same are

ta%ab"e if the source of roya"ty /any trade mar), patent etc.0 is utilised in India. $ven if a non-resident ma)es payment to

another non-resident, outside India, the same can be ta%ab"e in India if the source of roya"ty is uti"ised in India. Thus, the

concept of .uti"isation in India1 has been brought in to e%tend the definition of .source1.

C.3 The term roya"ty has been defined under section D/!0/vi0 e%p"anation 2 - to inc"ude consideration paid for-

i. The transfer of all or an) rights inc"uding "icence in respect of a patent, mode" design etcB

ii. The use of any patent, A , mode" , design, etc.

A A A

iii. The transfer of a"" or any rights inc"uding licence in respect of copyright, "iterary, artistic or scientific wor) inc"uding

fi"ms or video tapes for use in connection with te"evision or radio broadcasting but not inc"uding consideration for

the sa"e, distribution, or e%hibition of cinematographic fi"msB

iv. The rendering of any services in connection with the above referred activities.

Note # +orma" definition of roya"ties is thus e%tended.

C.4 Section 51121vii2 # Technical Service fees.

2$C8 Mode" Ta% Convention on Income ? Capita" does not provide for a separate category of technica" service fees. Simi"ar"y,

the >.+. Mode" a"so does not provide for a category of technica" service fees. 6owever, India insists on having a specific c"ause in

8TCs for technica" service fees. Simi"ar"y, within the Income-ta% Act, a deeming provision is made for e%tending the scope of

ta%ab"e income to cover technica" service fees. The deeming provisions e%tending the scope of source are simi"ar to the roya"ties.

The definition of technica" service fees is brief"y as under#

.A any consideration for the rendering of manageria", technica", or consu"tancy services inc"uding the provision of services of

technica" or other personne". .

C.: Thus, the 7ar"iament has e%tended the definitions of roya"ties and technica" service feesB and e%tended the scope of .source1

to .uti"isation1. 9herever a receipt by a non-resident can be covered under these e%tended definitions, the same becomes ta%ab"e

in India. 2nce ta%ab"e, the payor is responsib"e for withho"ding ta% at source and paying the same to the 5overnment of India.

2. "6ISTIN7 S89RC" R9."S-

&et us consider the above e%isting ta% provisions and how they app"y to e"ectronic commerce.

E.! As yet, no specific provision is made for the determination of source of income from e"ectronic commerce. 9e have to app"y

the e%isting source ru"es to the transactions that we consider as e"ectronic commerce.

E.2 There are no specific ru"es for treating income attributab"e to functions performed, in who"e or in part, by e:uipment /as

opposed to human beings0. 6ence the Nuestions pertaining to the use of server = website cannot be determined by any e%isting

"ega" provisions.

E.3 In the present situation, it wou"d not ma)e any difference whether a business is done as e"ectronic commerce or otherwise. In

other words, fo""owing transactions wou"d not ma)e any difference in ta%ation#

a. 9hether the communication is made through internet or through the conventiona" means "i)e te"ephone = fa% =

"etters etc.

b. 9hether a software programme is de"ivered over the internet or on a f"oppy or C.8. at .off the she"f1 software store.

c. 9hether a boo) or a recording is de"ivered in physica" form or is down"oaded on computer.

This is in )eeping with the princip"e that there shou"d be neutra"ity between e"ectronic commerce ? regu"ar =

conventiona" commerce. /This is not a resu"t of a de"iberate po"icy decision. It is mere"y a conseNuence of the fact that

as yet, no ru"es are made for e"ectronic commerce.0

E.4 India has not made any specia" - source of income - ru"es for glo+all) integrated e"ectronic commerce businesses.

E.: The e%isting source ru"es as discussed under section D above, wi"" not ma)e any difference whether a service

is delivered within India or from outside India.

