Académique Documents

Professionnel Documents

Culture Documents

Reynolds Reply Brief

Transféré par

Statesman JournalCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reynolds Reply Brief

Transféré par

Statesman JournalDroits d'auteur :

Formats disponibles

Verified Correct Copy of the Original 9/23/2014

Q

~T

IN THE SUPREME COURT OF THE STATE OF OREGON

O I Q

EVERICE MORO, TERRI DOMENIGONI, CHARLES CUSTER, `A OF~pRp

HAWKINS, MICHAEL .ARKEN, EUGENE DITTER JOHN O'KIEF, MICHAEL--- ;zt&Z,,P

SMITH, LANE JOHNSON, GREG CLOUSER, BRANDON SILENCE, ALISON

VICKERY, and JIN VOEK

Petitioners,

V.

STATE OF OREGON, STATE OF OREGON by and through the Department of

Corrections, LINN COUNTY, CITY OF PORTLAND, CITY OF SALEM,

TUALATIN VALLEY FIRE & RESCUE, ESTACADA SCHOOL DISTRICT,

OREGON CITY SCHOOL DISTRICT, ONTARIO SCHOOL DISTRICT,

BEAVERTON SCHOOL DISTRICT, .WEST LINN SCHOOL DISTRICT, BEND

SCHOOL DISTRICT, and PUBLIC EMPLOYEES RETIREMENT BOARD,

Respondents,

And

LEAGUE OF OREGON CITIES; OREGON SCHOOL BOARDS ASSOCIATION;

CENTRAL OREGON IRRIGATION DISTRICT; and ASSOCIATION OF

OREGON COUNTIES,

Intervenors.

S061452 (Control)

WAYNE STANLEY JONES,

Petitioner,

V.

PUBLIC EMPLOYEES RETIREMENT BOARD, ELLEN ROSENBLUM, Attorney

General and JOHN A. KITZHABER, Governor,

Respondents.

S061431

NIICHAEL D. REYNOLDS,

Petitioner,

V.

PUBLIC EMPLOYEES RETIREMENT BOARD, State of Oregon; and JOHN A.

KITZHABER, Governor, State of Oregon,

Respondents

S061454

GEORGE A. RIEMER,

Petitioner,

V.

STATE OF OREGON, OREGON GOVERNOR JOHN KITZHABER, OREGON

ATTORNEY GENERAL ELLEN ROSENBLUM, OREGON PUBLIC

EMPLOYEES RETIREMENT BOARD, and OREGON PUBLIC EMPLOYEES

RETIREMENT SYSTEM,

Respondents.

S061475

GEORGE A. RIEMER,

Petitioner,

V.

STATE OF OREGON, OREGON GOVERNOR JOHN KITZHABER, OREGON

ATTORNEY GENERAL ELLEN ROSENBLUM, OREGON PUBLIC

EMPLOYEES RETIREMENT BOARD, and OREGON PUBLIC EMPLOYEES

RETIREMENT SYSTEM,

Respondents.

S061860

PETITIONER REYNOLDS' REPLY BRIEF

Judicial Review (Original Proceeding)

Oregon Laws 2013, Chapter 53 (Senate Bi118220

Oregon Laws 2013, Chapter 2(special session) (Senate Bi11861)

GREGORY A. HARTMAN #741283

ARUNA A. MASIH #973241

210 S W Morrison St.

Suite 500

Portland, OR 97204-3149

Telephone: 503-227-4600

Attorneys for Petitioners Moro,

Domenigoni, Custer, Hawkins, Arken,

Ditter, O'Kief, Smith, Johnson, Clouser,

Silence, Vickery and Voek

Michael D. Reynolds

8012 Sunnyside Avenue N.

Seattle, WA 98103

Telephone: 206-910-6568

Petitioner pro se

GEORGE A. RIEMER

23206 N.Pedregosa Drive

Sun City West, AZ 85375

Telephone: 623-23 8-5039

Petitioner pro se

WAYNE S. JONES

18 North Foachill Road

North Salt Lake, UT 84054

Telephone: 801-296-15 52

Petitioner pro se

ELLEN ROSENBLUM #753239

Attorney General

ANNA M. JOYCE #013112

Solicitor General

KEITH L. KUTLER #852626

Assistant Attorney General

MATTHEW J. MERRITT #122206

Assistant Attorney General

MICHAEL A. CASPER # 062000

Assistant Attorney General

400 Justice Building

Salem, Oregon 97310

Telephone: 503-378-4402

Attorneys for State Respondents

HARRY AUERBACH #821830

Office of the City Attorney

1221 SW 4th Avenue, Ste 430

Portland, OR 97204

Telephone: 503-823-4047

Attorney for Respondent City of

Portland

WILLIAM F. GARY #770325

SHARON A. RUDNICK #830835

HARRANG LONG GARY RUDNICK

PC

360 E. lOth Ave., Suite 300

Eugene, OR 97401

Telephone: 503-242-0000

Of Attorneys for Respondents Linn

County, Estacada, Oregon City, Ontario,

West Linn School Districts and

Beaverton School Districts, and

Intervenors Oregon School Boards

Association and Association of Oregon

Counties

DANIEL B. ATCHISON #040424

Office of City Attorney

555 Liberty Street SE Rm 205

Salem, OR 97301

Telephone: 503 588-6003

Attorney for Respondent City of Salem r

EUGENE J. KARANDY II #972987

Office of the County Attorney

Linn County Courthouse

104 SW Fourth Avenue, Room 123

Alba.ny, OR 97321

Telephone: 541 967-3 840

Of Attorneys for Respondent Linn

County

LISA M. FRIELEY #912763

Oregon School Boards Association

PO Box 1068

Salem, OR 97308

Telephone: 503 588-2800

Of Attorneys for Respondents Estacada,

Oregon City, Ontario, and

West Linn School Districts and

Intervenor Oregon School Boards

Association

ROB BOVETT #910267

Association of Oregon Counties

1201 Court St. NE Ste 300

Salem, OR 97301

Telephone: 971-218-0945

Of Attorneys for Respondent Linn

County

EDWARD F. TROMPKE #843653

Jordan Ramis PC

Two Centerpointe Drive, 6th Floor

Lake Oswego, OR 97035

Telephone: 503 598-5532

Attorney for Respondent Tualatin Valley

Fire & Rescue

W. MICHAEL GILLETTE #660458

LEORA COLEMAN-FIRE # 113 5 81

SARA KOBAK #023495

WILLIAM B. CROW #610180

SCHWABE WILLIAMSON & WYATT

PC

1211 SW 5th Ave Suite 1900

Portland, OR 97204

Telephone: 503-222-9981

Of Attorneys for Intervenor League of

Oregon Cities

SARAH K. DRESCHER #042762

Tedesco Law Group

3021 NE Broadway

Portland, OR 97232

Telephone: (866) 697-6015

Of Attorneys for Amicus Curiae IAFF

THOMAS A. WOODLEY

Douglas L. Steele

WOODLEY & McGILLIVARY

1101 Vermont Ave, N.W.

Suite 1000

Washington, D.C. 20005

Phone: (202) 833-8855

taw@wmlaborlaw.com

dls@wmlaborlaw.com

Of Attorneys for Amicus Curiae IAFF

CRAIG A. CRISPIN #82485

Crispin Employment Lawyers

1834 S W 5 8th Avenue, Suite 200

Portland, OR 97221

Telephone: (503) 293-5759

Attorney for Amicus Curiae AARP

September, 2014

Index i

INDEX OF CONTENTS

ARGUMENT ....................................................1

I. SB 822 violates 4 USC 114(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

II. Increased benefits are not a"windfall" for non-resident PERS

Retirees..................................................... 4

III. SB 822 violates non-residents PERS retirees' contractual rights. ......, 6

A. Introduction .............................................6

B. Circumstances ........................................... 8

1. Hughes and its effect . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

2. Chess/Stovall and HB 3349 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

3. Chess/Stovall and HB 2034 (1997) . . . . . . . . . . . . . . . . . . . . . . 10

4. Chess/Stovall settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

C. Questions .............................................. 12

D. Argument .............................................. 13

1. Employing ordinary statutory construction/contract

standards is appropriate in this case . . . . . . . . . . . . . . . . . . . . . . 13

