Académique Documents

Professionnel Documents

Culture Documents

Report

Transféré par

Latiful AzamTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Report

Transféré par

Latiful AzamDroits d'auteur :

Formats disponibles

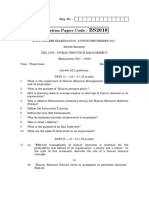

Chapter-1

Introduction

2

1.1 Introduction:

The internship program is important part of Bachelor of Business Administration (BBA).Internship

creates a unique opportunity for the student to apply their theoretical knowledge into practice and gain

valuable real world business experience. Banking is new an essential part of our economic system.

The banking sector is the largest service sector of Bangladesh. The growth of this sector is emerging.

Almost all the banks are improving year after year. But the growth of a bank depends mostly on credit

management of the bank. Commercial banks lend money to different categories of borrowers for

various purposes with a view to generate revenue. Accordingly, while processing and appraising a

loan proposal, bank essentially analyze the information relating to borrowers, assess the purposes of

lone and determine the viability of the loan proposal. If the proposal is sound and safe for lending,

loan is sanctioned and disbursed.

1.2 Background of the Report:

Economic history shows that development has started ever1where with the banking system and its

contribution towards financial development of a country is highest in the initial stage. As a mandatory

requirement of the Bachelor of Business Administration (BBA) program, I was assigned to do my

internship in Southeast Bank Limited for a period of three months. From practical knowledge, we will

be able to know real world situations and start a career with some practical experience. Southeast

Bank Limited (SEBL) is banking company incorporated in the peoples Republic of Bangladesh with

limited liability. This report Credit Risk Management Of Southeast Bank Limited, has been

prepared to fulfill the partial requirement of BBA program as a mean of internship program, while

preparing this report, I had a great opportunity to have an in depth knowledge of all the banking

activities of Southeast Bank Limited.

1.2 Significance of the report:

Education will be the most effective when theory and practice blends. Theoretical knowledge get its

perfection with practical application. And the internship is designed to link the gap between the

theoretical knowledge and real application. The prime reason of this study is to become familiar with

the practical business world and to attain practical knowledge about the overall Banking and corporate

world, which is so much essential for each and every student to meet the extreme growing challenges

in job market.

3

1.3 Scope of the Report:

The study mainly focuses on Credit Management of Southeast Bank Limited. To conduct a study on

this main issue, I have gathered valuable information from Southeast Bank Limited. The study would

focus on the following areas of Southeast Bank Limited:

An overview of Southeast Bank Limited.

Credit appraisal system of Southeast Bank Limited.

Procedure for different credit facilities.

Lending and recovery procedure of Southeast Bank Limited.

Credit management of Southeast Bank Limited.

Recovery performance of Southeast Bank Limited.

Each of the above areas would be critically analyzed in order the efficiency of Southeast Bank

Limited credit risk management system.

1.5 Objectives of the Report:

1.5.1. Broad Objective:

The prime objective of the report is to analyze the credit management of Southeast Bank Limited.

1.5.2. Specific Objectives:

This study was operated to gain the following secondary objectives:

To know the policies for making overall loan portfolio decision and the principles that are

followed for providing loan and advances to the client.

To know the lending procedure & monitoring system of credit department of SEBL.

To analyze the credit growth of SEBL over the year.

To know the sector wise & geographical location wise loan disbursement of the bank

To know the status of classified and unclassified loan of the bank.

4

1.6. Methodology of the Report:

The following methodology will be followed for the study:

1.6.1 Sources of Data:

To prepare this report all the necessary information collected from both primary and secondary

sources of data.

Primary sources

Secondary sources

Primary sources of data:

In the preparation of this report, data was collected from different primary sources.

Discussion with officials.

Observation while working in different desk.

Secondary sources of data:

Mainly my report is based on secondary data. Secondary data are collected from the following

sources:

Secondary sources of data are of two kinds:

Internal: Manuals, brochures, Annual reports of Southeast Bank, Other published

documents of the bank, Southeast banks website.

External: Books, Newspaper, Web browsing

5

1.7.1 Limitations of the Report:

Observing and analyzing the broad performance of a bank and one of its branches are not that easy.

Moreover due to obvious reasons of scrutiny and confidentiality, the bank personnel usually dont

want to disclose all the statistical information about their organization. However the some of the

limitation I have face while preparing this report are listed as follows:

Time Limitation: To complete the study, time was limited by three months. It was really

very short time to know details about an organization like SEBL.

Inadequate Data: Lack of available information about the business operations of SEBL,

because of the unwillingness of the busy key persons, necessary data collection become hard.

The employee are extremely busy to perform their duty.

Lack of Record: Large-scale research was not possible due to constrain and restrictions

posed by the organization. Unavailability of sufficient written documents as required making

a comprehensive study. In many cases up-to-date information was not available.

Lack of experiences: Lack of experiences has acted as constraints in the way of meticulous

exploration on the topic. Being a member of the organization; it was not possible on my part

to express some of the sensitive issues.

Website Facility: Southeast bank limited website is not rich to collect data thats why it

makes sometimes difficult to collect information.

6

Chapter-2

An Overview of Southeast Bank Limited

7

2.1 Background of the Company:

Southeast Bank Limited was established in 1995 with a dream and a vision to become a pioneer

banking institution of the country and contribute significantly to the growth of the national economy.

The Bank was established by leading business personalities and eminent industrialists of the country

with stakes in various segments of the national economy. The incumbent Chairman of the Bank is Mr.

Alamgir Kabir, FCA, a professional Chartered Accountant. Mr. M. A. Kashem a member of the Board

and Mr. Yussuf Abdullah Harun were past Presidents of the Federation of Bangladesh Chamber of

Commerce and Industries (FBCCI).

Southeast Bank is run by a team of efficient professionals. They create and generate an environment

of trust and discipline that encourages and motivates everyone in the Bank to work together for

achieving the objectives of the Bank. The culture of maintaining congenial work - environment in the

Bank has further enabled the staff to benchmark themselves better against management expectations.

A commitment to quality and excellence in service is the hallmark of their identity.

Southeast Bank takes pride for bringing women into the banking profession in a significant number

for gender equality. At present, 32% of SEBL's employees are women that will rise to 45% over the

next five years.

8

2.2 Corporate Information at a glance:

The following table shows the corporate information of Southeast Bank Limited

Name Southeast Bank Limited

Name of the Company Southeast Bank Limited

Chairman Alamgir Kabir, FCA

Vice Chairman: Ragib Ali

Managing Director: Mahbubul Alam

Company Secretary: Muhammad Shahjahan

Legal Status: Public Limited Company

Date of Incorporation: March 12, 1995

Registered Office Eunoos Trade Centre 52-53, Dilkusha C/A

(Level 2, 3 & 16), Dhaka-1000

Line of Business Banking

Authorized Capital: Tk.10,000.00 million

Paid Up Capital: 8,732.86 million

Year of Initial Public Offer: 1999

Stock Exchange Listing: April 10, 2000 (DSE) & April 24, 2000 (CSE)

Phone: 9571115, 7160866, 7173793, 9555466 &

9550081

Fax: 99550086, 9550093 & 9563102

E-mail: info@sebankbd.com

Website: www.sebankbd.com

9

2.3 Vision:

To be premier banking institution in Bangladesh and contribute significantly to the national economy.

2.4 Mission:

High quality financial services with the help of the latest technology

Fast and accurate customer service.

Balanced growth strategy.

High standard business ethics.

Steady return on shareholders' equity.

Innovative banking at a competitive price.

Attract and retain quality human resource.

Firm commitment to the society and the growth of national economy.

2.5 Objectives:

Make sound investments.

-based income.

