Académique Documents

Professionnel Documents

Culture Documents

Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014

Transféré par

Riya VermaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014

Transféré par

Riya VermaDroits d'auteur :

Formats disponibles

www.TheEquicom.

com 09200009266

24/Sep./2014

www.TheEquicom.com

09200009266

DAILY OPTION NEWS LETTER

www.TheEquicom.com 09200009266

The markets bleed today. Sensex close down 431.05 falls 1.58% & the Nifty close down

128.75 falls 1.58%, posted its biggest single-day fall in two-and-a-half months as blue-

chips such as ICICI Bank tracked weaker global stocks on disappointment over

European manufacturing data and concerns about an unemployment measure in a

survey in China. Shares of Cipla, Tata Motors, Hindalco Industries, Gail India, Tata Steel

& DLF tanked 3-7 percent while HCL Technologies outperformed, up 1.5 percent today.

CATEGORY BUY

CONTRACT

BUY VALUE

[Cr.]

SELL

CONTRACT

NET VALUE

[Cr.]

NET BUY/ SELL

[Cr.]

INDEX OPTION 537969 21799.51 501352 20279.32 1520.19

STOCKS OPTION 84165 3320.07 88392 3494.95 -174.88

www.TheEquicom.com 09200009266

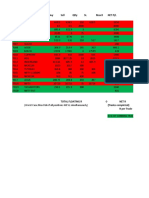

TOP OPTION GAINERS

COMPANY NAME EXPIRY

DATE

OPTION

TYPE

STRIKE

PRICE

LTP

CANG.

(RS)

CHAG.

(%)

OPEN

INTREST

SKSMICRO 25-Sep-14 PE 300 11.00 9.15 494.59 12000

RECLTD 25-Sep-14 PE 240 1.75 1.45 483.33 67000

TATACHEM 25-Sep-14 PE 390 8.30 6.85 472.41 28000

CIPLA 25-Sep-14 PE 580 3.40 2.80 466.67 152000

RELIANCE 25-Sep-14 PE 980 15.80 13.00 464.29 478500

TOP OPTION LOSERS

COMPANY NAME EXPIRY

DATE

OPTION

TYPE

STRIKE

PRICE

LTP CANG.

(RS)

CHAG.

(%)

OPEN

INTREST

INFY 25-Sep-14 PE 2700 0.30 -39.00 -99.24 250

RCOM 25-Sep-14 CE 170 0.05 -5.75 -99.14 0

LUPIN 25-Sep-14 CE 1540 0.05 -3.95 -98.75 500

HAVELLS 25-Sep-14 CE 272 0.50 -33.15 -98.51 0

AXISBANK 25-Sep-14 PE 290 0.15 -5.90 -97.52 3750

www.TheEquicom.com 09200009266

PRODUCT NO. OF CONTRACTS TURNOVER IN RS. CR. PUT CALL RATIO

INDEX FUTURES 5,88,284 23,801.51 -

STOCK FUTURES 14,27,002 55,167.64 -

INDEX OPTIONS 75,54,784 3,06,446.04 1.06

STOCK OPTIONS 4,77,425 18,617.05 0.53

F&O TOTAL 1,00,47,513 4,04,033.46 1.02

INDEX STRIKE

PRICE

P.CLOSE OPEN HIGH LOW LAST VOLUME CHANGE

%

NIFTY OPTION 8100 65.00 75.00 9.60 70.45 11.50 49148750 -83.68

BANK NIFTY OPTION 16100 155.90 169.60 23.00 160.70 24.65 1046875 -84.66

www.TheEquicom.com 09200009266

OUTLOOK OUTLOOK OUTLOOK OUTLOOK

TREND: TREND: TREND: TREND:- -- - CONSOLIDATE CONSOLIDATE CONSOLIDATE CONSOLIDATE STRATEGY: STRATEGY: STRATEGY: STRATEGY:- -- - BUY ON DIPS BUY ON DIPS BUY ON DIPS BUY ON DIPS

Resistance 1:- 8100 2:- 8200

Support 1:- 7950 2:- 7870

Technical View:

Our yesterdays Nifty 8100 call option made high 75.00 traded near to our target. Tomorrow

traders can buy Nifty (8000 Put) option at 25.00 for the target of 40.00 (Intraday).

www.TheEquicom.com 09200009266

OUTLOOK OUTLOOK OUTLOOK OUTLOOK

TREND: TREND: TREND: TREND:- -- - CONSOLIDATE CONSOLIDATE CONSOLIDATE CONSOLIDATE STRATEGY: STRATEGY: STRATEGY: STRATEGY:- -- - BUY ON DIPS BUY ON DIPS BUY ON DIPS BUY ON DIPS

Resistance 1:- 16100 2:- 16320

Support 1:- 15810 2:- 15650

Technical View:

Our yesterdays Bank Nifty 16200 call made high 106.00 traded near to our target.

Tomorrow traders can buy Bank Nifty (15900 Put) option buy above 65.00 for the target of

95.00 (Intraday).

www.TheEquicom.com 09200009266

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not

accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them

the most.

Sincere efforts have been made to present the right investment perspective. The information contained herein is based on

analysis and up on sources that we consider reliable.

This material is for personal information and based upon it & takes no responsibility

The information given herein should be treated as only factor, while making investment decision. The report does not provide

individually tailor-made investment advice. TheEquicom recommends that investors independently evaluate particular

investments and strategies, and encourages investors to seek the advice of a financial adviser. TheEquicom shall not be

responsible for any transaction conducted based on the information given in this report, which is in violation of rules and

regulations of NSE and BSE.

The share price projections shown are not necessarily indicative of future price performance. The information herein,

together with all estimates and forecasts, can change without notice. Analyst or any person related to TheEquicom might be

holding positions in the stocks recommended. It is understood that anyone who is browsing through the site has done so at

his free will and does not read any views expressed as a recommendation for which either the site or its owners or anyone

can be held responsible for . Any surfing and reading of the information is the acceptance of this disclaimer.

All Rights Reserved.

Investment in Commodity and equity market has its own risks.

We, however, do not vouch for the accuracy or the completeness thereof. we are not responsible for any loss incurred

whatsoever for any financial profits or loss which may arise from the recommendations above. TheEquicomdoes not

purport to be an invitation or an offer to buy or sell any financial instrument. Our Clients (Paid Or Unpaid), Any third party or

anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by us to/with anyone

which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Vous aimerez peut-être aussi

- Options Trading Beginner: Rach's Self ImprovementDocument4 pagesOptions Trading Beginner: Rach's Self Improvementhc87Pas encore d'évaluation

- Options Strategy for Nifty Index with Potential Profit of ₹2,035Document4 pagesOptions Strategy for Nifty Index with Potential Profit of ₹2,035radesh.reddyPas encore d'évaluation

- Angel BrokingDocument10 pagesAngel BrokingNitin GujjarPas encore d'évaluation

- Nifty ProjectionDocument4 pagesNifty ProjectiondhaneshPas encore d'évaluation

- Straddle Including Expiry DayDocument47 pagesStraddle Including Expiry DayMnvd prasadPas encore d'évaluation

- Bank Nifty Weekly FnO Hedging StrategyDocument5 pagesBank Nifty Weekly FnO Hedging StrategySanju GoelPas encore d'évaluation

- Long Put ButterflyDocument2 pagesLong Put ButterflypkkothariPas encore d'évaluation

- Previous Day'S Price: Projection For TodayDocument5 pagesPrevious Day'S Price: Projection For TodaycratnanamPas encore d'évaluation

- BN 2pm Straddle 1% SlippageDocument99 pagesBN 2pm Straddle 1% Slippagealistair7682Pas encore d'évaluation

- Different Option StrategiesDocument43 pagesDifferent Option StrategiessizzlingabheePas encore d'évaluation

- Pivot Point Calculator in ExcelDocument3 pagesPivot Point Calculator in ExcelMuhammad SyahbainiPas encore d'évaluation

- 2018-9 16am PDFDocument16 pages2018-9 16am PDFAsis SahooPas encore d'évaluation