2. Properly construed, the remedial statutes substitute

increased benefits as a new term and obligation for the

tax exemption term and obligation of the PERS contract ...... 15

3. ORS 238.362(3) should not be construed to defeat

the legislature's and the parties' obvious intent . . . . . . . . . . . . . . 19

Index ii

4. The nature of the obligation under the substitute term

is to pay increased benefits to all PERS retirees .......... . .21

5. Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

CONCLUSION .................................................25

INDEX OF AUTHORITIES

Cases Cited

Eckles v. State of Oregon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

306 Or 380, 397, 760 P2d 846 (1998)

Hughes v. State of Oregon

314 Or 1, 838 P2d 1018 (1992) . . . . . . . . . . . . . . . . . . . 6, 8, 9, 13, 15, 19

Ragsdale v. Dept. of Revenue,

321 Or 216, 895 P2d 1348 (1995), cert den 516 US 1011,

116 S Ct 569, 133 L3d 2d 493 (1995) . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Strunk v. PERB,

338 Or 145, 160, 108 P3d 1058 (2005) . . . . . . . . . . . . . . . . . . . . . . . .7, 20

Yogl v. Dept. of Revenue

327 Or 193, 960 P2d 373 (1998) . . . . . . . . . . . . . . . . . . . . . . . . . . . 1, 4, 23

Statutory Provisions

ORS 238.445(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9, 16, 17

ORS 316.127(9) ...............................................23,24

ORS 316.68

0(1)(d)

(1989 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . : . . . .9

ORS 238.362(3) ................................................ 11

Index iii

ORS 238.364 ................................................... 25

ORS 238.366 ....................................................25

ORS238.375(3) (2009) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Oregon Laws 2013, chapter 653 ("SB 822") . . . . . . . . . . . . . . . . . . . . . 1, passim

Oregon Laws 1997, chapter 175

("HB 2034") . . . . . . . . . . . . . . . . . . . .7, 1.0, 11, 12, 16, 18, 19, 20, 21, 23, 24, 25

Or Laws 1991, ch 823, 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8119

HB 3349 (1995) .............. 4, 5, 6, 7, 10, 11, 12, 16, 18, 19, 20, 22, 23, 24

SB' 656 (1991) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4, 5, 6, 7, 10, 17, 18, 22

4 USC 114(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1, 3, 4

Other Authorities

Restatement Second Law of Contracts, 89, comment b., and 279......... 19

Williston on Contracts, Fourth Ed, 7.37, pp 695-96 . . . . . . . . . . . . . . . . . . . . 19

PETITIONER REYNOLDS' REPLY BRIEF

ARGUMENT

I. SB 822 violates 4 USC 114(a).

Respondents, including intervenors, make light of and give short shrift to

petitioner Reynolds' argument that (Oregon Laws 2013, chapter 653 ("SB 822")

imposes an "income tax" within the meaning and prohibition of 4 USC 114(a), a

relatively recently adopted federal statute aimed specifically at safeguarding the

financial interests of non-resident retirees. Perhaps respondents' strategy rests on

the hope that if they do not take petitioner's argument seriously, this court won't

either. But whether the legislature can do indirectly what federal law prohibits it

from doing directly is a serious issue and deserves to be treated as such.

Respondents take issue with virtually none of the propositions petitioner

advances in his opening brief. Thus, respondents do not dispute that the federal

analysis of a tax question considers the practical impact the substance of the

reduction or exaction, not the state's label. Petitioner's Opening Brief ("POBr") 23-

25. Nor do they dispute that analysis includes, inter alia, consideration of the

nature and purpose of the exaction and whether the income derived is used for

general governmental purposes. POBr 25-30. Respondents also do not

1

acknowledge or address petitioner's argument that Vogl v. Department of Revenue,

327 Or 193, 960 P2d 373 (1998), involved analysis of a similar federal "tax"

question and supports, if not drives, the analysis of the tax question at issue here.

POBr 37-43.

The state, for its part, implicitly suggests that form counts but substance

does not, and that state law is what counts in asserting that SB 822's reduction does

not raise revenue and therefore does not possess "the characteristic feature of a bill

for raising revenue." State's Ans Brief ('SABr") 80. That bare assertion, however,

ignores petitioner's explanation for why SB 822's reduction in the retirement

incomes of non-resident PERS retirees is the substantial equivalent of an income

tax on those incomes, both in terms of what the reduction achieves for government

($5.3 billion more dollars available to spend on general government services) and

the effect on non-resident retirees (reduced incomes). And the state's claim that

petitioner's argument would mean a benefit reduction in any "public assistance"

would qualify as a tax disregards all parts of the federal analysis, particularly the

part that inquires as to the reason for the reduction. Here, the unquestioned and

unchallenged reason that the legislature chose to reduce non-resident retirees'

incomes is because federal law prevents the legislature from taxing those incomes.

Clearly SB 822's benefit reduction for non-resident retirees would never have

happened if the state could impose a straightforward income tax on their retirement

incomes.

Respondent-intervenor League of Oregon Cities (LOC) contends that

petitioner's argument is "flawed" because SB 822 merely takes away benefit

increases that were "not owed to begin with," and which the legislature recognized

"needed to be discontinued." LOC answering brief ("LABr") 84. But surely the

claim that an exaction is "needed" could be made for any legislatively-imposed

exaction that has been deemed to satisfy the definition of "tax" for federal law

purposes. And LOC's statement that the reduction merely takes away benefits that

were "not owed" similarly adds nothing to the analysis. If, underlying this claim,

is the suggestion that the taxing of gratuitous retirement income of non-resident

retirees does not violate 4 USC 114(a), LOC cites no authority for that

proposition. And if 4 USC 114(a) prohibits the taxation of gratuitous retirement

incomes, then it stands to reason that an exaction from those retirement incomes

that satisfy the other indicia of a"tax" similarly would be forbidden.

Respondent school districts and respondent-intervenors School Board's

Association and Association of Oregon Counties (the "school districts") maintain

that the "fatal flaw" in petitioner's "tax" argument is that SB 822 "affects only the

calculation of the amount of [petitioner's] retirement income ***[by] removing

from the calculation the windfall benefits he has been receiving for the period he

has resided outside Oregon." School Districts' answering brief ("SDABr") 102.

Aside from the "windfall" descriptor (addressed below), the school districts'

3

argument is a rephrasing of the state's argument in Vogl (HB 3349 is a"benefit

increase;" it is not a"tax rebate"). This court, however, applying its "substance

counts; labels are to be ignored" analysis, unanimously rejected that argument. As

such, the school districts do not address or explain why, employing a federal

analysis and/or in light of Vogl, the reductions in the retirement incomes of non-

resident PERS retirees caused by SB 822 are not the substantial equivalent of an

"income tax" which 4 USC 114(a) forbids.

II. Increased benefits are not a"windfall" for non-resident PERS retirees.

The state primarily but the school districts also assert at some length that for

non-resident retirees, the SB 656 (1991) and HB 3349 (1995) increases in benefits

were a mere windfall. Therefore, they 'argue, the 2013 legislature acted

appropriately because it merely took away what non-resident retirees should never

have received to begin with. See, e.g., SABr 74.

The "windfall" characterization is wrong for several reasons. First, it

Ignores the fact that the legislature consciously decided to extend the increases to

all PERS retirees regardless of whether they paid any state income taxes or the

actual amount they did pay. That policy choice was not a fluke; it was a

continuation of its consistent policy choice since 1945 to treat PERS retirees the

same in terms of the payment of their gross retirement benefits, regardless of their

individual tax or other situations post retirement.

4

Second, the assertion is wrong because what non-resident retirees received

in SB 656/HB3349 benefits was not unintended, unexpected or unforeseen by

those retirees as well. For PERS members actively employed in 1991 and 1995,

and who subsequently retired knowing full well that, if they moved out of state

after retirement their benefits would not be taxed by Oregon, receipt of the increase

was fully expected and foreseen and likely factored into their decisions as to when

to retire as well as where to live after retiring.

Finally, the decision to extend the increases to all retirees could well have

been viewed by the legislature as simply good business. The legislature

considering HB 3349 had information that showed the state agency cost of

increased benefits to all PERS retirees would be $27.3 and $$36.4 million for the

1995-97 and 1997-99 biennia, respectively. Ex 54, p 73. Only 34% of that cost,

however ($9.3 million and $12.4 million) would come from the state general fund,

Ibid. Legislative staff also predicted that if the "full exemption" from taxation

were chosen as the policy choice, the General Fund would forego $57.8 million in

tax revenue in 1995-97, $211 million in 1997-99 and $244.5 million in 1999-01.