10

2.6 Core values:

11

2.7 Organization Structure:

Chairman

Managing Director (MD)

Deputy Managing Directors (DMD)

Senior Executive Vice President (SEVP)

Executive Vice President (EVP)

Senior Vice President (SVP)

Vice President (VP)

Senior Assistant Vice President (SAVP)

Assistant Vice President (AVP)

First Assistant Vice President (FAVP)

Senior Principal Officer (SPO)

Principal Officer (PO)

Senior Officer (SO)

Officer

Officer-1

Junior Officer (JO)

12

2.8 Organization of the Bank according to administration:

2.9 Boa

Chairman

Vice Chairman

Board of the Directors

Managing Director

Management Committee

Head Office

Different Department at Head Office Branches

Head of the Departments

Executives & Officers

Branch Managers

Executives & Offices

13

2.9.Board of Directors:

Chairman

Mr. AlamgirKabir, FCA

Vice Chairman

Mr. Ragib Ali

Mr. M.A. Kashem

Mr. AzimUddin

Ahmed

Mrs. Duluma Ahmed

Mrs.

JusnaAraKashem

Mr. MD.

AkikurRahman

Mrs. SiratMonira

M/S. Karnafuli Tea

Company

Represted by Mr.

Abdul Hoi

Dr. ZaidiSattar

Mr. A.H.M

MoajjemHossain

Directors

Managing Director

ShahidHossain

14

2.10. Functions:

Products and Services

Offering customers with diversified products and services is one of the major goals of SEBL. In

implementation of this, the Bank launched a new deposit product named Millionaire Deposits Scheme

(MDS) in 2009 to extend its deposit product base. All application forms of various products and

services were modified as per the guideline of Bangladesh Bank for customers convenience. The

Bank also opened ten new branches and ten SME centers in 2009. The Bank also introduced SEBL

Travel Card, Merchant Banking etc. to diversify product base and validated special scheme products

with the changes of time catering to clients needs. The South East Bank Limited is offering a wide

range of services to satisfy their customer need. Along with conventional Banking they provide,

SME Banking

Dual Currency VISA Credit Card

Southeast VISA Platinum Card

Southeast My Remit Card

SEBL ATM / Debit Card

Virtual Card

Remittance Business

Western Union

SWIFT Services

Locker Services

ATM Services

Internet Banking Services

Bill Payment Services

E-Statement Services.

15

Chapter-3

Theoretical Aspect

16

3.1. Credit:

A contractual agreement in which a borrower receives something of If you dont have a credit policy

for your business, everyone will want to buy from you, which can result in unpaid and past-due

invoices on your books.

3.2. Credit Management:

Credit management is a term used to identify accounting functions usually conducted under the

umbrella of Accounts Receivables. Essentially, this collection of processes involves qualifying the

extension of credit to a customer, monitors the reception and logging of payments on outstanding

invoices, the initiation of collection procedures, and the resolution of disputes or queries regarding

charges on a customer invoice. When functioning efficiently, credit management serves as an

excellent way for the business to remain financially stable.

3.3. Objective of Credit Management:

In order to be effective, your credit policy must meet the following objectives:

Effectively outlines policies and procedures that will help provide your customers with

options when they cannot pay in full.

Implements a plan that will enable your business to adequately provide reasonable credit

limits for your customers that have revolving credit accounts.

Outlines the steps to take to collect from past-due or late-paying customers and how to

eliminate bad debt.

Provides guidelines to legally collect money that is due to your company from slow or

nonpaying customers and from bad checks.

Value now and agrees to repay the lender at some date in the future, generally with interest. The

term also refers to the borrowing capacity of an individual or company.

3.4. Factor related with credit:

Risk

Time

Interest Rate security or collateral

17

Operating expense etc.

3.5. Importance of Credit:

Credit plays a vital role in national economy in the following ways-

It provide working capital for industrialization

It helps to create employment opportunities

It bring social equity

Raise standard of living

3.6. Credit Administration:

There can be a natural tension between bank lenders and Credit Administration. For a lender, their

job, their compensation in fact, is based on their ability to put loans on the books. Each year they are

given origination goals which may seem harder and harder to reach. Contrast that against Credit

Administration who also wants to put loans on the books, but is willing to say no to a credit if it

doesnt meet certain guidelines. It can often make a lender feel that Credit Administration is standing

in their way, making their job more difficult with some of their policies and procedures. I have

spoken to more than one Relationship Manager who felt frustrated because they thought they had a

good loan and for reasons they didnt understand, Credit Administration would not approve it. And,

sometimes a lender does have a good loan, but it is still turned down and reason is that Credit

Administration is looking at the overall risk profile of the bank and may feel that there is a

concentration in certain types of credits which makes the department unwilling to put any more of a

certain type of credit on the books.

3.6.1. Financial Statement:

By now, it is obvious to most everyone that for a commercial loan or an on-going line of credit

(excluding mortgages and HELOCs) that it is prudent to ask for updated financial statements.

Whether it is quarterly or annually, it is one of the most common covenants in any loan. But,

unfortunately, many lenders fail to follow up on getting updated financial statements,

3.6.2 .Lending Covenants:

A few well-designed loan covenants can make all the difference in the quality of a credit. They are

critical early warning systems that can warn the loan officer of potential trouble

in a credit and give the loan officer time to resolve issues before the loan goes into default.

18

3.6.3 .Collateral:

For many types of loans, accounts receivable lending, as one example, it is key to secure the loan with

collateral. UCC filings and security agreements are two ways to secure a credit. The loan officer

needs to make sure that the collateral is in place and adequately secured.

3.6.4. Compliance and documenting the file:

One area that is consistently overlooked by lenders is denied loans and adequate documentation of the

file. Both can get a lender into trouble with internal audit and credit review as well as with the

regulators.

3.6.5. Communication:

Credit Administration does not need to be a lenders adversary. They can be there to help a lender get

a loan through the door. I recommend early communication with Credit Administration if your loan is

not simply a cookie cutter credit.

3.7. Credit Monitoring:

Credit monitoring is a financial service offered to people who are concerned about fraud and identity.

When someone uses this service, an agency keeps watch on that person's credit report and financial

activities, looking for signs that unauthorized activity is occurring. In a sense, this could be considered

the stepped-up version of checking one's credit report one or two times a year: instead of checking

every six months, a monitoring agency checks all the time.

3.8. Credit Recovery:

The recovery unit of CRM should directly manage accounts with sustained deterioration. The

recovery unit primary functions are:

Determine Account Action Plan

Regular review of grade 6

Ensure adequate and timely loan loss provisions are made based on actual and expected

losses.

19

Chapter-4

Credit Management System of

Southeast Bank Ltd

20

4.1 Significance of credit in the Bank

Credit is a concept, which has conceived in the minds of many a banker and has been thought about to

bring the unexplored area of the consumers who belong mainly to the middle class to enjoy the

benefits of Bank finance. This group consists of the people who are employed individuals, self-

employed persons, and even businessmen. Arranging credit facilities for these individuals who have a

limited income may think of buying a car or any electronic items, like - TV, fridge, etc. or spend for

house renovation or expenses for marriages and enjoy a minimum comfortable living standard. Such

credit options have become a desperate need and Southeast Bank Limited among the many other

banks has successfully introduced the scheme in the year 1997. Southeast Bank Limited has attained a

remarkable response from this section of people including those of financial/educational institutions,

self-employed individuals, government officials, businessmen and employees of this Bank.

4.2 Meaning of Credit

Credit comes from a Latin word Credo, which means I trust i.e. moneylenders trusts his borrowers

to pay them back. In terms of bank, bank trusts his borrower will repay the loan as per terms &

conditions. Before allowing credit bank should have confidence in the borrowers ability &

willingness to repay the loan. Credit does not exist because of confidence alone. Credit is a scarce

financial resources which needs to be monitored very carefully prospective entrepreneurs who are

creative and innovative with sound financial background and risk taking ability when decides to go

for capital expenditure in a particular project usually approaches DFTs\NCBs or private commercial

Banks for financial assistance in the form of long\short term loan and equity support. The Credit

landings are now need based and profit oriented but liquidity and safety should be given the prime

consideration for lending loan & Advance.