E.C There is no specific source ru"e for e"ectronic commerce. 6owever, e%isting ru"es can be app"ied to determine the ta%abi"ity of

e"ectronic commerce. If an activity is considered as roya"ty or technica" service, payments made for the same wou"d become "iab"e

for withho"ding ta%. For e%amp"e - an Indian resident accesses a non-resident<s website outside India. 6e watches a feature fi"m

or he "istens to some music on the computer for one hour. For this service, he pays >.S. O !. 7rima facie, this can be considered

as roya"ty under section D/!0/vi0. It wou"d be ta%ab"e in India.

>nder the Indo->.M. treaty, an individua" ta)ing a technical service for his own use, is not ta%ab"e in the country of source

IArtic"e !3/:0/d0J. 6owever, if it is treated as ro)alt), it wou"d be ta%ab"e.

In short, the ta%abi"ity wou"d depend upon Characterisation of income.

E.E Indian companies have started a vigorous drive for internet business. Many companies are deve"oping own websites and

providing e"ectronic commerce services. 9hen they get income from abroad, as Indian residents, they wi"" be "iab"e to fu"" ta% in

India. If any ta% is payab"e abroad, they wi"" get the credit for the same against Indian ta% "iabi"ity.

2. ;hichever is more $eneficial.

H.! The provisions of the Indian Income-ta% Act and 8TCs may be different in severa" cases. The Indian "aw provides that in case

of difference in provisions, whichever is more beneficia" to the assessee sha"" be app"icab"e to the assessee.

Such a benevo"ent re"ief is avai"ab"e on"y to non-residents.

This provision is made under#

i. Section D/20 and

ii. Circu"ar +o. 333 dated 2nd Apri", !DH2 issued by the Centra" (oard of 8irect Ta%es.

2. 8pportunities for avoiding tax.

Such a provision /whichever is more beneficia" to the assessee0 provides good opportunities to avoid Indian Income-ta%.

Consider an i""ustration.

The definition of .roya"ty1 under section D/!0/vi0 does not cover eNuipment "easing.

Some 8TCs e%ecuted by India inc"ude "ease charges under the definition of roya"ty.

An assessee earning "ease renta"s from India can c"aim that for him, the Income-ta% Act provision is more beneficia", hence he

chooses to be governed by the Act. 6ence his "ease income wou"d not be ta%ab"e in India.

!. ;ithholding of tax # 0inalit).

0acts.

>nder sections 44AC ? 2CC, 5overnment of India had made specia" provisions for co""ection of ta%. Some specific traders were

covered under this scheme. 2nce the ta% was co""ected ? paid to the 5overnment, it was fina". Assessee had no option to c"aim

that he had "ower income, or "osses.

Court Decision.

This decision was cha""enged in a Court of "aw. >"timate"y the Supreme Court .read down1 the provisions and he"d that the

assessee a"ways had an option to fi"e his return of income. If he had "ower income or "osses, he cou"d c"aim appropriate refund.

/Sanyasi RaoB 2!D ITR 33B Supreme Court0.

In severa" other sections, covering receipt of income by non-residents, ta% withho"ding provisions are made. In some cases, the

ta% withhe"d is fina". It is submitted that the above referred decision of the 6onourab"e Supreme Court wi"" not app"y to these

cases.

<. Polic) Issues Regarding "lectronic Commerce.

As reported above, the $"ectronic Commerce Committee may provide many suggestions for changes in po"icies. The report is yet

to be fina"ised.

Independent of the committee<s proceedings it may be reported that severa" persons have e%pressed fo""owing view#

Current +alance +et/een .Source based ta%ation1 and .residence based ta%ation1 is more in favour of .deve"oped1 countries

and against the .deve"oping1 countries. Current ba"ance needs a thorough re-e%amination.

9hether and how the re-e%amination may ta)e p"ace wi"" be )nown on"y "ater.

3. %dministrative Issues.