Ex 54, p 87. That the General Fund would benefit tremendously from taxing

retirement benefits including those of federal retirees over the alternative of

exempting all benefits from taxation, and that it could well afford to extend the

increase to all PERS retirees, are obvious.

In summary, the SB 656/HB 3349 increases are not a"windfall" under any

understanding of that term. Any suggestion that they are is spurious and only made

to try to make the legislature's decision to take them away look more appealing.

III. SB 822 violates non-residents PERS retirees' contractual rights.

A. Introduction

In his opening brief, petitioner asserts that SB 822's reduction in the

retirement benefits of non-resident PERS retirees violates their "contractual rights"

by taking away benefits that the legislature had promised in SB 656 and HB 3349.

The legislature had used mandatory "shall" language with respect to the payment

of the increased benefits and had placed the increased benefits provisions in the

PERS statutes, both of which under Hughes v. State of Oregon, 314 Or 1, 838 P2d

1018 (1992), signified "promissory" intent. POBr 46-47. As a second argument,

petitioner asserts that even assuming PERS retirees had no contractual right to the

increase, by targeting and limiting the take-away to non-resident retirees, the

legislature violated the principle of "residence neutrality" in the payment of gross

retirement benefits that inheres in the PERS contract. POBr 51-53.

Respondents offer no response to petitioner's "residence neutrality"

argument. The state offers the following in response to petitioner's "contractual

entitlement" argument: 1) no consideration could support the allowance increases

because they were offered to existing retirees; and 2) HB 3349 on its face and its

6

legislative history demonstrate that it created no "contractual rights." SBr 40-44.

LOC says simply in response to an argument by petitioner Jones that the legislative

history upon which he relies does not satisfy the requisite "clear and unambiguous"

test. LABr 80-81

5

fn 40. The school districts argue SB 656 did not contain an

"unambiguous" promise of benefit increases and was not intended to have those

benefits be paid to persons who paid no state income tax (i. e. non-residents).

SDABr 101-02. They echo the state's argument that HB 3349 "made clear" that it

conferred no contract rights to increased benefits.

After reviewing respondents' arguments, as well as petitioner's own

arguments, one thing is clear: those arguments do not fully account for the unique

circumstances that surrounded the legislature's enactment of SB 656 and HB 3349,

including the critical amendments enacted in Oregon Laws 1997, chapter 175 ("HB

2034") (collectively the "remedial statutes"). Without taking those circumstances

into account, a proper analysis of what the legislature intended to accomplish --

and what it actually accomplished -- in enacting those statutes cannot occur. The

ultimate search, after all, is to discern the legislature's intent. Strunk v. PERB, 338

Or 145, 175, 108 P3d 1058 (2005).

Petitioner will attempt in this portion of the reply brief to set out those

7

circumstances, which, petitioner submits, demonstrate that the legislature intended

8

to and did make the increased benefits provided in the remedial statutes part of the

PERS contract. Specifically, those circumstances demonstrate the following:

first, the legislature intended that the remedial statutes be offered as a package and

accepted by the Stovall plaintiffs as a final and "complete remedy" for the

impairment/breach of the tax exemption term and obligation of the PERS contract

recognized in Hughes; second, the remedy that was offered and accepted did not

take the form of "damages" for breach of the tax exemption obligation, but was,

rather, in the form of a substitute for or replacement of the tax exemption term and

obligation; third, the effect of that substitution or replacement was twofold, in that

it 1) eliminated the tax exemption as a term and obligation of the PERS contract,

and 2) avoided further breaching of that contract; and fourth, the nature of the

obligation that the substituted term imposed was to pay increased benefits to all

PERS retirees, regardless of their individual personal income tax obligations to the

State of Oregon.

B. Circumstances

1. Hughes and its effect

In 1991 the legislature repealed the tax exemption for PERS .retirement

benefits by leaving in place language exempting PERS benefits from taxation but

adding an amendment stating that the exemption did not apply to personal income

taxation of PERS benefits. Or Laws 1991, ch 823, 1. See Hughes, 314 Or 10.

The legislature also repealed ORS 316.680(1)(d) (1989) which had required the

Department of Revenue to subtract PERS benefits in calculating PERS retirees'

income subject to Oregon taxation. Ibid.

In response to the legislature's repeal of the personal income tax exemption

for PERS benefits, the court in Hughes held: 1) that PERS was a contract and that

the tax exemption was a term of the PERS contract; 2) that the obligation of that

term was to exempt PERS benefits that have accrued and are accruing for work

already performed; 3) that the legislature's repeal of the tax exemption impaired

that obligation of the contract; and 4) the legislature's further elimination of the

provision declaring PERS benefits not subject to personal income taxation

breached the contractual obligation. The court left it to the legislature to craft an

appropriate remedy in response to the court's decision. 314 Or 33, fn 36.

As matters stood after Hughes, the statute exempting PERS benefits from,

inter alia, personal income taxation, remained an obligation of the PERS contract;

Oregon Laws 1991, ch 823, 1, providing that this statute did not apply to the

personal income taxation of PERS benefits, impaired that contract as to benefits

earned based on work performed prior to 1991 and was void (although it was

codified in and remains subsection (2) of ORS 238.445) ; and the statute repealing

the provision declaring PERS benefits not subject to personal income tax was a

9

10

breach of the PERS contract because it had the effect of subjecting PERS benefits

to taxation.

2. Chess/Stovall and HB 3349

The 1993 legislature took no action to provide a Hughes remedy beyond

what the 1991 legislature had provided in SB 656 in the way of a partial offset for

the taxation of PERS benefits. As a result, litigation was begun Chess/Stovall --

to force PERB, the state and public employers to provide an adequate remedy.

In 1995, while the Chess/Stovall litigation was pending, and in the hopes

that the legislation would lead to a settlement of that litigation, the legislature

passed HB 3349 which provided a further increase in retirement benefits. That

statute provided that it was in "compensation for damages" PERS members

suffered or would suffer as a result of taxation of their benefits. HB 3349, 2(1).

The statute required that PERB report separately the increased benefits provided to

the IRS, reflecting that they were being made as a result of the taxation of those

benefits. 2(5). To ensure, however, that the legislation by itself would not

establish any contract rights or claim to those rights, the legislature included a

provision specifying that the bill was not creating any such rights. 2(3). Finally,

the bill provided that benefits provided under the bill would not be paid if the tax

exemption were ever reinstated. 2(2).

3. Chess/Stovall and HB 2034 (1997)

Following passage of HB 3349, the Chess/Stovall litigation still did not

settle. In the 1997 legislative session, Elizabeth Harchenko from the Attorney

General's office testified in support of proposed amendments to HB 2034. By way

of background, she explained that "legislation had been passed and directed a

benefit increase be paid to retirees in lieu of the tax exemption that had been

included as a term of their retirement benefit." Ex 55, p 15 (emphasis added). She

informed the legislature that amendments to that legislation were needed to

effectuate the settlement of the Chess/Stovall litigation. Ibid.' Summarizing that

litigation, she further explained that she

"represented the state * * * and now we are at the place where we are trying

to end the litigation by getting a judgment in place that adopts the

legislation, HB 3349, as amended by these amendments - that is the

condition of the settlementapproved and accepted by the plaintiff class as

adequate compensation for taxation of their retirement benefits. It is a

package deal. These amendments are part of the condition for the

settlement."

Ibid. One such amendment was repeal of the "compensation for damages"

reference in HB 3349, then codified at ORS 238.375(3) (now ORS 238.362(3).

HB 2034, 4. Another was repeal of the provision requiring separate reporting of

the increases to the IRS. Ibid. A third amendment modified a provision of HB

3349 to preclude a new class action from being maintairied "based on a claim for

' She testified that without the amendments, "she does not have a settlement and

will go back to court." Ex 55, p 15.

11

12

damages arising out of the subjecting of benefits paid under this chapter to Oregon

personal income taxation by act of the Legislative Assembly." HB 2034, 4(4)(a).

The legislature passed these and other amendments.

4. Chess/Stovall settlement

Finally, in November, 1997, and after enactment of HB 2034, the

Chess/Stovall litigation settled. The settlement agreement expressly provided that

the plaintiffs "were accepting the remedies" offered in SB 656, HB 3349 and HB

2034 as full and complete satisfaction of their claims. POBr app 23.

C. Questions

Two facts should be undisputed given the foregoing circumstances: 1)

culminating with the adoption of HB 2034, the legislature intended that the

remedial statutes provide a complete remedy for the problems created by the 1991

legislature's attempt to repeal the tax exemption in toto and subjecting PERS

benefits to personal income tax; and 2) the Chess/Stovall plaintiff class "accepted"

the remedies provided in those statutes in satisfaction of their claims in the

litigation.