Importance of credit is realized from both macro and micro aspects of economy, At Macro level credit

influences, and is influenced by, quantity of money, level of economic activity, imports and net

21

foreign assets. At Micro level credit influences behavior of economic sector (industry, agriculture),

and behavior of economic agents (business, financial institutions, households)

Macro aspects:

Credit provides vital linkage among government sector, private sector, financial sector and

foreign sector.

Credit is an important determinant of money creation, and hence of production, consumption,

and national income.

Credit influences imports and capital movements, and hence the outcome of balance of

payments. For example, excessive credit can lead to inflation, over importation, capital flight,

and balance of payments deficit.

Micro aspects:

Credit is the most important activity of banks, because interest on loans constitutes the major

part of bank income.

Credit is important to business and industrial firms, banks provide financing for imports

working capital and investment.

Credit is important to households since it enables them to incur expenditures in excess of

income in a given time period. Thus, credit supplements savings.

4.3 Categories of Loan & Advance

Banks offers loans and advances to traders, businessman and industrialists against security of some

assets or on the basis of personal security or guarantee of the borrower. In either cases the bank bear

the risk of default in repayment. According to Bangladesh bank there are five kinds of loan, which are

as follows:

22

Cash Credit (CC): Those loans which have no specific payment period and any party or businessman

take from the bank as he/they can do transaction anytime. But In such category there will be an expiry

date and loan limit which is compulsory. Such as CC (Cash Credit) and OD(Over Draft). These are

also called continuous loan as a party can take such advantage for raising the capital and he/they can

return it within given time and loan limit. Advance in the form of overdrafts in allowed on a current.

The customers may be sanctioned a certain limit within which he can withdraw his loan amount for

several times within a stipulated period. Here interest will be charged on the withdrawal loan amount

overdraft facility in normally given to the party for the expansion of business and this facility is given

for maximum one year. The credit department of bank has to report such loan in CL-2 form.

Demand Loan: Such loan is payable to bank when the bank will charge to the party to pay. For

example: Forced lime, PAD, FBP etc.CL-3 form is used to report such type of loan.

Fixed Term (Below 5 years) or Time loan: The loan which is payable at specific term and at

specific payment schedule is known as Fixed Term. Such as project loan.CL-4 form is used to report

the loans below 5 years.

Fixed Term (Above 5 Years) or Term loan:This type of loan is also like fixed term loan below 5

years. It is also have an specific term of pay and fixed payment schedule to recover his/their loan.CL-

5 form is used to report for loan of above 5 years.

Short term Agricultural Credit and Micro Credit:The department of Agricultural Credit

Department of Bangladesh Bank established the law that Short term loan is payable within 12 months

and those which are payable below 12 months and the loan limit is up to 10000 taka, such type of

non-agricultural loan is known as Micro credit.CL-6 form is used to report the loan.

Miscellaneous: In the category of loan such as staff advances and other 6 large sectors loan

classification and provisioning, CL-1 form is used. These types are i) Continuous loan, ii) Demand

loan iii) Fixed Term (below 5 years) iv) Fixed term (Above 5 years) and Short term Agricultural and

Micro credit it means according to sectors the loans of CL form, total dues of loans, Unclassified and

classified loans due balance, the basic of provisions, the kept amount of provisioning and the stopped

interest amounts balance report are make on this CL-1 form. In the lower portion of CL-1 form, the

rates of provisioning against different types of loan are given. Banks count this rate of provisioning of

Bangladesh Bank to calculate the Provisioning.

4.4 Credit Management

Customers satisfaction is the top priority of the bank. Southeast Bank being the first private sector

bank is always one step ahead of the other competitors in serving the customers need. The principals

reasons of Southeast Bank Ltd that centered by state and a federal authority is to make loans to their

23

customers. Southeast Bank Ltd wants to support their local communities with an adequate supply of

credit for all legitimate business and consumer financial needs and to price that credit reasonably in

line with competitively determined interest rates, indeed, making loans in the principal economic

function of Southeast Bank, to fund consumption and investment spending by business, individuals,

and unites of government. Southeast Bank performs this lending function has a grate deal to do with

economic health of its reason, because Southeast Bank loans support the growth of new business and

jobs within the banks trade territory and promote economic vitality. Moreover SEBL loans often seem

to convey positive information to the market place about a borrowers credit quality, enabling a

borrower to obtain more and perhaps somewhat cheaper funds from other sources. When Southeast

Bank gets into serious financial trouble, its problem usually spring from loans that have become

uncollectible due to mismanagement, illegal manipulation of loans. Misguided lending policies or an

unexpected economic downturn. No wonder then when examiners appear at a bank they make a

thorough review of the banks loan portfolio. Usually this involves a detailed analysis of

documentation and collateral for the largest loans. Southeast Bank is extending credit facilities in all

sectors covering commercial credit lines to the business community. In addition to that other facilities

like consumer credit, student loan scheme, PC loan, loan against DSC, supervisory credit to the

farmers, weavers in the agricultural sector etc. to be extended for development of the country.

4.5 Types of Credit Facilities Extended BY SEBL

Generally two kinds of credit are provided by the commercials Bank as:

Funded credit facility,

Non - funded credit facility.

Funded credit facility

This is the type of credit facility that a Bank offer to a customer that results in actual disbursement of

cash to the customer directly or any designated representative of the customer. To provide such

facility, the Bank has to arrange for funds primarily through accepting deposits. Funded facility

affects the balance sheet of the Bank both in terms of increase in liability and increase in assets.

Non - funded credit facility

Its a Banks commitment to a third party on behalf of the customer. The commitment itself

constitutes facility but does not involve cash out flow from the Bank. A non-funded credit facility is a

contingent liability for the Bank, which may or may not turn in to real liability within a future date.

Such facility does not affect the balance sheet of the Bank at the time of commitment but continuous

the possibility.

24

4.6 Principals of Sound Lending

The Loan-able Funds of the Bank are invested with the borrower. It is expected that the Funds along

with the interest will be recovered in time. The Bank has to follow some general principles before

extending any advance to the client:

Safety: Safety First is the most important principles of good lending when a banker lends, he

must feel certain that the advance is safe; that is, the money will definitely come back. Because

the very existence of a bank depends on the safety of its outstanding which should never,

therefore, he sacrificed to the profit earning capacity of its advances. The banker must ensure that

the money goes to the right type of borrower and utilized in such a way that it will remain safe

throughout serving a useful purpose in the trade or industry where it is employed, and repaid with

interest.

Liquidity: The liquidity of an advance means its repayment on demand or on due date or after a

short notice. Bank Credit is repayable on demand or in accordance with the agreed terms of

repayment. So the borrowed fund should be for short term requirement. The sources of repayment

must also be definite.

Purpose: The bank must closely scrutinize the purpose for which the money is required and

ensures that the borrower applies the money borrowed for a particular purpose accordingly. It

should not be utilized for any other speculative or anti-social activities. If the borrower deviates

from the purpose and diverts the fund for another purpose, in most cases it is found that the loan

becomes stuck up.

Profitability: Bank as a commercial organization must make profit. Its main source of income

comes from the difference in interest paid to the depositors and interest received from the

borrowers. While lending to borrowers the Bank must be sanguine that the borrower is financially

sound, commercially viable enough to repay the debt and it has constant source of Revenue

generation and the particular venture itself is profitable from which the Banks dues may be paid

out comfortably.