- Stockmock - Monthly 1-3pmDocument4 pagesStockmock - Monthly 1-3pmHarieswar ReddyPas encore d'évaluation

- Options Max Pain Calculator and Excel - StockManiacsDocument7 pagesOptions Max Pain Calculator and Excel - StockManiacssujithsidhardhanPas encore d'évaluation

- Trend Formula For Bank Nifty: Open Price Low HighDocument3 pagesTrend Formula For Bank Nifty: Open Price Low HighsrivardanPas encore d'évaluation

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumarPas encore d'évaluation

- Automated Excel DetailsDocument10 pagesAutomated Excel DetailsPrashant mhamunkarPas encore d'évaluation

- Buy Level Buy LevelDocument9 pagesBuy Level Buy LevelJeniffer RayenPas encore d'évaluation

- Nifty SignalDocument14 pagesNifty SignalmahendraboradePas encore d'évaluation

- Indicators For Trading ViewDocument3 pagesIndicators For Trading ViewAdegoke EmmanuelPas encore d'évaluation

- Using Futures and Options as ATM MachinesDocument5 pagesUsing Futures and Options as ATM MachinesomkarsansarePas encore d'évaluation

- Stock Mock - Backtest Index Strategies2Document5 pagesStock Mock - Backtest Index Strategies2Avinash GaikwadPas encore d'évaluation

- Course Plan Part 1 PDFDocument19 pagesCourse Plan Part 1 PDFmohamed100% (1)

- Q: A Brief Background and Your Tryst With Markets: Manu Bhatia'sDocument3 pagesQ: A Brief Background and Your Tryst With Markets: Manu Bhatia'sSavan JaviaPas encore d'évaluation

- Backtest Index Strategies Performance Over Monthly Periods 2017-2021Document95 pagesBacktest Index Strategies Performance Over Monthly Periods 2017-2021ThE BoNg TeChniCaLPas encore d'évaluation

- Vijay ThakkarDocument41 pagesVijay Thakkarfixemi0% (1)

- Spy LevelsDocument3 pagesSpy Levelsudhaya kumarPas encore d'évaluation

- 142a Banknifty Weekly Options StrategyDocument6 pages142a Banknifty Weekly Options StrategyudayPas encore d'évaluation

- Nifty Options Writing StrategyDocument8 pagesNifty Options Writing Strategyfrank georgePas encore d'évaluation

- Only Α- Sniper Shot 3: MyfnoDocument10 pagesOnly Α- Sniper Shot 3: MyfnoPhani KrishnaPas encore d'évaluation

- The Top Ten Mistakes Traders Make PDFDocument9 pagesThe Top Ten Mistakes Traders Make PDFPaulo ExtoPas encore d'évaluation

- Product Guide - Buy Today Sell Tomorrow (BTST)Document5 pagesProduct Guide - Buy Today Sell Tomorrow (BTST)SivaAgathamudiPas encore d'évaluation

- Pine Script SiroyaDocument3 pagesPine Script SiroyaSergio TerebeikoPas encore d'évaluation

- National Stock Exchange: Trading StrategiesDocument72 pagesNational Stock Exchange: Trading StrategiesRavi KhushalaniPas encore d'évaluation

- How To Be 100% Sure of A Chart SignalDocument5 pagesHow To Be 100% Sure of A Chart SignalbhushanPas encore d'évaluation

- Trading Setups (Observable)Document2 pagesTrading Setups (Observable)Mohd IzwanPas encore d'évaluation

- Delta Hedging Dayton ManufacturingDocument10 pagesDelta Hedging Dayton ManufacturingMeet JivaniPas encore d'évaluation

- Laththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty TrendDocument1 pageLaththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty Trend9952090083Pas encore d'évaluation

- Nifty Trend 2Document3 pagesNifty Trend 2Prasad SwaminathanPas encore d'évaluation

- Velluri Strategy Nifty FiftyDocument15 pagesVelluri Strategy Nifty FiftyPrajan JPas encore d'évaluation