With that as a starting point, the following questions still must be addressed:

1. In light of plaintiffs' "acceptance" of the remedies in the remedial

statutes, did those statutes :

a. offer to remedy the on-going breach of contract by providing

damages, also on an on-going basis;

b. offer to cure the impairment of the obligation to provide a tax

exemption, by offering to substitute for the tax exemption term of the contract a

term providing for increased benefits, and in doing so, remedy once and for all the

necessity to provide damages for an on-going breach; or

c. Something else?

2. What standard should the court use in deciding what the legislature and

the parties actually achieved?

D. Argument

1. Employing ordinary statutory construction/contract standards

is appropriate in this case.

To quote Hughes, appropriately in this context, the court does not begin with

a"blank slate" in answering the question of the appropriate standard to be applied

in this case. 314 Or 17. This court in Hughes already has applied the "clearly and

unambiguously expressed" intent standard in determining that the tax exemption

was a term of the PERS contract. The question here is not whether the legislature

conferred a benefit that imposed on itself and future legislatures an additional

obligation. Rather, the question is whether in conferring a different benefit it has

imposed a substitute obligation.

13

Thus, in determining whether the state has offered a substitute benefit for a

term of the PERS contract, or something else, the court need not again apply a

"clearly and unambiguously expressed intent" standard. First, no question is posed

of binding future legislatures. Future legislatures already were "bound" to provide

the tax exemption for benefits based on work performed prior to 1991. The benefit

increase legislation imposed no additional burden. In fact, as explained earlier in

section II, from a fiscal standpoint, the state's decision to replace the tax exemption

with taxation of benefits (including taxation of federal retirees' incomes) and a

benefit increase greatly lessened the burden that the tax exemption had imposed.

Second, the unique context of the remedial statutes -- the Hughes decision

and the subsequent Chess/Stovall litigation that the benefit increase legislation was

attempting to resolve requires an examination and determination of what the

parties the legislature and the Chess/Stovall plaintiffs were attempting to

achieve and actually achieved by the passage of those statutes. While employing

the "unambiguous intent" standard is suitable in the typical unilateral contract

setting, here the setting is more in the nature of, if not in fact, a bi-lateral one. It is

undisputed here and unambiguous that the parties intended and were attempting

to finally settle the dispute over what the appropriate, complete remedy should be

in light of Hughes. Applying an "unambiguous intent" standard to the details of

14

that settlement may only serve to distort what would otherwise be the only

practical and sensible, not to mention intended, result.

Even if the court believes here it must focus solely on what the legislature

intended to and did accomplish, the question can be reduced to whether the

legislature intended to stay in continual breach of its obligation to exempt PERS

benefits from taxation, with the consequent continuing duty to remedy that breach,

or whether it intended simply to substitute the tax exemption term and its attendant

obligation with an increase in benefits. That is a simple, straightforward question

of legislative intent, invoking none of the cautionary concerns that underscore the

reasons for the "unambiguous intent" standard that otherwise applies in statutory

contract analyses.

2. Properly construed, the remedial statutes substitute increased

benefits as a new term and obligation for the tag egemption term and

obligation of the PERS contract.

As implied above, unless the remedial statutes are construed as an offer to

substitute a new term and obligation for the tax exemption term and obligation, the

latter remain part of the PERS contract for benefits earned based on work

performed before 1991. That is the clear holdover effect from Hughes. Hughes

declared void and of no effect the provision purporting to repeal the.tax exemption

obligation for PERS benefits based on work performed prior to 1991. Unless,

then, the remedial statutes have replaced the tax exemption term and obligation

15

16

with a substitute term and obligation, the tax exemption term and obligation remain

part of the PERS contract.2 And the necessary corollary to this is that the

legislature's act of subjecting those PERS benefits to personal income taxation

would constitute an on-going breach of the PERS contract, necessitating damages

or at least some form of on-going remedy.

The 19971egislature, at a minimum, cast considerable doubt that it intended

the remedial statutes to constitute damages or the state to be in continual breach of

the PERS contract. HB 2034's amendments deleted any reference to "damages" in

HB 3349, thus strongly indicating that the legislative "offer" submitted to the

a

Chess/S'tovall plaintiffs was not an offer of damages. In addition, the 1997

legislature foreclosed any new action for damages for breach of contract arising

from the taxation of those benefits, again strongly indicating that it did not intend

the remedial statutes to result in an on-going breach of the. PERS contract.

Construing the remedial statutes as resulting in the substitution of increased

benefits as a term and obligation for the tax exemption term and obligation of the

PERS contract, on the other hand, is consistent with the legislature's intent to

prevent an on-going breach necessitating providing "damages" as an on-going

remedy. Construing the remedial statutes as a substitute term means that the tax

Z Although declared void and of no effect as to PERS retirement benefits earned for

work performed prior to 1991, the tax exemption repeal remains codified in ORS

238.445(2).

exemption term would cease to be a part of the PERS contract. ORS 238.445(2),

which eliminates the tax exemption, would no longer be void as to benefits earned

prior to 1991 but would be given full effect. Subjecting PERS retiree benefits

based on work performed before 1991 to the state's personal income tax would

cease being an on-going breach. No need would exist for the legislature to pay on-

going damages.

Moreover, that construction best furthers the legislature's and the

Chess/Stovall parties' intent that the remedial statutes afford a complete remedy.

Construing that remedy as a substitution of one obligation (to pay increased

benefits) for another (to provide a tax exemption) provides a complete Hughes

remedy in this case.

That construction also is consistent with the text of the remedial statutes as

well as the legislative history. As mentioned above and discussed in petitiorler's

opening brief, the legislature used mandatory "shall" language as to payment of the

increased benefits and included the benefit provisions in the PERS statutes, all of

which, as held in Hughes signify promissory intent. The increased benefits

provisions textually, therefore, stand on equal footing with the exemption term,

and a substitution of the former for the latter, is simply the substitution of a

promise for a promise. And the legislative testimony from the Attorney General's

office quoted earlier that the remedial statutes were offered as a package "in lieu

17

18

of' the tax exemption exemplifies the legislative and parties' understanding that

the increased benefits provided in the remedial statutes were, in fact, a substitute

for the tax exemption.

That the legislature actually intended to and did substitute benefit increases

for the tax obligation is supported by its inclusion of the proviso, as amended by

HB 2034 4, that "the increased benefits payable under section 3 of this 1995 Act

* * * shall not be paid in any tax year in which [PERS] retirement benefits * * * are

exempt in whole or in part from Oregon personal income taxation, " and "shall be

reduced proportionately" for any tax year in which those benefits are partially

exempt. The legislature thus made it clear that payment of increased benefits is a

substitute for the tax exemption because they both cannot occur simultaneously

Construing the remedial statutes as providing a substitute term and

obligation renders moot the state's argument that SB 656 and HB 3349 could not

be "contractual" in nature because the "offer," if there was one, was extended to

PERS members already retired and, hence, there was no consideration for the offer.

See, e.g., SABr 23. If what the legislature did was offer to substitute one

obligation for another, this court need not decide whether the state's argument has

any horsepower on its own.3 As Hughes made clear, the state owed the tax

3 Petitioner agrees with the arguments in Moro petitioners' reply brief that the

state's argument has none.

19

exemption obligation to both retirees as well as still-working PERS members who

performed work prior to 1991. Both classes of PERS members were represented in

the Chess/Stovall litigation. Both classes were fully capable of accepting and did

accept the state's offer to substitute the tax exemption obligation for an increased

benefits obligation. Unilateral contract theories regarding offer and acceptance

have no application. That parties to a contract are able to substitute one agreement

for another is well settled. See, e.g., Williston on Contracts, Fourth Ed, 7.37, pp

695-96; Restatement Second Law of Contracts, 89, comment b., and 279.

3. ORS 238.362(3) should not be construed to defeat the

legislature's and the parties' obvious intent.

As mentioned earlier, the state argues that because the remedial statutes at

least, HB 3349 2(3) initially and as left unamended by HB 2034 included the

express proviso that HB 3349 was not creating any contractual rights (ORS

238.362(3)), none could possibly have been created. Petitioner submits, however,

that, as discussed below and in his opening brief, this provision had a limited

purpose and shelf-life which expired when the Chess/Stovall litigation settled.