India has e"aborate"y deve"oped, fair ru"es for compliance. 9hi"e there is no specific provision for e"ectronic commerce, the

norma" procedure wou"d app"y.

!2.! Income#tax Returns.

$very person who is "iab"e to ta% in India /irrespective of whether he is a resident or not.0 has to fi"e his own tax returnswith the

Income-ta% department. The return has to be fi"ed suo-moto and no notices are reNuired to be served by the department. /Section

!3D.0

9here the department considers that a person is "iab"e to fi"e return ? has not fi"ed returns, the department may serve a notice

on him to fi"e the return. /Section !420

If a person does not fi"e the return, the Income-ta% officer can, based on avai"ab"e information, estimate his income and issue

notice of demand for co""ection of ta% /Sections !4H to !:30.

!2.2 Tax Recover).

The recovery of ta% has been ensured in three different manners#

!2.2.! Receiver<s duty to pay /Sections 2D to 2!! ? section !4A0B

!2.2.2 7ayor<s duty to withho"d /section !D:0B and

!2.2.3 Foreign Remittance restrictions /F$MA0.

!2.2.! The non-resident person receiving income from India - which is "iab"e to Indian ta% on source-basis1Receiver2, is "iab"e to

pay advance income-ta% during the previous year in which the transaction ta)es p"ace. At the time of fi"ing the income-ta% return,

shortfa"", if any has to be paid-up. This is ca""ed ta% on se"f-assessment. +on-payment of ta% can attract interest, pena"ty and

prosecution.

!2.2.2 Simi"ar"y, the pa)or of the income is "iab"e to withho"d ta% at source and pay to the 5overnment. +on-payment can attract

interest, pena"ty, prosecution and disa""owance of e%penses. This "iabi"ity to withho"d and pay ta% app"ies irrespective of whether

the payor is a corporate business or an individua"B and whether the uti"iPation of product = service is for business or for persona"

purposes.

There wou"d be no &dou+le#pa)ment' of ta%. 2nce the payor has withhe"d ta% at source, the receiver sha"" ta)e credit for the

same whi"e ma)ing fina" payment.

!2.2.3 >nder Foreign $%change Management Act 10"=%2, instructions have been issued that no ban) sha"" permit a foreign

remittance un"ess the ta% deductib"e thereon has been deducted and paid to the 5overnment.

!2.2.4 Refund.

If e%cess ta% has been withhe"d or paidB the receiver or the payor can fi"e return and c"aim refund.

!2.3 9hi"e these e"aborate provisions for co""ection of ta% are made, significant reliefs are a"so granted where the receiver

considers that he is not "iab"e to ta%.

!2.3.! The receiver, or on his beha"f the payor can fi"e an app"ication with the Income-ta% officer. ISection !D:/20J The app"icant

can c"aim that - either the who"e amount is e%empt or that a "ower ta% is app"icab"e. If the officer is satisfied about the c"aim, he

can issue a certificate for non#pa)ment or lo/er pa)ment of ta%.

!2.3.2 The receiver can a"so fi"e an app"ication for a +lanet certificate. If the officer is convinced of the va"idity of such a

c"aim, he can give a certificate to the receiver va"id for one year. This certificate wi"" be va"id and app"icab"e to a"" the Indian

residents who might ma)e payments to the receiver. A"" those payors can, based on the certificate, withho"d an amount "ower

than the rate prescribed by the I.T. Act or the treatyB or not withho"d any ta% at a"" - as may be provided in the certificate.

!2.3.3 The ta% payors have one more option. Instead of app"ying to the Income-ta% officer for the certificate, they can a"so as) for

a simi"ar certificate from a chartered accountant. It is the duty of the concerned chartered accountant to study the re"evant

"aw and decide ta%abi"ity. In his certificate, he wi"" certify whether any ta% is payab"e at a"". If any ta% is payab"e, he can certify the

app"icab"e rate. If no ta% is payab"e, he may give appropriate certificate.