- Trading Rules "Randomness Is Unstructured Freedom Without Responsibility."Document1 pageTrading Rules "Randomness Is Unstructured Freedom Without Responsibility."getpaid2tradePas encore d'évaluation

- MCX Options - Hedging Instruments for Bullion & Jewellery industryDocument29 pagesMCX Options - Hedging Instruments for Bullion & Jewellery industryOlivia JacksonPas encore d'évaluation

- 30 Trades Sample SizeDocument13 pages30 Trades Sample SizePraful AroraPas encore d'évaluation

- VolAtality FibDocument3 pagesVolAtality FibAnand MuralePas encore d'évaluation

- FiboHenryZone Calculator SignDocument39 pagesFiboHenryZone Calculator SignSyahrizul Ahmad Zabidi0% (1)

- Long Ratio Put SpreadDocument3 pagesLong Ratio Put SpreadpkkothariPas encore d'évaluation

- Delta Neutral Strategy using Future SyntheticsDocument4 pagesDelta Neutral Strategy using Future SyntheticsAsokaran PraveenPas encore d'évaluation

- 27 Aug Risk Management Theory NotesDocument5 pages27 Aug Risk Management Theory NotesChitranjan SharmaPas encore d'évaluation

- Delta Neutral Vega LongDocument6 pagesDelta Neutral Vega LongPankajPas encore d'évaluation

- BatMan Option StrategyDocument13 pagesBatMan Option StrategyVenu MadhuriPas encore d'évaluation

- Simple Rules To Trade Using 5 EMA (LOW-HIGH)Document9 pagesSimple Rules To Trade Using 5 EMA (LOW-HIGH)JoTraderPas encore d'évaluation

- Hedging Breakeven CalculatorDocument11 pagesHedging Breakeven CalculatorjitendrasutarPas encore d'évaluation

- Pristine - S Guerilla Trading TacticsDocument4 pagesPristine - S Guerilla Trading Tacticsminab123Pas encore d'évaluation

- Study On Option Strategy Fin Vikash SinhaDocument22 pagesStudy On Option Strategy Fin Vikash SinhaVikash SinhaPas encore d'évaluation

- A Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFADocument13 pagesA Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFAtudorPas encore d'évaluation

- Stockmock PositionsDocument16 pagesStockmock Positionskumar mhPas encore d'évaluation

- Pivots AlgoDocument5 pagesPivots AlgokalelenikhlPas encore d'évaluation

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeD'EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifePas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 22 October 2014Document7 pagesStock Option Latest News by Theequicom For Today 22 October 2014Riya VermaPas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 27 October 2014Document7 pagesStock Option Latest News by Theequicom For Today 27 October 2014Riya VermaPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-16-October-2014Document7 pagesStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-16-October-2014Riya VermaPas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 21 October 2014Document7 pagesStock Option Latest News by Theequicom For Today 21 October 2014Riya VermaPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 14 October 2014Document7 pagesStock Option Latest News by Theequicom For Today 14 October 2014Riya VermaPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 13 October 2014Document7 pagesStock Option Latest News by Theequicom For Today 13 October 2014Riya VermaPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Stock Option Analysis by Theequicom For 17 September 2014Document7 pagesStock Option Analysis by Theequicom For 17 September 2014Riya VermaPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News Letter 19sep2014Document7 pagesDaily Option News Letter 19sep2014Riya VermaPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News Letter 19sep2014Document7 pagesDaily Option News Letter 19sep2014Riya VermaPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 12 September 2014Document7 pagesStock Option Latest News by Theequicom For Today 12 September 2014Riya VermaPas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 16 September 2014Document7 pagesStock Option Latest News by Theequicom For Today 16 September 2014Riya VermaPas encore d'évaluation

- Aqa Econ2 QP Jan13Document16 pagesAqa Econ2 QP Jan13api-247036342Pas encore d'évaluation

- Infosys Aptitude Questions and Answers With ExplanationDocument5 pagesInfosys Aptitude Questions and Answers With ExplanationVirrru NarendraPas encore d'évaluation