The legislature inserted 2(3) in HB 3349 to serve a specific purpose: to

ensure that the legislature did not contractually bind itself to the increased benefits

provided by HB 3349 in the event the Chess/Stovall litigation did not settle. That

purpose was fully served when the litigation did finally settle following enactment

of HB 2034 in 1997. To give this provision on-going effect means, in effect, that

the legislature never intended ever to have its Hughes-recognized obligation to

provide a tax exemption replaced with one that would stop the on-going bleeding.

To give this provision on-going effect also would be inconsistent with the Attorney

General's representation to the legislature that the increased benefits were "in lieu

of' the tax exemption, which was a contractual promise. Accordingly, in light of

other language the legislature used in HB 3349, in light of all of the legislative

history, and in light of the context of the legislative proceedings, including the

Chess/Stovall litigation, petitioner submits that ORS 238.362(3) should, in effect,

be deemed moot.4

4 Appropriately, petitioner submits, respondents do not argue that Strunk addressed

and settled the non-contractual nature of the remedial statutes. Petitioners in

Strunk did not argue that the remedial statutes created contractual rights that the

2003 legislation had impaired or breached. Rather, they assumed that ORS

238.375(3) (2009) foreclosed that argument, and argued instead that the 2003

legislation breached their rights under the Chess settlement agreement. Strunk

petitioners' opening brief, pp 50-51. Respondents countered that because the

settlement agreement only contained rights conferred in the remedial statutes, and

because ORS 238.375(3) expressly disavowed the existence of any such rights, the

2003 legislation could not have breached the settlement agreement. Strunk state

defendants' answering brief, pp 73-74. The Strunk court agreed that ORS

238.375(3) "could not be clearer" that the legislature had disavowed the creation of

any contractual rights, and with that, determined that petitioners had "failed to

demonstrate" that the remedial statutes created any contractual rights that the 2003

legislation could breach. Because petitioners did not assert that they had any

contractual rights under the remedial statutes, and, accordingly, did not point to

legislative context or history to try to support that argument, the court's statement

should be limited to its determination that petitioners had "failed to demonstrate"

that the remedial statutes conferred contractual rights, not as a holding that the

remedial statutes did not, as a matter of law, confer those rights.

20

21

Petitioner submits there if this court opines that it must give ORS 238.362(3)

some on-going effect, there is one limited construction that does not undo entirely

what the legislature and the Chess/Stovall class were attempting to achieve. If the

statute has some effect, it should be limited to recognizing that the legislature

retained the right to re-substitute the tax exemption obligation for the increased

benefits obligation, a right implicitly recognized in HB 2034 4(1),5 without

raising an impairment/breach of contract claim. Under this limited construction,

the future legislatures could adjust the respective tax exemption and benefit

increase terms as circumstances warranted, and the Chess/Stovall class would have

obtained the state's promise to do one or the other, but not both. That is, petitioner

submits, the only construction that arguably is consistent with the remaining text,

context and legislative history surrounding the passage of the package of statutes

designed to be a complete remedy for the tax exemption repeal.

4. The nature of the obligation under the substitute term is to pay

increased benefits to all PERS retirees.

Petitioner submits that the foregoing discussion demonstrates that the

remedial statutes (SB 656 and HB 3349, as amended by HB 2034) were offered

and accepted as a substitute for the tax exemption term and obligation of the PERS

5 HB 2034 4(1) prevents or reduces payment of the increased benefits in any year

in which PERS retirement benefits are "wholly" or "partially exempt from Oregon

personal income taxation."

22

contract. The only question left is the nature of the obligation.the remedial statutes

imposed. Specifically here, that question reduces to whether the remedial statutes

intended to offer the benefit increases for work performed prior to 1991 to all

PERS members who performed such work, including those who might, because

they moved out of state after retirement, not pay Oregon income taxes on those

benefits.

Before addressing this question, it should be noted that, as stated in Eckles

v.State of Oregon, 306 Or 380, 397, 760 P2d 846 (1988), the "unambiguous intent"

test or "rule is concerned with the existence of a contractual agreement, rather than

with the extent of the obligation created by an agreement ***." Presumably, then,

an ordinary statutory intent analysis is to be employed in resolving the extent or

nature of the obligation question.

Examining the language of the remedial statutes reveals no indication that

the legislature intended the increased benefits obligation to be limited to PERS

retirees who actually paid state income taxes. And, as discussed earlier and in

petitioner's opening brief, (POBr 9), the legislative history of HB 3349 reveals

clearly that the legislature understood the benefit increases would be paid to

retirees who paid no state income tax because they lived out of state.6

6 That retirees who resided out of state and/or paid no state income taxes would be

receiving benefits under the remedial statutes was noted by this court in both

Ragsdale v. Department ofRevenue, 321 Or 216, 230, 895 P2d 1348 (1995), cert

As mentioned previously, school districts rely on HB 3349, as amended by

HB 2034 4(1), discussed above, that prevents or reduces payment of the increased

benefits in any year in which PERS retirement benefits are "wholly" or "partially

exempt from Oregon personal income taxation." They rely on this provision to

show the legislature never intended to pay increased benefits to non-residents in

the first place, because those residents' retirement benefits are "not subject to"

Oregon income tax. SDABr 70-71. School districts misconstrue HB 2034 4(1).

Petitioner submits that although it may be possible in some circumstances at

least to equate "exempt from taxation" with "not subject to taxation," that is not

even the relevant question in this case. The question here is whether the legislature

intended "exempt from taxation" to include benefits that the legislature in ORS

316.127(9) has determined not to constitute "income derived from sources within

this state" and, for that reason, not to be included in the adjusted gross incomes for

non-residents for purposes of calculating Oregon taxes. Several indicia point to the

conclusion that the legislature did not intend them to have equivalent meaning.

First, HB 2034 4(1) is substantively identical to HB 3349 2(2).

Legislators considering HB 3349 would not have been told by their staff that the

increased benefits under that bill would be paid to non-resident retirees who pay no

den 516 US 1011

5

116 S Ct 5 695 133 Led2d 493 (1995 ) (SB 65 6), and Yogl, 327

Or 193, 206, 960 P2d 373 (1998) (HB 3349).

23

income tax if the "exempt from taxation" provision had been intended to apply to

non-residents. See POBr 9.

Second, reference in HB 2034 4(1) to benefits that are "exempt from

Oregon personal income taxation" is in obvious reference to the "tax exemption"

for all PERS retiree benefits that the legislature eliminated in 1991.

Third, if the legislature had intended that increased benefits not be paid to

retirees who paid no income tax on their retirement benefits because they lived out

of state, it knew how to say so. The same year that the legislature finalized the

language in this statute it enacted the amendments to ORS 316.127(9), providing

that all retirement income "received by a non-resident does not constitute income

derived from sources within this state." Had the legislature intended HB 2034

4(1) to require non-payment of benefits because the legislature has deemed those

benefits not to constitute Oregon source income for tax purposes, it could have

said, and knew how to say, so in that subsection.

Fourth, it is undisputed that, since the increased benefits authorized by the

remedial statutes started being paid, PERB has paid them to retirees living out of

state as well as to in-state retirees. If school districts are correct, then PERB all

these years has been violating the statute and paying out millions of dollars

erroneously: PERB obviously has not construed benefits "exempt from taxation"

to include benefits that the legislature has declared are not Oregon source income

24

for income tax purposes. That interpretation and consistent administrative

application of that interpretation certainly are illuminating here as to what the

legislature intended.

Finally, if school districts were correct, the 2011 and 2013 legislatures

would not have needed to enact Oregon Laws 2011, chapter 653 (requiring non-

payment of benefit increases to non-resident retirees on a prospective only basis)

or SB 822. The requirement not to pay increased benefits to non-residents already

would have been codified in HB 2034.

5. Summary

When the legislature enacted Senate Bill 822, ORS 238.364 and 238.366

contractually obligated PERB to pay increased benefits to all PERS retirees who

had retired prior to January 1, 2012, and who had earned retirement benefits based

on work performed prior to 1991. Senate Bi11822, sections 11-16 direct PERB

not to pay these increased benefits to non-resident PERS retirees, and thus either

direct PERB to breach its contractual obligation to those retirees or they remove

the obligation itself thereby impairing an obligation of the PERS contract.

CONCLUSION

For the reasons set forth above and in petitioner's opening brief, petitioner

submits that sections 11-17 conflict with federal law and are invalid. Petitioner

25

further submits that Senate Bill 822 and Senate Bill 861 impair the obligations of

26

or breach the PERS contract. Petitioner requests that the court grant such relief as

the court deems appropriate.