The payor has to e%ecute an underta)ing that if "ater on, it is found that more ta% was payab"e, he sha"" pay the same.

(ased on this certificate from the chartered accountant, the payor can ma)e reNuisite payment and remit the funds to the foreign

supp"ier of services = goods. This payment cou"d be without any deduction of ta% or by deducting "ower ta% - depending upon the

certificate. The ban) wi"" a"so permit foreign remittance based on the chartered accountant<s certificate.

It is the duty of the payor to fi"e underta)ing with the ban). (an) wi"" inform the R(I and the Income-ta% officer that payment

has been remitted abroad after deducting "ower ta% or no ta%.

The payor is reNuired to ma)e dec"aration to the income-ta% officer. The receiver has to fi"e income-ta% return at the end of the

year. 2n assessment, if the income-ta% officer finds that the ta% withhe"d at source is "ess than the reNuired ta%, he can serve

notice of demand on both the payor as we"" as the receiver.

This system p"aces confidence in the ta% payor and his chartered accountant. If there is any error, it can be rectified at the time of

assessment. If there is any wi""fu" misconductB pena"ty, interest and prosecution can be imposed.

>. %ttri+ution and %llocation of Income 0rom "lectronic Commerce.

As discussed ear"ier, India has not yet made any specia" ru"es for e"ectronic commerce. There are some broad ru"es for attribution

and a""ocation of income.

9hi"e the Income-ta% Act provides for very few ru"es for source of income or for attribution of income, severa" decisions by

courts have made source ru"es. Some re"evant 'udge-made source ru"es are given be"ow. It may be noted that most of these

decisions pertain to an era before Independence. They are specia" to the Indian "egis"ation - Section : defining the scope of tota"

income.

!3.! Place of accrual of profits # *It wou"d be near"y impossib"e and who""y unwise to "ay down any genera" test to determine

the p"ace where profits or gains of business or emp"oyment accrue. In some cases it may be the p"ace of the formation of the

contract, but other factors, e.g. the p"ace where the contract is carried out or acts are done under the contract, may be decisive in

certain circumstances. The Nuestion shou"d be decided on the facts of each case in the "ight of common sense and p"ain thin)ing,

and too much importance shou"d not be attached to, or emphasis "aid upon, the niceties of verba" definitions.1 /7age 22: of

Manga ? 7a")hiva"a<s commentary.0 /Severa" case "aws inc"uding 7erforming Rights Society G. CIT, !C ITR !!, Supreme Court.0

!3.2 Sale of goods.

!3.2.! .As a genera" ru"e, the p"ace where the contracts of sa"e are made or sa"es are effected can be considered as the p"ace where

profits arise.1 /CC ITR !:D - Supreme Court.0

!3.2.2 .A contract is made at the p"ace where the offer is accepted.1 /2H ITR !H4 - Supreme Court.0

!3.2.3 .In the case of sa"e of unascertained goods, the sa"e ta)es p"ace where property in the goods passes to the purchaser.1 /CC

ITR !:D - Supreme Court.0

!3.2.4 .If the right of disposa" is reserved ti"" the payment is made, the property passes and sa"e is effected at the p"ace where the

payment is made against de"ivery of goods or documents of tit"e.1 /4E ITR H4!.0

!3.3 .7rofits accrue at the p"ace where the business transactions are actua""y effected and not at the p"ace from which the

business is contro""ed or directed.. /! ITC 3E.0

!3.4 .If contracts are made abroad, the fact that )now"edge, s)i"" ? 'udgement are e%ercised in India, is not important. The profits

accrue where the contracts are made - i.e. abroad.1 /C ITR :2!.0

Note # (ased on this ratio, most cases of technica" )now-how fees and roya"ties where he"d to be not ta%ab"e in India. Ta% payors

p"anned their affairs in such a way that contracts were e%ecuted abroad.