- Deed of Sale 2Document6 pagesDeed of Sale 2Edgar Frances VillamorPas encore d'évaluation

- T-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury BillsDocument5 pagesT-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury Billsbb2Pas encore d'évaluation

- Audi Power To Gas News (Media)Document3 pagesAudi Power To Gas News (Media)asmecsiPas encore d'évaluation

- Bullock CartDocument23 pagesBullock CartsrajecePas encore d'évaluation

- Aviation ProjectDocument38 pagesAviation ProjectSomraj PathakPas encore d'évaluation

- 1b Partnership OperationDocument7 pages1b Partnership OperationMark TaysonPas encore d'évaluation

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On ONE Trade Per DayDocument8 pagesDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On ONE Trade Per DaymudeyPas encore d'évaluation

- Parag Milk & Namaste India Milk Dairy by Manish Kumar Rajpoot (MBA)Document17 pagesParag Milk & Namaste India Milk Dairy by Manish Kumar Rajpoot (MBA)Manish Kumar Rajpoot100% (1)

- Akpk SlideDocument13 pagesAkpk SlideizzatiPas encore d'évaluation

- User Exits in Sales Document ProcessingDocument9 pagesUser Exits in Sales Document Processingkirankumar723Pas encore d'évaluation

- Solar Crimp ToolsDocument4 pagesSolar Crimp ToolsCase SalemiPas encore d'évaluation

- JPM - Economic Data AnalysisDocument11 pagesJPM - Economic Data AnalysisAvid HikerPas encore d'évaluation

- The Optimum Quantity of Money Milton FriedmanDocument305 pagesThe Optimum Quantity of Money Milton Friedmantrafalgar111100% (4)

- PUMBA - DSE A - 506 - LDIM - 1.1 - Nature and Scope of International Trade Law - NotesDocument4 pagesPUMBA - DSE A - 506 - LDIM - 1.1 - Nature and Scope of International Trade Law - NotesTô Mì HakkaPas encore d'évaluation

- PNB VS ChuaDocument1 pagePNB VS Chuacareyssa Mae IpilPas encore d'évaluation

- Blades in The Dark - Doskvol Maps PDFDocument3 pagesBlades in The Dark - Doskvol Maps PDFRobert Rome20% (5)

- Proposal HydrologyDocument4 pagesProposal HydrologyClint Sunako FlorentinoPas encore d'évaluation

- Construction Work Schedule For Boundary WallDocument1 pageConstruction Work Schedule For Boundary WallBaburam ChaudharyPas encore d'évaluation

- Analysis Master RoadDocument94 pagesAnalysis Master RoadSachin KumarPas encore d'évaluation

- 19th Century Changes: Economic Changes Cultural Changes Political Changes Social ChangesDocument1 page19th Century Changes: Economic Changes Cultural Changes Political Changes Social ChangesShina P ReyesPas encore d'évaluation

- Lost SpringDocument39 pagesLost SpringNidhi rastogiPas encore d'évaluation

- Fremantle Line: Looking For More Information?Document12 pagesFremantle Line: Looking For More Information?lerplataPas encore d'évaluation

- Iraqi Dinar - US and Iraq Reached On Agreement To IQD RV - Iraqi Dinar News Today 2024Document2 pagesIraqi Dinar - US and Iraq Reached On Agreement To IQD RV - Iraqi Dinar News Today 2024Muhammad ZikriPas encore d'évaluation

- GIDB3647341-Money WorksheetDocument6 pagesGIDB3647341-Money WorksheetAnonymous GxsqKv85GPas encore d'évaluation

- The Impact of Colonialism On African Economic DevelopmentDocument13 pagesThe Impact of Colonialism On African Economic Developmentsulaiman yusufPas encore d'évaluation

- Dairy TemplateDocument3 pagesDairy TemplateSK FoodnBeveragesPas encore d'évaluation

- Fanshawe College Application FormDocument2 pagesFanshawe College Application Formdaljit8199Pas encore d'évaluation

- Blstone 2Document508 pagesBlstone 2Kasper AchtonPas encore d'évaluation