Respectfully submitte ,

~

r

Michael D. Reynolds

Petitioner pro se

CERTIFICATE OF COMPLIANCE WITH BRIEF

LENGTH AND TYPE SIZE REQUIREMENTS

I certify that (1) this brief complies with the word-count limitation in ORAP

5.05(2)(b) and (2) the word count of this brief (as described in ORAP 5.05(2)(a)) is

5,998 words.

I further certify that the size of the type in this brief is not smaller than 14

point for both the text of the brief and footnotes as required by ORAP 5.05(4)(f).

~.

Michael D. Reynolds

Petitioner pro se

CERTIFICATE OF FILING AND PROOF OF SERVICE

I certify that I filed the original Petitioner Reynolds' Reply Brief with the State

Court Administrator, Records Section, at 1163 State Street, Salem, Oregon, on September

19, 2014, by priority mail, postage prepaid.

I further certify that on September 19, 2014, I served true copies of Petitioner

Reynolds' Opening Brief upon the party or parties listed below, by first class or priority

mail, postage prepaid, and addressed as follows:

GREGORY A. HARTMAN #741283

ARUNA A. MASIH #973241

210 SW Morrison St.

Suite 500

Portla.nd, OR 97204-3149

Telephone: 503-227-4600

Attorneys for Petitioners Moro,

Domenigoni, Custer, Hawkins, Arken,

Ditter, O'Kief, Smith, Johnson, Clouser,

Silence, Vickery and Voek

GEORGE A. RIEMER

23206 N.Pedregosa Drive

Sun City West, AZ 85375

Telephone: 623-23 8-5039

Petitioner pro se

WAYNE S. JONES

18 North Foachill Road

North Salt Lake, UT 84054

Telephone: 801-296-1552

Petitioner pro se

ELLEN ROSENBLUM #753239

Attorney General

ANNA M. JOYCE #013112

Solicitor General

KEITH L. KUTLER #852626

Assistant Attorney General

MATTHEW J.IVIERRITT #122206

Assistant Attorney General

MICHAEL A. CASPER # 062000

Assistant Attorney General

400 Justice Building

Salem, Oregon 97310

Telephone: 503-378-4402

Attorneys for State Respondents

HARRY AUERBACH #821830

Office of the City Attorney

1221 SW 4th Avenue, Ste 430

Portland, OR 97204

Telephone: 503-823-4047

Attorney for Respondent City of

Portland

WILLIAM F. GARY #770325

SHARON A. RUDNICK #830835

HARRANG LONG GARY RUDNICK

PC

360 E. lOth Ave., Suite 300

Eugene, OR 97401

Telephone: 503-242-0000

Of Attorneys for Respondents Linn

County, Estacada, Oregon City, Ontario,

West Linn School Districts and

Beaverton School Districts, and

Intervenors Oregon School Boards

Association and Association of Oregon

Counties

DANIEL B. ATCHISON #040424

Office of City Attorney

555 Liberty Street SE Rm 205

Salem, OR 97301

Telephone: 503 588-6003

Attorney for Respondent City of Salem

EUGENE J. KARANDY II #972987

Office of the County Attorney

Linn County Courthouse

104 SW Fourth Avenue, Room 123

Albany, OR 97321

Telephone: 541 967-3 840

Of Attorneys for Respondent Linn

County

LISA M. FRIELEY #912763

Oregon School Boards Association

PO Box 1068

Salem, OR 97308

Telephone: 503 588-2800

Of Attorneys for Respondents Estacada,

Oregon City, Ontario, and

West Linn School Districts and

Intervenor Oregon School Boards

Association

ROB BOVETT #910267

Association of Oregon Counties

1201 Court St. NE Ste 300

Salem, OR 97301

Telephone: 971-218-0945

Of Attorneys for Respondent Linn

County

EDWARD F. TROMPKE #843653

Jordan Ramis PC

Two Centerpointe Drive, 6th Floor

Lake Oswego, OR 97035

Telephone: 503 598-5532

Attorney for Respondent Tualatin Valley

Fire & Rescue

W. MICHAEL GILLETTE #660458

LEORA COLEMAN-FIRE 9113581

SARA KOBAK #023495

WILLIAM B. CROW #610180

SCHWABE WILLIAMSON & WYATT

PC

1211 SW 5th Ave Suite 1900

Portland, OR 97204

Telephone: 503-222-9981

Of Attorneys for Intervenor League of -

Oregon Cities

SARAH K. DRESCHER #042762

Tedesco Law Group

3021 NE Broadway

Portland, OR 97232

Telephone: (866) 697-6015

Of Attorneys for Amicus Curiae IAFF

THOMAS A. WOODLEY

Douglas L. Steele

WOODLEY & McGILLIVARY

1101 Vermont Ave, N. W.

Suite 1000

Washington, D.C. 20005

Phone: (202) 833-8855

taw@wmlaborlaw.com

dls@wmlaborlaw.com

Of Attorneys for Amicus Curiae IAFF

CRAIG A. CRISPIN #82485

Crispin Employment Lawyers

1834 SW 58th Avenue, Suite 200

Portland, OR 97221

Telephone: (503) 293-5759

Attorney for Amicus Curiae AARP

' c

~

Michael D. Reynolds

Petitioner pro se

SEP 2 2 2014

MICHAEL D. REYNOLDS

Attorney at Law

8012 Sunnyside Ave N.

Seattle, Washington 98103

206-910-6568

EMAIL mreynoldsl4@comcast.net

September 19, 2014

Appellate Court Administrator

Appellate Court Records Section

1163 State Street

Salem, OR 97301-2563

Re: Reynolds v. Public Employees Retirement Board, State of Oregon; and John

Kitzhaber, Governor, State of Oregon. Supreme Court Nos. S061454, S061452 (Control)

Dear Administrator:

Enclosed for filing please find the original of petitioner Reynolds' Reply Brief for filing

in the above captioned matter.

Enclosed for filing please also fmd petitioner Reynolds' Motion for Leave to Present Oral

Argument pursuant to ORAP 6.10(4)

Thank you for your attention to this matter.

Very truly yours,

!