Security: Although it is told that the man behind the plough i.e. the borrower is the most

important factor for lending yet considering the socio-economic scenario of the sub-continent

security is still considered as insurance or a cushion to fall back upon in case of emergency. The

branch must carefully scrutinize the different aspects of an Advance before granting it including

the adequacy and acceptability of the security. Most of the senior lawyers and Bankers opine,

25

Diversification of Advances: Diversification of advances is an important principle of lending.

Under this principle the bank spreads the entire Risks involved in lending over a large number of

borrowers, over a large number of Industries and areas and over different types of securities.

Selection of Borrower: On the basis of the above, the Bank has to finance the borrower who is

the most important factor in Credit Operation. The traditional three Cs character, capacity and

capital are considered the basic attributes of a borrower. In the language of Southeast Bank

Limited the same is termed as Know your Customer which is very important in all credit

Operations.

National Interest: Banks are wheels of the economy and it has a great role to play in the

economic development of the country. So the Bank extends its credit operations in the fields of

trade, transport, small business, constructions, import, export, industry in different areas of the

country.

4.7 Selection of Borrower

In lending, the most important step is the selection of the borrower. Due to the asymmetric

information and moral hazard, banks have to suffer a lot due to the classified loans and advances,

which weakens the financial soundness of the Bank.. From this point of view, SEBL follows the

following procedures:

A. Studying past track record: After getting an application for a loan, an SEBL Official studies the

past track record of the applicant. Generally the study includes:

1. Account balances and the past transactions.

2. Credit report from other banks.

3. Information of the Industry by studying market feasibility.

4. Financial statements (balance sheet, cash flow statement, and income statement). If

the borrower is a sole-proprietor, then the single entry accounting treatment is

converted to double entry system.

5. Report from Credit Information Bureau of Bangladesh Bank.

B. Borrower analysis: Borrower analysis is done mainly from the angle of 3-Cs (character, capital,

capacity) or 3-Rs (reliability, resourcefulness, responsibility). It follows that the bank forms a

rational judgment about the integrity of the borrower, which should be undoubted. The human

skill, conceptual skill, operational skill is qualitatively analyzed.

Five Cs I.e. Five Ps I.e.

C = Character P = Person

26

C = Capacity P = Purpose

C = Capital P = Product(s)

C = Condition P = Place

C = Collateral Security P = Profit

Five Ms I.e. Five Rs I.e.

M = Man R= Responsibilities

M = Money R = Reliability

M = Materials R = Respectability

M = Market R = Resources

M = Management R = Returns

C. Business analysis: Business analysis is done from two angles-terms and conditions and

collateral securities.

4.8 Detail Operation Mechanism of Each Types of Credit

OVERDRAFT (O/D)

In this case the customer is allowed on the basis of prior arrangement with the Bank by overdraw this

or her current account by drawing checks more than the available balance up to an agreed limit with a

certain period of time but not exceeding more than one year, against acceptable securities .These

facilities exceeding are granted after the credit standing, financial ability and status of the customer as

well as the purpose have been favorably established. The overdraft limits to base on ADVISED

LINE OF CREDIT available on a revolving basis and reviewed prior to expiration of the agreed

period of time between the Bank and the customer.

Eligibility: Overdraft facilities are generally granted to businessmen for expansion of their business,

against the securities of stock-in-trade, shares, debenture, Government promissory notes, fixed

deposit, life policies, gold and gold ornaments etc.

Nature: Short term loan

Interest rate: 15% per annum.

Terms and Conditions:

27

Bank may cancel / alter the sanction without assigning any reason whatsoever.

In case of client failure to pay the Banks dues within the validity of the limit Bank

may en cash client pledge without any prior intimation to client.

Outstanding amount: As on 31.12.2010 the total amount of Tk.4,014,7.24 Lac was outstanding.

Types of O/D facilities:

O/D against pledge of goods

O/D against hypothecation of stocks.

O/D against pledge of goods

O/D against pledge of goods must be extended to the borrower against pledge of raw materials or

finished products as security according to credit and margin restrictions imposed by Bangladesh Bank

and the SEBL Head office from time to time. In this case the customer signs a duly stamped letter of

pledge by which the customer surrenders the physical possession of the goods under effective control

of the Bank. The ownership of the goods remains with the borrower and the outstanding liabilities are

adjusted out of the sales proceeds.

O/D against Hypothecation of Stock

This is the second type of OD facility provided by the southeast Bank. This type of facility is

mostly pursued by the management of SEBL and is given priority over pledge. Under this

arrangement credit facility is proved to the borrower on signing a letter of hypothecation to the Bank

as primary security against the advance. In this case both the ownership and physical possession

remains with the borrower who binds himself to an arrangement to surrender physical possession of

the goods to the Bank as and called upon to do so.

CONSUMER CREDIT SCHEME (CCS)

This is one of the latest additions in the Banking products or services in Bangladesh. The

objective of this loan is to provide financial assistance and credit facilities to the service holders for

the purchase of consumer durable items and other essential house hold items. Major items include:

automobile, computer, television and other durable goods.

28

Eligibility: Customers who are eligible in this special credit program must be an official of any of

the following organizations:

Government Organization

Semi Government or autonomous bodies

Multinational organizations

Banks and insurance companies

Reputed commercial organizations

Professionals.

Customers equity: The customer has to provide equity for the purchase of an item before

the disbursement of loan. According to recent regulations, total credit facility will be

maximum to a limit of 75% of the quoted value of the item to be purchased and rest 25% has

to be paid by the customer as a source of equity.

Terms and conditions: The following are the method or the mode of disbursement of CCS loan:

Client will procure the specified items from the stores or against acceptable to the

Bank.

All the documents and the payment receipts have to be made in the name of the Bank

ensuring ownership of the items to the Bank. The ownership shall be transferred to

the customer after full repayment of the loan.

The customer will have to bear all the expense of registration. License or insurance of

items purchased and all maintenance costs will be borne by the customer.

Repayment Procedure: There is a unique repayment procedure for CCS program. The procedures

are as:

Repayment in equal monthly installments.

Monthly installment has to be paid by seventh of each month.

The employer will deduct the repayment amount from the monthly salary of the client

where applicable.

Outstanding amount: As on 31.12.2010 the total amount of TK. 43,537,252 was outstanding.

29

.

LOAN AGAINST IMPORTED MERCHANDISE (LIM)

Loan against imported merchandise (LIM) is allowed retaining margin prescribed on the landed

cost and other categories and Bangladesh Bank restrictions.

Salient Features of LIM:

Storage of imported goods under LIM facility must be allowed for a specified time within

that period the importer should take delivery of the goods against the payment.

Usually partial delivery or partial payment is not allowed under LIM facility.

While creating a forced LIM, manager should satisfy that the forced sale value covers the

outstanding LIM, if not; arrangement should be made to recover the liabilities by selling the

goods.

Outstanding amount:As on 31.12.2010 the total amount of Tk.6,113,451 was outstanding.

LETTER OF TRUST RECEIPT (LTR)

SEBL has given the facility of LTR. Under this arrangement, credit is allowed against trust receipt

and the exportable goods remain in the custody of the exporter but he/she is required to execute a

stamped export trust receipt in favors of the Bank. Where in a declaration is made that he/she holds

goods purchased with financial assistance of Bank in trust for the Bank. LTR can be two types:

LTR (for release of shipping documents): The borrower to realize shipping documents

for taking delivery of merchandise, which is hypothecated to the executives this. The

30

borrower agree to take delivery of the merchandise and agrees that the Bank remains owner of

the goods and the borrowers will be holding the goods on behalf of the Bank as an agent or

trustee until full payment has been made to the Bank.

LTR (for pre-shipment financing): This is executed by the borrower for availing pre-

shipment finance by creating lien on the original letter of credit (L/C). The borrower agrees

that the credit facilities will be utilized for the purchase of merchandise for shipment as per

the terms of the credit.