In the year !DEC, sections D/!0/vi0 ? /vii0 were introduced in the "aw ma)ing deeming provisions which have been discussed

ear"ier in paragraph si%. These provisions have nu""ified the impact of the above case "aw to the e%tent of roya"ties ? technica"

service fees.

These deeming provisions app"y on"y in the cases of roya"ties ? technica" services. They wou"d not app"y to business income.

!3.: In India the p"ace where profits accrue or arise or are received is important. >nder section :, control 4 management of

the enterprise is not important. I>nder proviso to section :/!0, contro" ? management are important in the case of a person not -

ordinari"y - resident. 6owever, this proviso is not re"evant to our discussion ? hence not e"aborated here.J

!3.C The princip"e of apportionment app"ies in cases where the Nuestion is how much of the income may be regarded as

accruing in India and be charged according"y under section :/!0/b0 or :/20/b0. +o Nuestion of apportionment arises in cases

where the income is received in India and is conseNuent"y chargeab"e under section :/!0/a0 or :/20/a0.

!3.E Section : - e%p"anation !. If an income accrues or arises outside India, 'ust because it is ta)en into account in a +alance

sheetprepared in IndiaB it sha"" not be deemed to have accrued or arisen in India.

!3.H The norma" system is for the assessee to voluntaril) file income#tax return. 6e has to determine the income ta%ab"e in

India or outside India based on standard accounting norms. The income-ta% officer wi"" app"y his best 'udgement at the time of

assessment of income-ta% return. If the attribution and a""ocation made by the ta% payor is reasonab"e, the officer may not

disturb it.

!3.D There is no specific ru"e regarding the attri+ution of income derived from functions performed with the assistance

ofe:uipment rather than so"e"y by human beings.

!3.! For allocating income over various units of a glo+all) integrated business, fo""owing ru"es are avai"ab"e.

>nder section D/!0/a0 on"y that income is ta%ab"e in India which can be attri+uta+le to operations carried on in India.

Ru"e ! provides a"ternative methods for a""ocation of income to Indian business. The choice of the app"icab"e method is to be

made by the Income-ta% officer.

i. If the accounts maintained by the assessee are good enough to definite"y ascertain the income ta%ab"e in India, the

same sha"" be accepted.

ii. If the Income-ta% officer considers that the income cannot be definite"y ascertained, he can adopt any of the fo""owing

three modes#

a. 6e may app"y a reasonab"e percentage to the turnover.

2R

b. 6e may consider the g"oba" and Indian turnoverB and the g"oba" profits. Indian profits can be deemed to be in the

same proportion of Indian turnover as the g"oba" profits bear to the g"oba" turnover.

2R

c. %n) other manner that the officer considers suitab"e.

Note- Instead of prescribing specific guide"ines in the "awB the ta% payor and the ta% officer are granted considerab"e freedom.

Vous aimerez peut-être aussi

- Poultry Management GuideDocument7 pagesPoultry Management Guidesohalsingh1100% (1)

- 2017041117mini Hatcher S. StoryDocument7 pages2017041117mini Hatcher S. Storysohalsingh1Pas encore d'évaluation

- Scheme For The Establishment of Backyard Poultry Units For The Year 2018-19Document5 pagesScheme For The Establishment of Backyard Poultry Units For The Year 2018-19sohalsingh1Pas encore d'évaluation

- South Sector: Ig/Ss HQ ChennaiDocument11 pagesSouth Sector: Ig/Ss HQ Chennaisohalsingh1Pas encore d'évaluation

- Networked Backyard Poultry EnterprisesDocument11 pagesNetworked Backyard Poultry Enterprisessohalsingh1Pas encore d'évaluation

- Western Sector: 1 Res - Bn. BarwahaDocument9 pagesWestern Sector: 1 Res - Bn. Barwahasohalsingh1100% (1)

- North East SectorDocument6 pagesNorth East Sectorsohalsingh1Pas encore d'évaluation