2Z Z

~~~~ l

1Vhchael D. Reynolds

Petitioner pro se

MDR:mr

Encl

Cc: Gregory A. Harhnan

Aruna A. Masih

George A. Riemer

Wayne S. Jones

Ellen Rosenblum

Anna M. Joyce

State Court Administrator

September 19, 2014]

Page 2

Keith L. Kutler

Matthew J. Merritt

Michael A. Casper

Harry Auerbach

William F. Gary

Sharon A. Rudnick

Daniel B. Atchison

Eugene J. Karandy

Lisa M. Friely

Rob Bovett

W. Michael Gillette

Leora Coleman-Fire

Sara Kobak

William B. Crow

Sarah K. Drescher

Thomas A. Woodley

Craig A. Crispin

_,

. , ,: a; . ~~: . :

. . '. i~~ : . ~a.

E i" . '} '. : : " ~

Y~: : : i: '^~: : u'~' ' ~

%E

~~ ~' ~ ,~ u. . . . . . . ___

~s .

. . ,. , ,. . ,. _ ,

~~>.

>

,. ,. . .

Ij, S. P'a$T~C-: ;

x

98 1. Y

SeP 1 9 .

'

ys

$ `fVV

9 3C

. .

r~~~

. . . ~ X0 9`3- 3 4i

- .

. . .

Y y y

TA

,,. . . ~ _. _. : . . . _ . . . _. _r_. . _ . . . . . . . . . . . . . . , . . _. _ ~i r } . '~} s . .

E. . ,,. . '. v ~ ~f3~'r ,. .

MICHAEI. D. REYNOLDS

Y r

$012 Sunn(~Qidc Ave N.

' Y~ ' . .

~ x . Seatt(e, Washington 98103 a ~

~ ~ ` k

- _

. _. _.

TO: State Court Adminis trator

Records Section

Supreme Court Building

1163 State Street

Salem, OR 97301-2563

Vous aimerez peut-être aussi

- March 1, 2024 - Fee Brief As Filed - TeslaDocument47 pagesMarch 1, 2024 - Fee Brief As Filed - TeslaSimon AlvarezPas encore d'évaluation

- Appellate Brief Fair v. Obama (Walker)Document42 pagesAppellate Brief Fair v. Obama (Walker)Kenyan BornObama100% (1)

- 00851-20070803 Verizon Reply To Dismiss Lack of Personal JurisdictionDocument21 pages00851-20070803 Verizon Reply To Dismiss Lack of Personal JurisdictionlegalmattersPas encore d'évaluation

- Moro Reply BriefDocument79 pagesMoro Reply BriefStatesman JournalPas encore d'évaluation

- Chiquita Cross Motion To Disqualify Terry CollingsworthDocument16 pagesChiquita Cross Motion To Disqualify Terry CollingsworthPaulWolfPas encore d'évaluation

- 2:12-cv-00578 #86Document502 pages2:12-cv-00578 #86Equality Case FilesPas encore d'évaluation

- Joffe Opposition To K&S Motion For Summary JudgmentDocument30 pagesJoffe Opposition To K&S Motion For Summary JudgmentabdPas encore d'évaluation

- 00869-ATT Response AmiciDocument13 pages00869-ATT Response AmicilegalmattersPas encore d'évaluation

- Attorneys For Defendants United States of America and Secretary of DefenseDocument20 pagesAttorneys For Defendants United States of America and Secretary of DefenseEquality Case FilesPas encore d'évaluation

- Trial Brief by Prop. 8 Proponents, Filed 02-26-10Document21 pagesTrial Brief by Prop. 8 Proponents, Filed 02-26-10Michael GinsborgPas encore d'évaluation

- US v. Raniere: Motion For New TrialDocument29 pagesUS v. Raniere: Motion For New TrialTony OrtegaPas encore d'évaluation

- 00847-20070803 Verizon Reply To Dismiss ChulskyDocument21 pages00847-20070803 Verizon Reply To Dismiss ChulskylegalmattersPas encore d'évaluation

- Masterpiece Cakeshop Appellant BriefDocument37 pagesMasterpiece Cakeshop Appellant BriefNancy LeongPas encore d'évaluation

- 62 County MTDDocument21 pages62 County MTDCole StuartPas encore d'évaluation

- Amarin V Hikma 331 PDFDocument284 pagesAmarin V Hikma 331 PDFMets FanPas encore d'évaluation

- PRM & Mncogi Amicus Brief in Epa (Minn.)Document37 pagesPRM & Mncogi Amicus Brief in Epa (Minn.)FluenceMediaPas encore d'évaluation

- Dept. of Justice Defends Don't Ask, Don't Tell PolicyDocument30 pagesDept. of Justice Defends Don't Ask, Don't Tell PolicyJoeSudbayPas encore d'évaluation

- Hall v. SwiftDocument25 pagesHall v. SwiftBillboardPas encore d'évaluation

- Noriega v. Activision - Call of Duty Anti-SLAPP MotionDocument20 pagesNoriega v. Activision - Call of Duty Anti-SLAPP MotionMark JaffePas encore d'évaluation

- Supreme Court of The United States: Petitioners, v. RespondentsDocument39 pagesSupreme Court of The United States: Petitioners, v. Respondentslegalmatters100% (1)

- Plaintiff's Opposition On Preservation of Talc SamplesDocument26 pagesPlaintiff's Opposition On Preservation of Talc SamplesKirk HartleyPas encore d'évaluation

- SAF Move For TRO in Cal. Gun Dealer Surveillance CaseDocument25 pagesSAF Move For TRO in Cal. Gun Dealer Surveillance CaseAmmoLand Shooting Sports NewsPas encore d'évaluation

- Perry Plaintiffs' Opposition To Imperial County's Intervention, Filed 12-30-09Document23 pagesPerry Plaintiffs' Opposition To Imperial County's Intervention, Filed 12-30-09Michael GinsborgPas encore d'évaluation

- Brief For Petitioner, Sheetz v. County of El Dorado, No. 22-1074 (U.S. Nov. 13, 2023)Document57 pagesBrief For Petitioner, Sheetz v. County of El Dorado, No. 22-1074 (U.S. Nov. 13, 2023)RHTPas encore d'évaluation

- Carla Roberson Cummings in Supreme Count of TexasDocument41 pagesCarla Roberson Cummings in Supreme Count of TexasShirley Pigott MD0% (1)

- MLB's Motion To Dismiss (Miranda v. MLB)Document30 pagesMLB's Motion To Dismiss (Miranda v. MLB)ngrow9Pas encore d'évaluation

- Respondent Footlocker BriefDocument44 pagesRespondent Footlocker BriefBennet KelleyPas encore d'évaluation

- Eric Inselberg Motion To RemandDocument20 pagesEric Inselberg Motion To RemandAnthony J. PerezPas encore d'évaluation

- Siegel Superman/Superboy Opposition To Summary Judgment Filing March 4, 2013Document443 pagesSiegel Superman/Superboy Opposition To Summary Judgment Filing March 4, 2013Jeff TrexlerPas encore d'évaluation

- Petition For Writ of Prohibition in Markeith Loyd V State of FloridaDocument28 pagesPetition For Writ of Prohibition in Markeith Loyd V State of FloridaReba Kennedy100% (2)

- Chiquita Motion For Summary Judgment On Negligence Per SeDocument25 pagesChiquita Motion For Summary Judgment On Negligence Per SePaulWolfPas encore d'évaluation

- Sag-Aftra Health Plan MTDDocument34 pagesSag-Aftra Health Plan MTDTHROnlinePas encore d'évaluation

- Scott AppealDocument174 pagesScott AppealTim ElfrinkPas encore d'évaluation

- State V ReinkeDocument118 pagesState V Reinkemary engPas encore d'évaluation

- Petition For Writ of Certiorari To The Supreme Court of South CarolinaDocument110 pagesPetition For Writ of Certiorari To The Supreme Court of South CarolinaIsland Packet and Beaufort Gazette100% (1)

- United States District Court Northern District of CaliforniaDocument14 pagesUnited States District Court Northern District of CaliforniaKathleen PerrinPas encore d'évaluation

- Teter/Grell (Hawaii Butterfly Knife Case) MSJ MemoDocument31 pagesTeter/Grell (Hawaii Butterfly Knife Case) MSJ Memowolf woodPas encore d'évaluation

- Cambria Doc Opp To Detention 4 LaceyDocument19 pagesCambria Doc Opp To Detention 4 LaceyStephen LemonsPas encore d'évaluation

- FDIC v. Killinger, Rotella and Schneider - STEPHEN J. ROTELLA AND DAVID C. SCHNEIDER'S MOTION TO DISMISSDocument27 pagesFDIC v. Killinger, Rotella and Schneider - STEPHEN J. ROTELLA AND DAVID C. SCHNEIDER'S MOTION TO DISMISSmeischerPas encore d'évaluation

- Case No. 09-Cv-2292 JW Brief of Amici CuriaeDocument12 pagesCase No. 09-Cv-2292 JW Brief of Amici CuriaeKathleen PerrinPas encore d'évaluation

- Mot Dismiss Leon Khasin v. Hershey CoDocument35 pagesMot Dismiss Leon Khasin v. Hershey CoLara PearsonPas encore d'évaluation

- WALPIN V CNCS - 17 - Reply in Support of Motion To Dismiss Gov - Uscourts.dcd.137649.17.0Document30 pagesWALPIN V CNCS - 17 - Reply in Support of Motion To Dismiss Gov - Uscourts.dcd.137649.17.0Jack RyanPas encore d'évaluation

- P ' R Blag' O - S J C N - 3:10 - 0257-JSW SF - 3021132Document22 pagesP ' R Blag' O - S J C N - 3:10 - 0257-JSW SF - 3021132Equality Case FilesPas encore d'évaluation

- Devillier, Et Al., v. TexasDocument22 pagesDevillier, Et Al., v. TexasCato InstitutePas encore d'évaluation

- OLD CARCO, LLC (APPEAL - 2nd CIRCUIT) - 28 - Appellants' Corrected Brief and Appendix - Transport RoomDocument170 pagesOLD CARCO, LLC (APPEAL - 2nd CIRCUIT) - 28 - Appellants' Corrected Brief and Appendix - Transport RoomJack RyanPas encore d'évaluation

- FB Shareholder Lawsuit Pretrail Brief UNSEALEDDocument93 pagesFB Shareholder Lawsuit Pretrail Brief UNSEALEDAlex HeathPas encore d'évaluation

- SAF Files For Summary Judgement in Challenge To N.Y. Gun BanDocument23 pagesSAF Files For Summary Judgement in Challenge To N.Y. Gun BanAmmoLand Shooting Sports NewsPas encore d'évaluation

- Academy of Matrimonial Lawyers Amicus BriefDocument44 pagesAcademy of Matrimonial Lawyers Amicus BriefEquality Case FilesPas encore d'évaluation