Salient features of LTR:

The trust receipt is a document, which creates the Bankers lien over the goods and

particularly amounts to hypothecation of the proceeds of sale in discharge of the lien.

The customer holds the goods or their sales proceeds in trust for the Bank till such time; the

loan against the trust receipt is fully paid off.

Eligibility: Loan against trust receipt is generally granted to Exporter for exportation of goods.

Interest Rate: 15% P.A with monthly rest subject to the change that may be made by the Bank from

time to time.

Outstanding amount: As on 31.12.2010 amount Tk. 2,175,321,765 was outstanding.

Terms and Conditions:

Disbursement will be made after completion of all formalities as per sanction terms.

Suppliers credit report to be obtained before opening of L/Cs.

Excess drawing over the sanction limit is strictly prohibited.

Customer will maintain effective and constant supervision and follow up to ensure timely

adjustment of the loan to avoid overdue.

EDUCATION LOAN

In Bangladesh, mostly people resort to employment just on completion of Graduation degree or

having a general Post-graduation degree and as a result a considerable number of employees feel the

need of further higher studies general or specialized. Usually such studies require a sizable single shot

31

payment to the Educational Institution as well as other periodic expenditures. The intending pursuers

often find it hard to immediately meet those financial requirements for their regular source of income,

which they can otherwise pay-off in a longer stretched period of time through installments. Thus, here

creates an opportunities for a financial intermediary to play a supportive role which can be

remunerative vies-a-vies contribute in discharging its Corporate Social Responsibility (CSR).Keeping

above in mind the Management of the SEBL has decided to introduce a new asset product called

Southeast Bank Education Loan (SEL).

Objective of SEL:

To provide financial assistance to the already employed personnel to pursue further

studies.

To discharge Banks CSR.

Maximum loan amount: Tk.3.00 lack only per person.

Maximum loan tenure: 3 years.

Rate of interest: 13% p.a. with quarterly rest and in case of SEBL employee 9.5% p.a.

Repayment period: 3 years.

GENERAL LOAN

When an advance is made in a lump sum repayable either in fixed monthly installments or in

lump sum and no subsequent debit is ordinarily allowed except by way of interest, incidental charges,

etc. it is called a loan. The whole amount of loan is debited to the consumers name on a loan account

to be opened in the ledger, and, is paid to the borrower either in cash or by way of credit to

current/savings account.

Eligibility: Loans are normally allowed to those parties who have either fixed source of income or

who desire to pay it in lump-sum.

Interest Rate: 15% per annum.

Terms and Conditions:

Disbursement will be made after completion of all formalities.

32

Bank reserve the right to cancel or amend the terms and condition partly or wholly at

is direction without assigning any reason whatsoever.

When the principal debtor defaults in fulfilling the obligation or promise liability

bestow on guarantor.

CREDIT AGAINST WORK ORDER

Credit facility can be provided to a customer against a work order for the completion of the work

order in the stipulated time according to the contract.

Salient features of consideration in a work order credit facility:

The customers management capability, equity strength, nature of the scheduled work and

feasibility study is carried out to come to a decision.

If there is a provision for running bills for the work, appropriate amount to be deducted for

each bill to ensure complete adjustment of the liability within the payment period of the final

bill.

Apart from assigning bills receivables, additional collateral security has to be provided by the

customer.

The progress of the work under contract should be reviewed periodically.

CREDIT FACILITY AGAINST FDR/BCD

The Bank provides advances or loans against fixed deposit receipts (F.D.R.) or bearer certificate

deposits (BCD) to the customers. The following issues are considered while providing such a credit

facility:

FDR/BCD cannot be in the name of minor.

When the FDR is issued as a security for availing the credit facility, a letter of lien

will be issued and the Bank creates a lien of the specified amount of the FDR/BCD

which indicates that the Bank has a right over it and informs this to the concerned

authorities holding the FDR/BCD.

ADVANCES-PACKING CREDIT

Advances-packing Credit is essentially a short-term advance granted by SEBL to an exporter for

assisting him to buy process, pack and ship the goods. The credit is generally extended for payment of

freight, handling charge, insurance and export duties. The export credit advances does not normally

33

extend 180 days and has to be liquidated by negotiation/purchase of the export bills covering the

particular shipment for which the export credit was granted.

Eligibility: Advances-packing credit facility has given for small-scale indigenous manufacturers or

exporters.

Terms and Conditions:

I. Disbursement will be made after completion of all formalities as per sanction terms.

II. The amount of advance against export credit will be adjusted from the amount payable to exporter

on negotiation or purchase of the bill.

III. The exporter letter of credit should be irrevocable, constricted and valid and confirming Bank

must mark lien on it.

BILLS AGINST LETTER OF CREDIT (BLC)

A loan facility provided by the SEBL to the customers against the documents/bill like bill of

lading, delivery ordered, dock warrant. In other word, payment made by the Bank against lodgment of

shipping documents of goods imported through L/C fall under this head. It is an advance connected

with import and is generally liquidated shortly against payment usually made by the party for

retirement of the documents for release of imported goods from the customers authority. It falls

under the category commercial lending.

Eligibility: This type of credit facility is generally given to exporter and importer.

Interest rate: 14% per annum

Terms and Conditions:

In the event of default by the borrower SEBL has the right to sell the goods.

Insurance policy to be obtained against the goods.

Bank reserve the right to cancel or amend the terms and conditions partly or wholly at

its direction without assigning any reason whatsoever.

LETTER OF CREDIT (L/C)

Opening or issuing letter of credit is one of the important services provided by SEBL. A letter of

credit is a document authorizing a Bank to pay the bearer a specified sum of money; it provides a

34

useful means of settlement for a foreign trade transaction, the purchaser establishing a credit in favor

of his credit at a Bank.

Letter of Credit is of two types:

1. Travelers letter of credit issued for the convenience of the traveling public, and

2. Letter of commercial credit issued for the purpose of facilitating trade transaction.

Eligibility: Letter of credit facilities are given to exporter, manufacturers/producers.

Terms and Conditions:

I. It should stipulate the name of the loan/credit/Grant.

II. It should bear the name of the designated Bank.

III. Items mentioned in the LCA form must contain with the permissible items.

IV. The Bank officers periodically inspect the goods and verify that they conform to the quantity

and quality etc. as mentioned the particular letter of credit.

V. In case of first class customers, the facility may, however be granted against form contracts

with overseas buyers.

Rate of Commission: 0.4% for 90 days. After 90 days, it is 0.3%.,

BANK GUARANTEE:

A letter of guarantee has special significance in the business of Banking as a means to ensure

safety of funds lent to the customers. In case, the borrower is unable to provide the security of

tangible assets or, the value of the assets falls below the amount of the loans, and the borrowers

personal security is not considered sufficient, an additional security is sought by the Banker in the

form of a guarantee given by a third person.

Terms and Conditions:

The Banks legal adviser must verify all the security documents.

When the principal debtor defaults in fulfilling this obligation or promise the liability

bestow on guarantor.

Bank reserves the right to cancel or amend the terms and condition partly or wholly at

its direction without assigning any reason whatsoever.

35

4.9 Credit Approval process of Southeast Bank Ltd

After receiving the application from the client, the corresponding official of the respective branch of

SEBL prepares a Credit Line Proposal (CLP) and forwards the same to the Head Office to place

before Head Office credit Committee (HOCC) for approval. It includes:

1. Request for credit limit of customer (Application for Limit).

2. Critical risk analysis (Credit Memorandum).

3. Project profile/profile of business (Portfolio Review).

4. Copy of trade license/IRC duly attested.

5. Copy of T I N certificate.

6. Certificate copy of Memorandum & Articles of Association, Certificate of incorporation,

Certificate of Commencement of business, and Resolution of the Board, (partnership Deed (where

applicable).

7. Register of joint Stock Companies search solicitors.

8. 3 years Balance Sheet and profit & Loss account.