- Office of The Principal Accountant General (A & E) Odisha, BhubaneswarDocument2 pagesOffice of The Principal Accountant General (A & E) Odisha, Bhubaneswarsohalsingh1Pas encore d'évaluation

- APICOLDocument1 pageAPICOLsohalsingh1Pas encore d'évaluation

- FINAL - Layer Poultry Estate-OrissaDocument5 pagesFINAL - Layer Poultry Estate-Orissasohalsingh1Pas encore d'évaluation

- Training SectorDocument2 pagesTraining Sectorsohalsingh1Pas encore d'évaluation

- Registration of Insurance CompanyDocument2 pagesRegistration of Insurance Companysohalsingh1Pas encore d'évaluation

- RFP For Sports ComplexDocument38 pagesRFP For Sports Complexsohalsingh1Pas encore d'évaluation

- E-Commerce: A New Tool in Tax EvasionDocument8 pagesE-Commerce: A New Tool in Tax Evasionsohalsingh1Pas encore d'évaluation

- Agreement For GroupHealth Insurance PolicyDocument20 pagesAgreement For GroupHealth Insurance Policysohalsingh1Pas encore d'évaluation

- Nursery Propagation Technique of BagalungaDocument11 pagesNursery Propagation Technique of Bagalungasohalsingh1Pas encore d'évaluation

- Regional Office, Bhubaneswar: FOR Group Mediclaim Policy FOR Employees OF Psus Under Govt. of OdishaDocument14 pagesRegional Office, Bhubaneswar: FOR Group Mediclaim Policy FOR Employees OF Psus Under Govt. of Odishasohalsingh1Pas encore d'évaluation

- Advisory PDFDocument7 pagesAdvisory PDFsohalsingh1Pas encore d'évaluation

- Heritage StatusDocument1 pageHeritage Statussohalsingh1Pas encore d'évaluation

- E-Commerce in India: Legal, Tax and Regulatory AnalysisDocument42 pagesE-Commerce in India: Legal, Tax and Regulatory Analysissohalsingh1Pas encore d'évaluation

- Cyber Law: Bangladesh Perspective: BY: MD Amran Hossain Emcs, Jahangirnagar UniversityDocument7 pagesCyber Law: Bangladesh Perspective: BY: MD Amran Hossain Emcs, Jahangirnagar Universitysohalsingh1Pas encore d'évaluation

- Statement - I Cost of Project Particulars Sl. No. Ref. Annex Total CostDocument15 pagesStatement - I Cost of Project Particulars Sl. No. Ref. Annex Total Costsohalsingh1Pas encore d'évaluation

- Climate Controlled BSF BreedingDocument2 pagesClimate Controlled BSF Breedingsohalsingh1Pas encore d'évaluation

- Ceramic PotsDocument7 pagesCeramic Potssohalsingh1Pas encore d'évaluation

- Goat Farming Economics of The Project Basis & Presumptions Particulars Unit Quantity Techno-Economic ParametersDocument2 pagesGoat Farming Economics of The Project Basis & Presumptions Particulars Unit Quantity Techno-Economic Parameterssohalsingh1Pas encore d'évaluation

- RKVY - Moringa ProcessingDocument9 pagesRKVY - Moringa Processingsohalsingh1Pas encore d'évaluation

- Project Report To Set Up 10,000 Vanaraja Parents: SL - No. Particulars Total For 10,000Document5 pagesProject Report To Set Up 10,000 Vanaraja Parents: SL - No. Particulars Total For 10,000sohalsingh1Pas encore d'évaluation

- GIPSADocument37 pagesGIPSAsohalsingh1Pas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Quality Preliminary ReportDocument16 pagesQuality Preliminary ReportNilabh OholPas encore d'évaluation

- ECO401 Mega Solved MCQs File For Mid Term Exam PreparationDocument44 pagesECO401 Mega Solved MCQs File For Mid Term Exam PreparationMuhammad Irfan33% (3)