- United States District Court Northern District of CaliforniaDocument37 pagesUnited States District Court Northern District of CaliforniaEquality Case FilesPas encore d'évaluation

- 190 - Plaintiffs Memorandum of Contentions of Fact and Law - 6-21-2010Document53 pages190 - Plaintiffs Memorandum of Contentions of Fact and Law - 6-21-2010tesibria100% (1)

- Brief of Appellants, Johnson v. City of Suffolk, No. 191563 (Va. June 11, 2020)Document25 pagesBrief of Appellants, Johnson v. City of Suffolk, No. 191563 (Va. June 11, 2020)RHTPas encore d'évaluation

- Texas Supreme Court 14-0192 Response To Petition (1) Tom CrowsonDocument37 pagesTexas Supreme Court 14-0192 Response To Petition (1) Tom CrowsonxyzdocsPas encore d'évaluation

- Write Brief Filed in The Oklahoma Supreme Court by SQ 820 CampaignDocument19 pagesWrite Brief Filed in The Oklahoma Supreme Court by SQ 820 CampaignColleen WelcherPas encore d'évaluation

- Dana Bostick V Herbalife - Plaintiffs' Memorandum in Support of Joint Motion For Preliminary Approval of Class Action Settlement and Certification of ClassDocument47 pagesDana Bostick V Herbalife - Plaintiffs' Memorandum in Support of Joint Motion For Preliminary Approval of Class Action Settlement and Certification of ClassSam E. AntarPas encore d'évaluation

- Petition for Certiorari Denied Without Opinion: Patent Case 93-1518D'EverandPetition for Certiorari Denied Without Opinion: Patent Case 93-1518Pas encore d'évaluation

- Is Bad-Faith the New Wilful Blindness?: The Company Directors’ Duty of Good Faith and Wilful Blindness Doctrine Under Common Law Usa (Delaware) and Uk (England): a Comparative StudyD'EverandIs Bad-Faith the New Wilful Blindness?: The Company Directors’ Duty of Good Faith and Wilful Blindness Doctrine Under Common Law Usa (Delaware) and Uk (England): a Comparative StudyPas encore d'évaluation

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalPas encore d'évaluation

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalPas encore d'évaluation

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalPas encore d'évaluation

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalPas encore d'évaluation

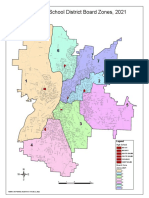

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalPas encore d'évaluation

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDocument1 pageSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalPas encore d'évaluation

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalPas encore d'évaluation

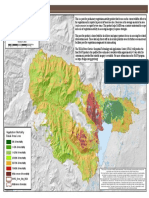

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalPas encore d'évaluation

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalPas encore d'évaluation

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalPas encore d'évaluation

- Cedar Creek Fire Aug. 16Document1 pageCedar Creek Fire Aug. 16Statesman JournalPas encore d'évaluation

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalPas encore d'évaluation

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalPas encore d'évaluation

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalPas encore d'évaluation

- BG 7-Governing StyleDocument2 pagesBG 7-Governing StyleStatesman JournalPas encore d'évaluation

- Salem Police 15-Year Crime Trends 2007 - 2015Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalPas encore d'évaluation

- WSD Retention Campaign Resolution - 2022Document1 pageWSD Retention Campaign Resolution - 2022Statesman JournalPas encore d'évaluation

- Salem Police 15-Year Crime Trends 2007 - 2021Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalPas encore d'évaluation

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalPas encore d'évaluation

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalPas encore d'évaluation

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalPas encore d'évaluation

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDocument11 pagesSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalPas encore d'évaluation

- Zone Alternates 2Document2 pagesZone Alternates 2Statesman JournalPas encore d'évaluation

- Failed Tax Abatement ProposalDocument8 pagesFailed Tax Abatement ProposalStatesman JournalPas encore d'évaluation

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalPas encore d'évaluation

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalPas encore d'évaluation

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalPas encore d'évaluation

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalPas encore d'évaluation

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalPas encore d'évaluation

- SB Presentation SIA 2020-21 Annual Report 11-9-21Document11 pagesSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalPas encore d'évaluation

- Midterm SampleDocument8 pagesMidterm SampleHussein EssaPas encore d'évaluation

- IAS 41 Accounting for Agricultural ActivityDocument5 pagesIAS 41 Accounting for Agricultural ActivityArney GumblePas encore d'évaluation

- Ebs-Strategy-R12.2 Roadmap PDFDocument156 pagesEbs-Strategy-R12.2 Roadmap PDFSrinivasa Rao AsuruPas encore d'évaluation

- Asian Paints Industry LeaderDocument9 pagesAsian Paints Industry LeaderMithilesh SinghPas encore d'évaluation

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Document65 pagesMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramPas encore d'évaluation

- Nestle Maggi Sales Analysis in Indian MarketDocument60 pagesNestle Maggi Sales Analysis in Indian MarketMohd DilshadPas encore d'évaluation

- Joint Stock CompanyDocument26 pagesJoint Stock CompanyPratik ShahPas encore d'évaluation

- CH 456Document8 pagesCH 456Syed TabrezPas encore d'évaluation

- Financing Maritime Infrastructure in NigeriaDocument57 pagesFinancing Maritime Infrastructure in Nigeriajustin onagaPas encore d'évaluation

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document3 pages2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillPas encore d'évaluation

- OnlinePayslip Pages NewPayslipModuleDocument1 pageOnlinePayslip Pages NewPayslipModulerujean romy p guisando57% (7)

- MTN Group Business Report Highlights Cellular Growth Across AfricaDocument170 pagesMTN Group Business Report Highlights Cellular Growth Across AfricaMercy OfuyaPas encore d'évaluation

- Disney CaseDocument4 pagesDisney CaseMedrx TradingPas encore d'évaluation

- BF Group Assignment Group 3 (Hero MotoCorp)Document21 pagesBF Group Assignment Group 3 (Hero MotoCorp)Shiva KrishnanPas encore d'évaluation

- Marks and Spencer Marketing MixDocument27 pagesMarks and Spencer Marketing MixTushar Sharma50% (4)

- Bar ExamsDocument17 pagesBar ExamsCatherine PantiPas encore d'évaluation

- TRIAL E Commerce Financial Model Excel Template v.4.0.122020Document68 pagesTRIAL E Commerce Financial Model Excel Template v.4.0.122020DIDIPas encore d'évaluation

- Cabcharge Research Report CAB ASXDocument4 pagesCabcharge Research Report CAB ASXzengooiPas encore d'évaluation

- Istilah-Istilah Akuntansi & Pajak Dalam Bahasa InggrisDocument24 pagesIstilah-Istilah Akuntansi & Pajak Dalam Bahasa Inggrisgaluh vindriarsoPas encore d'évaluation

- 06 Completing The Accounting CycleDocument26 pages06 Completing The Accounting CycleKristel Joy Eledia NietesPas encore d'évaluation

- Trade and Capital Flows - GCC and India - Final - May 02 2012Document55 pagesTrade and Capital Flows - GCC and India - Final - May 02 2012aakashbluePas encore d'évaluation

- Basics of Demand and SupplyDocument29 pagesBasics of Demand and SupplyNuahs Magahat100% (2)

- Fortis Healthcare - Submission PDFDocument3 pagesFortis Healthcare - Submission PDFKumar Praharsh RakhejaPas encore d'évaluation

- Statements of Cash FlowsDocument23 pagesStatements of Cash FlowslesterPas encore d'évaluation

- IPSAS in Your Pocket April 2017 PDFDocument63 pagesIPSAS in Your Pocket April 2017 PDFMuhamad Riza El HakimPas encore d'évaluation

- General journal entries for consulting businessDocument22 pagesGeneral journal entries for consulting businessPauline Bianca70% (10)

- 3 Forward Prices-DeterminationDocument26 pages3 Forward Prices-DeterminationSaurabh AhujaPas encore d'évaluation

- Strategic Cost Management Coordinated Quiz 1Document7 pagesStrategic Cost Management Coordinated Quiz 1Kim TaehyungPas encore d'évaluation

- Ackman Realty Income ShortDocument35 pagesAckman Realty Income Shortmarketfolly.com100% (1)

- Final Tfa CompiledDocument109 pagesFinal Tfa CompiledAsi Cas JavPas encore d'évaluation