9. Personal net worth statement of the owner/directors/partners etc.

10. Account Profitability of the proposed credit line.

11. Copy of insurance policy of the collateral.

12. Valuation certificate of the collateral security in Banks form with photograph of the security.

13. C I B Inquiry form duly filled in (for proposal of above 10 lac).

14. Call report issued by the corresponding Relationship Officer.

15. Credit report from another banks.

16. Stock report prepared by the client (where applicable).

36

17. Stock Inspection report prepared by the representative of the bank.

18. Indent/Performa invoice/Quotation.

19. Price verification report of the assets.

20. Bangladesh Bank Approval on large credit.

21. Statement of accounts.

22. Declaration of the name of the sister concern and their liability.

23. In case of L/C detailed performance of L/C during last year.

Therefore, the steps in lending can be sum up as follows:

1. Entertainment of Application for limit of loan proposal by respective branch.

2. Preliminary screening of credit proposal by Credit Department.

3. Feasibility study & Appraisal of loan proposal or Credit investigation done by Credit

Department.

4. Sanction of loans or advances by the Head Office Credit Committee.

5. Documentation done by Credit Department.

6. Disbursement of loans or advances done by Credit Department through Sales and Services Center

(Branch)/Trade Services Department.

7. Supervision and follow up of loans and advances by Credit Department.

Credit Information Bureau (CIB): The Credit Information Bureau (CIB) was created in on

August 18, 1992. After establishment of Credit Information Bureau (CIB) at Bangladesh Bank,

collection of information about the borrower has become easier. Bankers of Course, have their own

ways to collect information about the prospective borrower. The credit information Bureau (CIB) of

Bangladesh Bank has undertaken the task of collecting, collating and storing detailed credit

information from scheduled Banks and other financial institutions in its proper prospective so that

these can be exchanged among the scheduled banks, financial institutions and Bangladesh Bank for

quick processing of new loan proposals and re-scheduling of existing loans.

As a matter of policy, all the scheduled banks are required to submit the details of each and every loan

showing the status of the loans on quarterly basis. The position of the loans up to Tk. 1.00 lac is to be

reported to Bangladesh Bank. While considering sections of loans to a party, banks are required to

obtain CIB reports from Bangladesh bank to know whether the proposed borrower has any classified

loan with any other branch of the other bank.

37

Flow chart for approval Process of Loans & Overdrafts:

Credit Application processed by credit officers and

recommended by Credit In charge/ Head of Branch of the

branch.

Branch Credit Committee

Head of Branch (HOB)

Head Office, Credit Division

Head Office Credit Committee

Managing Director

Executive Committee/Board of Director

S

a

n

c

t

i

o

n

/

D

e

c

l

i

n

e

38

Fig: Flowchart for approval process of loans and advances

4.10 Securities

To make the loan secured, charging sufficient security on the credit facilities is very important. The

banker cannot afford to take the risk of non-recovery of the money lent. SEBL charges the following

two types of security:

1. Primary security: These are the security taken by the ownership of the items for which bank

provides the facility.

2. Collateral security: Collateral securities refer to the securities deposited by the third party to

secure the advance for the borrower in narrow sense. In wider sense, it denotes any type of

security on which the bank has personal right of action on the debtor in respect of the advance.

Securities against Advances

Securities mean tangible securities, which are normally known as collateral securities. The tangible

securities which are pledged/hypothecated/assigned by the borrower to the bank and additionally held

by the bank to secure a loan is called collateral securities or simply collaterals. There are four main

ways in which a banker may create a charge on the borrowers securities and acquire an interest in the

property of a debtor as collateral security.

Lien: Lien means the right of the banker to retain the goods of the borrower until the debts are

repaid. A bankers lien is an informal security and differs from the other forms of charge in that

it is not the subject of a formal or expressed contract. A banker can retain all securities in his

possession till all claims against the concerned persons are satisfied.

39

Pledge: Pledge is the bailment of the goods as security for payment of a debt performance of a

promise. When negotiable instruments and goods, or the symbol of goods, such as bill of lading

or dock warrants, are delivered to a banker as security for a debt, the delivery is termed as

Pledge or Pawn.

Hypothecation:It creates a charge on the securities offered by the borrower but does not

involve the actual passing of the control of the securities into the possession of the bank. In case

of hypothecation the possession and the ownership of the goods both rest the borrower.

Mortgage: According to section (58) of the Transfer of Property Act, 1882 mortgage is the

transfer of an interest in special immovable property for the purpose of securing the payment of

money advanced or to be advanced by way of loan, existing or future debt or the performance of

an engagement which may give rise to a pecuniary liability. The banker usually exercises the

equitable mortgage. A mortgage is a conveyance of an interest of property for the purpose of

securing of debt but the term is usually reserved for a conveyance of an interest on immovable

property. A legal mortgage is created by registered deed and gives the mortgage the right of sale

in case of default on the part of the mortgagor.

Documentation

Documentation can be described as the process or technique of obtaining the relevant documents. In

spite of the fact that banker lends credit to a borrower after inquiring about the character, capacity and

capital of the borrower, he must obtain proper documents executed from the borrower to protect him

against willful defaults. Moreover, when money is lent against some security of some assets, the

document must be executed in order to give the banker a legal and binding charge against those

assets. Documents contain the precise terms of granting loans and they serve as important evidence in

the law courts if the circumstances so desire. Thats why all approval procedure and proper

documentation shall be completed prior to the disbursement of the facilities.

Charge documents as required by the different types of advances are mentioned bellow:

A. LOAN:

1. D P Note signed on revenue stamp.

2. Letter of agreement.

3. Letter of disbursement.

4. Partnership deed (partnership farm) or Board of resolution (limited companies).

5. Letter of pledge.

6. Lien for packing credit

7. Letter of hypothecation.

8. Letter of lien and ownership/share transfer form (in case of advance against share).

40

9. Letter of Line (in case of advance against F D R).

10. Letter of lien and transfer authority. (in case of advance against P S P, B S P)

11. Legal documents for mortgage of property (As draft by legal adviser).

12. Copy of sanction letter mentioning details of terms and condition duly acknowledge by

the borrower.

13. Letter of Trust receipt.

B. OVERDRAFTS:

1. D P Note.

2. Letter of agreement.

3. Letter of continuity.

4. Letter of Revival.

5. Letter of Supplementary Agreement.

6. Letter of lien and transfer authority. (In case of lien)

7. Letter of Hypothecation. ( In case of Hypo)

8. Letter of Pledge.

9. Legal documents for mortgage of property.

10. Sanction letter HO & Branch (Accepted by client)

C. TIME LONE:

1. D P Note.

2. Letter of agreement.

3. Letter of continuity

4. Letter of hypothecation [In case of cash credit (Hypothecation)]

5. Legal documents for mortgage of property

6. Letter of pledge or Agreement of pledge. [In cash of cash credit (pledge)]

7. Letter of lien. [In cash of cash credit (lien)]

8. Sanction letter HO & Branch (Accepted by client)

D. BILLS PURCHASED:

1. D P Note.

2. Letter of partnership. (in case of partnership farm) or Board of resolution (in case of

limited company)

3. Letter of agreement.

4. Letter of acceptance, where it calls for acceptance by the drawee.

41

5. Letter of hypothecation of bill.

Securities and Charge Documents

Securities against Advances: The following securities are to be obtained by the branches

depending on the nature of Advances allowing secured advances to the parties:

1. Pratirakshya Sanchaya Patra, Bangladesh Sanchaya Patra, ICB unit certificate, Wage

Earner Development Bond.

2. Fixed Deposit Receipt issue by any branch of Southeast Bank Limited.

3. Shares quoted in the Dhaka Stock Exchange Limited.

4. Pledge of goods and produce.

5. Hypothecation of goods, produce and machinery.

6. Immovable Property.

7. Fixed assets of a manufacturing unit.

8. Cheques, Drafts, pay Order, Railway Receipts, Steamer Receipts, and Burg Receipts of

the Govt. or Corporations.