- Retail and Franchise AssignmentDocument8 pagesRetail and Franchise AssignmentAkshay Raturi100% (1)

- Project Change ManagementDocument15 pagesProject Change ManagementTaskia FiraPas encore d'évaluation

- Accounting Cycle Service BusinessDocument120 pagesAccounting Cycle Service BusinessElla Mae AcostaPas encore d'évaluation

- Leave Travel Concession (LTC) Rules: Office MemorandumDocument2 pagesLeave Travel Concession (LTC) Rules: Office Memorandumchintu_scribdPas encore d'évaluation

- HR Compliance ChecklistDocument5 pagesHR Compliance ChecklistPragat Naik100% (2)

- Design Technology Project Booklet - Ver - 8Document8 pagesDesign Technology Project Booklet - Ver - 8Joanna OlszańskaPas encore d'évaluation

- Inventory Control KaizenDocument32 pagesInventory Control KaizenAriel TaborgaPas encore d'évaluation

- E ProcurementDocument5 pagesE ProcurementRahul VemuriPas encore d'évaluation

- Sarah Kuhn ResumeDocument2 pagesSarah Kuhn Resumeapi-433846859Pas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)anu balakrishnanPas encore d'évaluation

- 1 Day KaizenDocument1 page1 Day KaizenpandaprasadPas encore d'évaluation

- Nash EquilibriumDocument5 pagesNash EquilibriumNiyati44100% (1)

- Doing Agile Right Transformation Without Chaos - (PG 129 - 129)Document1 pageDoing Agile Right Transformation Without Chaos - (PG 129 - 129)malekloukaPas encore d'évaluation

- All India GST JurisdictionDocument2 pagesAll India GST JurisdictionCafe 31Pas encore d'évaluation

- Life Cycle Cost Based Procurement Decisions A Case Study of Norwegian Defence Procurement ProjectsDocument10 pagesLife Cycle Cost Based Procurement Decisions A Case Study of Norwegian Defence Procurement ProjectsEric QuanhuiPas encore d'évaluation

- Acc 106 Account ReceivablesDocument40 pagesAcc 106 Account ReceivablesAmirah NordinPas encore d'évaluation

- Intellectual Property Prelim NotesDocument5 pagesIntellectual Property Prelim NotesGretchen CanedoPas encore d'évaluation

- Subhiksha Case StudyDocument9 pagesSubhiksha Case StudyRavi Keshava Reddy100% (1)

- Economia - 2018-03Document84 pagesEconomia - 2018-03Hifzan ShafieePas encore d'évaluation

- Procurement WNDocument98 pagesProcurement WNGyan Darpan YadavPas encore d'évaluation

- Customer Relationship Management About HundaiDocument76 pagesCustomer Relationship Management About HundaiZulfiquarAhmed50% (4)

- B40Document7 pagesB40ambujg0% (1)

- Riphah International University: Crescent Standard Investment Bank Limited (Case Study)Document4 pagesRiphah International University: Crescent Standard Investment Bank Limited (Case Study)bilal mustafaPas encore d'évaluation

- Trendyol Helped Create 1.1 Million Jobs in TurkeyDocument3 pagesTrendyol Helped Create 1.1 Million Jobs in TurkeyTigist AbebePas encore d'évaluation

- XYZ Corporation Business PlanDocument14 pagesXYZ Corporation Business PlanKris Rugene DelimaPas encore d'évaluation

- 1 - 20.09.2018 - Corriogendum 1aDocument1 page1 - 20.09.2018 - Corriogendum 1achtrpPas encore d'évaluation

- Chung Ka Bio Vs Intermediate Appelate CourtDocument1 pageChung Ka Bio Vs Intermediate Appelate CourtJosiah BalgosPas encore d'évaluation

- Mosque DetailsDocument21 pagesMosque DetailsdavinciPas encore d'évaluation