9. Shipping documents.

Securities Advances:

All securities are not suitable for all types of advances. Each security has its own suitability.

Special Securities to be obtained by the branches while allowing advances are shown as

follows against the types of advances:

Types of Advances Securities:

Loan Lien of various kinds of Sanchayapatra, Government Securities, and shares

quoted in the Stock Exchange, Debentures. Fixed Deposit Receipts, Pledge of

Gold/Gold ornaments hypothecation of vehicles. Collateral of Immovable

properties.

Overdraft Sanchayapatra, Non-Resident Foreign Currency Deposit (NFCD) Shares, Govt.

Promissory Notes, Fixed Deposit Receipts, Life Insurance Policies, Gold and

Ornaments, Work Order.

Time Lone Pledge or Hypothecation of stock-in-trade, Goods, Produce and Merchandise,

Machinery, Land & Building on which Machinery are installed.

42

Inland Bills Bill it.

PAD Shipping documents for imports.

LIM Pledge of imported merchandise.

TR Trust Receipt obtained in lieu of Import Documents.

Export Cash

Pledge or hypothecation of goods or export trust receipts.

4.11 Credit Disbursement

Having completely and accurately prepared the necessary loan documents, the credit officer issues a

sanction letter in favor of the borrower. When the borrower agrees with all the terms and conditions,

43

SECTOR WISE DISBURSEMENT OF CREDIT

Amount in lack Tk.

SECTOR AMOUNT % TOTAL ADVANCES

Term Loan (Industrial Loan) 12,175.99 9.35%

Working Capital (Industrial Loan) 9,235.00 7.11%

Export Credit 3,069.27 2.36%

Commercial Credit 72,643.96 55.94%

Small & Cottage Industries 5.75 0.05%

Others 33,141.33 25.52%

Total 1,30,271.31 100.00%

Source: Annual Report of SEBL, 2013

Figure; Sector Wise Disbursement of Credit

Sector Wise Disbursement of Credit

55.94% 2.36%

7.11%

9.35%

25.52%

2.36%

Term Loan

Working

Capital

Export

Credit

Commercial

Credit

Cottage

Industries

Others

44

MODE WISE DISBURSEMENT OF CREDIT

Amount in Lack Tk.

Sector Amount % Total Advances

Demand Loan 344.68 0.25%

Time Loan 20,414.81 16.10%

Term Loan 37,787.05 29.68%

Consumer Credit Scheme (CCS) 435.37 0.32%

Bills against Letter of Credit (BLC) 4,673.84 3.65%

Loan against Trust Receipt (LTR) 21,753.21 17.17%

Advances-packing Credit 37.57 0.03%

LIM 61.13 0.05%

Car Loan Staff 897.86 0.66%

House Building Loan Staff 448.44 0.33%

Loan against Foreign Bill (FBP) 231.68 0.16%

Cash Credit & O/D 40,147.24 31.60%

Total 126,432.94 100%

Source: Annual Report of SEBL, 2013

D

e

m

a

n

d

L

o

a

n

T

i

m

e

L

o

a

n

C

C

S

B

L

C

L

T

R

L

I

M

C

a

r

L

o

a

n

F

B

P

O

/

D

T

e

r

m

L

o

a

n

A

d

v

a

n

c

e

s

-

p

a

c

k

i

n

g

C

r

e

d

i

t

H

o

u

s

e

B

u

i

l

d

i

n

g

L

o

a

n

0

0.04

0.08

0.12

0.16

0.2

0.24

0.28

0.32

Figure Mode Wise Disbursement of Credit

45

4.12 Credit Risk

A comprehensive and accurate appraisal of the risk in every credit proposal of the Bank is mandatory.

No proposal can be put on place before approving authority unless there has been a complete analysis.

In order to safeguard Banks interest over the entire period of the advance, a comprehensive view of

the capital, capacity, integrity of the borrower, adequacy, nature of security, compliance with all

regulatory /legal formalities, condition of all documentation and finally a continuous and constant

supervision on the account are called for. It is absolute responsibility of the Credit Officer / RM to

ensure that all the necessary documents are collected before the proposal is placed for approval.

Where Loans/Advances/Credit facilities are granted against the guarantee of the third party, that

guarantor must be subject to the same credit assessment as made for the principal borrower.

While making lending decisions, particular attention shall be given to the analysis of credit proposals

received from heavily leveraged companies and those dealing in non-essential consumer goods, taking

special care about their debt servicing abilities.

Emphasis shall be given on the following several credit principles:

a) Present and future business potentiality for optimum deployment of Banks fund to increase

return on assets

b) Preference for self-liquidating Quality business

c) Avoiding marginal performers

d) Risk depression is basic to sound credit principles and policies. Bank shall be careful about large

and undue concentration of credit to industry, one obligor and common product line, etc.

e) Managing the amount, size, nature and soundness of one-obligor exposures relative to the size of

the borrower and Banks position among his other lenders.

f) Personal guarantee of the principal partners or the Directors of the Company shall be obtained.

46

5.1. Credit of SEBL as % of total credit:

It has been seen that the amount of loan of SEBL in the year 2013 was TK 134863.82 million against

TK 126968.97 million in the year 2013.The growth rate was 3.00% in the year 2013 against 3.08% In

the year 2012. The Loans and Advances covers up the areas of corporate, SME, Retail and Credit

Card. The credit portfolio of the bank also includes mix of scheme loans, namely- Renovation &

Reconstruction of Dwelling House Loan (RRDH0) , Marriage Loan, Car Loan.

Year 2009 2010 2011 2012 2013

Chapter-5

Performance Analysis of Southeast Bank

47

Total Credit (in Millions) 77497.57 93981.2 107288.56 126968.97 134863.82

% 3.18% 2.85% 2.94% 3.08% 3.00%

Table: Credit of SEBL as % of total credit

Figure: Credit of SEBL as % of total credit

Interpretation: From the above graph we can growth rate of loan & advances of SEBL in 2009 was

3.18%, in 2010 it has decreased to 2.85% and in 2011 it has increased, in 2012 it has increased 3.08%,

and in 2013 it has decreased 3.00%. The bank should be concerned about increasing the growth rate

of loans and advances because it is the main earning source of bank.

5.2Credits to Deposit Ratio:

Deposit and other accounts include non-Interest bearing current deposit redeemable at call, interest

bearing demand & short term deposits, saving deposit and fixed deposit. These items are bought to

financial statements at gross values of outstanding balances.

Year Credit(Million in TK) Deposit(Million in TK) Credit to Deposit Ratio

48

2009 77497 96669.5 80.16%

2010 93981 107253.2 87.62%

2011 107288.56 127178.2 83.36%

2012 126968.97 152901.2 83.03%

2013 134863.82 177519.5 75.97%

Interpretation:

The above graph shows that the credit to deposit ratio of SEBL is fluctuating over the years. In 2009

the ratio was 80.16%, IN 2010 It increased to 87.62% , in 2011 it decreased to 83.36% . But in 2012

and 2013 it was decreased to 83.03% and 75.97%. This is not good sign for the bank main source of

income is lending their deposit.

5.3. Capital Adequacy Ratio:

Capital adequacy ratio determines the capacity of the bank in terms of meeting the liability and other

risk such as credit risk, operational risk etc.

CAR=( Tier 1 capital+ Tier 2 capital)/ Risk weighted assets

Year Capital Adequacy Ratio

2009 11.72%

49

2010 11.25%

2011 11.46%

2012 10.87%

2013 10.90%

Source: Annual Report of SEBL (2009-2013)

Figure5.3: Capital Adequacy Ratio

Interpretation: The above graph shows fluctuating trend in capital adequacy ratio in 2009

the credit ratio was 11.72%% in 2013 the credit was 10.90%.

5.4 Geographical credit distribution of SEBL:

Division Credit( Million in TK) Credit as % of total loan &

advances

Dhaka 91,711,846,396 69.61%

Chittagong 32,954,080,187 25.54%

50

Khulna 537,766,851 0.62%

Sylhet 2,935,925,379 2.28%

Rangpur 529,856,013 0.39%

Barisal 80,848,036 0.06%

Rajshahi 2,048,466,652 1.51%

Interpretation:

The above figure shows that SEBL distributes a large portion of credit in Dhaka division. In Dhaka

division the bank distributes 69.61% where Chittagong division gets 25.54% and Rajshahi division

gets 1.51% Dhaka and Chittagong are industrial area thats why these two division have large credit

distribution.

5.5Industry Wise Concentration of Loan and Advances (2013):

Industry % of Loan & Advances

Agricultural Sector 0.69%

Industry 21.59%

Working capital financing 23.52%

Dhaka, 69.61%

Chittagong,

25.54%

Khulna, 0.62%

Sylhet, 2.28%

Rangpur, 0.39%

Barisal, 0.06% Rajshahi, 1.51%

Credit Concentration

Dhaka

Chittagong

Khulna

Sylhet

Rangpur

Barisal

Rajshahi

51

Figure 5.6: Industry Wise Concentration of Loan and Advances

Interpretation: The above figure shows that SEBL providing high amount of loan almost 31.69%

in commercial credit. They also provide in working capital 23.52%.SEBL provide maximum loan in

commercial credit sector.

Export credit 4.11%

Commercial credit 31.49%

Small and cottage industries 0.45%

Others 18.15%

Total

100%

52

5.6. Year wise classified loan as percentage of loan and advance

Year 2009 2010 2011 2012 2013

Unclassified loans and

advances

74604.58 88513.12 103776.92 121579.23 130339.85

Classified loans and advances 2892.99 3938.49 3769.50 5687.92 5350.23

Total 77497.57 92452.61 107546.42 127267.15 135690.08

% as UC loans and advances

of total loans and advances

96.3% 95.7% 96.5% 95.5% 96.1%

% as classified loans and

advances of total loans and

advances

3.73% 4.26% 3.5% 4.47% 3.94%

Interpretation:

The above graph shows that in 2009 percentage of unclassified loan and advances was 96.30% and in

2013 percentage of unclassified loan and advances was 96.10%. Last year percentage of unclassified

loans & advances decreased and classified loan and advances increased. So the bank should try to

give more concentration to decrease their classified loan.

53

5.7 Various Classified Loan as a % of total Classified Loan & Advances:

Type of Loan 2009 2010 2011 2012 2013

Classified loans and advances 2892.99 3938.49 3769.50 5687.92 5350.23

% as asubstandard of classified loan 25.97% 20.61% 18.58% 16.54% 1.67%

% as a doubtful of classified loans 8.71% 41.28% 8.24% 8.24% 3.28%

% as a bad or loss of classified loan 65.31% 38.10% 56.90% 75.21% 95.04%

Interpretation:

From the figure we can see, percentage of substandard loan, percentage of doubtful loan and

percentage of bad or loss loan are fluctuating. In 2013 percentage of bad or loss loan increase

compare the previse year. It is a bad sign for the bank because bad or loss loans are hundred % risky.

54

5.8 Provision for Loans and Investment:

Year 2009 2010 2011 2012 2013

Amount of Provision

(Million in TK)

360.88 309.76 256.64 345.78 565.43

Interpretation: From the figure we can see, in 2009 amount of provision for loans and investment

was 360.88 million TK .In 2010-2011 amount of provision for loan and investment decrease. But in

2012-2013 amount of provision for loans and investment increased.

55

5.9 Income from Investment:

Year 2009 2010 2011 2012 2013

Total Investment 2615.81 3788.42 3267.90 3208.57 4713.18

Source: Annual Report (2009-2013)

Table: Income from Investment

Figure: Income from Investment

Interpretation: The above graph shows that the income from loan and advances was increasing year

by year except in 2013. Bank should try to give more concentration to increase their income from loan

& advances>

5.10 Non performing loan analysis:

56

A loan is nonperforming when payment of interest and principal are past due by 90 days or more, or

at least 90 days of interest payment have capitalized, payment are less than 90 days overdue.

Year 2009 2010 2011 2012 2013

Non-Performing loans 2892.98 3938.47 3769.5 5687.91 5350.22

% of Non-Performing loans 3.94% 4.47% 3.51% 4.26% 3.73%

Interpretation: From this first graph we can see that amount of non-performing loans increasing day

by days. Higher non-performing loans in the year 2012. From the second graph we can see that, % of

non-performing loans of SEBL is increasing except in 2010. In 2010non-performing loan higher than

previous years.

57

Chapter-6

Major Finding, Recommendation& Conclusion

58

Major Finding:

It has seen that, SEBL credit management policies and principles that are followed for

providing loans & advances effectively shaped with all rules and regulation of Bangladesh

Bank.

SEBL, credit approval authority is enriched with managing directors, board of directors and

other high officials. Before giving any loan this authority check whether every aspect of

sanction a loan is followed or not.

The growth of credit is fluctuating over the last five years. It has 3.18% in 2009, 2.85% in

2010, 2.94% in 2011, 3.08% in 2012 and 3.00% in 2013.

Capital adequacy ratio for SEBL is satisfactory because last two year this ratio has increased

so the banks ability to meet liabilities is increasing.

The growth of deposit is fluctuating year by year. I has 40.68% in 2009, 10.94% in 2010,

18.57% in 2011, 20.22% in 2012 and 16.10% in 2013.

SEBL is providing large proportion of credit in only Dhaka division which is almost 69.41%

to their total credit. Maximum portion of loan amount distribute in Dhaka division because

most of the industry and commercial sector establish in Dhaka division.

SEBL provide highest loan in commercial credit almost 31.49% of total loan and second

highest working capital financing almost 23.52%.

In classified loan, bad or loss portion increase. So the risky portion of classified loan has

increase.

59

Non-performing loan of the bank was decreasing. It is a good sign for bank

Recommendations:

The South East Bank Limited is to be the number one institute in the arena of banking services. For

the achievement of such an emphatic and comprehensive goal the bank should design credit policies

that will encompass credit products for each and every stratum of the society.. However, from the

analysis and based on the findings, we can conclude with the following recommendations:

That will not just increase the branch profitability; it will also decrease the dependence on

interest income. An increased attention should be given to improve the standard of ancillary

services.

Southeast Bank should imply other services and innovate more new services. The service

hour should be more convenient for the clients and 24 hour banking should be started.

Besides making profit the main focus should be on how to make customer satisfied, those

who are providing business to the bank. Standard of customer service needs to improve on.

There is a lack of skilled manpower in the Staffs do not have proper IT knowledge though

Southeast Bank is providing On-line Banking facility all over the Bangladesh.

New arrangements should be made with well-known international financial and exchange

companies. It will be helpful for international trade financing and speed up processing of

foreign exchange.

Credit division of Southeast Bank takes a lot of time to process a loan where as other banks

takes just one week to process a loan. Most of the time people are coming with the complain

that you are consuming too much time but other banks are processing loan very quickly. For

this reason Southeast Bank is losing potential customer. So management needs to work on

this.

Service provided by the credit card department is very poor, most of the cases they failed to

deliver credit card on time. Very often they have failed to give any specific answer to the

cardholder query. For this drawbacks of the credit card division branches are not been able to

increase the list of it credit cardholder.

60

Credit management of Southeast Bank is very poor. Sometimes loans are given to a person

who is not eligible to get such volume of loan; end result is they become defaulter. In addition